Execution Command

Mastering options block trade efficiency involves orchestrating market interactions with strategic intent. This domain centers on the Request for Quote (RFQ) mechanism, a powerful instrument for institutional participants. An RFQ empowers traders to solicit competitive bids and offers from multiple liquidity providers simultaneously, securing superior pricing for substantial options positions.

This process bypasses the fragmented nature of public order books, allowing for a consolidated view of liquidity and a precise capture of market depth. Professional traders recognize this as a foundational step toward optimized transaction costs and enhanced portfolio performance.

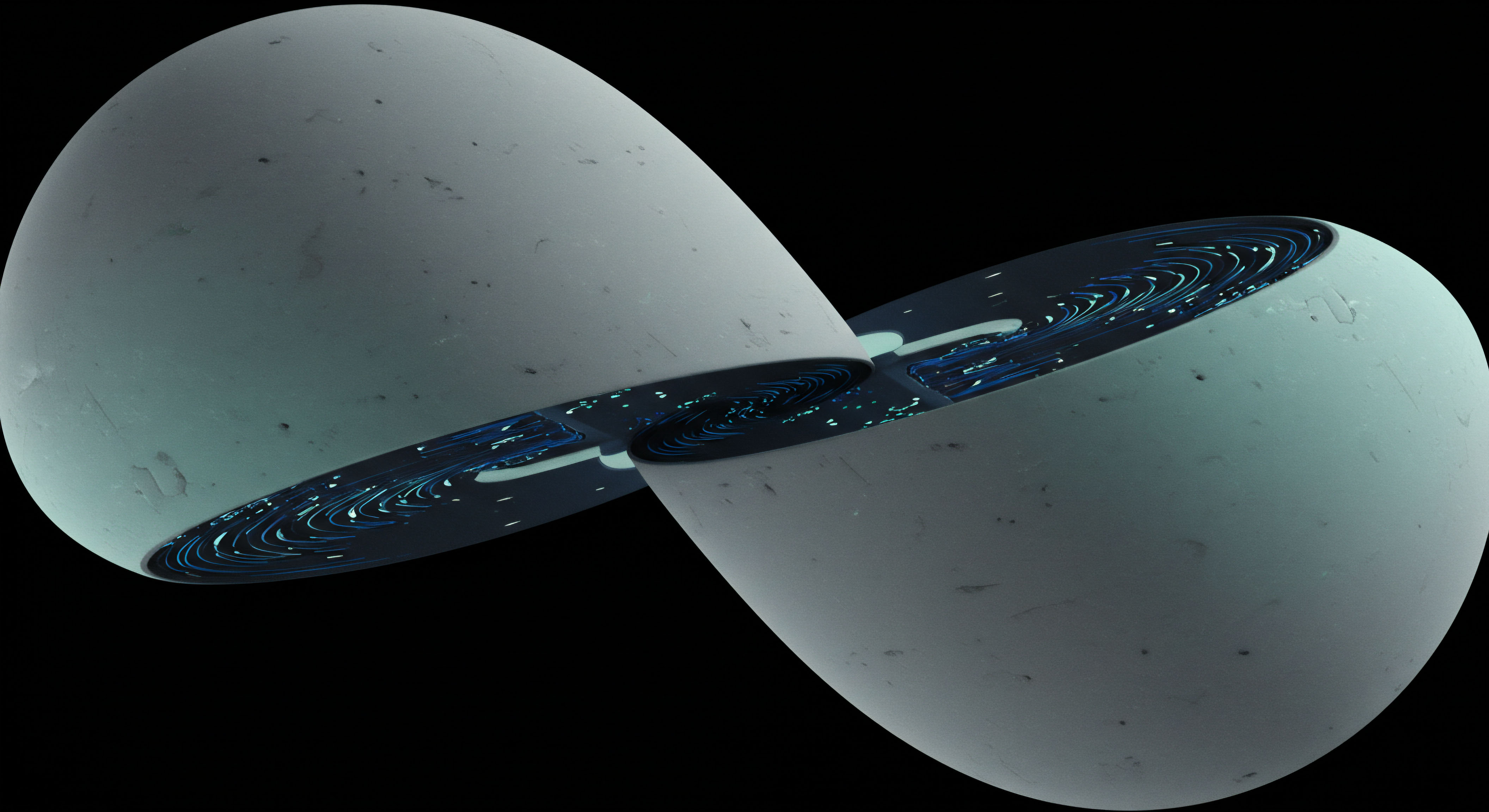

The core purpose of RFQ systems extends beyond mere price discovery; it reshapes the dynamics of large-scale options execution. Engaging multiple dealers in a private, competitive environment ensures an optimal clearing price for significant volumes. This mechanism fundamentally alters how large orders interact with available liquidity, transitioning from reactive price taking to proactive price making. Understanding this systemic advantage forms the bedrock for achieving a consistent market edge in derivatives trading.

