Commanding Liquidity on Your Terms

Executing large block trades introduces a fundamental challenge ▴ market impact. The very act of placing a significant order can move the market against your position before it is fully filled, leading to slippage and a degraded average price. A disciplined approach to sourcing liquidity is therefore the primary determinant of execution quality. Professional traders operate with a system designed to minimize this footprint, engaging with the market on their own terms.

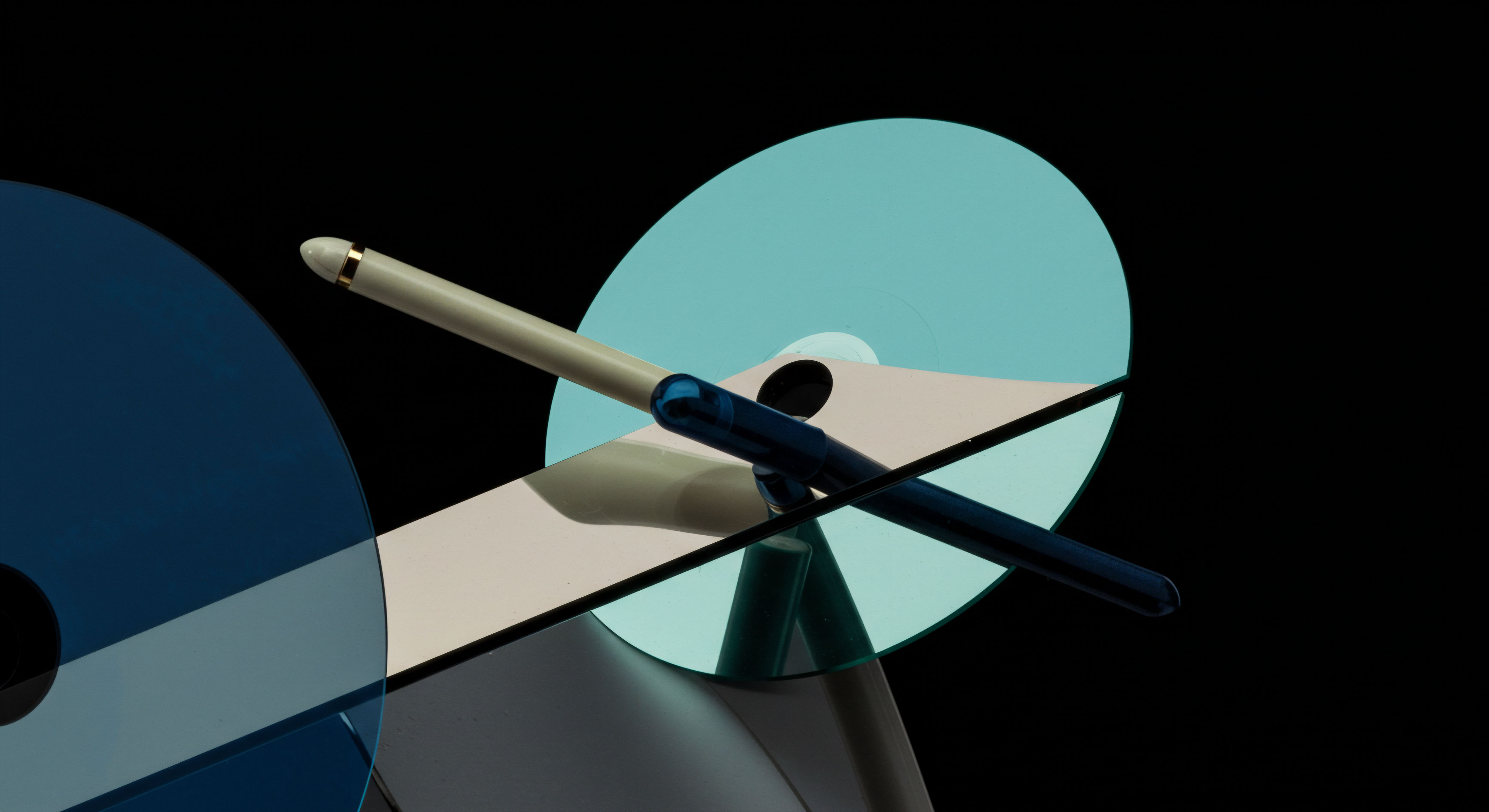

This system revolves around a process of controlled, private negotiation, which allows for the discovery of competitive pricing without broadcasting intent to the public order books. The Request for Quote (RFQ) mechanism is a cornerstone of this methodology.

