Execution Certainty Foundations

Navigating the crypto options landscape demands an uncompromising approach to pricing. The Request for Quote mechanism, often termed RFQ, provides a direct conduit to verifiable liquidity. This systemic tool empowers sophisticated participants to solicit simultaneous pricing from multiple liquidity providers. Such a competitive dynamic secures an optimal entry or exit point for significant options blocks.

Understanding this process means grasping a fundamental truth of market microstructure. Traditional order books, while effective for smaller sizes, introduce inherent slippage and information leakage when deploying larger positions. RFQ circumvents these frictions, offering a controlled environment for price discovery. It represents a professional-grade solution, architected for precision and capital efficiency in a volatile asset class.

Acquiring mastery over RFQ transforms a speculative venture into a calculated operation. It builds confidence, translating directly into superior outcomes for complex derivatives strategies. This foundational understanding equips a trader with the essential knowledge to command market liquidity, ensuring their strategic intent translates into realized financial advantage.

RFQ provides a direct conduit to verifiable liquidity, securing optimal entry or exit points for significant options blocks.

Strategic Deployment of Options RFQ

Implementing RFQ in crypto options trading demands a disciplined framework, focusing on quantifiable edge. This section outlines actionable strategies for deploying the mechanism, translating theoretical knowledge into tangible investment results.

