Commanding Digital Liquidity

Professional traders recognize the profound impact of execution quality on overall portfolio performance. Every basis point surrendered to market friction erodes potential returns, particularly within the volatile landscape of crypto block trades. Achieving superior outcomes requires a strategic approach, moving beyond reactive order placement to a proactive engagement with liquidity. The Request for Quote (RFQ) mechanism stands as a foundational tool for orchestrating large digital asset transactions with precision.

An RFQ system enables a trader to solicit competitive bids and offers from multiple liquidity providers simultaneously, all within a private, controlled environment. This process inherently drives price competition among dealers, compelling them to present their most aggressive pricing for substantial order sizes. Understanding the core mechanics of RFQ reveals its value in securing optimal execution for significant capital deployments.

Many perceive advanced trading tools as inherently complex, requiring extensive specialized knowledge. However, the foundational principle of an RFQ simplifies a fragmented market reality into a singular, competitive interaction. It streamlines the discovery of fair value for large positions, transforming what could be a costly endeavor into a managed, transparent process.

Optimal execution in crypto block trades stems from a disciplined approach to liquidity sourcing, leveraging competitive pressure to define superior pricing.

Strategic Deployment for Superior Outcomes

Deploying RFQ effectively transforms a trader’s capacity to manage large positions, offering a clear advantage in an often opaque market. This strategic application of RFQ protocols extends across various digital asset classes, from spot crypto to complex options structures. Precision in execution becomes a definable edge, impacting profitability directly.

Orchestrating Large Spot Trades

Executing substantial spot cryptocurrency orders on open exchanges frequently encounters market impact and slippage. An RFQ circumvents these issues by allowing the trader to engage directly with institutional liquidity. This direct engagement ensures the desired quantity can be filled at a firm price, significantly reducing price deviation from the moment of intent.

Minimizing Market Impact

Submitting a large order to an order book often moves the market against the trader. RFQ mitigates this by allowing liquidity providers to quote a single, all-in price for the entire block. This shields the order from the incremental price discovery of the public order book, preserving the intended entry or exit point.

Securing Optimal Price Discovery

Multiple dealers compete for the RFQ, presenting their most advantageous prices. This competition ensures the trader accesses the tightest possible spread for their specific size, leading to a superior fill price compared to fragmented market execution. The transparency inherent in the competitive quoting process drives genuine price discovery.

Options Block Execution Precision

The complexity of crypto options trading, particularly for multi-leg strategies, magnifies the need for precise execution. RFQ for options blocks provides a robust mechanism for constructing and deconstructing complex positions with accuracy and efficiency. This system ensures that all legs of a strategy are executed simultaneously, eliminating leg risk.

Multi-Leg Strategy Integration

Executing a multi-leg options strategy on disparate venues risks mispricing or partial fills. RFQ enables a trader to request quotes for an entire spread or combination, receiving a single price for the composite position. This simplifies the execution workflow and guarantees the intended payoff profile.

Volatility Hedging Efficiency

Large volatility hedges, often involving significant options positions, demand swift and accurate execution. RFQ provides the means to source deep liquidity for these structures, allowing for efficient rebalancing or initiation of hedges without incurring substantial transaction costs. This maintains the integrity of the portfolio’s risk profile.

Considerations for an RFQ on a multi-leg options trade:

- Defining the Strategy ▴ Clearly outline the options contract (e.g. BTC, ETH), expiry dates, strike prices, and desired quantities for each leg.

- Specifying Leg Ratios ▴ Indicate the precise ratio of each option leg within the overall spread.

- Setting Price Tolerances ▴ Establish acceptable price deviations from the theoretical fair value to guide liquidity providers.

- Indicating Desired Direction ▴ Convey whether the trade is an opening or closing position, influencing how dealers price the quote.

- Selecting Liquidity Providers ▴ Choose a diverse set of institutional dealers known for competitive pricing and deep liquidity in crypto options.

Executing multi-leg options via RFQ ensures atomic fills, safeguarding strategic intent against market fragmentation and sequential execution risks.

The pursuit of an execution edge demands relentless focus. Optimal price delivery, particularly for large orders, forms the bedrock of sustainable alpha generation. This is a critical discipline.

The Pinnacle of Execution Advantage

Beyond individual trade execution, mastering RFQ translates into a systemic advantage across an entire trading operation. This involves integrating RFQ into broader portfolio management and risk mitigation frameworks, evolving from tactical application to strategic command of market dynamics. Professional traders continually seek to refine their processes, recognizing that consistent performance stems from a robust operational framework.

Portfolio-Wide Slippage Mitigation

Integrating RFQ as a standard for all large order execution creates a portfolio-wide firewall against hidden transaction costs. This disciplined approach systematically reduces the aggregate slippage across all asset rebalances, hedging activities, and directional positions. The compounding effect of these savings significantly enhances long-term returns, distinguishing top-tier performance.

