Execution Command Center

Mastering block trade pricing demands a strategic approach, moving beyond reactive market engagement. Request for Quotation (RFQ) stands as a foundational mechanism for sophisticated participants, offering a structured pathway to superior execution. This system enables traders to solicit competitive bids from multiple liquidity providers simultaneously, creating an immediate, transparent auction for substantial orders. Understanding its core functionality equips a trader with a powerful instrument for price discovery and capital efficiency.

RFQ functions as a direct negotiation channel within the broader derivatives landscape, particularly impactful for crypto options and traditional options block trades. It allows a singular query to reach a curated network of dealers, each competing to offer the most advantageous terms. This controlled environment mitigates the slippage often associated with executing large orders on open exchanges, preserving value for the trading desk. Engaging with RFQ represents a proactive stance in securing optimal pricing.

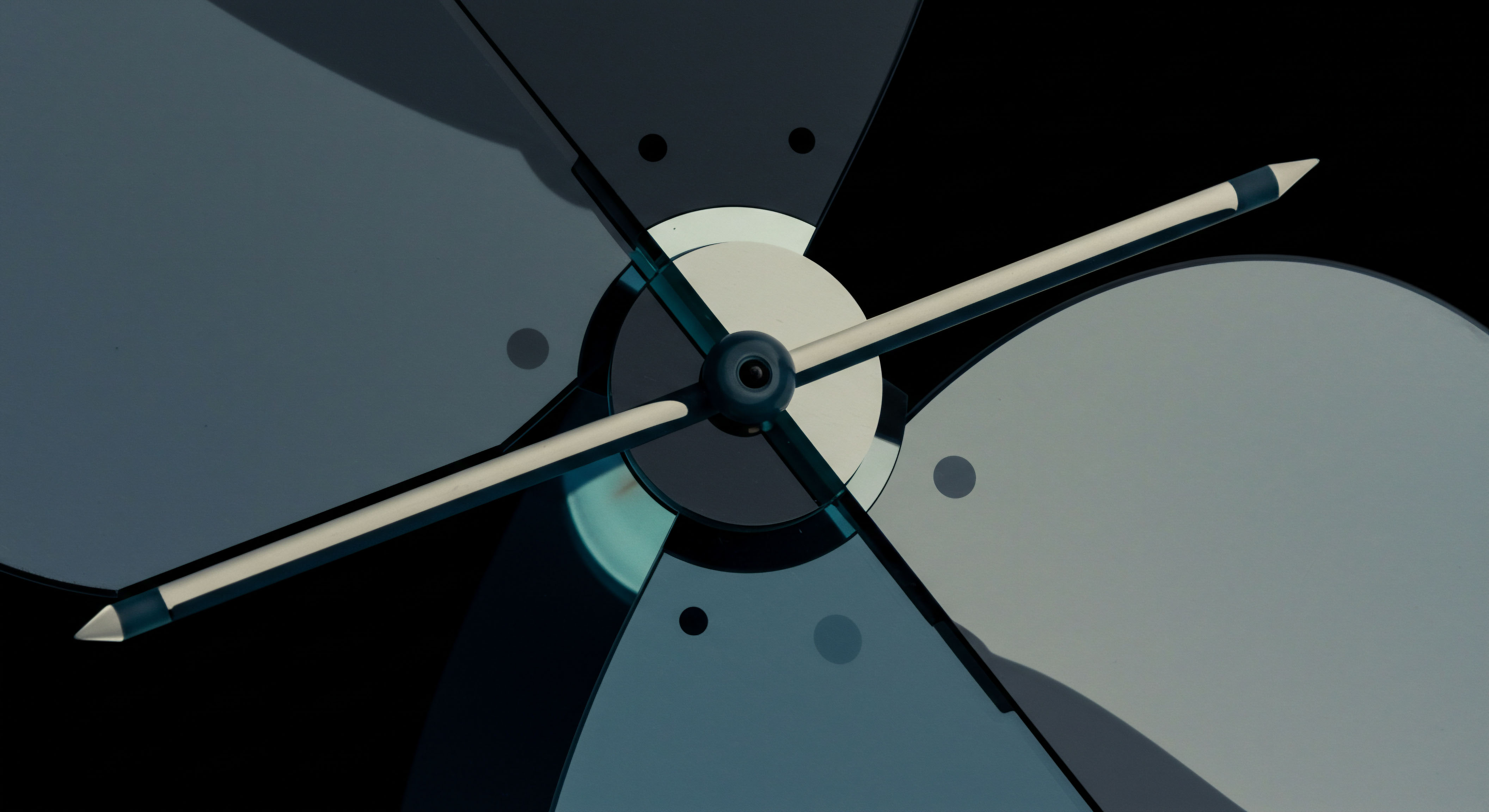

RFQ transforms large order execution into a competitive arena, securing optimal pricing through structured dealer engagement.

