Mastering Crypto Options Execution Edge

Achieving superior outcomes in digital asset options markets demands a precise operational stance. This arena, characterized by rapid shifts and unique liquidity dynamics, rewards participants who command their execution process. Professional-grade trading systems redefine how significant options positions transact, moving beyond the limitations of standard exchange order books. These specialized methods grant participants the ability to transact large volumes with controlled price impact, a critical differentiator in volatile conditions.

The strategic deployment of specialized execution methods grants a measurable edge in volatile crypto options markets.

Request for Quote, known as RFQ, represents a direct communication channel for securing liquidity. This mechanism allows a trader to solicit competitive pricing from multiple market makers simultaneously for a specific options contract or a complex multi-leg strategy. The resulting price discovery process enhances the cost basis for larger trades, directly influencing overall portfolio performance. RFQ systems operate by presenting a clear intent to transact, prompting liquidity providers to compete for the order flow, thereby sharpening the bid-ask spread.

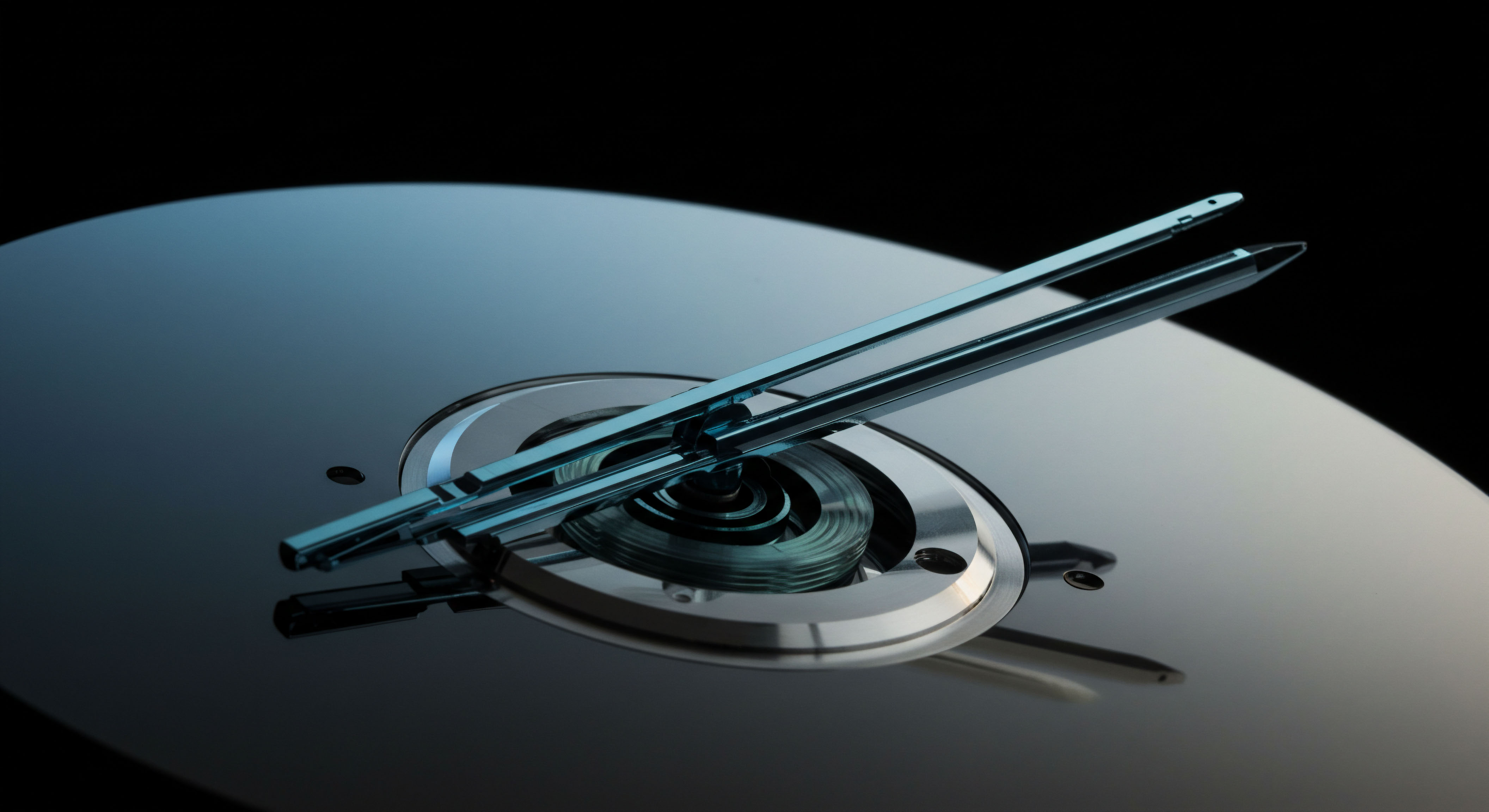

Block trading extends this capability, allowing substantial options positions to trade outside the visible order book. These transactions, often negotiated bilaterally or through intermediaries, mitigate market disruption. They preserve anonymity for the initiating party while executing volume that would otherwise move prices detrimentally on public venues. The efficacy of block trades hinges on accessing deep liquidity pools without signaling market intent, a practice central to institutional trading operations.

Understanding the interplay between RFQ and block execution requires a recognition of market microstructure nuances. The very nature of crypto options markets presents unique challenges concerning fragmentation and latency. Consequently, advanced execution structures become indispensable for securing favorable pricing and mitigating adverse selection. A rigorous approach to execution transforms theoretical edge into tangible alpha.

A trader’s persistent success in these dynamic environments often stems from their command over execution channels. The distinction between a profitable trade and a missed opportunity frequently resides in the precision of its entry and exit. Mastering these advanced execution tools signifies a commitment to professional-grade trading, moving beyond speculative entry to calculated deployment of capital.

Yet, the persistent challenge remains ▴ how does one consistently measure the invisible cost of execution across diverse liquidity pools, translating abstract slippage into a concrete impact on P&L? This measurement defines true mastery.

Capital Deployment Strategies

