Mastering Execution Dynamics

The pursuit of superior execution in financial markets demands a precise understanding of institutional mechanisms. Block trading, a cornerstone of professional capital deployment, transforms large orders from potential market disruptions into strategic advantages. This approach ensures significant capital moves through the market with minimal footprint. Achieving optimal outcomes requires navigating liquidity pools with sophistication, a capability directly addressed by Request for Quote (RFQ) protocols.

RFQ protocols offer a structured pathway for transacting substantial positions in derivatives markets, particularly for crypto options and traditional options. They facilitate engagement with multiple liquidity providers simultaneously, securing competitive pricing for large-scale orders. This process moves beyond fragmented liquidity, centralizing competitive bids and offers. Such a system empowers traders to command a clear view of the market’s true depth for their specific transaction size.

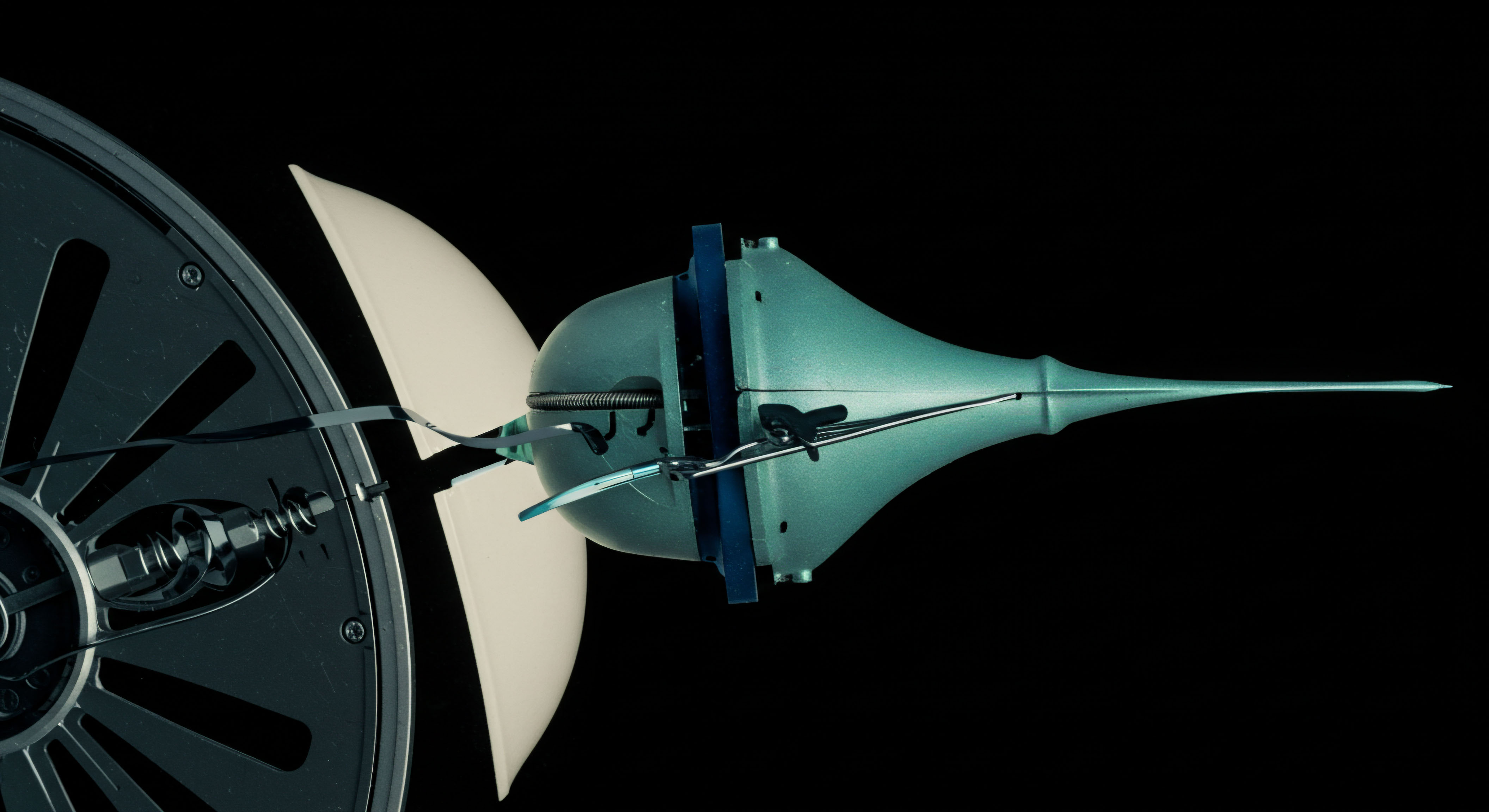

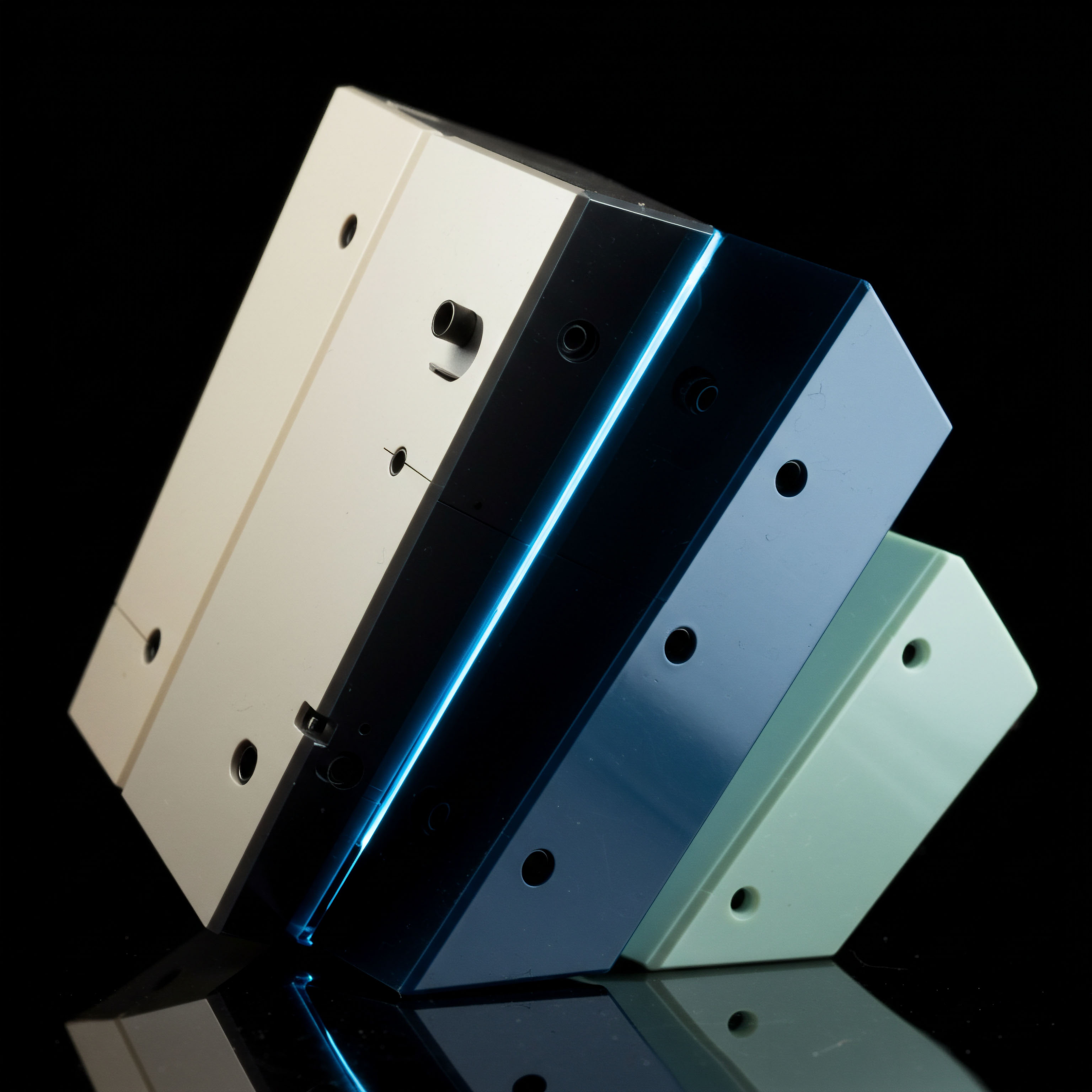

Precision execution for large trades leverages RFQ protocols, ensuring optimal pricing across diverse liquidity sources.

