Systemic Edge in Crypto Liquidity

Institutional participants approach large crypto orders with a strategic imperative ▴ eliminating the corrosive effects of slippage. This demands a proactive engagement with market microstructure, moving beyond reactive execution to a domain of precision engineering. The Request for Quote (RFQ) mechanism stands as a foundational instrument within this operational framework, enabling sophisticated entities to command bespoke liquidity on their terms.

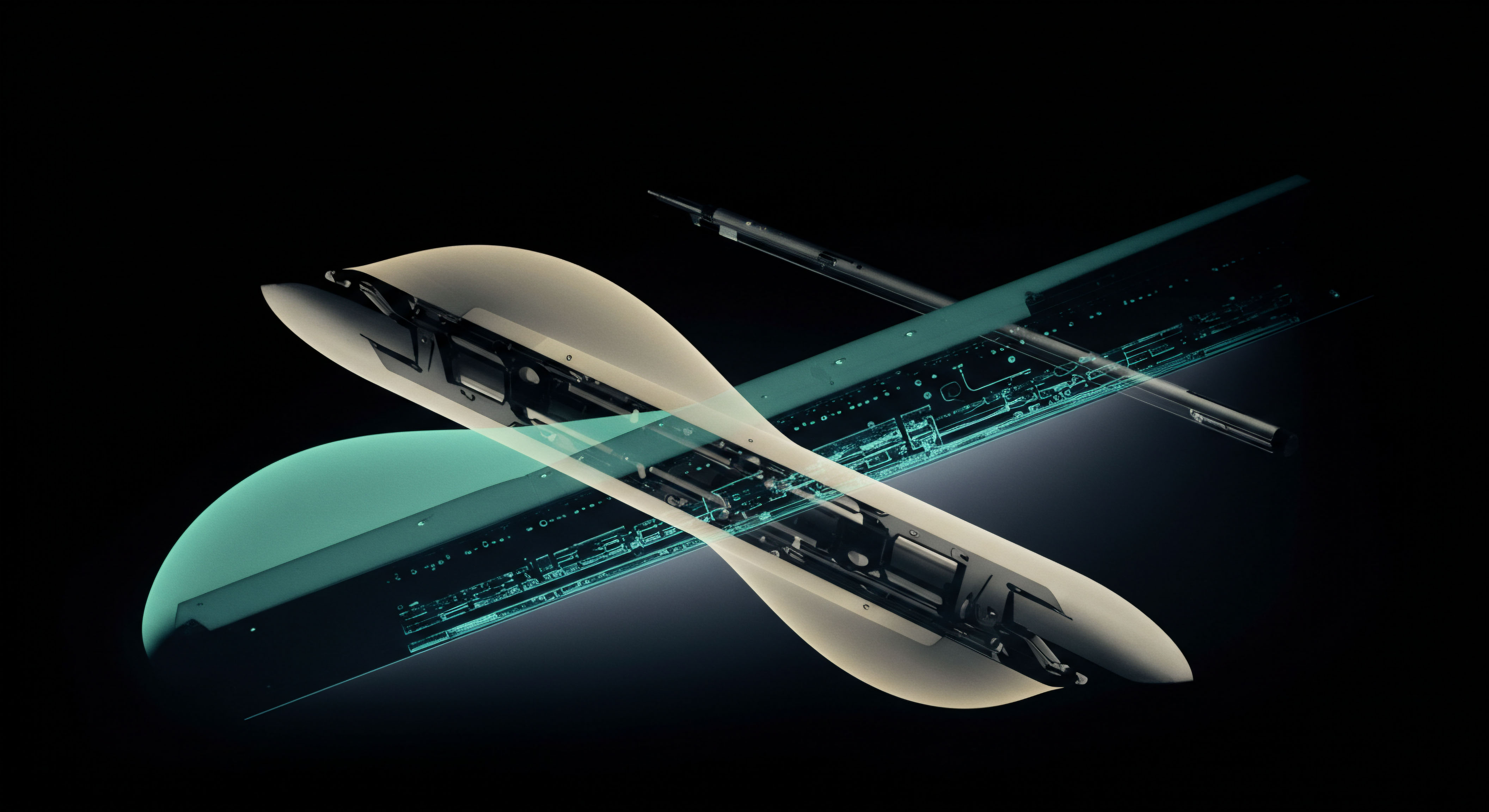

RFQ functions as a direct channel to multiple liquidity providers, initiating a competitive bidding process for specific order blocks. This structured inquiry bypasses the fragmented order books of public exchanges, allowing for price discovery within a private, negotiated environment. The result is a substantial reduction in market impact, ensuring the integrity of large trade valuations.

