Execution Precision Unlocked

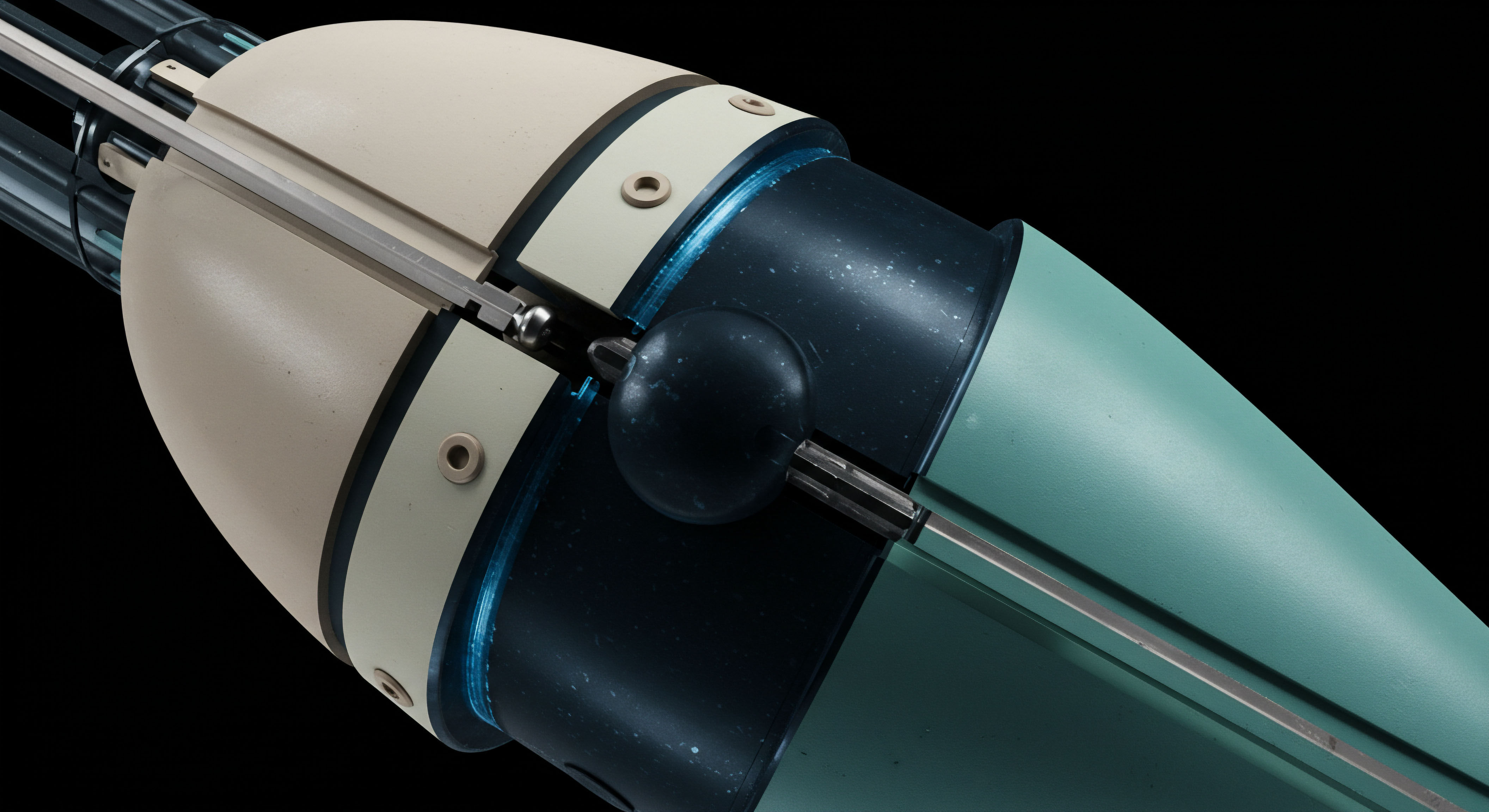

Mastering crypto markets necessitates a command over execution, a truth particularly evident in the realm of derivatives. Transactional costs, often masked as slippage, erode potential gains with insidious efficiency. Professional-grade Request for Quote mechanisms fundamentally transform this landscape, providing a direct channel to deep, multi-dealer liquidity for crypto options and blocks.