Translating theoretical knowledge into tangible returns demands disciplined application of execution tools. This section outlines specific, actionable strategies for deploying RFQ and block trading in crypto options, designed to enhance portfolio performance and secure a competitive edge.

Precise execution in crypto options elevates strategy from theoretical construct to realized gain.

Volatility Gain through RFQ Spreads

Securing volatility gains requires meticulous timing and precise pricing. RFQ systems enable multi-leg options spreads, allowing traders to construct complex positions like straddles, strangles, or iron condors with a single request. This approach ensures synchronous execution across all legs, limiting leg risk and securing a unified pricing outcome. Market makers compete to price the entire spread, yielding superior fills compared to executing individual legs sequentially on an order book.

Bitcoin Straddle Deployment

A Bitcoin straddle involves simultaneously buying an at-the-money call and an at-the-money put with the same expiry. This strategy profits from substantial price movement in either direction. Using RFQ for straddle execution allows a trader to receive consolidated bids and offers from multiple dealers.

This single price quotation for the entire straddle mitigates the risk of price discrepancies between the call and put legs, a common issue when attempting to leg into such positions on fragmented venues. Academic studies confirm that bundled execution reduces transaction costs for complex derivatives.

Ethereum Collar Implementation

An Ethereum collar combines a long put, a short call, and an underlying spot position. It serves as a hedging strategy, limiting downside risk while capping upside gains. RFQ enables efficient pricing for the put and call components, ensuring a tighter spread for the entire hedged position.

This integrated pricing mechanism supports capital preservation by precisely defining risk parameters from the outset. Employing RFQ for collar construction directly supports defined risk profiles, a hallmark of disciplined trading.

Large Position Execution

Executing substantial options positions without disrupting the market requires careful consideration of liquidity and price impact. Block trades provide a mechanism for transacting significant size away from public view, preserving price integrity and reducing slippage.

BTC Options Block Trading

Moving substantial Bitcoin options volume on traditional order books often lacks the depth to absorb the trade without adverse price movement. Engaging in a BTC options block trade allows institutions and sophisticated traders to negotiate directly with liquidity providers. This discreet method ensures price stability for large orders, avoiding the signaling effect that public order book entries can create. Transaction costs often see a reduction through this direct negotiation, a measurable benefit for large-scale capital deployment.

