Market Command Fundamentals

Navigating decentralized finance requires a precise operational blueprint. Mastering the Request for Quote (RFQ) system for block trades stands as a cornerstone for professional-grade execution. This mechanism provides a direct, negotiated avenue for transacting substantial crypto derivatives, offering a decisive edge in volatile markets. Understanding its mechanics equips participants with a foundational capability for superior price discovery and minimized market impact.

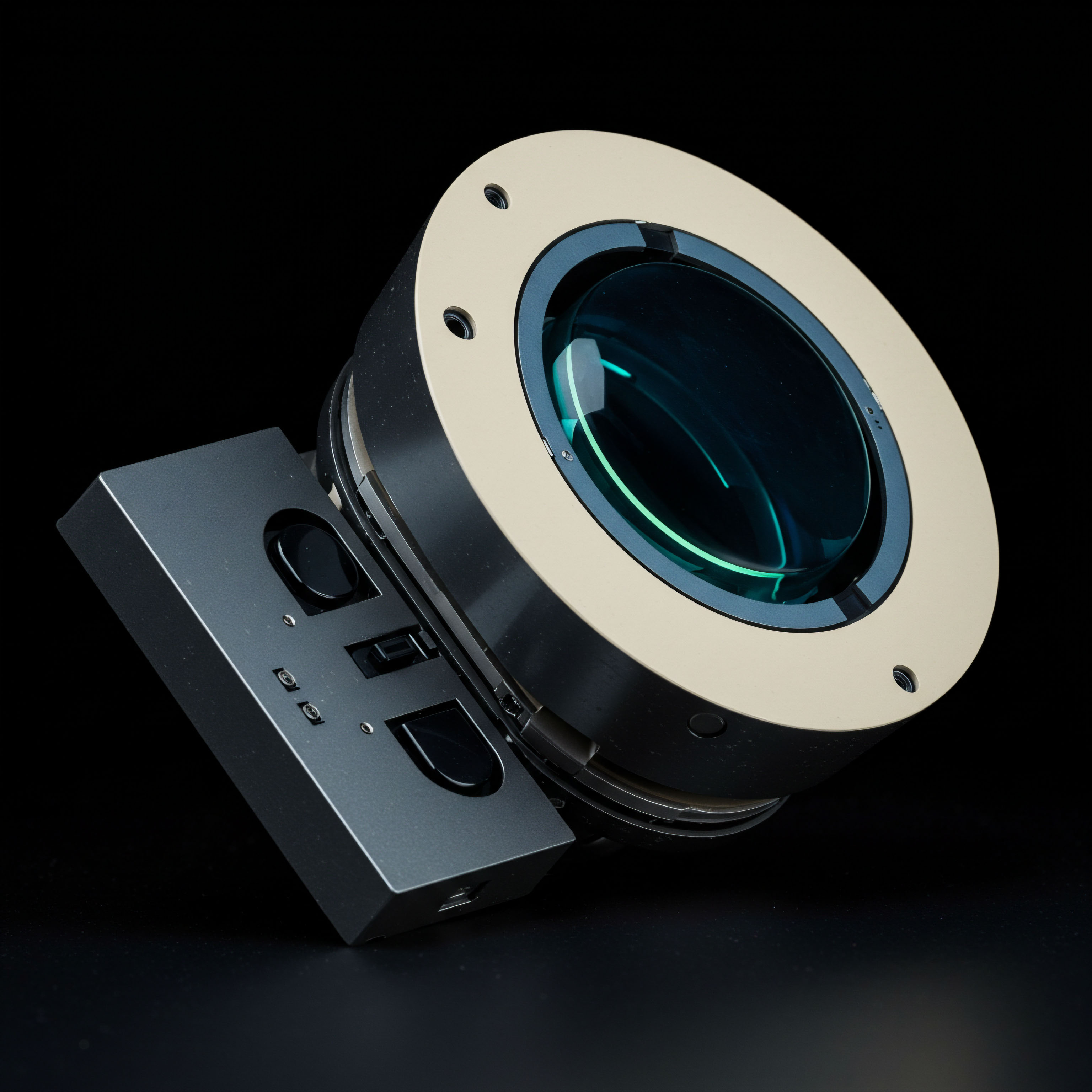

The RFQ system operates as a specialized conduit, connecting institutional participants directly with multiple liquidity providers. Traders submit their desired order parameters, including asset, size, and side, to a curated group of dealers. These dealers then compete by submitting firm quotes, allowing the initiator to select the most favorable terms. This competitive environment fosters optimal pricing, a critical factor for significant positions in Bitcoin options or ETH options.

