Volatility Shield

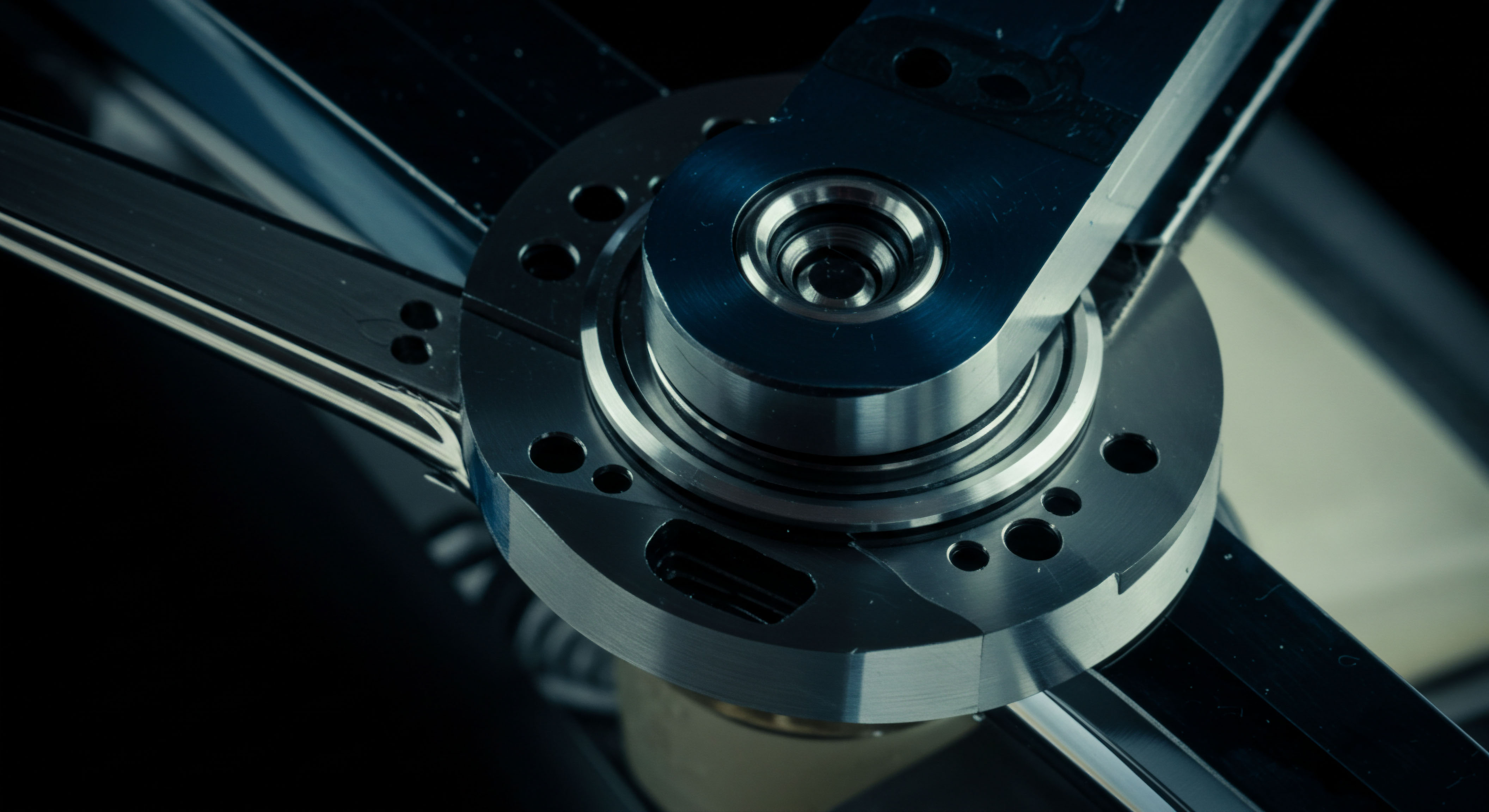

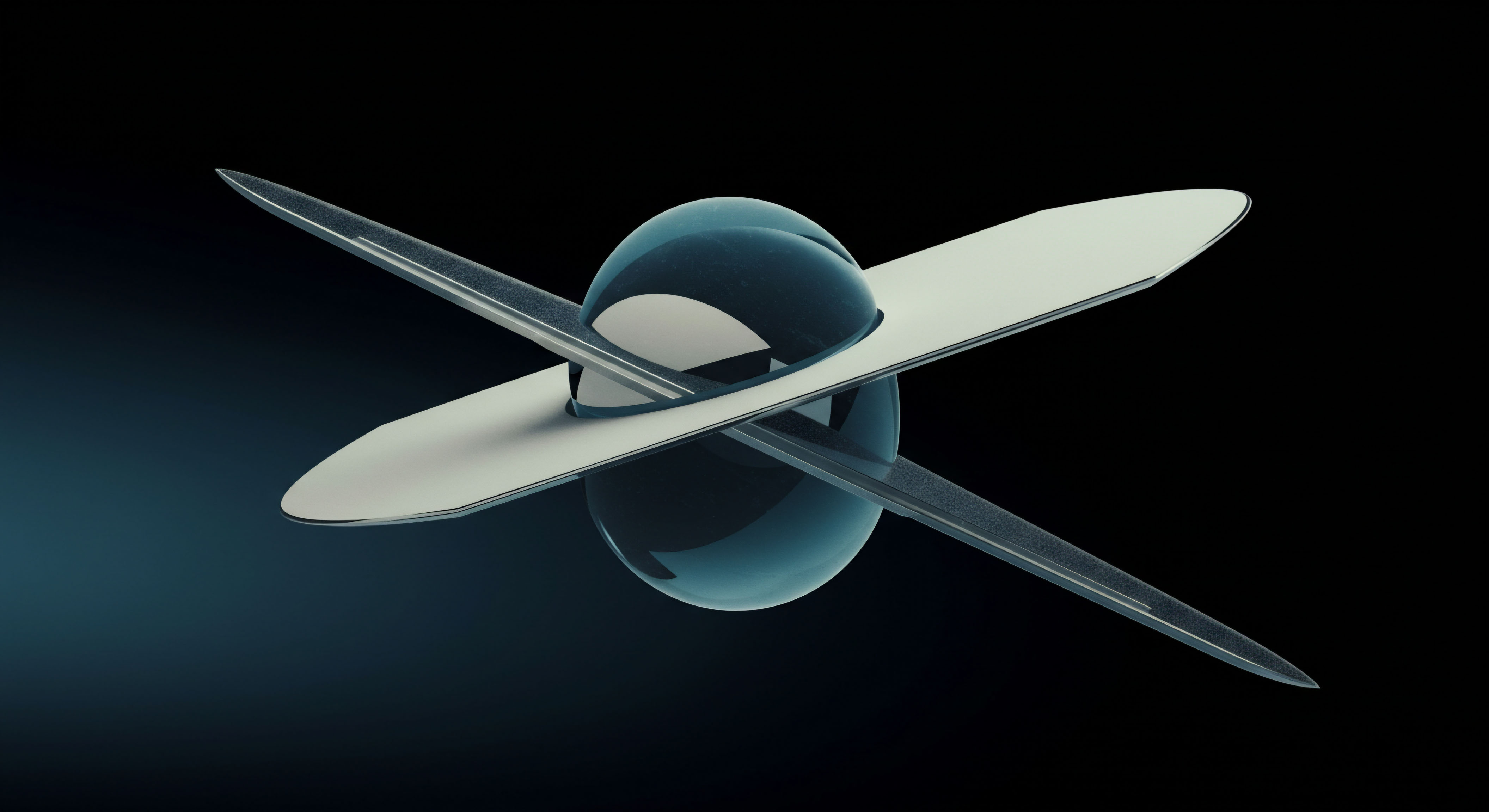

Mastering crypto markets demands a strategic defense against their inherent price swings. The options collar emerges as a precision instrument, allowing market participants to engineer a defined range of potential outcomes for their digital asset holdings. This sophisticated structure provides a robust framework for managing downside risk while preserving upside potential within a specified boundary. Understanding its fundamental mechanics establishes a critical foundation for advanced portfolio management.