This systemic approach allows participants to solicit competitive pricing from numerous counterparties simultaneously, effectively engineering a superior entry or exit point for significant positions. Understanding this core mechanism provides a distinct advantage, positioning you to move beyond the limitations of fragmented order books and directly access the institutional liquidity pools that define optimal trade settlement.

Slippage represents a measurable drag on profitability, a friction inherent in conventional execution methods where market orders interact with existing liquidity. Deploying an RFQ system circumvents this inherent inefficiency by creating a bespoke, competitive environment for each trade. It shifts the dynamic from passively accepting market prices to actively soliciting firm quotes, ensuring a more favorable average execution price.

This strategic deployment significantly mitigates the price impact often associated with larger trades, preserving capital and enhancing overall return profiles. The ability to source liquidity across a diverse set of market makers in a controlled, private environment fundamentally alters the economics of trade completion.

A strategic RFQ deployment creates a bespoke, competitive environment, ensuring superior average execution and mitigating price impact.

Engaging with these sophisticated tools requires a shift in perspective, recognizing that market participation transcends simple order placement. It involves orchestrating liquidity, understanding counterparty incentives, and leveraging technology to optimize every basis point of execution. The crypto options and block trading environments, with their inherent volatility and occasional liquidity dislocations, become fertile ground for those who master this operational discipline.

Achieving an execution edge in these dynamic markets is not a passive endeavor; it demands a proactive engagement with advanced trading infrastructure. Building this foundational understanding serves as the initial step toward capturing a measurable, repeatable alpha.

Strategic Capital Deployment

Deploying advanced execution mechanisms within crypto options and block trading offers a direct path to superior investment outcomes. This section details actionable strategies, providing a blueprint for leveraging Request for Quote (RFQ) capabilities to enhance profitability and manage risk effectively. Integrating these methods into your investment workflow translates directly into a tangible market advantage.