Employing RFQ for block trades addresses inherent challenges within open order book systems, particularly for larger transactions. Traditional order books can exhibit shallow liquidity at desired price points, leading to significant slippage and adverse price movements. RFQ circumvents this by centralizing liquidity provision for a specific trade, securing firm pricing before execution. This approach transforms potential market friction into a controlled, advantageous interaction.

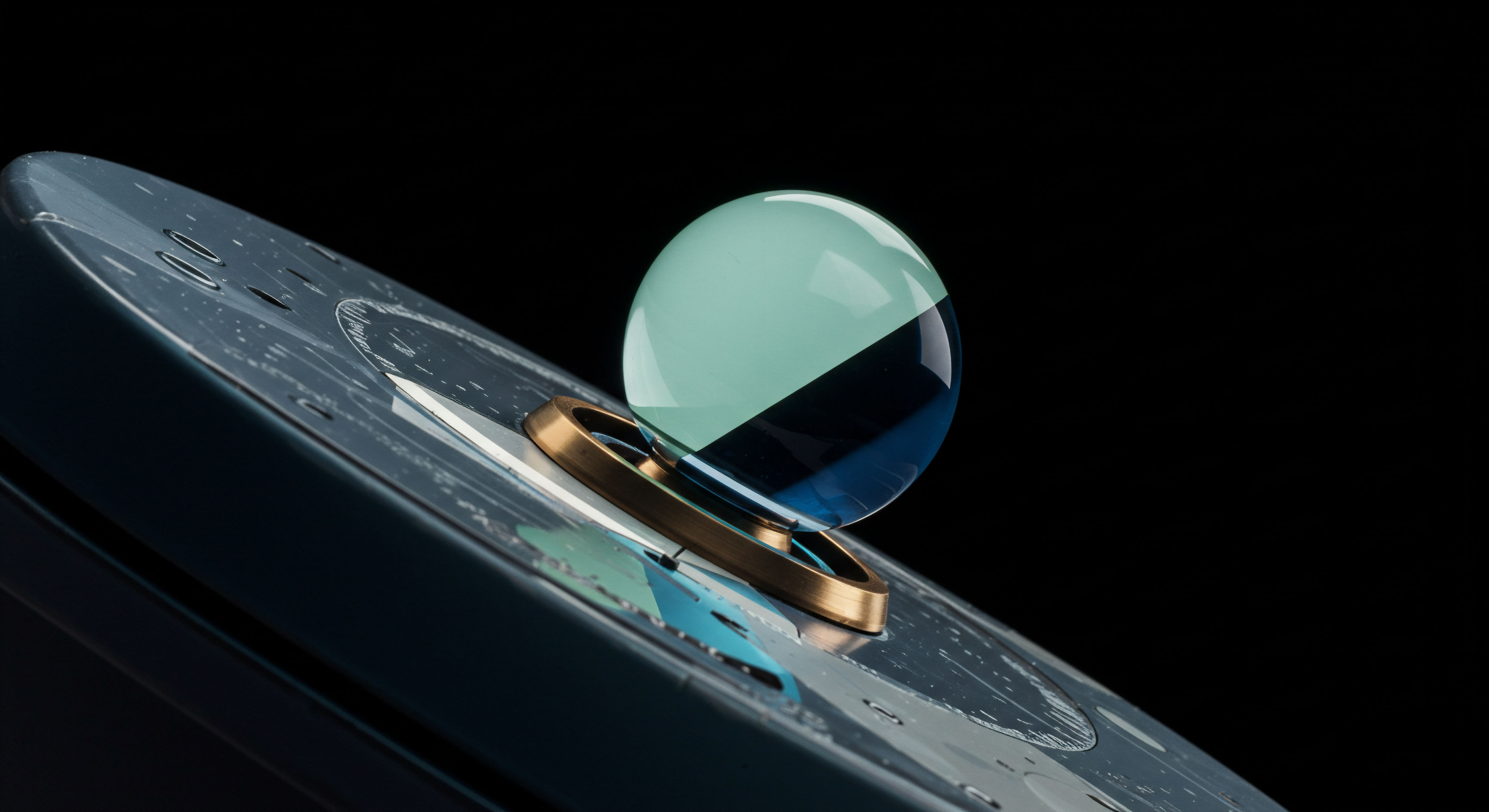

The RFQ system transforms crypto derivatives trading, providing a direct channel for securing optimal block trade execution.