A collar involves simultaneously holding an underlying asset, purchasing an out-of-the-money put option, and selling an out-of-the-money call option. The put option safeguards against significant price depreciation, offering a floor for the asset’s value. The sold call option generates premium income, offsetting the cost of the protective put and capping the asset’s appreciation at a predetermined level. This strategic combination transforms raw market exposure into a controlled financial trajectory.

A strategic options collar engineers a defined outcome range, transforming raw crypto volatility into a manageable financial trajectory.

Deploying a collar aligns with the disciplined approach of a seasoned strategist, providing a method to capitalize on a market view without succumbing to extreme price movements. The structure permits a measured participation in asset growth while maintaining an impenetrable shield against adverse declines. This represents a tangible edge in environments characterized by rapid shifts and pronounced uncertainty.

Strategic Deployment

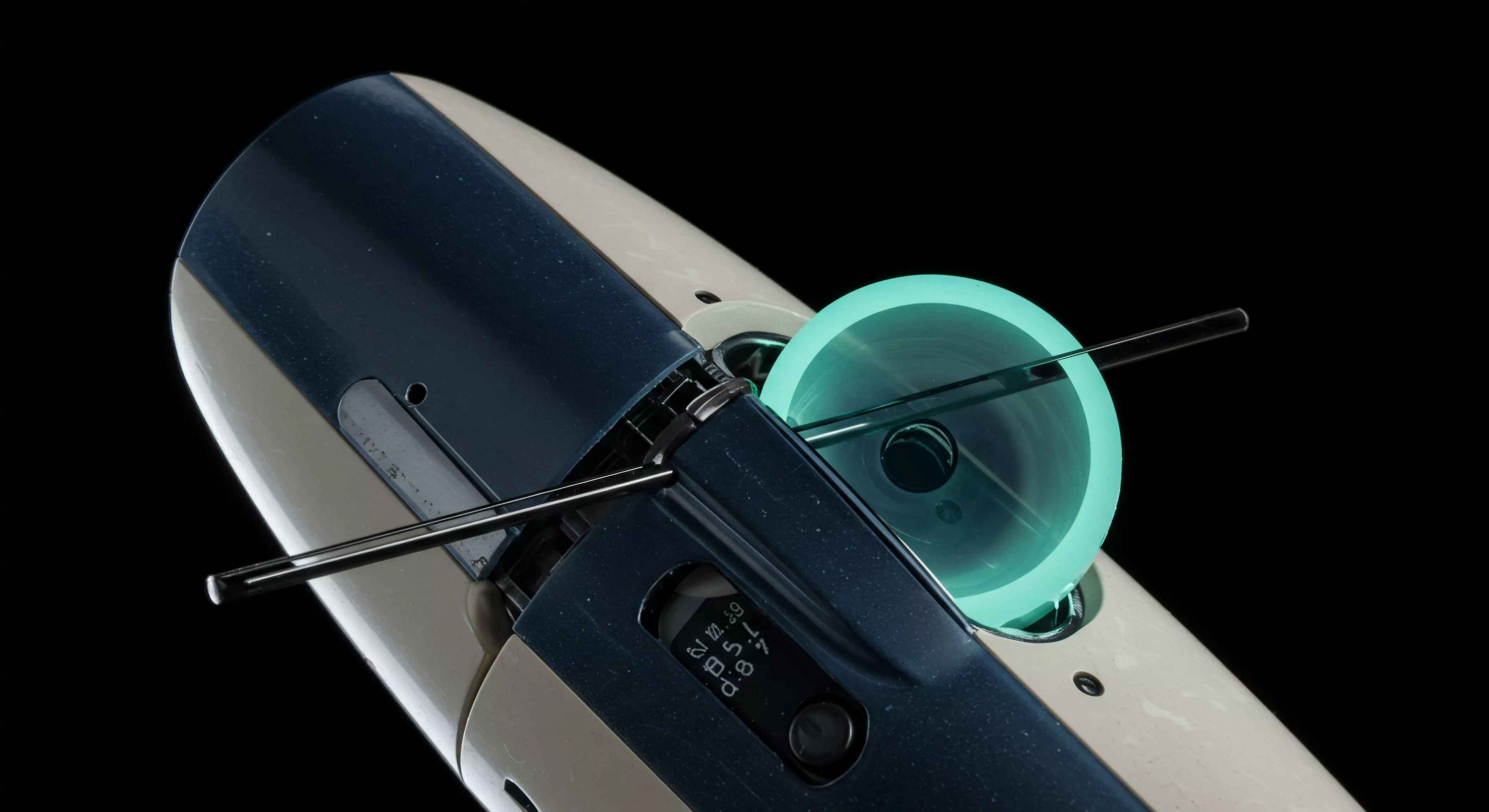

Applying the options collar demands a precise calibration of strike prices and expiration dates, aligning with a clear market outlook and specific risk parameters. This section details actionable strategies for integrating collars into a professional crypto investment guide, emphasizing capital efficiency and controlled outcomes.

Income Generation and Downside Protection

A primary application involves generating yield from existing crypto holdings while simultaneously protecting against significant drawdowns. This approach proves particularly valuable for long-term holders seeking to monetize their positions without relinquishing ownership. Selling the call option against a held asset creates a consistent premium stream, a tactical advantage in flat or moderately rising markets.

Selecting an appropriate put strike requires an assessment of tolerable loss, establishing a firm price floor. The call strike, conversely, reflects the acceptable cap on upside participation, balancing premium generation with potential asset growth. The interaction of these strikes, alongside the asset’s current price, dictates the overall risk-reward profile of the collar.

