Execution Mastery Fundamentals

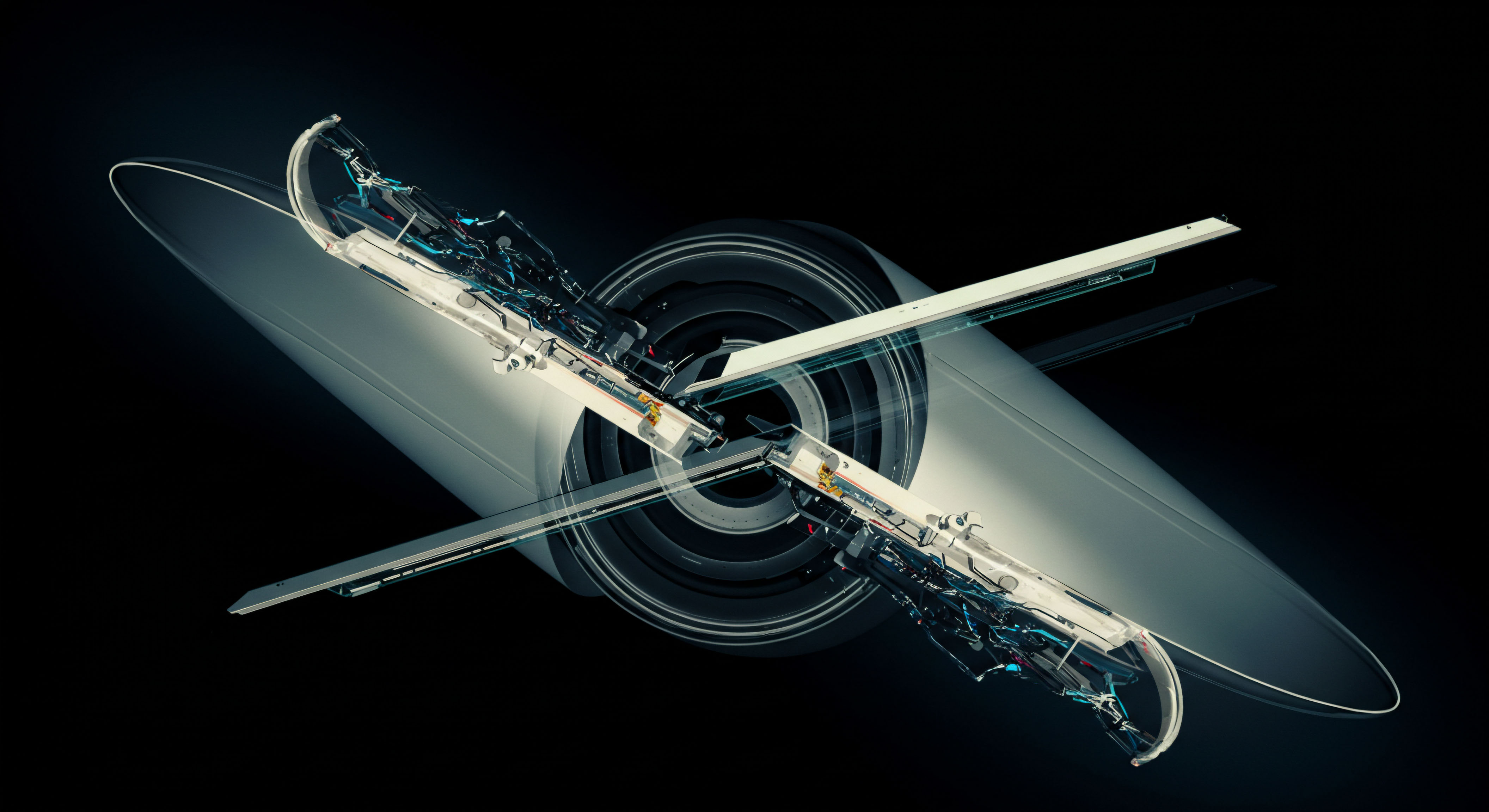

Achieving superior execution in the volatile crypto landscape demands a strategic departure from conventional methods. High-volume transactions require an operational architecture designed for precision and control. This foundational understanding equips traders with the insights necessary to command liquidity and secure optimal pricing, moving beyond mere participation to active market shaping.

