Execution Edge the RFQ Mechanism Unveiled

Navigating the nascent crypto options landscape presents unique challenges, especially when seeking optimal execution for substantial positions. Traders frequently encounter fragmented liquidity and wide bid-ask spreads, which erode potential profits. A professional-grade Request for Quote system addresses these inherent market frictions, offering a structured pathway to superior pricing and efficient order fulfillment. It stands as a vital instrument for any serious participant aiming to secure an advantage.

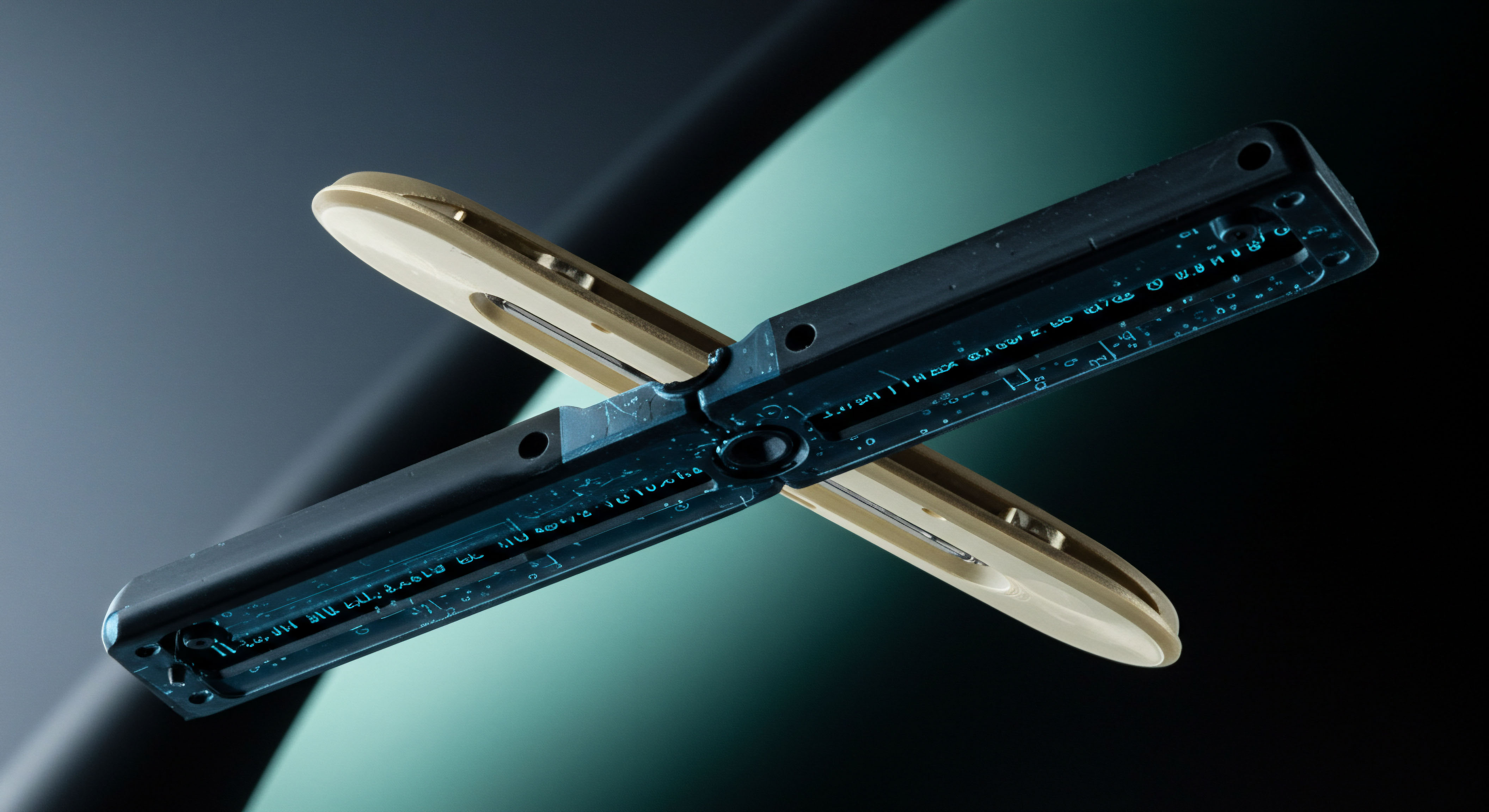

A Request for Quote (RFQ) system centralizes multiple market maker bids and offers for a specific options contract or complex strategy. This process allows a single inquiry to reach a network of liquidity providers, fostering competition and compressing spreads. Initiating an RFQ means demanding price discovery on one’s own terms, circumventing the passive acceptance of prevailing market rates. The system aggregates potential counterparties, delivering a comprehensive view of available liquidity and executable prices.