Strategic Capital Deployment

Deploying capital effectively in crypto derivatives demands a strategic mindset, with RFQ block trading serving as a potent instrument for achieving desired outcomes. This section outlines actionable strategies for integrating RFQ into an investment framework, translating theoretical understanding into measurable portfolio enhancement.

Bitcoin Options Block Execution

Executing large Bitcoin options positions requires meticulous attention to market impact. Utilizing RFQ for BTC options blocks allows for discreet entry or exit from substantial directional or volatility bets. Traders specify the exact strike, expiry, and quantity, soliciting competitive bids and offers from a network of dealers. This method ensures best execution by preventing the broad market from reacting to order flow, preserving alpha.

Consider a scenario where a conviction forms regarding Bitcoin’s future price trajectory. Instead of layering orders on a public book, which risks revealing intent and moving the market, an RFQ submission secures a single, competitive price for the entire block. This preserves the integrity of the initial market view, ensuring the trade executes at a price reflecting true market conditions rather than induced slippage.

ETH Collar RFQ Strategies

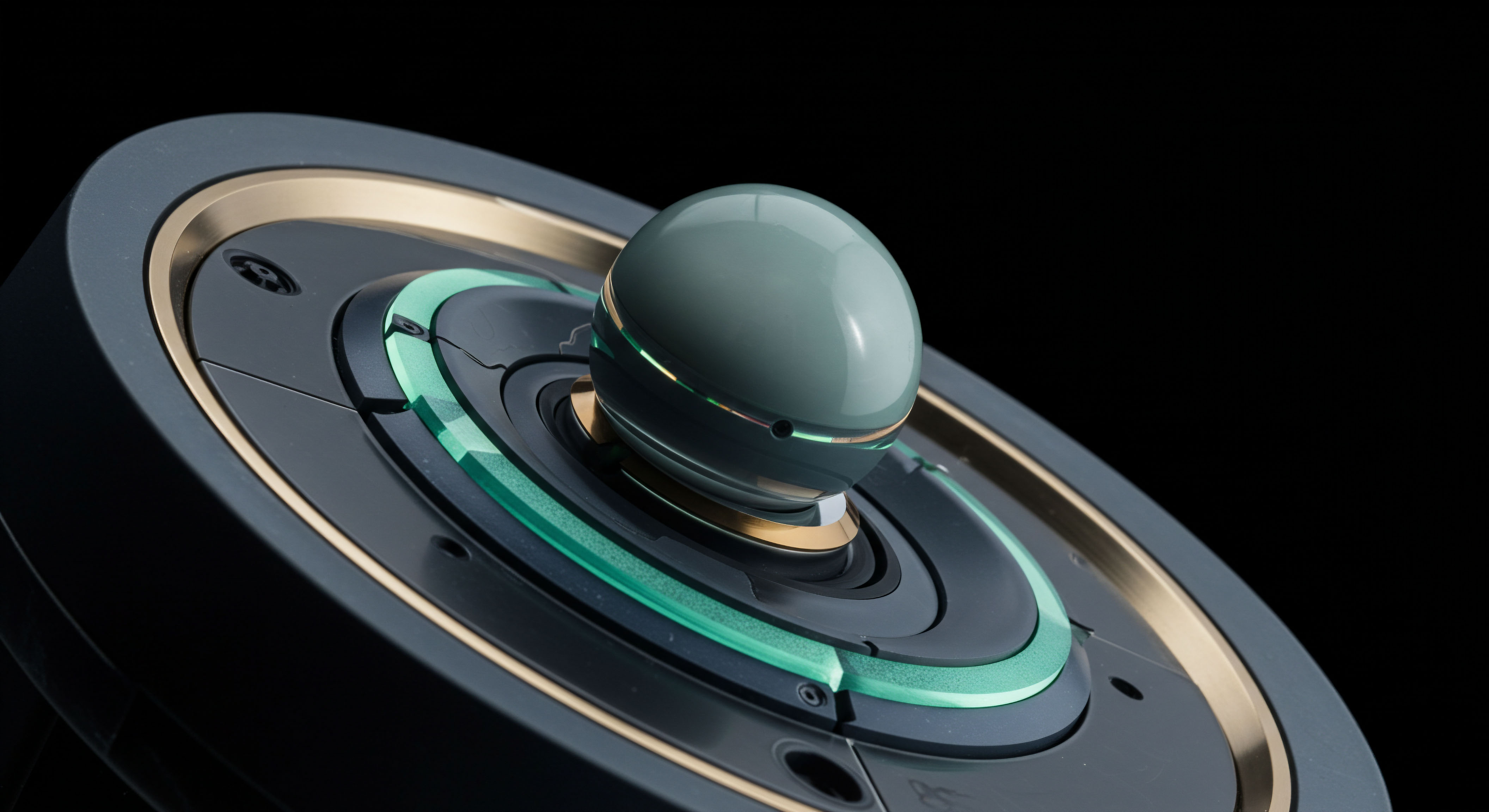

Risk management remains paramount for any sophisticated portfolio. The ETH Collar RFQ offers a powerful, customizable solution for hedging existing Ether holdings or structuring income-generating strategies. This multi-leg options structure involves simultaneously buying an out-of-the-money put option and selling an out-of-the-money call option against an existing long spot ETH position. The RFQ system facilitates the simultaneous execution of these legs, ensuring price cohesion.

Constructing a collar through RFQ provides a defined risk-reward profile. The long put offers downside protection, while the short call generates premium, offsetting the put’s cost. Executing these linked options via RFQ ensures all legs fill at a single, negotiated price, removing execution risk associated with separate orders. This disciplined approach constructs a financial firewall around core holdings, generating yield while limiting exposure.

Multi-Leg Options Spreads

Complex options spreads, such as iron condors or butterflies, present unique execution challenges on fragmented order books. RFQ streamlines the execution of these multi-leg strategies by allowing a single quote request for all components. This guarantees atomic execution, where all legs either fill together or none do, eliminating partial fills and adverse price movements across individual options contracts.

- Defined Risk Spreads ▴ Initiate iron condors or credit spreads on major crypto assets, securing a net credit with precisely defined maximum loss and profit points. The RFQ ensures simultaneous fills across all four legs.

- Volatility Plays ▴ Implement long or short volatility strategies through straddles or strangles, where the RFQ system provides competitive pricing for both the call and put components.

- Arbitrage Opportunities ▴ Capitalize on pricing discrepancies across different options tenors or strikes by executing complex calendar or diagonal spreads via a single RFQ, minimizing latency and slippage.

This approach elevates execution quality for intricate strategies, converting a fragmented market into a cohesive, manageable trading environment. Price integrity stands as a non-negotiable factor.