Options Spreads Precision

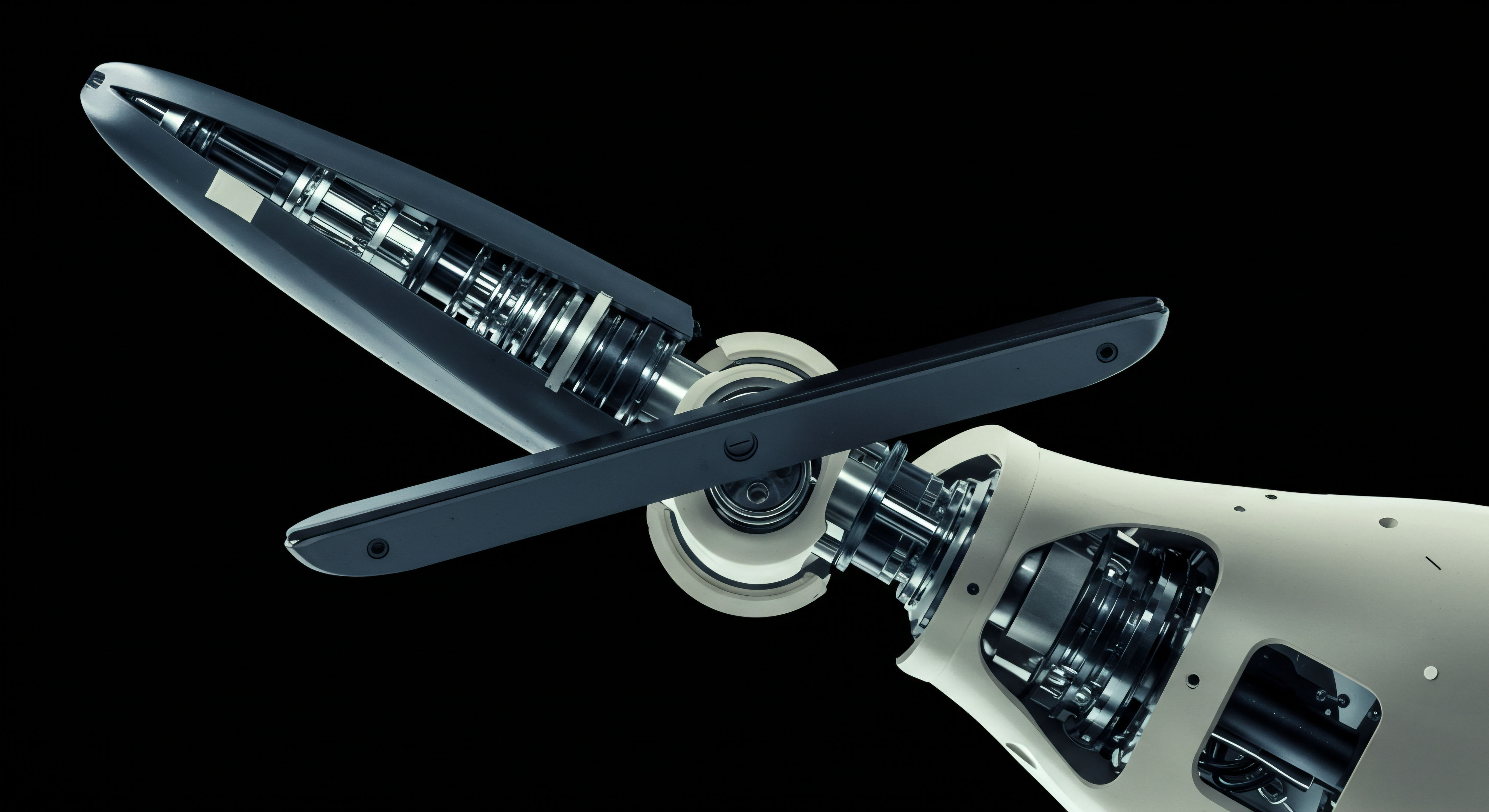

Constructing multi-leg options spreads demands exacting precision to minimize leg risk and overall cost basis. An Options RFQ facilitates simultaneous pricing across all components of a spread, ensuring a cohesive and optimized execution. This process significantly reduces the chance of adverse price movements between individual leg fills, a common pitfall in fragmented spot or single-option markets.

Consider an ETH collar RFQ, where you simultaneously bid for a protective put and offer a covered call against an existing Ether holding. This coordinated execution secures your desired risk-reward profile without incurring disproportionate transaction costs on individual components.

BTC Straddle Block Execution

Executing a BTC straddle block requires careful consideration of volatility exposure and price impact. Using a block RFQ for this strategy allows you to secure a single, composite price for both the call and put options at your desired strike and expiry. This approach eliminates the market risk associated with sequential order entry, ensuring your volatility view translates directly into a clean trade. The multi-dealer liquidity pool accessed through an RFQ ensures competitive pricing for these complex structures, a critical element when positioning for significant price movements.

Executing complex options strategies via RFQ ensures a single, composite price, eliminating sequential order risk and optimizing volatility exposure.