The core utility of an RFQ system rests upon its capacity to generate genuine price competition. Participants submit their trading interest, and qualified dealers respond with firm, executable quotes. This dynamic interaction cultivates a transparent environment where the true cost of a trade becomes evident. It transforms a potentially opaque negotiation into a standardized, auditable process, ensuring that the trader receives a market-leading price.

A Request for Quote system empowers traders to command liquidity, fostering genuine price competition for superior options execution.

Strategic Deployment Mastering Options Liquidity

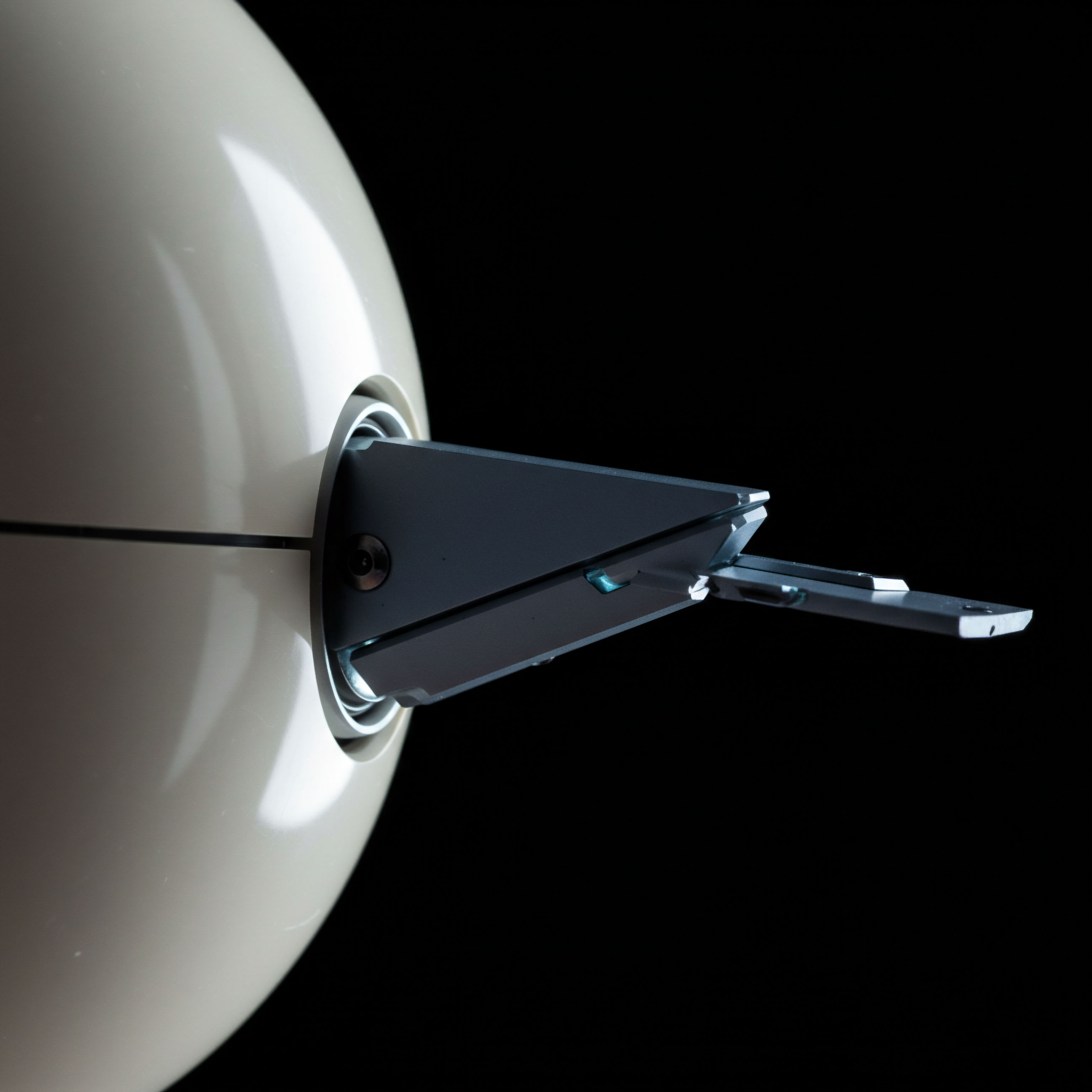

Deploying a Request for Quote system strategically transforms options trading from a reactive endeavor into a proactive pursuit of market alpha. Understanding the nuanced application of this tool provides a significant edge, particularly when executing multi-leg strategies or block trades. A deliberate approach to RFQ utilization directly enhances capital efficiency and mitigates adverse price movements.

Optimizing Single-Leg Block Trades

Executing large, single-leg crypto options orders demands precision. Initiating an RFQ for these block trades allows institutional participants to gauge market depth and secure better pricing than available on standard order books. This method is particularly effective for highly liquid assets such as Bitcoin and Ethereum options, where competitive responses from market makers are more probable. Traders present their desired size, receiving actionable quotes from multiple counterparties simultaneously.

