Command Liquidity Foundations

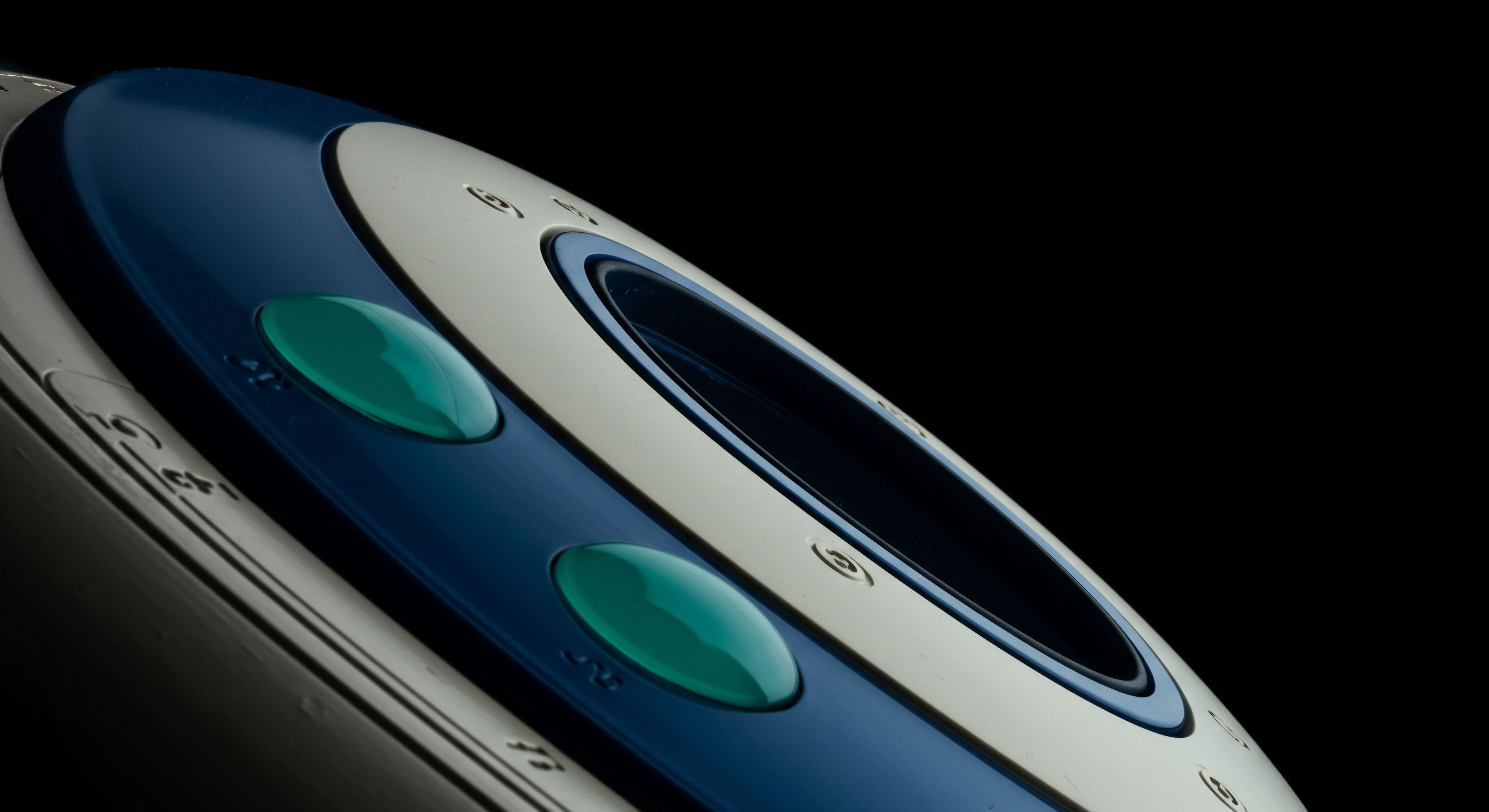

Mastering the crypto options landscape requires an active approach to market engagement. Command Liquidity Crypto Options Blocks represent a sophisticated mechanism for traders to define their execution parameters with precision. This system allows participants to bypass fragmented order books, orchestrating their desired liquidity directly.

The core advantage of this approach centers on achieving optimal pricing and minimizing market impact for substantial positions. Traders gain the ability to solicit quotes from multiple liquidity providers simultaneously, ensuring competitive execution. This method offers a structured environment for large-scale transactions, fundamentally altering how significant options trades materialize in volatile digital asset markets.

