Execution Mastery

The pursuit of alpha in crypto options markets demands a shift in operational thinking. Traders seeking a definitive edge move beyond conventional order books, recognizing the limitations of fragmented liquidity and price discovery. A sophisticated approach to options execution, particularly through specialized request for quotation mechanisms, unlocks superior pricing and capital efficiency for substantial positions.

Understanding these specialized execution avenues transforms how participants engage with volatility and directional views. It involves recognizing the inherent inefficiencies in retail-focused venues and strategically navigating towards environments designed for professional-grade volume. This transition establishes a foundation for consistent outperformance, aligning execution quality with strategic intent.

Commanding superior execution in crypto options markets means optimizing for price and liquidity beyond standard offerings.

Foundational Mechanisms

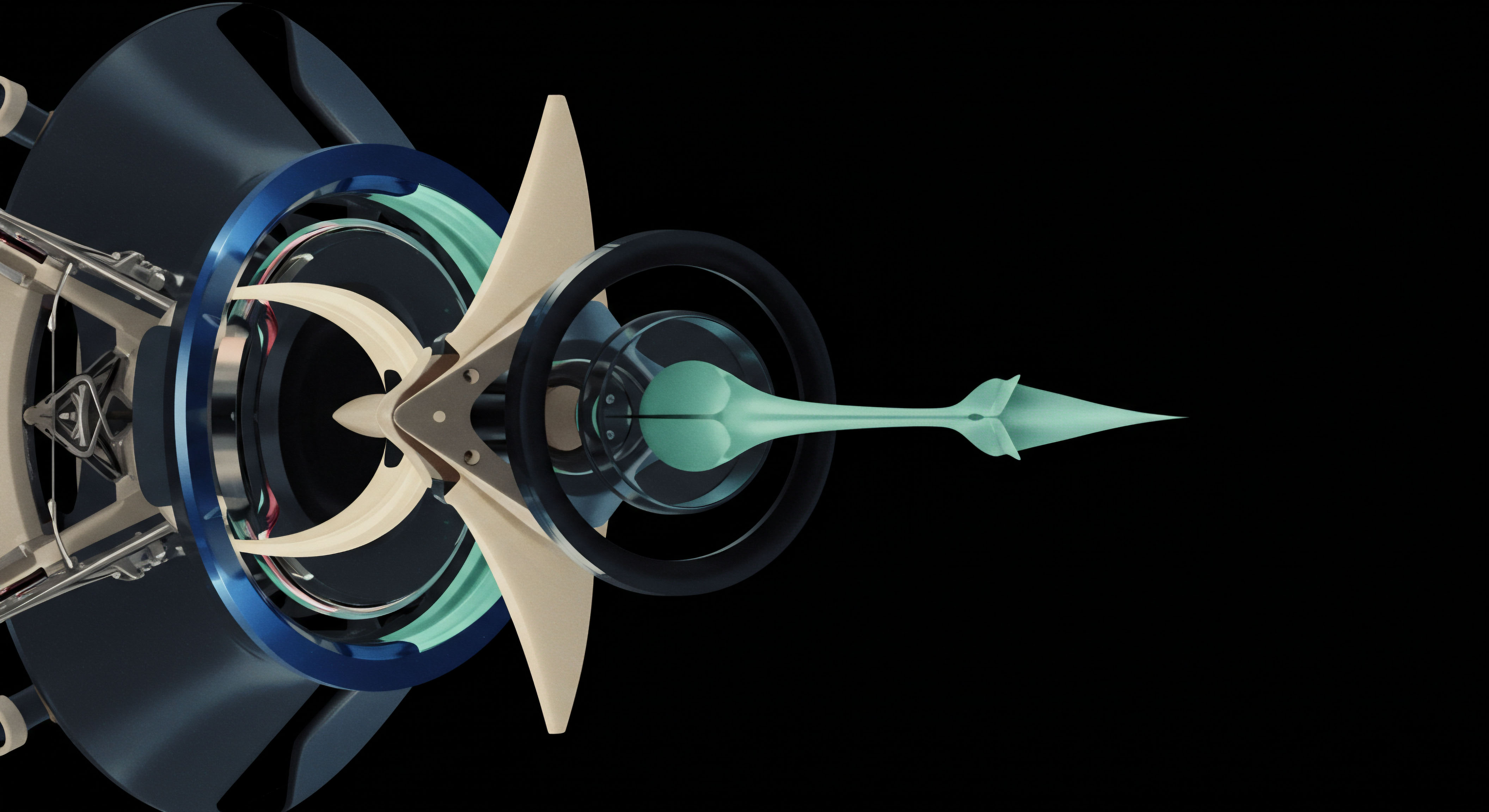

Specialized options execution channels represent a deliberate departure from generalized spot trading. These channels facilitate direct engagement with multiple liquidity providers, fostering competitive pricing for complex multi-leg options structures and large block trades. This structured interaction ensures that substantial orders exert minimal market impact, preserving the intended profit and loss profile.

