Systemic Alpha Generation

The pursuit of alpha in crypto markets demands a systematic approach, moving beyond reactive trading to engineered advantage. Architecting alpha-generating crypto arbitrage systems represents a definitive leap, transforming volatile market dynamics into predictable profit streams. This involves constructing sophisticated frameworks designed to identify and exploit fleeting price discrepancies across diverse venues. A clear understanding of these foundational mechanisms empowers traders to command their execution and unlock professional-grade strategies.

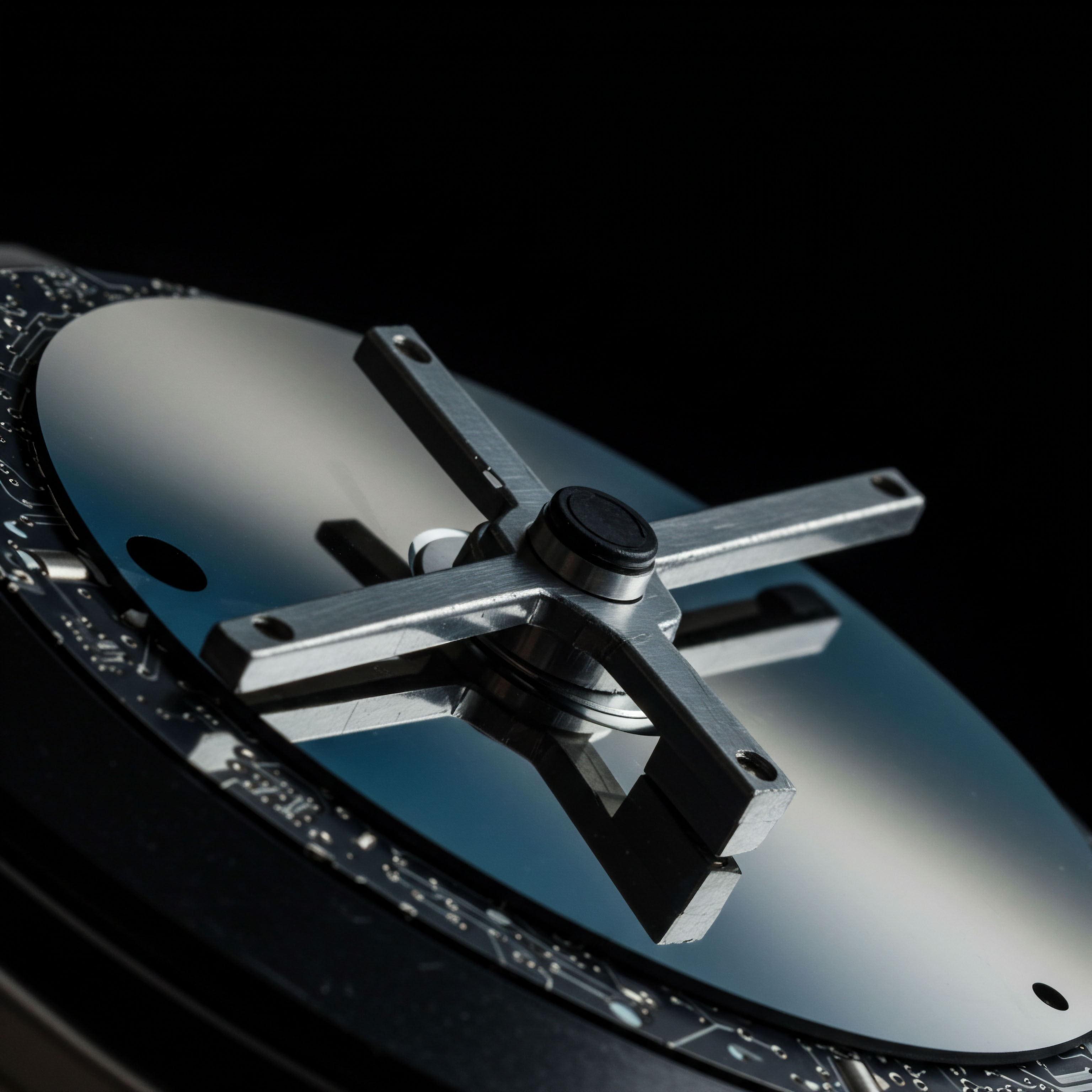

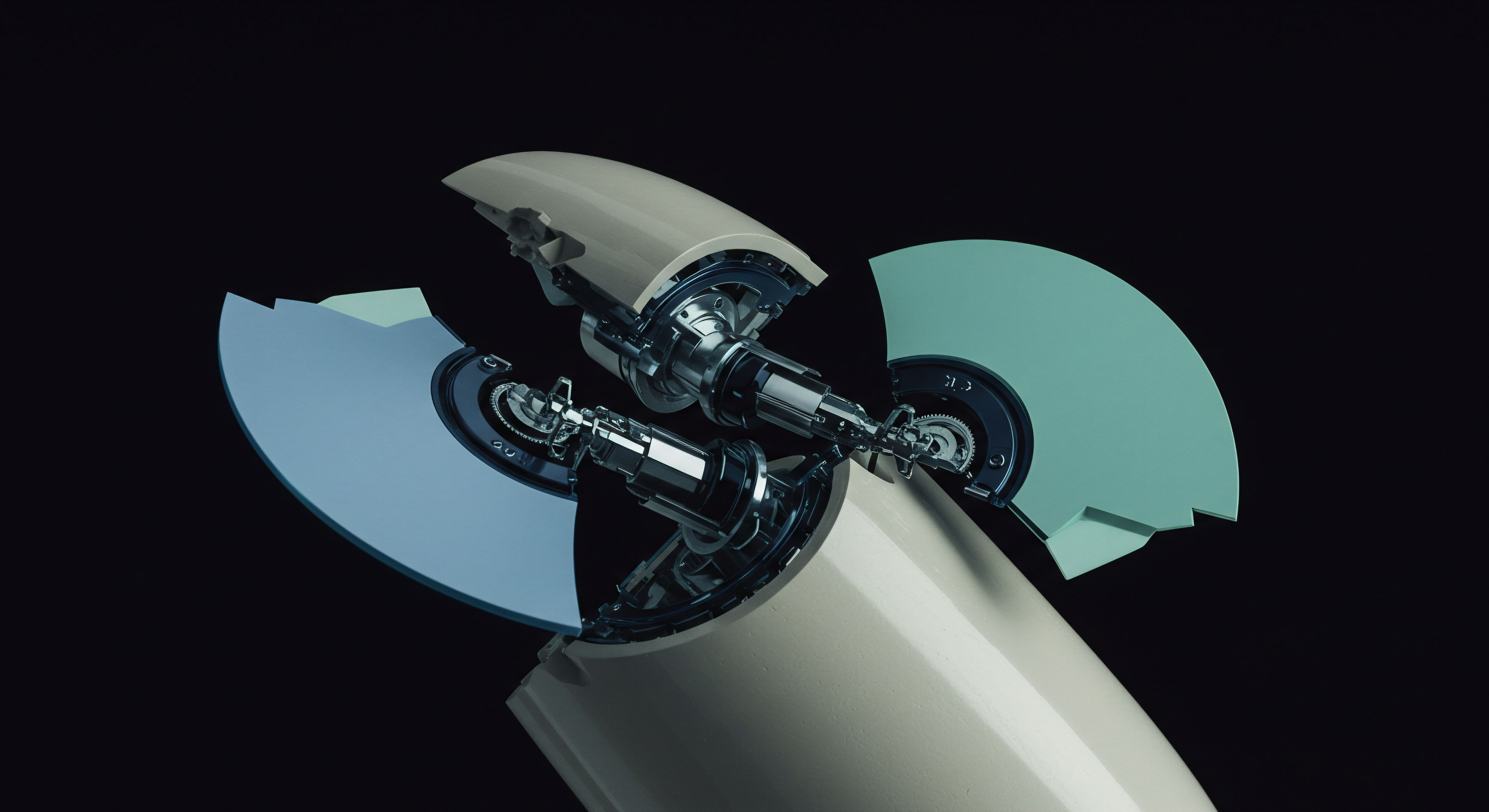

At its core, a crypto arbitrage system leverages price differentials for the same asset across different exchanges or trading pairs. These discrepancies, often transient, present opportunities for simultaneous buying and selling to capture a risk-free profit. Successful implementation hinges upon a meticulous design, encompassing rapid data ingestion, low-latency execution capabilities, and robust risk controls. The true edge emerges from the system’s capacity to process vast amounts of market data, discern actionable signals, and execute trades with unparalleled speed.

