Execution Mastery Fundamentals

The pursuit of superior price realization for digital assets stands as a defining challenge for market participants. Traders continually seek ways to improve their acquisition and liquidation valuations. Achieving superior price realization directly translates into a clear market advantage.

This ambition requires a proactive engagement with market liquidity. Grasping how institutional systems deliver best possible pricing constitutes the initial step towards higher trading outcomes. A direct path to this efficiency involves employing multi-dealer request for quotation (RFQ) systems.

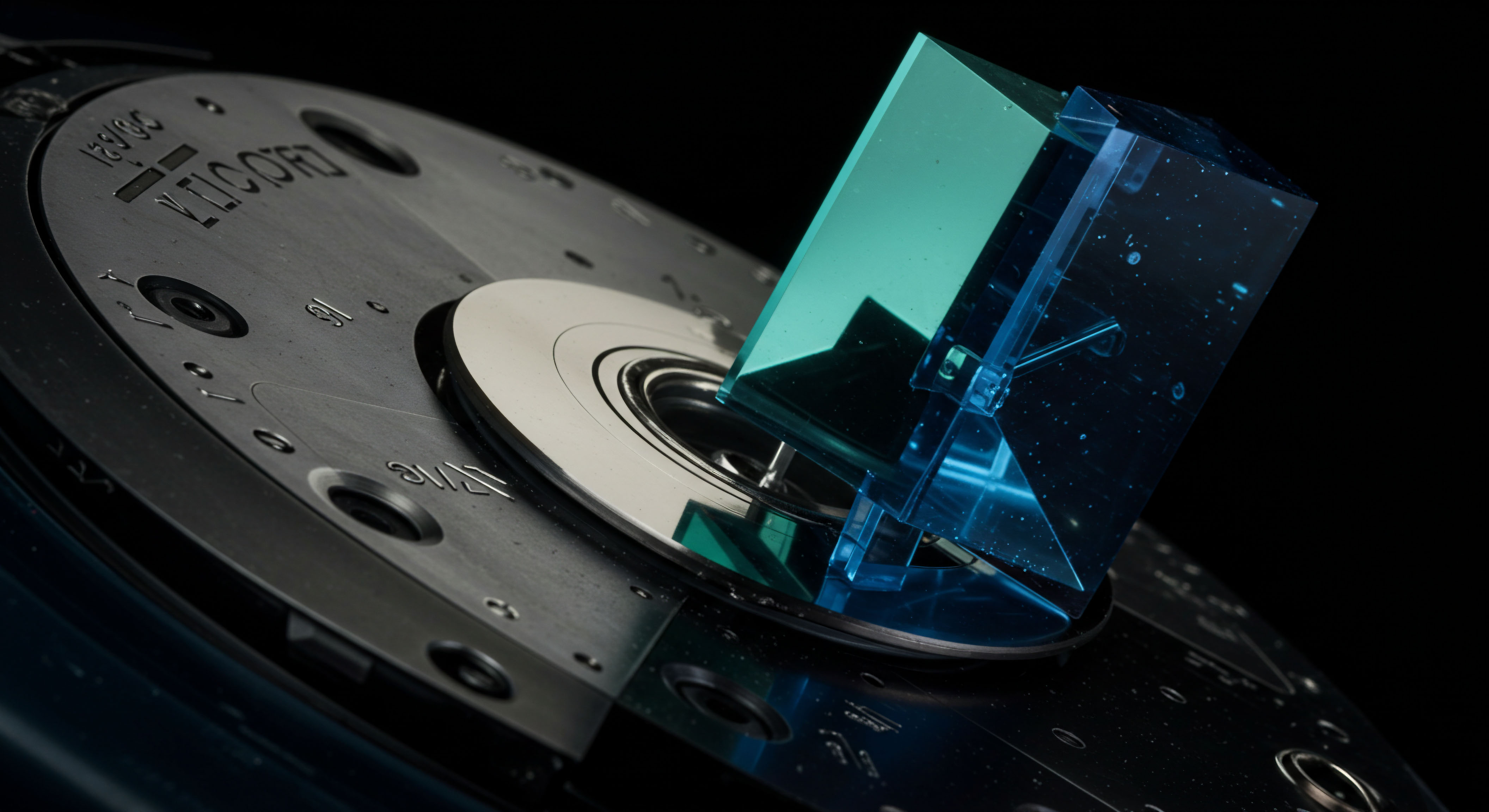

RFQ systems represent a formalized process for soliciting competitive bids and offers from multiple liquidity providers. This competitive dynamic ensures a trader receives the most favorable price for their desired volume. Such a system simplifies liquidity discovery, a vital component in fragmented crypto markets. It establishes a controlled environment where price discovery stems from direct competition, ultimately benefiting the order initiator.