Orchestrating market interactions with strategic intent unlocks superior pricing for substantial options positions.

Consider the profound implications for risk management. Executing a block trade through an RFQ minimizes market impact, a critical factor when deploying capital at scale. The ability to transact large positions without unduly influencing price movements preserves the integrity of a chosen strategy.

This disciplined approach safeguards capital and ensures the execution aligns precisely with the intended market exposure. Every serious trader seeks this level of control.

Strategic Deployment

Deploying options block trade efficiency demands a methodical approach, integrating RFQ capabilities into diverse trading strategies. The alpha-focused portfolio manager prioritizes systemic solutions that yield measurable returns. Utilizing multi-dealer liquidity via RFQ significantly reduces execution slippage, directly impacting the profitability of large-scale options positions. This is a critical factor for strategies requiring precise entry and exit points.

Multi-Leg Execution Precision

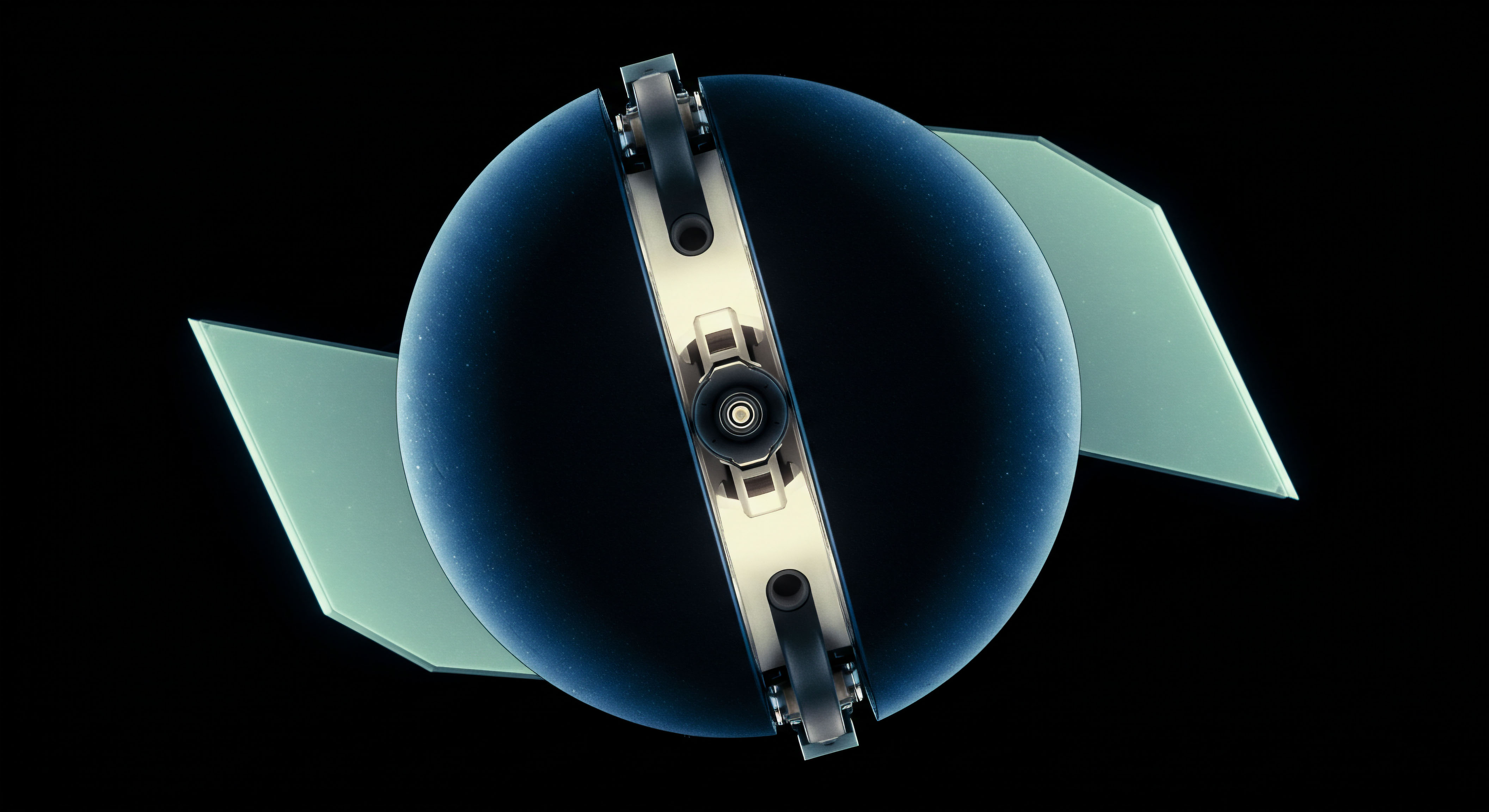

Executing multi-leg options spreads through an RFQ offers unparalleled precision. A common challenge in constructing complex strategies involves the simultaneous execution of multiple options contracts. RFQ streamlines this by allowing a single quote request for the entire spread, ensuring all legs clear at a unified, optimal price. This method preserves the intended risk-reward profile of the spread, eliminating the adverse price movements often encountered when legging into positions individually.

