Crypto Options Precision

Commanding superior outcomes in crypto options markets begins with understanding the fundamental mechanisms that drive execution quality. Request for Quote, or RFQ, represents a direct pathway to optimized pricing, a system where your specific trade requirements meet multiple liquidity providers simultaneously. This direct interaction cultivates a competitive environment, ensuring you access the most favorable prices for your options positions. Mastering this foundational interaction empowers participants to elevate their trading capabilities beyond conventional methods.

The RFQ mechanism operates by broadcasting your desired options trade to a curated network of market makers. Each market maker then responds with a firm quote, reflecting their current assessment of fair value and available liquidity. This process bypasses the fragmented order books often encountered in spot markets, providing a consolidated view of executable prices for complex derivatives. Engaging with this system positions traders to secure advantageous pricing, a direct result of fostering competitive bids and offers.

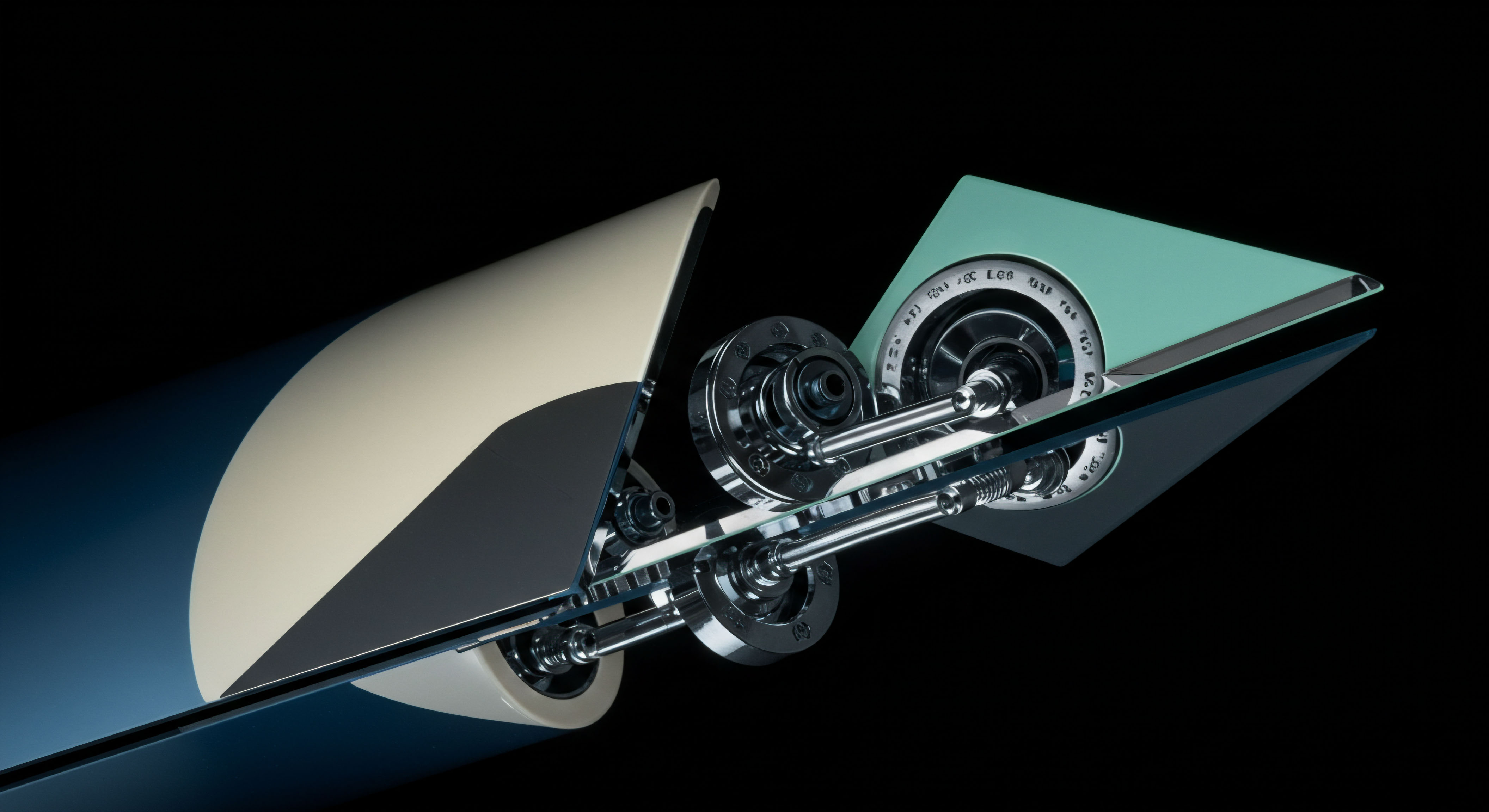

Optimal options pricing arises from a direct, competitive interaction with diverse liquidity sources.

