Execution Mastery for Crypto Options

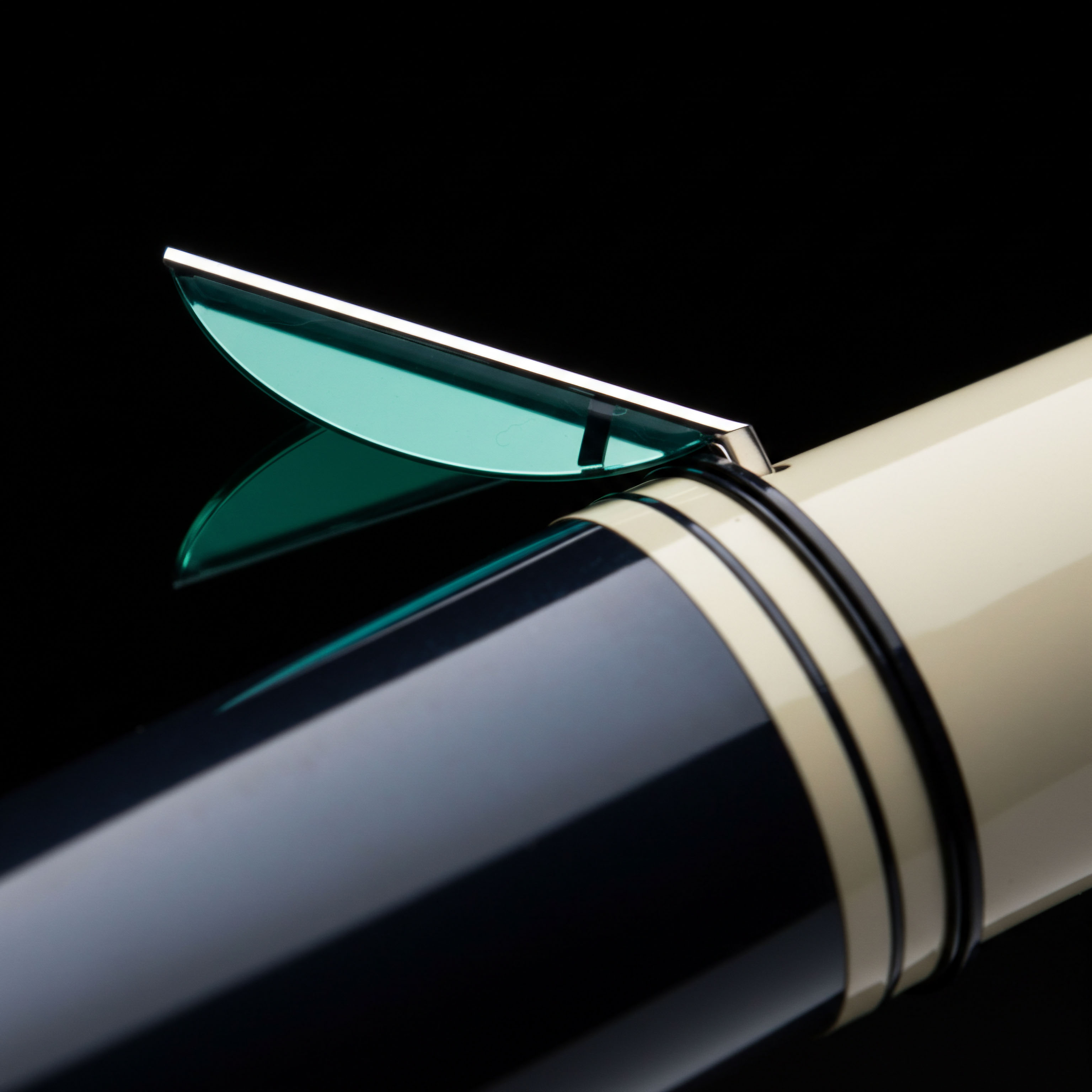

Superior execution for substantial crypto options positions represents a critical advantage in volatile digital asset markets. Sophisticated traders understand the imperative of minimizing market impact and securing optimal pricing for their strategies. A professional-grade Request for Quote system provides the direct pathway to this objective.

This mechanism allows participants to solicit competitive bids and offers from multiple liquidity providers simultaneously, all within a private, controlled environment. The system aggregates diverse pricing, fostering a dynamic environment where competition among dealers drives tighter spreads and better fill rates. Participants gain access to deep, multi-dealer liquidity without exposing their intentions to the broader market, a fundamental element for large position sizing.