Tailoring Volatility Exposures

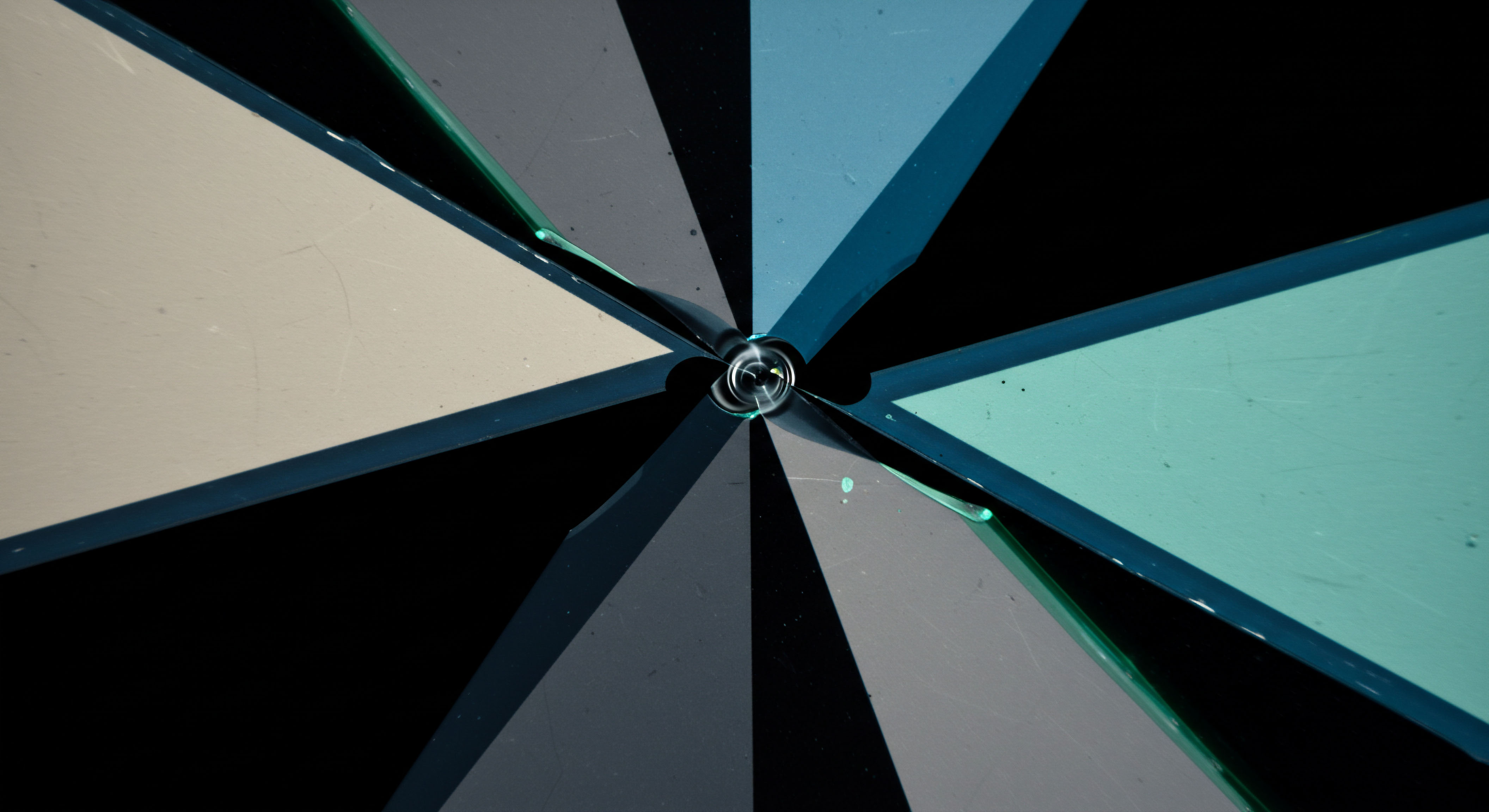

Collars serve as a dynamic tool for adjusting an asset’s effective volatility exposure. Traders can tighten the collar (narrowing the range between put and call strikes) to reduce perceived risk and increase premium income, particularly during periods of heightened market anxiety. Expanding the collar offers greater upside participation at the expense of higher put costs or lower call premiums.