Block trading, a powerful mechanism, facilitates the execution of large orders without disrupting market equilibrium. These sizeable transactions occur off-exchange, reducing immediate price impact. Participants gain privacy and secrecy, maintaining their market intent from public view.

Commanding execution quality forms the bedrock of consistent excess return generation in volatile crypto markets.

The true utility of these systems resides in their ability to provide transparent, confirmable execution quality. Measuring slippage and fill rates becomes a concrete measurement, allowing for accurate performance attribution. A astute trader evaluates every basis point saved, recognizing its compounding influence on investment collection returns. The underlying complexity of reconciling fragmented order books with the demand for instant, large-scale settlement presents a challenging intellectual obstacle, yet the systematic application of RFQ and block trading provides a strong pathway through this labyrinth.

This progression towards advanced execution begins with a clear comprehension of these core mechanisms. Equipping oneself with knowledge of these tools represents a wise investment in one’s trading future. Every experienced market participant acknowledges the direct correlation between execution accuracy and consistent profitability.

Investment Methods for Optimal Execution

Converting theoretical understanding into realized trading gains demands a structured execution approach. The astute investor employs particular mechanisms to secure favorable pricing across diverse market conditions. This proactive stance distinguishes speculative ventures from structured capital deployment.

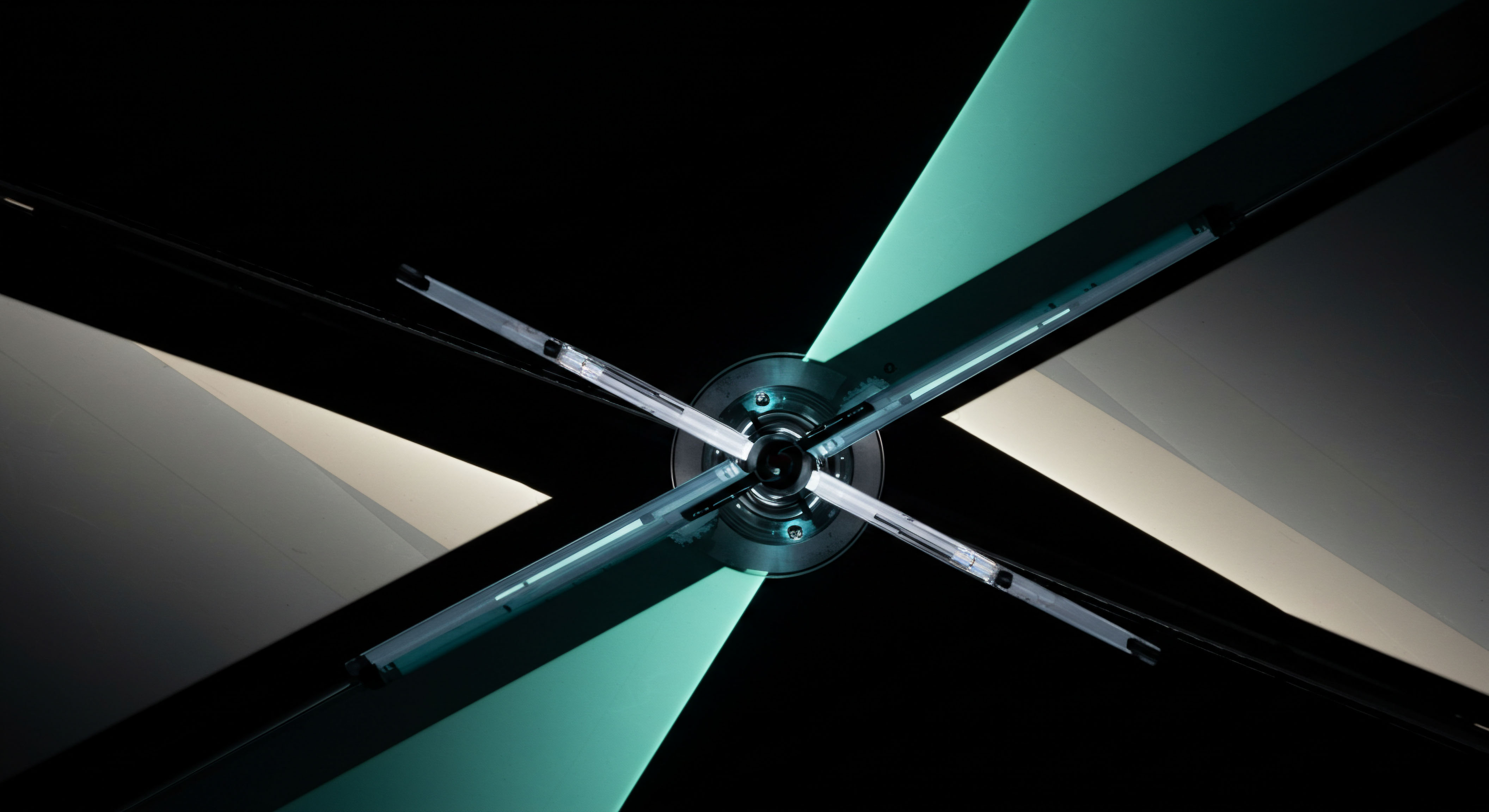

Utilizing options within a competitive quoting environment presents a clear advantage. Bitcoin options RFQ and ETH options RFQ enable participants to solicit precise quotes for chosen strike prices and expiries. This process ensures pricing reflects the actual market sentiment, free from the inefficiencies of standard order book dynamics.

Options Spreads Optimization

Multi-leg options spreads represent an advanced method for expressing directional views or volatility forecasts with accuracy. Executing these complex structures requires an environment supporting pricing for multiple legs at once. An options spreads RFQ streamlines this process, allowing all components to be negotiated together. This reduces leg risk and ensures the entire spread receives pricing as a single unit, reflecting a cohesive market view.

