Commanding Liquidity

The digital asset options market presents unparalleled opportunities for those who master its unique dynamics. Executing substantial options positions requires a precise methodology, moving beyond the limitations of standard order books. Professional traders recognize the imperative of bespoke liquidity channels, particularly when dealing with significant notional values. This strategic approach ensures optimal execution and minimizes market impact, a constant consideration for any substantial trade.

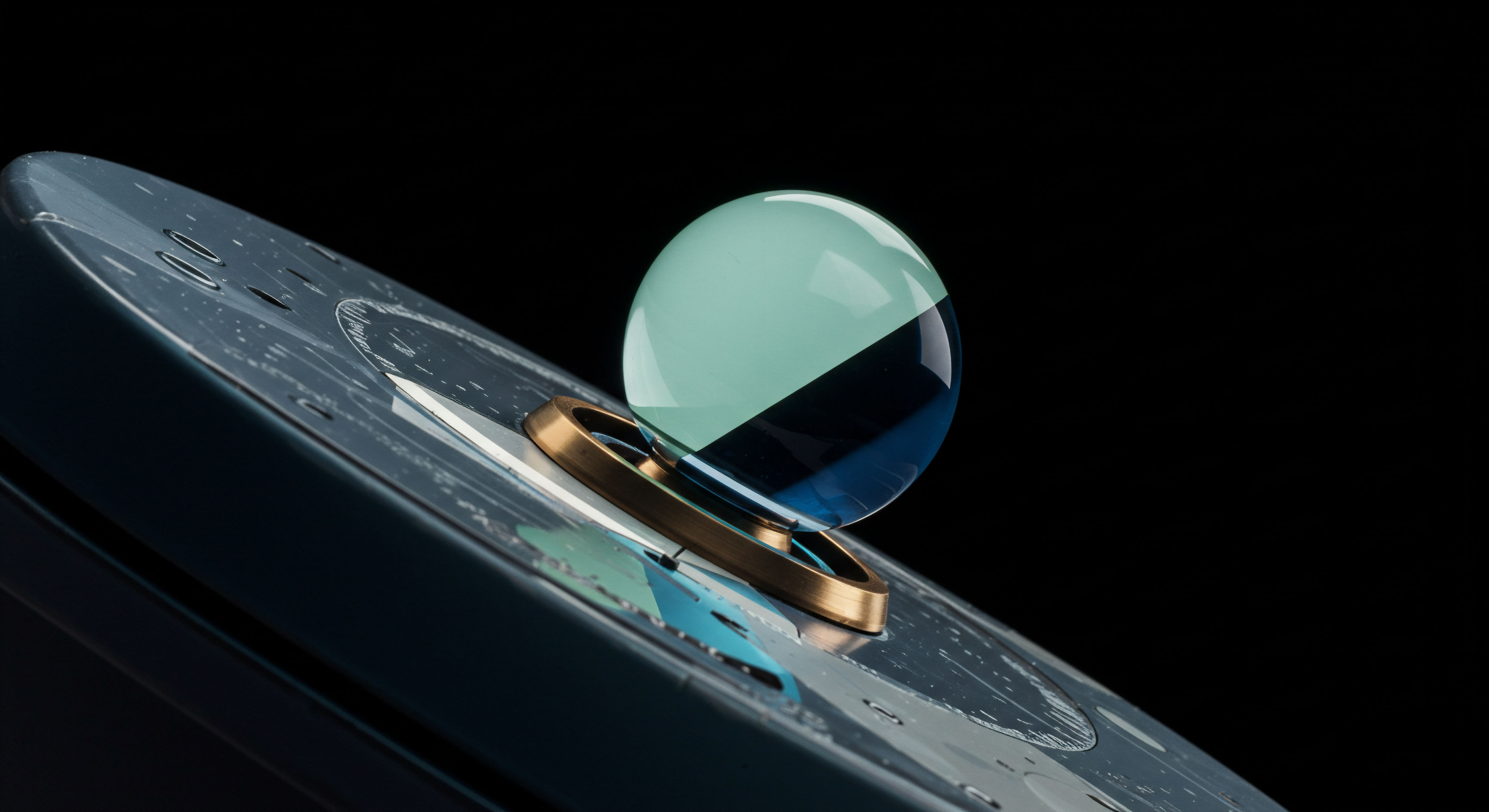

Achieving superior execution inherently involves establishing execution control. A dedicated Request for Quote (RFQ) system offers a structured environment for sourcing liquidity from multiple dealers simultaneously. This mechanism allows participants to solicit competitive bids for large crypto options trades, moving them from fragmented public venues into a private, competitive negotiation. Such a process transforms execution from a reactive endeavor into a proactive one, securing desired pricing and volume without disrupting the broader market.

Mastering bespoke liquidity channels in crypto options unlocks superior execution and reduces market impact for substantial positions.

Understanding the underlying market microstructure illuminates the benefits of this approach. Centralized exchanges, while accessible, frequently exhibit insufficient depth for large orders, leading to considerable slippage. RFQ environments circumvent this challenge by directly engaging liquidity providers, who then compete for the opportunity to fill the order.

This competitive tension frequently results in price improvement, a measurable advantage for the discerning trader. The system empowers a trader to define the parameters of their trade, then invite the market to meet those terms.

Strategic Capital Deployment

Deploying capital with precision in large crypto options positions demands a disciplined approach to execution. The RFQ environment provides the ideal conduit for implementing sophisticated strategies, ensuring that the intended market view translates directly into a favorable trade outcome. This section outlines actionable strategies and the operational considerations for maximizing returns.

