Engineered Liquidity

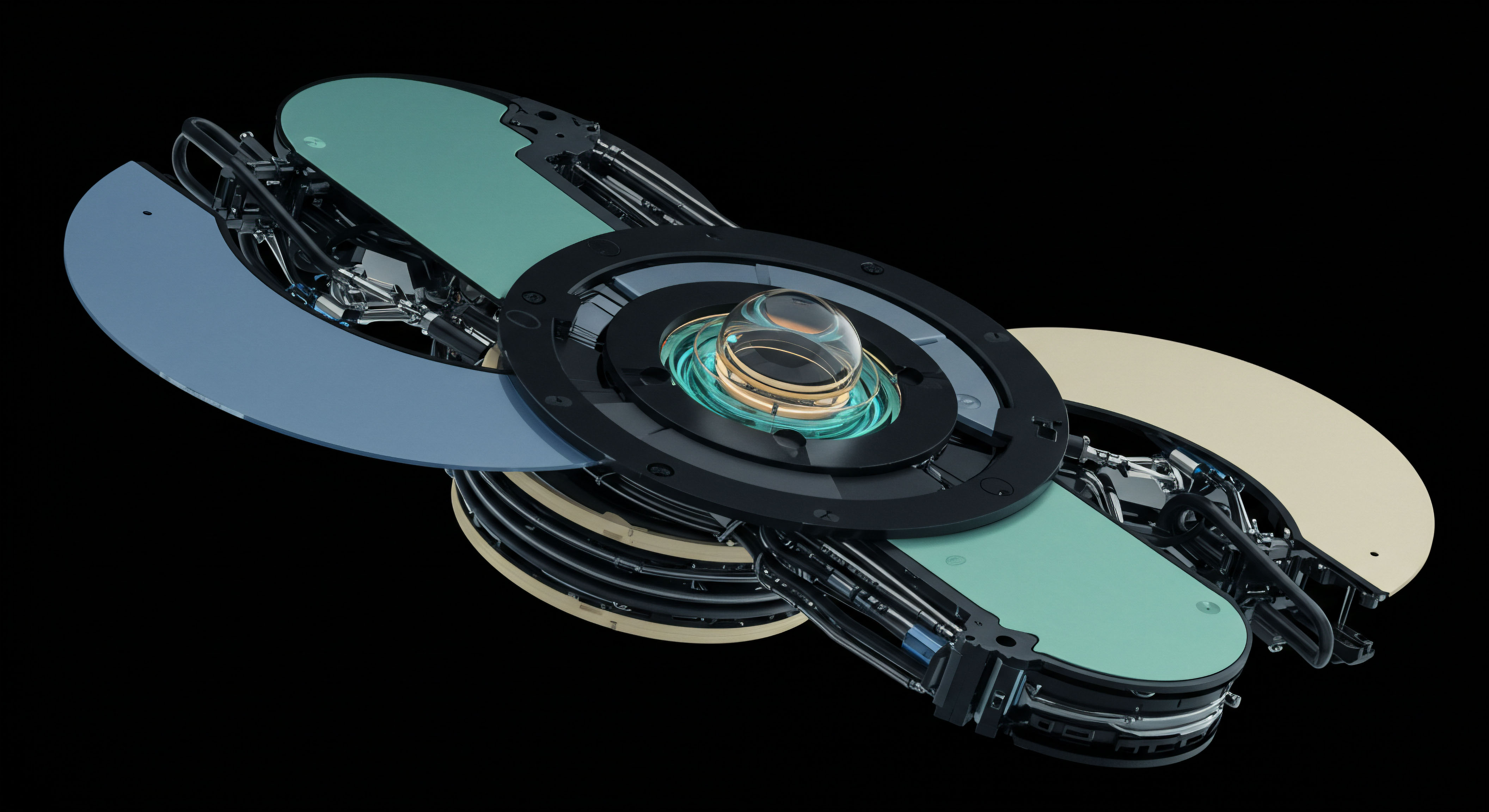

The pursuit of superior execution in crypto options demands a deliberate approach, moving beyond fragmented market interactions. Commanding liquidity represents a strategic imperative, transforming market engagement into a precision operation. This involves orchestrating access to deep order books and multiple market makers, ensuring optimal pricing and minimal impact on the underlying asset. Understanding this dynamic empowers a trader to dictate terms, securing advantageous entry and exit points for complex derivatives positions.