Engineered arbitrage systems transform market flux into a reliable source of alpha, offering a calculated advantage in high-velocity crypto markets.

Building such a system requires a deep appreciation for market microstructure, understanding how order books function, and how liquidity fragments across the ecosystem. This knowledge forms the bedrock for designing algorithms that minimize slippage and optimize fill rates. A proactive stance on market behavior and a clear vision for strategic execution define the pathway to superior outcomes.

Deploying Arbitrage Strategies

Translating the theoretical framework into actionable investment strategies requires a pragmatic approach to system deployment and continuous refinement. Investors seeking to capitalize on crypto arbitrage must consider various structural opportunities, each demanding specific algorithmic design and risk management protocols. This section outlines key strategies for establishing a resilient, alpha-generating arbitrage engine.

Spot Exchange Arbitrage

Spot exchange arbitrage targets price differences for a crypto asset listed on multiple centralized exchanges. The system monitors real-time order book data across a curated selection of exchanges, identifying instances where a token can be purchased on one platform and immediately sold on another for a profit. Execution speed proves paramount in these scenarios, as price discrepancies often vanish within milliseconds. A well-designed system employs direct API connections to exchanges, minimizing latency and maximizing fill probabilities.

- Market Data Ingestion: Collect and normalize real-time order book data from all target exchanges. This requires a robust data pipeline capable of handling high-throughput, low-latency feeds.

- Opportunity Identification: Algorithms continuously calculate potential profit margins, factoring in trading fees and estimated slippage. Thresholds determine trade viability.

- Atomic Execution: Orchestrate simultaneous buy and sell orders across exchanges. The system must possess contingency plans for partial fills or execution failures to prevent unintended inventory exposure.

- Capital Allocation: Dynamically allocate capital across exchanges, ensuring sufficient liquidity resides where opportunities are most likely to materialize.