ETH Options Block Liquidity

Ethereum options block liquidity offers similar advantages for large ETH options positions. The ability to source liquidity from a network of dealers for a single, substantial trade protects the trade’s price point. This method is effective for positions that might otherwise overwhelm standard exchange liquidity, maintaining the integrity of the execution price. Block liquidity represents a critical tool for managing large directional bets or significant hedging operations.

Execution Quality Metrics

Evaluating the efficacy of RFQ and block trading demands a rigorous assessment of execution quality. Metrics such as slippage, fill rate, and price improvement directly quantify the benefits derived from these advanced methods.

- Slippage Reduction ▴ RFQ and block trades reduce slippage by sourcing competitive quotes and executing away from thin order books. Direct interaction with market makers mitigates adverse price movements often associated with large market orders.

- Enhanced Fill Rates ▴ These systems yield higher fill rates for large orders. Dedicated liquidity provision from market makers ensures orders execute in full, preventing partial fills and subsequent re-quotes.

- Price Improvement ▴ Competitive bidding within RFQ often results in price improvement over prevailing public market prices. Superior pricing directly translates to improved trade profitability and capital efficiency.

- Reduced Market Impact ▴ Executing blocks off-exchange greatly diminishes market impact. This preserves liquidity for other participants and prevents self-inflicted price erosion for the trader initiating the large order.

Advanced Strategic Mastery

Moving beyond individual trades, true mastery of crypto options execution combines these advanced methods into a cohesive portfolio strategy. This section examines sophisticated applications, connecting execution precision with long-term alpha generation and robust risk management.

Strategic deployment of advanced execution tools defines enduring market advantage.

Systemic Risk Management

Combining RFQ and block execution within a broader risk framework fortifies a portfolio against unforeseen market movements. Traders apply these methods to dynamically adjust hedging positions or to rebalance portfolio delta with minimal market disruption. The ability to transact large hedging orders discreetly protects the integrity of the overall portfolio’s risk profile. This proactive stance contrasts sharply with reactive adjustments, often incurring higher costs.