These sophisticated execution pathways allow participants to transact significant volumes without telegraphing their intentions to the broader market. The inherent discretion maintains a trader’s informational advantage, a critical component in preserving alpha. Such methods are not merely transactional tools; they embody a strategic stance against market slippage and adverse selection.

Strategic Capital Deployment

Deploying capital effectively in crypto options necessitates a methodical application of advanced execution techniques. Identifying and utilizing specific trading structures allows for the capture of targeted market exposures with enhanced precision. The objective remains clear ▴ secure optimal pricing and liquidity for every strategic initiative.

Professional traders leverage these execution channels to construct positions that align with intricate market forecasts. This involves a disciplined assessment of volatility surfaces, term structures, and implied correlations across various crypto assets. The ability to execute these views efficiently translates directly into tangible returns.

Block Trading Bitcoin Options

Executing substantial Bitcoin options positions demands a discreet and efficient method. Block trading via specialized request for quotation channels provides a direct route to deep liquidity pools, circumventing the incremental fills and potential price degradation associated with smaller, sequential orders. This approach secures a singular, agreed-upon price for significant size, ensuring consistency across the entire order.

Participants utilize this method for expressing conviction on directional movements or volatility plays in Bitcoin. A large straddle, for instance, requires precise entry pricing across multiple options contracts. The coordinated execution inherent in a block trade mitigates execution risk, solidifying the strategic intent of the position.

