Execution Command for Spreads

Achieving superior execution in multi-leg options spreads represents a distinct competitive advantage for traders. This involves leveraging a Request for Quote (RFQ) system, a powerful mechanism for orchestrating liquidity in derivatives markets. An RFQ initiates a competitive bidding process among multiple liquidity providers, compelling them to submit their best prices for a specific multi-leg options strategy. This structured approach directly addresses the challenge of securing optimal pricing for complex trades, which often suffer from fragmented liquidity across disparate venues.

The RFQ mechanism centralizes demand, attracting concentrated liquidity to a single point of interaction. Traders gain a clear view of available pricing, fostering an environment where tighter spreads and enhanced fills become standard. Understanding the operational dynamics of an RFQ empowers participants to move beyond passive order placement, actively shaping their execution outcomes. This professional-grade tool transforms the pursuit of favorable pricing into a systematic, repeatable process.

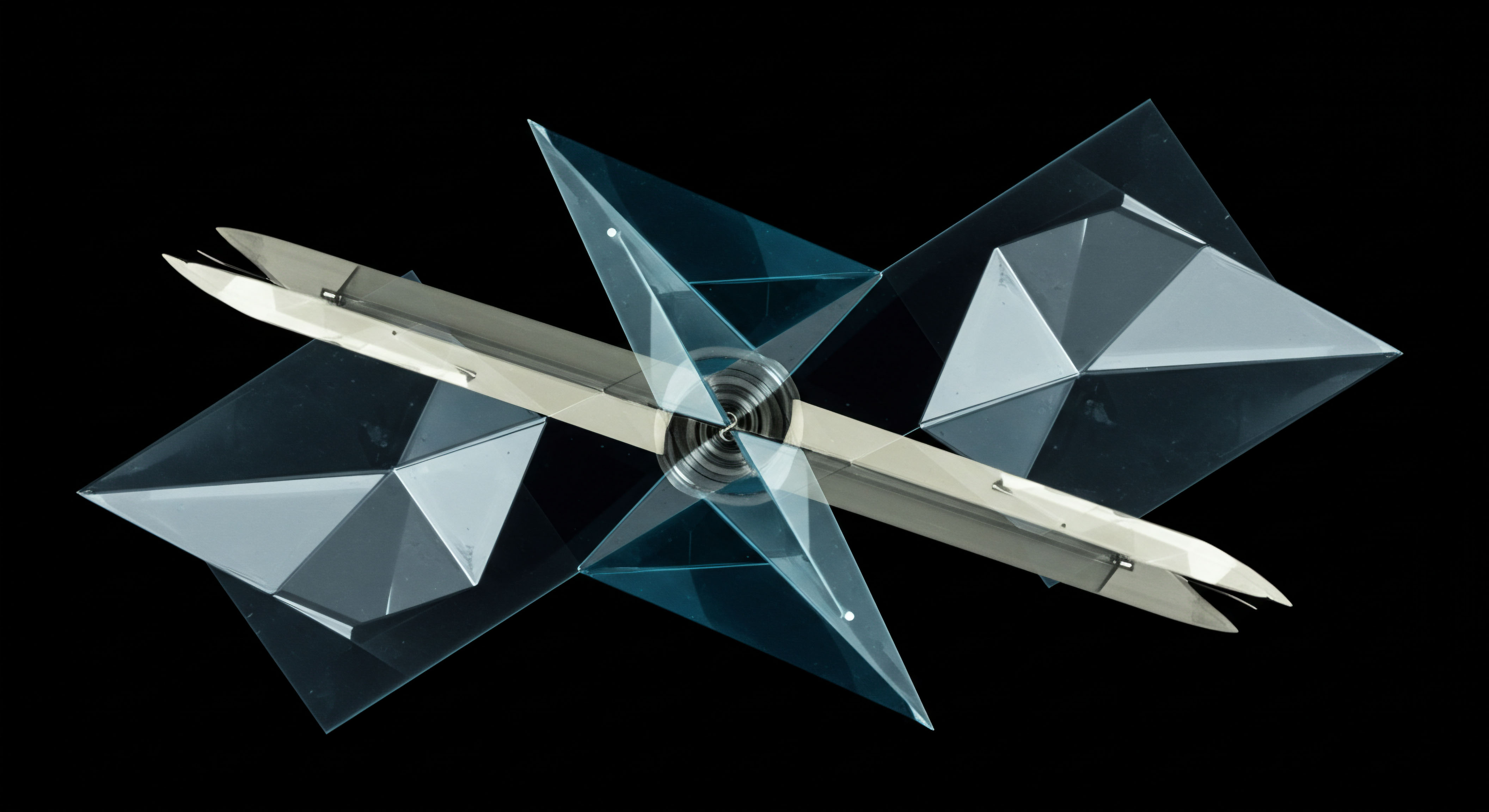

An RFQ transforms multi-leg options execution into a strategic advantage, centralizing liquidity for optimal pricing.