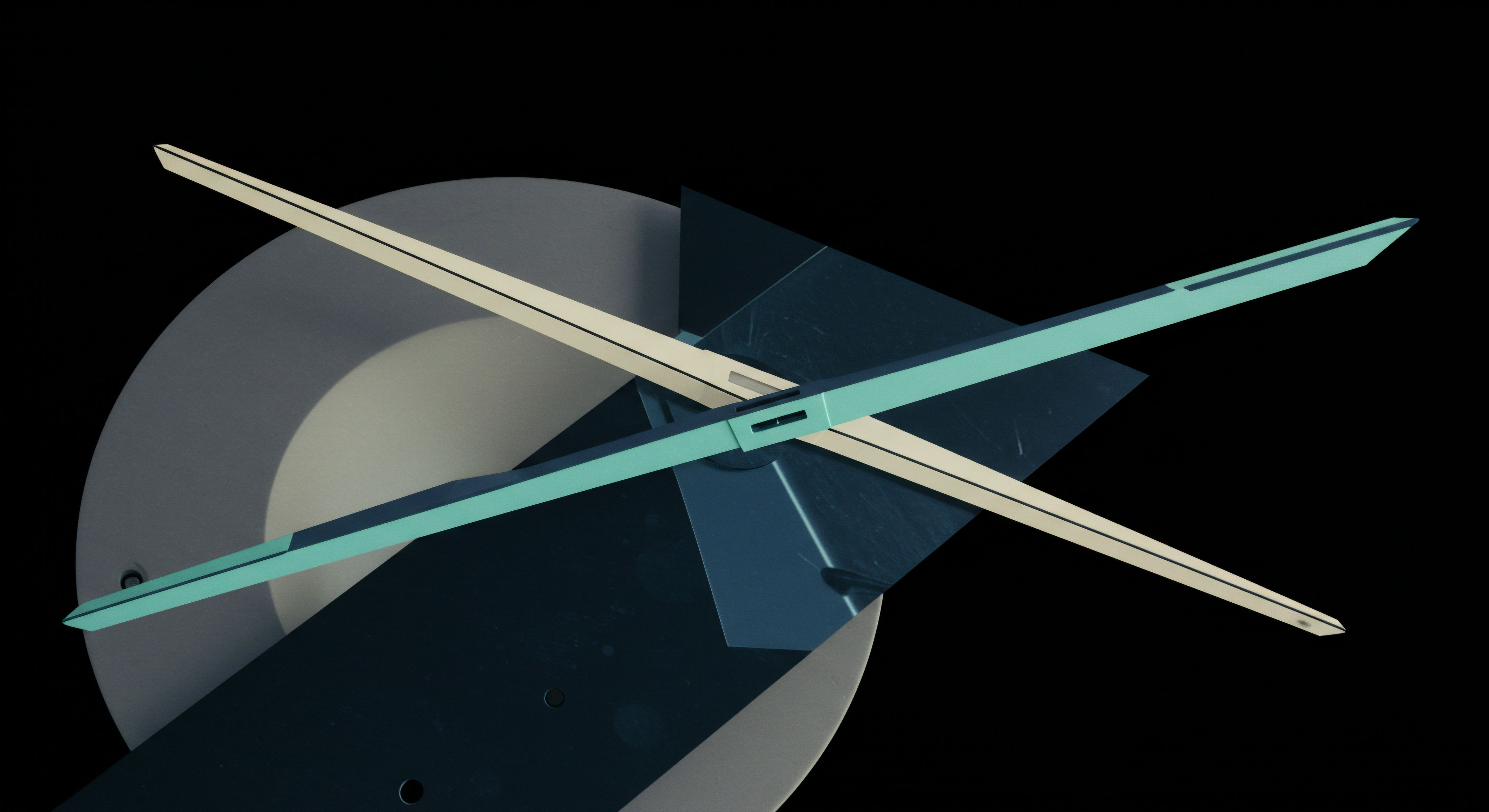

Consider a BTC straddle block, where a trader at the same time buys both a call and a put with identical strike and expiry. The objective involves profiting from sizeable price movement in either direction. Executing such a block via RFQ ensures competitive pricing for both legs, maintaining the desired volatility exposure.

An ETH collar RFQ involves selling an out-of-the-money call and buying an out-of-the-money put while holding the ETH. This structure mitigates negative exposure while generating income from the sold call. Securing best execution for both the call and put components through a multi-dealer system optimizes the cost of this safeguarding overlay.