A strategic deployment of RFQ offers a significant edge for those trading block sizes or multi-leg options structures. Instead of executing smaller clips across various venues, a single RFQ submission solicits comprehensive pricing for the entire order. This integrated approach minimizes market impact and reduces the potential for adverse price movements during execution. Understanding this system lays the groundwork for consistently achieving superior entry and exit points in dynamic crypto derivatives markets.

Strategic Options Deployment

Deploying crypto options effectively demands a strategic mindset, particularly when executing block trades or intricate multi-leg structures. The RFQ framework transforms complex options strategies into actionable, high-conviction positions. It facilitates the execution of large orders with minimal slippage, a paramount concern for institutional participants. Achieving superior outcomes necessitates a disciplined approach to sourcing liquidity, directly impacting the profitability of any options venture.

Block Trade Execution

Executing large Bitcoin options blocks or ETH options blocks requires a method that preserves price integrity. An RFQ submission for a significant notional amount compels market makers to compete for the entire order. This competitive dynamic ensures that the aggregated price received reflects the deepest available liquidity, preventing the price erosion often experienced with piecemeal execution. The efficiency gained from this consolidated approach directly contributes to improved portfolio performance.

Consider a scenario involving a substantial BTC straddle block. Initiating an RFQ for this complex, volatility-sensitive trade allows multiple dealers to bid on the entire package. The resulting bids present a transparent, aggregated view of the market’s willingness to absorb the position, offering a clear advantage in securing optimal pricing. This method bypasses the fragmentation inherent in standard order books, providing a decisive edge for sizable positions.

Multi-Leg Options Precision

Options spreads RFQ offers unparalleled precision for multi-leg strategies. Constructing a complex position, such as an ETH collar RFQ, involves simultaneously buying and selling different options contracts. Executing these legs individually risks significant basis risk, where the price of one leg moves adversely before the others are filled. A single RFQ for the entire spread eliminates this risk, guaranteeing simultaneous execution at a composite price.

This integrated execution for multi-leg strategies is a cornerstone of advanced risk management. It enables traders to lock in their desired risk-reward profile without the uncertainty of partial fills or price discrepancies across legs. Mastering this capability ensures that the theoretical edge of a multi-leg strategy translates into tangible P&L.

