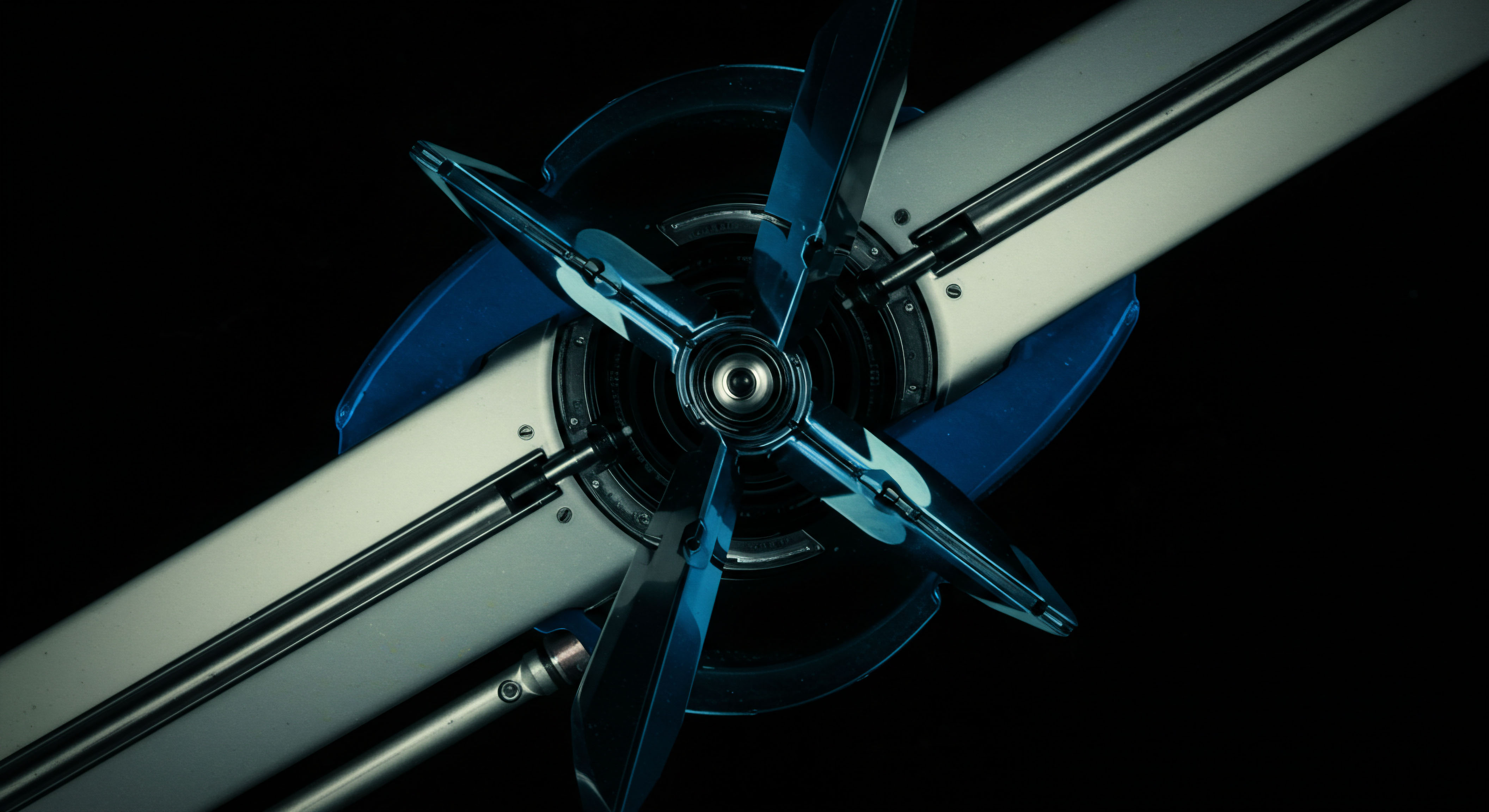

Execution Command

Mastering crypto options begins with commanding execution. A Request for Quote (RFQ) system represents the direct conduit to institutional-grade liquidity, transforming how participants interact with fragmented markets. This mechanism allows a trader to solicit competitive bids and offers from multiple market makers simultaneously for a specific options contract or a complex multi-leg strategy.