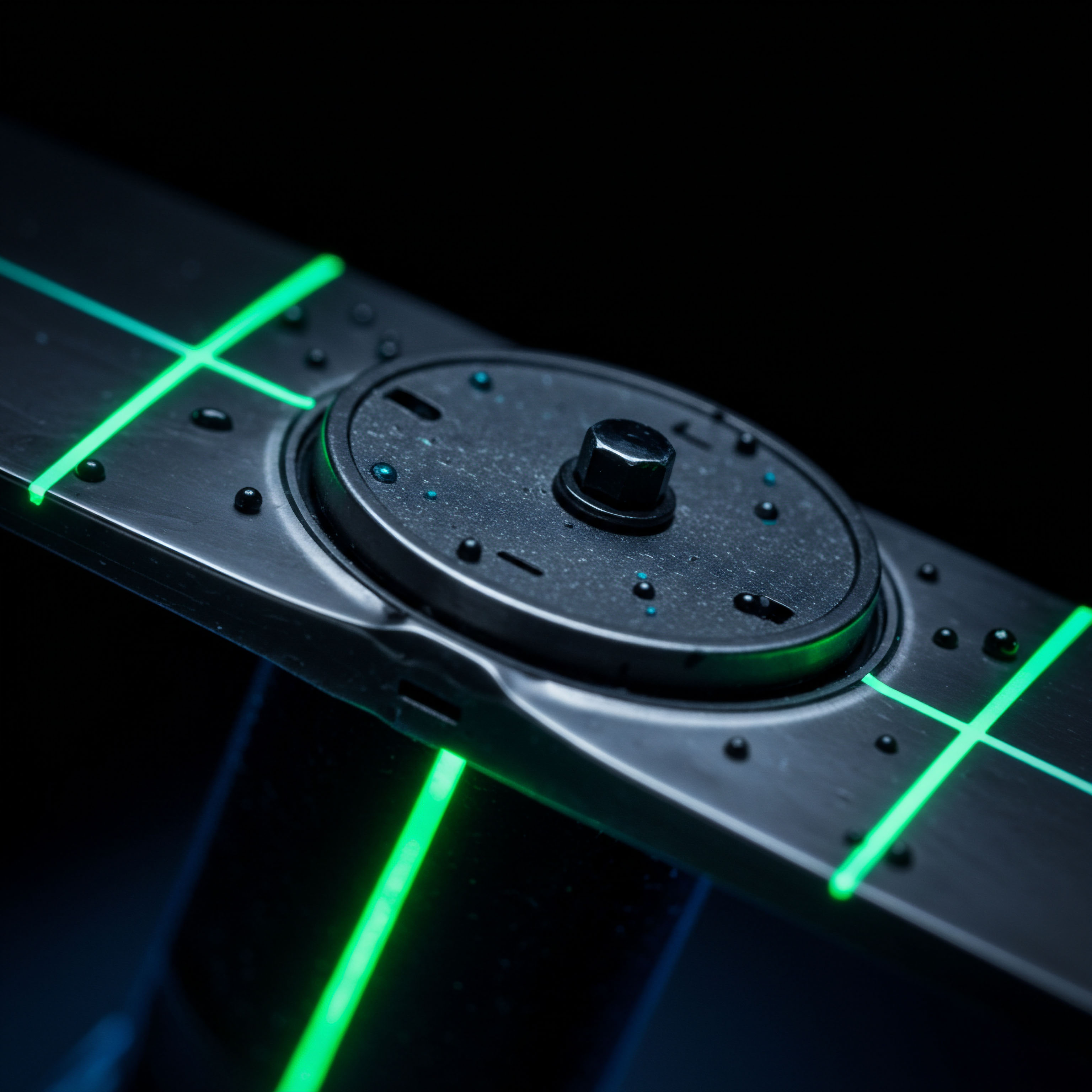

Employing RFQ for multi-leg options ensures atomic execution, preventing partial fills and securing precise pricing for complex strategies.

Achieving superior execution in crypto options block trades hinges upon disciplined engagement with the RFQ mechanism. The system empowers traders to command liquidity, not merely react to its ebb and flow. This provides a clear, actionable advantage in managing substantial positions and complex derivatives structures.

Mastery and Portfolio Integration

Elevating trading proficiency means integrating RFQ block capabilities into a broader portfolio strategy, transcending individual trade execution to achieve systemic alpha. This section delves into advanced applications, connecting RFQ usage to market microstructure advantages, volatility dynamics, and comprehensive risk frameworks.

Market Microstructure Edge

The RFQ system offers a distinct advantage within the evolving market microstructure of crypto derivatives. By enabling private, bilateral negotiations, it reduces information leakage that can plague public order books. Large orders executed through RFQ avoid the immediate price impact often seen when substantial volume hits a visible book, preserving the integrity of the market price for other participants and for the trader’s own execution. This discreet execution preserves capital efficiency across a portfolio, optimizing entry and exit points for significant allocations.

Understanding how RFQ influences market behavior provides a deeper layer of strategic insight. When institutional capital flows through these channels, it shapes the overall liquidity landscape in ways distinct from continuous order book activity. Observing this dynamic reveals a crucial element of sophisticated market participation.

Volatility Trading Optimization

Volatility trading, a sophisticated domain, benefits immensely from RFQ block power. Traders can execute large-scale volatility plays, such as BTC straddle blocks or ETH volatility swaps, with unparalleled precision. The ability to source firm quotes for these complex instruments minimizes the adverse selection risk inherent in fragmented markets. This ensures that a volatility thesis translates directly into a clean, efficiently priced trade.

