Commanding Execution Dynamics

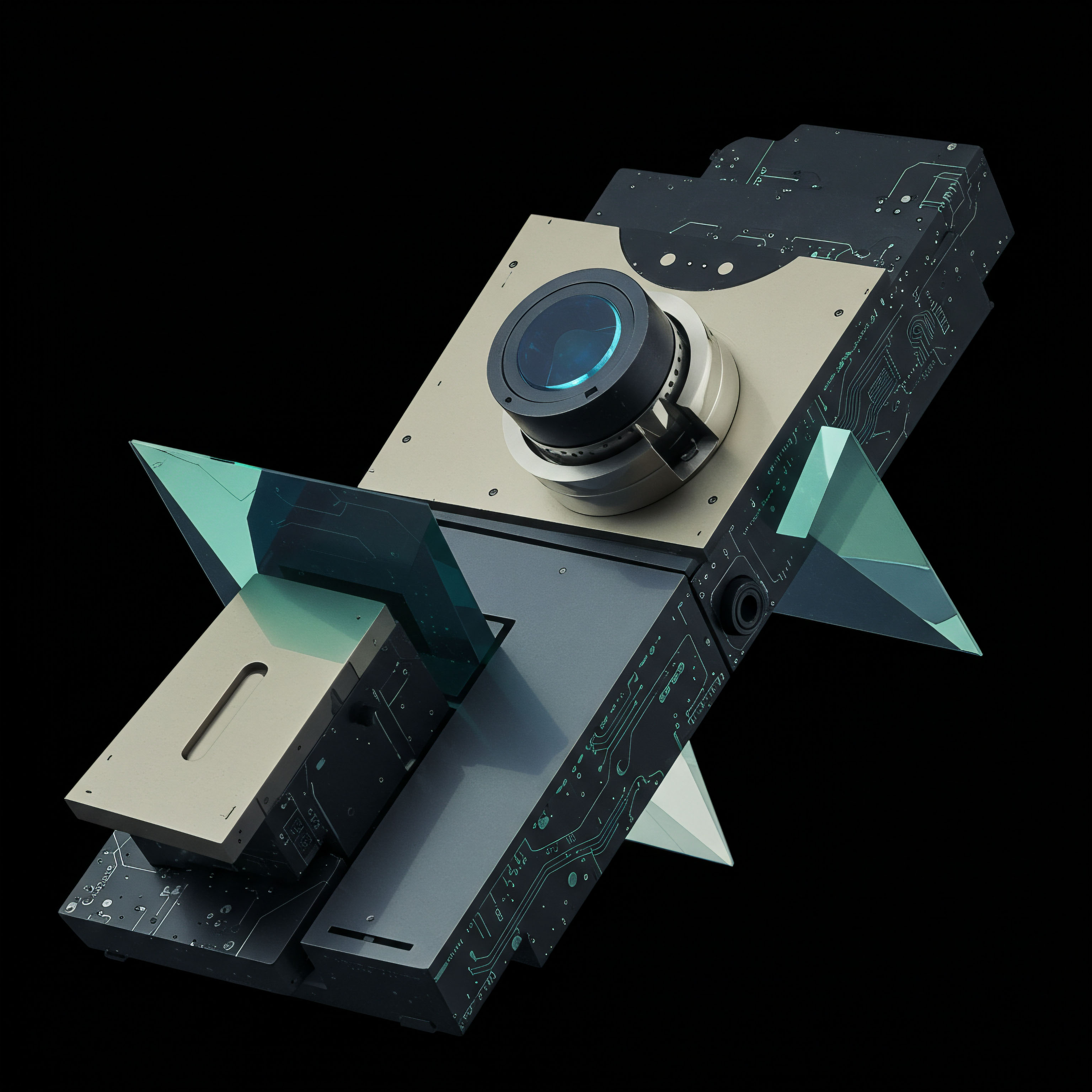

Professional traders recognize the profound impact of execution quality on realized returns. Slippage, a silent tax on trading profits, frequently erodes gains in volatile crypto markets. Mastering block execution requires a direct confrontation with this challenge, demanding mechanisms that secure favorable pricing and reliable fills. Understanding the Request for Quote (RFQ) system reveals its intrinsic value for large-scale digital asset transactions.

An RFQ mechanism provides a structured method for traders to solicit bids and offers from multiple liquidity providers simultaneously. This direct interaction moves beyond fragmented order books, offering a distinct advantage when transacting substantial volume. It cultivates a competitive environment, compelling market makers to offer their most aggressive pricing for the entire block. This system directly addresses the inherent market friction of finding deep liquidity for large orders without incurring significant price impact.

Achieving superior crypto execution hinges upon direct engagement with liquidity, ensuring price certainty for significant positions.