The system consolidates disparate liquidity sources into a single, actionable interface, providing transparency and efficiency. Understanding this operational blueprint marks the first step towards a superior trading experience.

The core value of an RFQ lies in its ability to centralize price discovery for illiquid or large options blocks. Instead of passively accepting prevailing market prices, a trader initiates a proactive engagement, forcing liquidity providers to compete for the flow. This competitive dynamic often yields tighter spreads and improved execution prices, directly impacting a trade’s profitability. For anyone seeking a quantifiable edge in crypto derivatives, grasping the mechanics of this direct market engagement becomes an essential prerequisite.

Achieving superior execution in crypto options frequently hinges on a 20-30 basis point improvement in price, a margin often secured through competitive RFQ environments.

This approach demystifies what many consider an advanced trading technique, presenting it as a logical evolution for any serious market participant. The shift towards an RFQ-driven workflow establishes a foundational discipline. It cultivates a mindset prioritizing precision and systemic advantage, moving beyond speculative entry points. Traders who internalize this foundational understanding prepare themselves for a sustained competitive presence within the derivatives landscape.

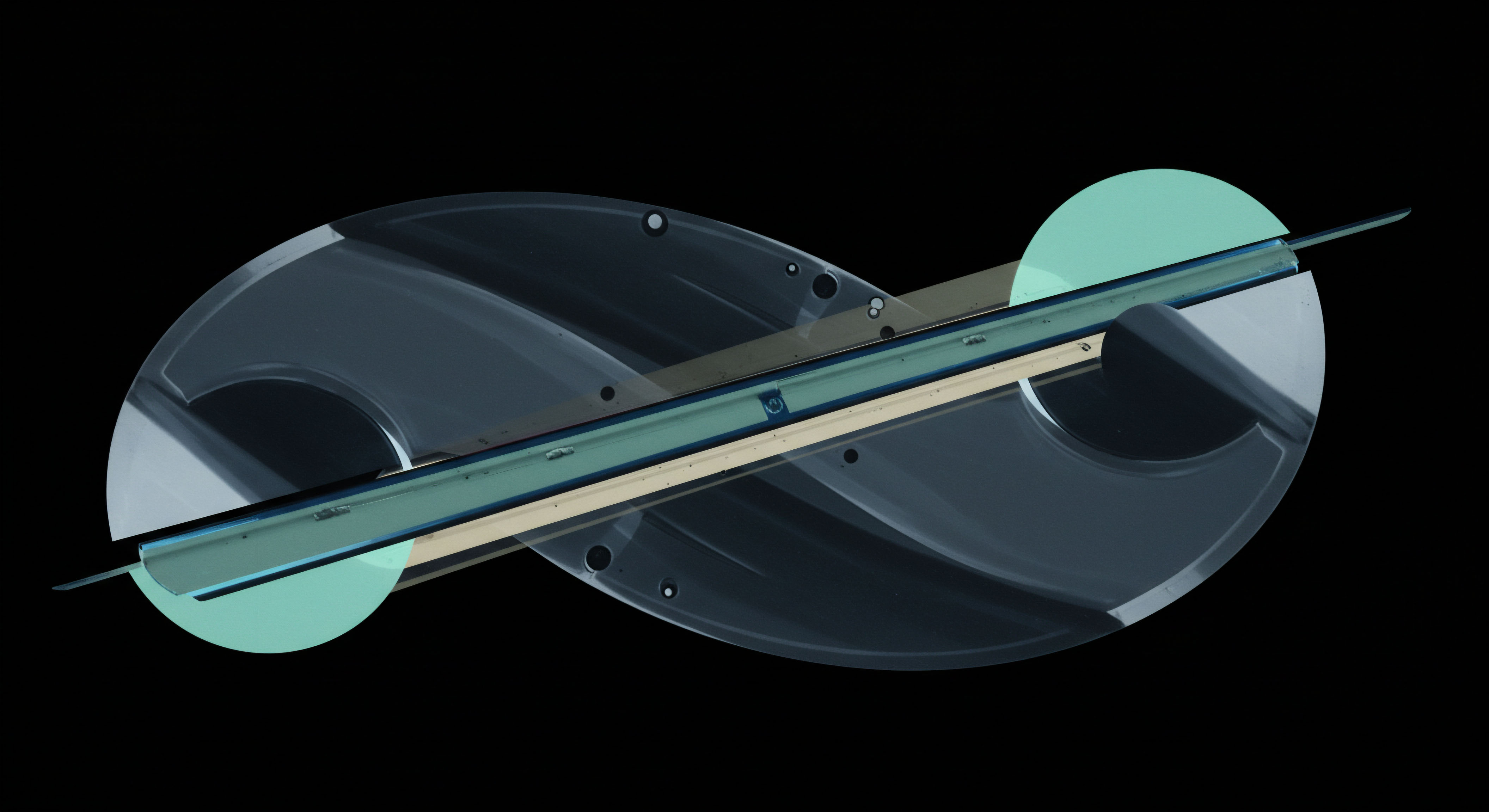

Strategic Deployment

Deploying a crypto options RFQ framework strategically translates market insights into tangible alpha. This involves a disciplined application of the system across various market conditions and trade objectives. A well-executed RFQ sequence optimizes transaction costs, preserves capital, and enhances overall portfolio performance. This section details actionable pathways for leveraging RFQ precision in your investment strategies.

Single-Leg Options Liquidity

Executing substantial single-leg Bitcoin or Ethereum options positions demands a focused approach to liquidity sourcing. Initiating an RFQ for a large block allows direct engagement with market makers, bypassing the often-thin order books of public exchanges. This method ensures a superior fill price, significantly reducing price impact for considerable size. Traders define their desired quantity and strike, then receive a stream of firm quotes from competing liquidity providers.

- Specify contract details ▴ underlying asset, expiration, strike, call/put.

- Indicate desired quantity, prioritizing minimum fill requirements.

- Evaluate competing quotes for price, size, and immediacy.

- Execute with the most advantageous counterparty, securing optimal terms.