Block Trading Precision

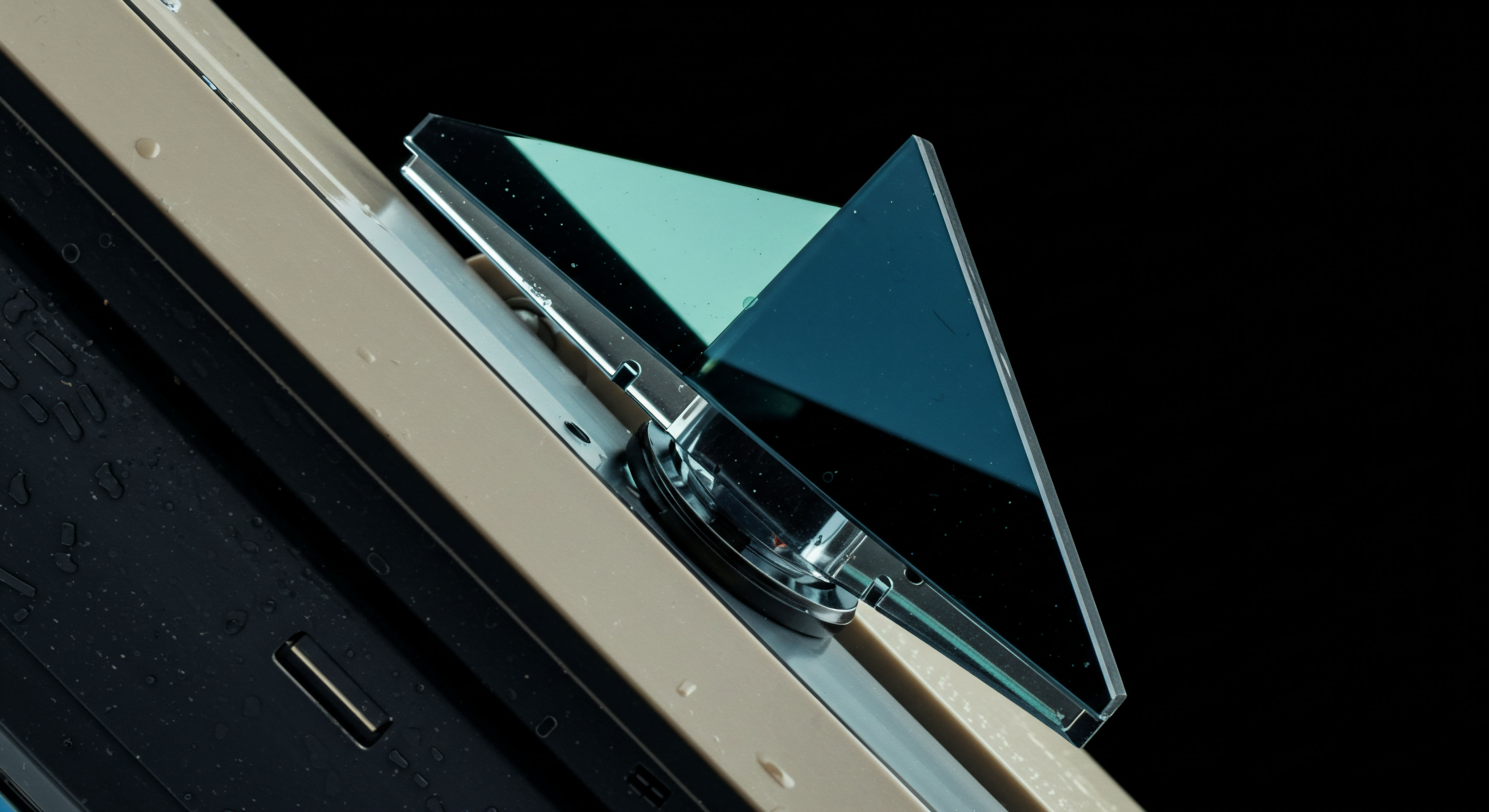

Executing substantial options positions requires a method that preserves price integrity. Block trading through RFQ ensures that large orders do not distort the prevailing market. A participant broadcasts their desired options contract and size to a select group of liquidity providers.

These providers then compete, offering their firm prices for the entire block. This competition drives tighter spreads and minimizes the price impact associated with large orders, directly impacting the overall profitability of a position.

