Execution Mastery Fundamentals

Superior execution in digital asset markets commences with a precise understanding of specialized trading mechanisms. Commanding crypto liquidity precision involves deploying sophisticated tools, moving beyond conventional spot trading. This systematic approach ensures optimal price discovery and minimal market impact. A trader’s ambition to navigate volatile digital landscapes demands an appreciation for these advanced capabilities.

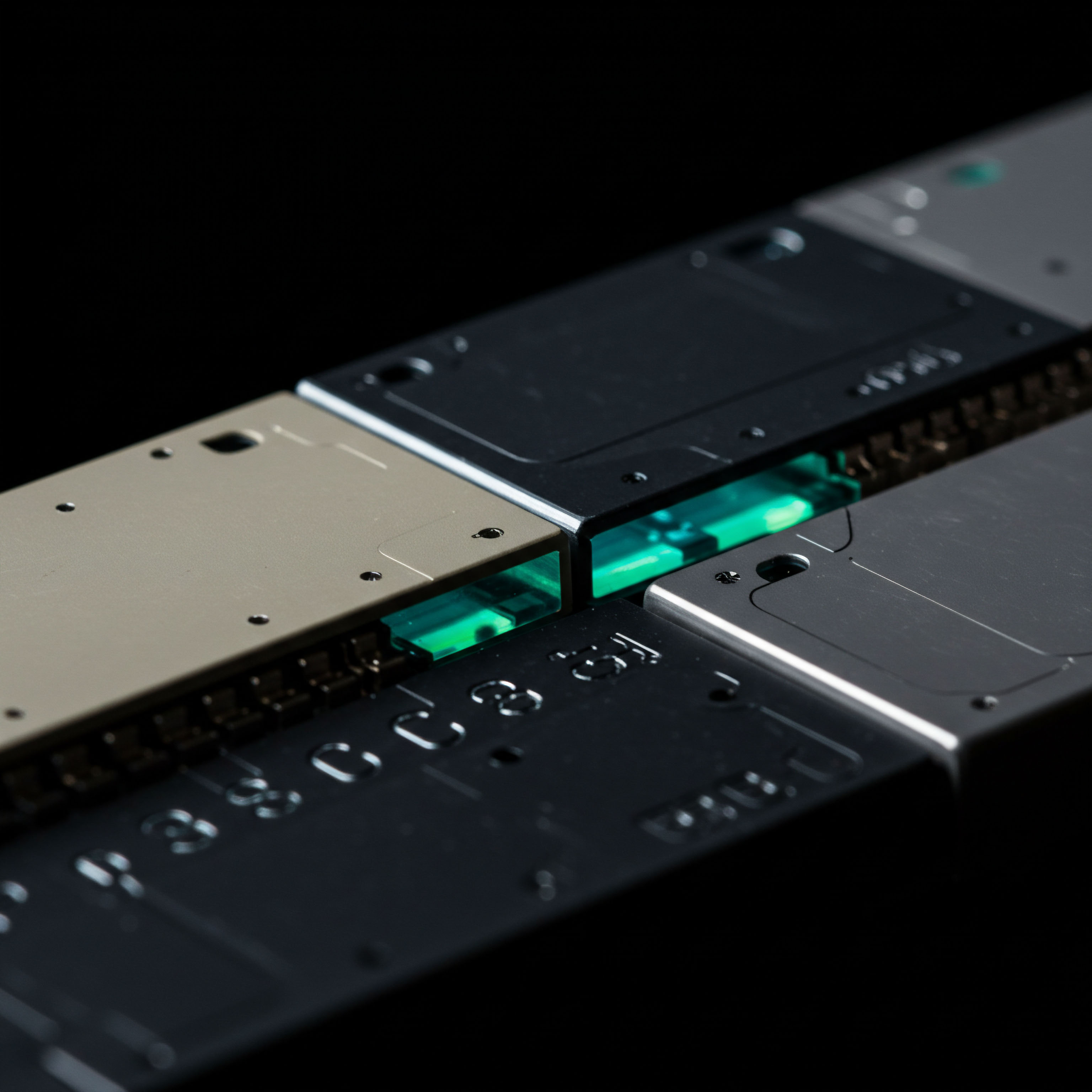

Request for Quotation, or RFQ, represents a direct channel for price negotiation. This mechanism allows participants to solicit bids and offers from multiple liquidity providers simultaneously, all within a private environment. It stands as a cornerstone for efficient execution of larger trades, where transparency and discretion converge. Employing an RFQ system ensures a competitive landscape for every order, optimizing outcomes.

Options trading introduces a dynamic dimension to portfolio construction. These instruments grant the right, but not the obligation, to buy or sell an underlying asset at a predetermined price. They serve as powerful levers for expressing nuanced market views, hedging existing positions, or generating income through defined risk parameters. Mastering options trading expands a trader’s strategic horizon significantly.