An RFQ system functions as a private auction. A trader wishing to execute a large block sends a request to a select group of institutional liquidity providers. These providers confidentially respond with their best bid or offer for the specified size. The trader can then select the most favorable price, executing the entire block in a single, off-book transaction.

This process contains information leakage, a critical factor in preventing adverse price movements. By soliciting quotes from multiple competitive market makers simultaneously, the initiator of the RFQ creates a competitive environment that directly fosters price improvement over what might be available on a central limit order book (CLOB). It is a structural method for turning the challenge of liquidity fragmentation into a strategic advantage.

The operational framework extends beyond simple requests. It involves understanding the dynamics of quote-driven markets, where liquidity is provided by designated dealers who profit from the bid-ask spread. This structure is distinct from order-driven markets where all participants can post public bids and offers.

Mastering the RFQ process means building a strategic network of liquidity providers and understanding their behavior, ensuring that when you need to execute with size, you are accessing a deep, competitive, and private pool of capital ready to compete for your order flow. This proficiency transforms the act of trading from passive order placement to active liquidity management.

The Execution Quality Flywheel

Achieving superior pricing on block trades is a result of a systematic, repeatable process. It is an operational discipline built on strategic engagement with market structure. The objective is to move beyond the passive acceptance of screen prices and into a domain where you actively engineer better outcomes.

This involves leveraging RFQ platforms and algorithmic execution strategies to create a flywheel effect ▴ better data leads to better counterparty selection, which leads to more competitive quotes, resulting in superior execution that, in turn, provides cleaner data for future decisions. This process is not theoretical; it is a practical application of market microstructure principles to generate tangible alpha.