Understanding the foundational mechanics of an RFQ reveals its strategic value. Initiating an RFQ broadcasts an intention to trade a specific instrument and size to a select group of dealers. These dealers then respond with executable quotes, creating a competitive environment. This structured interaction dramatically reduces information leakage and price impact, factors that frequently erode alpha in less refined execution methods.

Derivatives markets, with their inherent complexity, benefit profoundly from these controlled execution environments. Options RFQ systems, for instance, provide a transparent and efficient avenue for structuring and pricing intricate multi-leg options spreads. This capability allows portfolio managers to implement nuanced volatility views and hedging strategies with confidence. The mastery of these fundamental execution dynamics establishes a critical edge for any serious market participant.

Deploying Advanced Strategies

Transitioning from foundational understanding to active deployment requires a methodical approach to block trade execution and options strategies. Professional traders leverage RFQ systems to optimize their entry and exit points for substantial positions, preserving capital and enhancing returns. This disciplined application extends across various market conditions, adapting to volatility and liquidity shifts.

Optimizing Bitcoin Options Blocks

Executing large Bitcoin options blocks through an RFQ system allows for superior price discovery. A trader initiates an RFQ for a specific BTC options contract, receiving simultaneous quotes from several market makers. This competition among dealers ensures the best available price for the block, minimizing slippage that often plagues large, on-exchange orders. Employing this method significantly reduces the implicit costs of transacting considerable size.

ETH Collar RFQ Structures

The ETH Collar RFQ offers a robust method for managing downside risk while capturing potential upside in Ethereum holdings. A portfolio manager can request quotes for a protective put and a covered call simultaneously, forming a collar. The RFQ process provides a consolidated view of pricing for both legs, streamlining execution and ensuring the overall structure is priced efficiently. This approach constructs a financial firewall around a core position.

