Commanding Liquidity

Superior block trade execution in crypto options demands a decisive edge. Request for Quote (RFQ) systems represent a foundational shift, offering a structured environment for sourcing competitive pricing. This mechanism transforms a fragmented liquidity landscape into a unified auction, enabling participants to secure optimal terms for substantial derivatives positions. Understanding its operational mechanics lays the groundwork for strategic market engagement.

The RFQ process functions by allowing a trader to solicit bids and offers from multiple market makers simultaneously for a specific crypto options block. This simultaneous query creates a competitive dynamic, driving price discovery towards more favorable outcomes. Each market maker responds with their best executable price, fostering a transparent environment. This direct engagement minimizes information leakage and improves pricing accuracy for larger orders.

Professional traders recognize the distinct advantages RFQ systems provide for executing significant volumes. It mitigates the market impact often associated with large orders placed on open exchanges. Instead of affecting public order books, the negotiation occurs privately among selected liquidity providers. This discreet method safeguards trading intentions, a critical aspect for maintaining an alpha edge in volatile crypto markets.

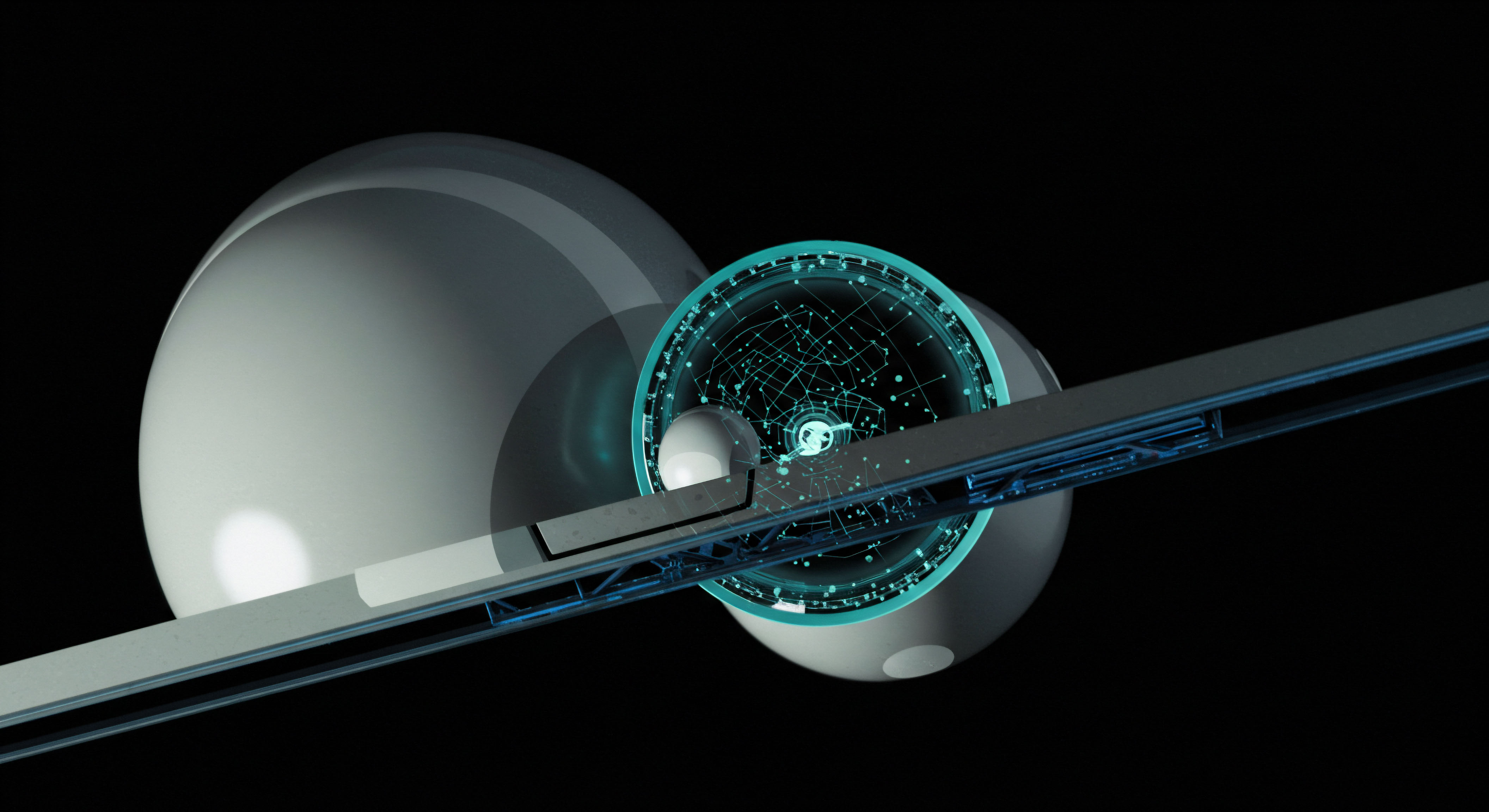

RFQ systems centralize competitive pricing for crypto options block trades, providing a critical advantage in liquidity acquisition.

A firm grasp of RFQ mechanics equips traders with the ability to navigate complex options structures. Executing multi-leg strategies, such as straddles or collars, becomes significantly more efficient through a single RFQ submission. This consolidated approach reduces execution risk and ensures the entire strategy is priced cohesively. Mastering this foundational tool empowers traders to approach the market with a new level of confidence.