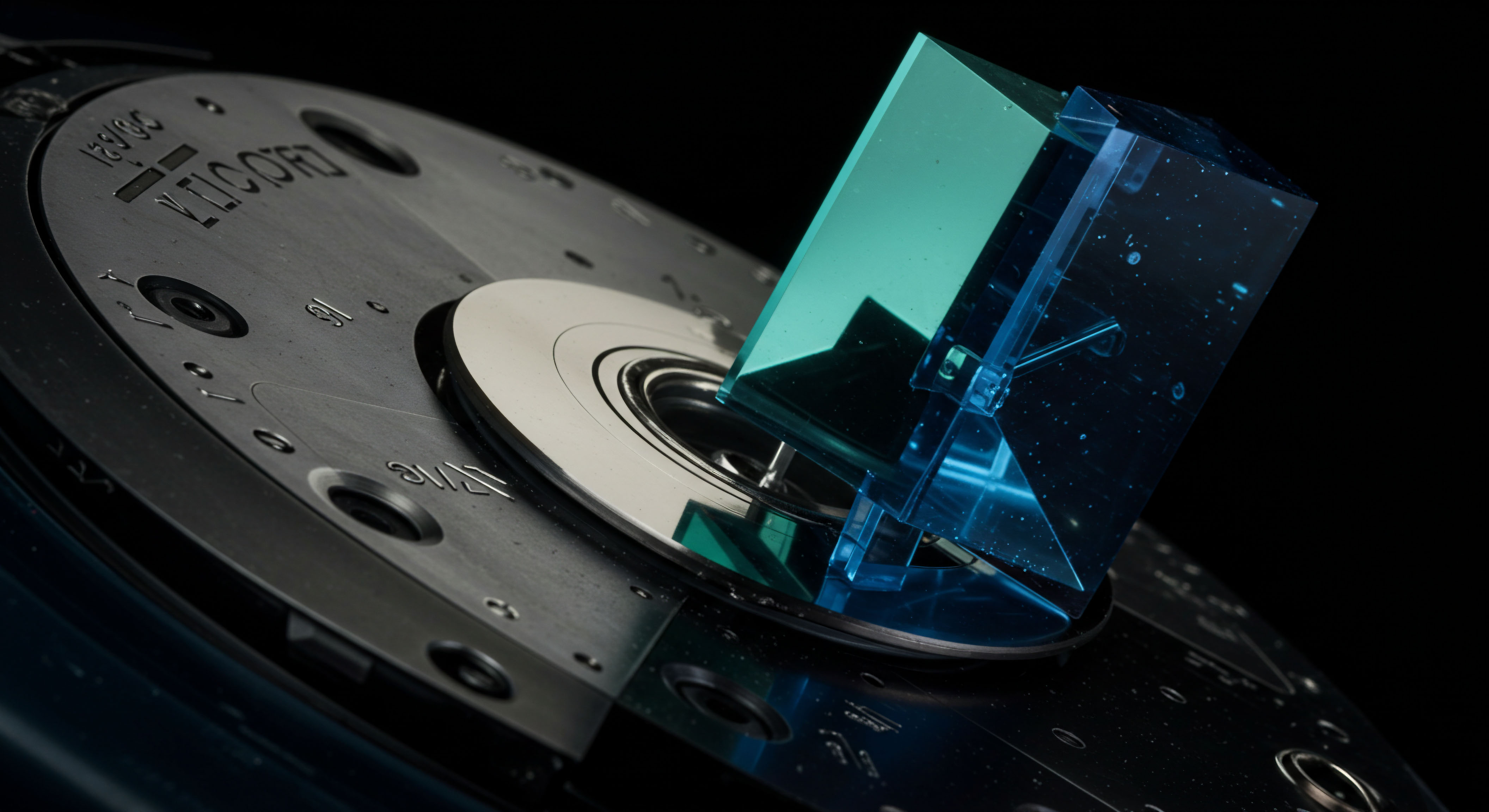

Calibrating the Anonymous RFQ for Volatility Events

During periods of high market volatility, public order books can become thin and erratic, making large executions particularly susceptible to slippage. An anonymous RFQ is the designated instrument for these conditions. Anonymity prevents market participants from pricing in the implicit distress or urgency of a large order, which could otherwise lead to predatory quoting. The strategy involves structuring the RFQ to maximize competition while minimizing information leakage.

A trader might, for instance, be looking to execute a large block of Bitcoin options to position for a significant price swing. The focus is on precision and control, ensuring the market reacts to the trade’s completion, not its anticipation.

Key Parameters for a Volatility Block Trade RFQ

The configuration of the RFQ is critical to its success. Each parameter must be set with intent, designed to elicit the best possible response from liquidity providers. This is a highly strategic process, balancing the need for competitive tension with the imperative of discretion. A poorly configured request can lead to suboptimal quotes or, worse, reveal too much about the trader’s intentions.

A well-configured request, however, commands the attention of top-tier market makers and extracts their sharpest prices. The process requires a deep understanding of both the asset being traded and the mechanics of the RFQ platform itself. This is where the trader’s skill directly translates into measurable price improvement. It is a domain of expertise that separates institutional operators from the rest of the market, where every basis point of improvement is a direct result of meticulous planning and a deep understanding of market dynamics.

This careful calibration is the very engine of price improvement, turning a standard market operation into a source of competitive advantage. The details are what define the outcome.

- Time-to-Quote (TTQ) ▴ A shorter TTQ, perhaps 30-60 seconds, creates urgency and forces liquidity providers to price aggressively based on current market conditions, preventing them from “waiting out” the request to see how the market moves.

- Number of Dealers ▴ Inviting a curated group of 5-7 dealers is often optimal. Fewer than this may not generate sufficient competition; more can sometimes dilute the perceived importance of the request, leading to less aggressive quoting from each participant.

- Anonymity Settings ▴ Full anonymity is non-negotiable. The dealers should only know that a request of a certain size has been initiated, without any information identifying the requesting firm. This prevents reputational pricing or pre-hedging against a known counterparty’s style.

