Commanding Liquidity

Mastering Request for Quote (RFQ) execution represents a fundamental shift in navigating crypto derivatives markets. This strategic approach empowers traders to orchestrate liquidity on their terms, moving beyond passive price acceptance. Understanding the RFQ mechanism provides a distinct advantage, allowing participants to solicit competitive bids and offers directly from multiple market makers. This direct engagement ensures superior pricing and controlled execution for significant positions.

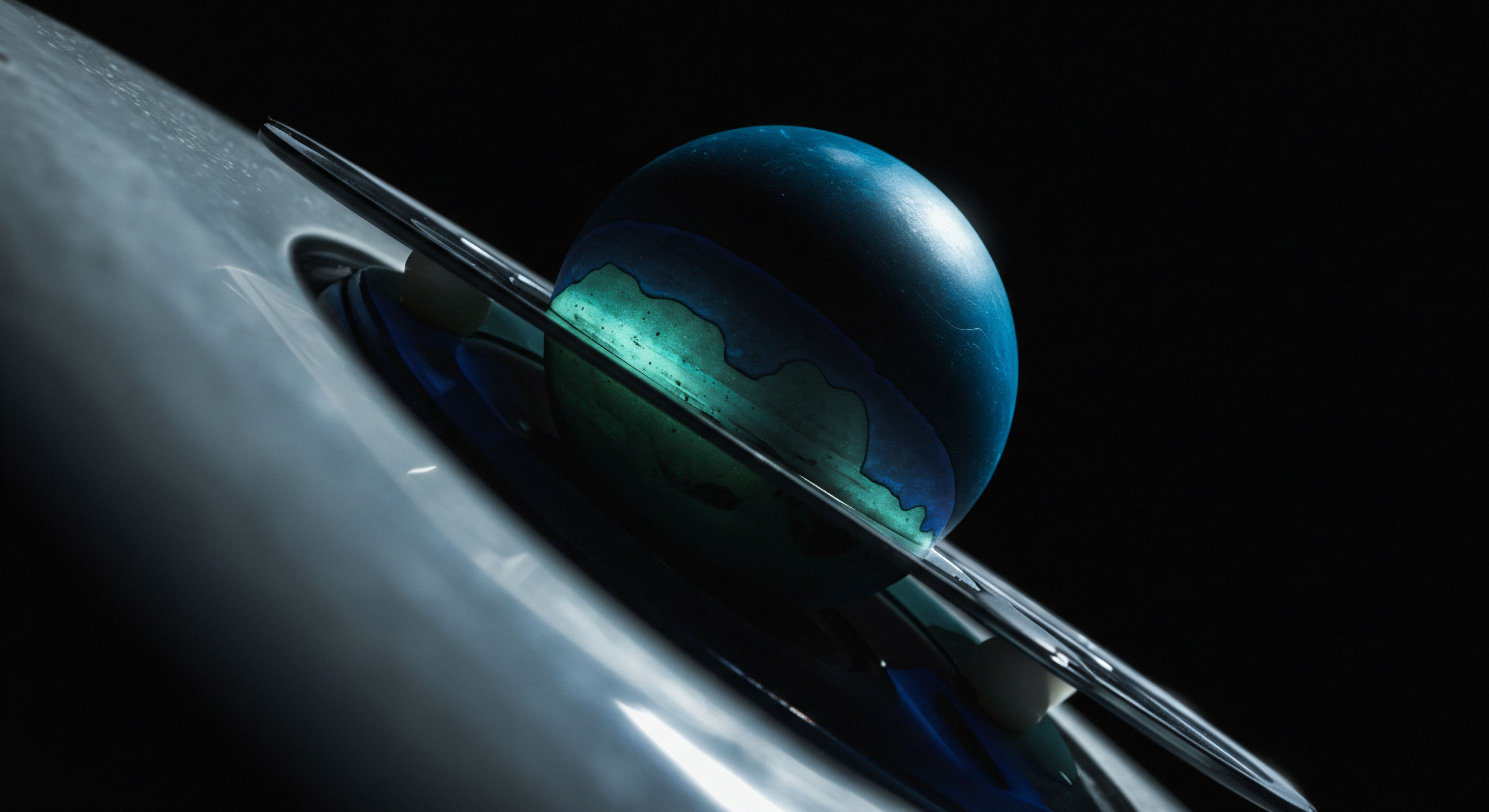

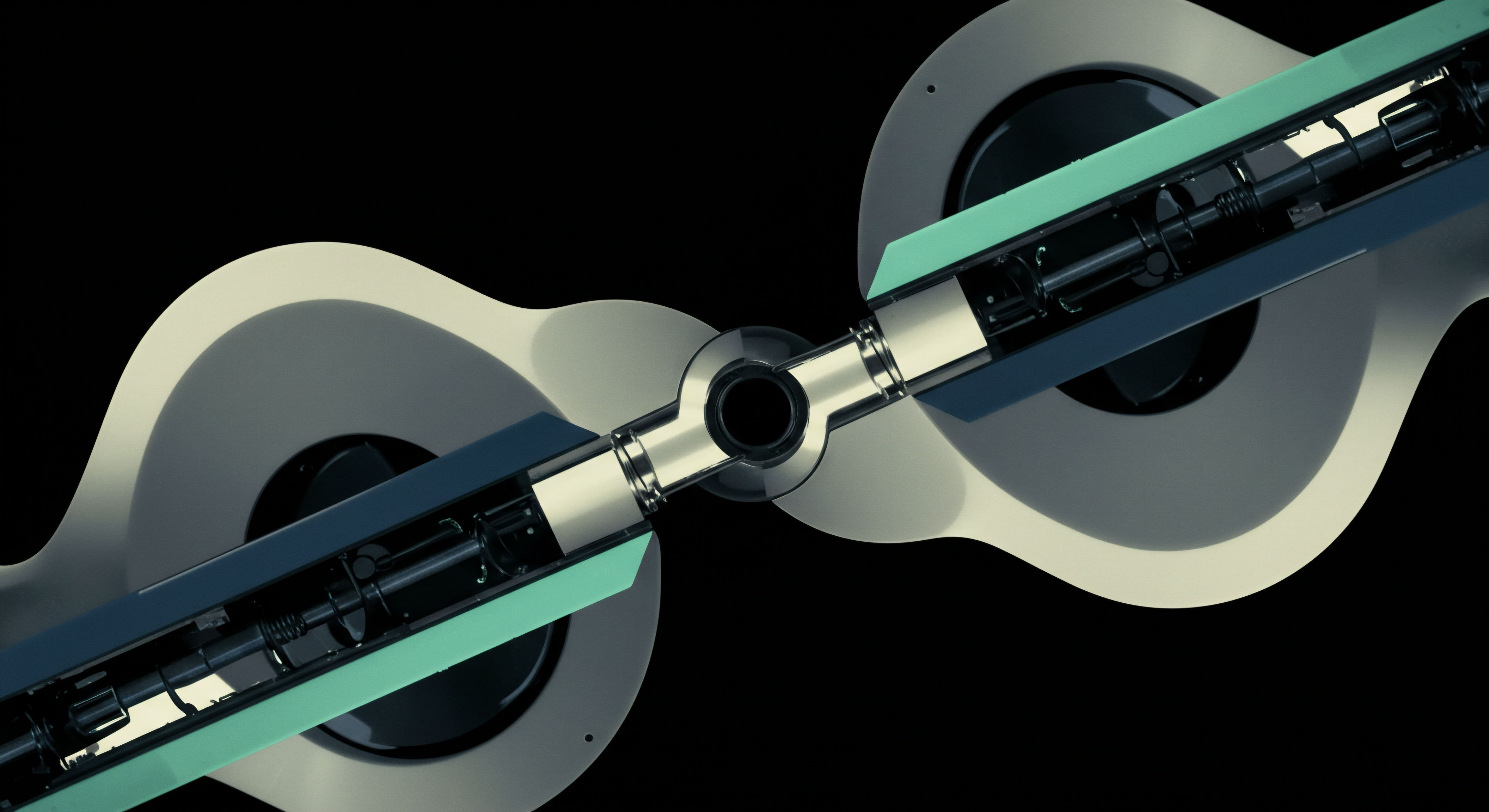

Precision execution through RFQ transforms market interaction, converting passive acceptance into active command over liquidity.

The core utility of RFQ stems from its capacity to centralize dispersed liquidity. In fragmented markets, finding optimal pricing for larger trades often proves challenging. An RFQ system aggregates interest from various professional counterparties, creating a competitive environment for your specific order. This process ensures a robust price discovery mechanism, which is critical for maintaining capital efficiency across all derivative instruments.

Deploying an RFQ system fundamentally reshapes how participants approach trade execution. Instead of interacting with a single order book, a trader broadcasts their intent, prompting a real-time auction among liquidity providers. This competitive dynamic inherently drives down execution costs, directly contributing to an enhanced profit and loss profile. The system grants unparalleled transparency into available pricing, a cornerstone of professional-grade trading.

