The Mandate for Price Control

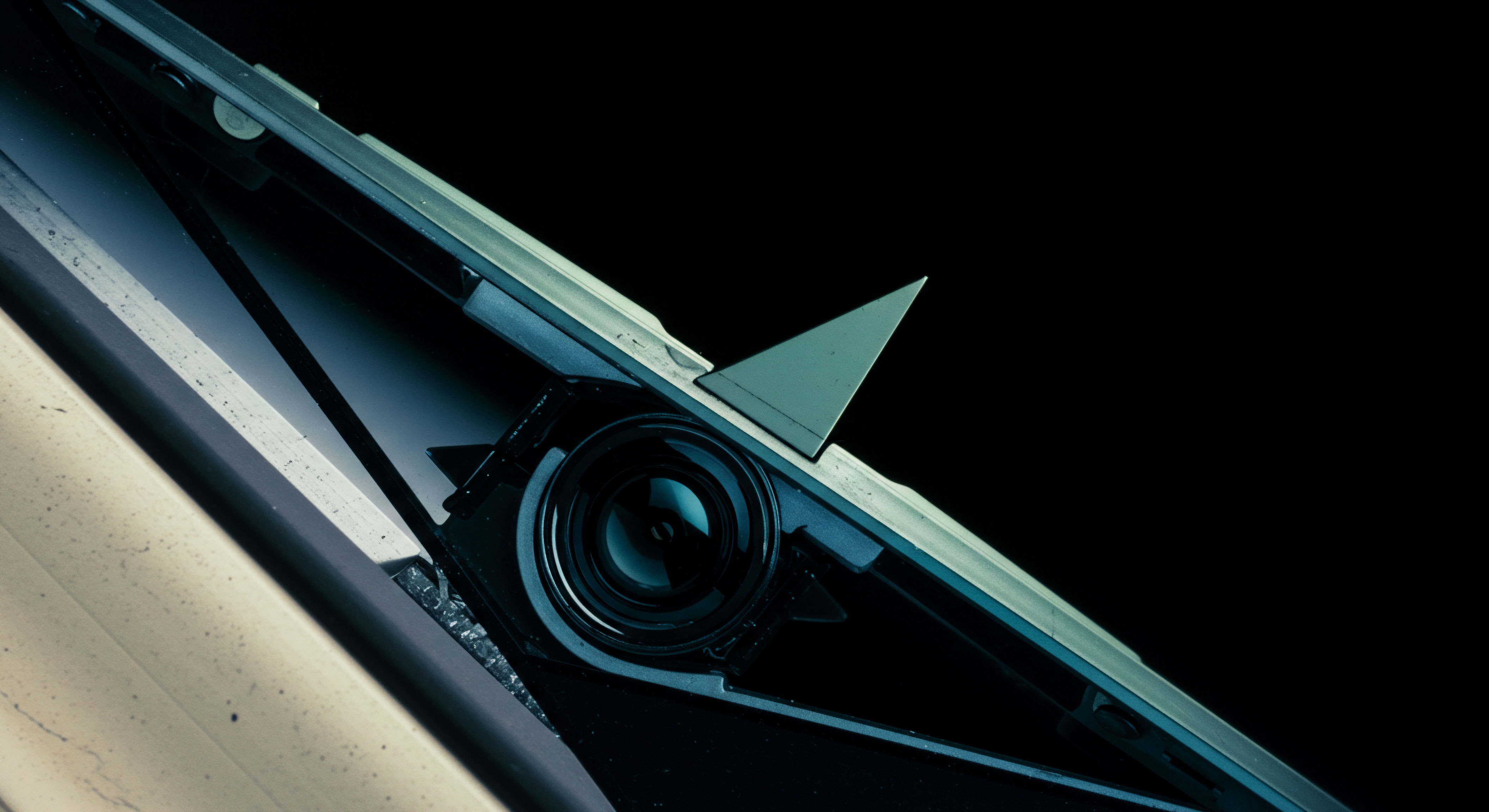

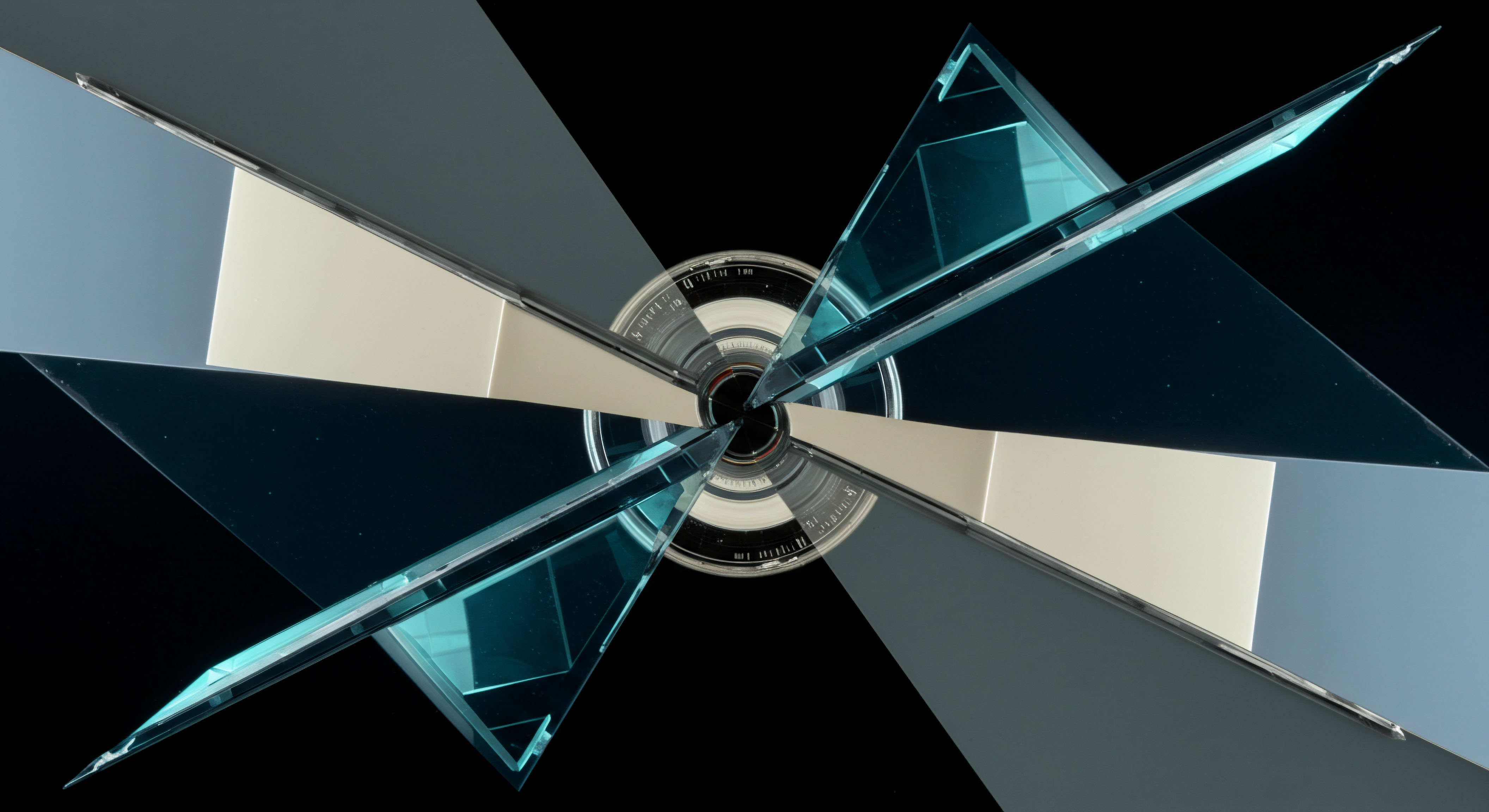

The sophisticated acquisition of equity holdings is an exercise in systemic precision. It involves a deliberate process of constructing a desired entry price, moving beyond the passive acceptance of on-screen quotes. This approach is built upon a foundational understanding that liquidity can be summoned and price can be defined through the correct application of financial instruments.