Leveraging Multi-Leg Options Spreads

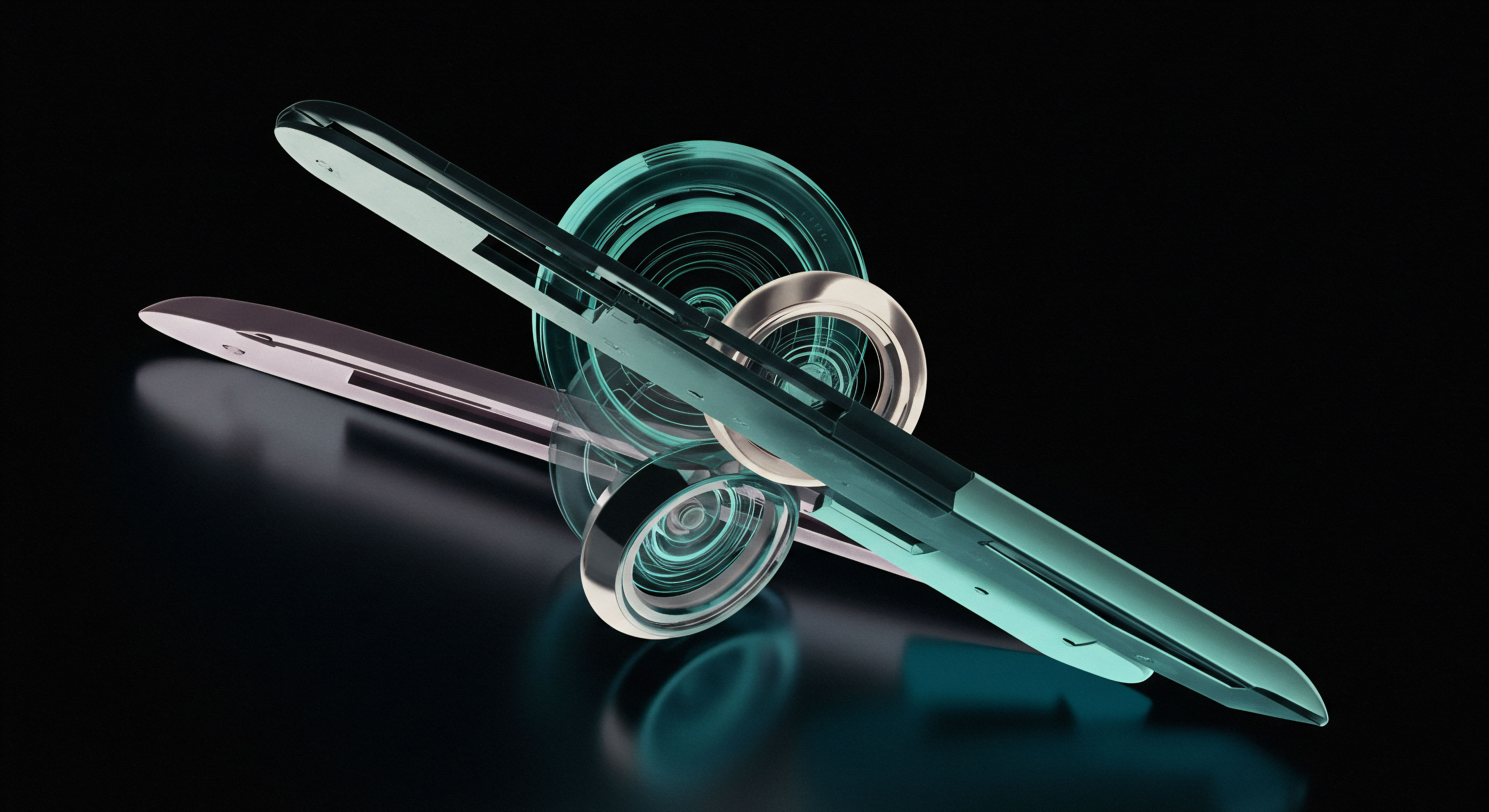

Complex options strategies, including straddles, collars, and iron condors, present unique execution challenges. These strategies involve simultaneous transactions across multiple option legs, necessitating synchronized pricing to preserve the intended risk-reward profile. An RFQ system facilitates the execution of these multi-leg spreads as a single, atomic unit. This functionality eliminates leg risk, where individual legs might fill at suboptimal prices, distorting the overall strategy.

- BTC Straddle Blocks ▴ Execute simultaneous buy and sell calls/puts at the same strike, leveraging the RFQ for combined price discovery.

- ETH Collar RFQ ▴ Combine a long stock position with a long put and a short call, securing favorable pricing for the entire protective strategy.

- Volatility Block Trades ▴ Transact large orders across various strikes and expiries to express a directional view on implied volatility.

The ability to execute multi-leg strategies as a singular transaction presents a profound advantage. It allows for the precise implementation of intricate market views, where the relationship between each option leg is paramount. A trader’s capacity to deploy these complex structures efficiently reflects a deep understanding of market dynamics and a commitment to advanced execution methods.

