Mastering Multi-Leg Spreads

Achieving consistent success in digital asset markets requires more than directional conviction; it demands operational excellence. Multi-leg crypto spreads represent a powerful class of instruments, enabling precise expression of market views concerning volatility, price trajectory, and hedging exposures. These structures allow for a sophisticated calibration of risk and reward, moving beyond the binary outcomes of simpler positions. Commanding these instruments, however, depends entirely on the quality of execution.

The inherent complexities of executing multi-leg strategies in fragmented crypto liquidity venues often erode the theoretical edge. Slippage, unfavorable fills, and information leakage diminish potential gains before a trade even establishes itself. Professional traders recognize the imperative for a robust execution mechanism, one that transcends the limitations of standard order books. Understanding the mechanics of such advanced systems becomes the initial step towards realizing superior trading outcomes.

Precision in multi-leg crypto spread execution transforms theoretical advantage into tangible market command.

Deploying Advanced Spreads

Translating strategic insight into profitable positions necessitates a disciplined approach to execution. Multi-leg crypto spreads, by their very nature, demand an integrated methodology for sourcing liquidity and managing order flow. This section outlines the practical deployment of professional-grade tools to secure an undeniable market edge.

Commanding Liquidity with RFQ

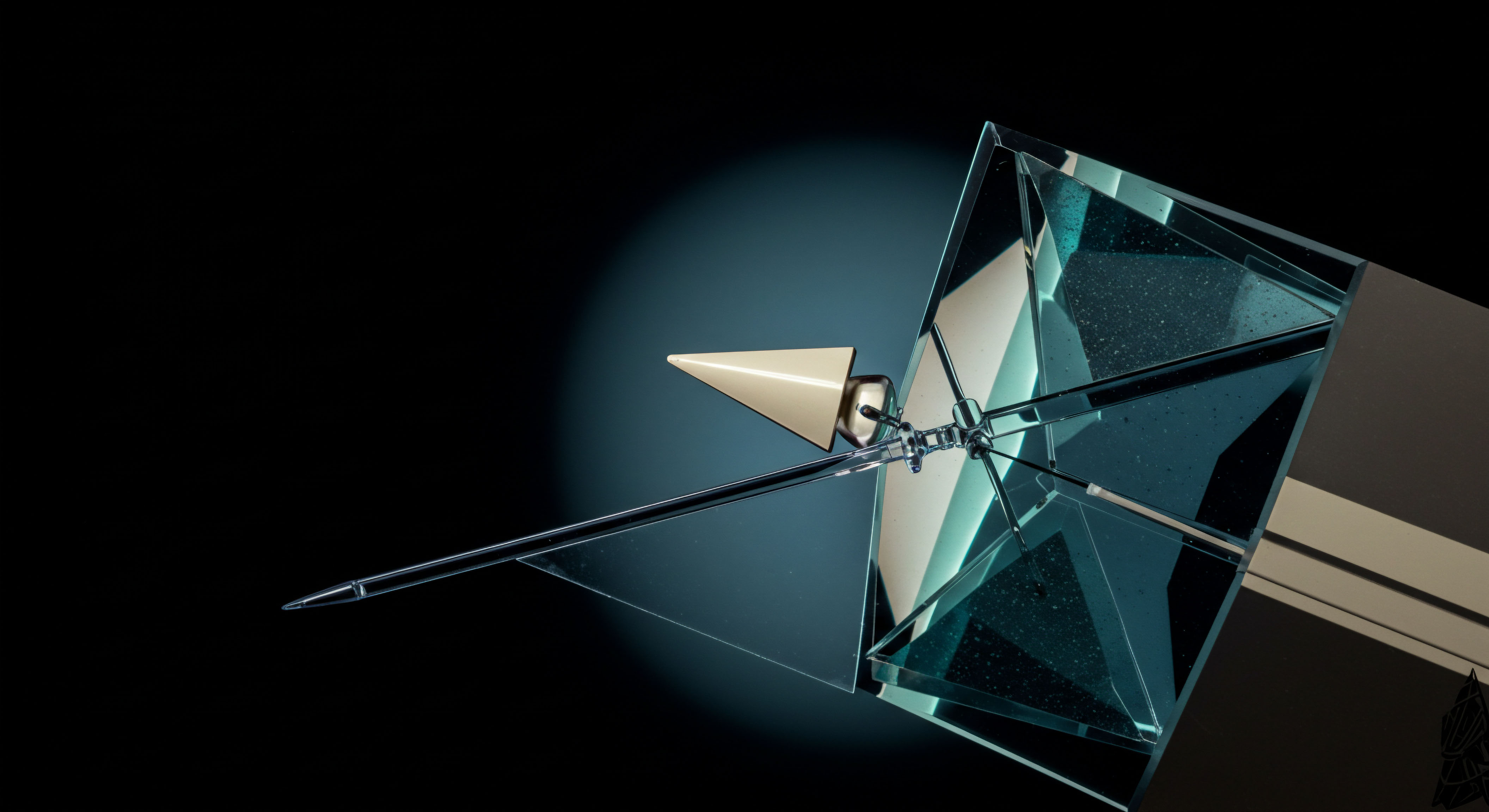

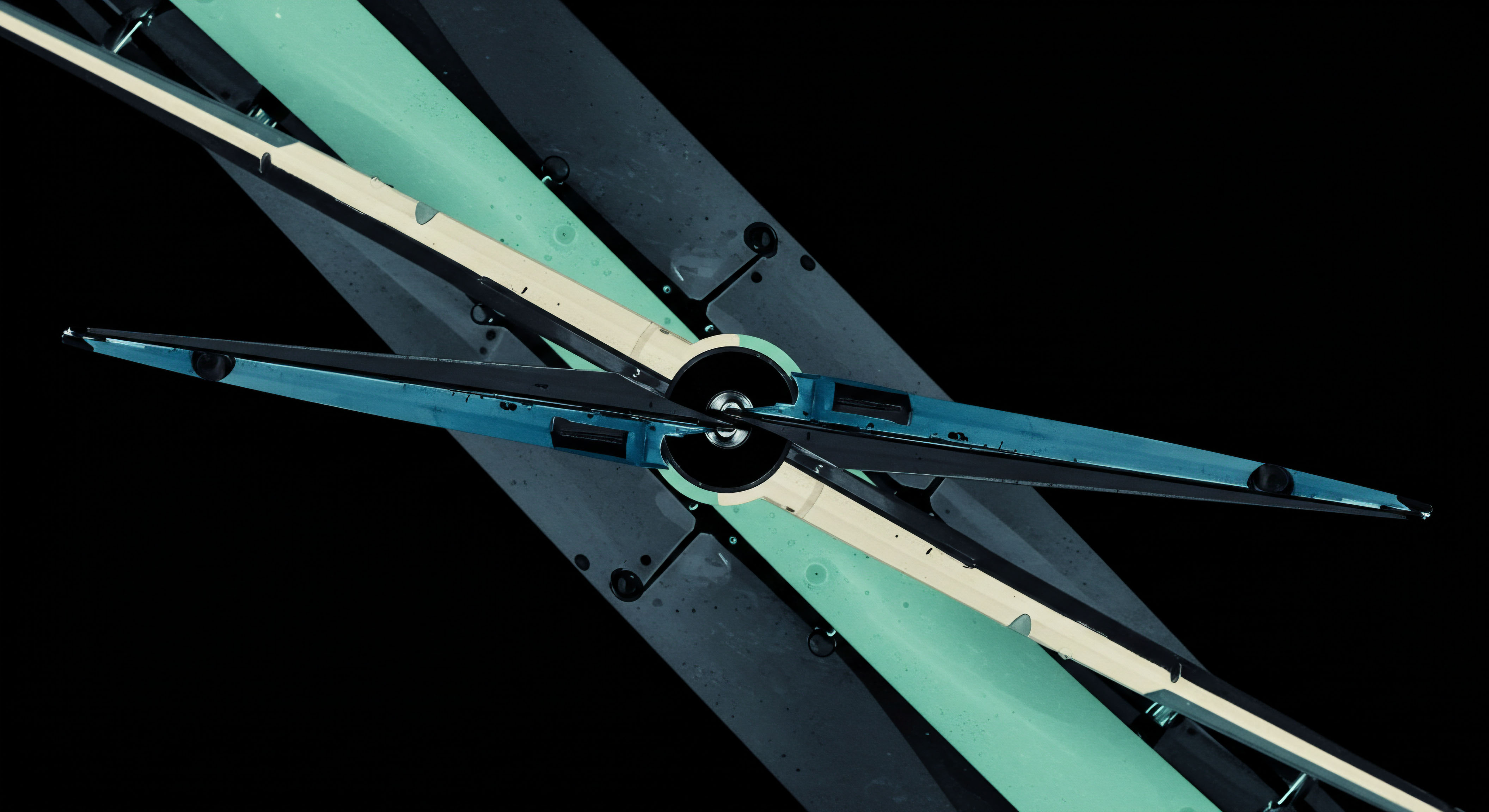

A Request for Quote (RFQ) system serves as the foundational element for superior multi-leg spread execution. This mechanism empowers traders to solicit competitive bids and offers from multiple liquidity providers simultaneously, all within a private, controlled environment. Employing RFQ ensures access to aggregated depth, which significantly improves pricing and fill rates for complex orders. This direct access to multi-dealer liquidity bypasses the challenges of public order books, allowing for the execution of large positions without telegraphing intent to the broader market.

The ability to compare prices from various counterparties in real-time provides an immediate advantage. Traders secure optimal pricing for each leg of a spread, which directly translates into a tighter overall spread cost. This operational efficiency becomes a consistent source of alpha, particularly when dealing with larger order sizes that would otherwise incur substantial price impact on traditional exchanges.

