Execution Mastery

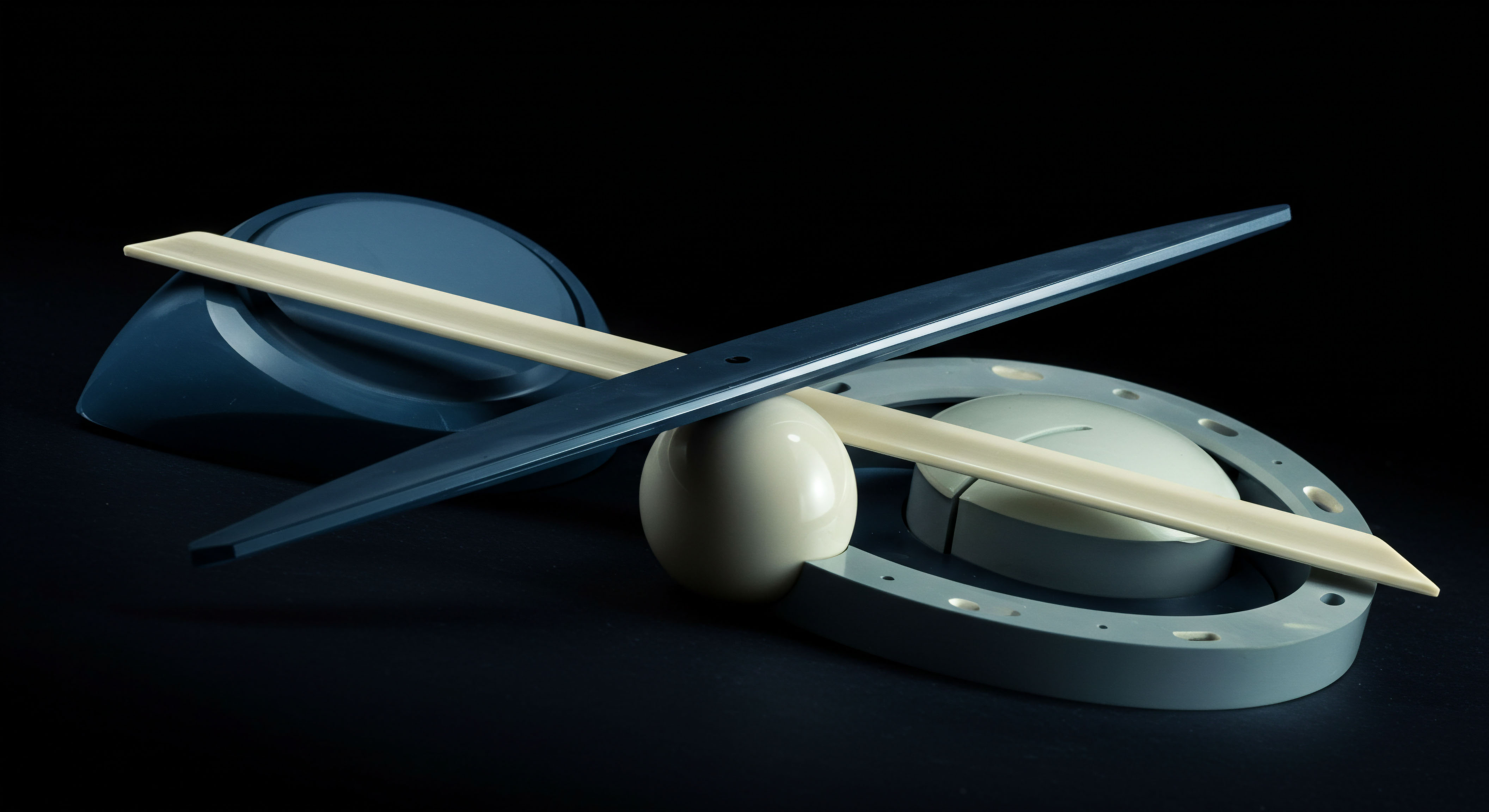

Superior trading outcomes begin with understanding the mechanisms that govern market interaction. A Request for Quote, commonly known as RFQ, provides a structured environment for professional traders to source liquidity for options and block trades. This system enables participants to solicit bids and offers from multiple dealers simultaneously, fostering competition among liquidity providers. The RFQ process stands as a deliberate counterpoint to open order books, where immediate price discovery often carries inherent costs for larger positions.