- BTC Straddle Block ▴ A trader anticipating significant volatility in Bitcoin without a directional bias can deploy a large BTC straddle block through an RFQ. This secures a single, competitive price for both the call and put options, minimizing spread execution risk.

- ETH Collar RFQ ▴ For managing existing Ethereum holdings, an ETH collar executed via RFQ offers a disciplined way to define risk parameters. The simultaneous sale of an out-of-the-money call and purchase of an out-of-the-money put, alongside the underlying, benefits from unified pricing.

- Options Spreads RFQ ▴ Any complex options spread, from iron condors to butterflies, gains substantial efficiency. The RFQ environment aggregates liquidity, ensuring that the intricate relationships between strike prices and expiries within the spread are priced optimally.

Volatility Block Trade Advantage

Capturing volatility plays through block trades requires a robust execution mechanism. Volatility block trades, whether expressing a view on implied volatility or hedging existing exposure, benefit immensely from the anonymous options trading environment an RFQ provides. The market does not immediately see the order, preventing front-running and allowing for a true reflection of prevailing liquidity. This preserves the strategic intent behind the volatility trade.

Consider the impact on large institutional positions. The ability to move significant blocks of options without revealing one’s hand to the broader market represents a distinct tactical advantage. This stealth execution is paramount when dealing with illiquid or thinly traded options, where transparency can lead to substantial price deterioration. The RFQ mechanism acts as a conduit for discreetly commanding liquidity.

Unified pricing across multi-leg strategies eliminates adverse price movements, preserving the intended risk-reward profile.

A seasoned strategist often grapples with the subtle interplay of price impact and execution speed for large positions. Balancing these elements requires a mechanism that can adapt to market conditions while maintaining discretion. The RFQ provides this equilibrium, offering a controlled environment for significant capital deployment.

Advanced Orchestration

Expanding proficiency in options block trade efficiency involves integrating these sophisticated execution methods into a comprehensive portfolio framework. The master advisor views RFQ as an indispensable component for constructing resilient, alpha-generating portfolios. This means moving beyond individual trade execution to understanding the systemic impact on overall portfolio performance and risk attribution.

Portfolio Hedging Optimization

Deploying large-scale portfolio hedges demands precision and cost efficiency. Options RFQ enables the optimal execution of protective puts or covered calls across an entire equity or crypto portfolio. The aggregated liquidity and competitive pricing reduce the overall cost basis of these hedges, thereby improving the net return of the portfolio. This strategic deployment transforms hedging from a cost center into a refined component of total return management.

The application extends to dynamic hedging strategies, where positions adjust frequently in response to market movements. Automated systems leveraging RFQ can execute rebalancing trades with minimal market footprint. This ensures that the portfolio’s delta, gamma, or vega exposure remains within desired parameters without incurring excessive transaction costs. Such continuous optimization refines the portfolio’s risk profile with surgical accuracy.

Arbitrage and Structural Opportunities

Identifying and capitalizing on arbitrage or structural opportunities in options markets often requires rapid, large-scale execution. The multi-dealer liquidity available through RFQ systems provides the necessary speed and depth. Capturing fleeting mispricings in volatility surfaces or cross-asset options relationships becomes achievable with a reliable, efficient execution channel. This empowers traders to exploit market inefficiencies that smaller, fragmented orders cannot access.

Consider the sophisticated interplay between spot and options markets. A robust RFQ system allows for seamless, anonymous options trading, complementing spot positions or futures contracts to construct complex synthetic exposures. This integrated approach ensures that the total market view translates into precise, low-impact trades, maximizing the capture of theoretical edge. It is a testament to disciplined capital deployment.

The pursuit of superior execution is an ongoing endeavor, a constant refinement of method and understanding. The market presents opportunities for those who command their interactions with liquidity, turning theoretical advantage into tangible returns. This proactive engagement defines mastery.

Commanding Market Dynamics

The pursuit of optimal execution in options block trading is a journey toward strategic command. Each successful RFQ interaction strengthens a trader’s position, reinforcing the understanding that precision in execution yields a distinct advantage. This continuous refinement of method and insight separates reactive participants from those who shape their market outcomes. Embrace the tools that define professional engagement, and elevate every trade.

Glossary

Options Block Trade Efficiency Involves

Block Trade

Options Block Trade Efficiency

Multi-Dealer Liquidity

Btc Straddle Block

Eth Collar Rfq

Options Spreads Rfq

Anonymous Options Trading

Options Block