Block Trading Benefits

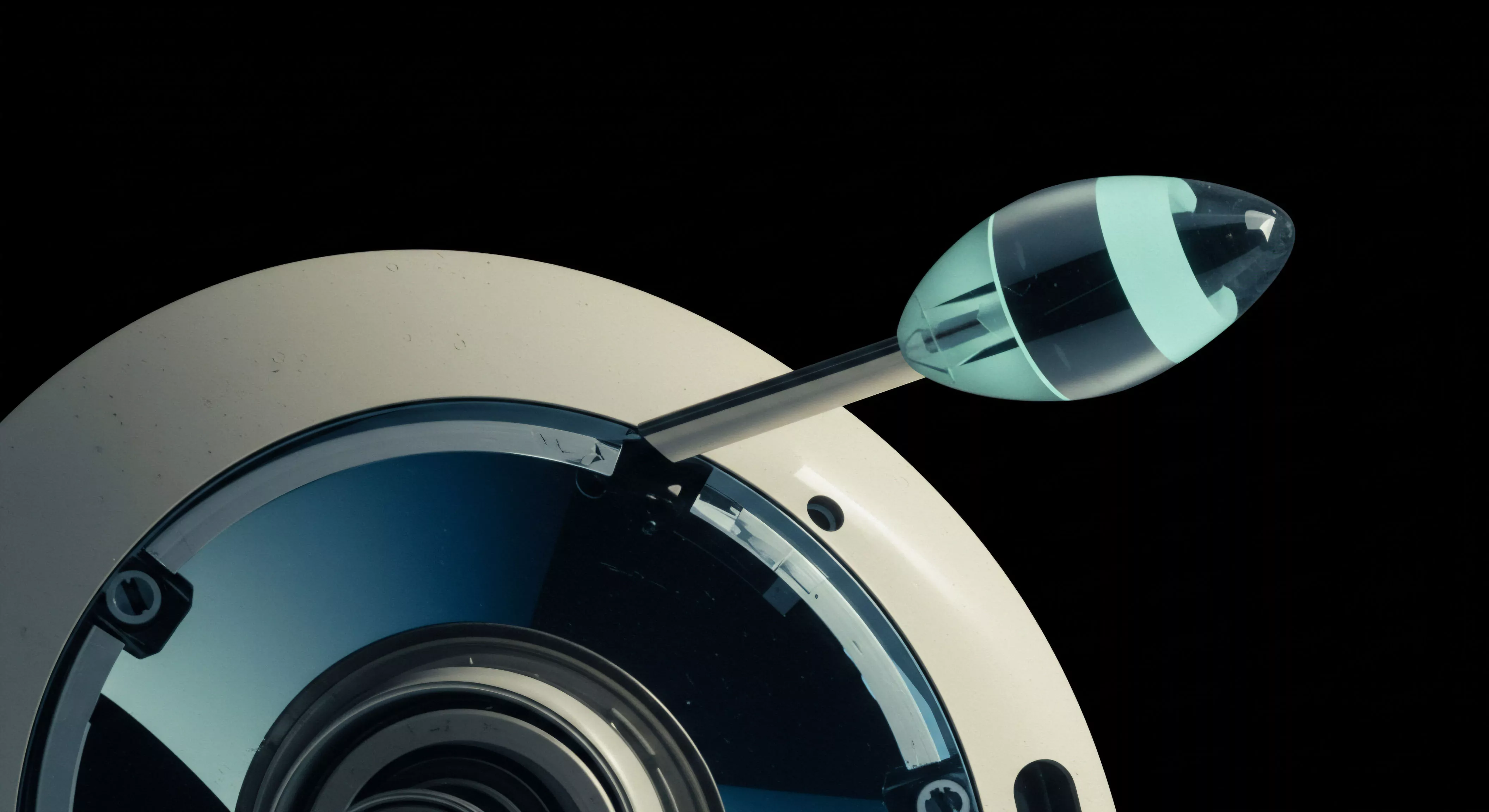

Executing large volumes without market impact stands as a hallmark of professional-grade trading. Block trading facilities cater to these requirements, providing a venue for large transactions away from public order books. This privacy shields market participants from unfavorable price movements caused by order visibility.

- Anonymous Options Trading ▴ Participants maintain secrecy during the quoting and execution phases, preventing front-running or market manipulation. This privacy maintains excess return.

- Multi-dealer Liquidity ▴ Accessing a wide network of liquidity providers ensures competitive pricing and higher fill rates for large orders. The extent of this liquidity reduces execution costs.

- Reduce Slippage ▴ Direct interaction with multiple dealers reduces the impact of order size on execution price. This leads to a tighter spread and better price capture.

- Best Execution Standards ▴ Formalized processes within RFQ and block trading adhere to strict standards, ensuring confirmable and examinable trade outcomes. This dedication to quality cultivates confidence.

The calculated application of these mechanisms converts execution from an unreactive outcome into a deliberate tool for investment collection excess return. Understanding the subtleties of each system allows for customized application, matching execution methods with particular market views and risk appetites. This structured approach reliably produces higher returns.

Advanced Execution and Portfolio Integration

Moving beyond individual trade execution, the advanced strategist integrates these effective tools into an integrated investment collection management framework. This approach lifts mere transaction enhancement to a pervasive advantage, affecting total risk-adjusted returns.

Consider volatility block trades, an advanced application for expressing views on implied volatility. Traders can execute large, single-leg options blocks or complex multi-leg volatility strategies, such as condors or butterflies, through an RFQ system. This allows for accurate entry and exit points in volatility markets, often with better pricing than available on standard exchanges. The ability to transact sizeable volatility exposure off-exchange offers a clear advantage in maintaining market discretion.

