Market Control Foundations

Crypto Iron Condors represent a powerful instrument for traders seeking to command market dynamics. This structured options strategy provides a defined risk and reward profile, allowing for strategic positioning in volatility regimes. Understanding its core components equips investors with a precise tool for generating yield in stable or moderately fluctuating crypto markets. Mastery of this strategy shifts focus from directional speculation to a calculated exploitation of market ranges.

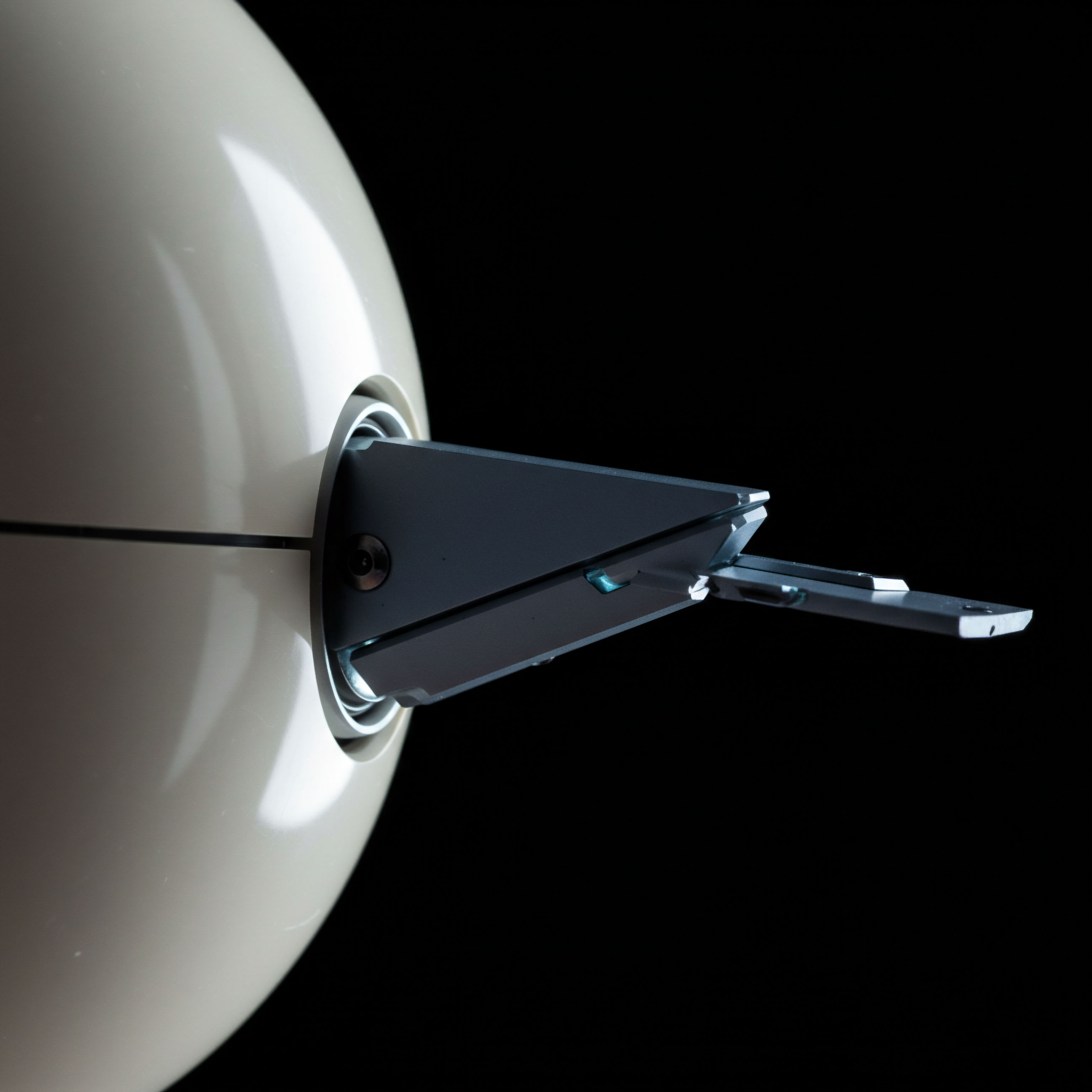

An Iron Condor involves the simultaneous sale and purchase of both call and put options, all with the same expiration date. Specifically, it combines a bear call spread and a bull put spread. The objective centers on the underlying asset remaining within a specific price range until expiration. This configuration constructs a powerful defensive perimeter around price movement, collecting premium from both sides of the market.

