Commanding Liquidity Dynamics

The pursuit of superior execution defines professional trading. Eliminating slippage within the volatile crypto markets demands a systematic approach, elevating transaction quality from an aspiration to a tangible outcome. Request for Quote (RFQ) systems represent a fundamental mechanism for achieving this precision.

They provide a direct channel for price discovery, allowing participants to solicit competitive bids and offers from multiple liquidity providers simultaneously. This direct engagement ensures a controlled environment for executing substantial orders, moving beyond the fragmented nature of public order books.

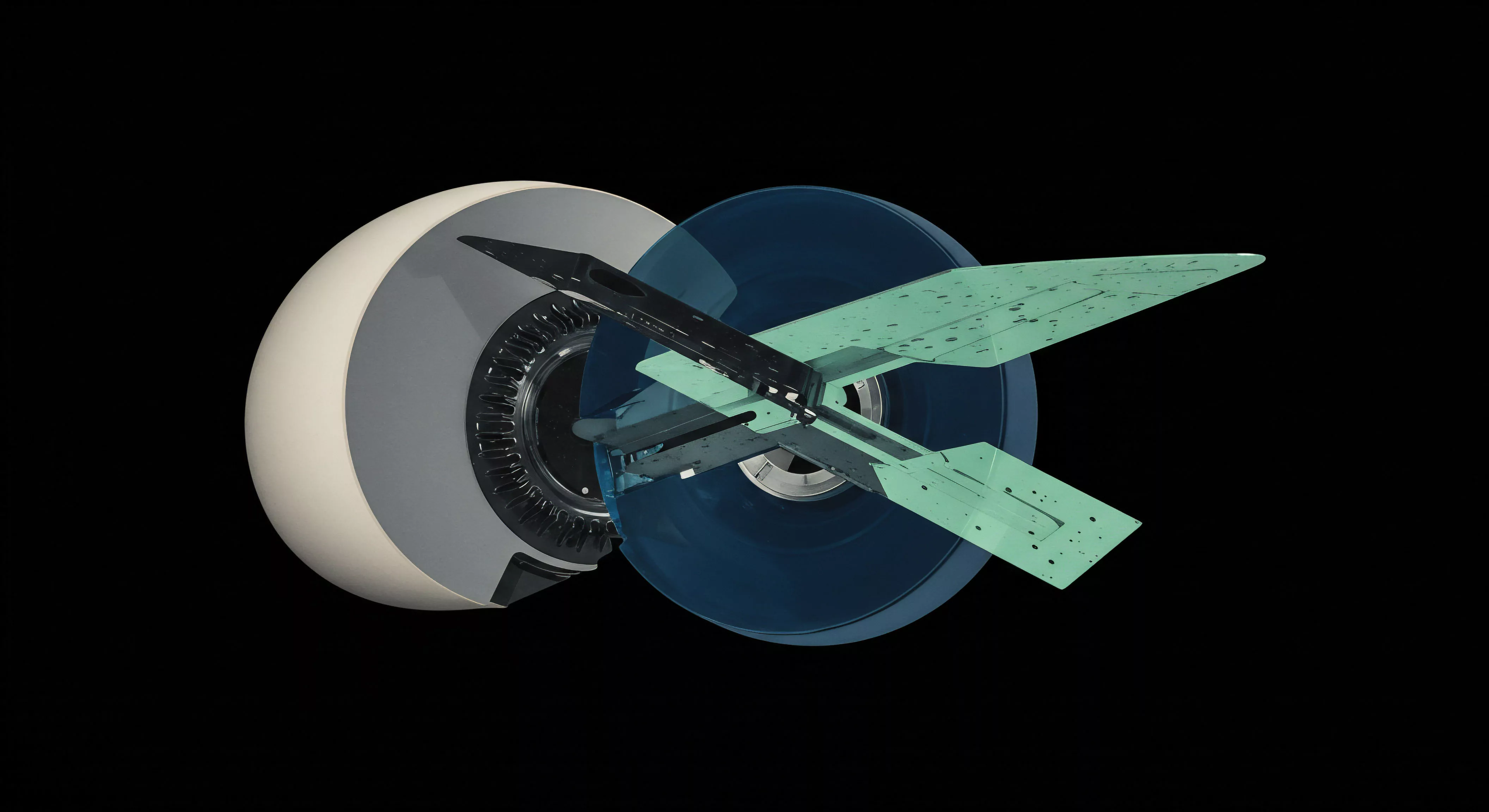

Understanding RFQ systems involves recognizing their capacity to centralize liquidity for specific transactions. A trader initiates a request for a particular instrument, specifying quantity and side. Multiple dealers respond with firm, executable prices.