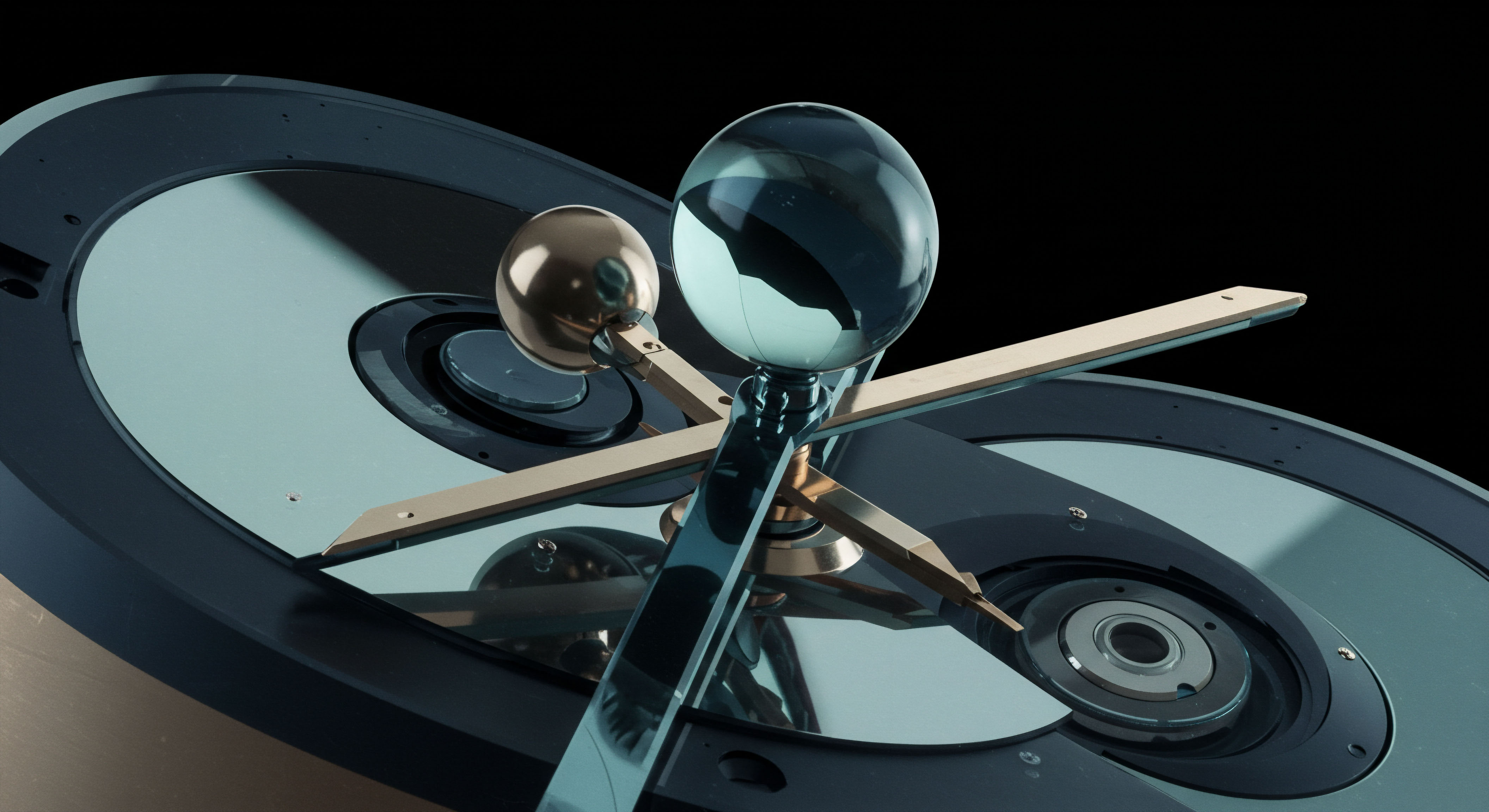

Triangular Arbitrage

Triangular arbitrage exploits price inconsistencies among three different cryptocurrencies on a single exchange. This involves a sequence of three trades ▴ converting an initial asset into a second, then into a third, and finally back into the initial asset, yielding a profit. This strategy requires exceptional computational speed to identify and execute the three legs of the trade before the pricing imbalance corrects.

Building the Execution Engine

The execution engine for triangular arbitrage demands a high degree of precision. It constantly scans trading pairs (e.g. BTC/USDT, ETH/BTC, ETH/USDT) to detect cyclical price discrepancies.

The system calculates the potential profit from each cycle, accounting for all trading fees. Automated order placement, often utilizing market orders for speed, secures the arbitrage.

