Relative Value Fundamentals

Mastering relative value in crypto markets provides a systematic path to consistent gains. This approach identifies pricing disparities between highly correlated or convertible assets. Such disparities present opportunities for precise execution. Traders can capitalize on these temporary misalignments, securing returns with controlled risk parameters.

A professional-grade execution framework underpins this capability, representing strategic market engagement. This method calibrates a trader’s market view with actionable, systemic solutions, offering a tangible edge.

Relative value strategies align market insight with superior execution, building consistent profit streams.

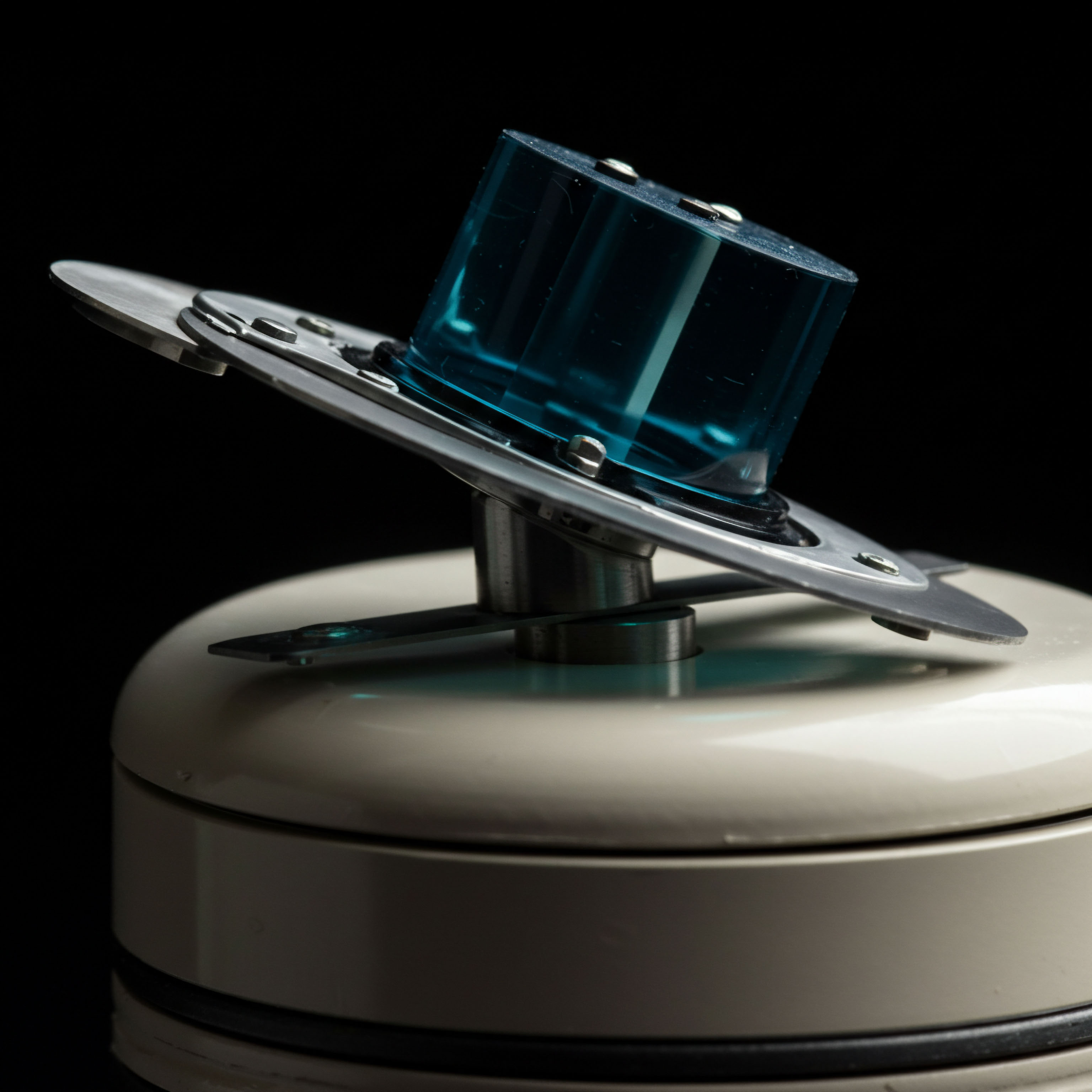

Request for Quotation (RFQ) systems stand as a core component within this strategic framework. RFQ facilitates transparent, competitive pricing for large crypto derivatives orders. It allows a trader to solicit bids and offers from multiple liquidity providers simultaneously. This competitive environment ensures optimal pricing and minimizes market impact for substantial positions.