Multi-Leg Strategy Optimization

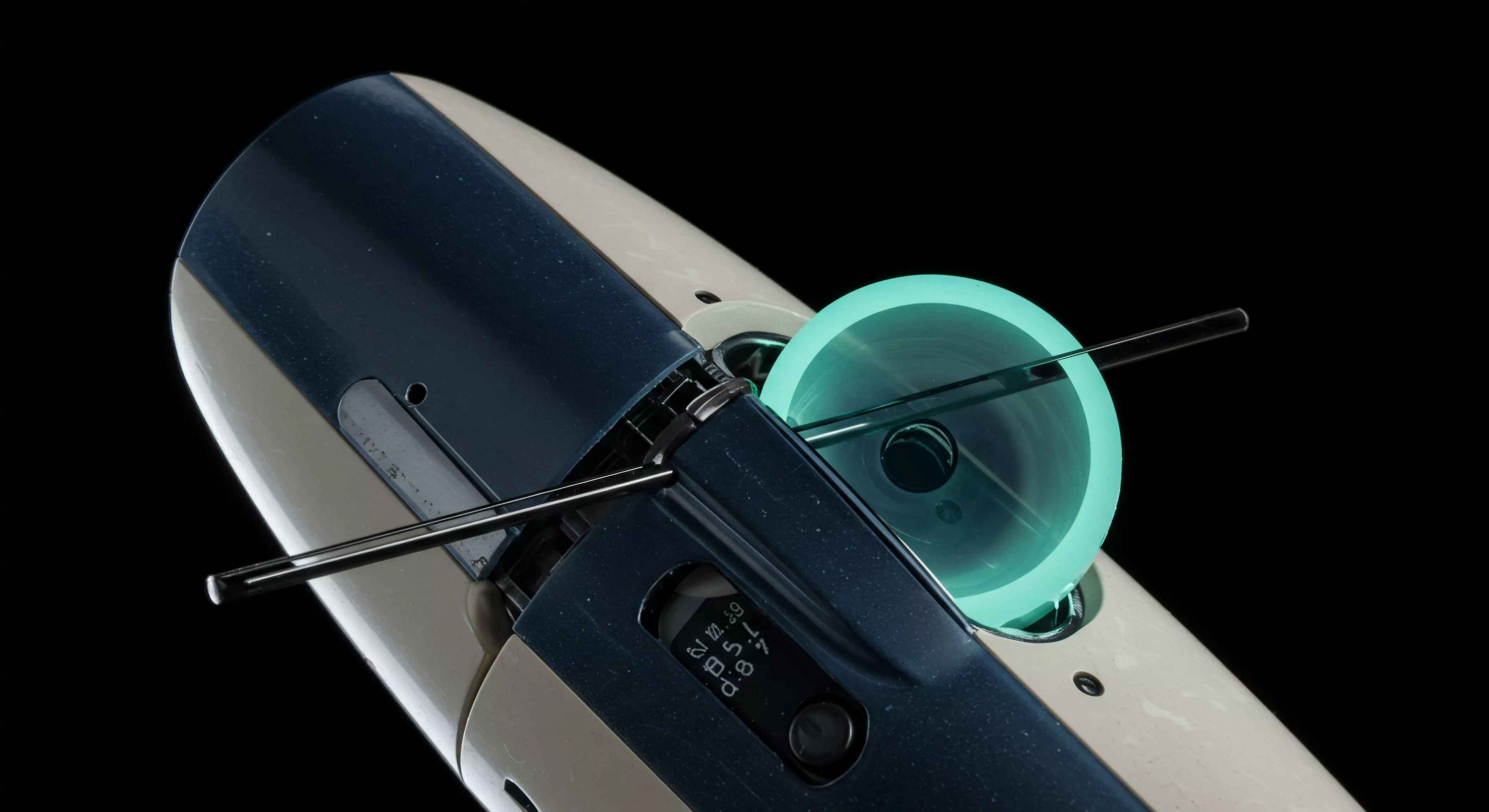

Complex options structures, such as straddles, collars, or butterflies, demand precise simultaneous execution of multiple legs. RFQ excels in this domain. Instead of executing each leg individually, risking adverse price movements between fills, a trader can request a single quote for the entire multi-leg combination. This ensures the intended risk-reward profile of the strategy remains intact, eliminating basis risk across constituent options.

Consider the practical applications:

- BTC Straddle Blocks ▴ Simultaneously acquiring a call and a put with the same strike and expiration to capitalize on anticipated volatility movements, while neutralizing directional bias. RFQ secures a consolidated price for both legs, preserving the volatility play’s integrity.

- ETH Collar RFQ ▴ Hedging an existing ETH holding by selling an out-of-the-money call and buying an out-of-the-money put. The RFQ process ensures the premium received for the call and the cost of the put are optimally balanced, establishing a clear risk fence around the underlying asset.

- Volatility Block Trades ▴ Directly trading implied volatility via combinations of options. RFQ facilitates the efficient execution of these sophisticated positions, ensuring the desired volatility exposure is acquired at a competitive composite price.

Minimizing Slippage and Transaction Costs

Slippage represents an often-overlooked erosion of capital. RFQ directly counters this by forcing liquidity providers to offer their firmest prices upfront for a specified quantity. This competitive dynamic inherently drives down transaction costs. Traders gain a clear understanding of their execution price before commitment, a significant advantage over market orders in less liquid environments.

RFQ directly counters slippage by forcing liquidity providers to offer firm prices upfront, driving down transaction costs.

Advanced Applications and Strategic Mastery

Transcending basic execution, the true power of RFQ lies in its integration into a comprehensive portfolio management framework. This section explores sophisticated applications, positioning the mechanism as a cornerstone for sustained alpha generation and advanced risk calibration.