This approach directly addresses the challenges of market microstructure, where large orders frequently encounter adverse price movement upon execution. RFQ trading allows for the discreet circulation of trade interest among a selected group of counterparties. The opacity inherent in this process mitigates information leakage, a critical factor for any substantial position. Receiving multiple executable quotes in a competitive environment directly contributes to achieving best execution, a cornerstone of any robust trading operation.

RFQ trading offers a strategic advantage, ensuring price discovery remains competitive while safeguarding order information.

A firm grasp of RFQ mechanics empowers traders to control their execution destiny. Understanding how dealers compete for your order flow transforms a passive acceptance of market prices into an active solicitation of optimal terms. This foundational knowledge forms the bedrock for applying more sophisticated strategies across various derivative instruments. It establishes a disciplined process for capital deployment, aligning execution with strategic intent.

Strategic Capital Deployment

Deploying capital with precision demands a refined approach to execution, particularly within the dynamic landscape of options and block trading. RFQ systems offer a controlled environment for securing optimal pricing across diverse instruments, from single-leg options to complex multi-leg spreads. This method delivers tangible advantages in managing price impact and securing competitive fills.

Options Spreads Execution

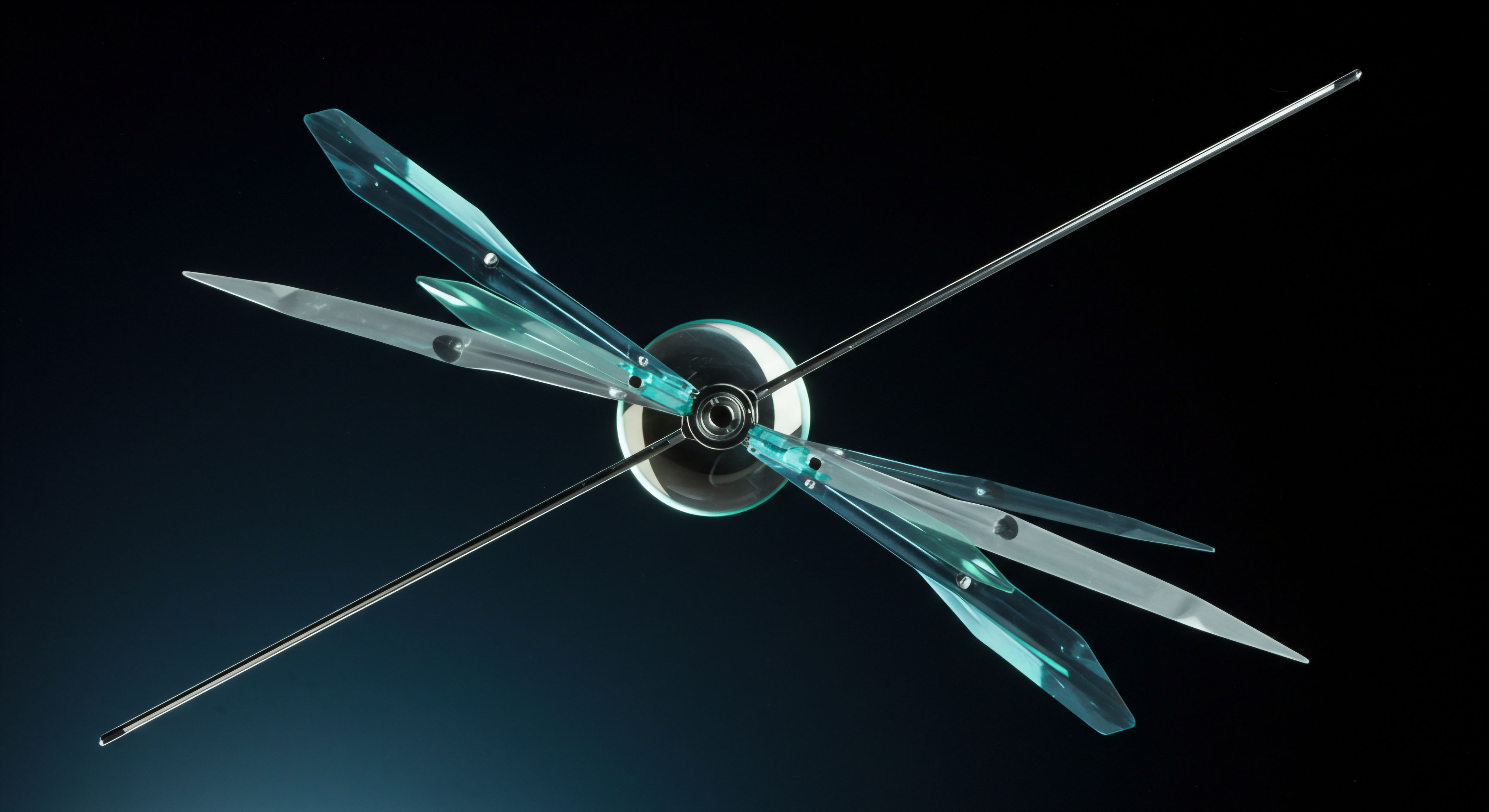

Executing multi-leg options spreads, such as straddles or collars, often presents significant challenges on conventional order books. Bid-ask spreads widen across individual legs, leading to considerable slippage upon execution. An RFQ streamlines this process, allowing a trader to submit an entire spread as a single order.

Dealers then quote the spread as a single unit, reflecting a composite price that accounts for all legs simultaneously. This dramatically reduces the aggregate transaction cost.