Systemic Risk Management

Integrating RFQ and block trading into a broader risk management framework provides a strong defense against market anomalies. By controlling execution quality, traders mitigate the risks associated with unfavorable price discovery and liquidity fragmentation. This proactive management extends to monitoring the true cost of trading across an entire investment collection.

The application of these methods extends to rebalancing activities within a larger digital asset investment collection. Executing large rebalancing trades via RFQ or block facilities prevents market signaling, maintaining the integrity of the investment collection’s calculated allocation. This method ensures rebalancing does not inadvertently erode excess return through poor execution.

Sophisticated execution strategies transcend individual trades, shaping a resilient, excess-return-generating investment collection.

The persistent pursuit of higher execution drives continuous new approaches in trading methods. Observing the interaction between market microstructure and advanced order types reveals pathways for further enhancement. This active understanding positions traders at the forefront of evolving digital asset markets.

The development of these tools reflects a deeper understanding of market dynamics, allowing for greater control over transaction costs and market impact. Commanding these applications translates directly into a confirmable edge, differentiating top-tier participants from the broader market. This command over execution represents the zenith of calculated trading in crypto assets.

Mastering Execution for Unrivaled Market Presence

The landscape of digital asset trading constantly shifts, presenting both challenges and opportunities. Those who prioritize execution quality secure a lasting advantage. This involves a dedication to advanced tools and a relentless drive for pricing excellence. The final measure of a strategist resides in their capacity to reliably extract best possible value from every market interaction, thereby shaping a legacy of financial acumen.

Glossary

Block Trading

Investment Collection

Options Rfq

Options Spreads Rfq

Btc Straddle Block

Best Execution

Eth Collar Rfq

Anonymous Options Trading

Multi-Dealer Liquidity