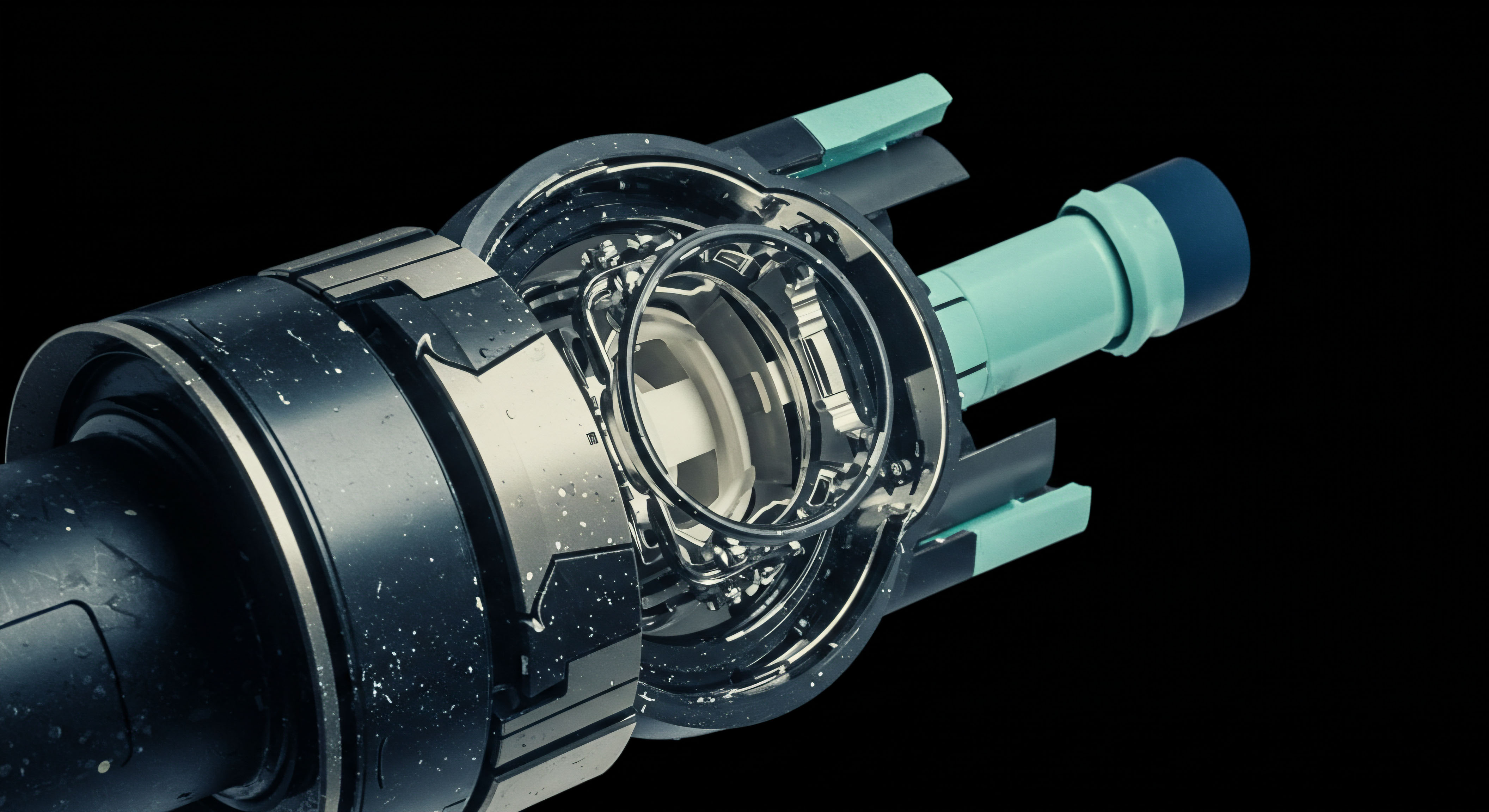

Integrated execution for multi-leg options strategies mitigates basis risk, securing the intended profit profile.

Volatility Block Trade Advantage

Capturing volatility through block trades demands swift, decisive action. A volatility block trade, perhaps a large straddle or strangle, profits from anticipated price movements. RFQ empowers traders to enter these positions with confidence, knowing they access the best available price for the entire block. This direct access to multi-dealer liquidity enhances execution quality, crucial when timing is everything.

Determining the optimal execution path for a large, intricate options position often presents a nuanced strategic challenge. One must reconcile the theoretical pricing models with the practicalities of market microstructure and real-time liquidity dynamics. This synthesis of theory and execution demands a framework for disciplined decision-making.

Key Elements for RFQ Optimization

- Liquidity Provider Selection ▴ Carefully choose market makers with demonstrated strength in the specific options class and size. This selection influences the competitiveness of received quotes.

- Timing of Submission ▴ Submit RFQs during periods of robust market activity to maximize the number of responsive bids and narrow spreads.

- Anonymity Maintenance ▴ Leverage the anonymous nature of RFQ to prevent market signaling, preserving your alpha.

- Quote Evaluation Metrics ▴ Assess quotes beyond raw price, considering fill rates, implied volatility, and overall market impact.

This systematic approach transforms the execution of complex options into a streamlined, high-performance operation. A diligent focus on these elements positions a trader to consistently achieve superior pricing and maintain a competitive advantage.

Advanced Market Command

Mastering crypto options pricing extends beyond individual trade execution, integrating into a holistic portfolio management strategy. The objective shifts towards optimizing capital efficiency and maximizing risk-adjusted returns across all holdings. This demands a proactive stance, where RFQ becomes a strategic lever for portfolio rebalancing, hedging complex exposures, and capitalizing on macro volatility shifts.

Portfolio Hedging with Precision

Deploying options for portfolio hedging requires surgical precision. Imagine protecting a significant ETH holding against a sharp downturn. A targeted ETH options block RFQ allows for the acquisition of protective puts at a highly competitive price, establishing a robust financial firewall.

This proactive risk mitigation safeguards capital without sacrificing upside potential. The ability to source such hedges efficiently enhances the overall resilience of a portfolio.

Furthermore, dynamic hedging strategies often necessitate frequent adjustments to options positions. RFQ streamlines this process, enabling swift and cost-effective rebalancing. This constant optimization ensures the hedge remains aligned with the evolving market landscape and the portfolio’s risk parameters.