Executing substantial crypto options positions demands a direct, engineered approach to liquidity.

Understanding this framework involves recognizing the distinction between passive order placement and proactive liquidity generation. Participants actively solicit bids and offers, shaping their immediate trading environment. This strategic posture yields superior outcomes, fostering a confident engagement with complex derivatives.

Strategic Investment Frameworks

Deploying Command Liquidity Crypto Options Blocks transforms speculative ventures into calculated investment strategies. This section details actionable approaches for leveraging this advanced mechanism to achieve defined financial objectives, emphasizing capital efficiency and execution quality.

Precision Hedging Tactics

Implementing a precision hedging strategy involves using Command Liquidity Blocks to acquire or offload options positions that directly mitigate existing portfolio risks. A portfolio manager might seek to establish a protective put spread on a significant ETH holding. This requires a precise entry price and minimal slippage to maintain the integrity of the hedge. By utilizing a block trade, the manager secures competitive pricing from multiple counterparties, ensuring the hedge’s effectiveness.

- Define the specific risk exposure.

- Determine the precise options strike and expiry for risk mitigation.

- Solicit competitive quotes through the block mechanism.

- Execute the trade at the optimal aggregated price.

- Monitor the hedge performance against portfolio volatility.

Yield Enhancement Strategies

Generating yield through covered call or cash-secured put strategies gains significant efficiency with Command Liquidity. For instance, an investor holding a substantial BTC allocation can sell covered calls to collect premium. Executing these calls via a block ensures the best available premium capture, directly contributing to portfolio income. This method enhances the overall yield profile of underlying assets.

Consider the structured approach for a covered call block trade:

Covered Call Block Execution

The process commences with identifying a target premium and an acceptable strike price for the underlying asset. Subsequently, the block mechanism facilitates simultaneous bids from various liquidity providers, creating a competitive environment. This ensures the highest possible premium for the seller, directly augmenting portfolio returns. The focus remains on optimizing the income generation aspect of the strategy.

Volatility Arbitrage Operations

Exploiting discrepancies in implied volatility across different options series or underlying assets represents an advanced application. A trader identifies a mispricing between two related volatility products, such as a BTC straddle and an equivalent ETH straddle. Executing both legs as a single, anonymous block transaction allows for the efficient capture of this arbitrage opportunity without signaling market intent. The block trade preserves the pricing edge inherent in the volatility disparity.

This operational sequence requires meticulous preparation and swift execution. Traders analyze market data, identify actionable volatility differentials, and then leverage the block system to secure simultaneous, favorable pricing for all components of the arbitrage. Success hinges upon rapid, discrete execution.

Strategic block trading enables superior pricing for complex options structures, translating directly into enhanced investment outcomes.

Mastering Advanced Applications

Moving beyond foundational deployment, mastering Command Liquidity Crypto Options Blocks involves integrating these mechanisms into a broader, multi-asset portfolio architecture. This progression signifies a shift from tactical execution to strategic market influence, building a robust, alpha-generating framework.

