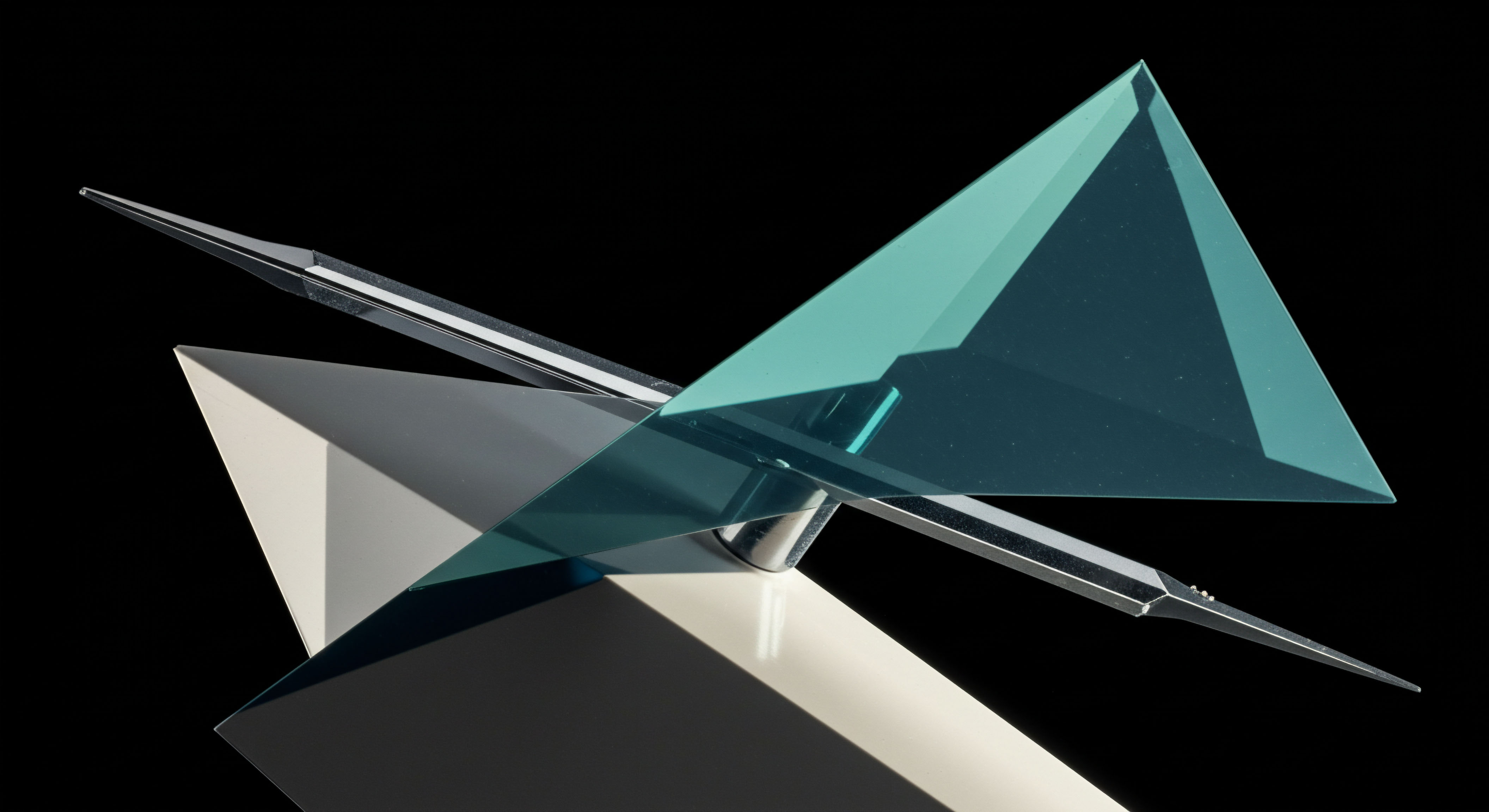

Execution Control Point

Market leadership necessitates exceptional execution quality. Astute traders recognize that superior outcomes arise from a deliberate mastery of liquidity, moving beyond passive acceptance of prevailing market prices. A Request for Quote (RFQ) system opens a direct channel to varied liquidity sources, granting participants the ability to solicit firm bids and offers for specified trade sizes and derivative configurations.