Volatility Structures

Harnessing Market Movements

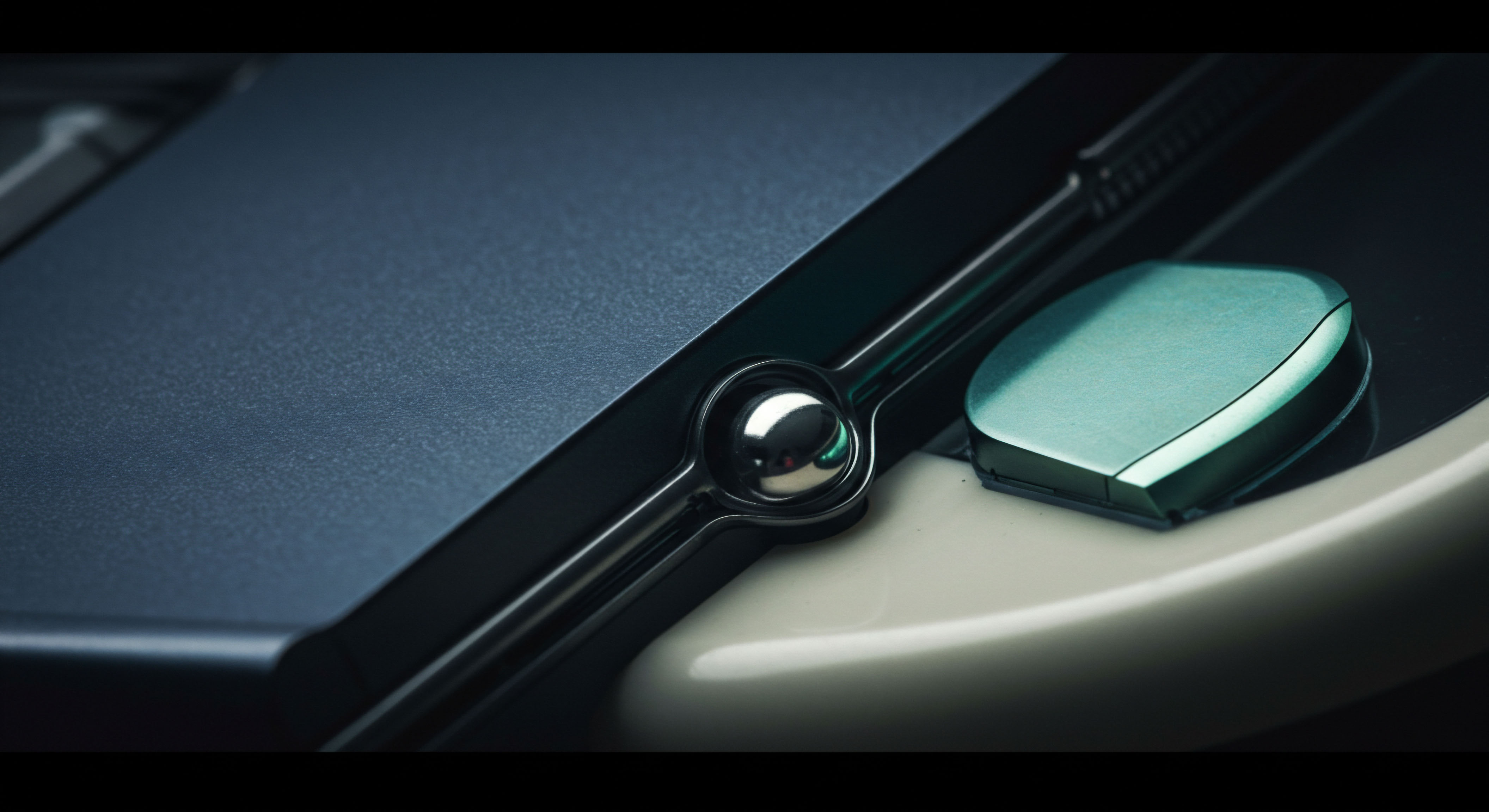

Volatility strategies, such as straddles and strangles, allow traders to capitalize on expected price swings without predicting direction. Executing these multi-leg structures within an RFQ system simplifies the process. A trader submits a single RFQ for the entire spread, receiving a composite quote that accounts for both legs.

This streamlined execution avoids leg risk, where individual components of a spread might fill at unfavorable prices, eroding potential gains. The system provides a unified price, securing the spread’s integrity.

Consider a BTC straddle block. A trader anticipates significant movement following an event but remains uncertain of the direction. By submitting an RFQ for both a call and a put with the same strike and expiry, they receive a firm price for the entire volatility play. This direct negotiation with multiple liquidity providers frequently yields tighter bid-ask spreads than attempting to execute each leg individually on a public order book.

Defined Risk Strategies

Protective Collars and Covered Calls

Managing downside risk remains paramount in any options strategy. Protective collars, comprising a long asset, a short call, and a long put, offer defined risk parameters. An RFQ streamlines the simultaneous execution of the options legs, ensuring the desired risk-reward profile materializes precisely. This proactive risk mitigation provides a financial firewall against adverse price movements, preserving capital.

Covered call strategies generate income from existing asset holdings. For large holdings, selling calls via an RFQ provides access to institutional liquidity, often resulting in superior premiums. This approach transforms static asset ownership into an active income-generating venture, enhancing overall portfolio yield. Execution discipline matters.