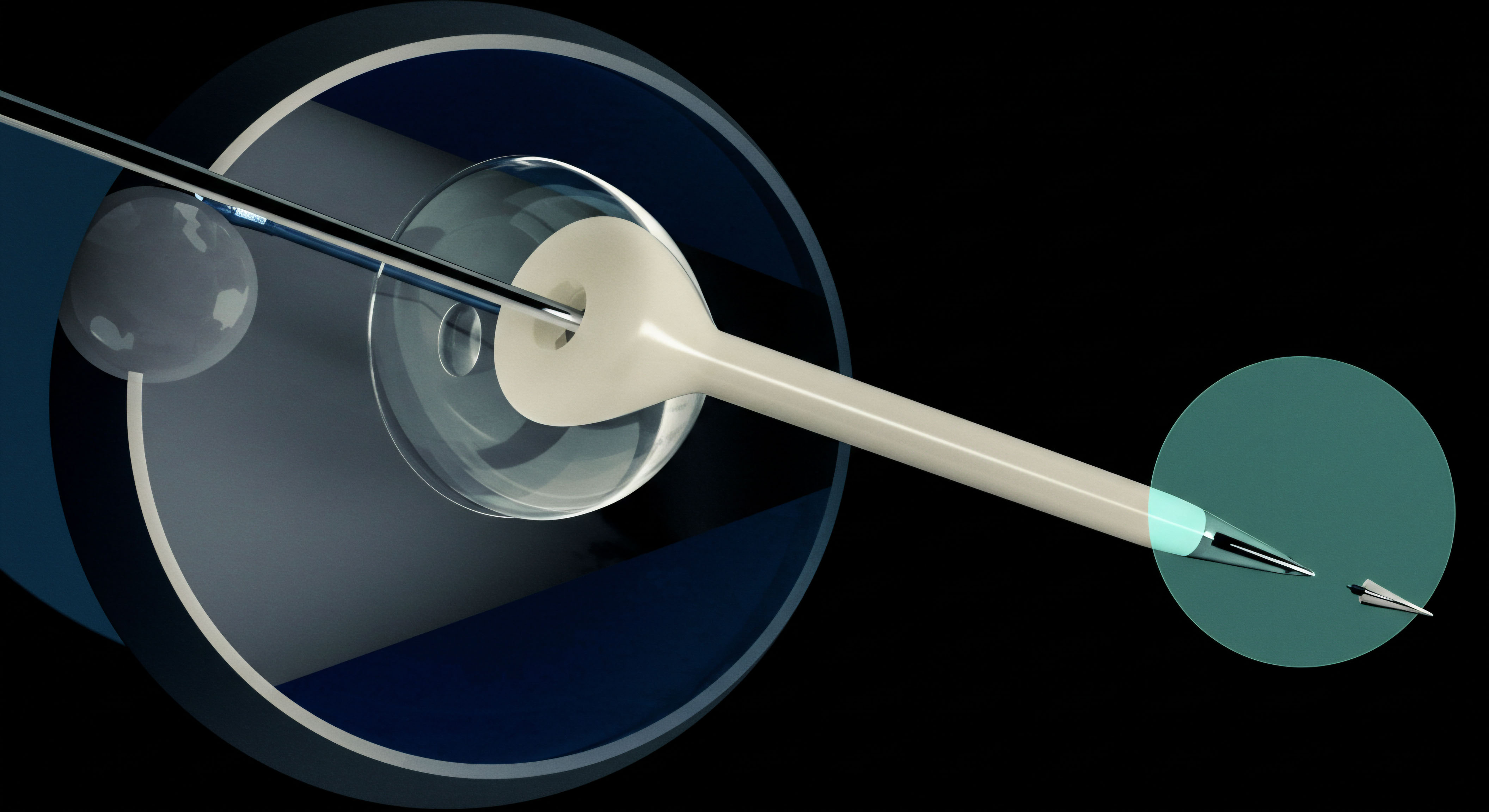

Multi-Leg Strategy Execution

Complex options strategies, such as straddles, collars, or iron condors, typically involve simultaneous execution of multiple legs. An RFQ system excels here by enabling atomic execution. This means all legs of the strategy are priced and traded as a single unit, eliminating leg risk and guaranteeing the desired spread relationship. This capability provides a distinct advantage, particularly in volatile crypto markets where individual leg prices can move rapidly.

Bitcoin Straddle Block

Constructing a Bitcoin straddle block via RFQ involves requesting simultaneous quotes for an equivalent number of calls and puts at the same strike and expiration. This approach isolates the volatility component of the trade, securing a precise entry point for the entire structure. The competitive bidding ensures a tighter net premium, maximizing the strategy’s profitability potential. A trader benefits from the streamlined execution, mitigating the complexities of manual multi-leg orders.

ETH Collar RFQ

An ETH collar strategy, designed for capital protection and income generation, finds particular utility within an RFQ environment. Requesting quotes for the entire collar ▴ selling an out-of-the-money call and buying an out-of-the-money put against an ETH holding ▴ ensures balanced pricing across all components. This method allows for a precise hedging cost determination and a clearer risk profile from the outset.

Volatility Block Trading

Capitalizing on implied volatility shifts often requires substantial block trades in specific options. An RFQ facilitates direct access to market makers specializing in volatility trading. This enables the efficient deployment of strategies designed to capture anticipated movements in market sentiment. Traders can quickly secure a large position in a volatility instrument, translating a macro view into a targeted options exposure.

The ability to execute large volatility positions without signaling intent to the broader market represents a significant tactical advantage. Anonymous trading through an RFQ preserves informational alpha, allowing the trader to establish a position before price discovery becomes public. This method secures superior terms, a critical element in the nuanced world of options pricing.