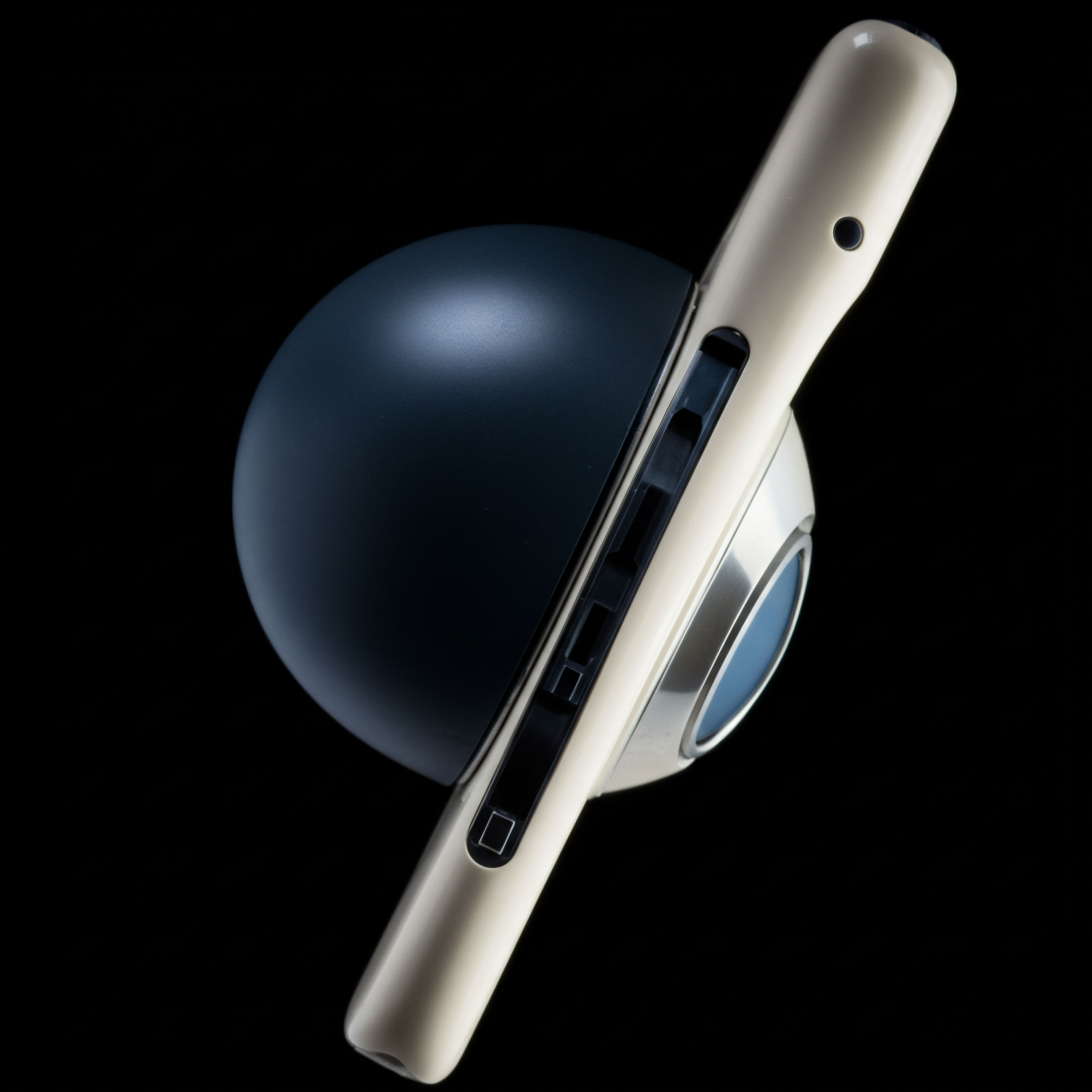

Careful consideration of the order size and desired execution speed influences the RFQ response quality. Larger block trades, while attracting fewer counterparties, often yield tighter pricing from specialized market makers capable of handling significant volume. Conversely, smaller, more frequent RFQs can benefit from a broader pool of liquidity providers.

Balancing these factors becomes a key determinant of execution success. This intricate dance between urgency and size, a constant preoccupation for any seasoned trader, reveals itself as a dynamic optimization problem within the RFQ environment, requiring both quantitative assessment and an intuitive understanding of market participants’ capacity and appetite.

Portfolio Command Advanced Execution Dynamics

Integrating RFQ execution into a broader portfolio strategy elevates trading beyond individual transactions, transforming it into a systematic pursuit of alpha. The application of these sophisticated methods extends to overall risk management and capital deployment, building a resilient and performance-driven portfolio. Mastery of RFQ systems allows for a strategic advantage in volatile crypto markets.

Systemic Risk Mitigation

Employing RFQ for options block trades contributes to a robust risk management framework. By obtaining firm, competitive quotes for larger positions, traders effectively control their cost basis and reduce slippage. This precise execution minimizes the unintended price impact that can arise from executing substantial orders on open exchanges. Managing transaction costs systematically directly enhances overall portfolio returns.

Enhancing Capital Efficiency

The competitive environment fostered by RFQ systems directly translates into improved capital efficiency. Achieving better entry and exit prices on options positions means less capital is tied up in adverse price discrepancies. This allows for more flexible allocation of resources across various strategies and assets. The capital freed from inefficient execution can be redeployed, generating additional trading opportunities.

Proactive management of liquidity fragmentation becomes a cornerstone of long-term success. RFQ systems offer a structured response to this market reality, providing a reliable channel for accessing deep liquidity pools. This capability is especially pertinent in less liquid options expiries or for less commonly traded strike prices, where traditional order books might present significant hurdles. Cultivating this direct access to market makers establishes a distinct competitive advantage.

Beyond the Bid and Offer a Trader’s Vision

The evolution of crypto options markets demands a commensurate evolution in trading practices. Embracing advanced execution tools like the Request for Quote system represents a clear commitment to superior outcomes. The journey from understanding to mastery involves a continuous refinement of process and a persistent pursuit of every available edge. Traders who actively command liquidity and minimize slippage define their own trajectory in these dynamic markets, shaping their financial future with deliberate action.

Glossary

Request for Quote System

Request for Quote

Options Trading

Quote System

Block Trades

Btc Straddle