Mastering Block Trade RFQ Fundamentals

Commanding superior options execution begins with a profound understanding of the Request for Quote mechanism for block trades. This powerful tool provides a direct conduit to professional-grade liquidity, transforming how large options positions are priced and filled. Its core function involves soliciting competitive bids and offers from multiple liquidity providers, ensuring an optimal price discovery process for significant order sizes.

This systematic approach mitigates market impact, a pervasive concern for substantial capital deployments. Traders gain the ability to transact at prices reflecting true market depth, avoiding the slippage often associated with executing large orders through fragmented public order books. Mastering this foundational mechanism positions an investor to secure an immediate, quantifiable edge in the derivatives arena.

Precision execution through RFQ unlocks a systemic advantage, ensuring capital efficiency for every significant options transaction.

Understanding the RFQ process represents a crucial step for any investor aiming to elevate their trading outcomes. It establishes a direct channel for price competition, delivering superior fill rates and tighter spreads. This operational discipline empowers market participants to achieve their desired outcomes with strategic clarity, moving beyond mere participation toward active market shaping.

Deploying RFQ for Investment Advantage

Translating theoretical knowledge into tangible investment returns requires a disciplined application of the RFQ mechanism. Strategic deployment ensures each options transaction contributes optimally to portfolio performance, reflecting a commitment to best execution principles. The alpha-focused portfolio manager views RFQ as an indispensable component of their operational architecture.

Optimized Capital Efficiency

Minimizing transaction costs for substantial options positions directly impacts overall capital efficiency. RFQ allows traders to secure highly competitive pricing across various market conditions, preserving basis and enhancing potential profit capture. This method becomes particularly vital when constructing or adjusting complex hedging overlays, where every cent of execution quality matters.

Multi-Leg Strategy Precision

Executing intricate options strategies, such as straddles, collars, or iron condors, demands simultaneous pricing across multiple legs. RFQ provides a unified execution environment, ensuring the entire spread transacts at a cohesive price. This eliminates the individual leg risk associated with sequential order placement, delivering structural integrity to complex positions.