The inherent design of RFQ addresses the challenges of liquidity fragmentation prevalent in many derivatives markets. By centralizing the solicitation of prices, it aggregates potential counterparties, ensuring a robust response for significant positions. This streamlined interaction delivers a tangible edge in market microstructure, allowing for precise execution of complex options spreads and volatility strategies. Recognizing the power of this system is the first step toward claiming its benefits.

Strategic Capital Deployment

Deploying capital effectively in block trades requires precision and a clear understanding of execution dynamics. RFQ empowers traders to navigate these complexities, securing superior pricing for options and multi-leg strategies. The systematic solicitation of bids ensures transparency and competition, leading to tighter spreads and reduced transaction costs. This direct engagement translates into measurable performance gains for the portfolio.

Optimal Price Discovery

The core benefit of RFQ lies in its capacity for optimal price discovery. Initiating an RFQ for a large options block compels dealers to present their sharpest prices, aware they compete against peers. This competitive tension is a potent force, driving down the cost basis of positions. Analyzing the received quotes allows for a rapid assessment of market depth and prevailing liquidity conditions, informing the final execution decision with data-driven clarity.

Mitigating Market Impact

Large orders inherently risk market impact, pushing prices against the desired direction. RFQ acts as a protective barrier, facilitating anonymous options trading and shielding the order from public view until execution. This discretion is invaluable for maintaining market neutrality and preserving the integrity of a strategic position. Executing a BTC straddle block or an ETH collar RFQ within this private environment significantly reduces adverse price movements.