The Request for Quote (RFQ) mechanism stands as a cornerstone for professional-grade execution. It facilitates direct, bilateral engagement with multiple liquidity providers, ensuring competitive price discovery for significant order sizes. This direct interaction minimizes information leakage and mitigates price impact, common frictions in fragmented spot markets. Understanding its mechanics reveals a pathway to enhanced capital efficiency.

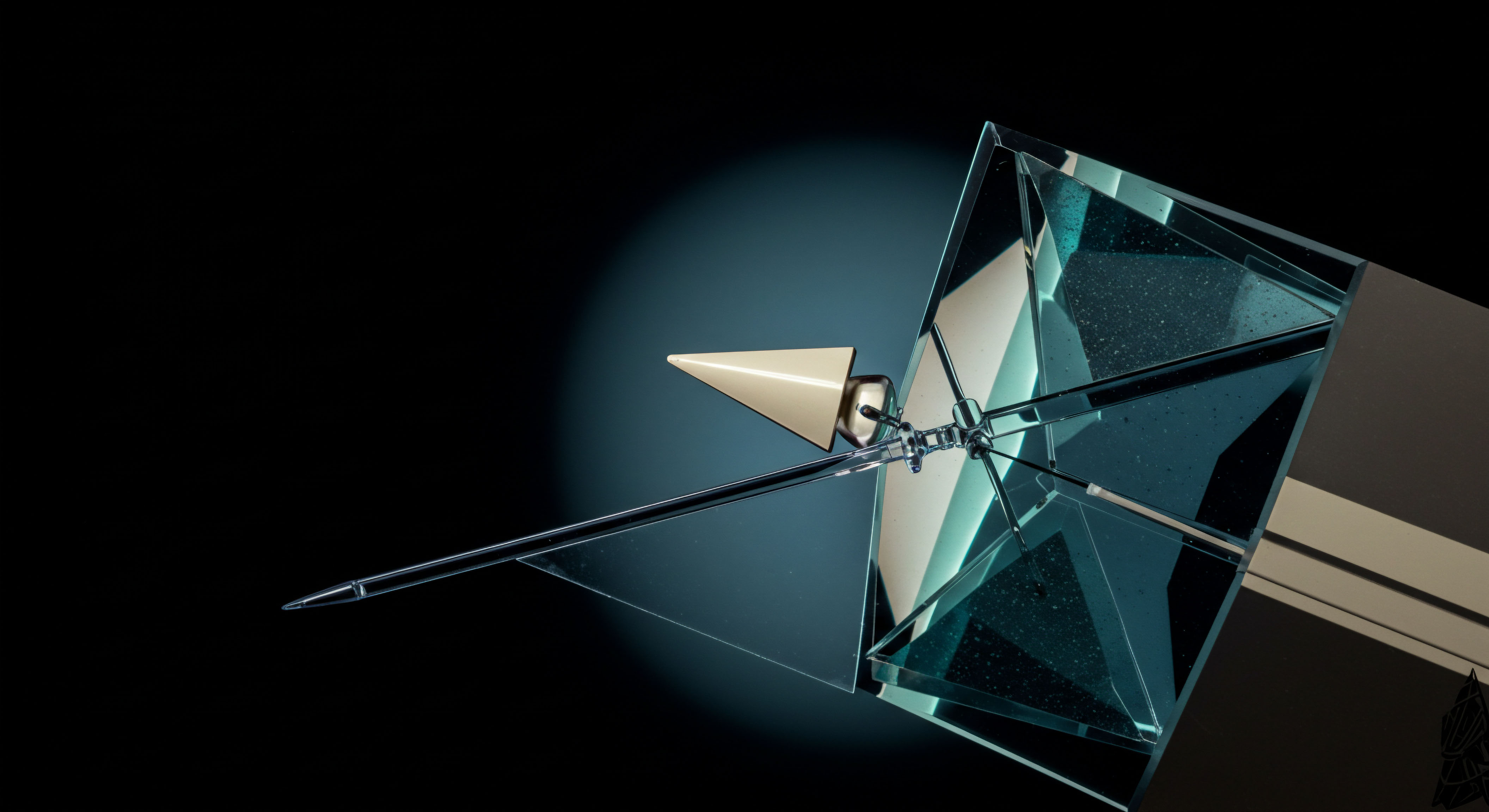

Mastering high-volume crypto execution involves deploying sophisticated tools for commanding liquidity and securing optimal pricing.