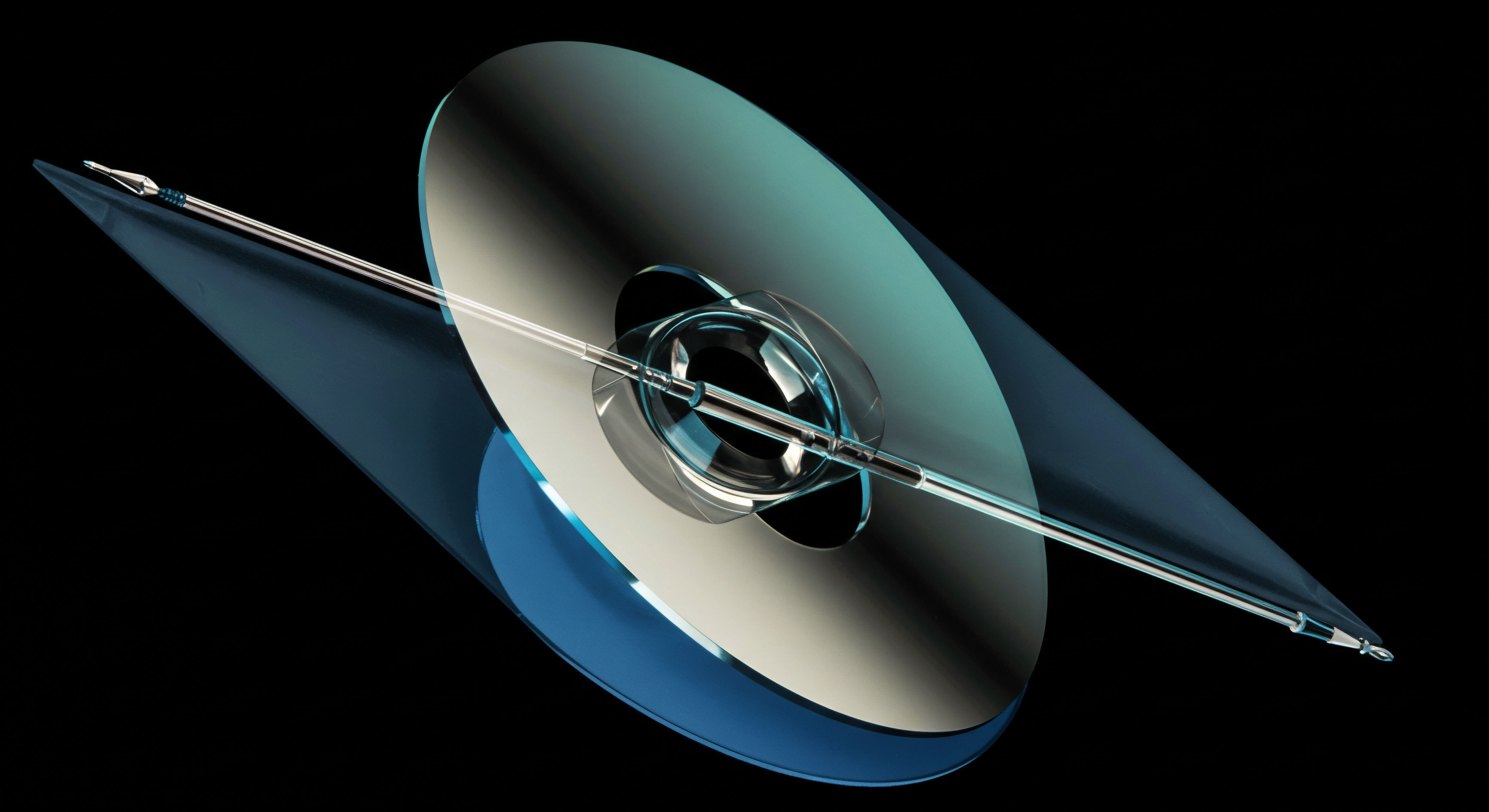

The RFQ mechanism consolidates liquidity, offering a streamlined path to precise, multi-leg options execution for sophisticated strategies.

Liquidity Aggregation Dynamics

RFQ serves as a powerful aggregator of deep, diverse liquidity pools. It consolidates pricing from various market makers, offering a comprehensive view of available depth beyond the immediate screen. This contrasts sharply with relying solely on exchange order books, which frequently exhibit fragmentation for larger sizes. Engaging multiple dealers through RFQ ensures access to optimal pricing even for illiquid or thinly traded options contracts.

Key RFQ Execution Considerations

- Order Size Thresholds ▴ Determining the optimal block size for RFQ submission, balancing market impact with liquidity access.

- Dealer Engagement ▴ Strategically selecting the number and type of liquidity providers to invite for quotes.

- Market Condition Adaptation ▴ Adjusting RFQ parameters based on volatility regimes and prevailing market sentiment.

- Strategy Complexity Matching ▴ Aligning RFQ execution with the specific requirements of multi-leg options structures.

Navigating the optimal balance between rapid execution and comprehensive price discovery in volatile markets presents a significant challenge. The strategist must weigh the urgency of a trade against the potential for better pricing derived from broader dealer engagement. This intellectual grappling requires a deep understanding of market microstructure and the immediate liquidity landscape, ensuring that speed does not compromise value.

Advanced RFQ Strategic Mastery

Elevating options execution to a master level involves integrating RFQ capabilities into a broader strategic framework, focusing on sustained alpha generation and sophisticated risk mitigation. This advanced perspective treats RFQ not as a standalone tool, but as a core component of a high-performance trading system.

Holistic Risk Management Integration

Deploying RFQ within a comprehensive risk management framework enables precise hedging of large options exposures. It provides the capacity to adjust portfolio delta, gamma, or vega with minimal market footprint, preserving capital during periods of heightened volatility. This systematic approach transforms reactive risk mitigation into a proactive portfolio defense mechanism.

Algorithmic Execution Synergy

Integrating RFQ submissions with proprietary algorithmic trading strategies represents a frontier of execution excellence. Automated systems can dynamically assess market conditions, identify optimal liquidity providers, and submit RFQs with precision timing. This synergy optimizes fill rates and price quality across a continuous trading cycle, moving beyond manual limitations.

Strategic Market Footprint Control

Controlling market impact for significant options trades remains paramount for institutional players. RFQ provides a mechanism for discreetly sourcing liquidity, reducing the informational leakage often associated with large orders. This capability ensures that an investor’s intentions do not unduly influence market prices, preserving advantageous entry and exit points. True mastery dictates a proactive stance.

Unlocking Market Dynamics

Mastering Block Trade RFQ for elite options execution represents a profound shift in market engagement. It moves an investor from merely reacting to market conditions to actively shaping their execution outcomes. This journey demands continuous refinement, a relentless pursuit of edge, and an unwavering commitment to strategic foresight.

The discerning trader recognizes that sustained alpha generation emerges from an integrated approach to liquidity access, price discovery, and systematic execution. This commitment to operational excellence differentiates superior performance, cementing a durable advantage in the dynamic world of derivatives. Embrace the command of your market.