Execution Dynamics in RFQ

Optimizing Bid-Offer Spreads

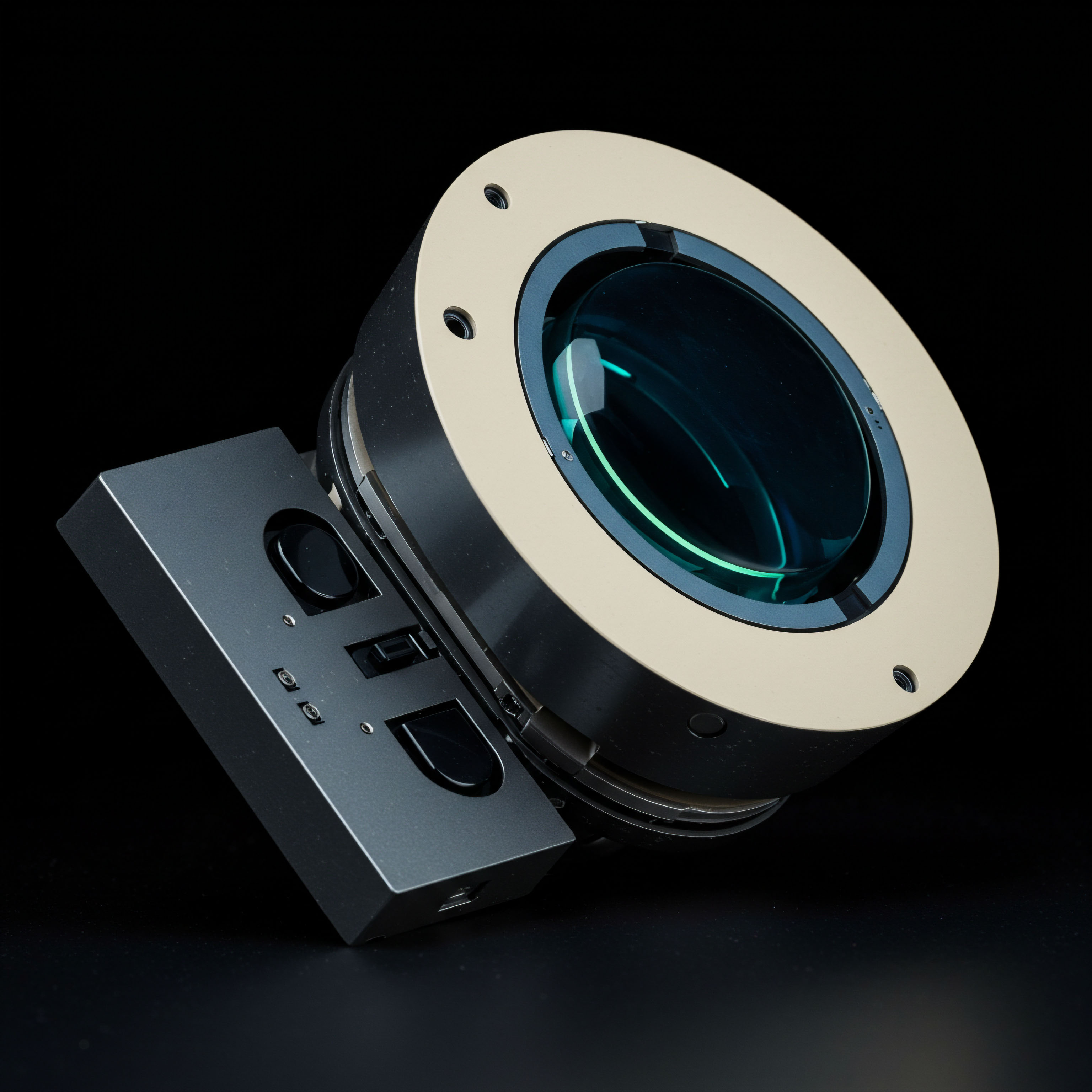

The multi-dealer RFQ environment fosters intense competition among liquidity providers. This competition compresses bid-offer spreads, directly benefiting the requesting party through improved pricing. Traders receive multiple quotes, enabling them to select the most advantageous offer. The transparency of multiple responses empowers decisive action.

- Anonymity ▴ Traders can execute large positions without revealing their intentions to the broader market. This prevents front-running and minimizes price impact, a critical consideration for substantial orders.

- Multi-Leg Order Handling ▴ RFQ systems efficiently handle complex multi-leg options strategies. A single request covers all components, simplifying execution and ensuring the integrity of the desired spread.