Understanding this mechanism empowers traders to navigate the inherent volatility of digital asset markets with enhanced control. It transforms the challenge of deploying significant capital into an opportunity for superior price acquisition, a critical factor for alpha generation. A mastery of RFQ mechanics marks a definitive step towards professional-grade execution in the digital asset landscape.

Proactive engagement with bespoke liquidity channels fundamentally redefines execution quality for substantial crypto orders.

The ability to solicit firm, executable quotes from a curated network of dealers introduces a layer of predictability and efficiency previously unattainable through standard exchange interactions. This foundational knowledge equips the discerning trader with the essential tools to build a robust execution strategy.

Unlocking Liquidity through Structured Engagement

Deploying capital effectively in digital asset markets necessitates a calculated approach to liquidity sourcing. The strategic application of RFQ protocols and block trading positions institutional players to secure optimal pricing and minimize adverse market movements. This operational discipline forms the bedrock of consistent trading performance.

Optimizing Large Order Fills

Achieving superior execution on substantial crypto positions requires more than simply finding a counterparty. It involves a systematic process of aggregating multi-dealer liquidity through RFQ, ensuring competitive pricing and anonymity. This method provides a clear advantage over public order book execution, where large orders invariably incur significant price impact.

Leveraging Options RFQ for Complex Spreads

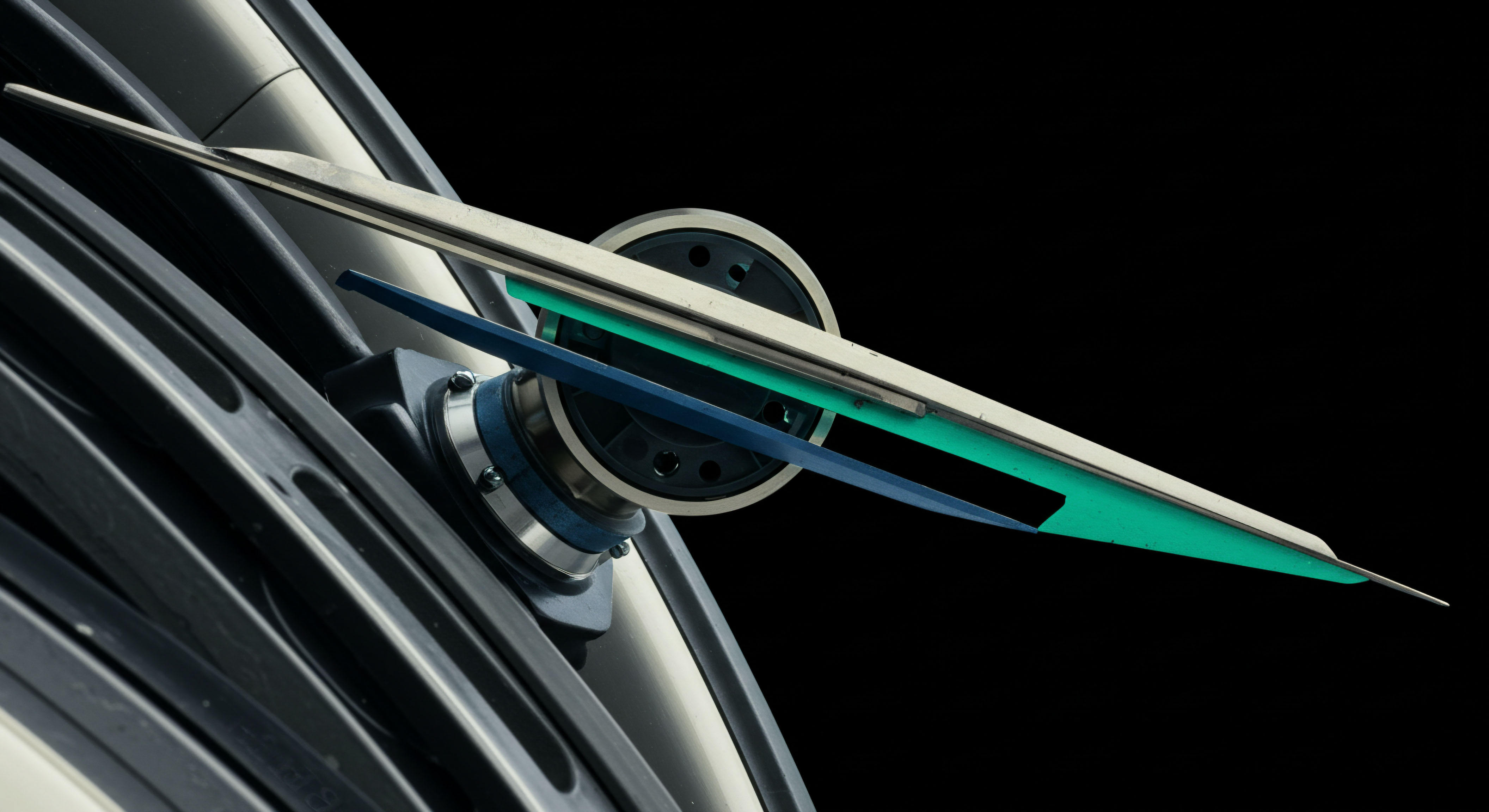

For derivatives traders, the Options RFQ offers a powerful avenue for executing multi-leg strategies. This mechanism permits the simultaneous pricing of complex options spreads, such as straddles, collars, or butterflies, across various dealers. The integrated pricing ensures precise execution of the entire strategy, preserving the intended risk-reward profile.

- Aggregating firm quotes from diverse liquidity providers.