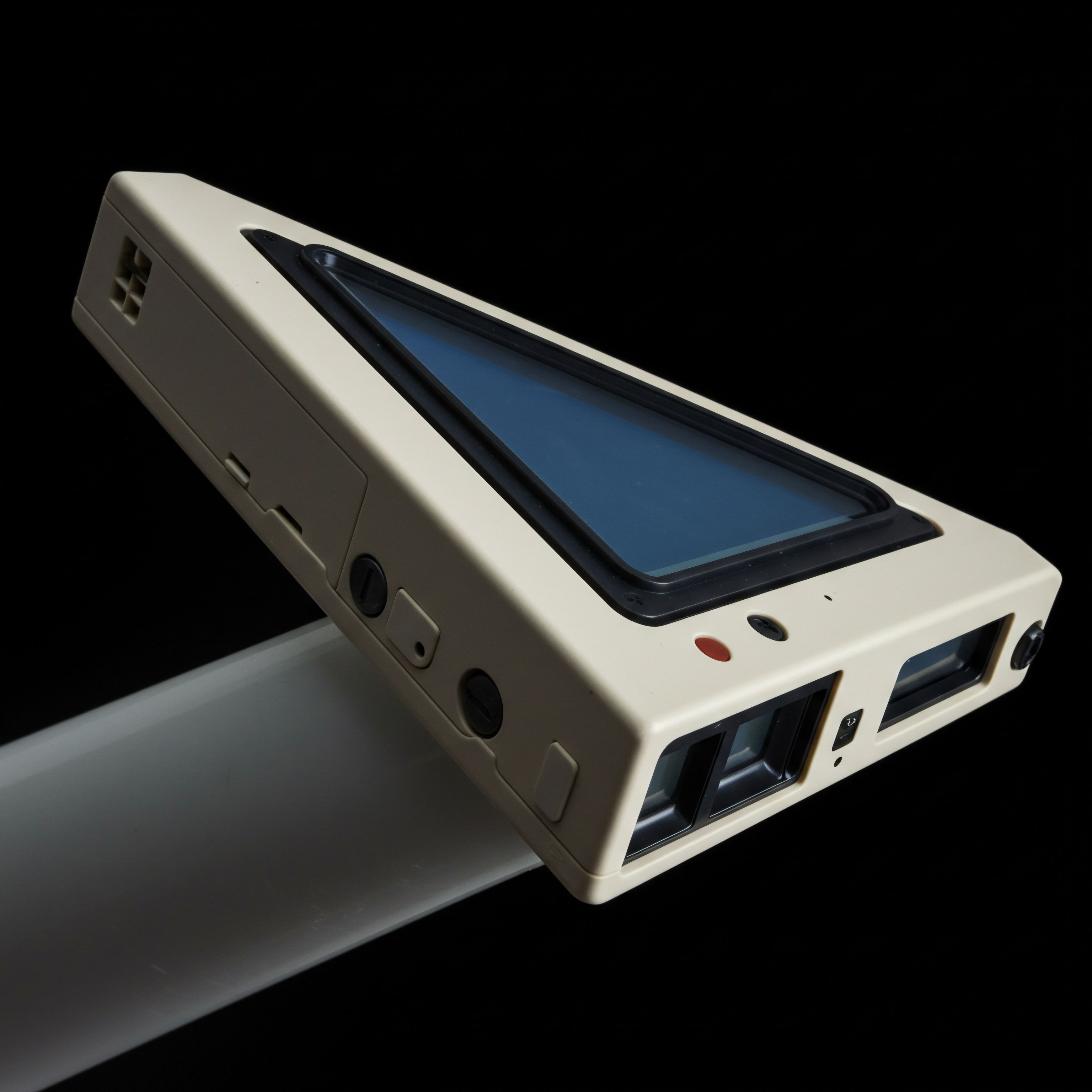

The entire endeavor is a departure from the conventional retail action of placing a simple limit order; it is an active, strategic operation to secure assets on preferential terms. The two principal mechanisms for this operation are derivatives, specifically the selling of put options, and the direct negotiation of large-volume transactions through block trading facilities.

