Engineered Profitability

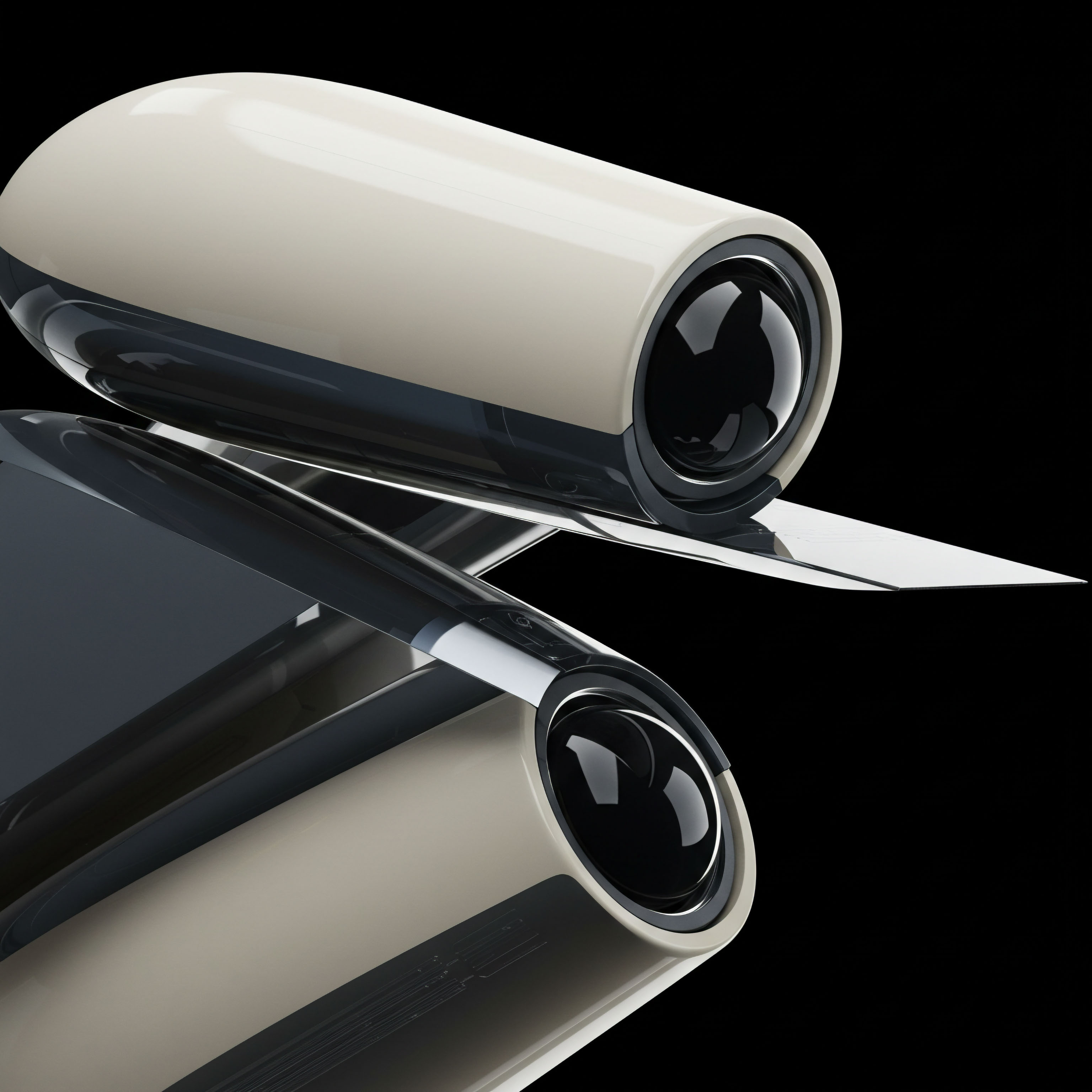

Mastering crypto markets demands a systematic approach to execution, a disciplined method for capturing consistent returns. This concept, Engineered Profitability, centers on leveraging sophisticated tools to achieve neutral alpha, extracting value independent of directional market movements. It signifies a strategic shift from speculative exposure to a deliberate, calculated deployment of capital within the derivatives landscape. Understanding this framework provides the foundation for superior trading outcomes, empowering participants to construct robust strategies.