Multi-Leg Pricing Efficiency

Consider a trader seeking to establish a Bitcoin options straddle. Submitting separate orders for a call and a put on an open book introduces execution risk, where one leg might fill at an unfavorable price before the other. Using an RFQ, the trader receives a single, unified quote for the entire straddle.

This integrated pricing ensures consistent execution for the entire strategy, preserving the intended risk-reward profile. The system functions as a unified gateway for complex position construction.

Block Trading for Size

Large block trades, especially in instruments like ETH options, demand discreet execution to prevent significant market impact. RFQ channels provide the necessary anonymity, shielding the true size of the order from the broader market. This discretion allows liquidity providers to quote tighter prices, knowing they are competing for a substantial trade without the immediate threat of market participants front-running their positions.

Liquidity Sourcing

Accessing multi-dealer liquidity through an RFQ ensures a broad spectrum of pricing responses. A single request reaches numerous qualified counterparties, each eager to compete for the order. This competitive tension invariably leads to superior pricing for the trader. It consolidates fragmented liquidity into a centralized, competitive process.

- Submit a multi-leg options order as a single RFQ.

- Specify desired anonymity levels for block trades.

- Compare quotes from multiple liquidity providers.

- Execute trades with confirmed, competitive pricing.

Effective execution hinges on process.

Advanced Strategic Integration

Mastering RFQ execution extends beyond individual trades; it involves integrating this capability into a comprehensive portfolio management strategy. The sophisticated application of RFQ principles allows for enhanced risk management and sustained alpha generation across diverse market conditions. This elevates execution from a tactical necessity to a strategic advantage.