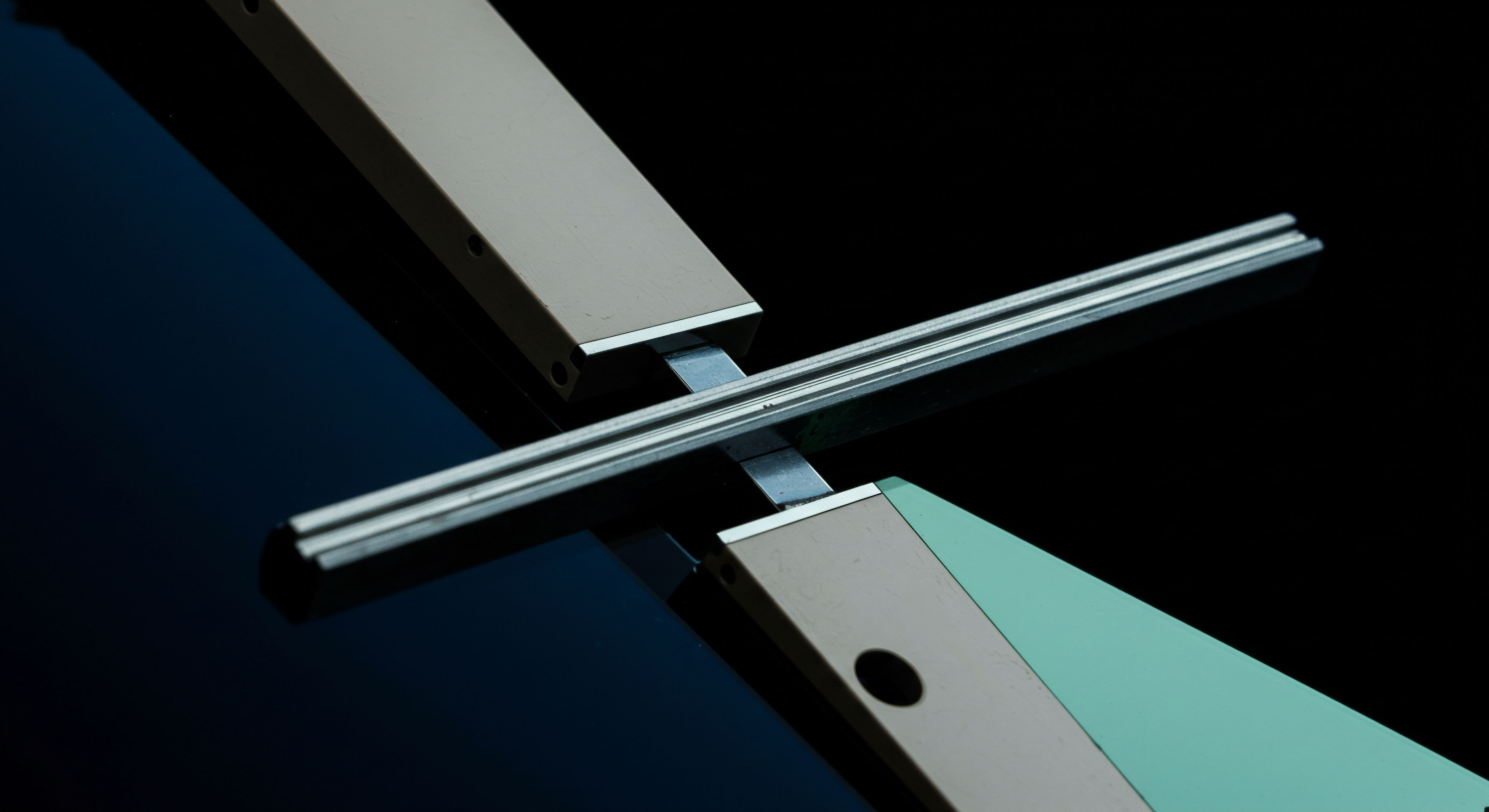

Multi-Leg Options Orchestration

Advanced traders utilize Command Liquidity for orchestrating complex multi-leg options strategies, such as iron condors, butterflies, or ratio spreads. Executing these structures as a single block transaction ensures that all legs are filled at a predetermined aggregate price, eliminating leg risk. This unified approach prevents adverse price movements between individual fills, preserving the intended risk-reward profile of the entire strategy.

Consider the strategic implications of executing a multi-leg options block. The ability to lock in the total spread price provides an unparalleled advantage in dynamic markets. This capability permits the construction of sophisticated risk profiles with confidence, knowing the execution aligns precisely with the strategic intent. This elevates options trading to a form of financial engineering.