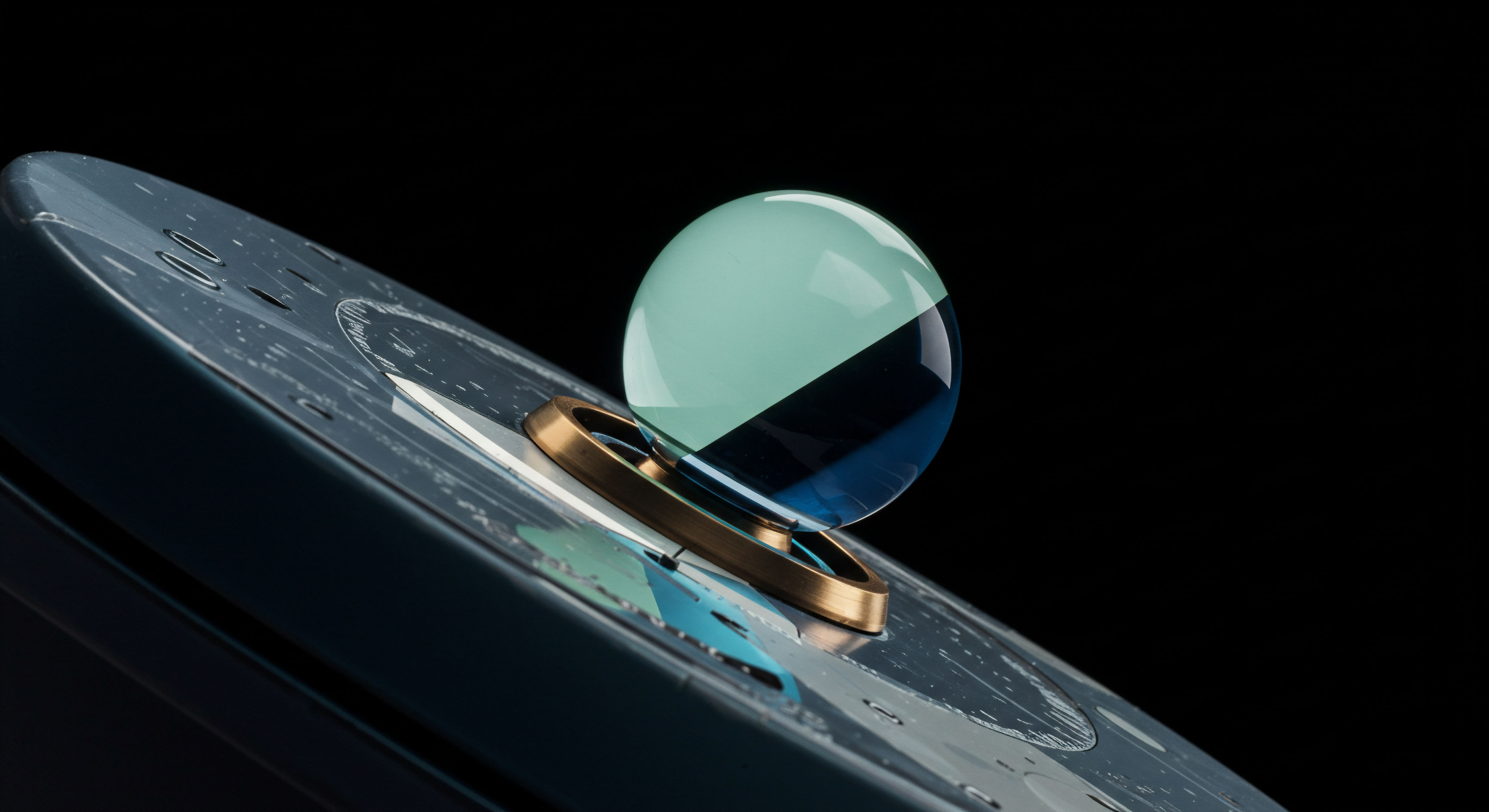

Volatility Surface Calibration

Advanced traders use RFQ to test specific points on the volatility surface, refining their implied volatility models. By requesting quotes for various strikes and expiries, they gain real-time insights into market makers’ pricing assumptions. This constant calibration of the volatility surface allows for more accurate options valuation and superior identification of mispriced opportunities. A precise understanding of the volatility landscape is vital for sustained profitability.