Executing an Iron Condor establishes a precise financial perimeter, converting anticipated range-bound price action into a quantifiable advantage.

Each leg of the Iron Condor plays a distinct role in shaping the overall risk graph. The sold options generate premium, while the bought options serve as crucial risk mitigation layers. This layered approach defines the maximum potential loss, a fundamental aspect of professional-grade risk management. Constructing these spreads demands an appreciation for strike selection and expiration timing, optimizing for the desired probability of profit.

Deploying this strategy offers a systemic solution for capitalizing on perceived market equilibrium. Traders gain a clear understanding of potential outcomes before trade initiation, a hallmark of disciplined capital deployment. Such an approach moves beyond reactive trading, establishing a proactive stance in volatile crypto asset markets.

Strategic Deployment Tactics

The transition from understanding an Iron Condor to its active deployment demands a rigorous, tactical approach. Implementing this strategy within crypto options requires a keen eye for volatility, liquidity, and precise execution mechanics. We prioritize systematic entries and exits, ensuring each trade aligns with a defined market thesis and risk tolerance.

Volatility Context and Entry Triggers

Identifying suitable market conditions forms the bedrock of Iron Condor deployment. High implied volatility environments often present attractive premium collection opportunities. Conversely, extremely low volatility might limit potential returns, diminishing the strategy’s efficacy. A systematic trader observes volatility metrics like the VIX equivalent for crypto assets, alongside historical price ranges.

- High Implied Volatility ▴ Seek opportunities to sell premium when option prices are elevated.

- Range-Bound Price Action ▴ Identify assets consolidating within established support and resistance levels.

- Technical Confirmation ▴ Use technical analysis to confirm potential price boundaries for strike selection.

- Upcoming Catalysts ▴ Avoid initiating positions immediately before significant news events that could induce sharp directional moves.