Multi-Leg Options Spread Execution

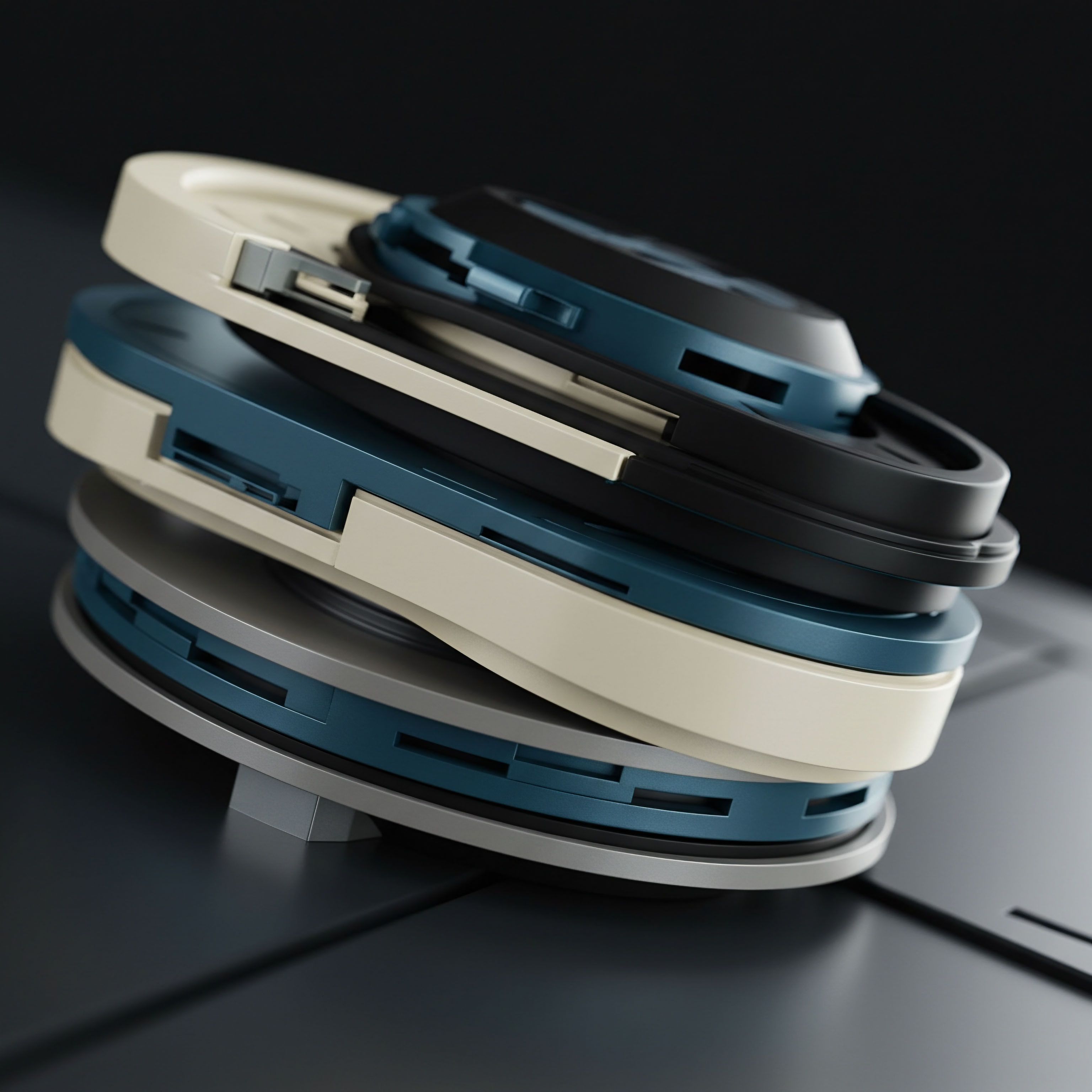

Multi-leg options spreads demand precise, simultaneous execution to maintain their intended risk-reward profile. An RFQ system facilitates this by allowing traders to request quotes for an entire spread as a single transaction. This capability ensures all legs of a complex strategy, such as a BTC straddle block or an iron condor, execute at a coherent price, mitigating leg risk. The efficiency gained from this unified execution mechanism directly contributes to enhanced trading outcomes.

Implementing these strategies necessitates a clear understanding of the quantitative impacts. Analyzing historical RFQ data can reveal patterns in dealer competitiveness and execution quality. This data-informed perspective refines a trader’s approach, identifying optimal times or conditions for initiating large block trades. The continuous refinement of execution tactics builds a durable market advantage.

Strategic deployment of RFQ for options blocks ensures competitive pricing and minimizes slippage across complex multi-leg structures.

Consider the following tactical applications for various market views:

- Volatile Markets ▴ Employing volatility block trades through RFQ to capitalize on increased option premiums.

- Directional Bias ▴ Executing large directional options blocks (e.g. deep in-the-money calls or puts) with reduced price impact.

- Yield Generation ▴ Utilizing covered call or put spread RFQs on underlying crypto assets to generate income.

- Hedging Large Positions ▴ Implementing large-scale portfolio hedges with greater precision and cost efficiency via multi-dealer RFQ.

Advanced Portfolio Command

True mastery of block trade strategies transcends individual transactions, integrating seamlessly into a broader portfolio construction and risk management framework. The advanced applications of RFQ and block trading capabilities provide a distinct edge, allowing for sophisticated capital allocation and dynamic risk adjustment. This elevates trading from tactical execution to strategic market command.