This direct interaction reconfigures the trading environment. It equips participants with the means to navigate disparate order books, securing advantageous pricing for large transactions and intricate options setups. The mechanism clears a path to minimize price impact, a constant consideration for substantial order flow. It develops a measurable advantage, contributing directly to improved portfolio performance.

RFQ engagement yields advantageous pricing for complex derivatives and block trades.

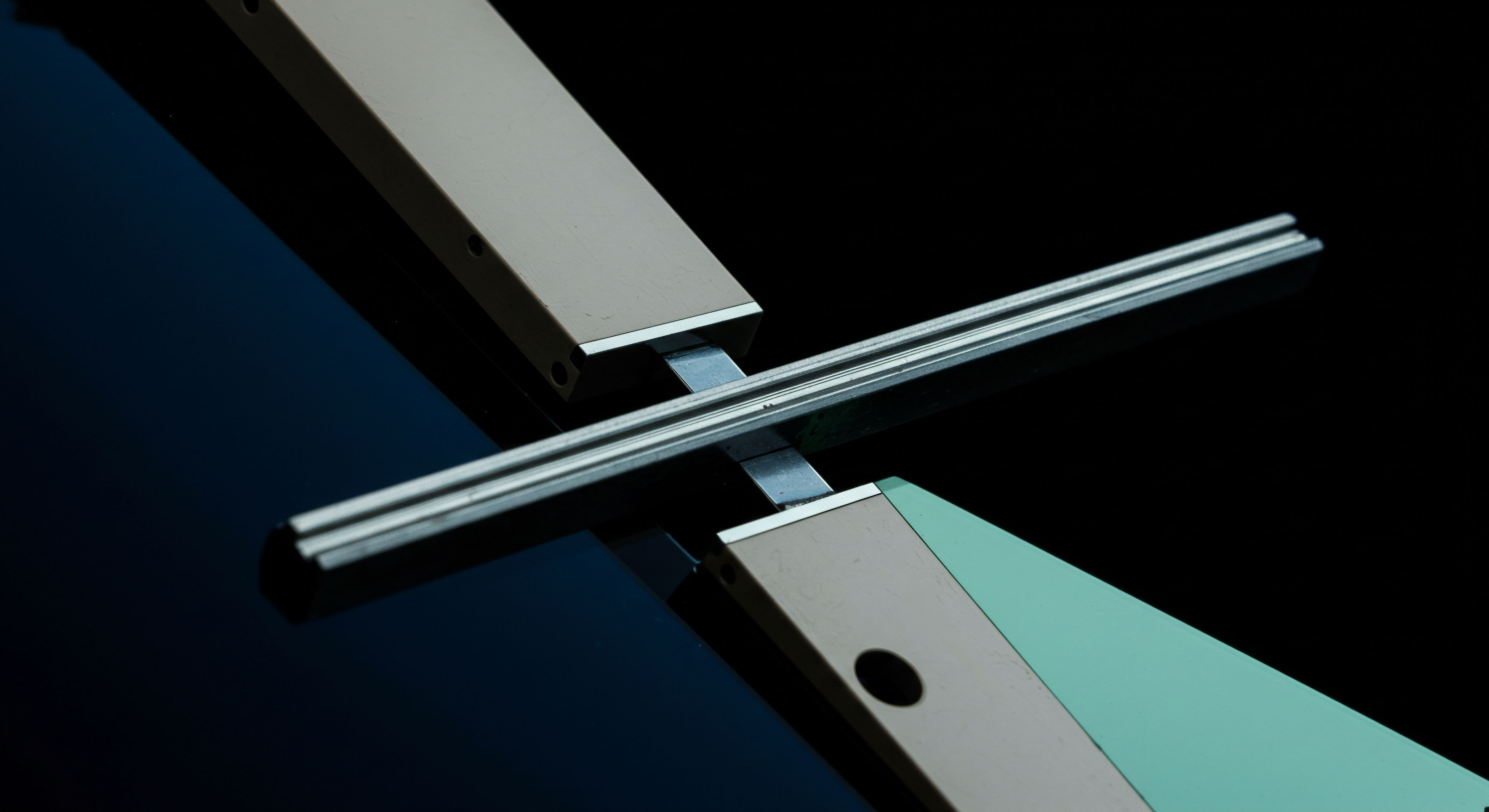

Understanding the operational makeup of RFQ constructs a foundational expertise. Participants initiate a request for a specific instrument and quantity. Multiple liquidity providers then respond with executable quotes, creating a competitive atmosphere.

