The Principle of Atomic Execution

In the high-velocity theatre of crypto derivatives, the simultaneous execution of a multi-leg options spread is the defining characteristic of professional trading. Legging risk, the exposure a trader incurs between the execution of individual components of a spread, represents a critical vulnerability. This exposure arises from the fractional delays between trades, moments where the volatile underlying asset can move, eroding or completely invalidating the strategy’s intended profitability.

The practice of “legging in” ▴ executing each transaction separately ▴ introduces an element of chance into a process that demands precision. Studies on managing strangles and other multi-leg positions have shown that legging in or out increases complexity and introduces additional directional risks without offering a consistent performance advantage over unified execution.

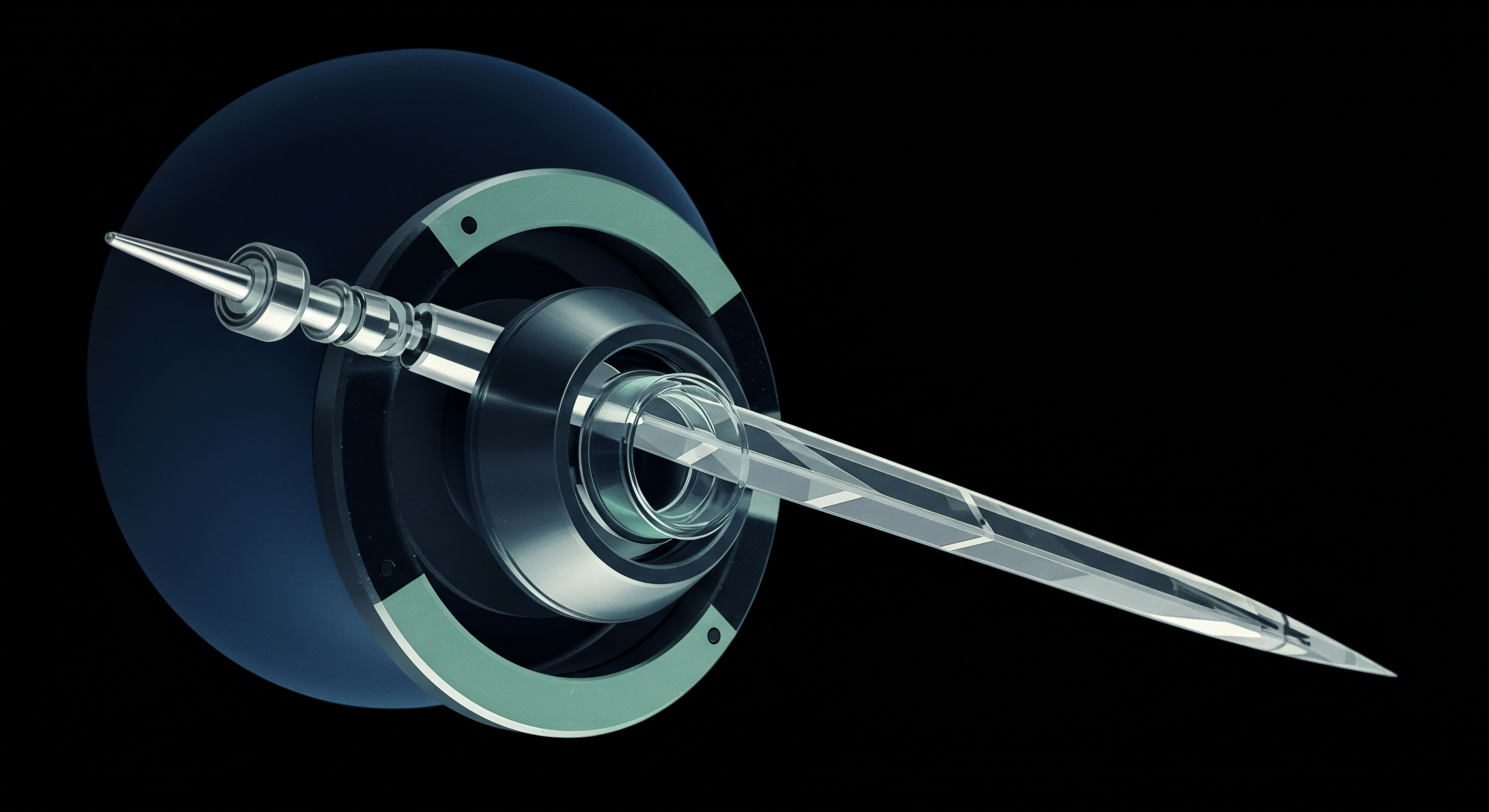

The institutional-grade response to this challenge is the adoption of systems that facilitate atomic execution. An atomic transaction ensures that a multi-leg order is treated as a single, indivisible unit. All components are filled simultaneously at agreed-upon prices, or none are filled at all. This mechanism transforms a sequence of risky, independent bets into one decisive strategic action.

The Request for Quote (RFQ) system is the primary vehicle for achieving this level of execution certainty in the crypto options market. It allows traders to solicit competitive, two-way prices for complex spreads from a network of professional liquidity providers. This process happens off the public order book, providing access to deep, institutional liquidity while guaranteeing the integrity of the spread.

Engaging with an RFQ system is a fundamental shift in operational procedure. It moves the trader from being a passive price-taker in a fragmented public market to an active participant who can command liquidity on specific terms. For Bitcoin and Ethereum options, where market-moving information can propagate in milliseconds, this control is paramount. The RFQ process provides price certainty before commitment, effectively eliminating the slippage and execution risk inherent in legging.

By ensuring that the entire structure is established at a single moment in time, the trader preserves the precise risk-reward profile they meticulously designed. This is the foundational step toward building robust, repeatable, and scalable options trading strategies in the digital asset space.

Engineering Certainty in Volatile Markets

Deploying capital in the crypto options market requires a systematic approach to execution. The RFQ process provides a clear framework for translating strategic intent into guaranteed outcomes. It is a disciplined procedure designed to secure best execution for complex, multi-leg structures that are vulnerable to the price volatility of assets like BTC and ETH. Mastering this process is a direct investment in the consistency and predictability of your trading results.

It allows for the precise implementation of sophisticated strategies, transforming theoretical edge into realized returns by removing the variable of execution uncertainty. Each successful RFQ trade reinforces a professional methodology, building a foundation for more complex and larger-scale operations.