At its core, a Request for Quote (RFQ) system provides a structured mechanism for achieving this control. It channels diverse liquidity sources into a singular, competitive environment. This process allows a trader to solicit bids and offers from multiple professional dealers simultaneously for a specific options contract or a multi-leg strategy. The result is a transparent, efficient price discovery process, crucial for significant capital deployment.

Orchestrating multi-dealer liquidity through RFQ transforms options trading into a precision-driven execution discipline.

This approach systematically reduces implicit transaction costs, often a hidden drain on portfolio performance. Executing large blocks of options or intricate spread strategies through a direct RFQ interface bypasses the limitations of traditional order books. It allows for the aggregation of interest from various participants, leading to tighter spreads and superior fill rates. A trader gains the ability to execute substantial positions without signaling market intent, preserving alpha and protecting strategic positioning.

Strategic Capital Deployment

Deploying capital within crypto options requires a strategic framework, particularly when leveraging the power of RFQ for significant positions. The objective centers on maximizing value capture and mitigating execution risk. This section outlines actionable strategies for institutional-grade trading, translating theoretical advantages into tangible market outcomes.

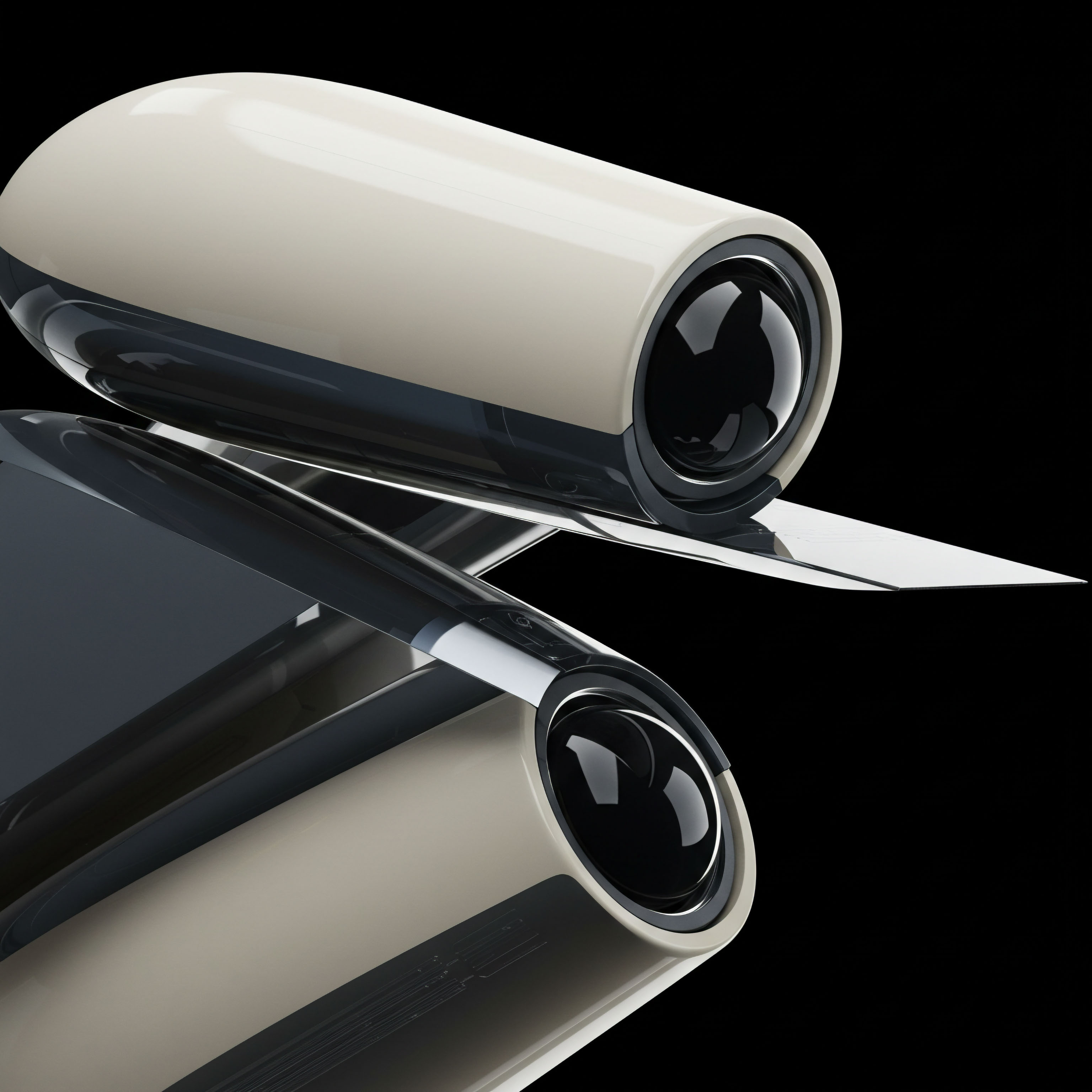

Bitcoin Options Block Trading

Executing large Bitcoin options positions through an RFQ system offers a distinct advantage for managing market impact. A trader submits a request for a substantial block of BTC options, specifying the strike, expiry, and desired side. Multiple dealers respond with their most competitive prices, fostering a genuine auction environment. This competitive tension directly translates into tighter pricing for the initiator.

- Define Position Sizing ▴ Clearly determine the notional value and number of contracts for the block trade. Over-sizing can attract adverse pricing.

- Select Optimal Expiry ▴ Consider implied volatility term structure when choosing an expiry. Shorter-dated options often exhibit higher sensitivity to underlying price movements.

- Monitor Market Depth ▴ Observe general market depth before initiating an RFQ. While RFQ aggregates liquidity, a severely illiquid underlying market may still affect pricing.