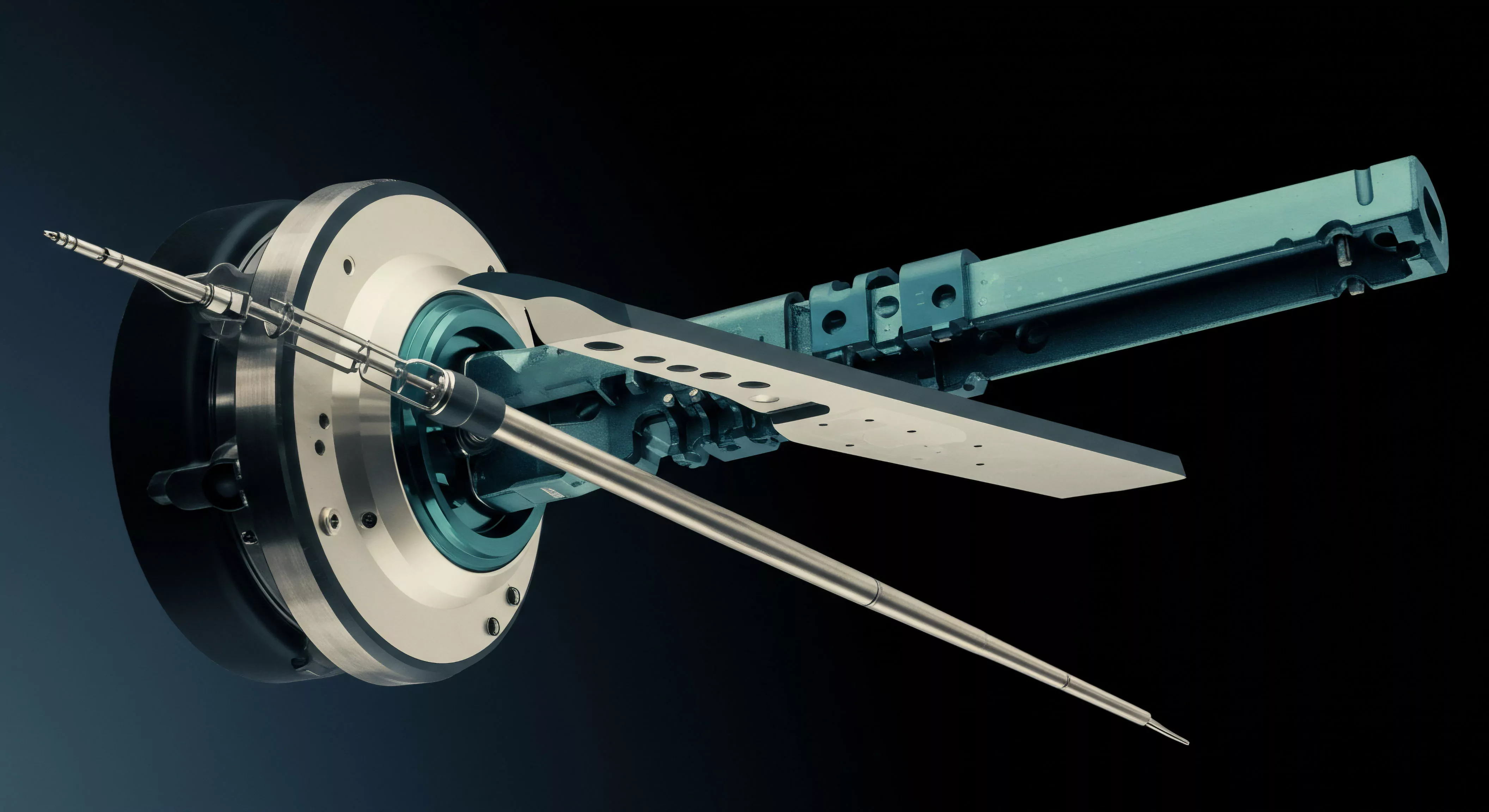

Algorithmic Execution Integration

Automating the RFQ and block trading process via sophisticated algorithms represents the zenith of execution edge. These systems can dynamically route orders, aggregate liquidity from multiple sources, and refine execution timing based on predefined parameters. Algorithmic integration removes human latency and emotional bias, ensuring consistent adherence to a predetermined trading plan.

Smart Order Routing for Options

Implementing smart order routing for crypto options involves directing RFQ requests to market makers most likely to offer the best price for a specific trade. This intelligent routing considers factors such as historical fill rates, latency, and quoted spreads from various liquidity providers. The objective remains to secure the highest probability of price improvement and optimal fill, regardless of the order’s size or complexity.

The pursuit of market advantage is a continuous endeavor. Every tick, every basis point saved on execution, accumulates into a substantial performance differential over time. It represents the compounding effect of operational excellence. The diligent application of these refined methods differentiates casual participants from those who truly shape their financial destiny.

We remain vigilant. The markets offer perpetual lessons. The relentless pursuit of an edge demands constant refinement of one’s tools and mental models.

This ongoing process separates transient success from enduring market command. Price impact is a silent killer of returns.

Consider the broader implications for capital efficiency. By reducing execution costs and controlling market impact, a trader effectively reduces the “drag” on their portfolio. This preserved capital can then be redeployed more effectively, generating additional returns.

The strategic application of these methods directly contributes to a higher Sharpe ratio and a more robust return profile over time. The long-term trajectory of capital is deeply influenced by the quality of its deployment, making these execution capabilities essential for any serious market participant.

Beyond the Bid-Ask

The journey to mastering crypto options execution extends beyond mere transactional efficiency. It represents a fundamental shift in how market participants perceive and interact with liquidity. The strategic application of advanced execution tools establishes a foundational pillar of sustained alpha generation.

This disciplined approach positions traders to actively shape their outcomes, consistently extracting value from market dynamics. The question for every ambitious trader then becomes ▴ how will you calibrate your own systems to command the future of your capital?

Glossary

Market Makers

Block Trading

Market Microstructure

Crypto Options

Options Block

Slippage Reduction

Capital Efficiency

Crypto Options Execution