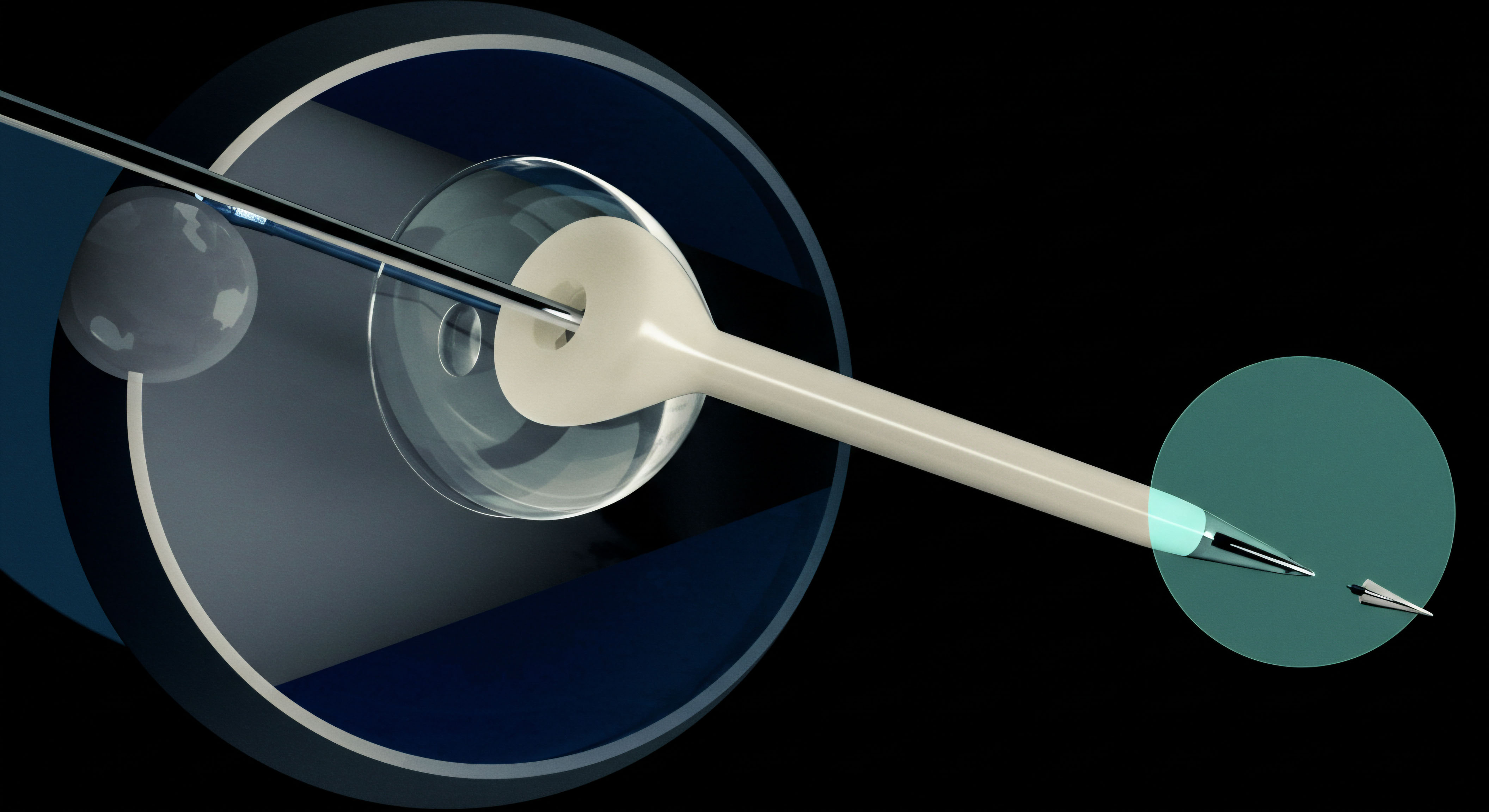

Strike selection determines the width of the profit zone and the maximum potential loss. Prudent traders select strikes sufficiently out-of-the-money, aiming for a high probability of expiration outside the sold strikes. The difference between the sold and bought strikes on each side defines the maximum risk per spread, impacting the overall capital requirement.