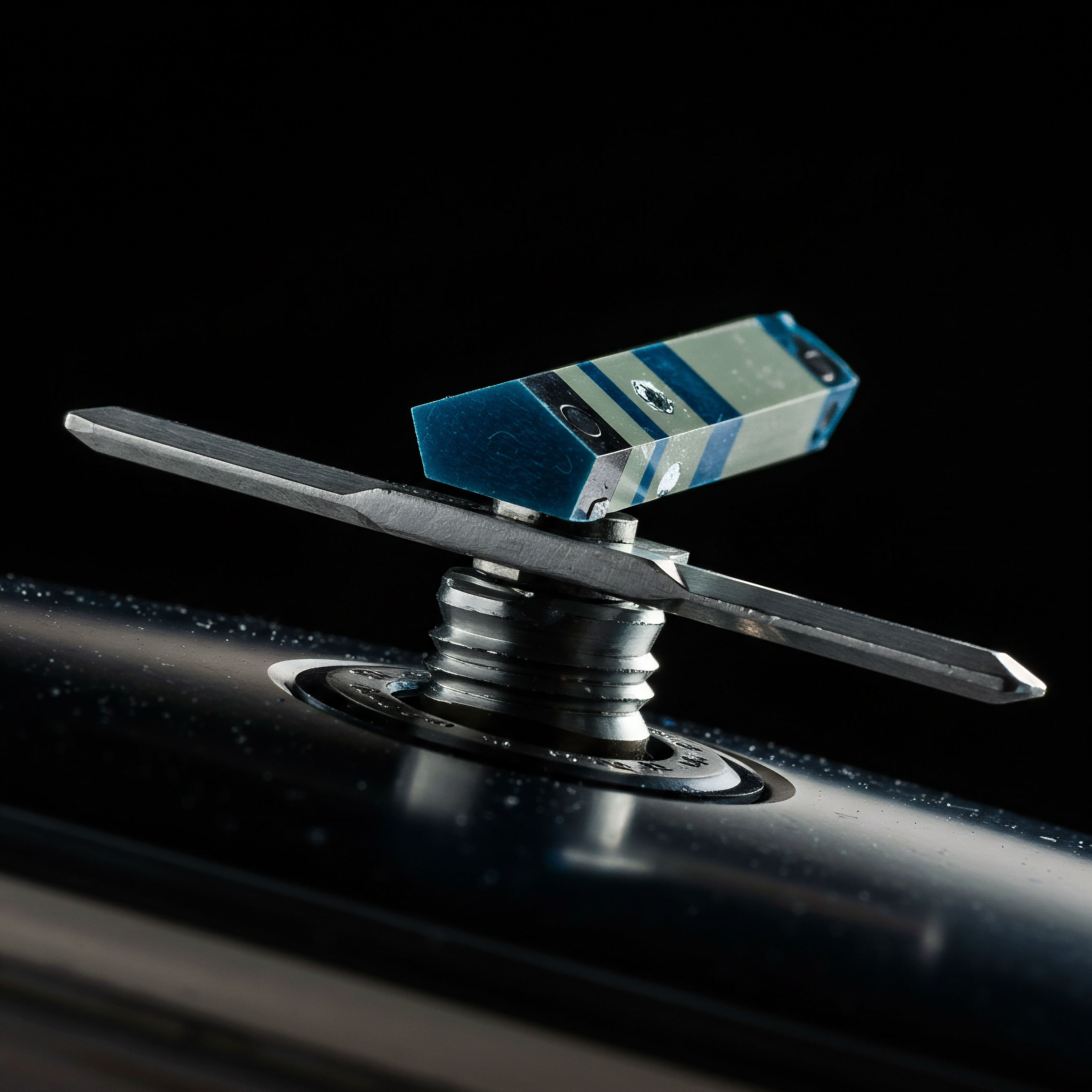

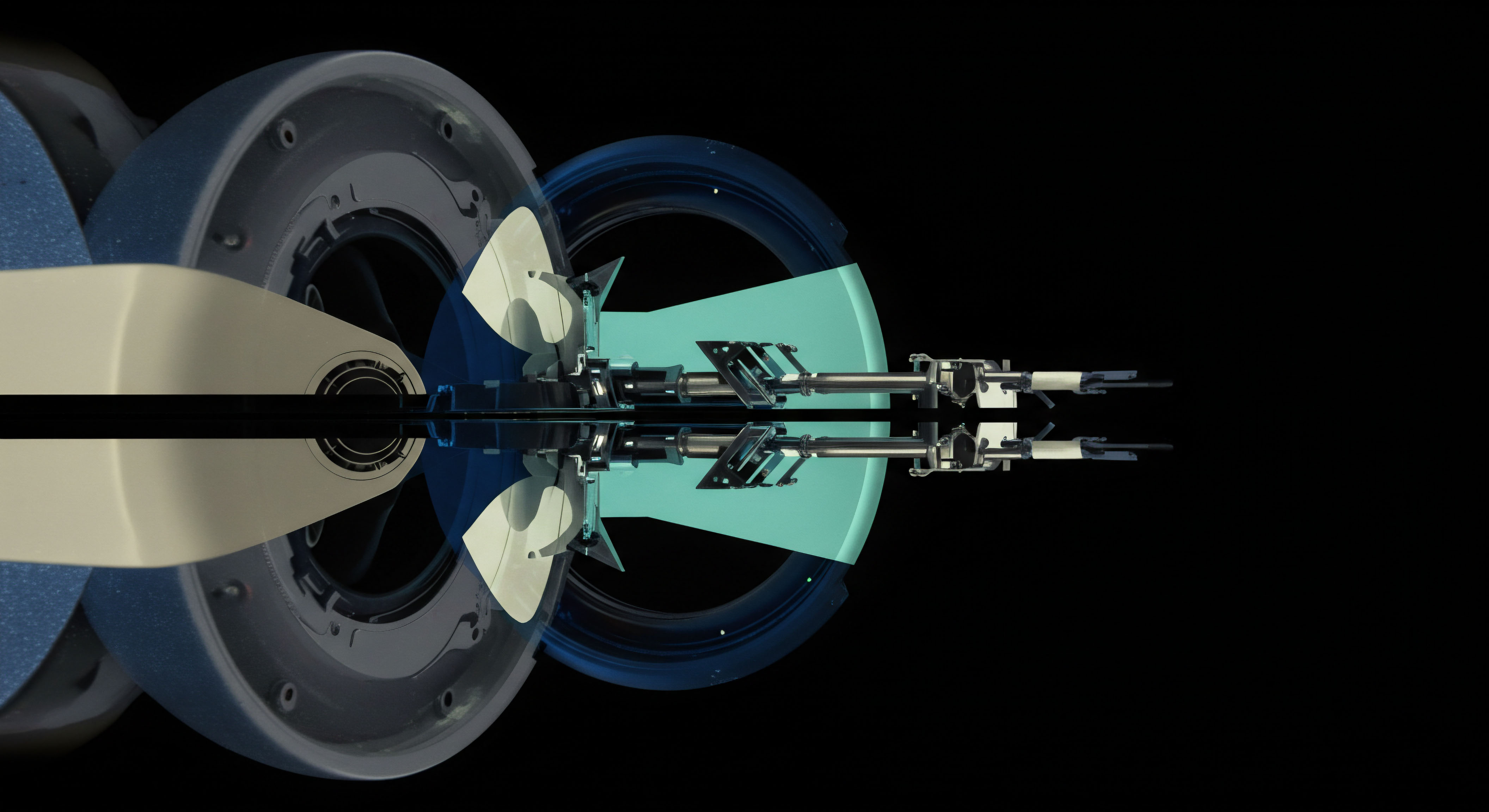

The Request for Quote (RFQ) system represents a cornerstone of this engineered approach, transforming how participants access liquidity for options and block trades. It permits the solicitation of competitive bids and offers from multiple dealers simultaneously, securing optimal pricing. This mechanism directly addresses the inherent liquidity challenges within nascent crypto derivatives venues, ensuring efficient execution for larger orders. Participants gain a clear advantage by compelling market makers to compete for their flow, tightening spreads and minimizing transaction costs.