Strategic Block Trading for Scale

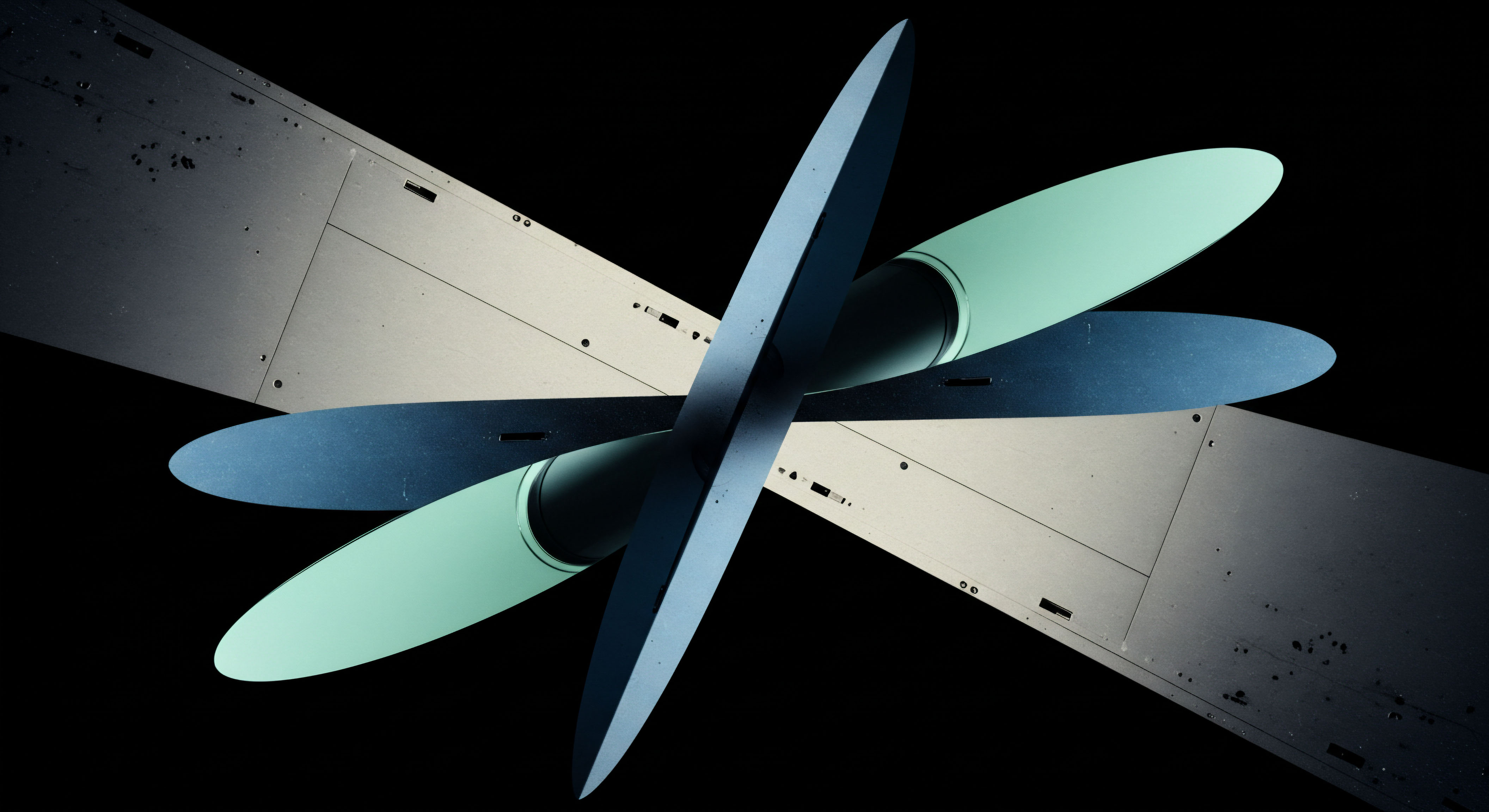

Block trading complements the RFQ mechanism, providing the means to execute substantial multi-leg orders discreetly. For positions exceeding typical exchange liquidity, block trades facilitate the transfer of significant risk between parties without disrupting market equilibrium. This approach is essential for institutional participants and sophisticated individuals managing larger portfolios. Executing a multi-leg spread as a single block minimizes the risk of adverse price movements between individual leg fills, ensuring the intended risk profile of the spread remains intact.

Consider the tactical advantage of transacting a large Bitcoin options straddle as a single block. This method locks in the precise implied volatility exposure across both calls and puts at a single price point, eliminating the execution risk inherent in leg-by-leg placement. Such precision becomes paramount when market conditions demand immediate, substantial positioning.