Portfolio Hedging with Precision

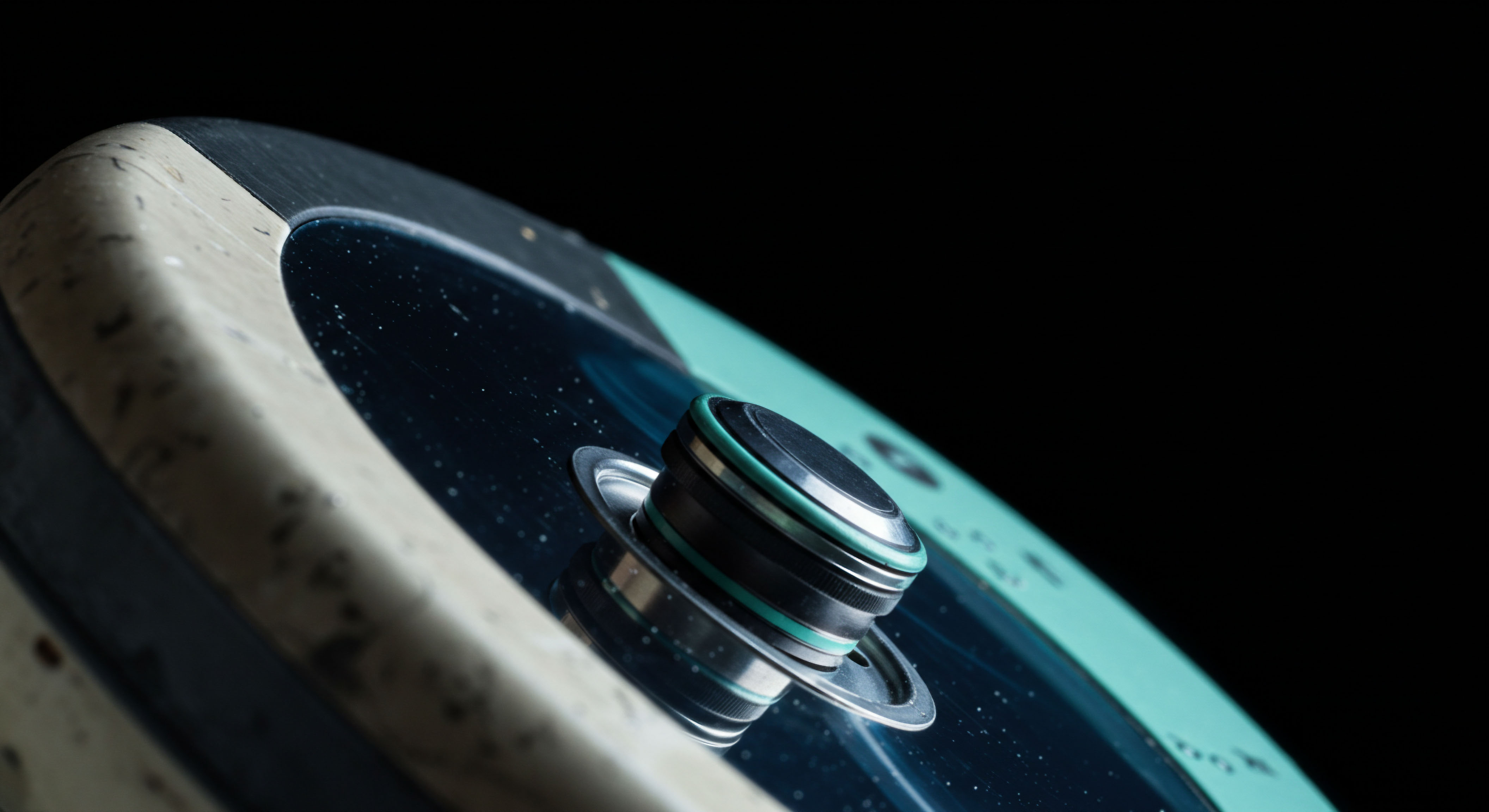

Sophisticated portfolio managers frequently employ options to hedge existing exposures or to express complex directional views. Executing these hedges efficiently, particularly for large positions, significantly impacts overall portfolio performance. An RFQ facilitates the precise placement of these hedges, ensuring the cost of protection aligns with the intended risk reduction. Consider a portfolio manager needing to implement a large-scale volatility hedge using ETH options.

The manager submits a detailed RFQ, requesting quotes for a specific volatility swap or a series of options designed to replicate its payoff. The system gathers competitive bids, allowing the manager to secure the hedge at an optimized cost, directly preserving portfolio capital.

The true challenge lies in the calibration of these advanced instruments against prevailing market dynamics. One must account for the subtle shifts in implied volatility and liquidity concentrations across different strike prices and expiries. This necessitates a continuous re-evaluation of execution parameters, adapting to the market’s evolving temperament. The RFQ mechanism then becomes a responsive tool, allowing for rapid adjustments to hedging strategies as market conditions dictate.