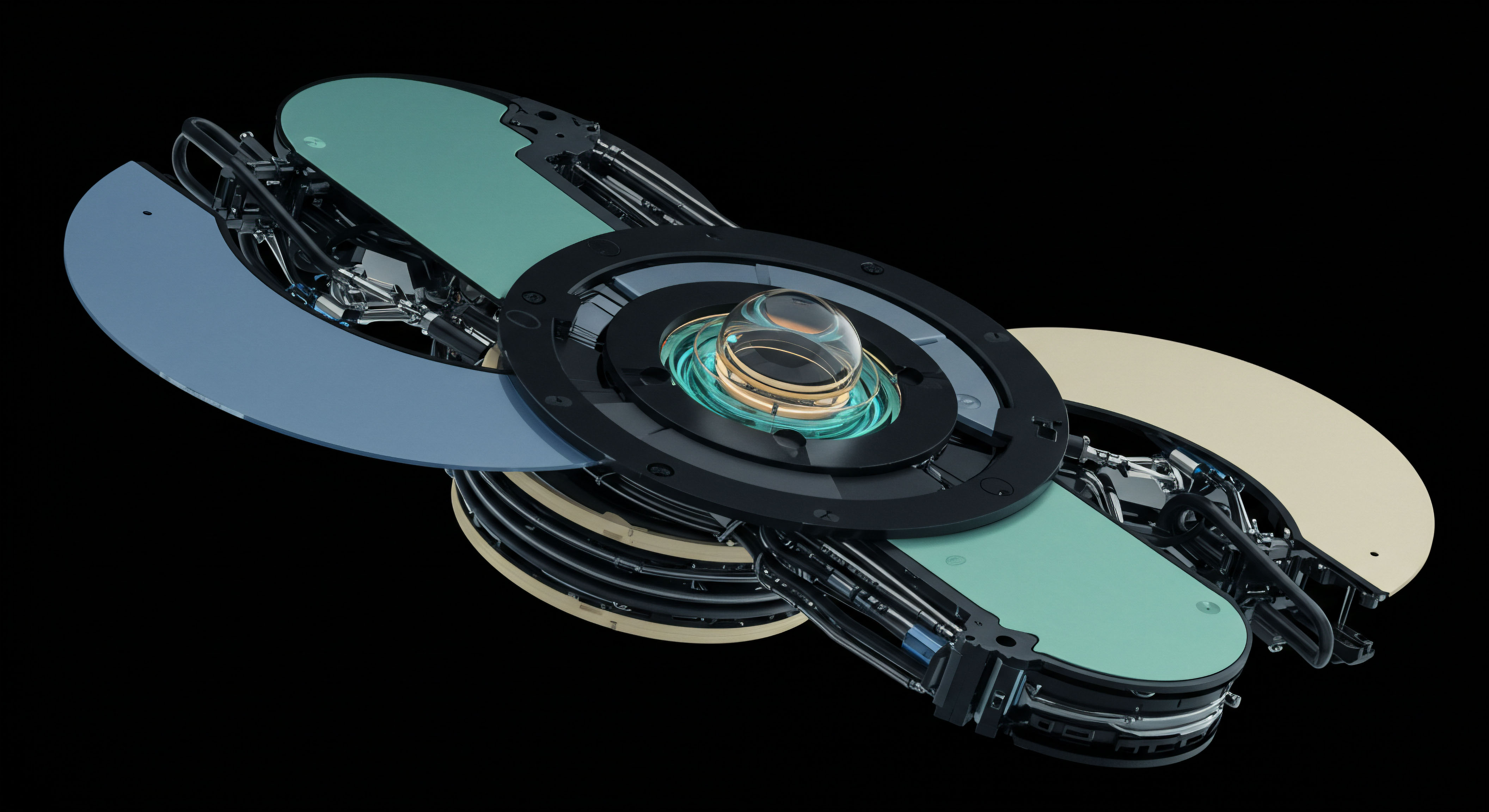

Inter-Exchange Liquidity Aggregation

The fragmented nature of crypto markets means liquidity often resides across multiple exchanges. Advanced RFQ systems possess the capability to aggregate quotes from diverse venues, presenting a unified view of available liquidity. This allows traders to tap into deeper pools without managing multiple accounts or navigating disparate interfaces, streamlining the sourcing process for optimal pricing.

Algorithmic RFQ Integration

Automating the RFQ process through algorithmic integration marks the next frontier. Trading algorithms can dynamically generate RFQs based on predefined parameters, market conditions, and portfolio needs. This enables rapid, systematic execution of complex strategies, particularly for high-frequency rebalancing or opportunistic block trades, further reducing human latency and potential errors. This seamless integration transforms execution into a true “Liquidity Command Center,” where capital deployment becomes a highly optimized, automated function.

Shaping Tomorrow’s Trading Edge

The evolution of digital asset markets continually presents new challenges and opportunities for sophisticated traders. The strategic deployment of tools like RFQ represents a fundamental shift in how professionals approach execution, moving towards a future where precision and control define success. Cultivating a disciplined approach to liquidity management remains paramount for anyone committed to achieving sustained market advantage.