Precision in crypto liquidity demands a strategic deployment of advanced trading mechanisms.

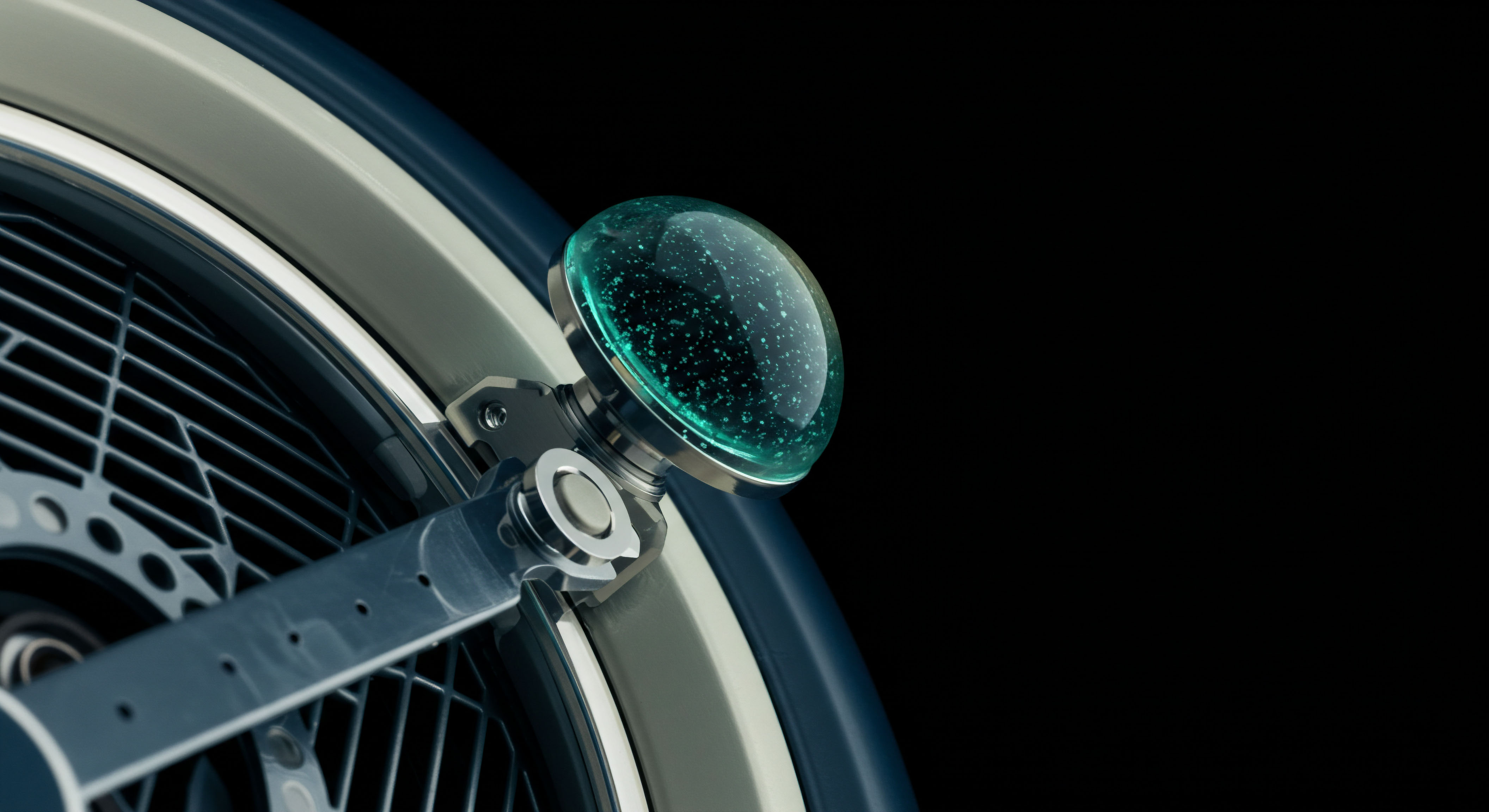

Block trading, particularly in crypto options, provides a conduit for executing substantial volumes without significant market disruption. These large, privately negotiated transactions bypass the open order book, mitigating price slippage and front-running risks. Institutional participants routinely utilize block trades to position significant capital with discretion, securing advantageous pricing. This method exemplifies the sophisticated handling of considerable order flow.

Strategic Capital Deployment

Translating theoretical understanding into tangible gains requires a disciplined application of these advanced execution methods. Crafting a robust investment strategy begins with identifying specific market conditions where RFQ, options, and block trades yield a distinct advantage. Every position must align with a clear objective and a defined risk profile.

Optimizing Options Spreads with RFQ

Options spreads allow for tailored risk-reward profiles, enabling strategies like covered calls or protective puts. Utilizing an RFQ for multi-leg options spreads consolidates the execution process. A single request solicits pricing for the entire spread, securing synchronized fills across all legs. This integrated approach mitigates leg risk, where individual components of a spread execute at unfavorable prices.