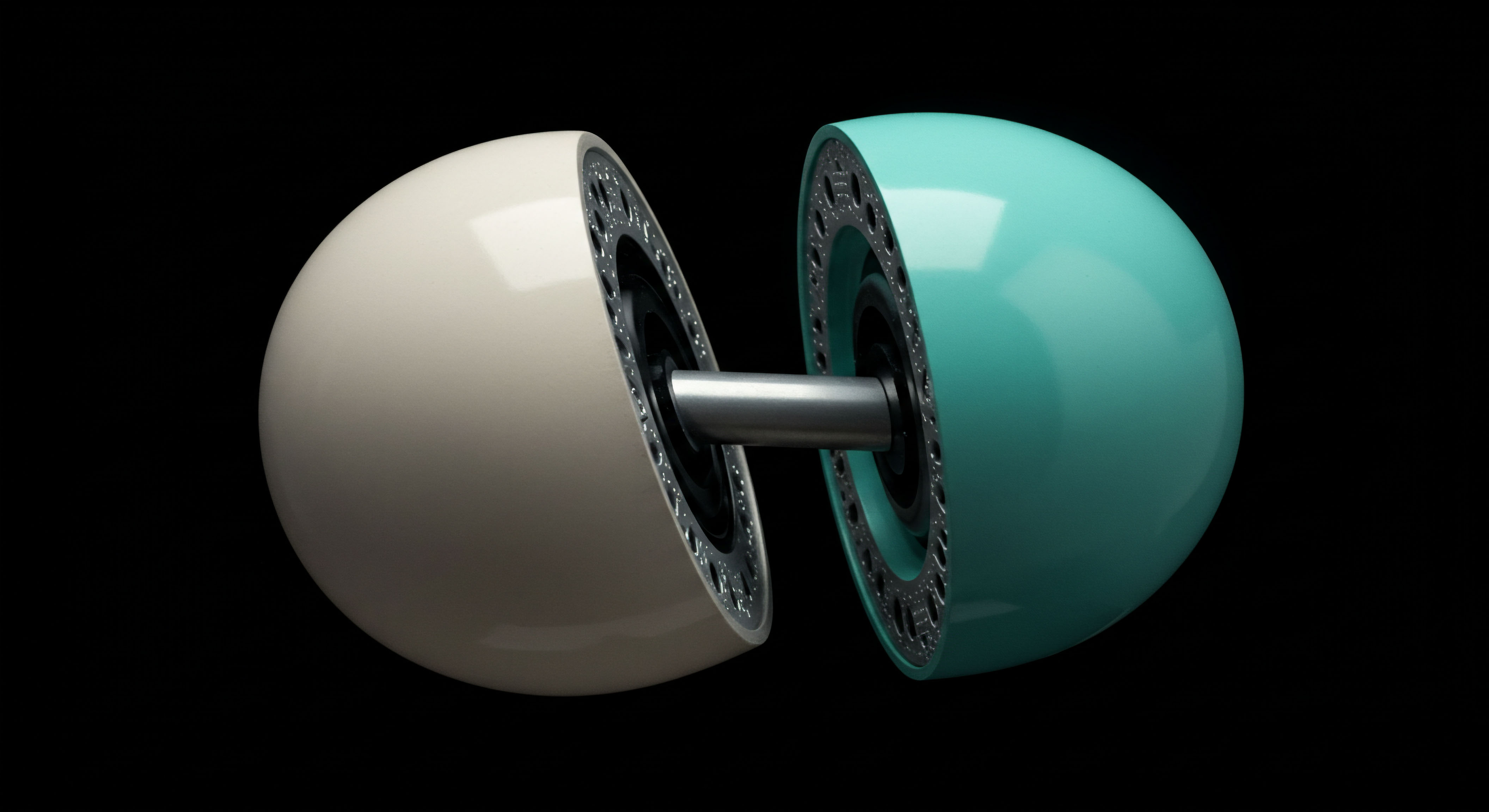

ETH Options Spreads RFQ

Multi-leg options strategies, such as straddles, collars, or iron condors, present unique execution challenges on standard order books due to leg risk. An RFQ system for ETH options spreads resolves this by ensuring simultaneous execution of all legs at a single, composite price. This eliminates the risk of one leg filling while another moves adversely, a critical concern for complex strategies.

Constructing an ETH Collar RFQ

A collar strategy involves buying a protective put and selling a covered call against a long spot ETH position. Executing this via RFQ secures the entire structure at a single price point. This provides a precise cost basis for downside protection and upside income generation.

Consider a scenario where a trader holds 100 ETH. They seek to hedge against a downturn while generating income.

- Identify Target Put ▴ Select a put option with a strike price below the current ETH price for downside protection.

- Identify Target Call ▴ Choose a call option with a strike price above the current ETH price for income generation, accepting limited upside.

- Submit RFQ ▴ Bundle these two options as a single multi-leg RFQ. The system solicits competitive quotes for the entire collar structure.

This approach guarantees a defined risk-reward profile upon execution, removing the uncertainty of fragmented fills. The collective intelligence of market makers ensures the best available price for the entire strategy.

Executing multi-leg options strategies through RFQ systems eliminates leg risk, securing a single, composite price.

Volatility block trades, often executed for larger sizes, gain immense efficiency through this mechanism. Whether initiating a BTC straddle block to capitalize on anticipated volatility or an ETH collar RFQ for managed risk, the ability to command multi-dealer liquidity translates directly into superior execution quality. This smart trading within RFQ frameworks elevates tactical market engagement to a strategic advantage.