Execution Dynamics and Risk Calibration

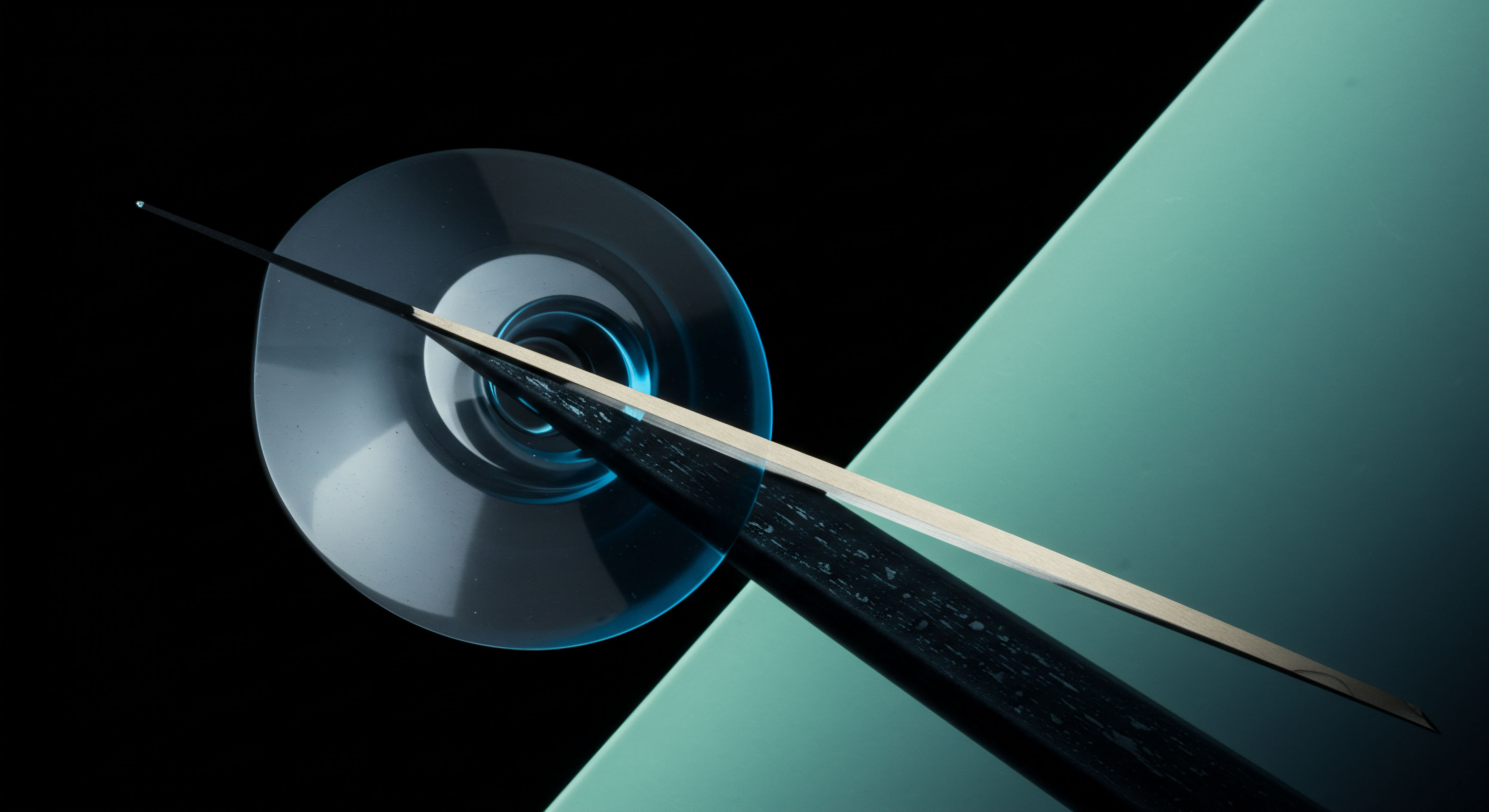

Executing a multi-leg options strategy demands precision. Leveraging multi-dealer liquidity via Request for Quote (RFQ) systems significantly enhances execution quality. This method allows for competitive pricing across various liquidity providers, minimizing slippage and ensuring best execution. Block trading functionalities become essential for larger position sizes, preserving anonymity and reducing market impact.

Calibrating risk involves more than simply defining maximum loss. Position sizing plays a critical role in portfolio management. Allocating a specific percentage of trading capital to each Iron Condor position prevents overexposure to any single trade. Adjusting position size based on the perceived edge and market conditions remains a core tenet of responsible trading.