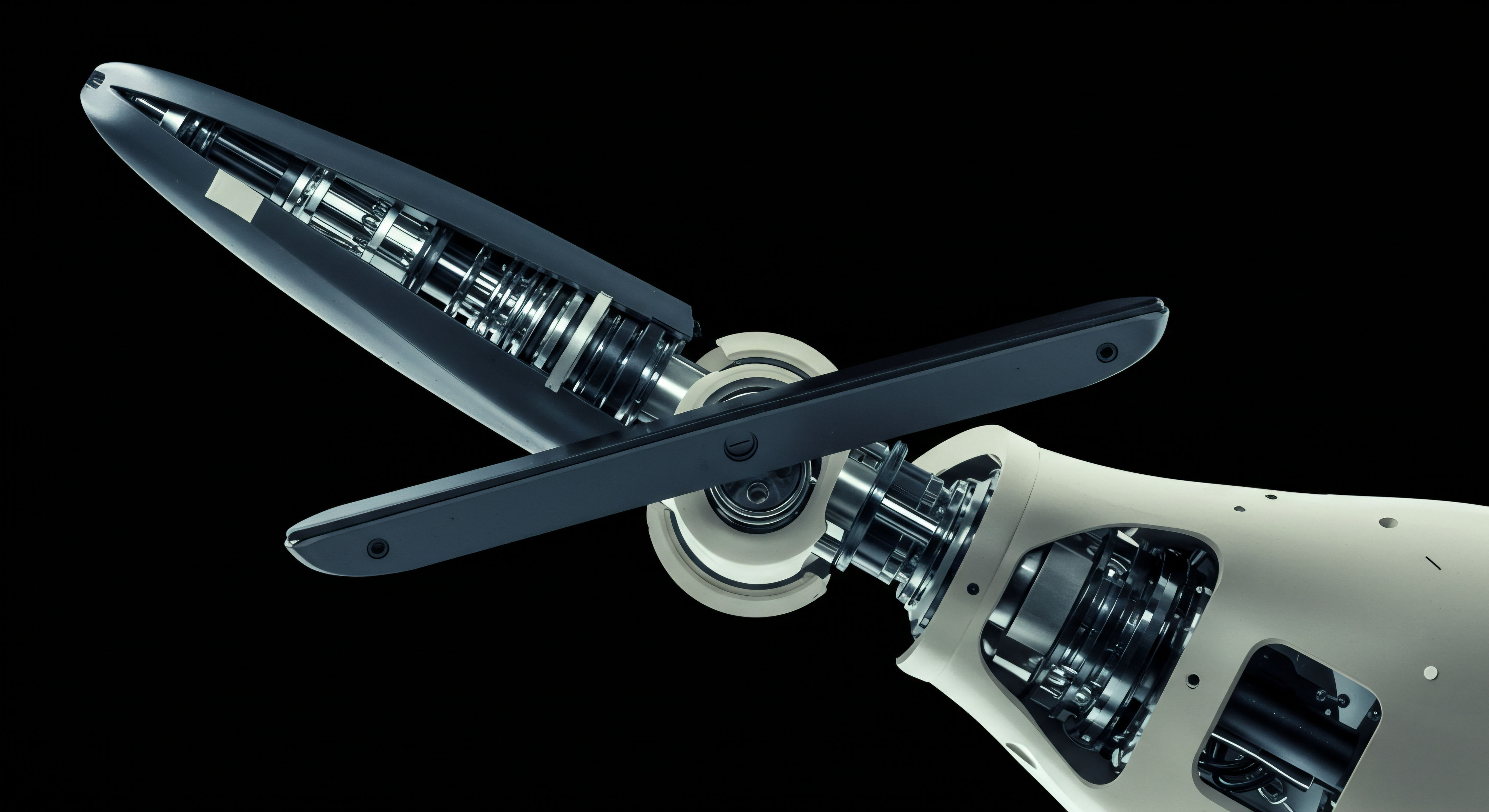

The Straddle and Strangle Lock for Event-Driven Volatility

Key market events, such as major economic data releases or significant project updates, are prime opportunities for volatility trading. A long straddle (buying a call and a put at the same strike) or a strangle (buying an out-of-the-money call and put) are classic strategies to capitalize on a large price move in either direction. However, attempting to leg into these positions on a live order book during a volatile period is exceptionally hazardous. The bid-ask spread can widen dramatically, and the price of one leg can shift significantly while you attempt to execute the other.

Using an RFQ system completely circumvents this risk. A trader can package the entire two-leg structure and request a single, net debit price from multiple market makers. The liquidity providers compete to offer the tightest spread for the entire package.

This ensures the trader enters the position at a known, fixed cost, capturing the desired exposure to implied volatility without any price slippage between the call and put legs. The execution is instantaneous and holistic, securing the exact profit and loss parameters of the strategy before the market-moving event occurs.