Structuring Common Multi-Leg Strategies

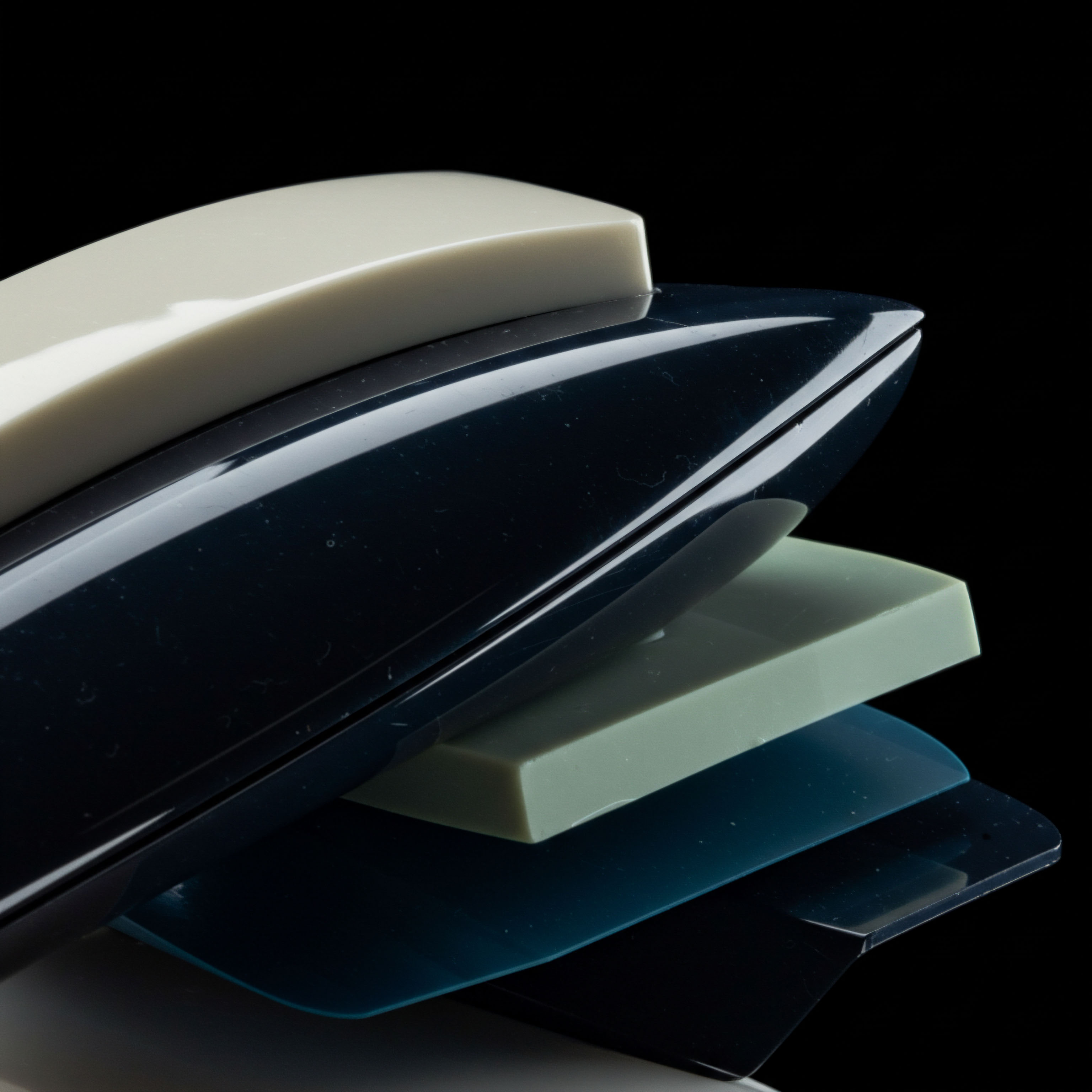

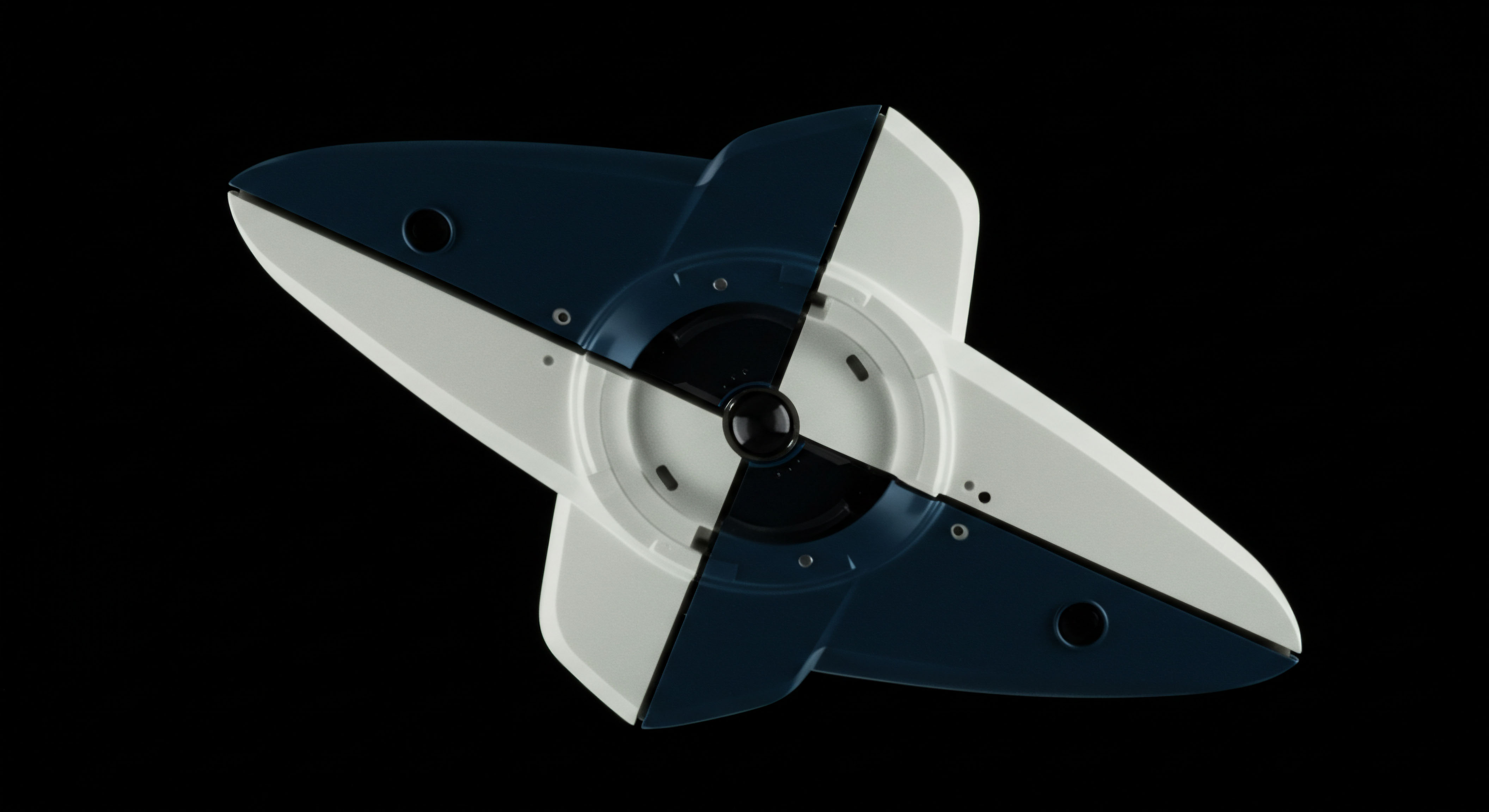

Constructing multi-leg spreads with professional tools ensures integrity from conception to completion. These strategies, ranging from simple covered calls to complex iron condors, derive their power from the specific relationships between their constituent options. The efficacy of these relationships hinges upon accurate and simultaneous execution.

- Straddles ▴ Implementing these volatility plays requires symmetric pricing for both the call and put. RFQ delivers competitive quotes for both legs, securing a fair market price for the combined position.

- Collars ▴ Hedging long asset positions with a collar demands a precise balance between the protective put and the income-generating call. Block trading a collar package ensures the entire hedge is established at a predetermined cost, protecting against adverse price shifts during execution.

- Iron Condors ▴ These income-generating strategies involve four distinct option legs. Executing them via RFQ ensures each leg is priced optimally, maintaining the desired risk-defined profile and maximizing potential credit received.

Operational discipline defines market mastery.

Strategic Portfolio Integration

The mastery of multi-leg crypto spreads extends beyond individual trade execution; it integrates into a holistic portfolio strategy, creating a resilient and alpha-generating framework. Advanced applications of these instruments demand a comprehensive understanding of their impact on overall portfolio risk and return characteristics. This is where the Derivatives Strategist truly separates from the crowd.