The requesting party assesses these quotes, selecting the most favorable terms. This structured method secures optimal transaction pricing for dealings that might otherwise face considerable market friction.

Capitalizing on Liquidity Dynamics

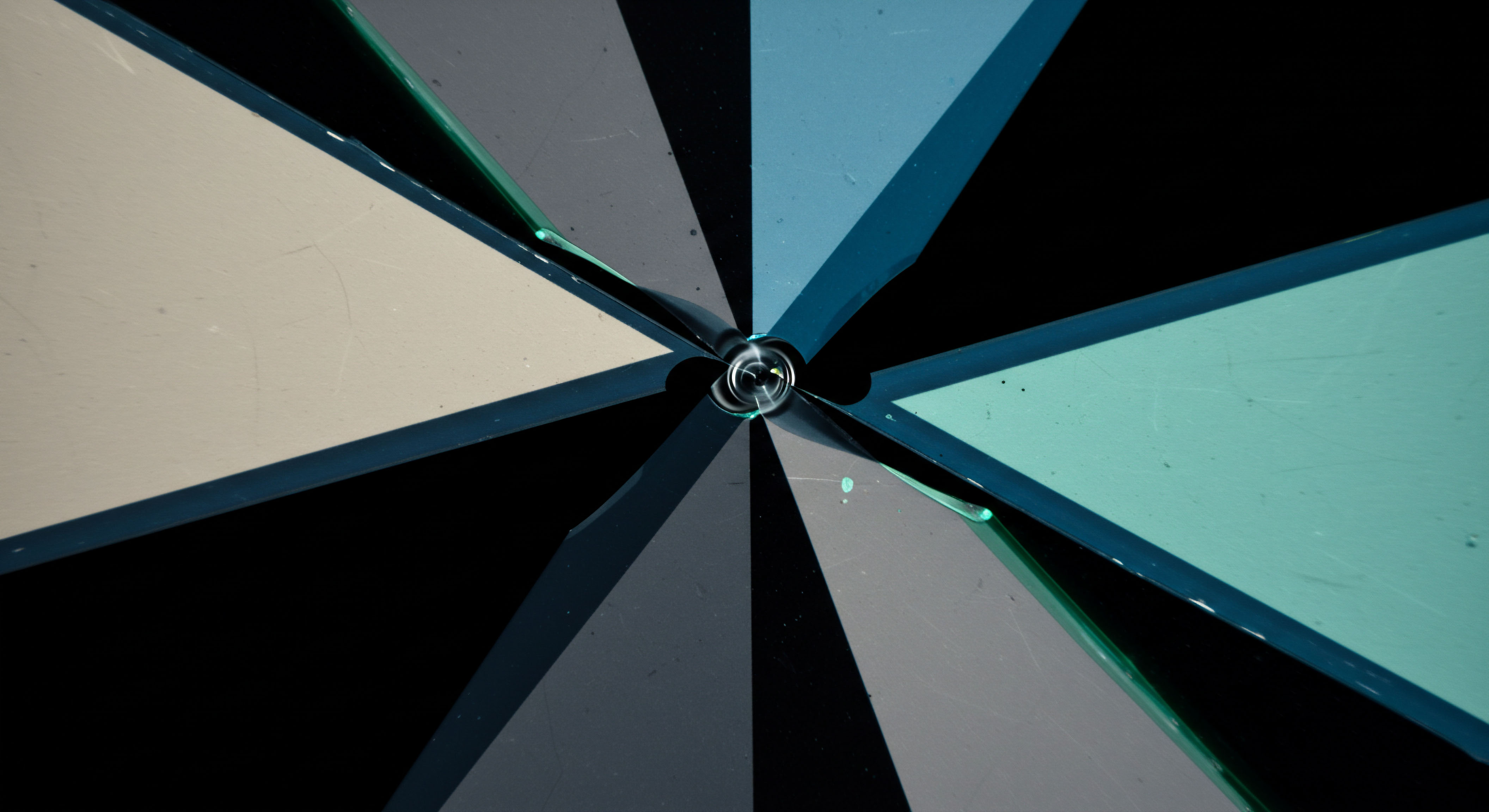

Deploying RFQ-based execution transforms theoretical market advantages into realized gains. This systematic method supports the precise capture of alpha across various derivatives segments. A keen understanding of market microstructure, coupled with a calculated deployment of RFQ, generates superior transactional outcomes. We meticulously detail specific avenues for application.