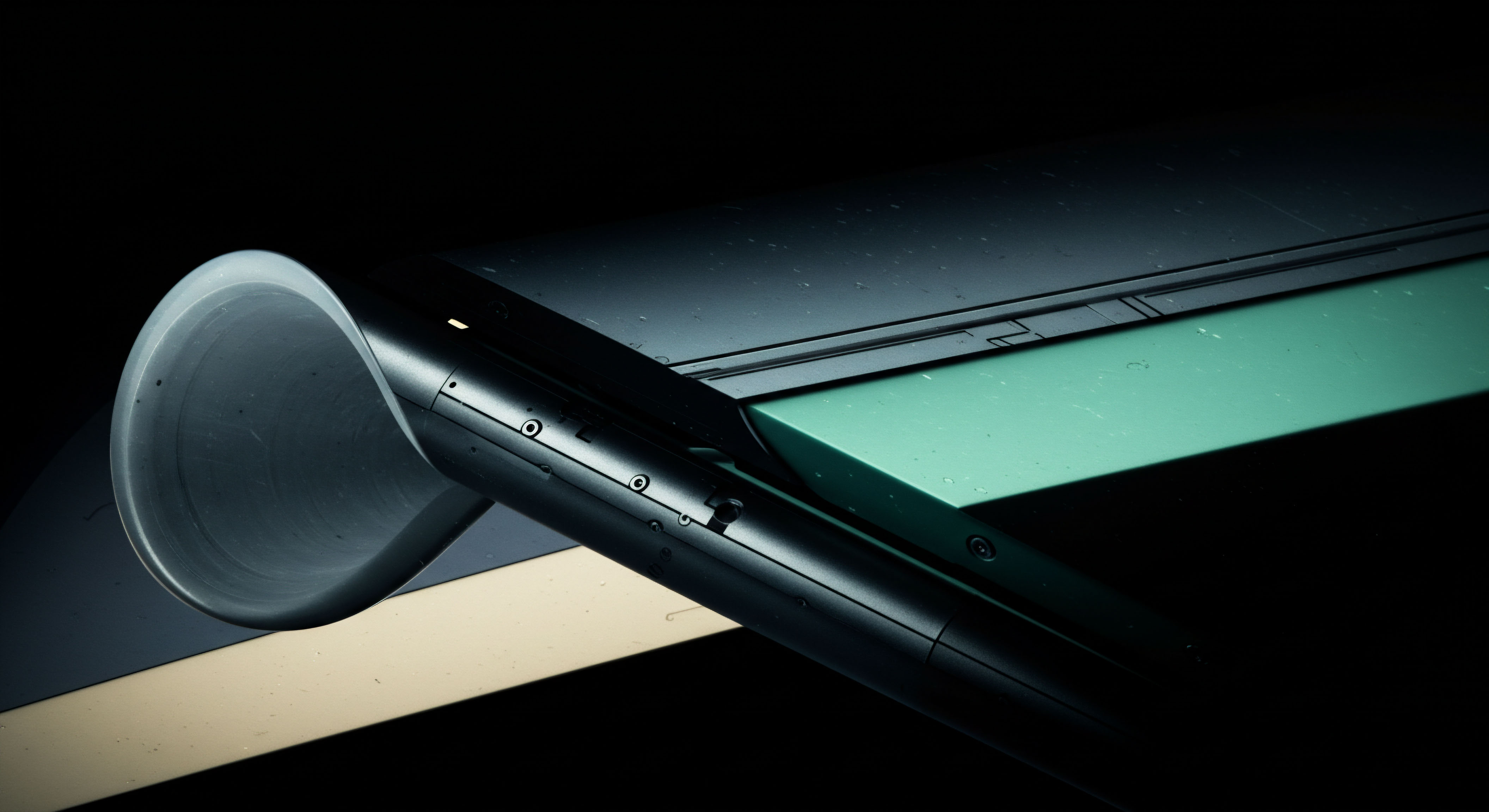

Algorithmic Execution Synergy

Integrating RFQ capabilities with algorithmic trading systems represents the vanguard of execution efficiency. Automated algorithms can analyze market data, identify optimal RFQ submission times, and even manage the quote comparison and execution process. This creates a powerful synergy, combining the discretion of RFQ with the speed and analytical power of automation. A well-designed algorithm can dynamically adjust RFQ parameters based on real-time market conditions, ensuring persistent execution advantage.

Systemic Alpha Generation

The consistent application of RFQ for significant options and block trades builds a measurable edge. Each basis point saved on execution translates directly into improved P&L. Over time, this systemic efficiency compounds, contributing materially to the portfolio’s overall return profile. RFQ trading transforms execution from a cost center into a reliable source of incremental alpha, solidifying a position of market leadership. This disciplined approach establishes a robust framework for managing execution quality as an ongoing operational imperative.

Mastering Market Mechanics

The landscape of options and block trading demands a strategic approach to execution, one that moves beyond conventional methods. A disciplined engagement with RFQ systems reshapes the dynamics of liquidity acquisition, transforming a reactive posture into one of proactive control. Traders who command these systems consistently secure an advantage, optimizing every transaction for superior outcomes. This deliberate approach to market interaction defines a new standard for operational excellence.

Glossary

Best Execution