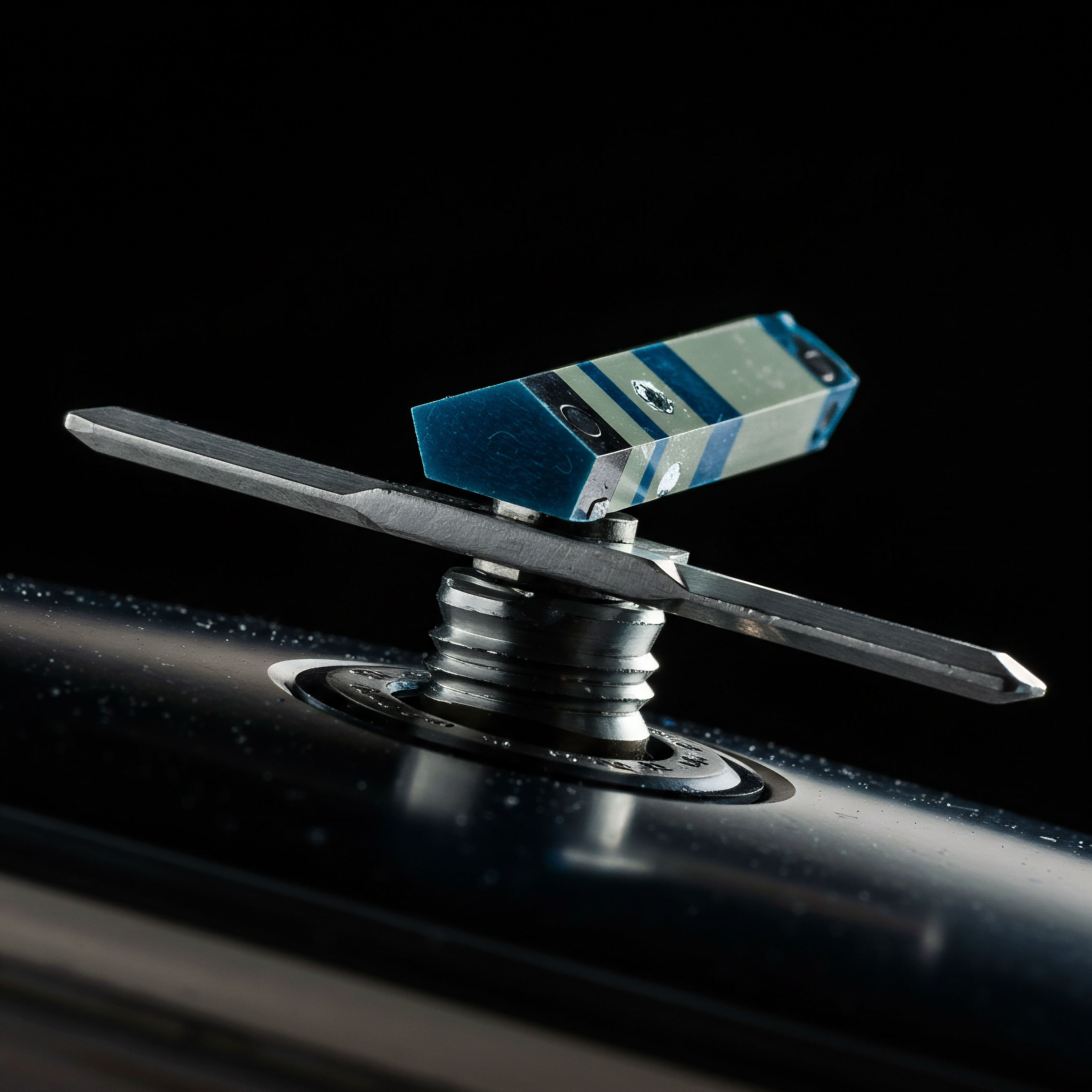

Statistical Arbitrage with Crypto Derivatives

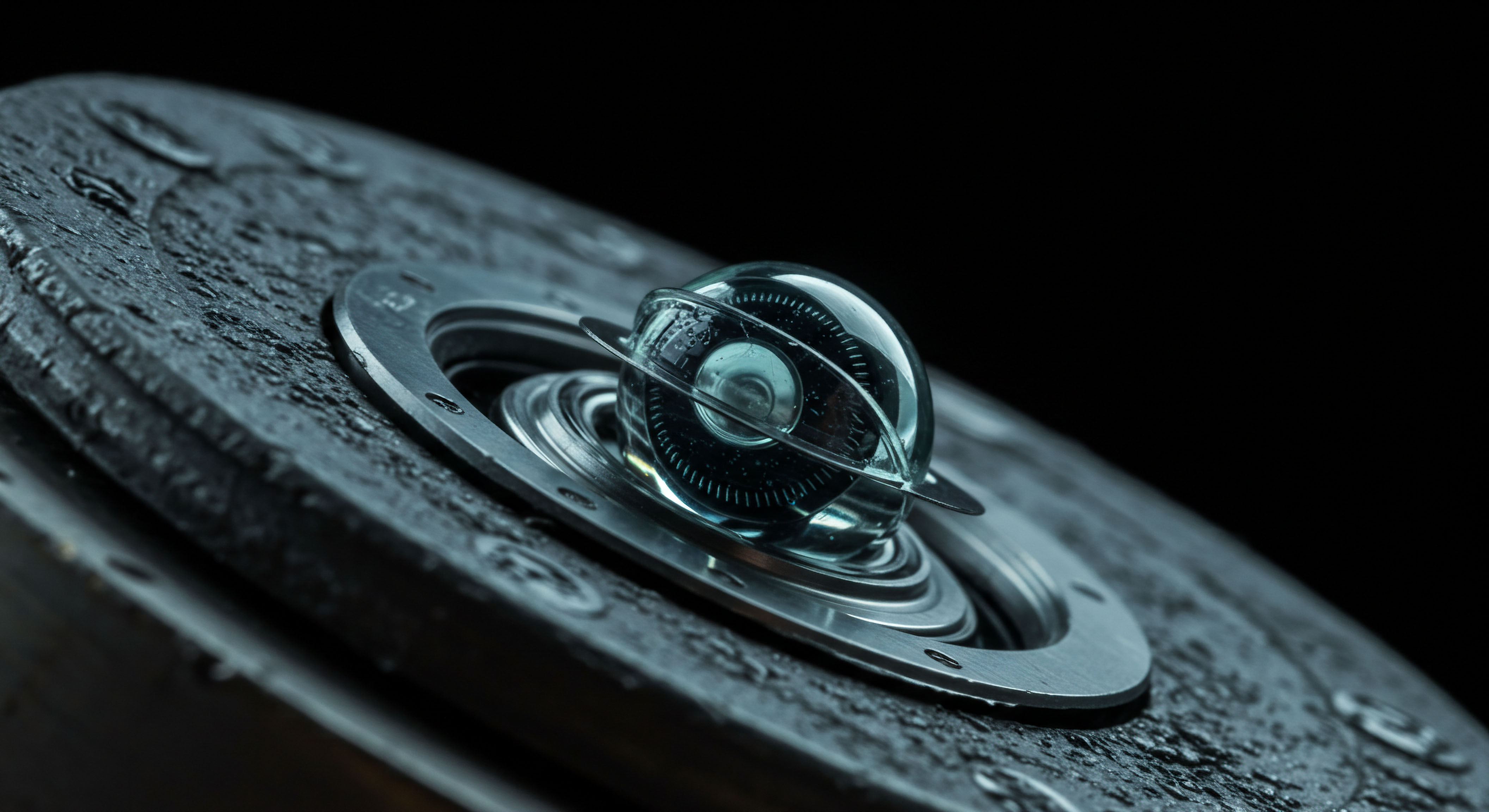

Moving beyond direct price differences, statistical arbitrage applies quantitative models to identify temporary mispricings between related crypto assets or derivatives. This includes strategies like basis trading, where a system simultaneously buys a spot asset and sells its corresponding futures contract when the futures price deviates significantly from its theoretical fair value. These systems rely on sophisticated econometric models to predict price convergence.