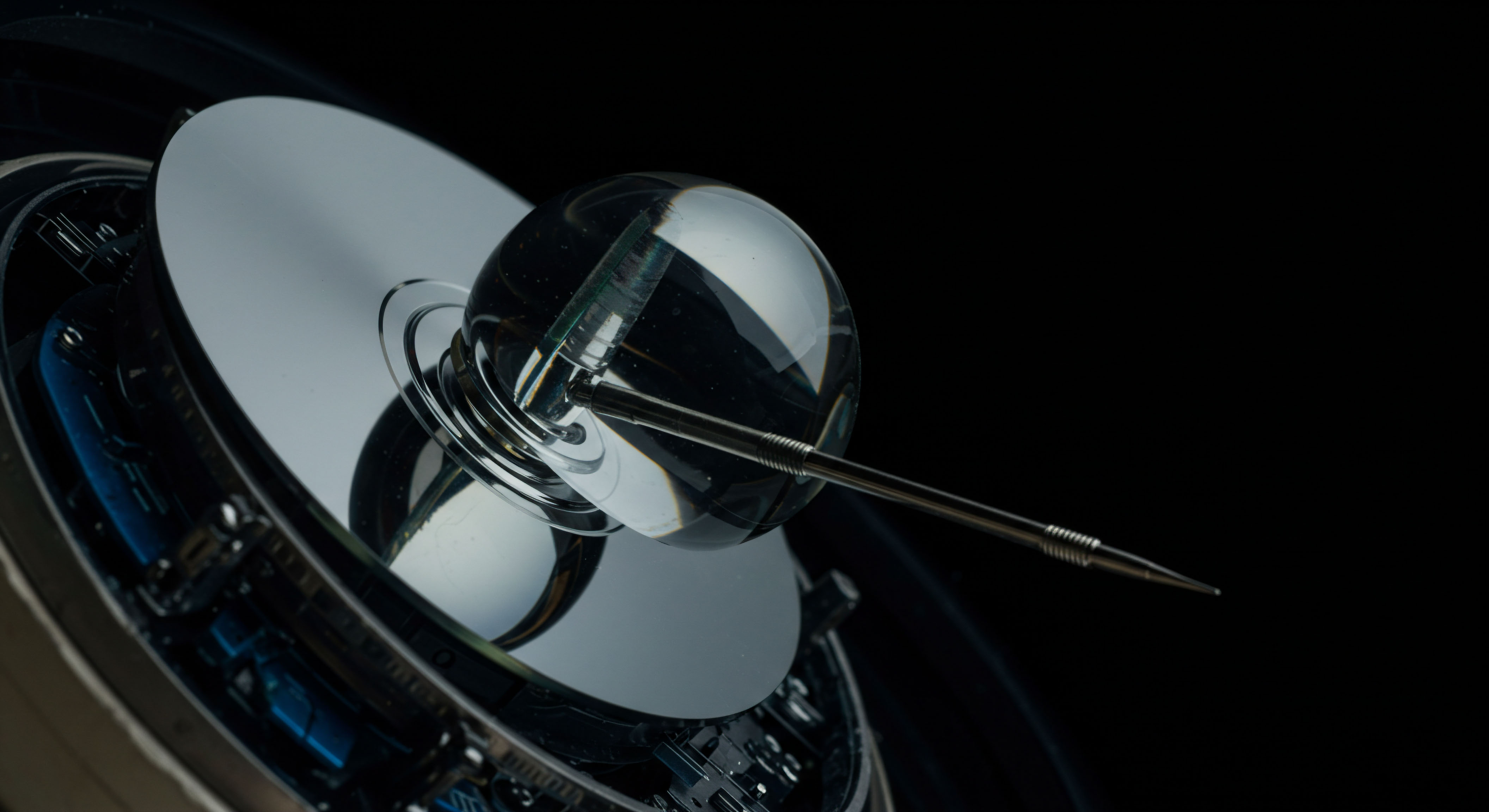

Consider the interplay of time decay, known as Theta, as a primary profit driver. An Iron Condor profits as time passes, provided the underlying asset remains within the defined range. Monitoring the Greek values, particularly Delta and Vega, becomes essential.

Delta measures directional exposure, while Vega quantifies sensitivity to implied volatility changes. Managing these exposures dynamically helps maintain a balanced risk profile.

Advanced Strategic Integration

Moving beyond initial deployment, the advanced strategist integrates Crypto Iron Condors into a broader portfolio framework, leveraging their unique characteristics for systemic advantage. This involves sophisticated risk adjustments, dynamic position management, and a deeper understanding of market microstructure to truly master control.

Dynamic Adjustments and Structural Integrity

Maintaining the structural integrity of an Iron Condor requires dynamic adjustments as market conditions evolve. Should the underlying asset approach one of the sold strike prices, proactive management becomes imperative. Rolling the entire Condor or individual spreads outward in time or upward/downward in strike price can extend the trade’s life or adjust its profit profile. This demands a keen sense of timing and a disciplined approach to risk mitigation.

A true market practitioner recognizes that passive monitoring offers limited value. Active management, informed by real-time data and a robust understanding of option greeks, distinguishes successful strategies. Rebalancing delta exposure, for instance, helps maintain a neutral directional stance, aligning with the core premise of the Iron Condor. Such interventions preserve the intended risk-reward symmetry of the position.

Proactive management of an Iron Condor transforms a static position into a dynamic, adaptive mechanism for consistent market engagement.

One might consider the complex interplay of factors when a position begins to challenge its initial parameters. The precise point at which to intervene often presents a significant challenge, requiring a blend of quantitative analysis and experiential judgment. There are no easy answers here.

Portfolio Synergy and Execution Edge

Integrating Iron Condors within a diversified crypto portfolio amplifies their effectiveness. They serve as a powerful hedge against long directional holdings, providing income during periods of consolidation. Combining them with other options strategies, such as straddles or collars, allows for a multi-layered approach to volatility exposure. This layered construction creates a resilient portfolio, designed to withstand various market states.

The pursuit of best execution remains paramount, particularly for advanced strategies. Leveraging anonymous options trading and multi-leg execution capabilities within an RFQ environment offers a distinct edge. This ensures that the strategic intent translates into optimal fill prices, directly impacting the profitability of complex spreads. A consistent execution edge compounds over time, significantly enhancing overall portfolio performance.

Mastery of Iron Condors extends to understanding their capital efficiency. This strategy typically requires less capital than outright directional bets, freeing up resources for other opportunities. The defined risk profile also contributes to predictable capital allocation, a cornerstone of institutional-grade trading. This systematic approach to capital deployment underpins a path toward sustained market control.

Commanding Crypto Volatility

The journey through Crypto Iron Condors illuminates a pathway toward precise market engagement. Traders who master this strategy move beyond reactive speculation, adopting a posture of deliberate control. The confluence of strategic design and disciplined execution establishes a distinct advantage, shaping market outcomes rather than simply enduring them. This represents a profound shift in how one approaches the inherently dynamic crypto landscape, transforming volatility into a predictable canvas for value creation.

Glossary

Iron Condors

Iron Condor

Risk Management

Crypto Options

Multi-Dealer Liquidity

Best Execution

Multi-Leg Execution

Options Trading