Risk Management Architectures

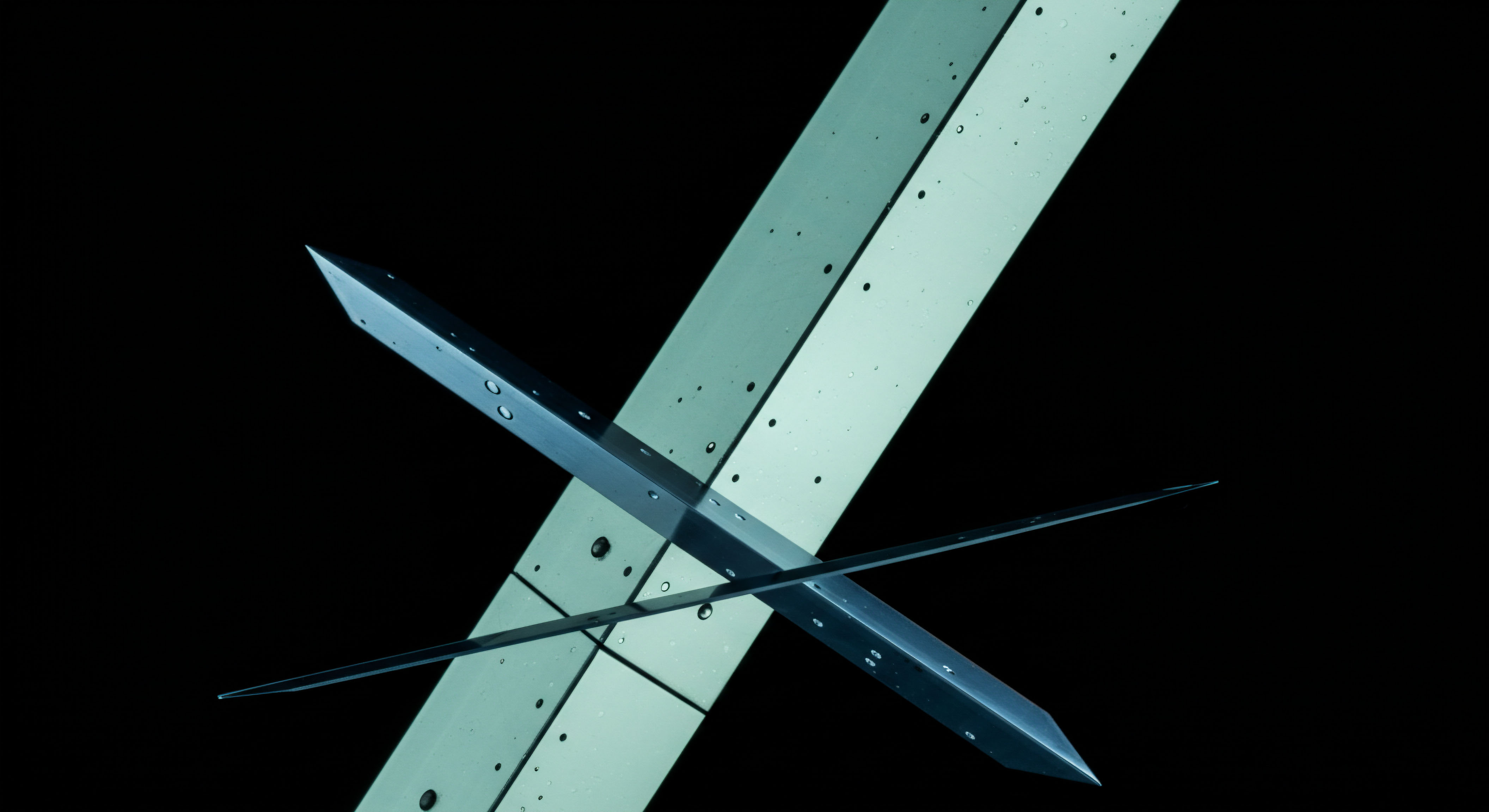

Deploying multi-leg spreads with professional execution mechanisms strengthens a portfolio’s risk management architecture. These structures, when executed with precision, offer defined risk parameters, allowing for granular control over potential losses and capital allocation. Employing RFQ and block trading for these complex positions means the actualized risk profile aligns directly with the intended strategic design. This systematic approach ensures capital efficiency, protecting against unforeseen market gyrations and allowing for strategic redeployment of resources.

The true challenge in market participation involves recognizing the limitations of one’s own models, especially when confronted with unforeseen volatility regimes or sudden shifts in liquidity. Maintaining a rigorous, adaptable framework for risk management, even as markets evolve, remains paramount.

Volatility Management and Alpha Generation

Multi-leg spreads, executed through advanced channels, transform volatility from a threat into a strategic asset. Traders gain the ability to express nuanced views on implied volatility, whether through selling premium in range-bound conditions or acquiring exposure during periods of anticipated expansion. This active management of volatility becomes a consistent source of alpha, adding another dimension to portfolio returns. Adapting these strategies to shifting market conditions requires constant calibration and a deep understanding of how various spreads react to changes in underlying asset price, time decay, and implied volatility.

Advanced multi-leg spread execution transforms market volatility into a structured alpha source.

The Future of Digital Asset Execution

The digital asset landscape continually evolves, yet the principles of superior execution endure. The drive towards more efficient, transparent, and robust trading mechanisms for derivatives continues unabated. Mastering multi-leg spreads today, through the lens of professional-grade execution, prepares traders for the opportunities of tomorrow. This forward-looking stance ensures a lasting market edge, positioning participants at the forefront of financial innovation.

The Unseen Edge

True market command arises from a fusion of strategic foresight and flawless execution. The meticulous structuring and precise deployment of multi-leg crypto spreads, facilitated by advanced trading systems, cultivates an enduring advantage. This systematic approach transforms speculative ventures into disciplined, high-probability endeavors, securing a demonstrable edge in volatile crypto markets.

Glossary

Multi-Leg Crypto Spreads

Multi-Leg Crypto

Multi-Dealer Liquidity