Executing Complex Strategies

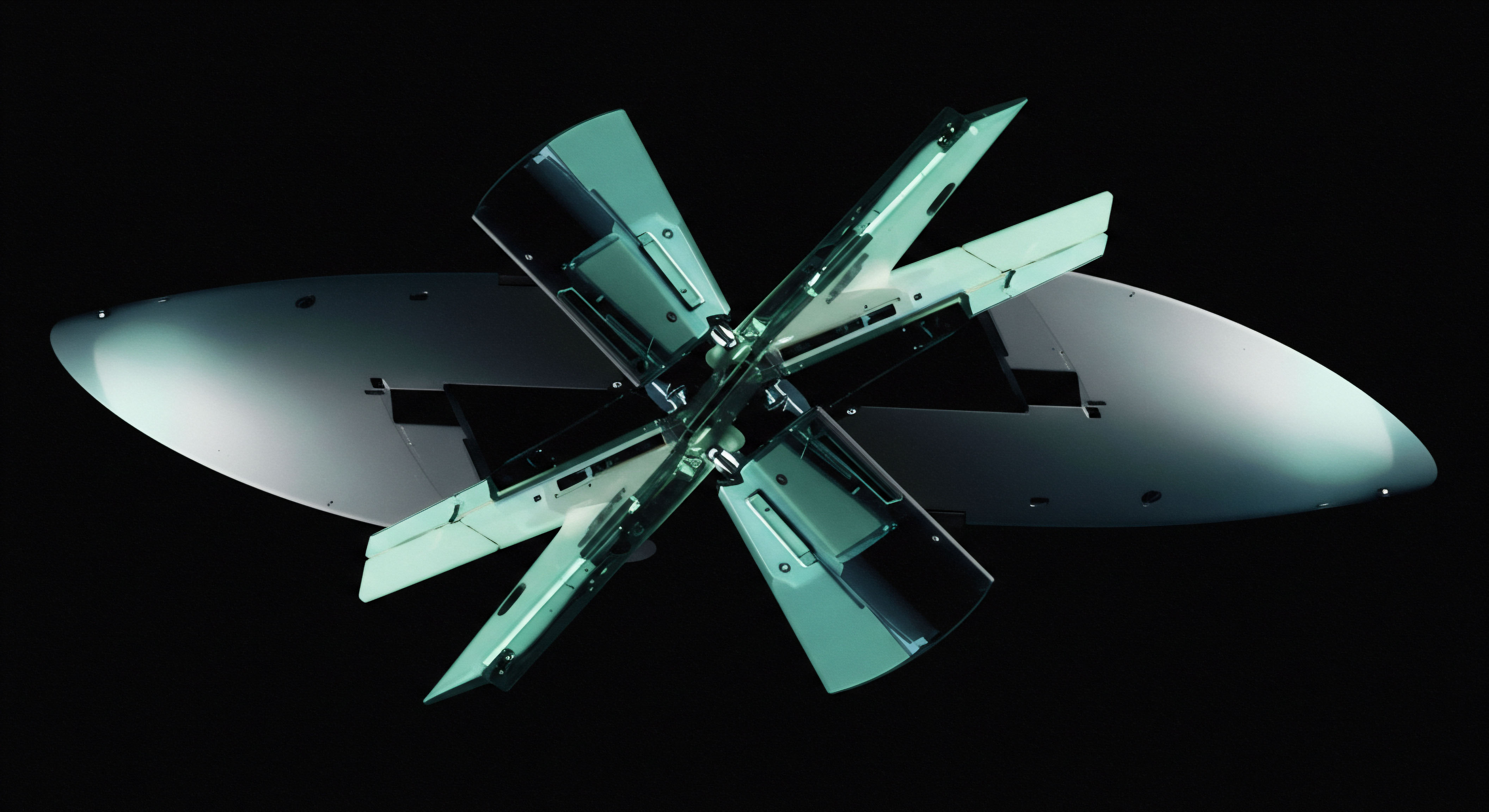

Multi-leg options spreads demand synchronous execution to preserve the intended risk-reward profile. RFQ streamlines this challenge, enabling a single request for an entire spread, such as an iron condor or a butterfly. Dealers then quote the complete package, guaranteeing the legs execute at a consistent, aggregated price. This capability is vital for strategies like volatility block trades, where precise relative pricing among legs determines profitability.

The strategic deployment of RFQ is not a passive exercise; it is an active command of market liquidity. Each interaction refines the understanding of dealer capabilities and market appetite, building an institutional memory of execution quality. This iterative process allows for continuous optimization of trading outcomes, transforming a simple request into a sophisticated data collection and negotiation event. The commitment to this disciplined approach yields consistent, superior results, establishing a clear advantage in a competitive landscape.

- Options Spreads RFQ For intricate multi-leg structures, an RFQ ensures synchronized pricing across all components, preserving the strategy’s integrity.

- Crypto Options Block Execute substantial Bitcoin or Ethereum options positions with minimal slippage, leveraging competitive dealer quotes.

- Multi-dealer Liquidity Access a diverse pool of liquidity providers, maximizing the probability of securing the best available price for large orders.

- OTC Options Facilitate over-the-counter options trading with a transparent, auditable process, enhancing trust and efficiency.

- Best Execution Standards RFQ naturally aligns with best execution principles, providing demonstrable evidence of seeking and attaining optimal trade terms.

Portfolio Resilience Amplification

Elevating execution from tactical wins to strategic portfolio resilience marks the path to market mastery. RFQ, when integrated into a comprehensive investment framework, transcends a mere trading tool; it becomes a core component of capital allocation and risk management. This advanced application extends its utility beyond single-trade optimization, shaping the overall performance trajectory of a derivatives portfolio.

Advanced Risk Management

Deploying RFQ within a broader risk management framework enables dynamic hedging and position adjustments for substantial exposures. Consider a scenario requiring a rapid rebalancing of a large options book; an RFQ allows for efficient, discreet execution of offsetting trades without signaling intent to the wider market. This preserves alpha and protects against adverse price shifts during periods of heightened volatility. Understanding the interplay between execution discretion and portfolio protection reveals a powerful synergy.