Deploying Capital Wisely

Active deployment of RFQ systems translates directly into superior investment outcomes. Traders move beyond reactive market participation, instead actively shaping their execution conditions. Strategic engagement with RFQ for crypto options blocks allows for precision entry and exit points, directly impacting overall portfolio performance.

Optimal Pricing for Bitcoin Options Blocks

Executing large Bitcoin options blocks through RFQ channels yields quantifiable advantages. By soliciting prices from multiple dealers, traders consistently achieve tighter spreads compared to fragmented exchange order books. This competitive tension ensures the execution price closely aligns with fair value, reducing transaction costs. Employing this method protects capital during substantial market entries or exits.

Consider a scenario involving a substantial BTC straddle block. Initiating an RFQ for this multi-leg position ensures that the implied volatility across both calls and puts aligns coherently. This unified pricing minimizes the risk of adverse selection or slippage inherent in attempting to leg into such a position on disparate order books. The system presents a streamlined path to precise volatility exposure.

Ethereum Options Collar RFQ Strategies

Structuring an ETH collar through an RFQ provides a robust risk management framework for long Ethereum positions. Traders sell an out-of-the-money call and purchase an out-of-the-money put, defining a profit range and limiting downside exposure. The RFQ process allows for the simultaneous pricing of these three components ▴ the underlying ETH, the call, and the put. This ensures an economically sensible execution of the entire hedge.

This approach offers a superior method for establishing or adjusting large hedging positions. A trader’s conviction in a specific price range becomes actionable with defined parameters. The system secures the most favorable collective pricing for the three instruments, effectively building a financial firewall around an existing asset. This precision in hedging translates into greater capital efficiency and enhanced portfolio stability, providing a clear path to managing directional risk with surgical accuracy.

Multi-Leg Options Execution

The RFQ system truly distinguishes itself when handling complex multi-leg options spreads. Executing these positions atomically guarantees the entire strategy fills at a single, composite price. This eliminates the significant execution risk associated with leg risk, where individual components of a spread might fill at unfavorable prices, distorting the intended risk-reward profile.

- Defined Spreads ▴ Traders specify desired spreads like verticals, butterflies, or condors, receiving consolidated pricing.

- Risk Mitigation ▴ The atomic execution reduces slippage and adverse price movements between legs.

- Capital Efficiency ▴ Consolidated pricing optimizes margin usage and overall trade cost.

- Custom Volatility Exposure ▴ Traders tailor volatility views with greater precision and confidence.

The system’s capacity to handle intricate orders underpins a sophisticated approach to market participation. It moves beyond simple directional bets, enabling nuanced strategies that capture specific market views. This capability represents a tangible advantage for those aiming to extract alpha from volatility and relative value plays.

Mastering Market Dynamics

Advanced applications of RFQ systems transcend individual trade execution, integrating into broader portfolio management and strategic risk calibration. Traders move towards a holistic command of their crypto options exposure, utilizing this tool for sustained market advantage. This represents the pinnacle of operational efficiency and strategic depth.

OTC Options Integration

RFQ systems bridge the gap between exchange-listed options and the Over-the-Counter (OTC) market, providing a unified channel for block execution. This integration grants access to a deeper pool of liquidity for specialized or highly customized options structures. The ability to source competitive pricing for illiquid or bespoke instruments through a familiar RFQ interface enhances overall market reach. This expanded access allows traders to capitalize on opportunities unavailable through standard exchange venues.

Consider the strategic implications of anonymous options trading within this context. RFQ systems permit participants to submit inquiries without revealing their identity until a price agreement is reached. This anonymity protects trading intentions and prevents front-running, preserving the integrity of large orders.

The capacity for discreet execution empowers traders to move substantial positions without signaling their market conviction. This privacy secures a significant tactical advantage.

A deep understanding of RFQ functionality involves analyzing how liquidity providers calibrate their responses based on market conditions and order size. Market makers deploy sophisticated algorithms to price and hedge these requests, reflecting their own risk tolerance and inventory. Traders benefit from this computational intensity, securing a price that reflects a highly optimized risk assessment from the counterparty. This continuous calibration of pricing mechanisms underscores the dynamic nature of RFQ interactions.

Algorithmic Execution Synergy

Combining RFQ systems with sophisticated algorithmic execution strategies elevates trading to an institutional standard. Automated systems can monitor market conditions, identify optimal moments for RFQ submission, and process responses with minimal latency. This synergistic approach maximizes the efficiency of block trade execution, reducing human error and improving response times. Such integration allows for systematic capture of pricing discrepancies.

The interaction between smart trading algorithms and multi-dealer liquidity via RFQ creates a powerful feedback loop. Algorithms can learn from historical RFQ responses, refining their pricing models and improving future bid/offer submissions. This continuous optimization enhances execution quality over time. Traders gain a sustained edge through this intelligent adaptation.

Shaping Tomorrow’s Trades

The evolution of crypto options trading demands a proactive stance, a readiness to deploy advanced systems that redefine execution standards. RFQ systems stand as a testament to this progress, offering a precise instrument for block trades. Traders who command these systems move beyond merely reacting to market shifts; they actively sculpt their financial destiny. The path to sustained market leadership involves a continuous refinement of these strategic tools.

Glossary

Block Trade Execution

Crypto Options

Rfq Systems

Bitcoin Options

Options Spreads

Algorithmic Execution

Multi-Dealer Liquidity