Consider the contrast between an RFQ and traditional spot market orders. A market order, particularly for larger sizes, can sweep through multiple price levels, increasing the average execution price. An RFQ, conversely, establishes a firm, pre-negotiated price for the entire trade, eliminating uncertainty. This foundational understanding empowers traders to view the market not as a reactive environment, but as a domain where precise execution is a tangible outcome of strategic tool deployment.

Deploying Strategic Advantage

Translating theoretical knowledge into tangible market edge requires precise application of advanced execution tools. For crypto options and block trades, the RFQ system transforms a potential liability into a significant opportunity for capital efficiency. Crafting a systematic approach to its deployment enhances profitability and minimizes unwanted price deviations.

Optimizing Options Spreads with RFQ

Options spreads, often multi-leg constructions, present unique execution complexities. Each leg carries its own liquidity profile and potential for slippage. Utilizing an RFQ for these intricate trades allows for simultaneous pricing of all components, guaranteeing a single, consolidated execution price. This unified approach protects the intended risk-reward profile of the spread.

A trader seeking to establish a Bitcoin call spread, for instance, submits the entire structure as a single RFQ. Market makers respond with a net price for the complete strategy. This method removes the incremental execution risk associated with leg-by-leg entry, a common pitfall for those relying on fragmented order books. It represents a significant upgrade in precision for derivatives strategists.