Options Spreads Precision

Executing multi-leg options spreads demands exceptional pricing accuracy. The RFQ mechanism aids traders in soliciting consolidated quotes for entire spread structures, bypassing the adverse selection often encountered when legging into positions. This preserves the intended risk-reward profile of the spread, refining entry and exit points.

Consider the refined dynamics of a BTC straddle block; obtaining a single, aggregated quote for both the call and put components substantially reduces slippage and execution uncertainty. Precision is paramount.

Volumetric Price Discovery

Block trading in crypto options often encounters fragmented liquidity. RFQ centralizes this discovery process, compelling multiple dealers to compete for your order. This competitive environment frequently uncovers latent liquidity, yielding price points unavailable through standard order book interaction. Such a disciplined method mitigates price impact, a primary determinant of trade profitability.

Hedging and Risk Mitigation

Derivatives traders employ RFQ for resilient hedging operations. Crafting complex hedges, such as ETH collar arrangements, gains immensely from the ability to obtain comprehensive quotes for multiple options legs simultaneously. This positions the synthetic holding at the most favorable collective price, solidifying the protective barrier for underlying assets. The efficiency gained directly influences overall portfolio stability and capital preservation.

Tailored Execution Flows

The flexibility of RFQ extends to highly customized trading flows. Participants can specify execution parameters, including settlement types, tenor, and even bespoke options types, to a select group of counterparties. This tailored method permits the execution of illiquid or highly specific positions that public markets struggle to accommodate. It represents a direct pathway to superior fill rates and bespoke pricing, adapting to the unique demands of each portfolio.

Key RFQ applications include:

- Bitcoin Options Block ▴ Consolidating large BTC options orders for competitive dealer quotes.

- ETH Options Block ▴ Securing aggregated pricing for substantial ETH options positions.

- Options Spreads RFQ ▴ Obtaining single, comprehensive quotes for multi-leg options combinations.

- Multi-dealer Liquidity ▴ Accessing a diverse pool of liquidity providers simultaneously.

- Anonymous Options Trading ▴ Executing trades without revealing intent to the broader market.

- Multi-leg Execution ▴ Combining complex options structures into one atomic transaction.

RFQ deployment generates superior transactional outcomes, preserving intended risk-reward profiles across complex derivatives.