Selling a cash-secured put option is a clear declaration of intent to purchase a specific stock at a predetermined price below its current market value. This financial instrument creates an obligation, and in exchange for taking on this duty, the seller receives an immediate cash premium. This premium is a critical component of the strategy, as it effectively lowers the net cost basis of the stock if the purchase is executed. The process allows an investor to generate yield while waiting for a target company’s stock to reach a more favorable valuation.

It transforms the passive act of waiting into a productive, income-generating period. The obligation to buy is not a risk to be feared but a strategic goal to be met, contingent on the market price falling to the level you have already defined as your optimal entry point.

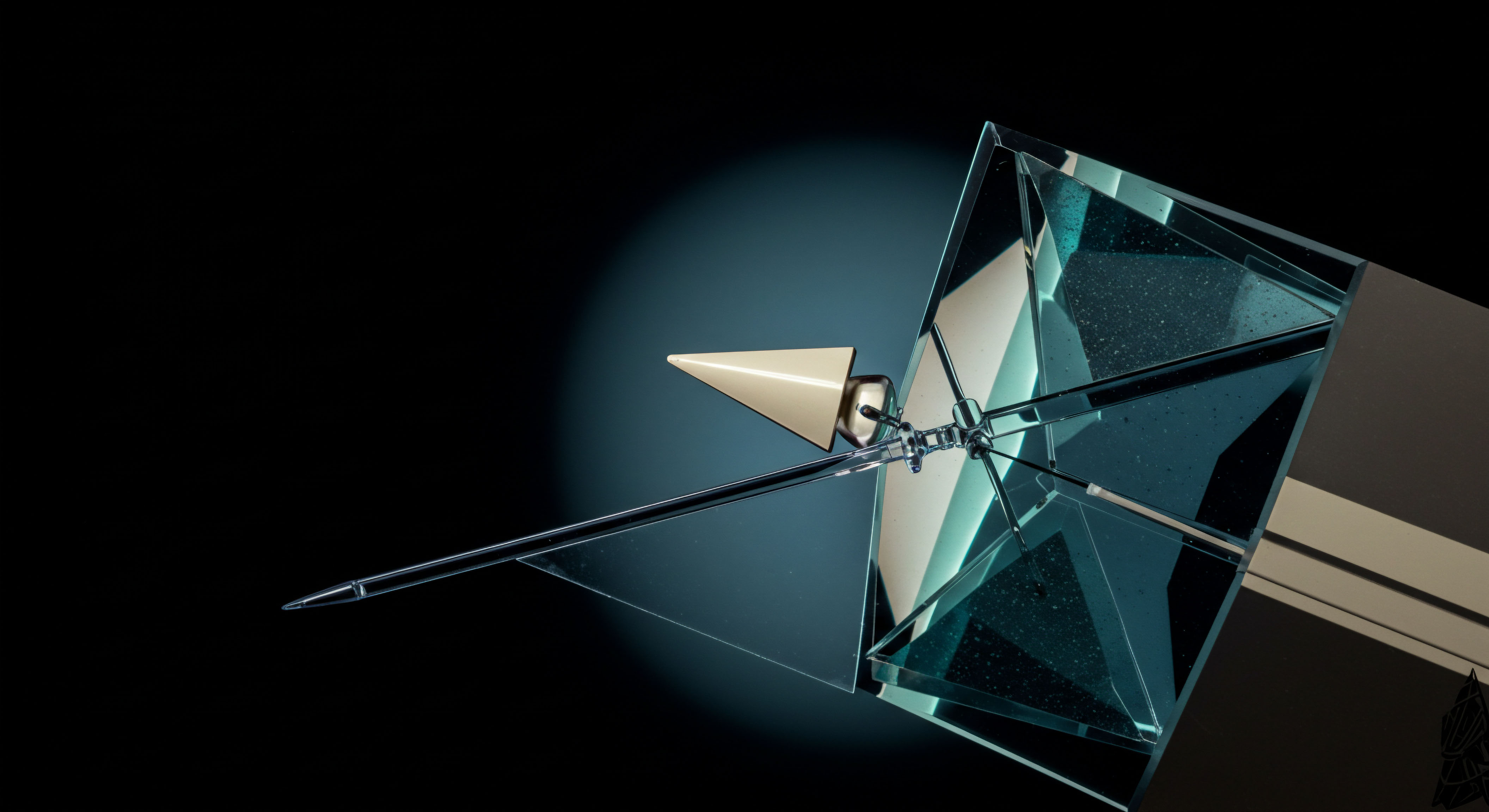

For substantial acquisitions, where the sheer size of an order could disrupt the market and lead to unfavorable pricing ▴ a phenomenon known as slippage ▴ a more direct method is required. Block trading, facilitated by a Request for Quote (RFQ) system, provides the necessary framework. An RFQ is a formal invitation to a select group of institutional market makers to provide a private, competitive bid for a large quantity of shares. This process occurs off the public order books, ensuring that the trader’s intention does not create adverse price movements.

The trader specifies the asset and size, and multiple liquidity providers respond with their best offer. This competitive dynamic works to the trader’s advantage, allowing for the execution of a significant position at a single, negotiated price that is often superior to what could be achieved through piecemeal execution on an open exchange.

Engineering Your Entry Point

The practical application of these principles requires a disciplined, process-driven mindset. Acquiring stocks at a discount is an engineering problem, where the tools of options and block trading are applied with surgical accuracy to achieve a specific financial outcome. Each step is deliberate, calculated, and designed to maximize the probability of a superior entry. This is financial engineering.