- Define your market view ▴ Determine the directional bias, volatility expectation, and time horizon.

- Select the appropriate spread strategy ▴ Choose structures like verticals, calendars, or butterflies.

- Construct the RFQ ▴ Specify the options series, strike prices, and desired quantity for each leg.

- Evaluate dealer quotes ▴ Compare prices from multiple liquidity providers to achieve the tightest spread.

- Execute the trade ▴ Confirm the best available price and secure a simultaneous fill.

This methodical execution ensures a controlled entry into complex options positions. Consistent application of this process refines a trader’s ability to capture alpha from volatility differentials and directional movements. It represents a fundamental shift towards proactive market engagement.

Leveraging Block Trades for BTC and ETH Options

Executing large orders in Bitcoin (BTC) and Ethereum (ETH) options presents unique challenges within public order books. Block trading bypasses these limitations, facilitating significant transactions without revealing intent prematurely. This method preserves the integrity of larger positions, securing better average execution prices.

Identifying appropriate block trading opportunities involves monitoring institutional liquidity and market depth. Engaging directly with OTC desks or specialized platforms provides access to this discrete liquidity. A deep understanding of prevailing implied volatility surfaces opportunities for advantageous entry or exit.

Strategic deployment of block trades can significantly enhance portfolio performance. Size matters.

Systematic application of RFQ and block trading defines a professional’s edge in crypto markets.

Enhancing Volatility Strategies

Volatility block trades represent a powerful mechanism for expressing views on market turbulence. Traders can acquire or divest substantial volatility exposure through instruments like straddles or collars in a single, confidential transaction. This allows for rapid positioning in response to significant market events or shifts in sentiment.

A well-defined volatility strategy considers both the magnitude and duration of expected price movements. Structuring a BTC straddle block, for example, offers exposure to significant price swings in either direction. An ETH collar RFQ provides a means to hedge existing spot positions while generating premium income. These advanced applications demand rigorous analysis and precise execution.

Advanced Market Integration

Mastering liquidity precision involves integrating these tools into a cohesive, high-performance trading framework. This transcends individual trade execution, focusing on their collective impact on portfolio resilience and long-term alpha generation. The ultimate goal remains constructing a financial edifice capable of weathering any market storm.

Multi-Dealer Liquidity Aggregation

Aggregating liquidity from diverse sources, including multiple dealers via RFQ, establishes a competitive environment for every trade. This continuous search for optimal pricing reduces implicit transaction costs. Understanding the nuances of dealer preferences and response times refines this process. Such a granular approach to liquidity sourcing forms the bedrock of superior execution quality.

This constant calibration of liquidity access and execution quality often requires a deep, almost visceral understanding of market microstructure. One might consider the subtle shifts in order book dynamics, the ebb and flow of institutional interest, and the very fabric of price formation. This relentless pursuit of a fractional edge, sometimes requiring a recalibration of deeply held assumptions about market behavior, defines the commitment to mastery.

Anonymous Options Trading and Price Impact Mitigation

Maintaining anonymity in large options trades protects against adverse price movements triggered by order visibility. Utilizing OTC options and block trading mechanisms ensures that significant capital deployment remains confidential until execution. This discretion directly translates into reduced slippage and better overall pricing. Price impact mitigation represents a critical objective for any substantial market participant.

Sophisticated traders understand that every order, regardless of size, casts a shadow on the market. Minimizing this shadow becomes a strategic imperative. The ability to execute multi-leg positions anonymously, for example, preserves the delicate balance of market supply and demand, preventing unfavorable price adjustments.

Algorithmic Execution and Smart Trading

Integrating RFQ and block trading capabilities into algorithmic execution strategies elevates trading efficiency. Smart trading algorithms can dynamically route orders, optimize timing, and select the most advantageous execution venues. This automation ensures consistent application of best execution principles across a wide array of market conditions.

Developing these advanced algorithms demands a deep understanding of market dynamics and the underlying mathematics of options pricing. It involves continuous backtesting and refinement, adapting to evolving market structures. The synergy between human strategic insight and algorithmic precision creates a formidable trading advantage. This proactive stance defines a true market leader.

The Unseen Advantage

The pursuit of commanding crypto liquidity precision transcends mere technical proficiency; it shapes a trader’s entire market philosophy. It cultivates a mindset that views market complexities not as obstacles, but as opportunities for strategic advantage. This journey transforms raw data into actionable intelligence, refining intuition with rigorous methodology.

The continuous quest for a fractional edge, honed through meticulous execution, defines the enduring legacy of a market master. This commitment to an advanced operational architecture reshapes the very contours of trading success.

Glossary

Block Trading

Block Trades

Market Microstructure

Otc Options

Smart Trading Algorithms