- Price Improvement ▴ Competition among liquidity providers frequently results in tighter spreads and superior fill prices compared to standard exchange execution.

For large crypto options positions, a fractional improvement in price translates into substantial capital preservation. The RFQ mechanism systematically captures this value.

Advanced Strategic Applications

Elevating one’s command of crypto options extends beyond individual trades, integrating advanced techniques into a cohesive portfolio management framework. The sophisticated trader views RFQ capabilities as an indispensable component of their strategic toolkit, enabling nuanced market interaction and sustained advantage.

Dynamic Portfolio Hedging

Precision Risk Mitigation

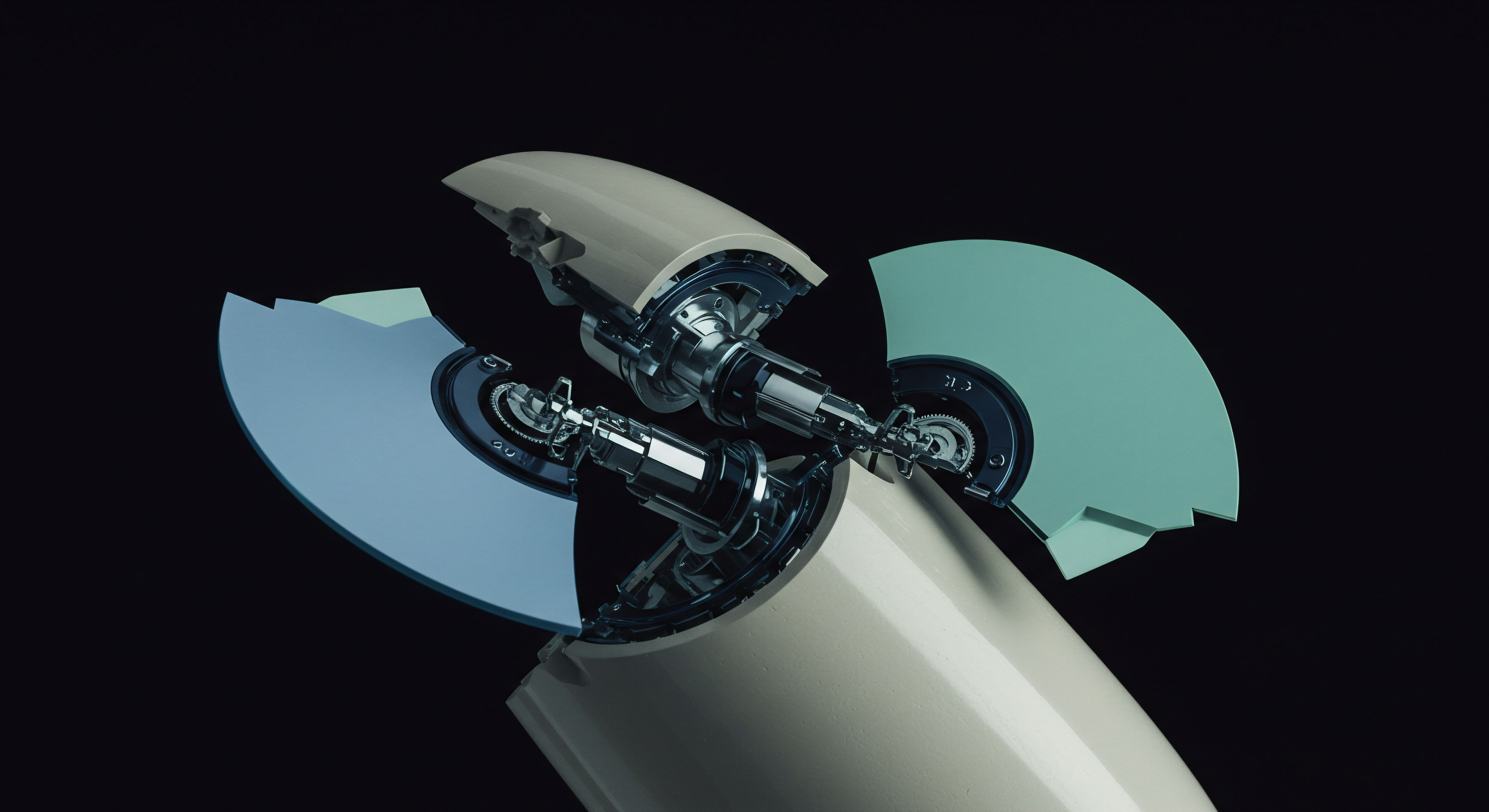

Advanced traders employ RFQ systems for dynamic hedging, calibrating portfolio risk exposures with exactitude. When adjusting delta or gamma across a large options book, rapid and precise execution becomes non-negotiable. Submitting RFQs for specific delta hedges ensures that rebalancing occurs at optimal prices, minimizing slippage and maintaining the desired risk profile. The market’s complexity often demands a continuous recalibration of positions.

Consider a scenario where market volatility shifts rapidly, necessitating a swift adjustment to a large options portfolio’s gamma exposure. Crafting an RFQ for a tailored options spread or a series of single-leg trades allows for immediate engagement with liquidity providers. This proactive management of risk, executed through a controlled channel, protects against unforeseen market dislocations. The challenge of maintaining a perfectly hedged book against continuous market flux remains a constant intellectual engagement.

Structured Product Creation

Bespoke Financial Engineering

RFQ environments facilitate the creation of highly customized structured products. Traders can combine various options and underlying assets to engineer specific payoff profiles, tailoring risk and return characteristics to precise specifications. This level of financial engineering transcends basic options trading, offering avenues for unique alpha generation. Such tailored instruments address distinct market opportunities.