- Executing multi-leg options strategies with integrated pricing.

- Securing anonymity for large order blocks, reducing front-running risk.

- Negotiating bespoke terms for specific market conditions.

- Measuring execution quality through realized slippage analysis.

Mitigating Volatility Impact

Volatility represents a constant in crypto markets, yet RFQ and block trading provide a means to buffer its impact on large orders. By locking in a price with a single counterparty or a small group of counterparties, traders insulate their execution from rapid price fluctuations that frequently plague public markets. Precision matters.

This controlled environment enables a more confident deployment of capital, transforming market uncertainty into a manageable variable. The focus shifts from reacting to price swings to strategically capturing the most favorable terms available from a concentrated pool of liquidity. This approach solidifies the foundation for repeatable success.

Strategic RFQ utilization on multi-dealer networks ensures superior price discovery and anonymity for substantial crypto and options orders.

Mastering Market Impact beyond the Trade

Advancing beyond individual trade execution, the Derivatives Strategist integrates these sophisticated liquidity management techniques into a comprehensive portfolio framework. This elevated perspective views execution quality as a continuous feedback loop, refining strategies and enhancing overall capital efficiency. The aim involves transforming market friction into a consistent source of alpha.

Portfolio-level risk management benefits immensely from bespoke execution. Traders can construct and hedge complex positions with greater certainty regarding their cost basis, a crucial element for accurate profit and loss attribution. This systematic approach fosters a robust, resilient portfolio capable of navigating diverse market cycles.

The interplay between pre-trade analytics and post-trade evaluation presents a continuous calibration challenge, requiring constant refinement of execution parameters against dynamic market conditions. This persistent intellectual grappling is essential for maintaining an adaptive edge.