RFQ brings institutional-grade execution capabilities directly to the individual trader, leveling the playing field against larger market participants. Understanding its mechanics marks a distinct step towards sophisticated trading operations.

Strategic Capital Deployment

Deploying relative value strategies demands precision and a keen eye for market mechanics. Professional traders systematically identify and capitalize on fleeting price discrepancies across crypto derivatives. These methods involve constructing multi-leg options spreads or executing large block trades with superior pricing efficiency. A structured approach converts market volatility into predictable profit opportunities, aligning directly with capital growth objectives.

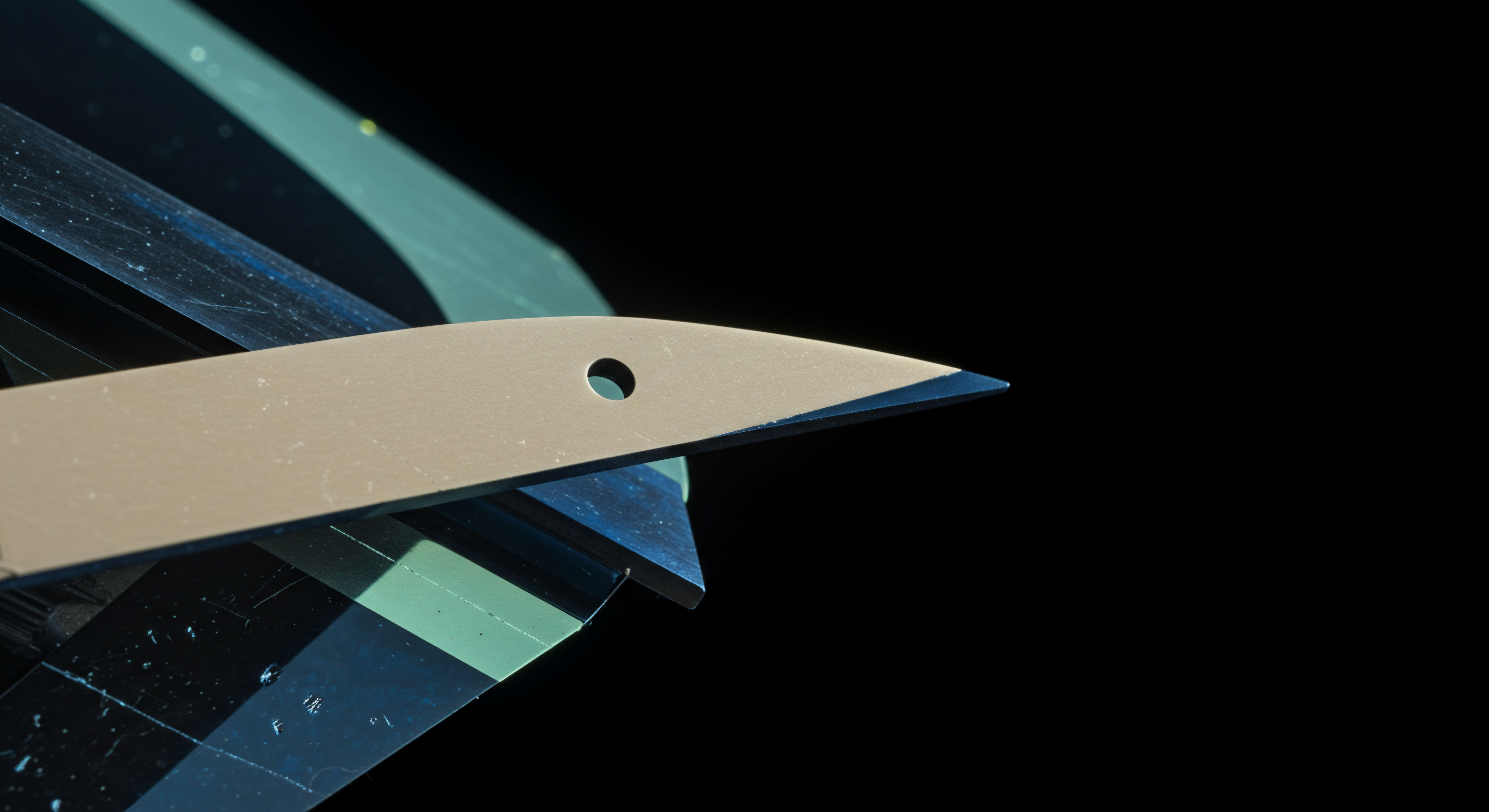

Options Spreads Precision

Constructing options spreads presents a primary avenue for relative value capture. This involves simultaneously buying and selling different options contracts on the same underlying asset. Traders frequently employ these strategies to express a refined view on volatility or directional movement.

Calendar spreads, vertical spreads, and butterfly spreads represent common structures. Each structure carries a defined risk-reward profile, tailored to specific market conditions and expected price action.

Calendar Spread Dynamics

Calendar spreads capitalize on differences in implied volatility between options of varying expirations. A trader might sell a near-term option and buy a longer-term option with the same strike price. This strategy profits from time decay affecting the shorter-dated option more rapidly. Market makers frequently employ these structures to hedge their overall book volatility, creating opportunities for informed participants.

Vertical Spread Mechanics

Vertical spreads involve options with the same expiration but different strike prices. They offer a limited risk, limited profit structure. Traders utilize these to express a directional view with capped exposure.

A bull call spread yields profit from a moderate upward price movement. The defined parameters allow for rigorous risk management, a hallmark of professional trading.