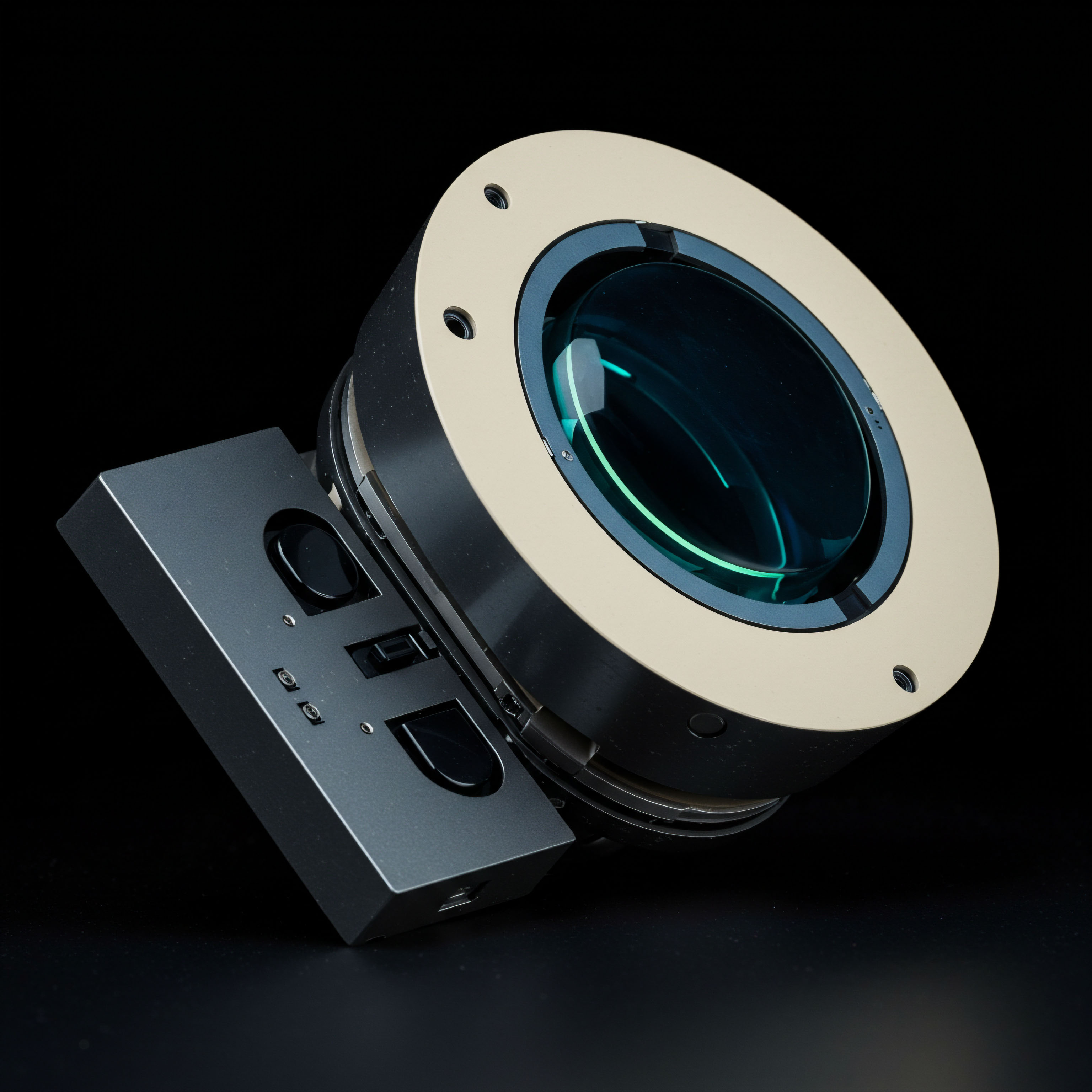

The Cash-Secured Put a Precision Instrument

Employing the cash-secured put strategy begins with identifying a high-conviction stock you wish to own for the long term. The strategy’s effectiveness is contingent on your genuine desire to acquire the underlying asset. The objective is to select an option contract that aligns with your price target and time horizon, creating a binding agreement to purchase shares at a discount to their current trading level.

Calibrating the Strike Price and Expiration

The selection of the strike price is the most critical decision. It represents the price per share at which you are obligated to buy the stock. A strike price set moderately below the current stock price offers a higher probability of being assigned the shares and typically generates a more substantial premium. A strike price set significantly lower results in a smaller premium but a steeper discount if the trade is executed.

The choice of expiration date also influences the premium received; longer-dated options command higher premiums due to increased time value and uncertainty, but they also require a longer commitment of capital. A common approach involves selling puts with 30 to 45 days until expiration to balance premium generation with the frequency of strategic review.

Analyzing Premium and Implied Volatility

The premium received from selling a put is directly influenced by the implied volatility of the underlying stock. Higher volatility leads to higher option premiums, as the perceived risk and potential for large price swings increase. Therefore, periods of heightened market fear or uncertainty can be the most opportune times to sell puts on fundamentally sound companies. The premium collected acts as a quantifiable buffer, reducing your effective purchase price.

For instance, if you sell a put with a $95 strike price and collect a $3 premium per share, your net cost basis upon assignment would be $92 per share ($95 strike – $3 premium). This is a guaranteed discount, engineered by you, irrespective of the stock’s price movement, so long as it closes below your strike at expiration.

Studies on institutional block trades consistently show that negotiated transactions via RFQ can reduce execution slippage by 30-50 basis points compared to algorithmic execution in volatile markets.