Algorithmic Integration Synergy

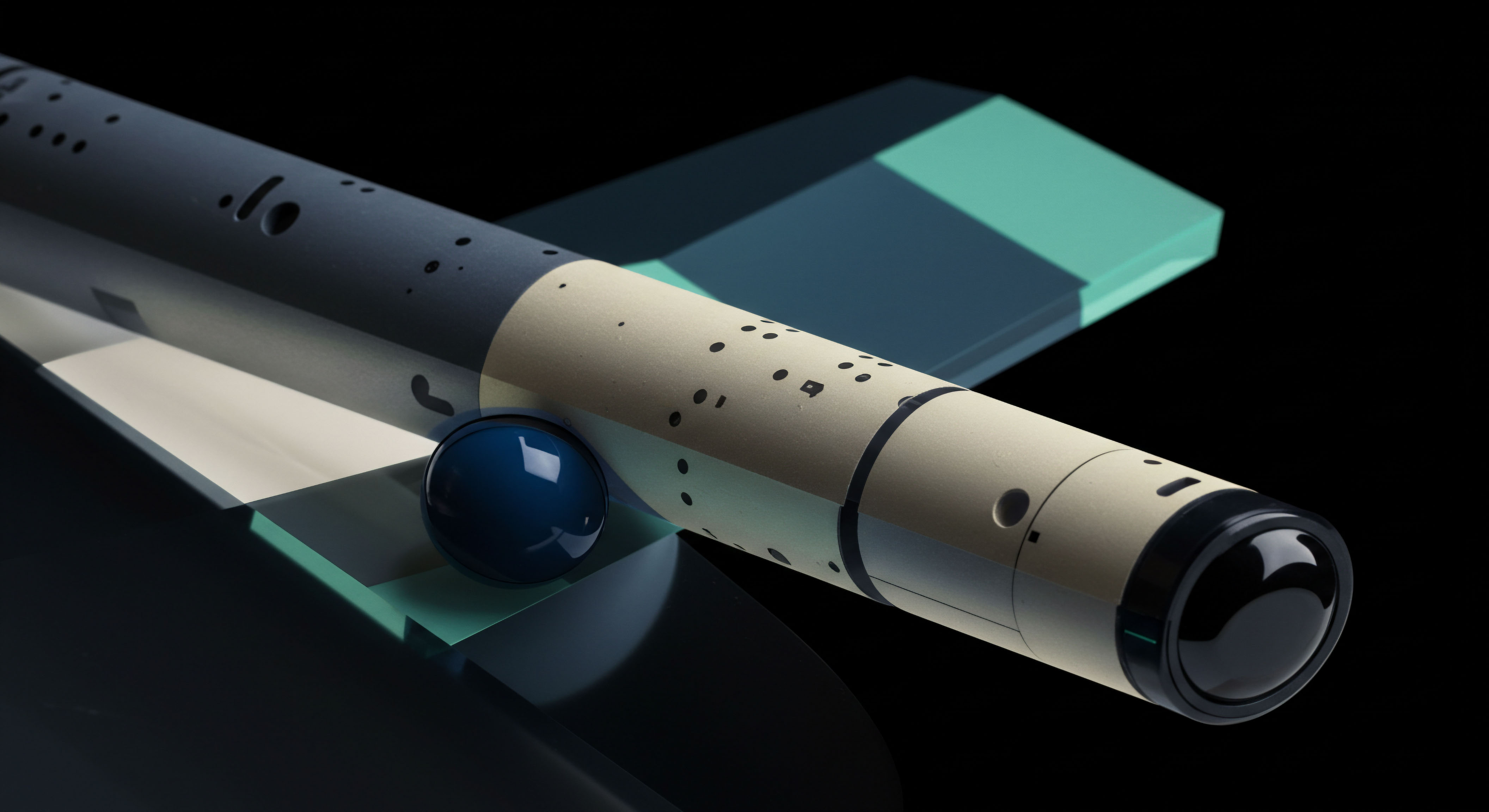

The future of block trading converges with algorithmic precision. Integrating RFQ capabilities into proprietary execution algorithms allows for automated, intelligent routing of large orders based on pre-defined parameters. These algorithms can dynamically assess market conditions, identify optimal liquidity providers, and submit RFQs with refined timing. The ability to programmatically command multi-dealer liquidity through RFQ offers a significant evolution in trading efficiency and control, creating a truly smart trading environment.

The strategic challenge of mastering RFQ for superior block trade pricing extends to understanding its limitations and optimizing its application within diverse market regimes. While RFQ excels in securing competitive prices for substantial orders, its efficacy hinges on the responsiveness and depth of the participating dealer network. Evaluating dealer performance metrics, such as fill rates and average response times, becomes an ongoing exercise in refining one’s execution strategy. This continuous feedback loop ensures that the tactical advantage gained from RFQ remains sharp and adaptive, a critical factor for sustained success.

Derivatives Valuation Precision

RFQ provides a real-time pulse on market sentiment and valuation for specific derivatives. The bids received reflect the collective intelligence and risk appetite of leading market makers. Analyzing these quotes offers invaluable insight into the perceived fair value of complex options structures, especially in less liquid or emerging crypto options markets.

This feedback loop enhances proprietary valuation models, allowing for more precise risk assessment and strategic positioning. Leveraging RFQ data refines the understanding of implied volatility surfaces and skew dynamics.

Commanding Market Dynamics

The journey to superior block trade pricing culminates in a profound understanding of market dynamics, where RFQ serves as a lever for control. This mechanism empowers participants to dictate terms, attracting liquidity to their specific needs. Embrace this sophisticated tool, and transform every large trade into a deliberate act of market command, securing an enduring advantage. The future of execution belongs to those who shape it.