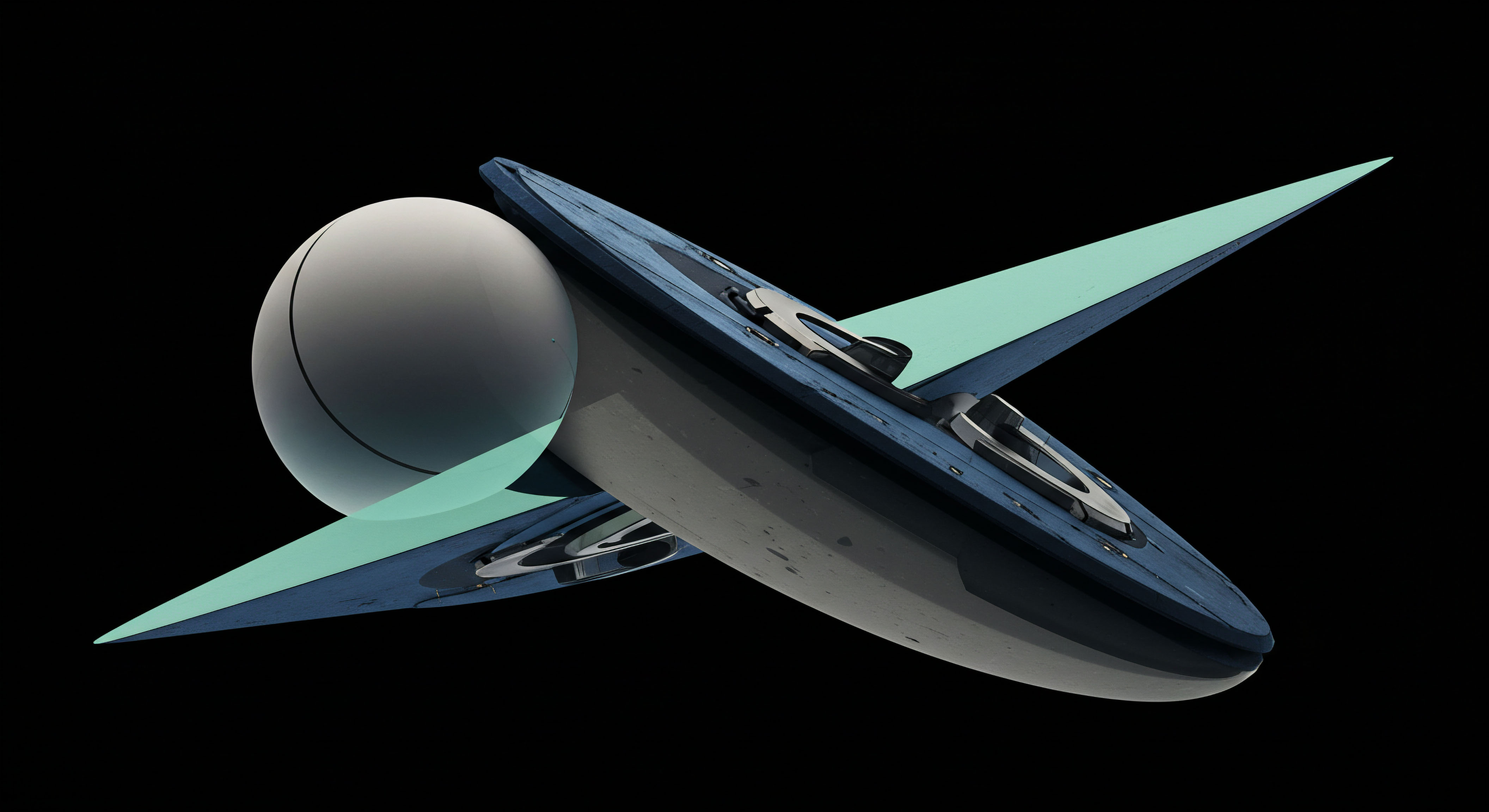

Designing Bespoke Liquidity Solutions

Institutional entities often require highly customized liquidity solutions, particularly for illiquid assets or highly structured derivatives. RFQ platforms extend their utility here, allowing for the negotiation of specific settlement terms, collateral requirements, and even novel instrument designs. This bespoke capacity moves beyond mere execution, entering the realm of financial engineering.