Systematic Alpha Generation

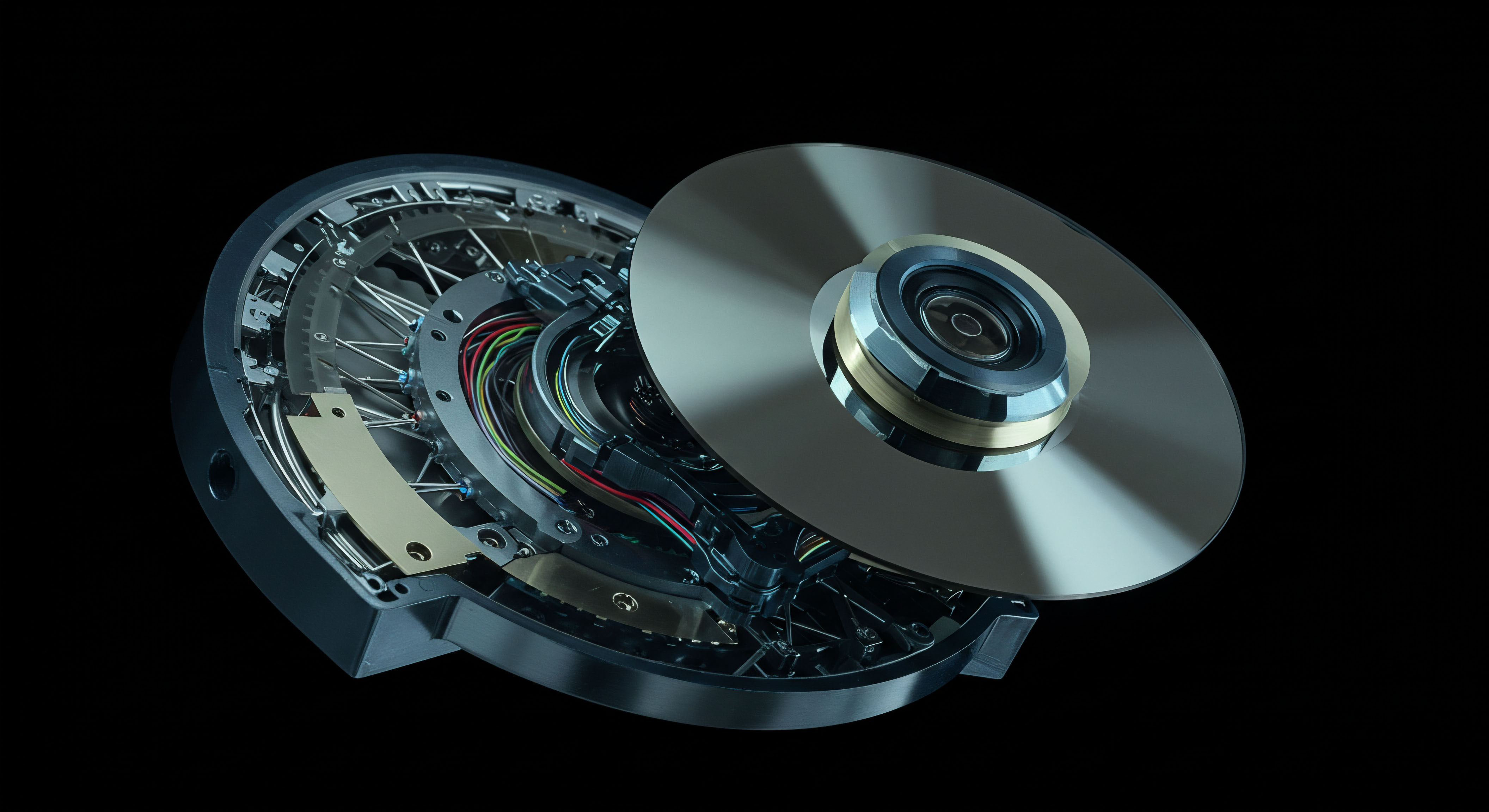

Integrating RFQ into algorithmic trading frameworks unlocks systematic alpha opportunities. Quantitative strategies designed to capture specific market inefficiencies, such as relative value discrepancies or volatility arbitrage, demand highly precise execution. RFQ provides the necessary infrastructure to execute these complex trades at scale, ensuring the theoretical edge translates into realized profits.

This requires a deep understanding of market microstructure and the ability to model liquidity dynamics across various crypto options. The efficacy of these systems hinges upon consistent, low-slippage execution.