Imagine constructing a complex yield-enhancement structure for a client with specific views on ETH price stability. An RFQ enables the simultaneous acquisition of multiple options components, securing the desired payout structure and premium at competitive rates. This bespoke assembly of financial instruments showcases the full power of controlled liquidity access, moving beyond off-the-shelf solutions to truly custom financial constructs.

Liquidity Aggregation and Market Impact

Minimizing Traceable Footprints

The true mastery of large crypto options execution involves minimizing market impact. RFQ systems, by design, aggregate liquidity privately, allowing significant order flow to transact without leaving a discernible footprint on public order books. This capacity for anonymous execution preserves the integrity of a trader’s intentions, preventing adverse price movements that often accompany large, visible orders. Maintaining discretion in large-scale trading offers a distinct advantage.

Understanding the intricacies of liquidity provision and demand dynamics provides a decisive edge. Liquidity providers, in turn, gain a clear view of the aggregated order, enabling them to offer tighter prices based on a more complete picture of demand. This symbiotic relationship within the RFQ framework ultimately leads to superior execution for the initiator.

Mastery beyond Markets

The journey toward commanding liquidity precision in large crypto options reshapes one’s entire approach to market engagement. It represents a commitment to operational excellence, transforming complex market dynamics into a field of strategic opportunity. This evolution in trading methodology elevates participation from speculative ventures to a refined practice of financial engineering.

Embracing professional-grade execution capabilities means actively shaping one’s trading environment, rather than passively accepting its constraints. It involves a continuous refinement of process, a relentless pursuit of measurable advantage, and an unwavering focus on the systemic elements that drive superior outcomes. The disciplined application of these principles ensures a consistent edge.

The next frontier involves leveraging these controlled execution environments for cross-asset hedging and the development of entirely new digital asset derivatives. The strategic vision extends beyond today’s market, anticipating future complexities and building the foundational capabilities to address them with unwavering confidence.

Glossary

Large Crypto Options

Liquidity Providers

Crypto Options

Btc Straddle Block