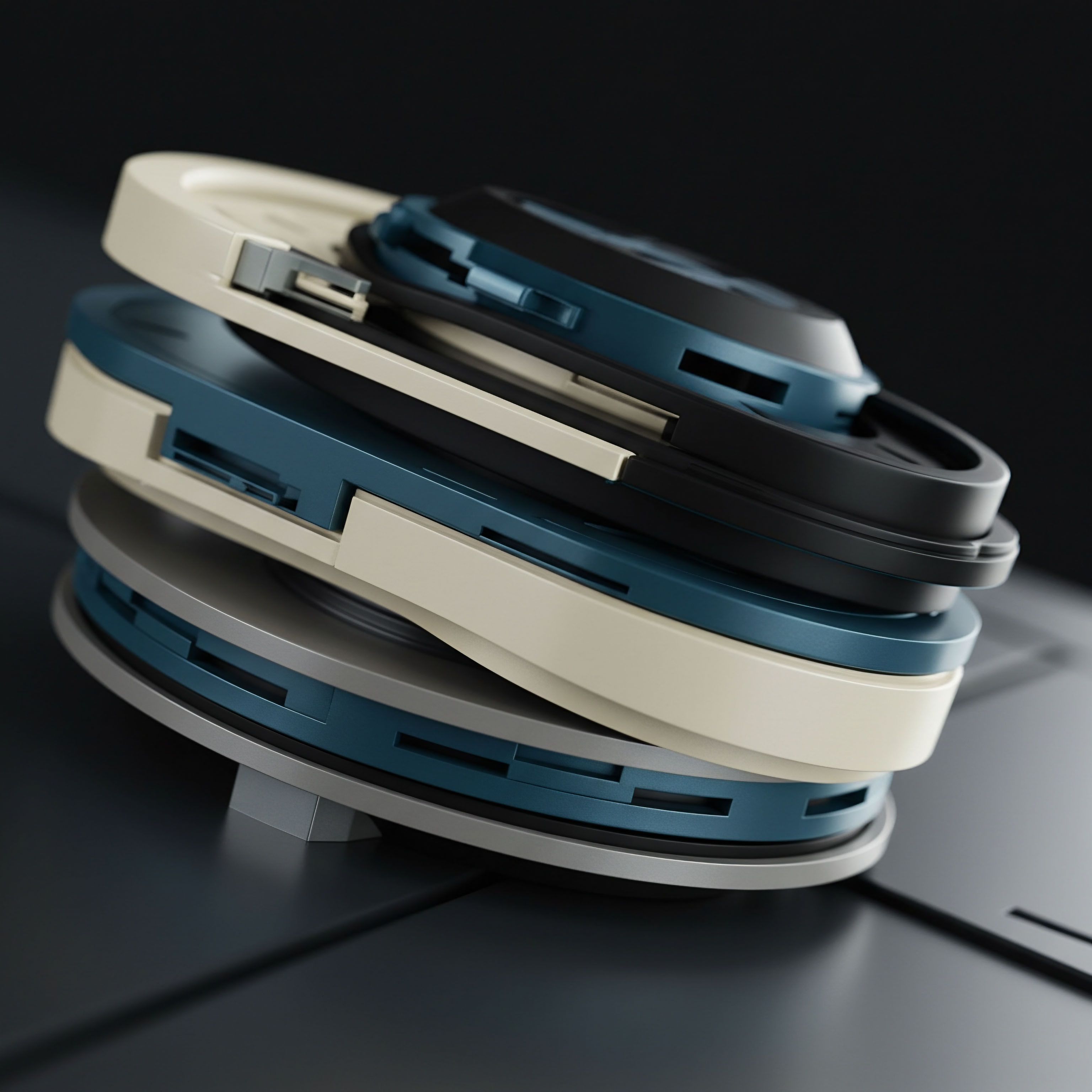

Options trading, when viewed through this engineering lens, becomes a powerful instrument for precise risk calibration and yield generation. It offers a versatile toolkit for expressing complex market views with defined parameters. Constructing multi-leg options spreads, for instance, allows for isolating specific volatility or directional biases while hedging against unwanted exposures. The strategic deployment of these instruments moves beyond simple speculation, becoming a component of a larger, carefully designed financial system.

Engineered Profitability reshapes crypto trading into a systematic discipline, utilizing advanced execution methods for consistent, market-agnostic returns.

Block trading, particularly for Bitcoin and Ethereum options, stands as a testament to the power of discreet, efficient execution. Large orders, when executed outside of central limit order books, mitigate significant market impact. RFQ systems provide the necessary infrastructure for these substantial transactions, preserving anonymity and securing competitive pricing. This capability elevates trading to an institutional standard, where significant capital can move with minimal footprint, a crucial factor for large-scale operations.

Strategic Capital Deployment

Deploying capital effectively within crypto derivatives requires precision and a clear understanding of execution dynamics. The strategies outlined here integrate RFQ mechanisms with options and block trading to achieve superior outcomes, focusing on quantifiable edges.