This process inherently reduces price impact and minimizes unintended market movements that often accompany large block trades on open exchanges. The system’s design prioritizes discretion and efficiency, critical elements for institutional-grade operations.

Precision execution in crypto markets stems from commanding liquidity, not merely reacting to it.

Mastering RFQ begins with internalizing its function as a strategic tool for price optimization. It grants participants the ability to negotiate directly, securing pricing that reflects true market depth without revealing full intentions to the broader market. This strategic advantage translates directly into enhanced capital efficiency. The mechanism effectively transforms a potentially opaque, fragmented landscape into a transparent, competitive arena for a specific trade.

Deploying Execution Superiority

The application of Crypto RFQ systems transforms theoretical market edge into quantifiable returns. Professional traders integrate these systems to engineer optimal entry and exit points, meticulously managing transaction costs across diverse derivatives. Strategic deployment involves a deep understanding of market microstructure and a disciplined approach to execution sequencing.

Optimizing Large Block Orders

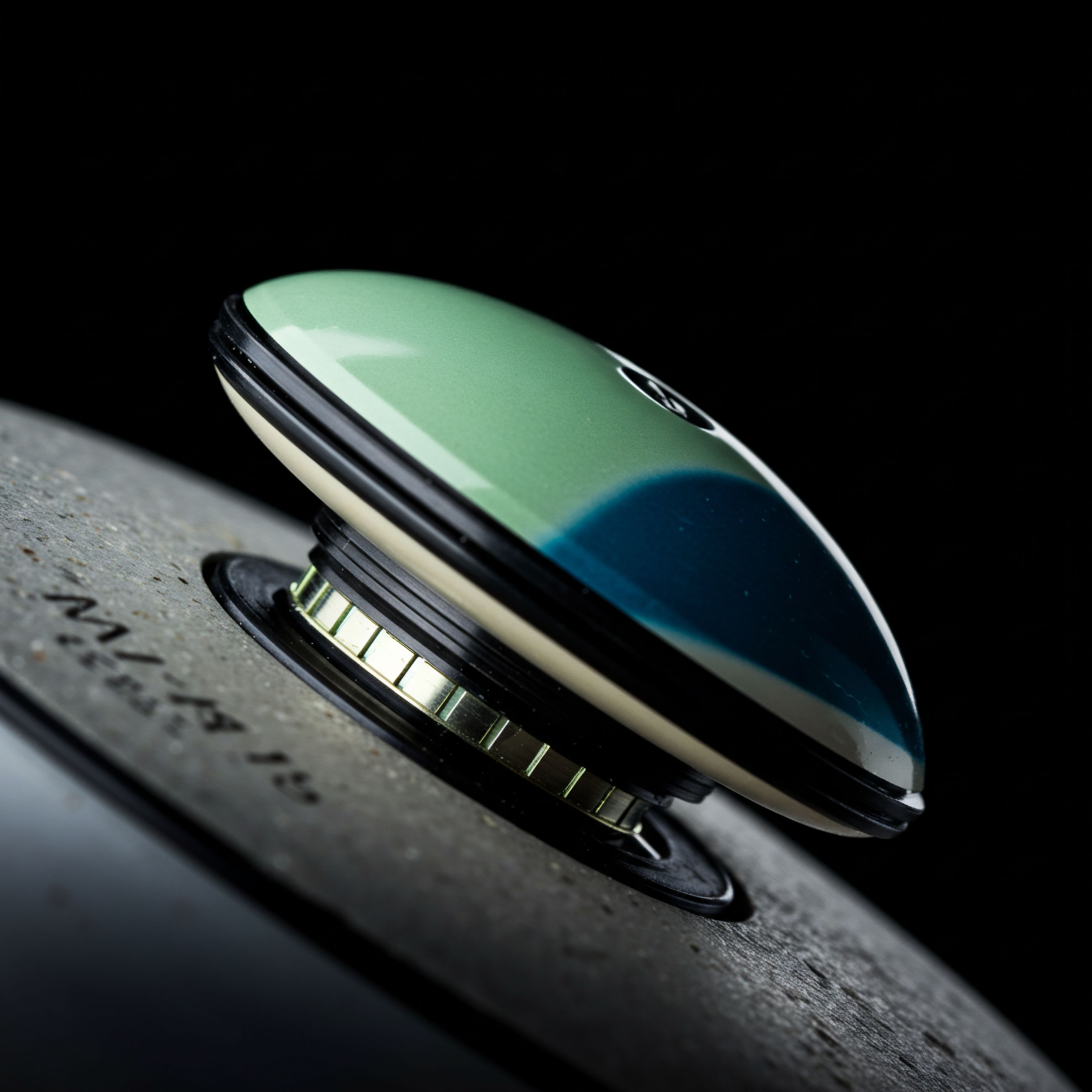

Executing significant positions demands a method that circumvents the pitfalls of market impact. Crypto RFQ systems deliver firm pricing for substantial blocks, ensuring trades clear at predetermined levels. This capability proves invaluable for portfolio rebalancing or taking directional exposures without incurring significant adverse selection.

- Define your precise instrument and quantity. Accuracy in this initial step sets the stage for optimal dealer responses.

- Engage a curated network of liquidity providers. The quality of these relationships directly influences the competitiveness of quotes received.

- Evaluate responses with a focus on both price and fill probability. The lowest bid holds little value without guaranteed execution.