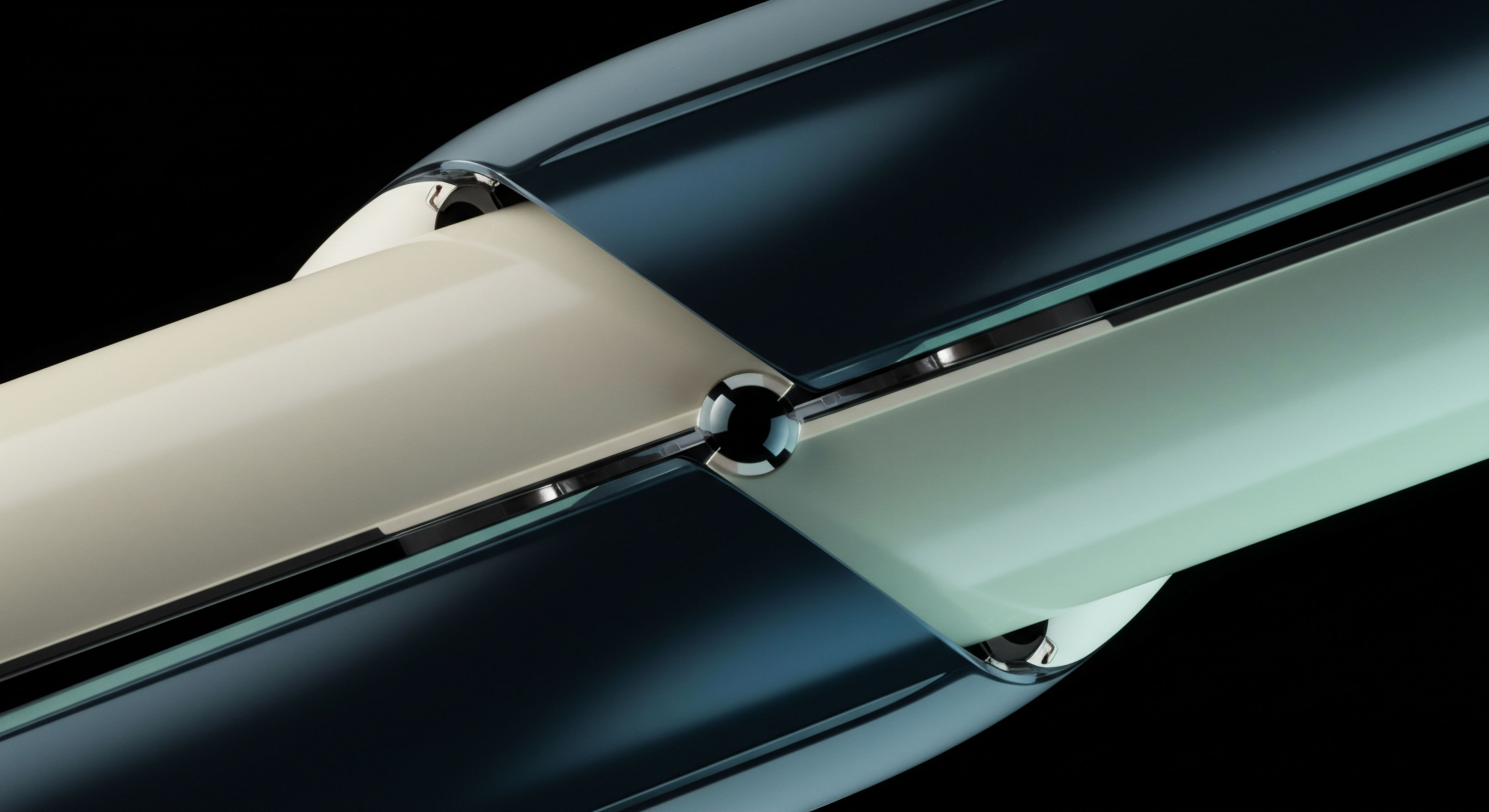

The Collar as a Yield Generation Engine

A collar strategy, which involves holding the underlying asset, selling a covered call, and buying a protective put, is a powerful tool for generating yield while defining a clear risk-reward range. The profitability of this structure is highly dependent on the net premium received from the two options legs. Legging into a collar exposes the trader to the risk that the underlying asset’s price will move after one leg is executed, altering the value of the second leg and diminishing the net credit received.

Multi-leg orders ensure that both legs get filled at a single price and guarantees execution on both sides, thus eliminating an unbalanced position.

An RFQ allows a trader to present the entire collar structure (e.g. selling a 30-delta BTC call and buying a 20-delta BTC put against a spot position) as a single package. Market makers then provide a firm, net credit or debit for the options combination. This guarantees the yield and the exact price levels of the upside and downside protection. It transforms a complex, three-part position into a single, clean execution, making it a reliable and repeatable method for systematic yield generation on a crypto portfolio.

A Disciplined RFQ Process

Successfully integrating RFQ into your trading involves a structured approach. The goal is to source the best possible price for your entire spread from a competitive pool of liquidity providers, ensuring anonymity and minimal market impact. This process is universal across leading platforms like greeks.live, Deribit, or Paradigm, which provide access to a network of institutional market makers.

- Structure Definition ▴ Begin by precisely defining the multi-leg options structure you intend to trade. This includes the underlying asset (e.g. ETH), the expiration date, the strike prices for each leg, and the quantity. For a bull call spread, this would be the long call and the short call.

- RFQ Submission ▴ Submit the entire structure as a single package through the platform’s RFQ interface. You will specify whether you are looking to buy or sell the spread. The platform then anonymously broadcasts this request to its network of liquidity providers.

- Competitive Quoting ▴ Market makers receive the anonymous request and have a set period, often just a few seconds, to respond with their best bid (the price at which they will buy the spread) and ask (the price at which they will sell the spread).