Volatility Arbitrage with Options RFQ

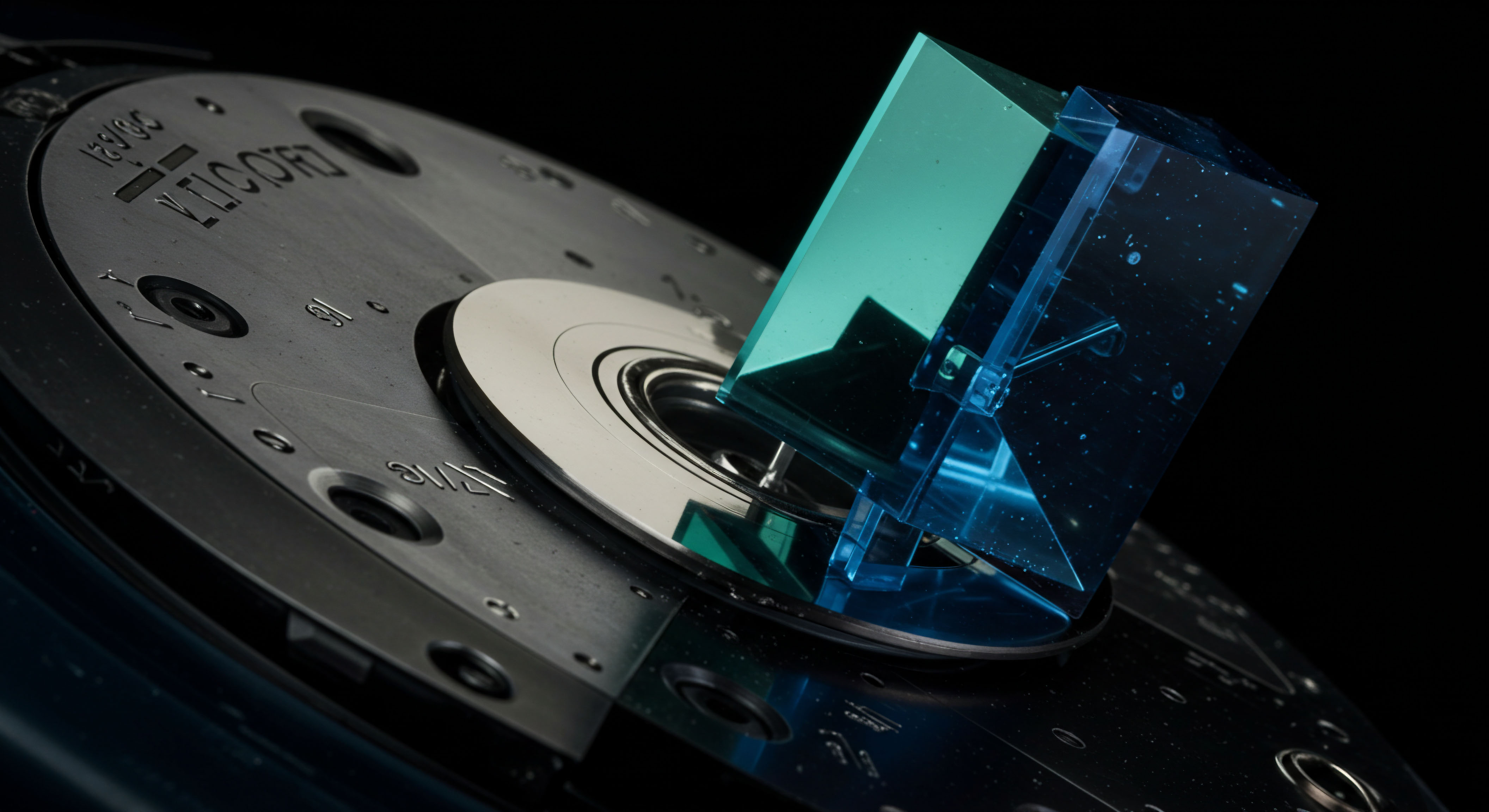

Exploiting discrepancies in implied volatility across different options contracts presents a compelling opportunity. A trader identifies a mispricing between a listed option and a synthetic equivalent, or across different expiry dates. The RFQ system then becomes instrumental in executing the spread legs simultaneously, locking in the statistical edge. This synchronized execution minimizes slippage, a critical factor for strategies reliant on narrow price differentials.

Hedged Yield Generation with ETH Collar RFQ

Generating consistent yield on existing ETH holdings involves a disciplined application of collar strategies. A participant sells an out-of-the-money call option while simultaneously purchasing an out-of-the-money put option, effectively creating a defined risk-reward profile. Using an RFQ for both legs ensures competitive pricing on the entire structure, enhancing the overall yield. This method caps upside gains yet provides downside protection, offering a balanced approach to asset management.

Large Position Entry Bitcoin Straddle Block

Executing a significant position in a Bitcoin straddle demands a mechanism that can absorb size without adverse price movement. A straddle, a volatility play involving buying both a call and a put with the same strike and expiry, carries substantial premium. Initiating this trade via a Bitcoin Options Block RFQ allows for a single, consolidated price from multiple liquidity providers. This prevents the price decay often associated with piecemeal execution on public order books, securing a superior entry point for the volatility view.

Successful implementation hinges on meticulous pre-trade analysis, identifying the specific market conditions that favor each strategy. This involves a rigorous assessment of implied volatility surfaces, liquidity depth across different strike prices, and the potential impact of order size on execution quality. Quantitative models often aid in determining optimal entry and exit points, ensuring a data-driven approach to every decision.

- Multi-Dealer Liquidity Aggregation ▴ The RFQ system collects bids from several market makers, presenting the participant with the best available price for a given options contract or block trade.

- Reduced Price Impact ▴ Executing larger orders through a block RFQ minimizes the observable impact on market prices, preserving the integrity of the trade.

- Enhanced Anonymity ▴ Participants can execute substantial trades without revealing their intent to the broader market, preventing front-running or adverse selection.