Structuring Complex Options Spreads

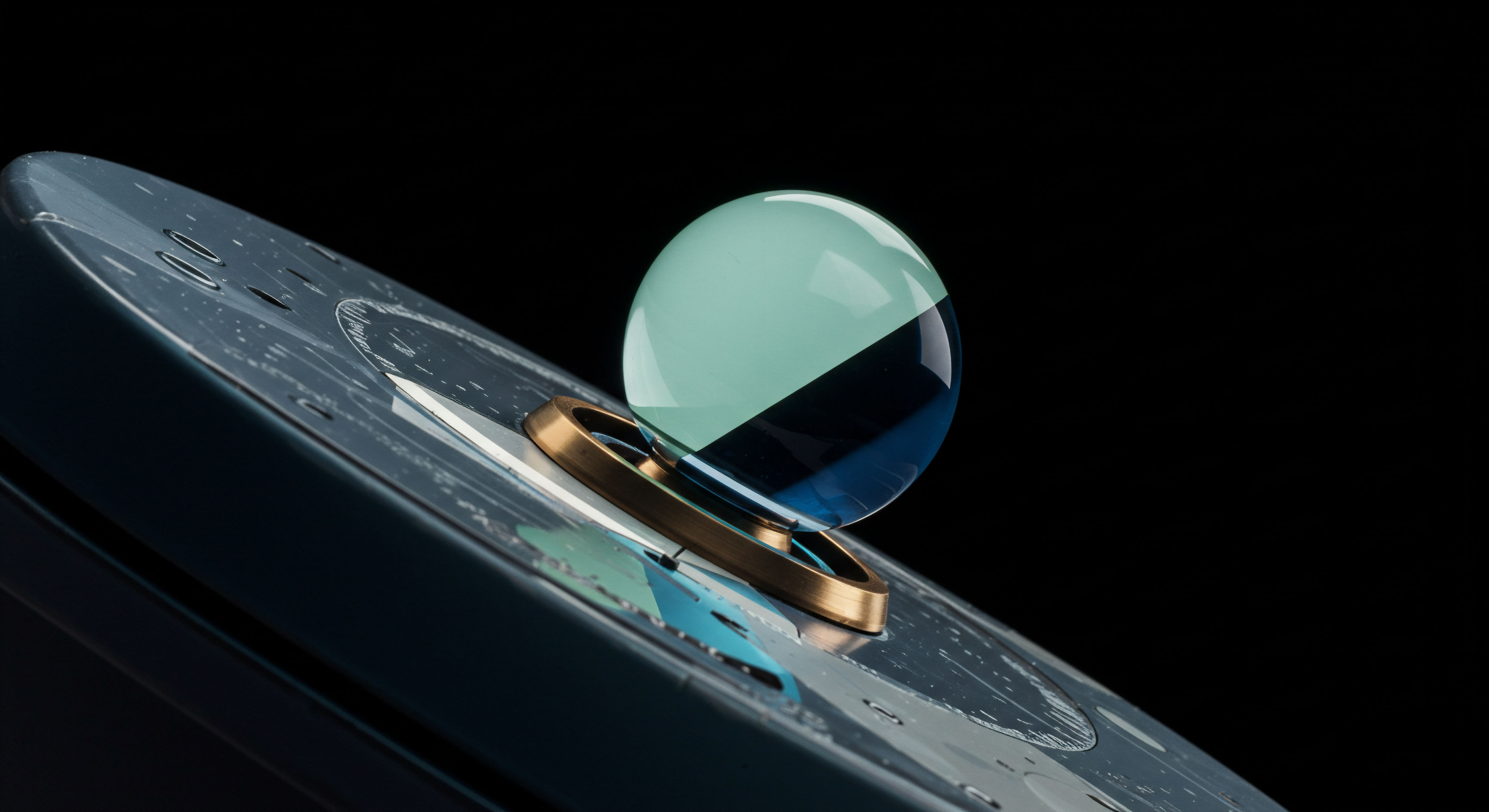

Multi-leg options strategies, such as straddles or collars, often face execution challenges on standard exchanges due to leg-by-leg fills and associated slippage. RFQ systems streamline this process, allowing for the execution of entire spreads as a single transaction. This ensures the intended risk-reward profile of the strategy remains intact from initiation.

Bitcoin Options Block Execution

For large Bitcoin options positions, RFQ provides a robust pathway. A trader might seek to implement a BTC straddle block, simultaneously buying both a call and a put option with the same strike and expiry. RFQ facilitates a single, aggregated quote for this entire structure, preserving the integrity of the implied volatility trade.

ETH Collar RFQ Implementation

An ETH collar, involving a long put and a short call against an existing Ethereum holding, benefits immensely from RFQ. The system allows a trader to solicit quotes for the entire three-leg structure, ensuring a coherent price for the protective and income-generating components. This minimizes the risk of one leg filling unfavorably, distorting the hedge.

The consistent application of RFQ for these complex instruments reflects a commitment to process. It acknowledges that the quality of execution impacts the overall profitability of a strategy.

Managing Volatility Exposure

Volatility block trades, whether expressing a view on implied volatility or hedging existing exposure, require precise execution. RFQ systems offer a controlled environment for these transactions, insulating them from the immediate, often unpredictable, shifts in market sentiment that affect public order books. This is a critical distinction.

The ability to compare multiple firm quotes provides a distinct informational advantage. It allows for a real-time assessment of market depth and competitive pricing, informing subsequent trading decisions. This strategic deployment translates into superior average execution prices over time.

Elevating Portfolio Command

Mastering Crypto RFQ systems extends beyond individual trades; it becomes an integral component of a sophisticated portfolio management framework. Integrating these tools allows for a systemic reduction in transaction costs, which compounds into significant alpha generation over extended periods. This represents a profound shift in operational efficiency.

Systemic Risk Mitigation