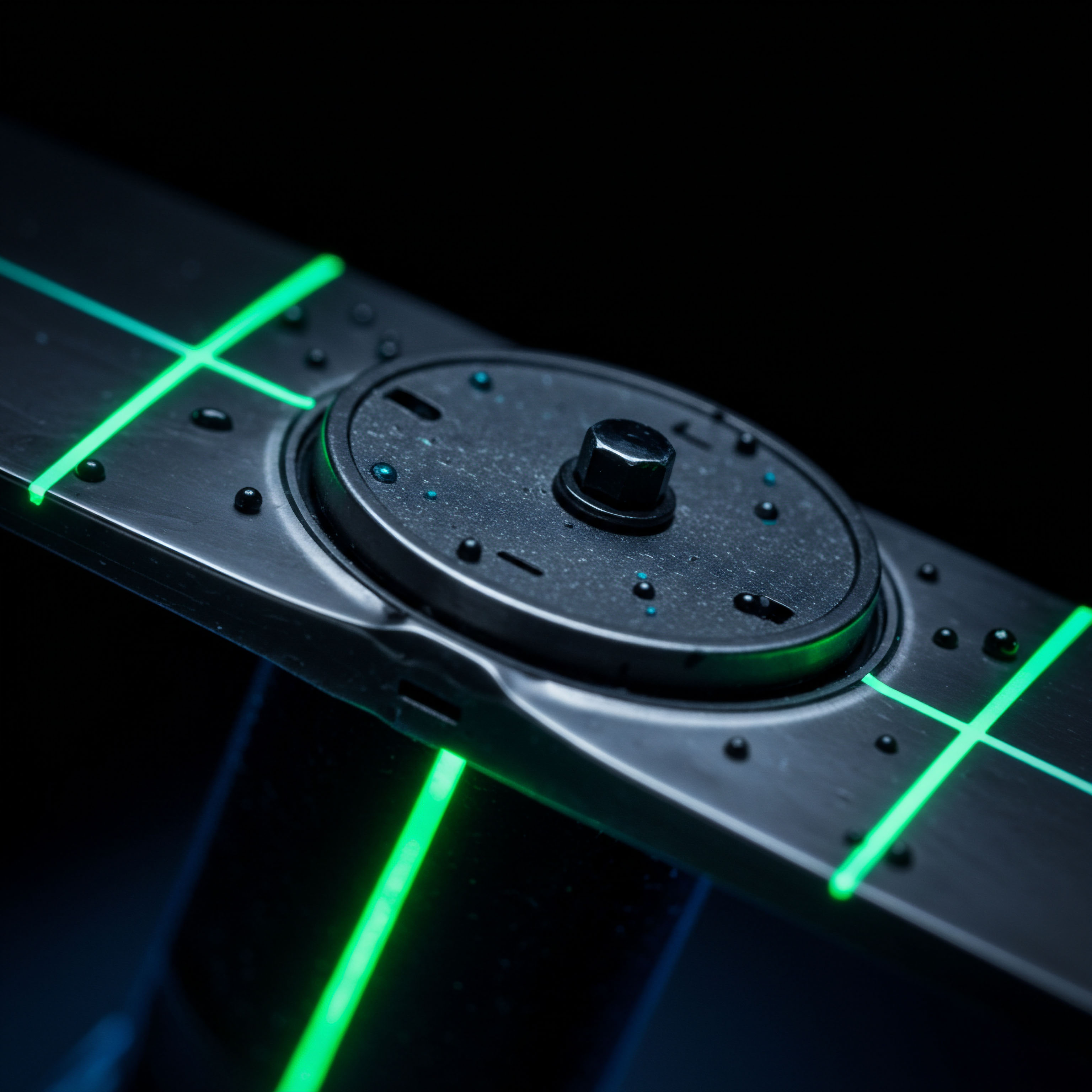

Portfolio Risk Rebalancing

Rebalancing a large derivatives portfolio often necessitates significant options adjustments. Command Liquidity Blocks offer an efficient method for executing these adjustments without undue market impact. A portfolio manager might need to reduce delta exposure across several Bitcoin options positions.

Aggregating these adjustments into a single block trade allows for anonymous, competitive execution, maintaining the portfolio’s desired risk parameters with minimal friction. The complexity of these operations is considerable, requiring deep analytical rigor.

This process demands a comprehensive understanding of the portfolio’s entire risk surface. The Derivatives Strategist actively identifies areas of imbalance and then crafts precise block orders to recalibrate exposure. This proactive risk management defines a superior approach to portfolio oversight. Achieving optimal rebalancing often feels like solving a complex, dynamic equation under real-time market pressure.

Market Microstructure Influence

Consistent, intelligent use of Command Liquidity Blocks allows sophisticated participants to subtly influence market microstructure. By executing large trades away from public order books, traders minimize signaling risk and reduce immediate price impact. This disciplined approach preserves the market’s depth for subsequent actions, a critical consideration for those managing substantial capital. The very act of executing a block contributes to a more efficient, yet less transparent, pricing environment for the participant.

Shaping Your Trading Horizon

The future of sophisticated crypto options trading resides in the ability to command market conditions. Embrace the discipline of block execution, and redefine the boundaries of your strategic potential. The tools exist; the mastery awaits.

Glossary

Command Liquidity Crypto Options Blocks

Crypto Options

Command Liquidity Crypto Options

Command Liquidity

Btc Straddle

Liquidity Crypto Options Blocks