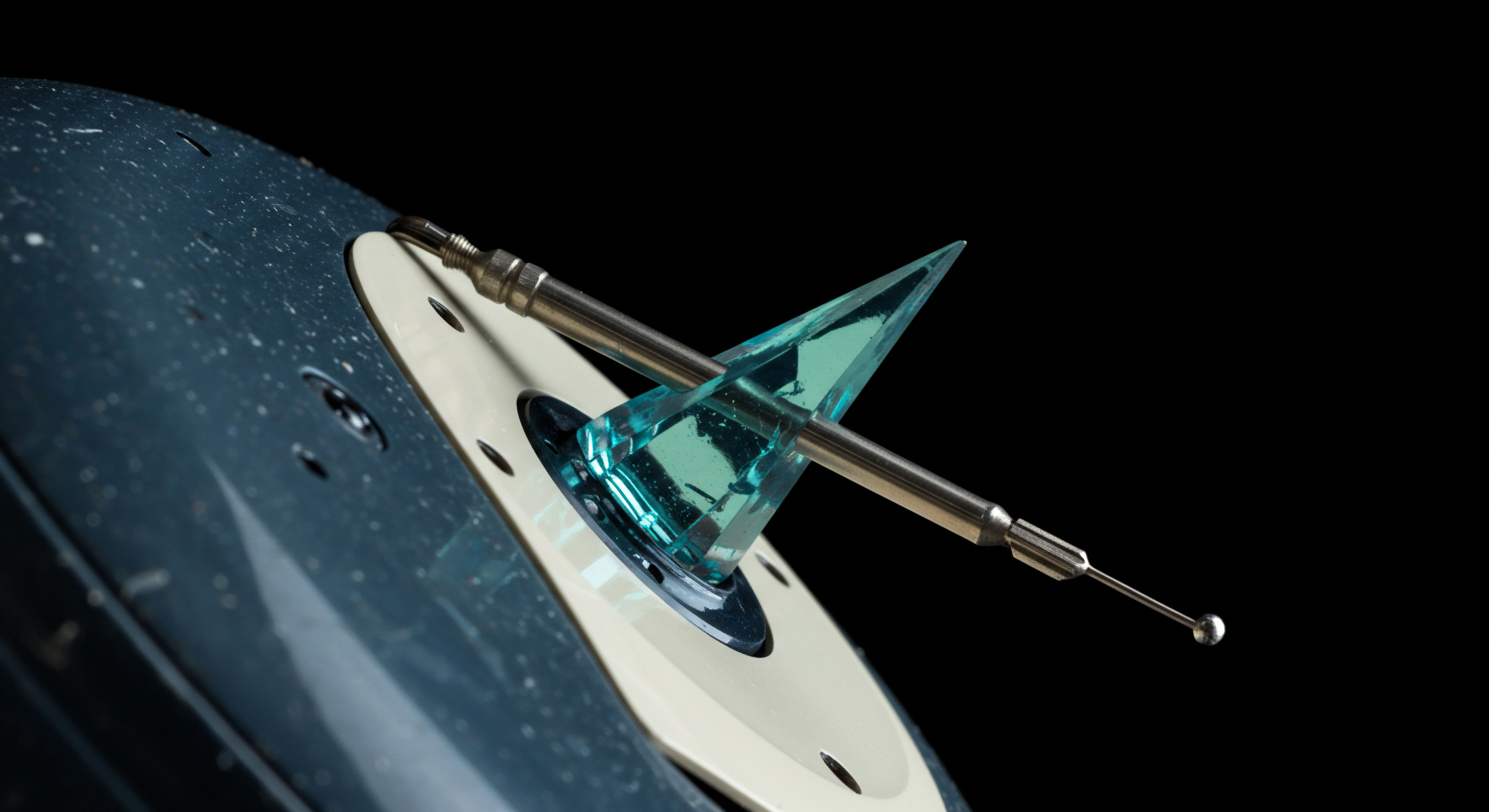

Derivatives, particularly options, offer a potent vehicle for expressing complex market views and managing directional exposure. Integrating RFQ for options trading elevates this capability, allowing participants to solicit competitive quotes for intricate multi-leg strategies. This approach transforms theoretical market analysis into tangible, executable positions with a clearer understanding of cost basis.