Deploying RFQ for all large block trades and complex derivatives structures establishes a baseline of superior execution quality. This consistency contributes directly to overall portfolio stability by minimizing unforeseen price impact and slippage. It acts as a continuous optimization loop, reinforcing positive trading habits.

Multi-Dealer Liquidity Aggregation

The capacity to access multi-dealer liquidity through a single RFQ interface streamlines the search for best execution. This aggregated access ensures competitive pricing for every transaction, irrespective of market conditions. It transforms liquidity fragmentation from a challenge into an opportunity for price discovery.

A truly professional approach acknowledges that even fractional improvements in execution quality accrue substantial benefits. This continuous refinement of the trading process defines enduring success. Sustained market advantage arises from such operational excellence.

Strategic Implication for Alpha Generation

The long-term value of RFQ systems resides in their contribution to consistent alpha. By systematically minimizing execution drag, capital remains more efficiently deployed, directly enhancing risk-adjusted returns. The competitive tension among liquidity providers ensures that a trader consistently captures favorable pricing. This is the bedrock of sustained outperformance.

Developing proficiency with these systems cultivates a deeper understanding of market dynamics. It compels a trader to think in terms of systemic advantages, identifying opportunities where controlled execution provides a measurable edge. This continuous refinement of strategy represents a professional imperative. Mastering these systems offers a distinct, tangible advantage.

The Unyielding Pursuit of Edge

The digital asset markets continue their rapid evolution, presenting both unprecedented opportunities and inherent complexities. For the discerning professional, the enduring power of disciplined execution remains paramount. Tools like Crypto RFQ systems are not transient trends; they represent fundamental advancements in market access and price capture.

Their integration into a trading workflow marks a definitive step towards commanding market outcomes, rather than simply participating in them. The journey towards absolute mastery of execution is continuous, a testament to the relentless pursuit of an undeniable edge.

Glossary

Rfq Systems

Crypto Rfq Systems

Crypto Rfq

Multi-Dealer Liquidity