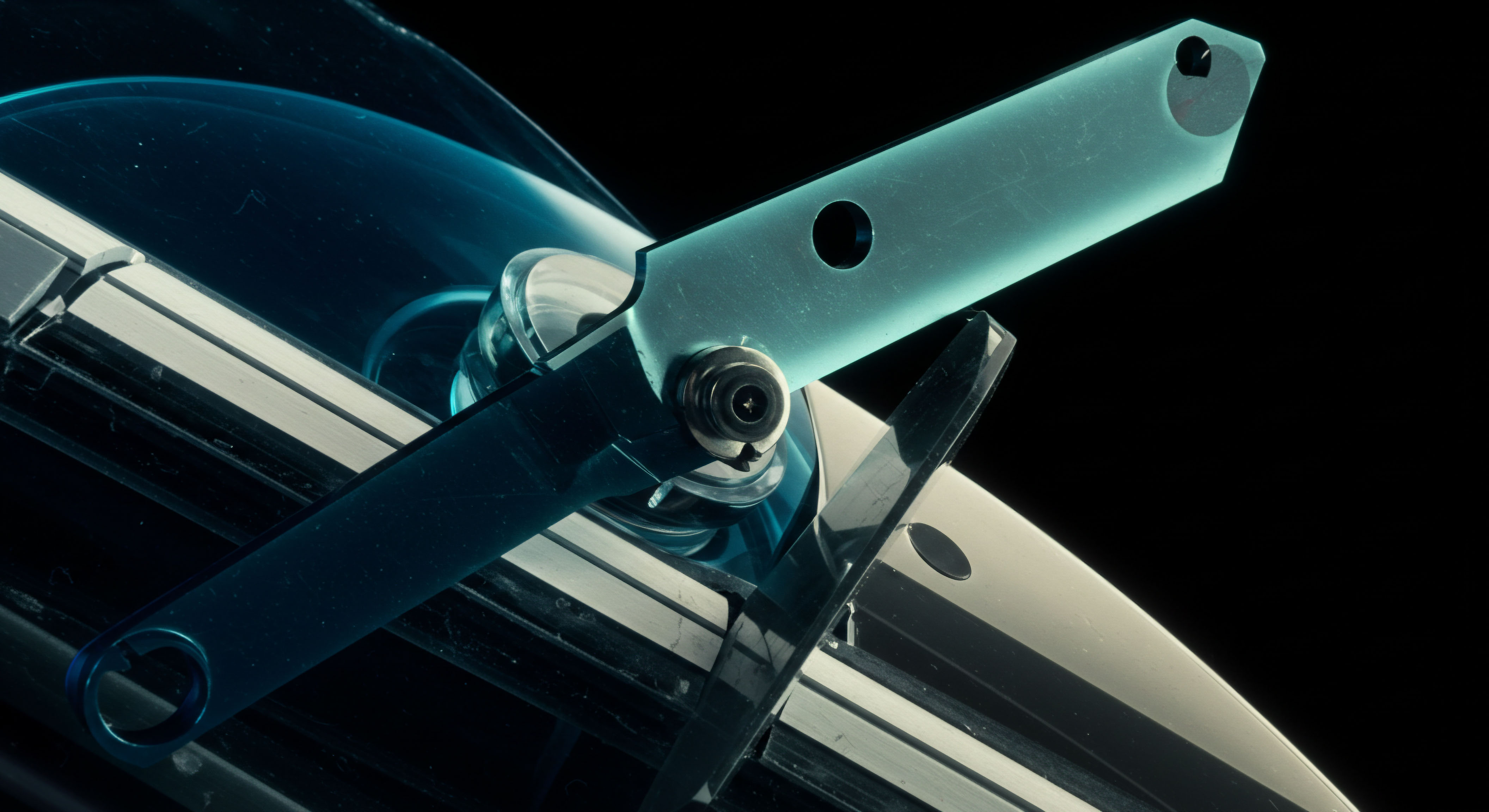

Consider the execution of multi-leg options spreads within a Request for Quote (RFQ) framework. This process allows institutional participants to solicit competitive pricing for the entire collar structure from multiple liquidity providers. This competitive dynamic ensures optimal execution and minimizes slippage, directly impacting the profitability of the strategy.

Execution Pathways for Collars

Executing options collars with institutional precision involves specific channels. These pathways prioritize best execution and efficient capital deployment.

- Multi-dealer Liquidity ▴ Leveraging an RFQ system provides access to multiple liquidity sources, securing competitive pricing for the entire options spread. This contrasts sharply with fragmented, single-dealer interactions.

- Anonymous Options Trading ▴ Certain RFQ platforms facilitate anonymous options trading, reducing market impact and preventing information leakage associated with large block trades.

- Bitcoin Options Block and ETH Options Block ▴ For significant positions, block trading mechanisms permit the execution of large collar components outside the visible order book, minimizing price impact. This is crucial for maintaining a low-cost basis.

Understanding these execution pathways enhances a trader’s capacity to deploy collars effectively, transforming theoretical knowledge into tangible market performance. The judicious selection of execution venues and methods stands as a cornerstone of successful options trading.