Leveraging Options Spreads

Options spreads present another avenue for statistical arbitrage, particularly in volatility markets. A system can construct multi-leg options strategies, such as straddles or collars, and identify instances where the implied volatility of these structures deviates from historical or predicted volatility. The system then executes the spread to capitalize on the expected convergence of implied volatility to its mean. Such sophisticated strategies demand a deep understanding of derivatives pricing models and robust risk parameterization.

Successful arbitrage deployment necessitates relentless optimization of execution latency, robust capital management, and continuous adaptation to market microstructure shifts.

The effective deployment of these systems requires meticulous backtesting against historical data to validate strategy efficacy and calibrate risk parameters. Live monitoring of system performance, including fill rates, slippage, and overall profitability, provides crucial feedback for iterative refinement.

Mastering Advanced Applications

The evolution from basic arbitrage to sophisticated, alpha-generating systems represents a journey towards market mastery. Expanding beyond direct price capture involves integrating advanced execution methodologies and a holistic risk management framework. This ensures sustained performance amidst shifting market conditions and increased competition. The ultimate goal remains cultivating a durable market edge through systemic superiority.

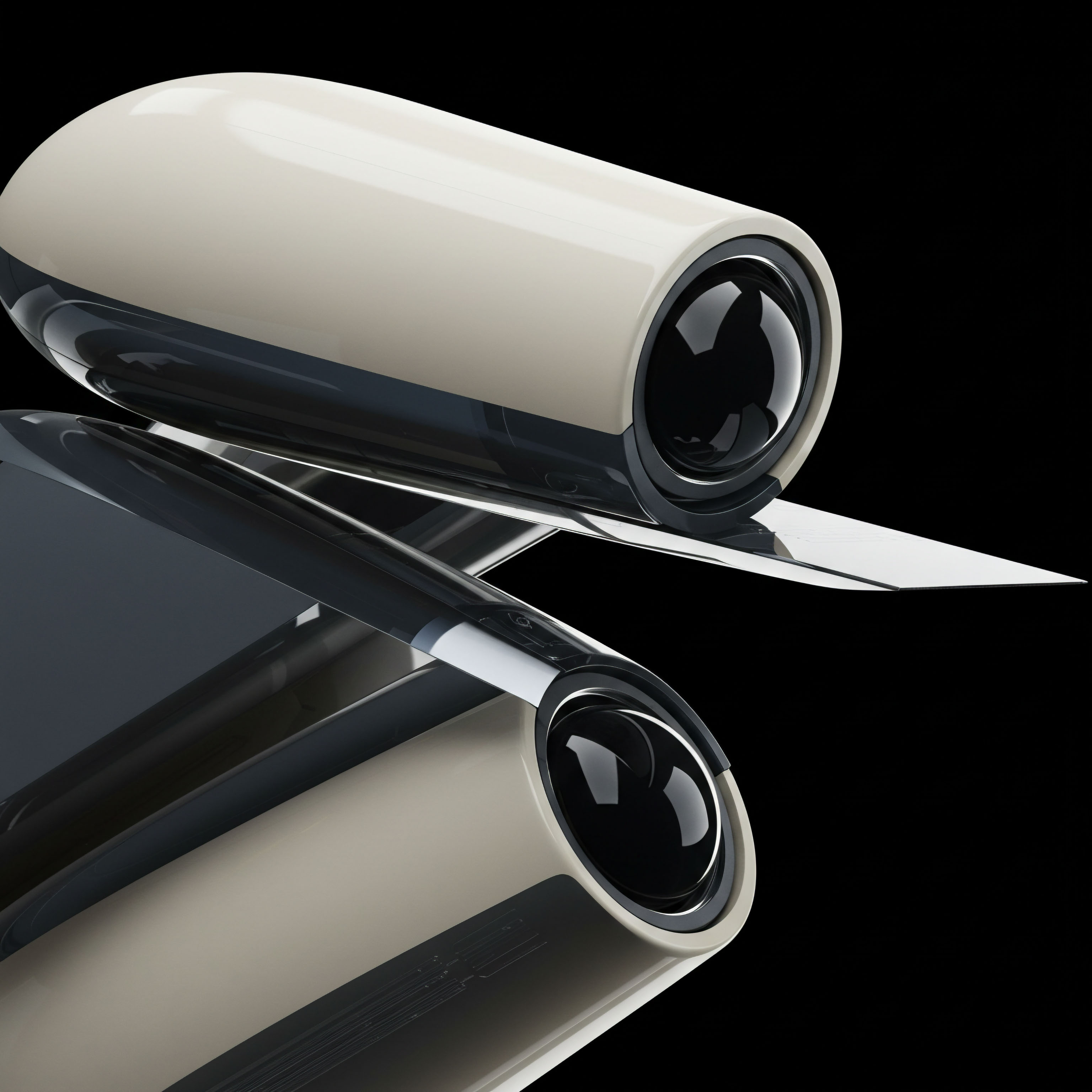

RFQ Integration for Block Trading

For larger crypto block trades, traditional order book execution often incurs significant price impact. Request for Quotation (RFQ) protocols offer a superior alternative, allowing institutional participants to solicit competitive quotes from multiple liquidity providers simultaneously. Integrating RFQ capabilities into an arbitrage system permits execution of substantial positions with minimal slippage, preserving alpha that might erode through conventional methods. This is where the true scale of an arbitrage operation begins to reveal itself.

A system configured for RFQ block trading leverages its existing market data infrastructure to identify optimal entry and exit points for large positions. It then automates the process of sending RFQs to a curated list of dealers, analyzing incoming quotes for best execution, and confirming trades. This method transforms the execution of large orders into a precise, controlled operation.

Anonymous Execution and Price Discovery