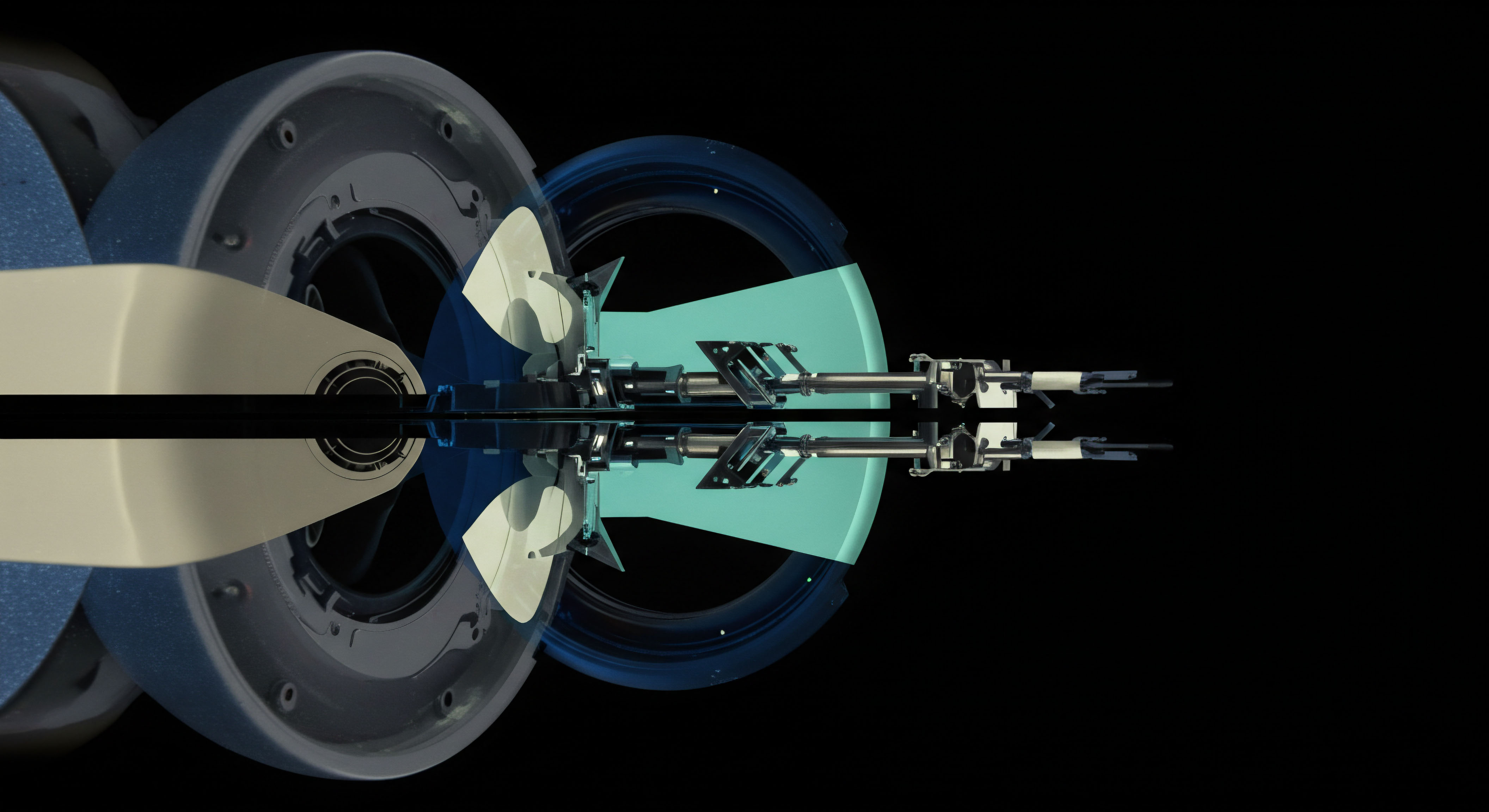

Multi-Dealer Liquidity Aggregation

The core benefit of an RFQ system lies in its ability to aggregate multi-dealer liquidity for specific trades. This process creates a concentrated liquidity event on demand, allowing you to access depth that might not be visible on public order books. When engaging in an OTC options transaction, the RFQ mechanism becomes an indispensable tool.