- Minimum Quantity ▴ Specifying a minimum fill quantity ensures that the responses are for a meaningful size, preventing dealers from offering a competitive price on only a small fraction of the total block.

Systematic Execution with Algorithmic Slicing

For trades that are large but perhaps less urgent, or for assets with deeper continuous liquidity, algorithmic execution offers a complementary approach. Strategies like Volume-Weighted Average Price (VWAP) and Time-Weighted Average Price (TWAP) are designed to break a large parent order into smaller “child” orders. These child orders are then fed into the market over a specified period, minimizing the price impact of the overall transaction.

A VWAP algorithm, for example, will attempt to execute the order in line with the trading volume profile of the asset throughout the day, making the large order blend in with the natural flow of the market. This is a form of camouflage, hiding significant trading activity in plain sight.

In OTC markets, the flow of RFQs itself becomes a source of pricing information, allowing sophisticated models to derive a “micro-price” that reflects true liquidity imbalances even in the absence of a public order book.

The selection of the algorithm is a strategic decision based on the trader’s objective. A VWAP strategy is suitable when the goal is participation at the market’s average price. A TWAP strategy, which executes evenly over time, is useful when minimizing signaling risk is the highest priority.

More advanced Implementation Shortfall algorithms go a step further, dynamically adjusting their execution speed based on market conditions to minimize the deviation from the price at which the decision to trade was made. These tools automate the process of minimizing market impact, allowing traders to manage large positions with a high degree of precision and control.