RFQ systems facilitate anonymous options trading and block liquidity sourcing, providing a layer of discretion crucial for institutional-grade execution. The ability to anonymously solicit prices from multiple dealers without revealing trade intent minimizes information leakage, securing superior pricing. This strategic advantage extends beyond simple price capture; it reshapes the very geometry of liquidity interaction.

Navigating the intricate landscape of derivatives, particularly Bitcoin and ETH options, requires a nuanced understanding of volatility surfaces and hedging dynamics. An advanced arbitrage system integrates options RFQ functionality to construct and execute complex multi-leg options spreads, such as BTC straddle blocks or ETH collar RFQs. These strategies capitalize on volatility dislocations while maintaining precise risk exposure. The system must possess the capacity to dynamically adjust hedges and rebalance positions in real-time, preserving the integrity of the alpha stream.

True market mastery stems from the continuous integration of cutting-edge execution protocols, transforming complex market dynamics into a systematic pursuit of alpha.

The challenge lies in synthesizing disparate data streams ▴ spot prices, futures curves, options implied volatilities, and RFQ responses ▴ into a singular, coherent trading signal. This requires a robust analytical framework, continuously calibrating models and adapting to evolving market microstructure. My professional journey consistently affirms that enduring success in these markets demands an unwavering commitment to architectural excellence and systematic refinement. This ongoing intellectual grappling with market complexity fuels the next generation of alpha.

Risk management within these advanced systems extends beyond individual trade parameters to encompass portfolio-level exposure. Stress testing, scenario analysis, and dynamic position sizing become indispensable tools. The ultimate expansion involves building a self-optimizing engine, capable of adapting its strategies based on real-time market feedback and pre-defined risk appetites.

Commanding Market Structure

The pursuit of alpha in crypto markets transcends mere trading; it becomes an exercise in engineering. We build systems that anticipate, execute, and adapt, transforming fleeting opportunities into consistent gains. This systematic approach establishes a profound market edge.

Glossary

Low-Latency Execution

Market Microstructure

Risk Management

Quantitative Models

Basis Trading

Derivatives Pricing

Block Trading