- Tailored Execution ▴ RFQ allows for highly customized orders, accommodating specific strike prices, expiry dates, and multi-leg combinations that might lack liquidity on standard exchanges.

These methods collectively create a systematic advantage, transforming the often-unpredictable crypto market into a landscape of predictable opportunities for the disciplined operator. The emphasis remains on a clear, repeatable process that consistently captures value.

Advanced Strategic Integration

Advancing beyond individual trade execution, the focus shifts to integrating these powerful tools into a cohesive portfolio management framework. This level of mastery involves considering systemic implications and optimizing for long-term alpha generation.

Dynamic Hedging with Options Spreads RFQ

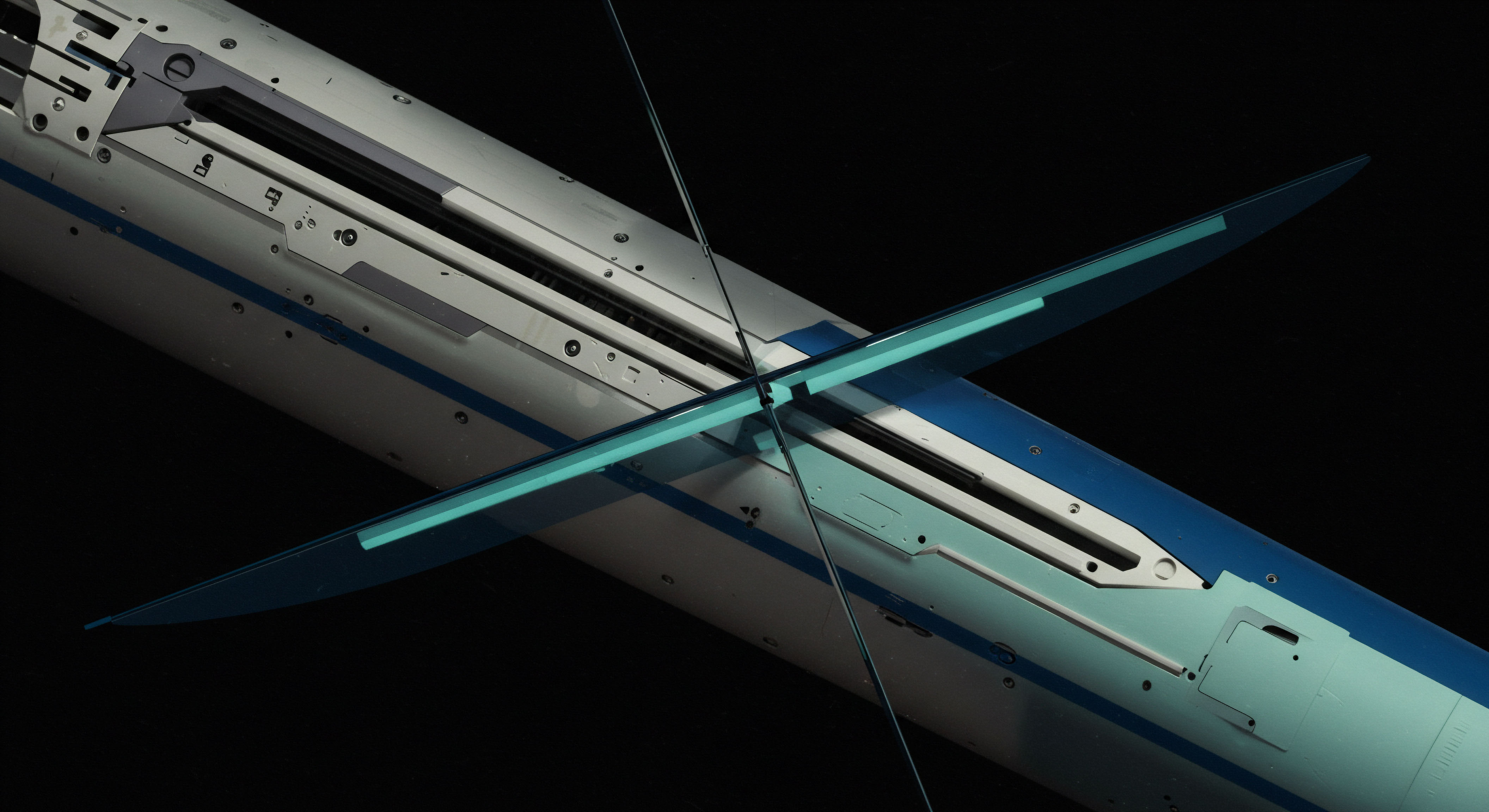

Portfolio managers often face the challenge of dynamically adjusting hedges in response to evolving market conditions. Utilizing Options Spreads RFQ for complex delta or gamma hedging allows for the efficient rebalancing of portfolio exposures. This involves constructing multi-leg options structures that precisely offset specific risk factors, executed with speed and price certainty through the RFQ system. The ability to quickly and accurately adjust these hedges minimizes slippage on large positions, preserving the portfolio’s intended risk profile.

Considering the intricate interplay of various derivatives and their sensitivity to underlying asset movements, a deep understanding of market microstructure becomes paramount for precise risk calibration. The continuous re-evaluation of correlation structures and volatility surfaces informs the precise adjustments necessary for maintaining a neutral alpha stance.

Volatility Skew Arbitrage via Custom Block RFQ

Sophisticated traders seek to capitalize on distortions in the volatility skew, the implied volatility difference between out-of-the-money and in-the-money options. Constructing custom block trades, perhaps involving a series of options with differing strikes and expiries, allows for isolating and monetizing these anomalies. The custom block RFQ facilitates the execution of these highly specific, often illiquid, structures with a consolidated price from specialized dealers. This advanced technique requires a robust quantitative framework to identify actionable skew dislocations, moving beyond simple directional bets.

Cross-Asset Volatility Trading