Advanced Portfolio Command

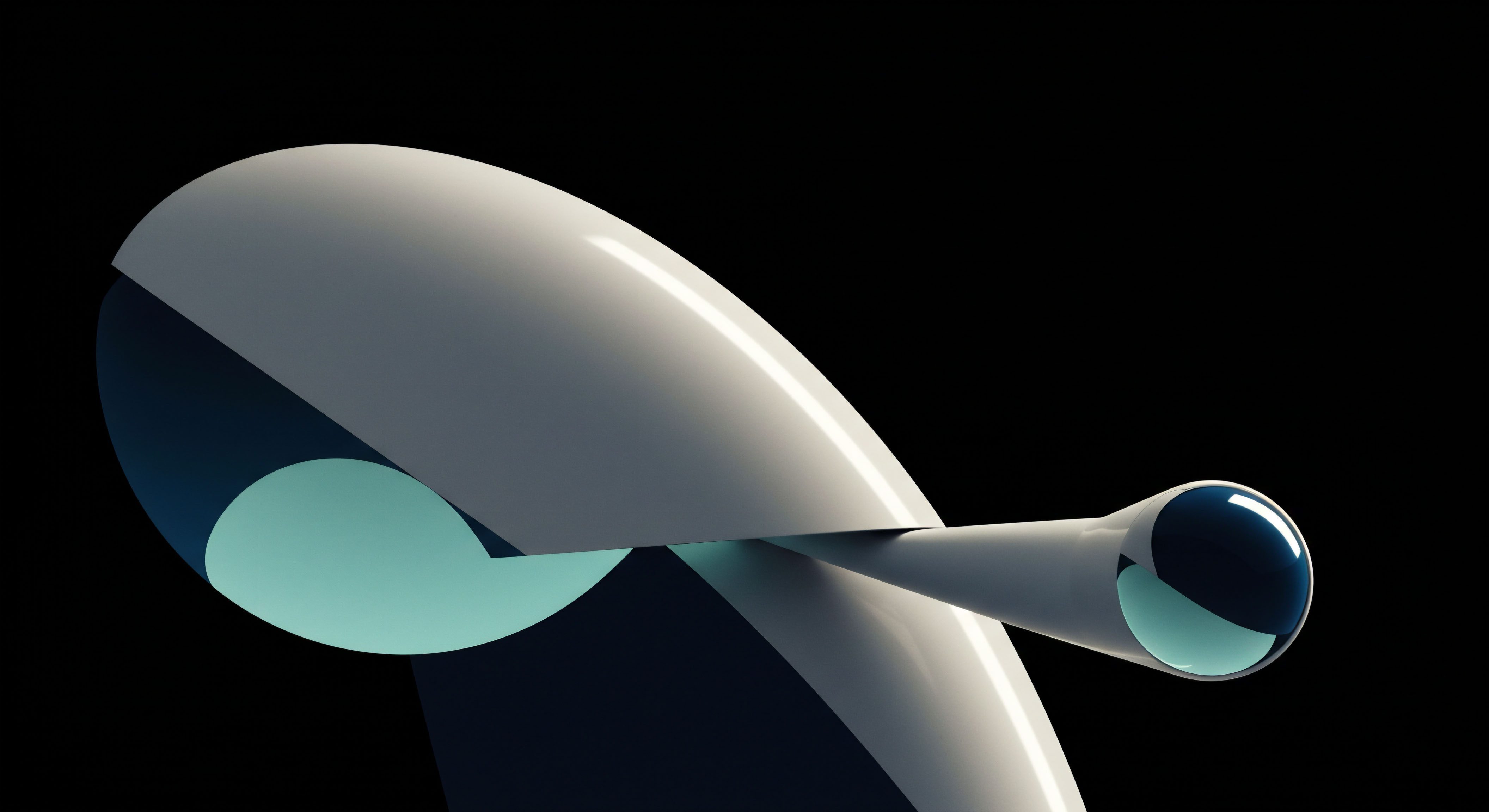

Beyond individual asset protection, the options collar integrates into broader portfolio strategies, elevating risk management and alpha generation. This involves viewing collars as components within a larger, dynamic financial system, where their application optimizes capital allocation and hedges systemic exposures.

Sophisticated market participants extend the utility of collars by applying them to baskets of correlated crypto assets or to manage implied volatility across a diversified portfolio. A synthetic approach might involve constructing a collar using options on an index or a fund holding various digital assets. This provides a layered defense against market-wide downturns while still permitting participation in broader market rallies.

The precision required for these advanced applications demands an acute awareness of market microstructure and derivatives pricing models. Calibrating the strike prices and expiration cycles for multiple assets within a portfolio involves solving a complex optimization problem. One grapples with the interplay of correlation matrices, volatility surfaces, and funding rates to construct a truly resilient portfolio hedge. This is where the theoretical meets the intensely practical, demanding both quantitative rigor and market intuition.

Integrating options collars into a portfolio transforms reactive hedging into a proactive command over market exposures.

Mastering advanced collar applications means moving beyond a reactive stance, instead proactively shaping the portfolio’s risk profile. It involves dynamically adjusting collar parameters in response to shifting market trends, such as an anticipated liquidity sweep or a significant volatility block trade. This continuous calibration ensures the portfolio remains optimally positioned to capture opportunities while mitigating unforeseen risks.

The strategic use of collars also extends to capital efficiency within a larger trading strategy. By reducing the capital at risk for individual positions, the overall portfolio can allocate resources more effectively to other alpha-generating ventures. This systemic advantage transforms a simple hedging tool into a foundational element of robust financial engineering.

Engineered Stability Horizons

The journey from understanding crypto volatility to commanding it with strategic options collars marks a profound shift in market engagement. It signifies a transition from passive exposure to an active, engineered approach to risk and return. The tools and frameworks discussed here empower participants to sculpt their financial destiny within the digital asset landscape, moving with precision and conviction. The horizon of engineered stability beckons, promising a future where volatility yields to strategic design.

Glossary

Options Spreads

Best Execution

Multi-Dealer Liquidity

Block Trading

Risk Management

Market Microstructure

Derivatives Pricing