- Quote Aggregation ▴ The platform aggregates all incoming quotes in real-time and displays the best available bid and ask prices to you. This provides a transparent view of the deepest liquidity available for your specific structure at that moment.

- Execution Decision ▴ You now have a firm, executable price. You can choose to trade by hitting the bid or lifting the offer. Upon execution, the platform ensures all legs of the spread are filled simultaneously at the quoted price. The entire transaction settles instantly in your account.

The Systemic Edge of Guaranteed Execution

Mastering atomic execution through RFQ systems is the gateway to operating at an institutional scale. The certainty of execution on multi-leg spreads unlocks more sophisticated strategies that are unfeasible with manual, legged execution. It allows a trader to move beyond speculating on simple price direction and begin trading the complex relationships across the entire volatility surface. This capability is what separates retail methods from professional portfolio management.

When you can guarantee the fill price of a four-leg iron condor or a complex calendar spread, you can systematically harvest risk premia and exploit pricing inefficiencies across different expirations and strike prices with a high degree of confidence. This confidence allows for larger position sizes and more active portfolio adjustments.

Volatility Surface Arbitrage and Relative Value Trades

The crypto options market, while maturing, still presents numerous pricing inefficiencies across its volatility surface. A trader might identify that the implied volatility of short-dated ETH options is overpriced relative to longer-dated options, or that the volatility smile for BTC is unusually steep. To capitalize on these observations, one must execute multi-leg spreads that isolate these specific volatility relationships.

For instance, a calendar spread (selling a front-month option and buying a back-month option) is a pure play on the term structure of volatility. Attempting to leg into such a trade is fraught with risk, as a shift in the underlying price can disrupt the delicate pricing relationship between the two legs.

An RFQ system permits the trader to execute the entire calendar spread as a single unit at a guaranteed net debit or credit. This precision allows for the systematic implementation of relative value strategies that are agnostic to the market’s short-term direction. It enables a portfolio to generate alpha from the structural properties of the options market itself, a hallmark of advanced derivatives trading.