Algorithmic Execution Integration

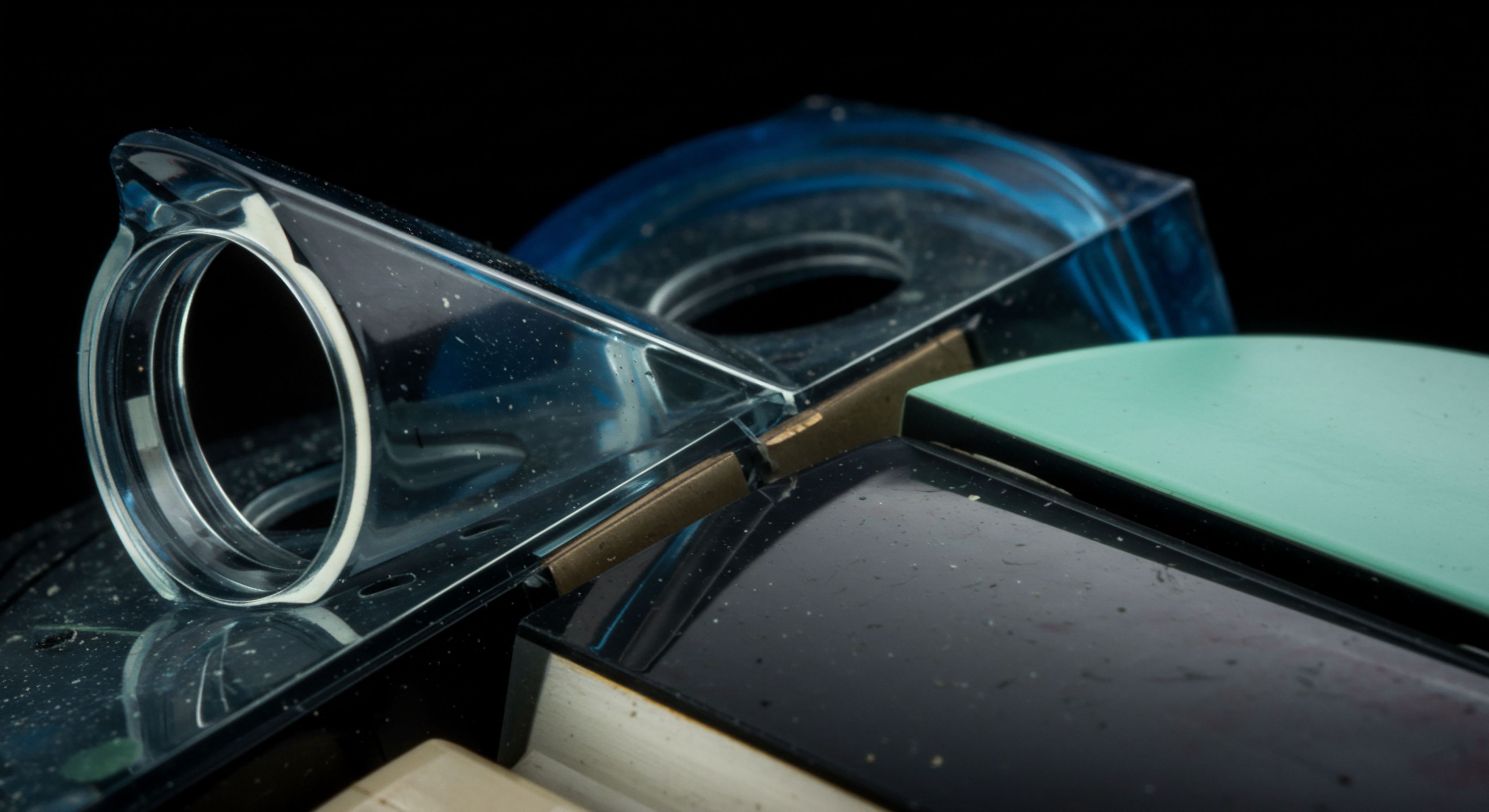

Integrating algorithmic execution with RFQ protocols represents a frontier in market efficiency. Sophisticated trading systems can dynamically trigger RFQs based on predefined market conditions, liquidity signals, or portfolio rebalancing needs. This automation ensures optimal timing for large block trades, reducing human latency and emotional biases. The fusion of quantitative models with direct-to-dealer execution channels unlocks new levels of capital efficiency.

Dynamic Risk Management Frameworks

Deploying advanced risk management frameworks alongside block trade strategies provides robust portfolio protection. Real-time monitoring of portfolio sensitivities (Greeks) enables rapid adjustments to options positions via targeted RFQs. For example, a sudden shift in implied volatility might necessitate a delta hedge adjustment or a re-pricing of an existing volatility block trade. The agility offered by RFQ in sourcing competitive prices for these adjustments maintains tight control over risk exposures.