Sourcing Liquidity for Size the RFQ Advantage

When the investment size is substantial ▴ typically in the tens or hundreds of thousands of shares ▴ executing on the open market is inefficient. Each incremental purchase can push the price higher, a costly effect known as price impact. The RFQ process is the professional-grade solution to neutralize this friction.

The procedure is methodical and grants the trader significant control over the execution process. It is a private negotiation that brings competition for your order directly to you. This method is standard for institutional investors who understand that minimizing market impact is a direct contributor to alpha.

- Initiation ▴ The trader initiates an RFQ through a trading platform or directly with a broker’s desk, specifying the stock ticker and the total number of shares to be purchased. The request is sent to a curated list of liquidity providers or market makers.

- Anonymous Quoting ▴ The market makers respond with firm quotes, indicating the price at which they are willing to sell the specified block of shares. This process is typically anonymous, ensuring that the identity of the counterparties does not influence pricing.

- Evaluation and Execution ▴ The trader receives multiple quotes simultaneously and can select the most competitive one. The best bid is chosen, and the trade is executed in its entirety at that single price.

- Settlement ▴ The transaction is then printed to the tape as a single block trade, and the shares are settled into the trader’s account. The entire process minimizes information leakage and market disruption.

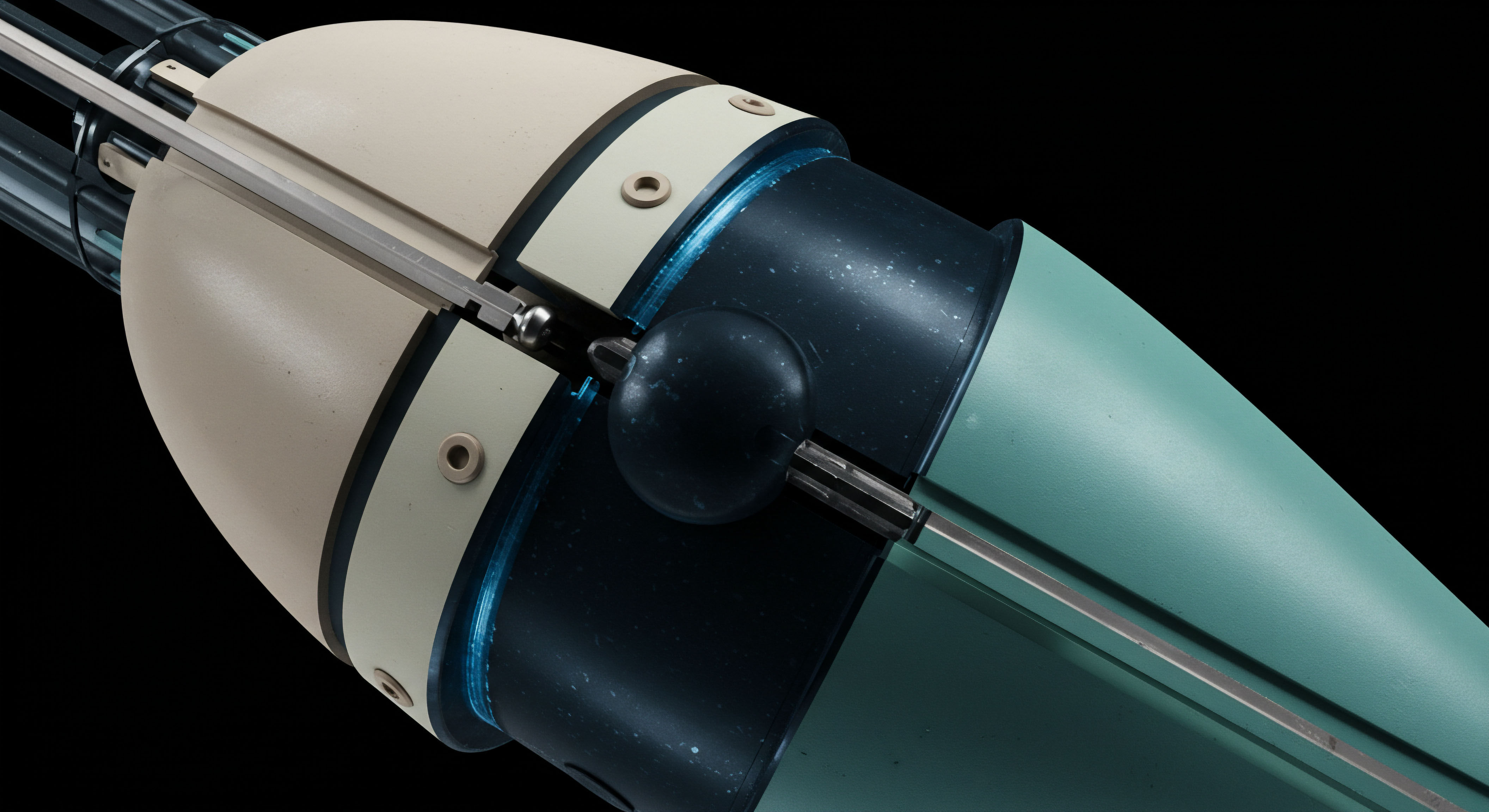

Portfolio Integration and Strategic Alpha

Mastery of discounted stock acquisition extends beyond single-trade execution into the realm of holistic portfolio management. Integrating these techniques as a core component of your investment strategy provides a durable edge. It reframes how capital is deployed, shifting from a reactive to a proactive stance on market entry. This systematic approach contributes to long-term alpha generation by consistently lowering the cost basis of core holdings and creating new income streams.

Layering Strategies for Enhanced Yield and Risk Management

The cash-secured put is a standalone strategy, yet its true power is unlocked when integrated with other options positions. Once shares are acquired through assignment, the investor can immediately begin selling covered calls against the newly established position. This creates the “wheel” strategy, a cyclical process of acquiring stock via puts and then generating further income by selling calls until the shares are called away at a profit. This systematic harvesting of options premium enhances the overall yield of the portfolio and can significantly improve risk-adjusted returns over a full market cycle.