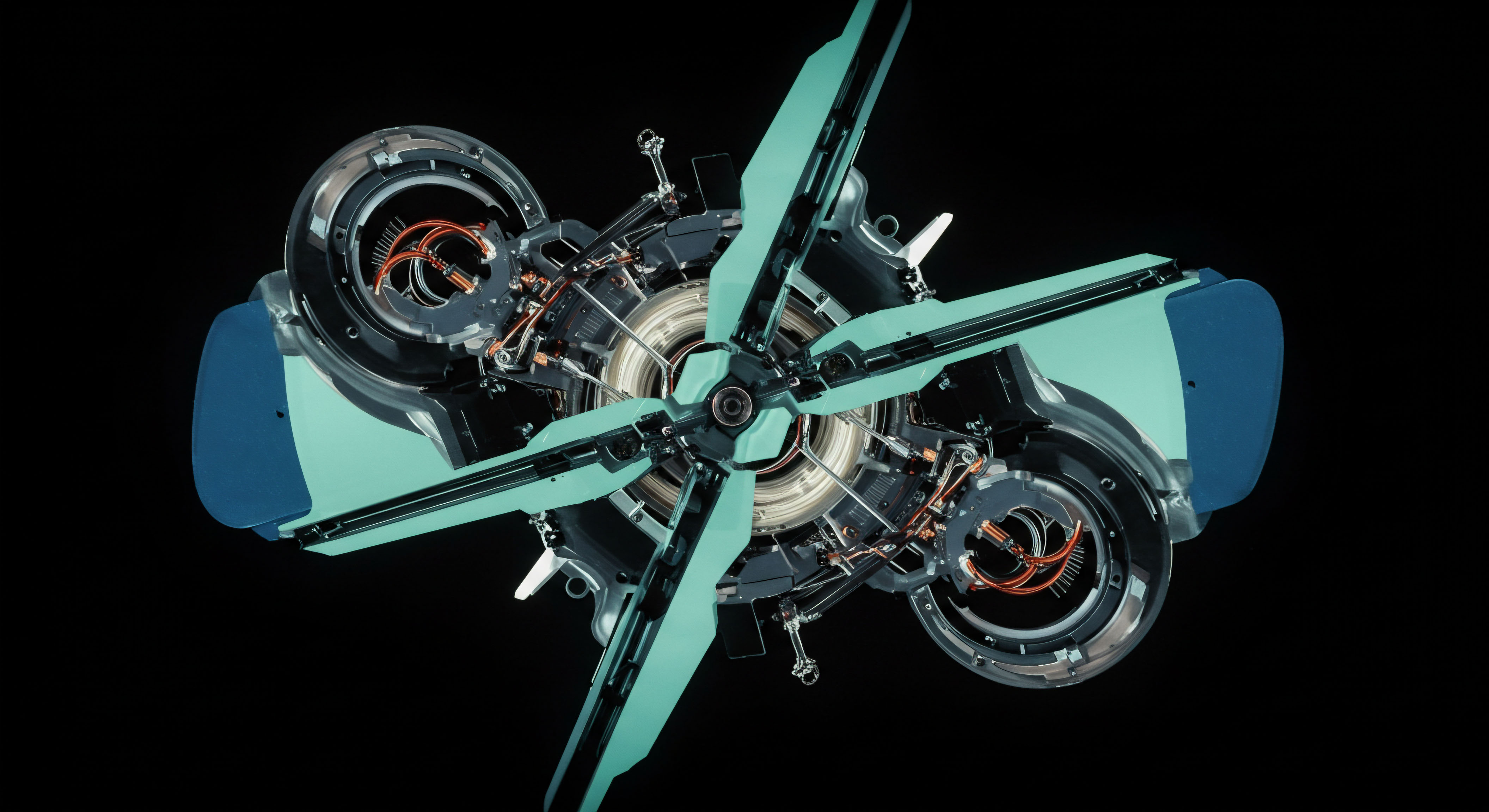

Managing Gamma Exposure at Scale

For traders managing large options portfolios, controlling Greek exposures ▴ particularly Delta and Gamma ▴ is a constant activity. As the underlying asset price moves, the portfolio’s directional risk can change rapidly. A common adjustment is to execute a risk reversal or a fence to flatten the portfolio’s delta. Executing these multi-leg structures in large, block sizes through an RFQ is the professional standard.

It allows a portfolio manager to neutralize unwanted risk exposure in a single, clean transaction without alerting the broader market. This is a level of risk management that is simply unattainable when executing leg by leg. The question then becomes one of optimizing liquidity sourcing. Is the on-screen order book deep enough for a standard hedge, or does the size and complexity of the required adjustment necessitate tapping into the anonymous, multi-dealer liquidity pool of an RFQ system to prevent information leakage and secure a competitive price?

The very existence of this choice is a function of a mature market structure, yet the strategic decision-making it enables is where a trader’s true edge is demonstrated. This is where the systems-level thinking of a portfolio manager becomes critical.

Anonymous Liquidity and Information Preservation

Executing large or complex options trades on a public order book is a form of information leakage. It signals your strategy and market view to all participants, including high-frequency traders who can trade against you. Legging into a large multi-leg position amplifies this problem, revealing your hand over an extended period. The RFQ process, particularly for block trades, offers a powerful solution.

By submitting your request to a select group of liquidity providers anonymously, you can source competitive pricing for your entire structure without revealing your intent to the public market. This preservation of information is a significant source of execution alpha. It prevents front-running and minimizes the market impact of your trade, ensuring your entry and exit prices more accurately reflect the true market value at the moment of your decision.

Execution Alpha Is a Deliberate Choice

The transition from speculative trading to systematic investing is defined by the deliberate control of variables. In the volatile domain of crypto derivatives, the greatest variable is often the chasm between a strategy’s design and its real-world execution. Eliminating legging risk through the disciplined use of atomic, multi-leg execution systems is the bridge across that chasm. It is a conscious decision to remove luck from the equation of implementation.

The tools that were once the exclusive domain of institutional trading desks are now accessible, offering a direct path to operational superiority. Adopting this methodology is an acknowledgment that how you trade is as important as what you trade. Price is a proposal. Execution is final.

Glossary

Underlying Asset

Legging Risk

Atomic Execution

Crypto Options Market

Liquidity Providers

Rfq Process

Rfq System

Options Market

Rfq

Volatility Trading

Order Book

Market Makers

Slippage

Deribit

Crypto Options

Eth Options

Execution Alpha