Deploying Strategic Execution

Translating foundational knowledge into actionable investment strategies requires a systematic approach to market engagement. Professional traders leverage specific execution pathways to capitalize on opportunities while diligently managing risk. These methods focus on securing favorable terms for substantial positions, ensuring every trade contributes positively to overall portfolio performance.

Options RFQ for Complex Positions

Utilizing the RFQ framework for options contracts provides a distinct edge when constructing sophisticated strategies. Instead of piecing together individual legs on an order book, a multi-dealer RFQ streamlines the process for structures such as straddles, collars, or butterflies. This ensures a unified price for the entire strategy, simplifying execution and reducing leg risk. A single request yields multiple competitive bids, empowering the trader to select the most advantageous terms.

Consider a scenario involving a BTC straddle block, where volatility is anticipated to rise significantly, or an ETH collar RFQ designed to hedge existing spot exposure. Initiating an RFQ for these multi-leg configurations enables a consolidated execution, bypassing the potential for adverse price movements across separate order book entries. This integrated approach ensures consistent pricing across all components of the derivative position, a critical aspect for risk-adjusted returns. The precision offered by RFQ in these instances underscores its value for high-stakes positions.

Block Trading Advantages

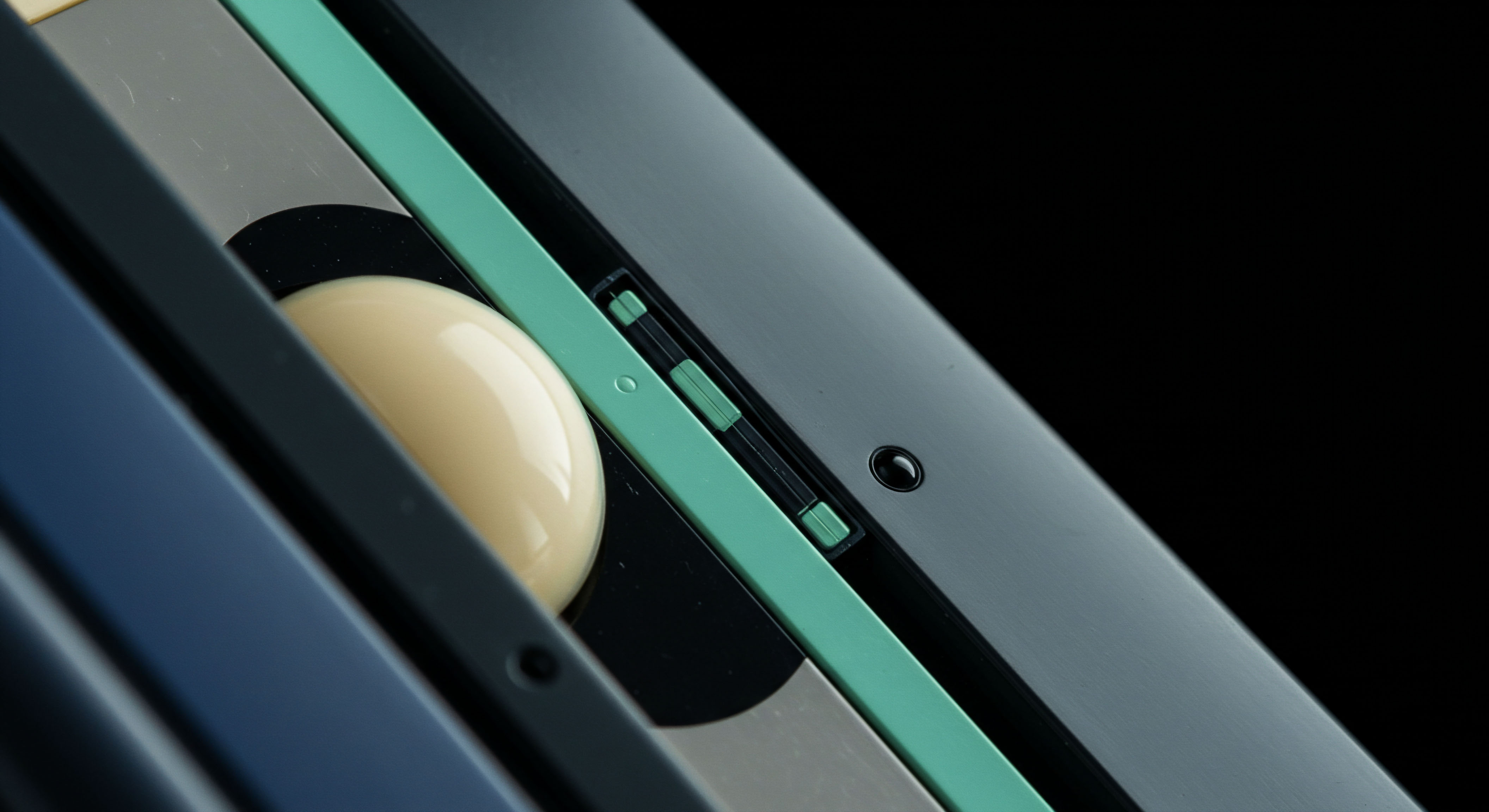

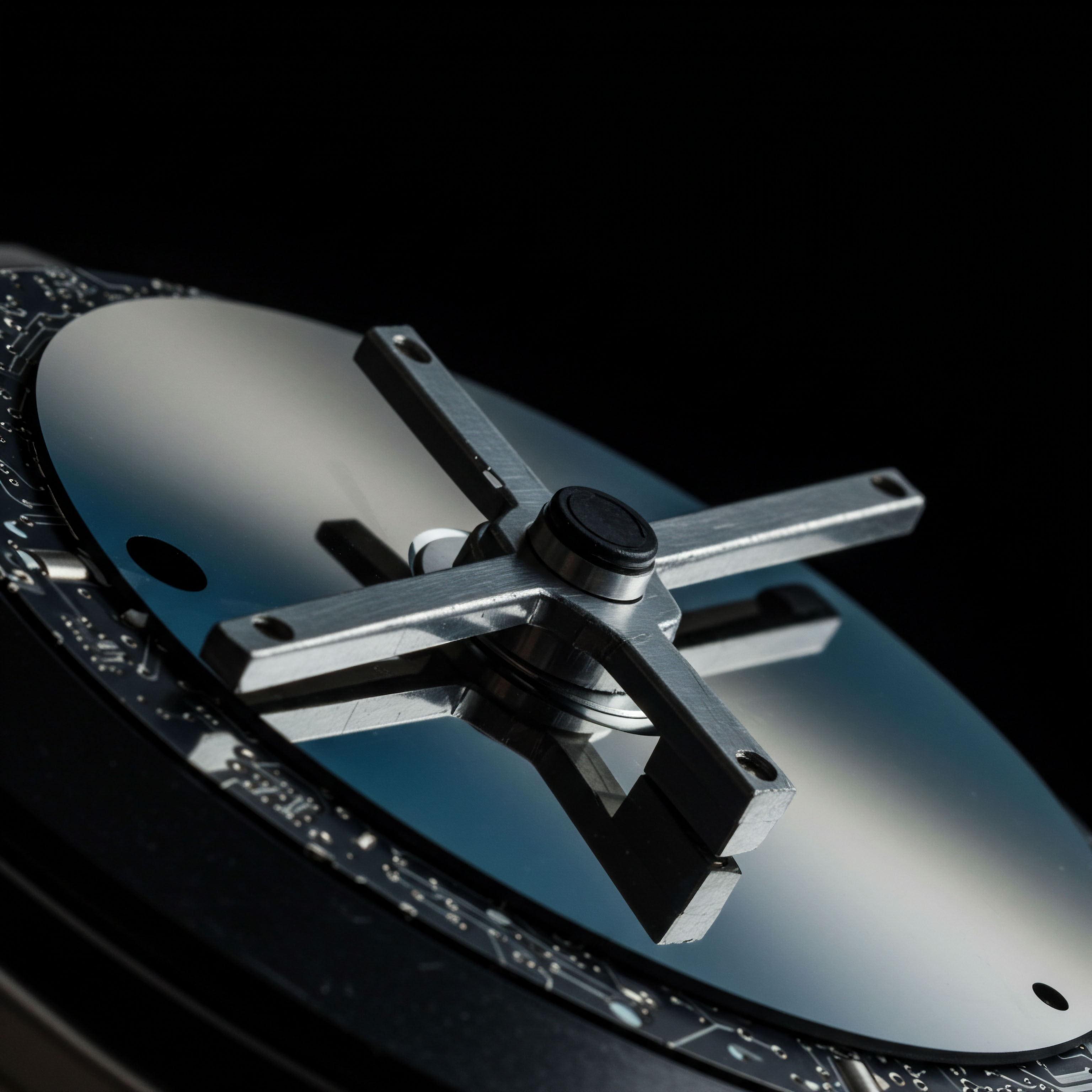

Block trading, particularly in the realm of Bitcoin and Ethereum options, serves as an essential tool for institutional participants. These transactions involve substantial volumes, often negotiated off-exchange or through dedicated channels to minimize market disruption. The ability to execute large orders without immediate public disclosure preserves anonymity and reduces the potential for front-running. This method becomes paramount when managing significant portfolio rebalancing or taking substantial directional stances.

- Anonymous Execution Securing liquidity without revealing intent, preserving alpha.

- Reduced Price Impact Minimizing the effect of large orders on market prices.

- Consolidated Pricing Obtaining a single, negotiated price for the entire block.

- Strategic Liquidity Access Tapping into deep, often private, pools of capital.

A structured approach to block trading involves careful selection of liquidity partners and a clear understanding of market depth across various venues. For instance, executing a large volatility block trade requires identifying counterparties capable of absorbing significant risk without unduly influencing the underlying asset’s price. The strategic deployment of block trades becomes a deliberate act of market interaction, where discretion and efficiency are paramount. This is where a trader’s acumen truly distinguishes itself, moving beyond simple order placement to orchestrating significant capital movements with finesse.