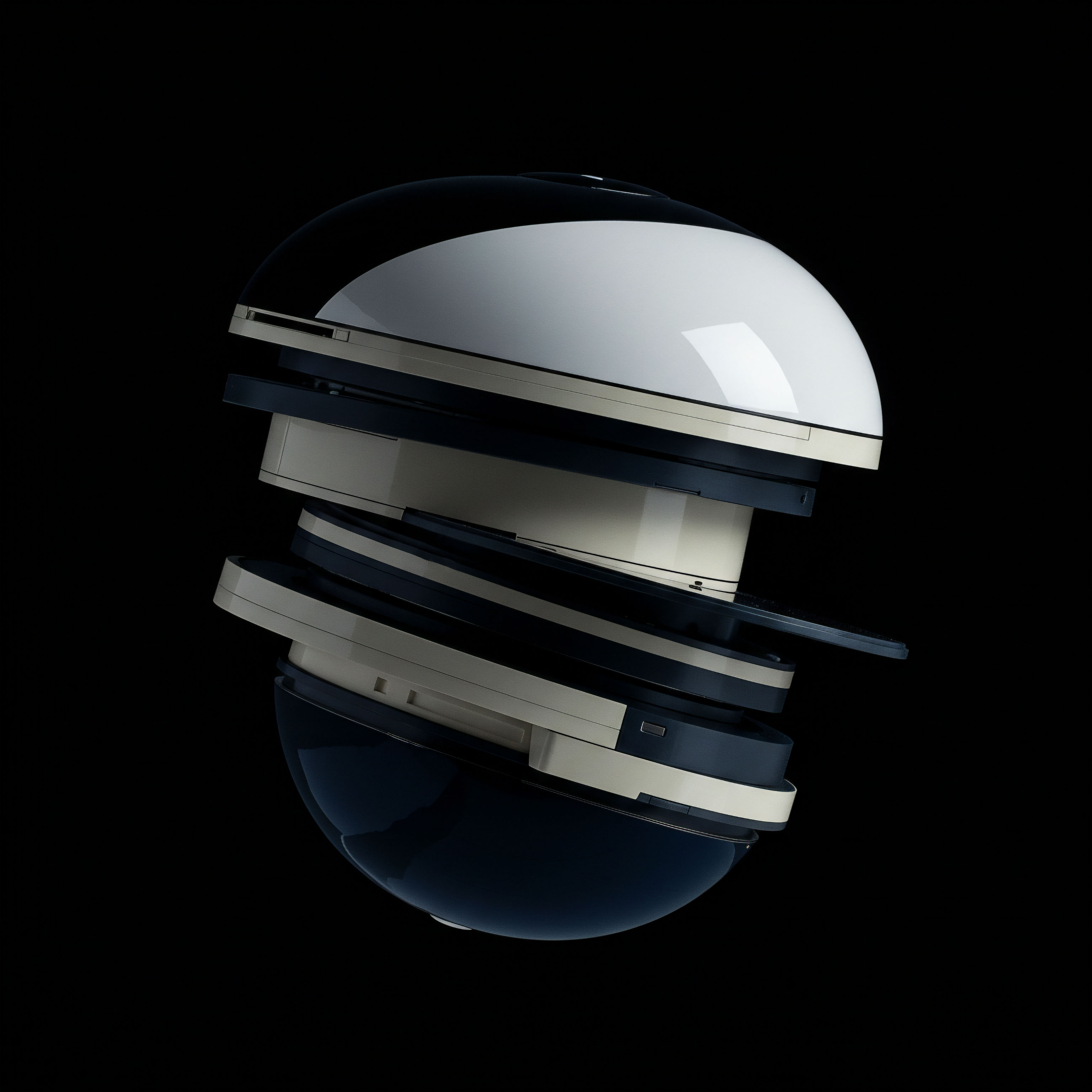

Engineering a Portfolio’s Liquidity Profile

Mastering block trade execution is a foundational skill that, when integrated into a broader portfolio management framework, becomes a significant and durable source of alpha. The focus shifts from the optimization of a single trade to the systematic enhancement of the entire portfolio’s cost basis. This involves developing an internal playbook for how different types of trades are executed under various market conditions.

A large, strategic reallocation is handled through a carefully managed RFQ process, while routine rebalancing might be automated via a TWAP algorithm. This programmatic approach to execution reduces emotional decision-making and institutionalizes best practices, ensuring that every transaction is designed to preserve capital and enhance returns.