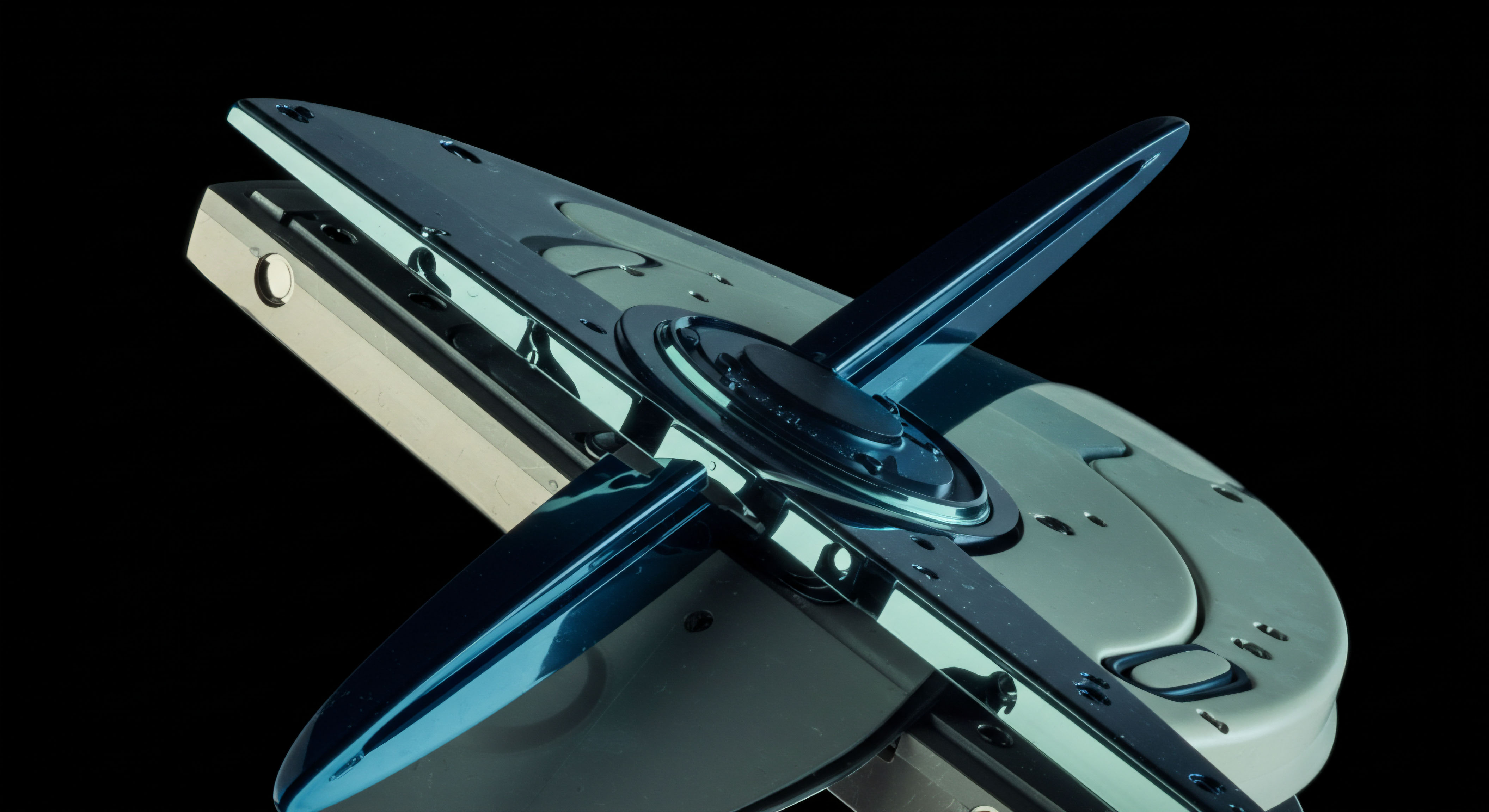

Mastering Execution Architecture

Advancing beyond fundamental applications, the mastery of crypto options liquidity extends into sophisticated portfolio integration and long-term strategic advantage. This phase of engagement transforms individual trade execution into a systemic edge, refining capital allocation and risk oversight. Understanding market microstructure at this level unlocks a persistent advantage.

Integrating RFQ execution into a broader portfolio strategy demands a disciplined framework. It involves pre-defining execution parameters, monitoring post-trade analytics, and continually refining the approach. This iterative process allows for the identification of optimal liquidity windows and the calibration of dealer selection. The consistent application of these principles contributes to a measurable improvement in overall portfolio alpha.

Advanced Volatility Trading with RFQ

Sophisticated traders often construct complex volatility exposures using options. This includes variance swaps, volatility spreads, and skew trades. Executing these intricate positions requires not only deep market understanding but also the ability to secure precise pricing across multiple instruments.

RFQ facilitates this by allowing for custom basket quotes, where a single request covers a combination of options designed to capture a specific volatility view. This anonymous options trading environment ensures fair pricing without revealing the full strategic intent to the broader market.

Optimizing Slippage and Best Execution