Consider the strategic implications for a portfolio manager navigating a period of anticipated market turbulence. Securing a large volatility exposure via RFQ allows for a more controlled, cost-effective entry compared to attempting to build the position incrementally on an open exchange. This represents a tangible optimization of capital allocation in dynamic conditions.

Systemic Risk Management

Integrating RFQ into a holistic risk management framework represents a sophisticated approach to portfolio protection. Beyond individual trade hedging, the ability to execute large, custom options strategies allows for dynamic rebalancing and precise exposure adjustments. This minimizes tail risk and optimizes capital allocation across diverse asset classes within a crypto portfolio.

The derivatives strategist views the market as a system of interconnected opportunities and risks. RFQ becomes a lever within this system, allowing for the proactive management of exposure, rather than reactive responses to market events. This represents a proactive stance, a hallmark of professional market engagement. The true measure of an execution framework resides in its capacity to deliver consistent, superior outcomes across varying market conditions.

Execution Mastery the Future Now

Commanding crypto markets demands more than mere participation; it necessitates a deliberate, sophisticated approach to execution. RFQ block power provides the foundational tools, the actionable strategies, and the advanced integration capabilities for those seeking a true market edge. This journey from foundational knowledge to portfolio mastery positions the astute trader at the forefront of a rapidly evolving financial landscape. The future of execution resides in precise, negotiated control, a strategic imperative for consistent performance.

Glossary

Rfq System

Best Execution

Eth Collar Rfq