Optimizing Transaction Costs

Minimizing slippage remains a paramount concern for all large-scale options trades. The competitive nature of an RFQ environment directly addresses this by compelling market makers to offer their keenest prices. This direct negotiation mechanism frequently yields better execution than passive order placement on public books. The immediate, firm quotes received through an RFQ empower traders to achieve best execution, translating directly into enhanced returns.

Consider the tangible impact of reducing execution costs by a few basis points on a multi-million dollar options position. Over time, these marginal improvements compound, significantly influencing overall portfolio returns. This relentless pursuit of optimal pricing defines the alpha-focused trader.

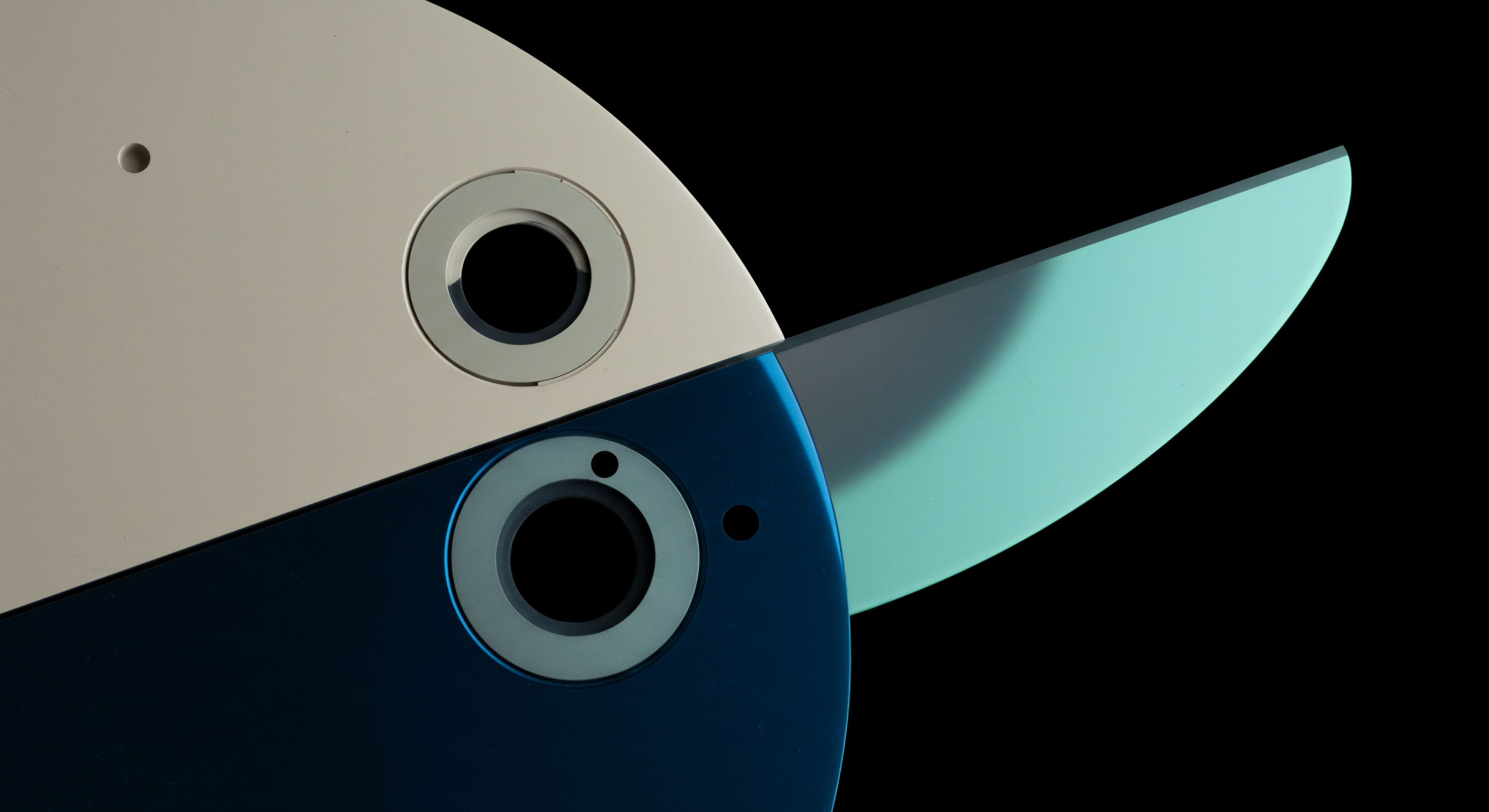

Advanced Integration

Integrating RFQ precision into a comprehensive trading framework elevates an options strategy beyond mere transaction execution. This involves a deeper understanding of market microstructure, quantitative risk management, and the systemic implications of liquidity sourcing. The aim centers on constructing a resilient, alpha-generating portfolio that actively shapes its execution outcomes.

Market Microstructure Dynamics

A sophisticated understanding of market microstructure informs advanced RFQ deployment. Liquidity fragmentation across centralized exchanges and OTC desks presents both challenges and opportunities. RFQ systems serve as a unifying layer, aggregating this disparate liquidity.

Analyzing the response times and pricing behavior of various market makers over time provides valuable intelligence, allowing for a more discerning selection of counterparties. This continuous feedback loop refines the execution strategy, optimizing for specific volatility regimes or trade sizes.

The real edge comes from interpreting how information asymmetry affects pricing. An RFQ allows a trader to control the information flow, revealing trade interest only to select counterparties. This careful management of market impact forms a cornerstone of professional-grade execution.

Developing an RFQ execution engine demands an appreciation for both immediate price capture and long-term liquidity provision dynamics. It requires a continuous calibration of execution parameters against observed market conditions. This persistent refinement builds a sustained competitive advantage, a testament to the trader’s dedication.

Quantitative Risk Management