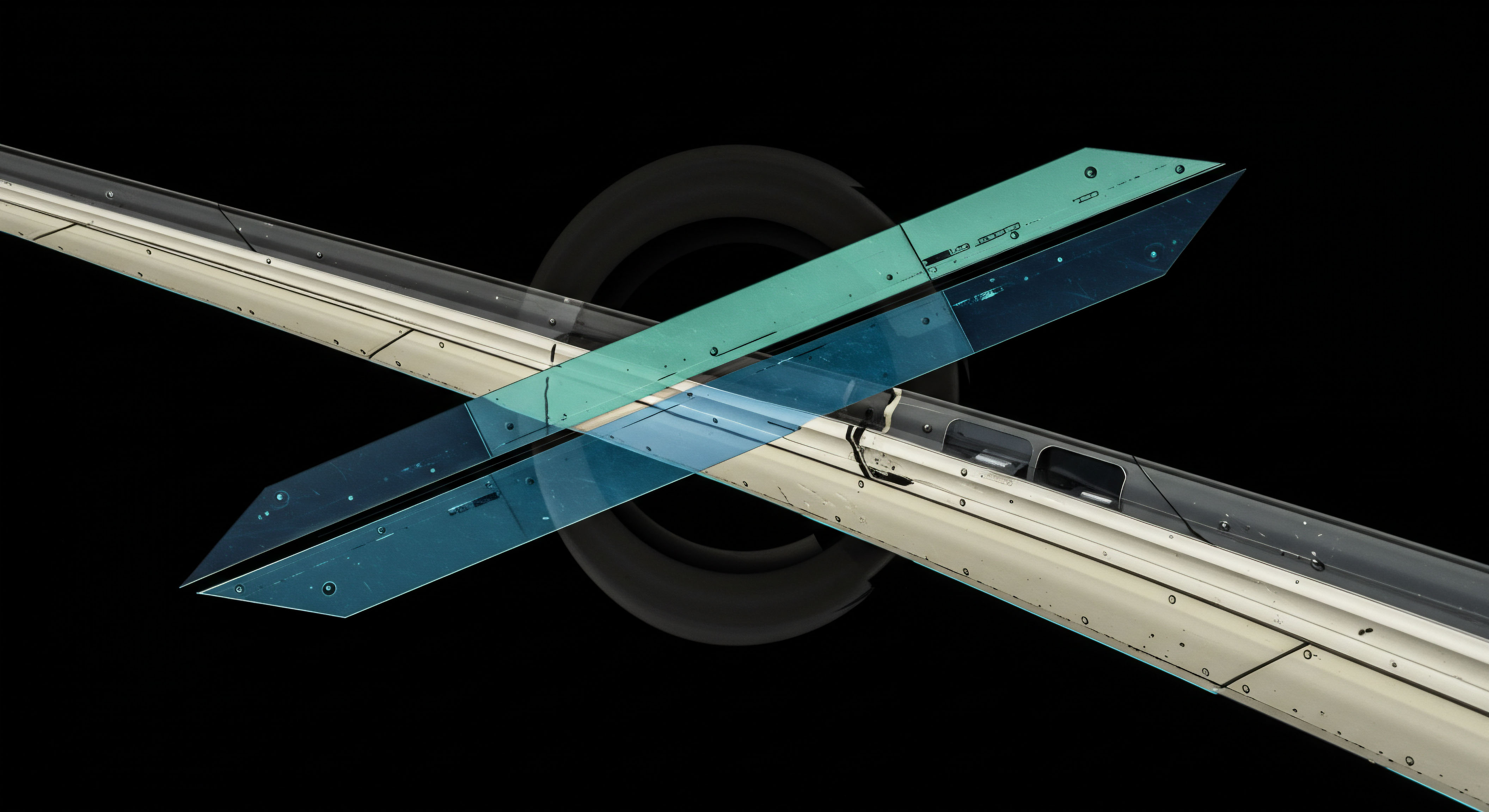

Block Trade Execution Efficiency

Executing large crypto block trades demands a specialized approach to minimize market impact. RFQ systems excel here, providing a controlled environment for substantial order flow. An RFQ submission allows a trader to solicit quotes from multiple liquidity providers, ensuring competitive pricing for substantial positions. This direct interaction bypasses fragmented public order books, preserving trade integrity.

The typical execution journey follows this sequence:

- Identify a relative value opportunity requiring a large position.

- Prepare the RFQ specifying desired assets, size, and side (buy/sell).

- Submit the RFQ to a selected list of liquidity providers.

- Review competitive quotes, selecting the best available price.

- Execute the block trade, confirming the favorable fill.

This process transforms potential market friction into an execution advantage. Optimal pricing matters.

Advanced Strategic Integration

Advancing your command over relative value techniques brings these strategies into a complete portfolio framework. This extends beyond individual trade execution, covering systematic risk mitigation and alpha generation across varied market conditions. A sophisticated trader views each position as a component within a larger, interconnected system designed for sustained performance.

Portfolio Volatility Hedging

Managing portfolio volatility presents a continuous challenge for asset managers. Options contracts provide versatile tools for constructing hedges. Implementing a Bitcoin options block collar combines buying an out-of-the-money put option with selling an out-of-the-money call option, alongside a spot position.

This caps both upside gains and downside losses, creating a defined profit range. The strategy provides downside protection while generating income from the sold call, a balanced approach to market exposure.

Dynamic Position Adjustments

Market conditions shift, requiring continuous adjustment of relative value positions. Traders employ quantitative models to monitor implied volatility surfaces and option greeks. Real-time data streams inform adjustments to strike prices, expirations, or position sizes.

This active management maintains the desired risk profile, preventing drift from the original trade thesis. Maintaining an optimal exposure demands vigilance.