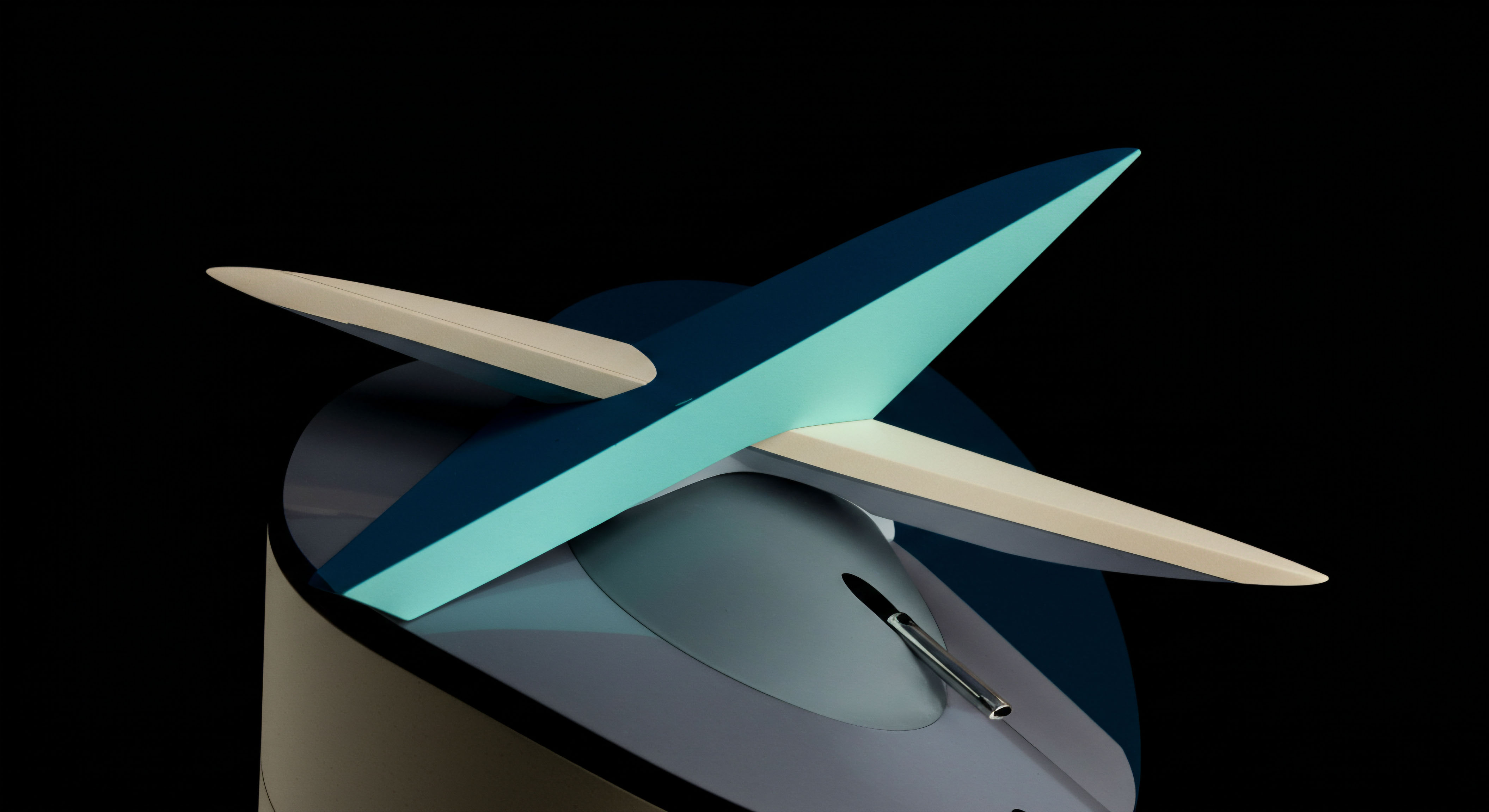

Advanced Portfolio Architectures

Expanding beyond individual trades, the true mastery of high-volume crypto execution lies in integrating these tools into a comprehensive portfolio framework. This involves constructing advanced risk management overlays and developing systematic approaches to alpha generation that account for market microstructure and evolving liquidity dynamics. The objective extends to sustained outperformance through intelligent capital deployment.

Systematic Risk Mitigation

Sophisticated traders implement dynamic hedging strategies using RFQ for options to calibrate portfolio exposure with precision. Imagine a portfolio heavily weighted in a particular asset; an RFQ for a tailored options spread provides a swift and efficient means to adjust delta or gamma, creating a robust financial firewall against adverse price movements. This proactive risk posture ensures portfolio stability even during periods of heightened market turbulence. A meticulous approach to these adjustments differentiates reactive trading from strategic portfolio management.

The application of quantitative finance principles allows for the continuous optimization of execution parameters. Understanding the nuances of transaction cost analysis (TCA) provides a feedback loop, refining execution strategies over time. Analyzing fill rates, slippage metrics, and price impact across different RFQ providers informs future liquidity selection, continually sharpening the edge. This iterative refinement transforms execution into a measurable performance driver, rather than a mere operational necessity.

The strategic deployment of multi-dealer liquidity within RFQ environments offers a significant advantage for anonymous options trading. This approach shields a participant’s true intentions from the broader market, preserving the integrity of their trading thesis. The ability to source diverse quotes without revealing one’s hand allows for optimal price discovery on a scale that fragmented public order books cannot match. It becomes a testament to the trader’s command over market information asymmetry.

Strategic liquidity access through RFQ and block trading builds a robust foundation for consistent portfolio outperformance.

The Unseen Edge

The pursuit of high-volume crypto execution transforms a trader’s interaction with markets from transactional to strategic. It reframes the very essence of market participation, elevating it to an art of calculated opportunity and disciplined command. The journey toward this level of mastery reshapes one’s entire approach to capital, forging a distinct advantage that resonates through every portfolio decision.

Glossary

Eth Collar Rfq

Volatility Block Trade

Market Microstructure

Transaction Cost Analysis

Anonymous Options Trading