It provides a transparent, auditable process for sourcing competitive quotes from multiple institutional counterparties, thereby validating your execution quality. This competitive tension among dealers directly contributes to reduced slippage and better overall pricing for larger trades.

- Anonymous Options Trading ▴ Execute large options positions without revealing your market intent prematurely, preserving your strategic advantage.

- Best Execution Assurance ▴ Secure the most favorable pricing across a diverse pool of liquidity providers, driven by competitive bidding.

- Multi-leg Efficiency ▴ Streamline the execution of complex options spreads, mitigating leg risk and ensuring a coherent trade structure.

- Volatility Block Trade Optimization ▴ Efficiently price and execute large positions sensitive to implied volatility, such as straddles or condors.

- Capital Preservation ▴ Reduce the hidden costs of slippage, directly enhancing your trade’s profitability and capital efficiency.

Advanced Portfolio Command

Moving beyond individual trade execution, mastering advanced RFQ and block trading mechanisms unlocks a higher echelon of portfolio management. This progression transforms isolated transactions into integral components of a sophisticated, alpha-generating framework. It represents a strategic evolution, where execution excellence becomes a consistent driver of overall portfolio performance.

Systemic Risk Mitigation

Integrating Request for Quote capabilities into your overarching risk management framework provides a robust defense against market volatility and liquidity shocks. For instance, consider dynamically hedging a large spot crypto position using an ETH collar RFQ. The ability to quickly and efficiently price and execute the protective put and income-generating call simultaneously ensures your hedge is implemented at optimal levels, preserving the integrity of your portfolio’s risk profile.

This proactive approach minimizes the slippage inherent in reactive hedging, translating into more resilient capital structures. Historically, efficient execution has always been the bulwark against unforeseen market turbulence, a principle now powerfully extended to digital assets.

The strategic deployment of multi-dealer liquidity through RFQ also enhances your capacity for opportunistic trading. When a sudden market dislocation creates a mispricing in derivatives, the ability to rapidly solicit firm quotes for large blocks allows you to capitalize on these transient opportunities with minimal price impact. This agility becomes a distinct competitive advantage, enabling you to capture alpha where others encounter significant execution hurdles. Such an approach transforms market volatility from a threat into a structured opportunity for strategic capital deployment.