The interdependencies between crypto assets and traditional financial markets present opportunities for cross-asset volatility trading. A strategist might observe a divergence in implied volatility between Bitcoin options and a related equity index option, or between ETH options and a specific DeFi yield instrument. RFQ systems, when integrated with comprehensive market data feeds, enable the rapid execution of spread trades across these disparate markets.

This approach leverages the distinct liquidity characteristics of each market while maintaining a neutral position on the underlying asset’s direction, capturing relative value. The constant monitoring of macroeconomic indicators and their influence on various asset classes provides critical context for identifying these relative value opportunities.

This integration demands a comprehensive understanding of risk aggregation, ensuring that the cumulative effect of individual trades aligns with overall portfolio objectives. It also necessitates a robust operational backbone, capable of processing and reconciling complex derivatives positions across multiple venues. The goal extends beyond single-trade profitability; it encompasses building a resilient, alpha-generating engine that withstands varied market cycles.

Integrating RFQ with advanced options strategies creates a resilient, alpha-generating engine, navigating complex market dynamics with precision.

Achieving mastery in this domain requires a relentless pursuit of analytical clarity and operational excellence. The continuous refinement of execution algorithms, coupled with a deep understanding of counterparty liquidity profiles, distinguishes sustained profitability from episodic gains. It means treating every trade as a component within a larger, self-optimizing system.

Commanding Market Flow

The journey toward Engineered Profitability transcends mere technique; it signifies a commitment to systematic advantage. It represents a paradigm where market outcomes stem from deliberate design, not happenstance. This path calls for a strategic mindset, one that views market dynamics as solvable equations rather than insurmountable challenges.

Participants who internalize these principles transform their trading into a precise, repeatable discipline. The future belongs to those who architect their market interactions, shaping their financial destiny with calculated intent.

Glossary

Bitcoin Options Block

Multi-Dealer Liquidity

Market Microstructure

Quantitative Framework