Integrating RFQ Networks for Cross-Asset Arbitrage

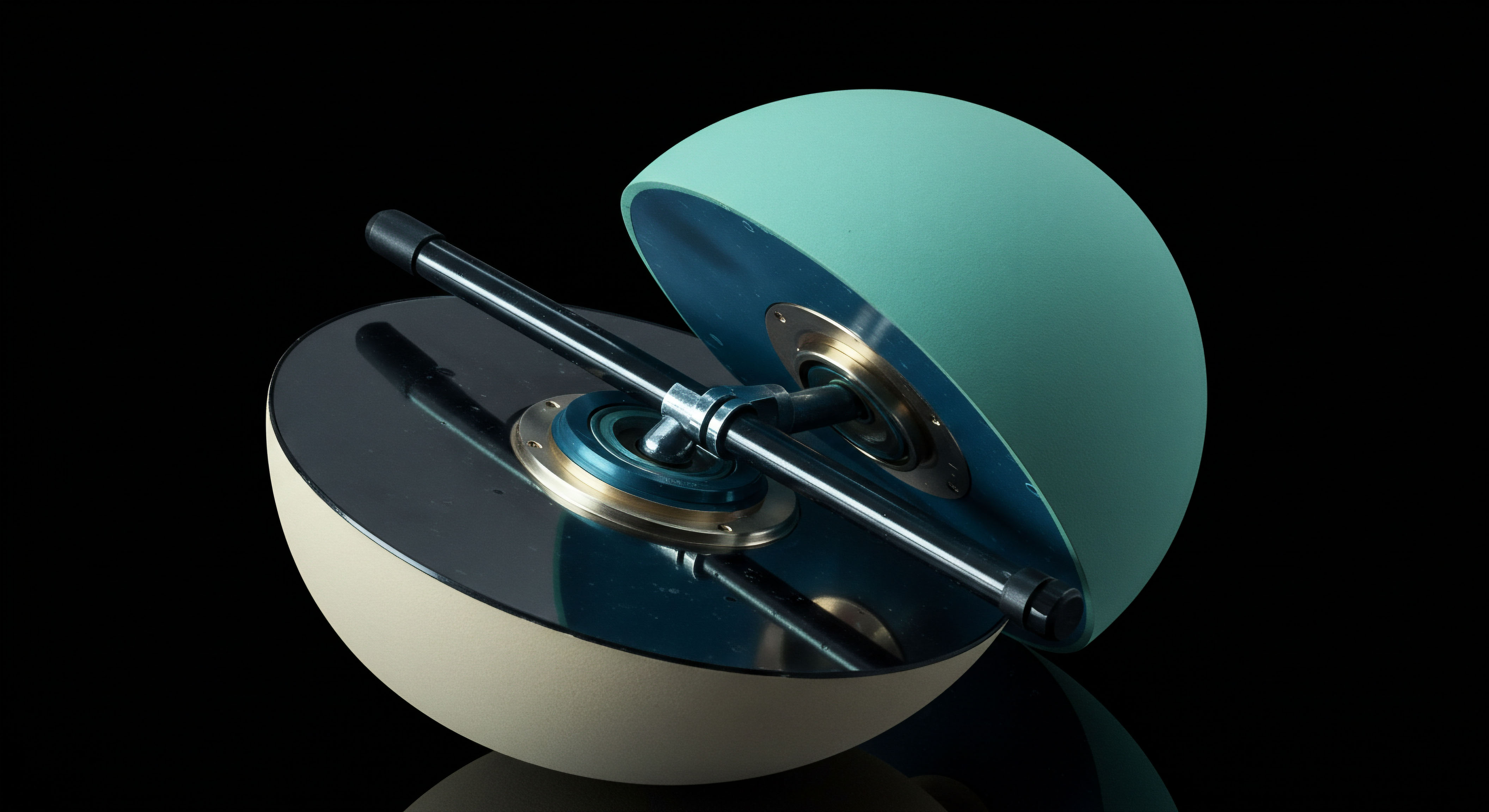

The true power of a mature execution framework is realized when it is applied to complex, multi-leg strategies. Consider a statistical arbitrage opportunity between a basket of crypto assets and their corresponding options. Executing this as four separate public trades would be inefficient and prone to significant slippage on each leg. A sophisticated trader, however, can use an RFQ platform that supports multi-leg orders to request a single price for the entire package.

This allows dealers to price the position as a net risk, often resulting in a much tighter spread than the sum of the individual legs. They can internalize some of the offsetting risks, a benefit they pass on in the form of a better price. This is the industrialization of arbitrage, turning complex market inefficiencies into a scalable source of returns through superior execution machinery.

The Future State Fusing CeFi and DeFi Liquidity

The continued fragmentation of liquidity across centralized (CeFi) and decentralized (DeFi) venues presents a persistent challenge. The forward-thinking strategist views this not as a barrier, but as an opportunity that can be solved with the right technology. The next frontier of execution mastery involves using a unified access point that can intelligently source liquidity from both ecosystems simultaneously. Imagine an RFQ that not only polls the top OTC desks but also queries the largest DeFi liquidity pools through a non-custodial settlement layer.

This creates a meta-market of liquidity, ensuring that a block trade is always routed to the venue or combination of venues offering the absolute best price, regardless of the underlying technology. Building this capability means constructing a resilient, future-proofed execution system that thrives on market structure evolution.

The Trader as System Designer

The journey toward consistent price improvement culminates in a shift in perspective. The objective evolves from simply executing trades to designing the very system through which those trades are executed. Every block transaction becomes a data point, refining the model and sharpening the edge for the next engagement. This is a proactive stance, one that treats market structure not as a given, but as a medium to be expertly navigated and shaped.

The principles of controlled liquidity access, competitive quoting, and minimized information leakage become the core components of a personal trading apparatus. This apparatus provides a persistent advantage, transforming the inherent friction of the market into a reliable source of superior performance.

Glossary

Average Price

Slippage

Request for Quote

Rfq

Liquidity Providers

Liquidity Fragmentation

Price Improvement

Market Microstructure

Bitcoin Options

Twap