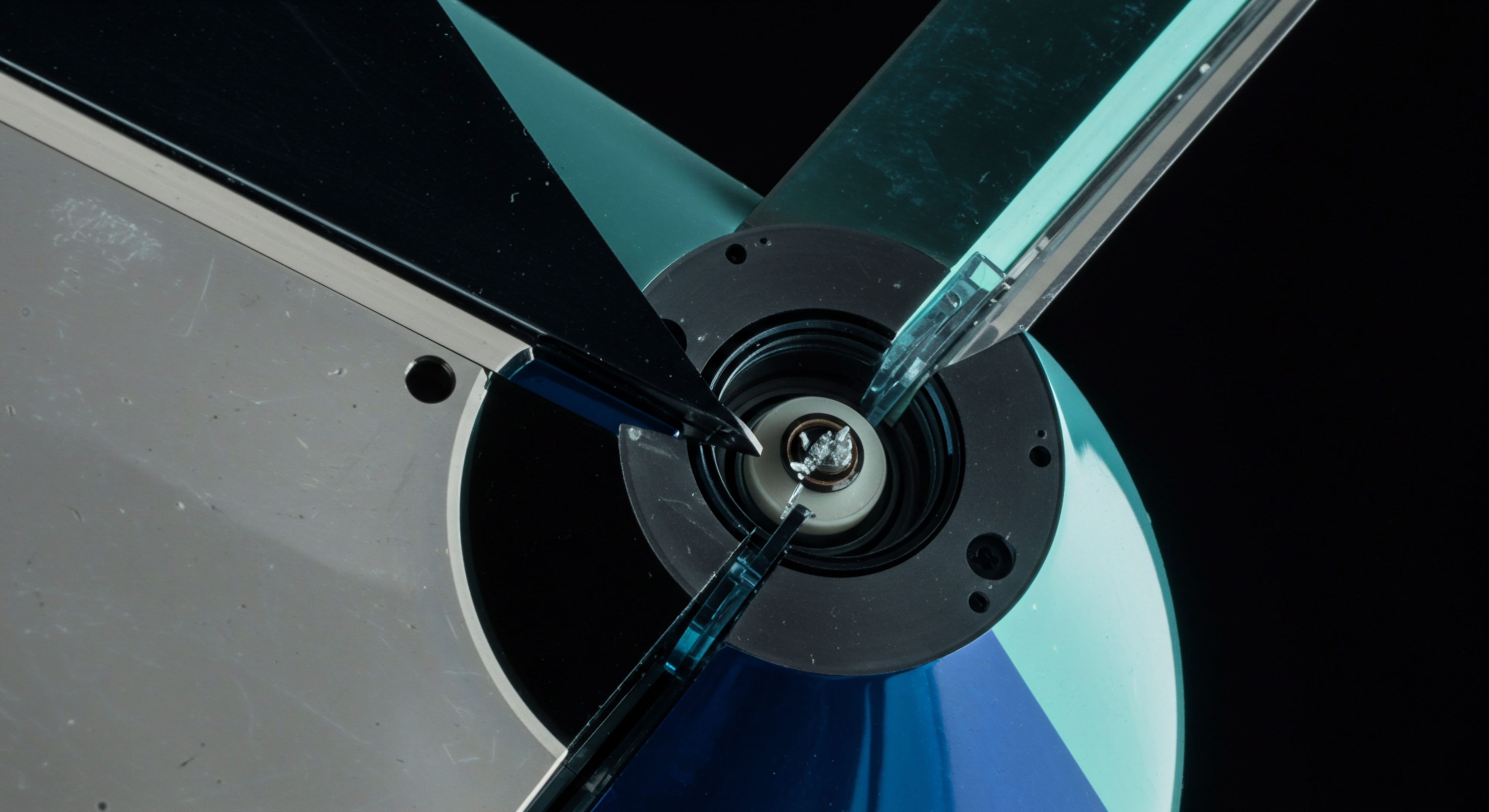

Executing Volatility Blocks

Capturing specific volatility views with large blocks of options demands a robust execution method. An RFQ provides the ideal conduit for such transactions. Whether structuring a BTC straddle block to capitalize on anticipated price swings or an ETH collar RFQ for downside protection with income generation, the ability to obtain competitive pricing for substantial size remains paramount.

Market makers compete vigorously for this flow, knowing the size of the trade offers a valuable opportunity. The resulting price discovery process within the RFQ environment often yields tighter spreads and more favorable fills than could be achieved through sequential, smaller orders. This direct access to multi-dealer liquidity stands as a hallmark of institutional-grade trading.

Navigating the intricacies of block execution demands a methodical application of advanced tools. A clear framework helps ensure consistent, high-quality outcomes. The following outlines key considerations for maximizing the efficacy of RFQ submissions:

- Define Trade Parameters ▴ Clearly specify asset, side, size, strike prices, and expiration dates for all legs. Precision in defining the trade minimizes ambiguity and attracts competitive quotes.

- Assess Liquidity Providers ▴ Understand the strengths of various market makers. Some specialize in specific assets or option tenors. Targeting the right counterparties enhances execution quality.

- Monitor Market Conditions ▴ Submit RFQs during periods of reasonable market depth and stability. Extreme volatility can impact pricing, although the RFQ still offers price certainty.

- Review Quote Depth ▴ Evaluate the range and competitiveness of received quotes. A wider array of quotes indicates a healthy market for the requested trade.

- Execute Decisively ▴ Once a favorable quote appears, act swiftly. Market conditions can shift, impacting quote validity.

This structured approach transforms the execution process from a speculative venture into a controlled, repeatable function. The consistent application of these steps yields a discernible advantage, shaping trading outcomes with deliberate action.

Mastering Market Influence

Moving beyond individual trade execution, the true mastery of RFQ systems lies in their integration within a broader portfolio context. This advanced perspective positions the trader to exert genuine influence over their market outcomes, transforming isolated gains into sustained alpha generation. Understanding how this mechanism alters market microstructure offers profound insights into long-term strategic positioning.

Advanced Risk Mitigation through RFQ

Sophisticated traders view RFQ not merely as an execution tool, but as a critical component of their risk management framework. Large positions, whether establishing new exposure or hedging existing holdings, introduce significant market risk during the execution phase. The certainty of a block price obtained through an RFQ mitigates this execution risk. It provides a reliable hedge against adverse price movements during the transaction window, a silent threat in open order book environments.

The nuanced interplay of market forces, liquidity provision, and trader intent often creates a complex environment for capturing consistent alpha. The challenge lies in consistently translating theoretical advantage into realized profit. It requires a deep understanding of market microstructure, coupled with the disciplined application of tools that allow for direct negotiation and precise control over execution.

This necessitates a constant calibration of strategy against market reality, refining one’s approach with each interaction. The pursuit of optimal execution becomes a continuous learning loop, demanding both intellectual rigor and practical agility.

Strategic Alpha Generation with Block Liquidity

For professional traders, the ability to transact large crypto options blocks anonymously provides a distinct alpha-generating edge. Avoiding immediate market signaling, which often accompanies large orders on public books, protects against front-running and adverse price reactions. RFQ systems offer this anonymity, allowing positions to be built or unwound with minimal market footprint.

This capacity extends to multi-leg execution strategies, where complex options structures can be deployed without telegraphing market intent. The resulting capital efficiency, combined with superior execution pricing, contributes directly to enhanced portfolio returns. It establishes a verifiable market edge, separating opportunistic trading from a truly strategic approach to digital asset markets.

The Trader’s Definitive Edge

The journey towards superior crypto block execution culminates in a deep understanding of direct liquidity engagement. Traders who command this domain move beyond reactive participation, shaping their market outcomes with precision. This mastery, grounded in sophisticated tools and strategic application, becomes an enduring source of market advantage, a testament to disciplined pursuit of optimal performance.

Glossary

Market Makers

Options Spreads

Btc Straddle Block

Eth Collar Rfq

Multi-Dealer Liquidity