For more sophisticated risk management, a position can be structured as a “collar” from the outset. This involves selling a cash-secured put to define a discounted entry point while simultaneously using a portion of the proceeds to buy a protective put at a lower strike price. This action defines a maximum loss on the position, creating a clear risk-reward profile before the trade is even initiated. The very act of locking in a discounted price through a large block trade presents a paradox.

One secures a superior entry point against the prevailing market ask, yet simultaneously forgoes the unpredictable, explosive upside that can sometimes follow periods of high volatility. The discipline, therefore, lies in valuing the certainty of the engineered discount over the phantom of a perfect market bottom.

Systematic Application across a Portfolio

Applying these principles across a diversified portfolio of target equities transforms the entire investment process. Instead of holding large cash balances that generate minimal returns while waiting for market pullbacks, the capital is actively deployed through cash-secured puts. This portfolio of puts acts as a series of conditional buy orders, each generating income and positioned to execute at strategically determined discount levels.

The result is a more capital-efficient portfolio that is constantly working to either generate yield or acquire high-conviction assets at favorable prices. This approach demands rigorous monitoring and a deep understanding of the underlying companies, yet the rewards are a structurally lower cost basis and a consistent stream of non-correlated returns from premium income.

The Ownership Mindset

Adopting these methods fundamentally alters one’s relationship with the market. The focus shifts from chasing price fluctuations to commanding entry points. It is a transition from being a price taker to a price maker. This mindset is built on the conviction that your capital deserves to be deployed on your terms, at prices you dictate, through processes you control.

The tools of derivatives and private negotiation are the mechanisms, but the true asset is the strategic discipline to use them. The result is a portfolio built with intention, precision, and a persistent structural advantage.

Glossary

Block Trading

Cash-Secured Put

Cost Basis

Entry Point

Request for Quote

Slippage

Strike Price

Implied Volatility

Price Impact

Options Premium