Portfolio Hedging with Precision

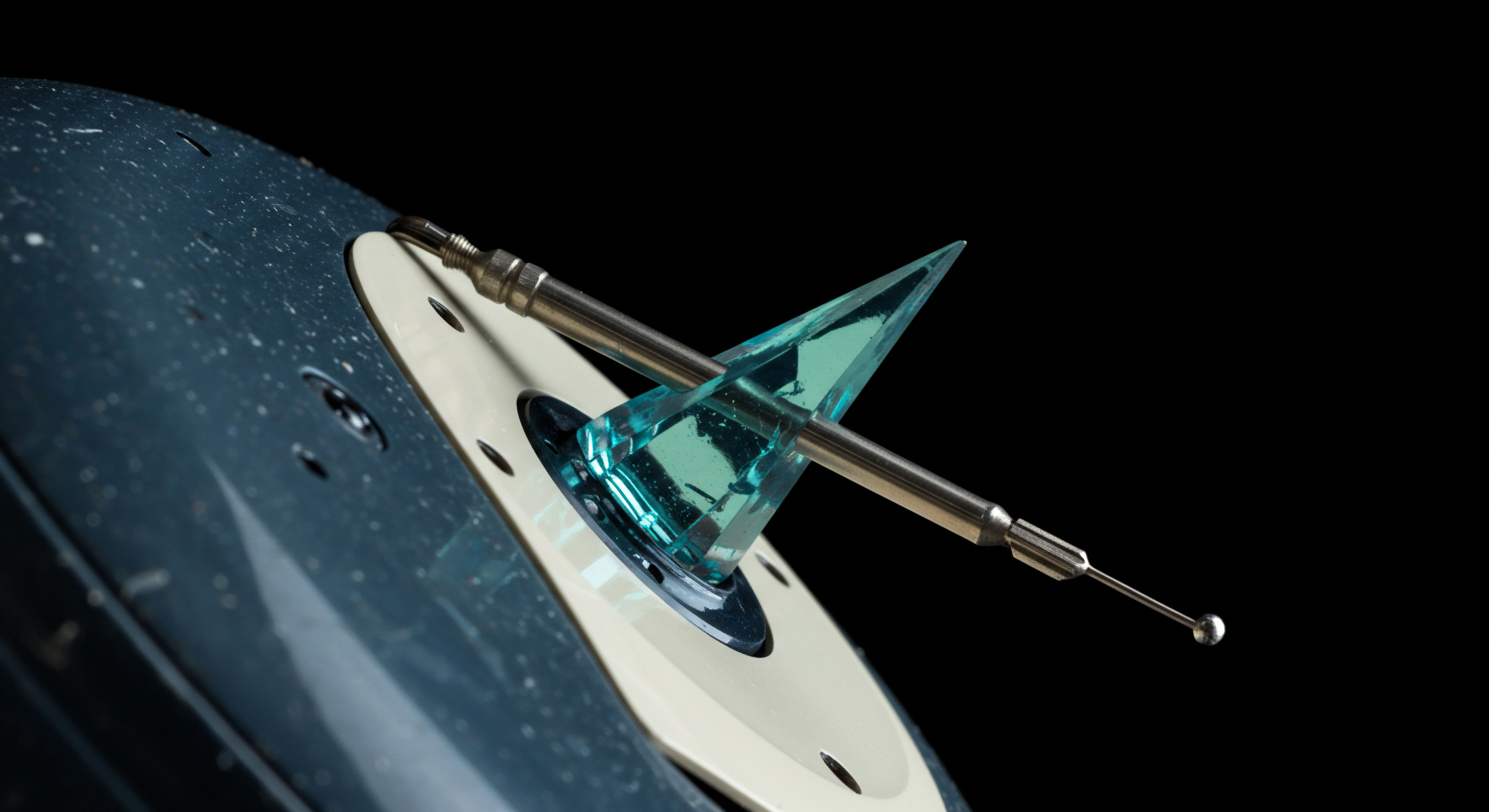

Managing a diversified crypto portfolio necessitates robust hedging capabilities. RFQ allows for the precise execution of large-scale hedges, mitigating downside risk without incurring excessive transaction costs. Imagine a scenario where a portfolio manager seeks to protect a substantial Bitcoin holding against a potential market downturn.

Deploying a series of protective puts via RFQ ensures that the desired level of insurance is acquired at the most competitive price, preserving portfolio value during periods of heightened uncertainty. This approach represents a deliberate engineering of portfolio resilience.

This level of precision in hedging, especially for substantial positions, presents a complex challenge. One grapples with the interplay of implied volatility surfaces, term structures, and the discrete nature of available strikes and expirations. Optimal execution here demands a continuous feedback loop between market conditions and the RFQ submission parameters.

The Architecture of Market Edge

Mastering RFQ is akin to developing a proprietary market edge. It moves a trader beyond reactive engagement with order books, enabling a proactive stance in liquidity sourcing. This strategic command over execution pathways transforms the trading process into a deliberate, engineered outcome.

It ensures that capital is deployed with maximum efficiency, aligning every trade with the overarching strategic objectives of the portfolio. The ability to anonymously source liquidity for large block trades also prevents front-running, preserving the integrity of a trading strategy.

Commanding Your Market Destiny

The pursuit of price certainty in crypto options defines a trader’s strategic acumen. It represents a commitment to precision, a dedication to leveraging the most effective tools available. This journey culminates in a profound understanding of market mechanics, allowing for the deliberate shaping of execution outcomes. Embracing this approach empowers participants to navigate volatility with unwavering confidence, transforming ambition into tangible results.

Glossary

Crypto Options

Options Trading

Block Trading

Btc Straddle