Mastering this initial phase establishes the groundwork for consistently capturing value. It introduces a disciplined methodology for engaging the market on advantageous terms, providing a tangible edge in complex derivatives trading. Traders learn to command the flow of bids and offers, ensuring their multi-leg positions are initiated with precision and efficiency.

Deploying Spread Strategies

Deploying multi-leg options spreads through an RFQ demands a clear strategic blueprint and unwavering execution discipline. This section details actionable frameworks for securing price improvement across common spread structures, emphasizing the measurable impact on your portfolio’s performance. The objective centers on transforming theoretical market views into quantifiable trading alpha.

Iron Condor Optimization

Iron condors, often employed for capturing range-bound market expectations, require precise entry pricing to maximize their probability of profit. Initiating these trades via RFQ allows a trader to solicit bids for the entire four-leg structure simultaneously. This ensures the component legs are priced cohesively, mitigating the slippage that often arises from executing each leg individually. The aggregate price received through RFQ reflects a true market consensus for the spread, eliminating adverse selection.

Consider the scenario of establishing an iron condor where each wing carries a specific risk profile. A unified RFQ approach secures a single, composite premium, optimizing the initial credit received. This systematic aggregation of liquidity yields tighter overall spreads for the complex structure.

Butterfly Spread Precision

Butterfly spreads, designed to profit from low volatility or specific price targets, possess a sensitive delta and gamma profile. Small deviations in individual leg pricing can significantly distort the intended risk-reward. An RFQ for a butterfly spread ensures that the three legs ▴ typically two out-of-the-money options and one at-the-money option ▴ are executed as a single unit. This unified execution prevents price degradation between legs, preserving the integrity of the strategy’s P&L.

- Identify the target price range and expiration for the butterfly.

- Calculate the desired net debit or credit for the entire spread.

- Submit a precise RFQ for the three-leg structure, specifying quantities and strike prices.

- Evaluate competitive bids from liquidity providers, selecting the offer that yields the most favorable net pricing.

- Confirm the execution, ensuring the entire spread is filled at the optimized price.

Calendar Spread Enhancement

Calendar spreads capitalize on time decay differentials between options of different expirations but the same strike. Executing these spreads requires meticulous attention to the relative pricing of the near-term and far-term options. An RFQ streamlines this process, allowing for simultaneous bidding on both legs.

This prevents the execution of one leg at a disadvantageous price while awaiting a fill on the other. Price improvement in calendar spreads directly translates into a wider profit window, bolstering the strategy’s overall efficacy.

The disciplined application of RFQ in these scenarios consistently improves execution quality. Traders systematically reduce transaction costs and enhance the net premium captured or paid for complex strategies. This method fosters a measurable uplift in trading outcomes.

Advanced Execution Mastery

Achieving advanced execution mastery with RFQ extends beyond individual trade optimization; it integrates into a broader framework of portfolio management and risk mitigation. This involves a strategic perspective on how superior execution contributes to long-term alpha generation and robust capital deployment. The focus shifts toward leveraging RFQ as a systemic component of a high-performance trading operation.

Portfolio Hedging with Precision

Integrating RFQ into portfolio hedging strategies offers a potent mechanism for reducing systemic risk exposures. When deploying complex hedges ▴ such as synthetic long or short positions constructed from options, or multi-leg protective structures ▴ an RFQ ensures these positions are established at the most competitive aggregate price. This precision in hedging minimizes the drag on portfolio returns often associated with less efficient execution methods. The capacity to secure tight pricing for large, complex hedges protects capital with enhanced efficiency.

Volatility Surface Management

Managing a portfolio’s exposure to volatility requires the dynamic adjustment of options positions across various strikes and expirations. RFQ becomes an indispensable tool for rebalancing these volatility exposures. A trader can initiate an RFQ for a complex package of options designed to flatten or steepen a particular segment of the volatility surface. This coordinated execution secures a composite price that accurately reflects the desired adjustment, preventing distortions that fragmented liquidity might otherwise introduce.

The ability to execute these intricate adjustments efficiently allows for more agile responses to shifting market dynamics. This ensures a portfolio’s volatility profile remains aligned with the prevailing market view, contributing to sustained performance.

The pursuit of excellence in execution becomes a continuous process of refinement. Each successful RFQ transaction reinforces a deeper understanding of market microstructure and the nuanced interplay of liquidity. This iterative learning cycle solidifies a trader’s position as a master of their craft, consistently extracting value where others perceive only friction.

Commanding Market Flow

The path to commanding market flow in derivatives trading is paved with systematic precision and an unyielding commitment to execution excellence. Leveraging RFQ for multi-leg spreads transforms a transactional act into a strategic advantage, redefining the very nature of price discovery. This systematic approach allows traders to transcend the limitations of conventional order books, shaping liquidity on their own terms. The market, in turn, reveals its most favorable contours, ready for those equipped with the right tools and the resolve to deploy them.

Glossary

Price Improvement

Iron Condor

Butterfly Spread

Portfolio Hedging

Volatility Surface