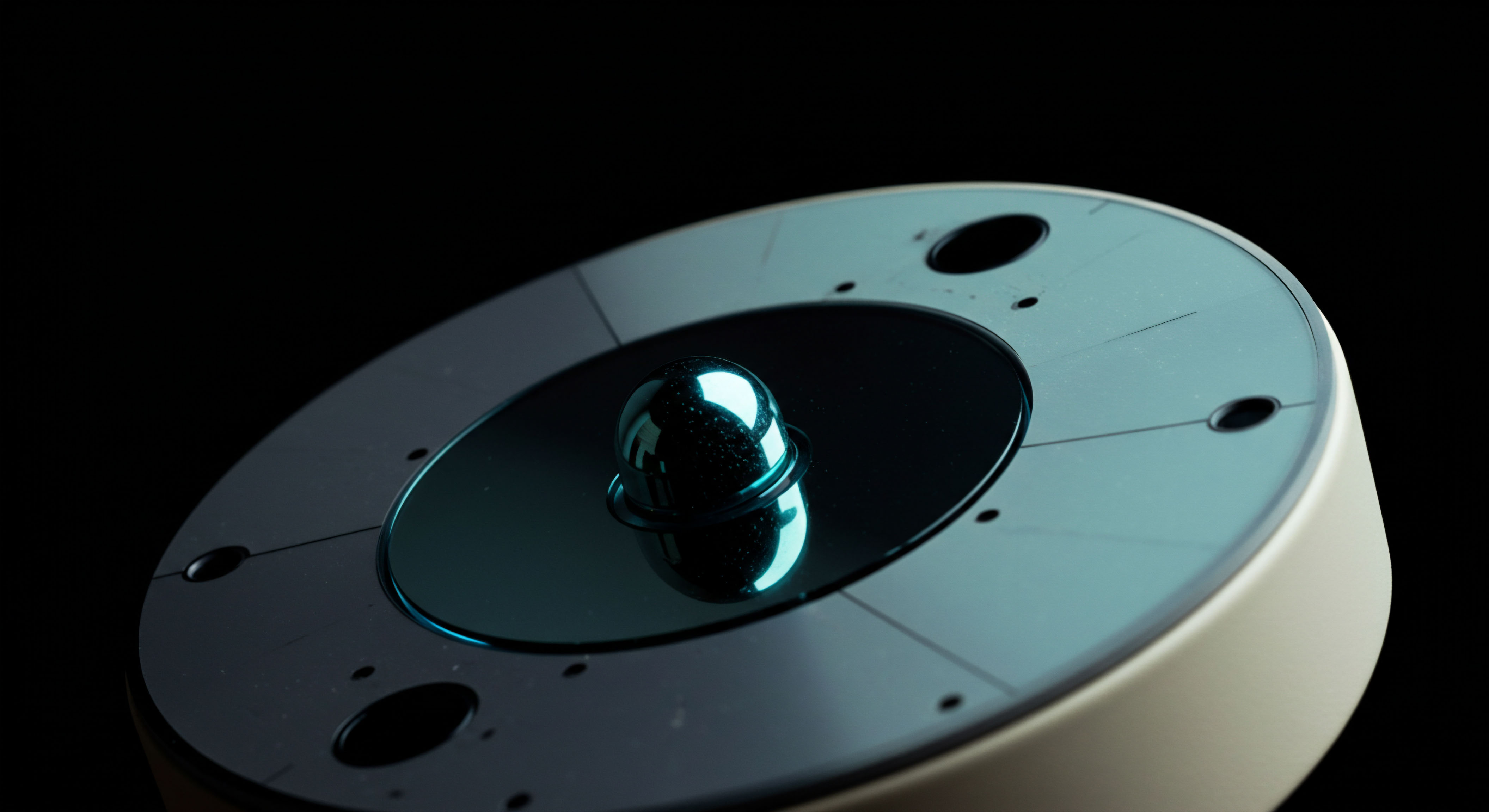

Advanced Liquidity Command

Moving beyond tactical application, the strategic mastery of RFQ transforms market engagement into a sustained competitive advantage. This involves incorporating RFQ capabilities into broader portfolio management systems, permitting dynamic adjustments to market conditions and risk exposures. The discerning trader considers RFQ a foundational element of their operating system, a powerful driver of superior outcomes.

Systemic Risk Mitigation

Sophisticated portfolio managers employ RFQ for systemic risk mitigation, particularly in volatile crypto derivatives markets. Consider the scenario of rebalancing a large, diversified options book. Executing multiple simultaneous block trades via RFQ minimizes the market signaling inherent in such large movements, preserving price integrity across the entire portfolio. One must continually refine the lens through which market dynamics appear; the true efficacy of RFQ resides in its capacity to preempt systemic shocks, moving beyond reactive measures.

Cross-Asset Arbitrage

RFQ extends its utility to cross-asset arbitrage methods. Identifying mispricings between related assets, such as spot BTC and its options, demands rapid and precise execution across multiple legs. RFQ supports the simultaneous pricing of these disparate components from various dealers, creating an efficient conduit for capitalizing on ephemeral dislocations. This capability represents a notable leap in execution quality for complex arbitrage operations.

Volatility Surface Shaping

Advanced traders apply RFQ to interact with and even shape the volatility surface. By strategically placing large RFQ orders for specific strikes and tenors, one can gauge and potentially influence implied volatility. This highly specialized application requires deep market insight and robust quantitative models, presenting a distinct edge in markets where volatility itself becomes a tradable asset. Such calculated interaction with the market’s underlying dynamics distinguishes the master from the novice.

The long-term value of mastering RFQ extends to its capacity for data production. Each RFQ interaction yields valuable pricing data, offering granular insights into dealer liquidity and market depth. This proprietary data feeds into advanced analytical models, continually refining execution algorithms and shaping future trading decisions. The ongoing feedback loop cements a sustained advantage, building an enduring edge.

Commanding Your Trading Destiny

The pursuit of alpha remains a constant endeavor, a relentless push against market entropy. The RFQ system stands as a testament to intelligent design, a precise instrument for those who demand more than average returns. Its integration into a disciplined trading framework elevates the strategic operator.

This mastery reshapes your engagement with volatility, liquidity, and ultimately, your own financial trajectory. Consider the boundless possibilities when you command the market on your own terms, proactively shaping outcomes.