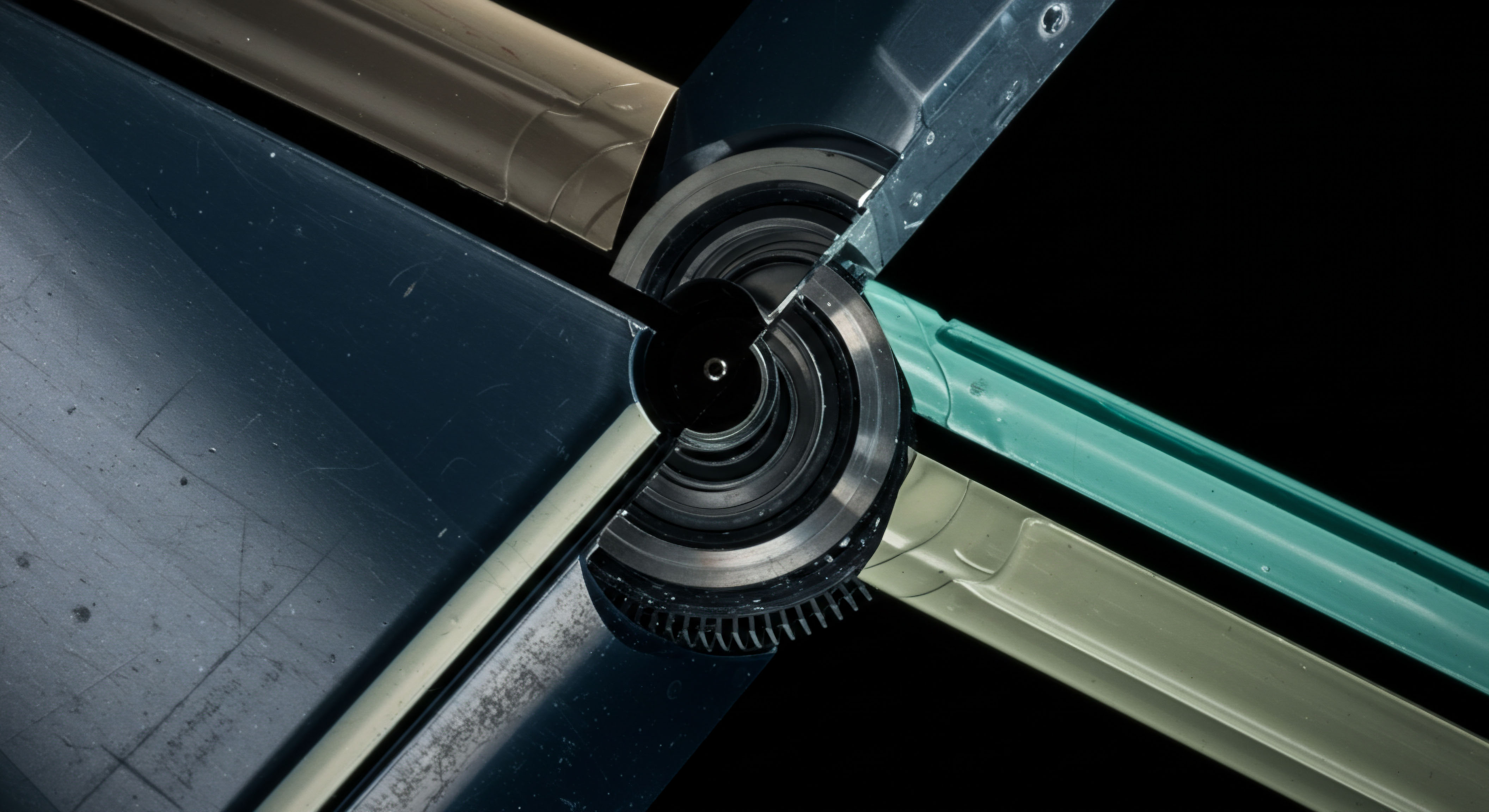

Proactive risk mitigation through targeted options RFQ establishes a robust financial firewall for capital preservation.

Volatility Arbitrage Enhancement

Sophisticated traders often pursue volatility arbitrage opportunities, capitalizing on discrepancies between implied and realized volatility. RFQ provides a critical advantage here. When an opportunity arises, the speed and efficiency of RFQ for BTC straddle blocks or ETH strangle blocks allow for rapid entry into these positions. This execution capability translates directly into higher capture rates for ephemeral market mispricings.

Structured Product Creation

For those with a deeper understanding of market dynamics, RFQ facilitates the creation of bespoke structured products. Consider packaging a yield-enhancing strategy for clients, combining spot assets with tailored options overlays. RFQ enables the precise pricing and execution of these custom options components, delivering unique value propositions. This moves beyond simply trading options to engineering financial solutions.

The true power of an RFQ system unfolds in its capacity to transform theoretical market insights into tangible alpha. It is a testament to disciplined execution. My personal conviction centers on the unwavering belief that meticulous attention to execution quality separates consistent winners from market participants who merely react.

The Edge Defined

The pursuit of unrivaled options pricing power represents a continuous journey of strategic refinement and operational excellence. Markets evolve, but the principles of superior execution endure. Embracing advanced trading mechanisms, like RFQ, fundamentally redefines a trader’s relationship with market liquidity.

It positions participants to not simply react to price, but to actively shape their desired outcomes. This systematic approach forms the bedrock of sustained market advantage.

Future market structures will undoubtedly bring new complexities, yet the core imperative for commanding execution quality remains constant. Those who consistently leverage the most efficient tools will invariably carve out a distinct, enduring edge. Adapt or be outmaneuvered.

Glossary

Options Spreads Rfq

Multi-Dealer Liquidity

Volatility Block Trade