The pursuit of best execution represents a continuous effort to minimize slippage and transaction costs. Within an RFQ environment, this involves analyzing dealer response times, pricing aggressiveness, and fill rates over time. A trader develops an internal model for dealer performance, favoring those consistently offering superior execution for specific asset classes or strategy types.

This data-informed selection process becomes a critical component of the overall execution architecture. The focus remains on securing a demonstrable edge in every trade, contributing directly to the portfolio’s net performance.

This proactive management of execution quality shapes the trajectory of long-term returns. It underscores the commitment to professional-grade trading, moving beyond passive market participation toward active liquidity command.

Orchestrating Market Outcomes

The journey toward commanding crypto options liquidity represents an evolution in trading philosophy. It shifts the focus from merely reacting to market conditions toward actively shaping execution outcomes. This disciplined approach, anchored in sophisticated RFQ utilization, empowers traders to engineer their market footprint, ensuring every capital deployment reflects a commitment to superior performance.

The capacity to orchestrate multi-dealer responses for complex derivatives strategies is a definitive marker of elite execution, a tangible edge in a dynamic financial landscape. This proactive stance defines the future of high-performance trading, where strategic intent meets precise execution.

Glossary

Multi-Dealer Liquidity

Btc Straddle Block

Anonymous Options Trading

Minimize Slippage