Commanding market liquidity through a structured Request for Quote process delivers a distinct edge in crypto options trading.

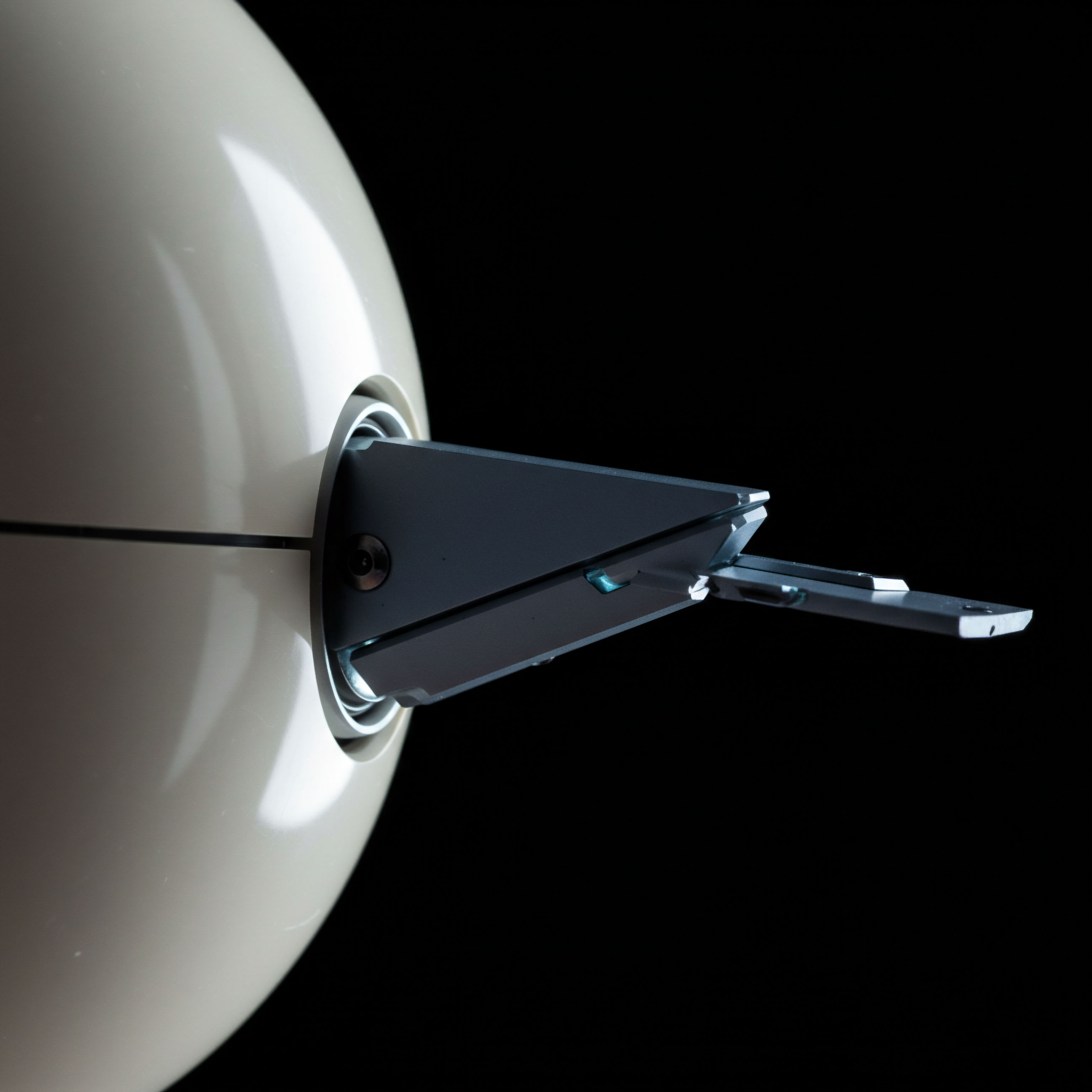

Understanding the mechanics of such a system unveils its intrinsic value. A trader submits a specific options trade request, detailing the instrument, strike, expiry, and desired size. This request then propagates to a curated network of market makers. These professionals respond with firm, executable prices.

The submitting trader reviews these quotes and selects the most favorable terms, finalizing the transaction with precision. This direct interaction bypasses fragmented order books, which often suffer from thin liquidity at larger sizes, leading to suboptimal execution.