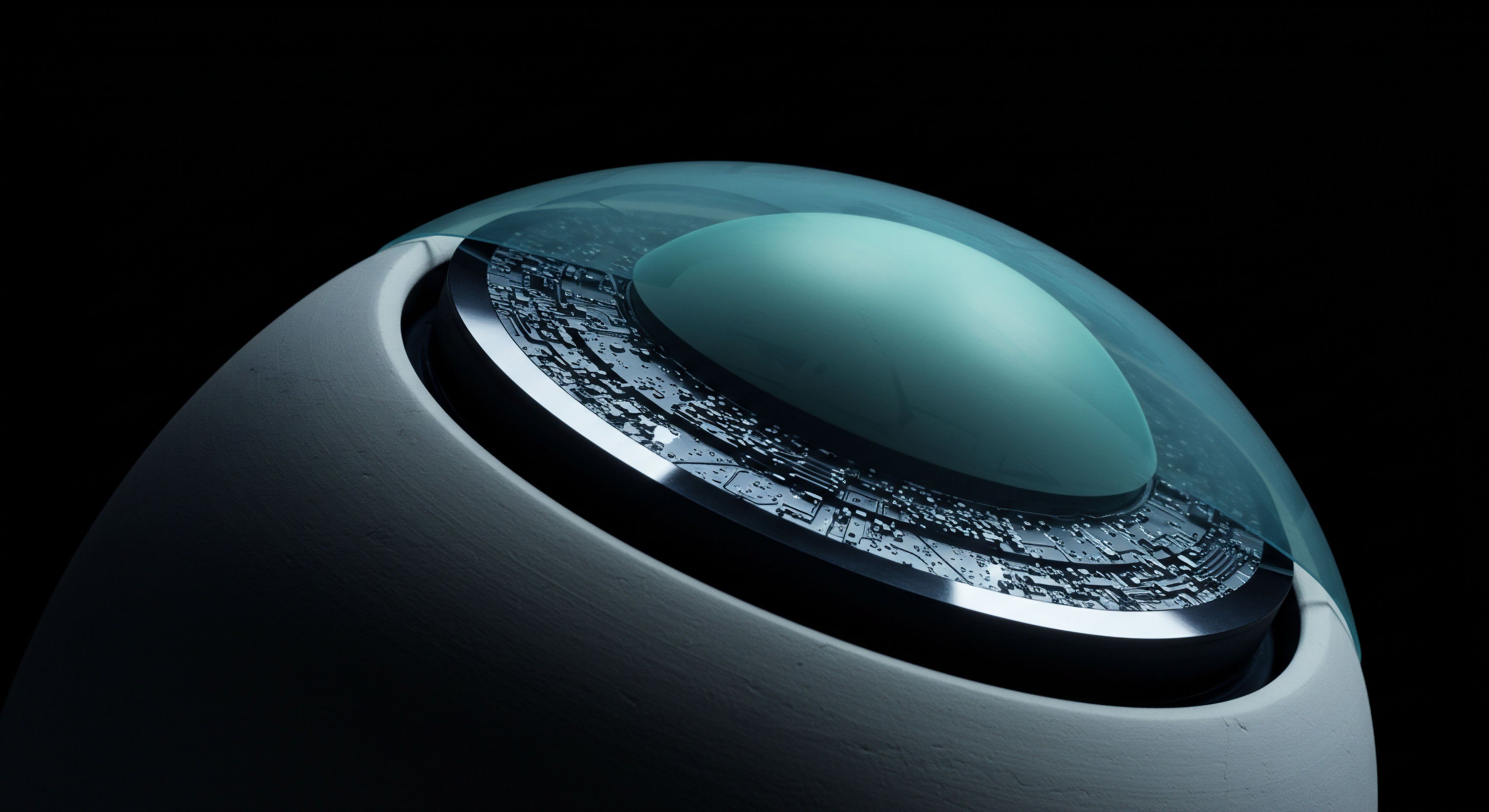

Synthesizing Market Intelligence for Edge

Each RFQ interaction generates valuable market intelligence regarding dealer appetite, pricing dynamics, and overall liquidity depth. Analyzing this data provides a continuous feedback loop, informing future execution strategies and refining the selection of liquidity providers. This iterative refinement sharpens the trader’s market perception, leading to a profound competitive advantage.

The strategic implication of mastering these execution methods extends far beyond individual trades; it establishes a systemic advantage that compounds over time. Consistent superior execution lowers average cost basis, improves hedging effectiveness, and ultimately drives higher risk-adjusted returns across the entire portfolio. This holistic integration of execution science represents the zenith of institutional trading.

Integrating advanced execution methodologies creates a compounding systemic advantage, elevating portfolio risk-adjusted returns.

Achieving market mastery involves an unwavering commitment to operational excellence, transforming every execution into a data point for future optimization. The persistent pursuit of marginal gains in execution quality aggregates into a substantial, defensible edge against less sophisticated market participants. This relentless drive for precision defines the enduring success of top-tier traders.

The Quantum Leap in Digital Asset Execution

The journey from reactive trading to commanding market liquidity represents a fundamental transformation in digital asset engagement. This guide illuminated the strategic pathways institutional traders employ to systematically eliminate slippage, leveraging tools that redefine execution quality. Mastering these advanced techniques transcends mere transaction processing; it shapes the very trajectory of a portfolio’s performance. The continuous pursuit of execution excellence forms the ultimate differentiator in the competitive landscape of crypto markets.

Glossary

Digital Asset

Multi-Dealer Liquidity

Options Rfq