ETH Options Spreads Precision

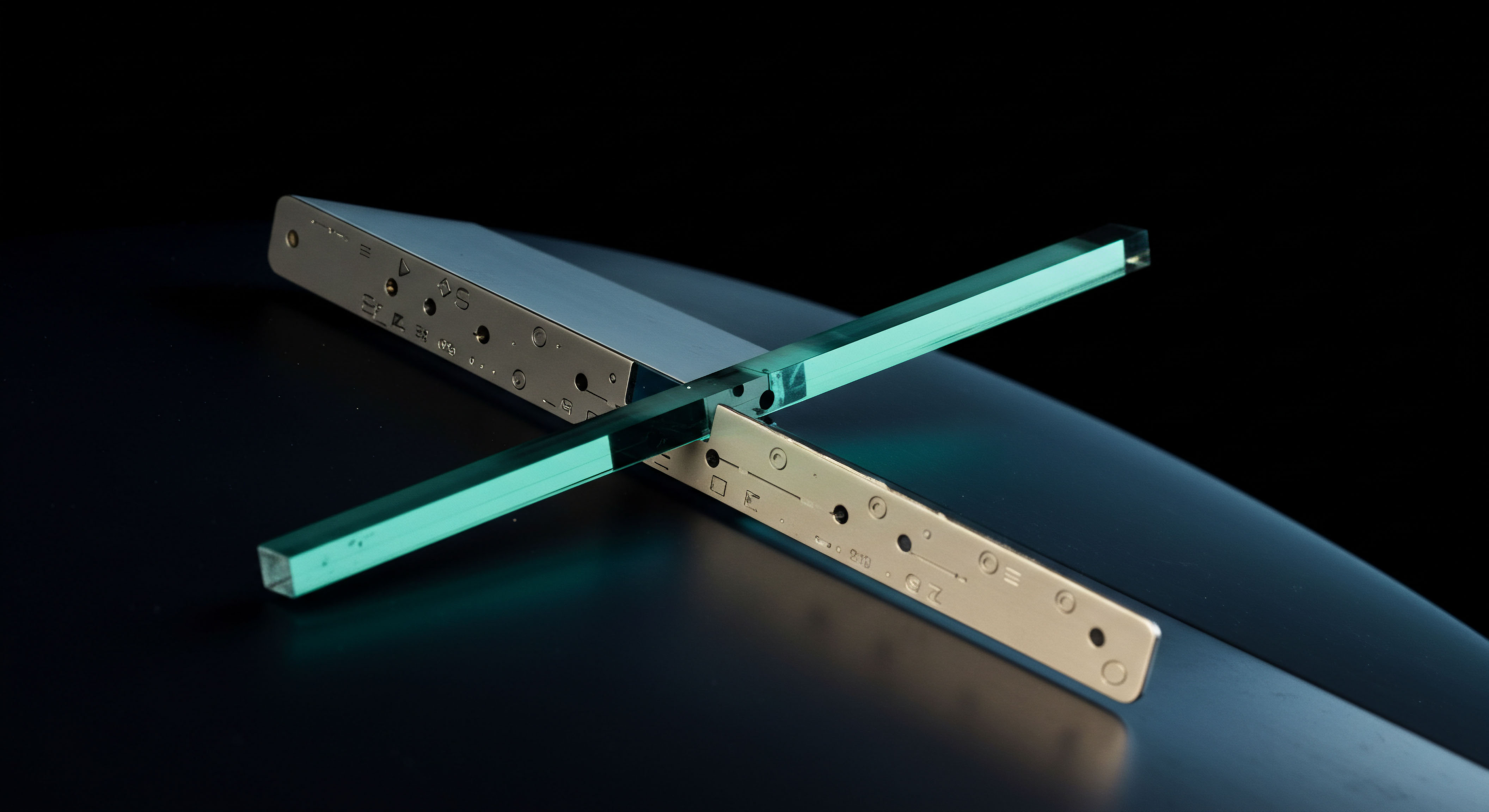

Ethereum options spreads offer a versatile vehicle for expressing nuanced market views, from covered calls to iron condors. Executing these multi-leg strategies through specialized channels ensures simultaneous pricing and execution of all components. This synchronous approach eliminates leg risk, where individual options legs fill at disparate prices, compromising the spread’s intended payoff structure.

A well-executed ETH collar, designed to hedge downside risk while generating income, relies on this synchronized execution. The ability to lock in the entire spread’s pricing provides certainty and control, critical elements for managing portfolio exposures in volatile conditions. This level of execution precision distinguishes informed traders.

- Define Market View ▴ Clearly articulate the directional bias, volatility expectation, and time horizon.

- Select Option Strategy ▴ Choose a multi-leg structure (e.g. straddle, spread, collar) aligning with the defined market view.

- Quantify Position Size ▴ Determine the notional value and number of contracts required for the desired exposure.

- Initiate Execution Request ▴ Submit the full multi-leg order through a specialized channel to multiple liquidity providers.

- Evaluate Quotes ▴ Analyze the competitive quotes received, focusing on overall spread cost and execution certainty.

- Confirm Trade ▴ Accept the optimal quote, ensuring simultaneous execution of all legs at the agreed-upon price.

This systematic progression secures a favorable entry point, crucial for any options strategy aiming for consistent profitability. The rigorous process minimizes external variables impacting the trade’s initial value.

Sophisticated options trading thrives on the certainty of execution, turning complex strategies into predictable outcomes.

Advanced Portfolio Integration

Mastering crypto options extends beyond individual trade execution; it involves integrating these instruments into a cohesive, alpha-generating portfolio framework. This elevated perspective considers options as dynamic components within a broader capital allocation strategy, capable of shaping overall risk and return profiles.

The effective deployment of advanced options applications requires a deep understanding of their impact on portfolio metrics. Traders continuously refine their approach, moving towards a systems-level view where each options position serves a specific purpose within the aggregate risk budget. This systematic optimization ensures sustained market edge.

Volatility Block Trade Dynamics

Executing large volatility-focused block trades, such as substantial long or short vega positions, requires a sophisticated understanding of market microstructure. These trades aim to capitalize on anticipated shifts in implied volatility, a primary driver of options pricing. Utilizing specialized channels for these large orders ensures efficient entry and exit, preserving the intended exposure without inducing adverse price movements.

A portfolio manager seeking to express a view on an impending volatility event will leverage block execution to establish a significant position with minimal slippage. This strategic deployment captures the anticipated market movement while maintaining the integrity of the overall portfolio’s risk-adjusted return objectives. The execution itself becomes a source of edge.

Multi-Dealer Liquidity Aggregation

Accessing multi-dealer liquidity through specialized request for quotation channels represents a significant advantage for sophisticated participants. This aggregation capability consolidates pricing from diverse liquidity sources, offering a comprehensive view of available depth and competitive bids/offers. The result is a tighter spread and a higher probability of executing large orders at optimal levels.

This dynamic liquidity environment supports complex multi-leg options strategies, particularly those requiring precise fills across multiple strike prices and expirations. The ability to survey and command liquidity from a centralized point empowers traders to execute intricate strategies with confidence, minimizing execution uncertainty and maximizing the potential for alpha generation.

A rigorous assessment of counterparty credit risk accompanies the selection of liquidity providers within this multi-dealer environment. Due diligence ensures the robustness of the trading ecosystem, a critical consideration for sustained, high-volume operations. This focus on foundational integrity supports all subsequent strategic maneuvers.

The Unseen Advantage

The journey to commanding crypto options execution is an ongoing process of refinement and strategic adaptation. It centers on the continuous pursuit of superior mechanisms that elevate trading outcomes beyond mere chance. True mastery stems from a proactive engagement with market structure, translating theoretical understanding into tangible, quantifiable edge.

This evolution in trading practice defines the difference between reactive participation and deliberate market influence. The systematic application of professional-grade execution methodologies allows traders to shape their own market reality, transforming volatility into opportunity. The future belongs to those who precisely engineer their market interactions.

Glossary

Options Execution

Crypto Options

Block Trading

Options Spreads

Eth Collar