Advanced RFQ applications intertwine seamlessly with robust quantitative risk management. Deploying large options blocks necessitates precise delta, gamma, and vega hedging. The RFQ process allows for the immediate offsetting of residual risks from a primary options trade, securing advantageous prices for the hedges themselves. This integrated approach ensures that the overall portfolio remains within defined risk tolerances, even when executing significant positions.

Furthermore, the granular data collected from RFQ responses ▴ bid-ask spreads, response times, fill rates ▴ provides a rich dataset for post-trade analysis. This data fuels sophisticated models designed to predict future liquidity conditions and refine optimal execution algorithms. A continuous feedback loop between execution and risk modeling forms the bedrock of an adaptive trading system. This approach transcends simple trade management, becoming a dynamic, self-optimizing system.

Algorithmic Execution Integration

The ultimate expression of RFQ mastery lies in its integration with algorithmic execution strategies. Developing proprietary algorithms that automatically generate and respond to RFQs, based on predefined parameters and real-time market data, unlocks unprecedented efficiency. These algorithms can identify fleeting arbitrage opportunities, execute complex multi-leg strategies with minimal latency, and dynamically adjust order sizing to minimize market impact. The systematic application of RFQ-driven algorithms represents the pinnacle of execution quality in crypto options.

This automated approach extends beyond simple order routing; it involves intelligent liquidity sweeping and dynamic pricing models. Such systems learn from past executions, continuously refining their parameters to achieve superior outcomes. The strategic advantage of such an integrated framework becomes evident in its consistent ability to capture alpha, even in rapidly evolving market environments.

Commanding the Options Horizon

The journey to options mastery demands a commitment to precision, a proactive stance in liquidity sourcing, and an unwavering focus on execution superiority. By harnessing the power of RFQ, traders elevate their approach, transforming market challenges into strategic opportunities. This systematic method of engaging with crypto derivatives provides a clear path forward. Embrace this framework, and you will shape your own market outcomes, defining your edge with unwavering clarity.

Glossary

Crypto Options

Market Makers

Rfq Precision

Anonymous Trading

Best Execution

Risk Management