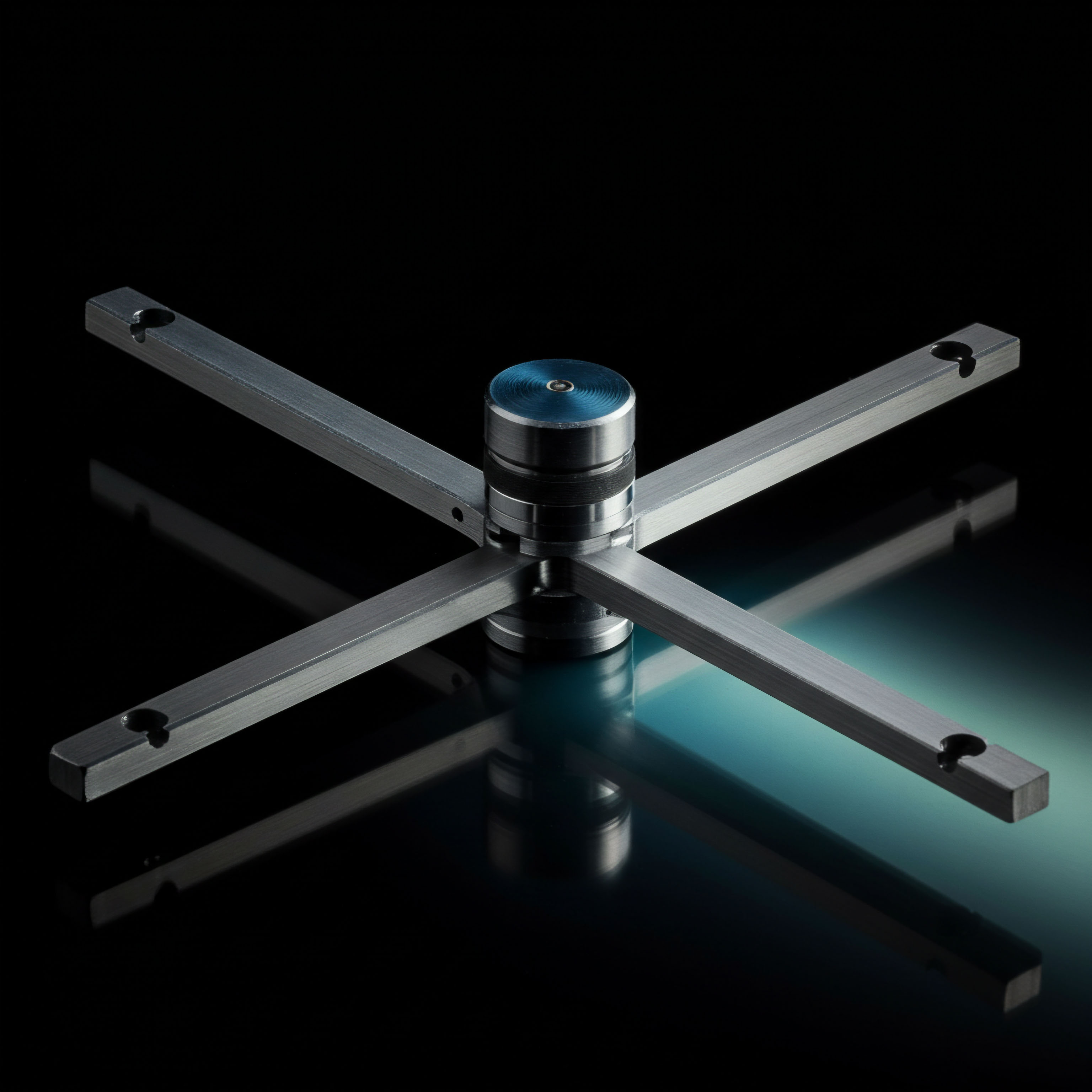

Algorithmic Execution Integration

Advanced traders increasingly integrate RFQ mechanisms within sophisticated algorithmic execution strategies. This hybrid approach combines the competitive pricing of a multi-dealer RFQ with the systematic efficiency of an algorithm. For large block trades, an algorithm can determine optimal timing and size for RFQ requests, submitting them to a curated list of counterparties.

This synergy ensures best execution for significant positions, further reducing slippage and enhancing overall fill rates. The fusion of human strategic oversight and automated precision creates a powerful engine for consistent market outperformance, reflecting the highest standards of institutional trading.

Mastering these advanced applications signifies a complete command of your trading environment. It moves beyond reacting to market conditions and towards actively shaping your execution outcomes. The consistent reduction in slippage, coupled with superior pricing for complex derivatives, compounds over time, building a formidable and sustainable market edge.

This path requires an ongoing commitment to refining your understanding of market microstructure and the tools available to navigate its complexities. Our collective commitment remains fixed on enabling traders to achieve unprecedented levels of control over their financial destinies.

Beyond Execution Friction

The relentless pursuit of market advantage converges on execution. For too long, slippage acted as an invisible tax, quietly eroding gains and frustrating strategic intent. Yet, within the advanced mechanisms of crypto RFQ and block trading, a potent antidote resides. These tools transcend simple transaction processing, offering a gateway to commanding liquidity and sculpting outcomes.

Embracing this operational rigor redefines what is possible, transforming every trade into a testament to precision and strategic foresight. This journey culminates not merely in better prices, but in a profound reshaping of your market presence.

Glossary

Multi-Dealer Liquidity

Options Rfq

Eth Collar Rfq

Btc Straddle Block

Otc Options

Anonymous Options Trading

Best Execution

Volatility Block Trade