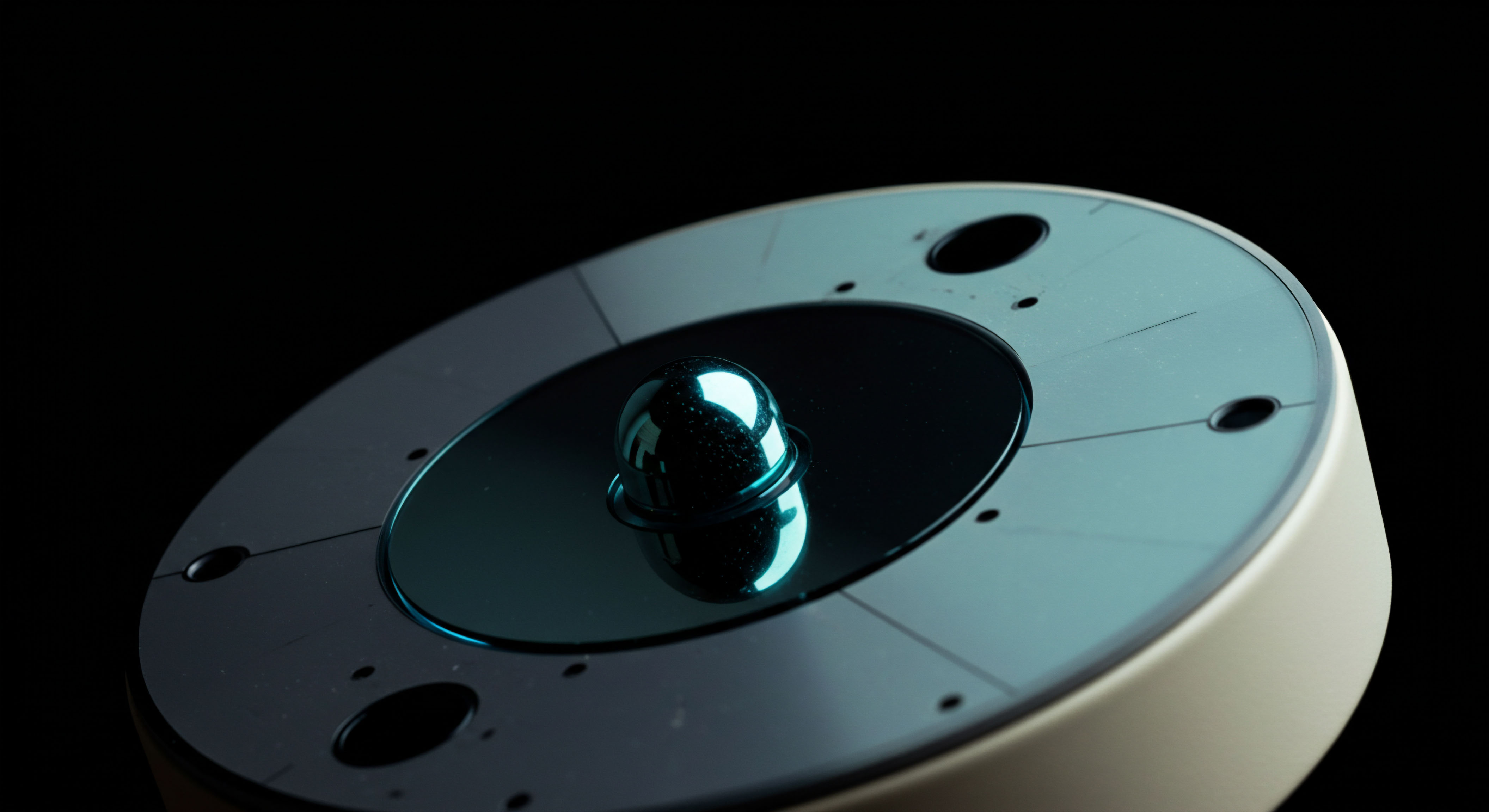

Multi-Leg Options RFQ Mastery

Executing complex multi-leg options strategies with optimal pricing represents a peak of trading skill. A single RFQ can cover an entire spread, ensuring all legs execute simultaneously at a single, competitive price. This safeguards against leg risk, where individual components of a spread trade at unfavorable prices due to market movement. The simultaneous execution provides a distinct advantage, avoiding adverse selection across individual legs, a key aspect for sophisticated market participants.

Observe the detailed pricing dynamics of a BTC straddle block executed through a single, complete RFQ. One might question the true efficacy of such aggregated liquidity mechanisms during periods of extreme market stress. While competitive pricing often prevails in calmer environments, the depth and consistency of responses during flash crashes or rapid, unidirectional movements demand continuous scrutiny.

The theoretical benefits of multi-dealer liquidity remain persuasive, yet practical application requires ongoing calibration against real-world market behavior. This persistent evaluation refines execution parameters, ensuring strong performance across all market cycles.

Mastering Market Dynamics

The pursuit of stable crypto profits hinges on a systematic engagement with market mechanics. Professional traders shape their market outcomes by applying rigorous analytical frameworks and precise execution methods. They recognize that consistent performance arises from a deliberate command over liquidity and pricing, stemming from systematic engagement. Your journey toward sustained alpha is a continuous refinement of these operational efficiencies.

Each strategic deployment builds upon the last, creating a resilient trading persona capable of moving through any market condition. Adopt this discipline; it shapes your financial destiny.

Glossary

Relative Value

Options Spreads

Risk Management

Bitcoin Options