Strategic Capital Deployment

Deploying capital strategically in crypto options requires a methodical approach, ensuring every position reflects an intentional market view and precise execution. Leveraging an advanced Request for Quote system transforms theoretical strategies into tangible outcomes. This approach applies across various derivatives structures, from directional plays to complex volatility strategies.

Block Trading Bitcoin Options

Executing significant Bitcoin options positions demands a discreet and efficient channel. A block trade executed through an RFQ system offers a robust solution. This method allows institutional participants to move large notional values without disturbing the spot market or revealing their full position. The competitive quoting environment ensures price discovery remains aligned with fair value, even for substantial orders.

- Identify a clear directional bias or volatility thesis for Bitcoin.

- Determine the specific strike, expiry, and option type (call or put) that best expresses this view.

- Calculate the optimal size for the position, considering capital allocation and risk parameters.

- Submit the request through a multi-dealer RFQ platform, inviting competitive quotes.

- Evaluate the received quotes, prioritizing the tightest spread and most favorable pricing for immediate execution.

Multi-Leg Options Spreads with Precision

Constructing multi-leg options spreads, such as straddles or collars, gains immense efficiency through a coordinated RFQ. These strategies often involve simultaneous execution of multiple option contracts to define a specific risk-reward profile. Slippage on individual legs can erode the intended profitability of the entire spread. A unified RFQ for multi-leg trades ensures synchronized pricing.

Consider an ETH collar strategy, designed to hedge downside risk while capping upside potential. This involves buying a put option and selling a call option against an existing ETH holding. Executing both legs concurrently via an RFQ locks in the spread’s economics. The challenge lies in coordinating multiple quotes for disparate legs.

A system that presents a single, composite price for the entire spread mitigates this operational complexity. This integrated approach solidifies the P&L engineering of the trade, allowing for clear assessment of expected returns and maximum drawdown.

Synchronized execution of multi-leg options spreads through an RFQ preserves the integrity of your strategic intent.

For example, constructing a BTC straddle to capitalize on anticipated volatility around a key event requires simultaneous purchase of an at-the-money call and put. The RFQ aggregates pricing for both legs, providing a single executable price for the combined strategy. This eliminates the risk of legging in, where one side of the spread executes at a suboptimal price, compromising the overall trade structure. The precision offered by this method transforms complex strategies into streamlined operations, enhancing confidence in achieving desired outcomes.

Advanced Portfolio Integration

Mastering advanced applications of RFQ-driven options execution extends beyond individual trades; it reshapes the entire portfolio construction and risk management framework. The ability to transact large crypto options with minimal market impact becomes a structural advantage, enabling sophisticated hedging, alpha generation, and volatility management across diverse digital asset holdings.

Systematic Volatility Trading

Integrating RFQ execution into systematic volatility trading strategies offers a distinct edge. Quantitative models often identify opportunities in volatility surfaces, requiring rapid and precise execution of options to capture these fleeting discrepancies. A dedicated RFQ pipeline allows for the efficient deployment of these model-driven trades, scaling exposure without compromising pricing.

The robust infrastructure supports high-frequency adjustments to volatility positions, a necessity for dynamic market conditions. This capability permits active management of implied volatility exposure, optimizing the portfolio’s sensitivity to market swings.

Cross-Asset Hedging Architectures

The strategic deployment of crypto options via RFQ facilitates sophisticated cross-asset hedging architectures. A portfolio might hold diverse digital assets, each with varying sensitivities to broader market movements. Options provide the ideal instruments for tailoring precise hedges. Executing these hedges in block size through an RFQ ensures their effectiveness by minimizing the cost basis and securing advantageous pricing.

Consider hedging a large exposure to a nascent DeFi asset using highly liquid ETH options. The RFQ mechanism allows for the efficient acquisition of these hedges, solidifying the portfolio’s resilience against adverse market shifts.

The ultimate objective involves translating theoretical risk management into actionable, low-impact transactions.

The Unseen Advantage in Execution

The journey toward superior trading outcomes is a continuous refinement of process and access. Unlocking the power of executing large crypto options with precision fundamentally redefines what is possible within digital asset markets. This approach moves beyond mere transaction processing, evolving into a strategic advantage that permeates every facet of portfolio management.

It cultivates a trading mindset focused on control and efficiency, empowering participants to shape their market interactions rather than merely reacting to them. The future of high-performance crypto derivatives trading belongs to those who master these refined execution channels.

Glossary

Crypto Options

Multi-Dealer Liquidity

Bitcoin Options

Price Discovery

Risk Management

Volatility Trading