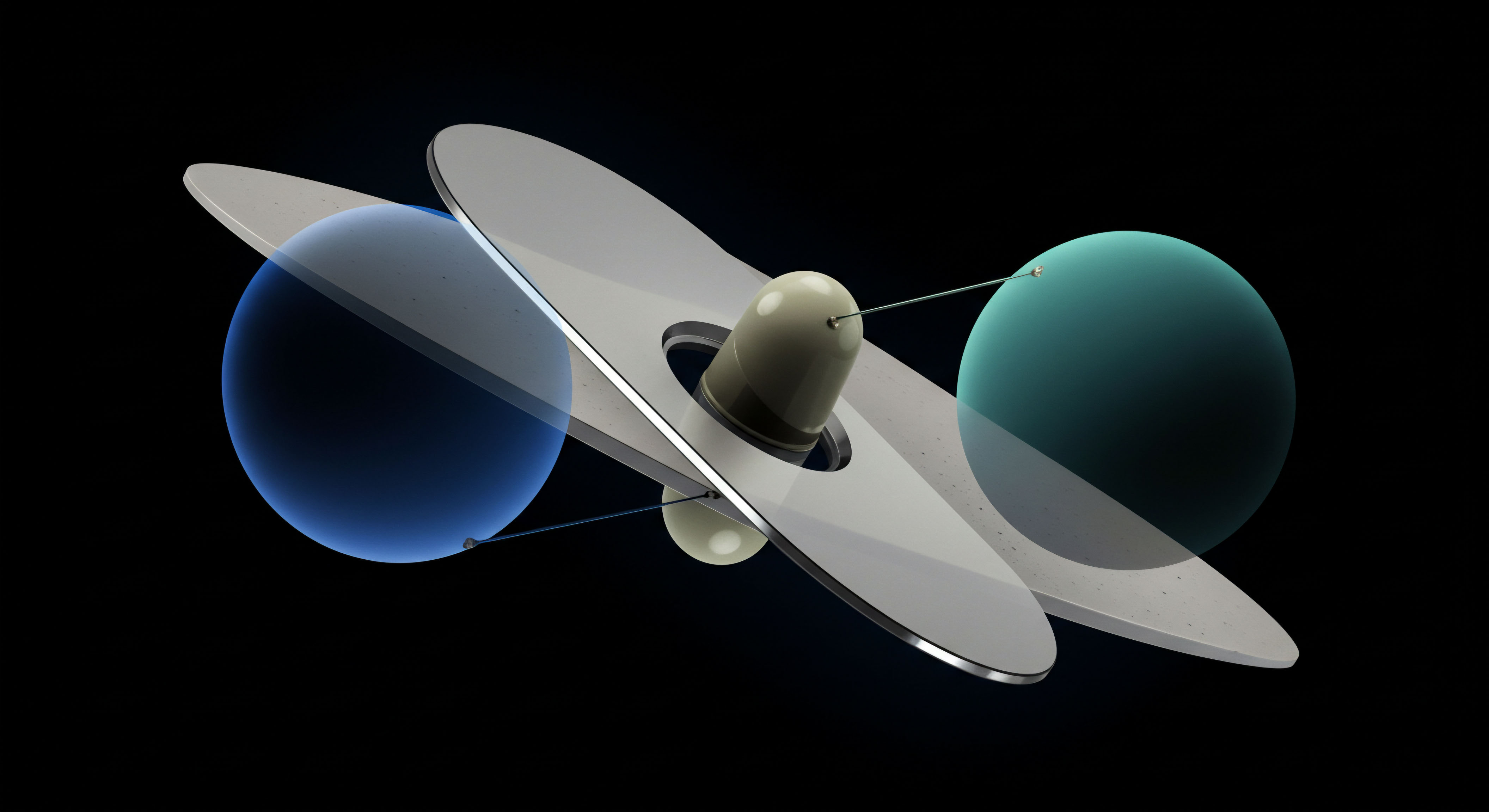

Cross-Asset Block Trading

The strategic application extends beyond single-asset derivatives. Consider cross-asset block trading, where a large position in one asset influences the hedging strategy in another. For instance, executing a significant ETH options block might coincide with a related adjustment in a DeFi yield position.

RFQ systems streamline the execution of these interconnected trades, ensuring that the overall portfolio maintains its desired risk profile. This holistic approach views the market as an interconnected system, ripe for precise intervention.

The continuous evolution of market microstructure demands an adaptable and proactive approach. Traders who master these advanced block trade strategies develop an acute sense for liquidity dynamics and execution costs. They translate this insight into a competitive advantage, consistently securing better pricing and managing larger positions with superior control. The long-term impact on alpha generation and capital preservation becomes undeniable.

The Unseen Edge

Market mastery emerges from a relentless pursuit of execution excellence, transforming complex instruments into levers of strategic advantage. The command of block trade strategies, powered by RFQ, reveals an unseen edge, reshaping how capital navigates the intricate currents of derivatives markets. This refined approach to large-scale transactions establishes a new standard for performance, propelling traders beyond conventional limitations. It redefines the very essence of market participation.

Glossary

Options Rfq

Block Trade

Eth Collar Rfq

Btc Straddle Block

Block Trade Strategies

Volatility Block Trade