This method of engagement elevates the standard for market participation. It signifies a deliberate choice to seek out the best possible terms for every trade, rather than relying on generalized market conditions. Traders gain an immediate, quantifiable edge by systematically extracting superior pricing through this structured negotiation. This systematic advantage compounds over time, building a foundation for consistent outperformance.

Strategic Capital Deployment

The strategic deployment of RFQ in crypto derivatives translates directly into tangible investment outcomes. This involves applying the foundational understanding to specific trading scenarios, maximizing returns, and mitigating inherent market risks. Professional traders leverage RFQ for block trades, options spreads, and volatility positions, consistently optimizing their entry and exit points.

Optimized Block Trading

Executing large crypto derivative blocks demands an approach that minimizes market impact. RFQ provides a controlled environment for these substantial transactions. Submitting a block order via RFQ allows multiple market makers to quote simultaneously, ensuring the best available price for the entire size. This method bypasses the slippage often associated with executing large orders on open exchanges, preserving capital for the portfolio.

Consider the strategic implications for a Bitcoin options block. A trader seeking to establish a directional position or hedge existing exposure can specify the exact strike, expiry, and size. The RFQ then elicits firm quotes, allowing for a swift and precise execution that reflects the true institutional liquidity available. This direct interaction reduces the hidden costs that erode returns over time.

Advanced Options Spreads

RFQ proves particularly effective for multi-leg options strategies. Constructing spreads, such as a BTC straddle block or an ETH collar RFQ, involves simultaneous execution of multiple options contracts. The RFQ system ensures these legs are priced and executed concurrently, eliminating the leg risk prevalent when executing each component individually. This precision preserves the intended risk-reward profile of the spread.

Executing an options spread via RFQ demands a clear understanding of the desired net premium and the specific market conditions. The system allows traders to receive a single, consolidated quote for the entire spread, simplifying the execution process and enhancing pricing accuracy. This integrated approach ensures the strategy’s integrity from inception.

Volatility Positions

Trading volatility through instruments like variance swaps or complex options combinations benefits immensely from RFQ. A volatility block trade, for instance, requires deep liquidity and precise pricing to capture specific market views. The competitive quoting environment of RFQ provides the necessary depth, allowing traders to express their volatility thesis with confidence.

Deploying a volatility-focused strategy through RFQ offers a significant edge. It allows for bespoke structuring of trades that precisely match the desired exposure to implied or realized volatility. This tailored execution minimizes adverse selection and ensures that the trade’s P&L dynamics align with the initial strategic intent. Consistent application of this method refines a trader’s capacity to capitalize on market movements.

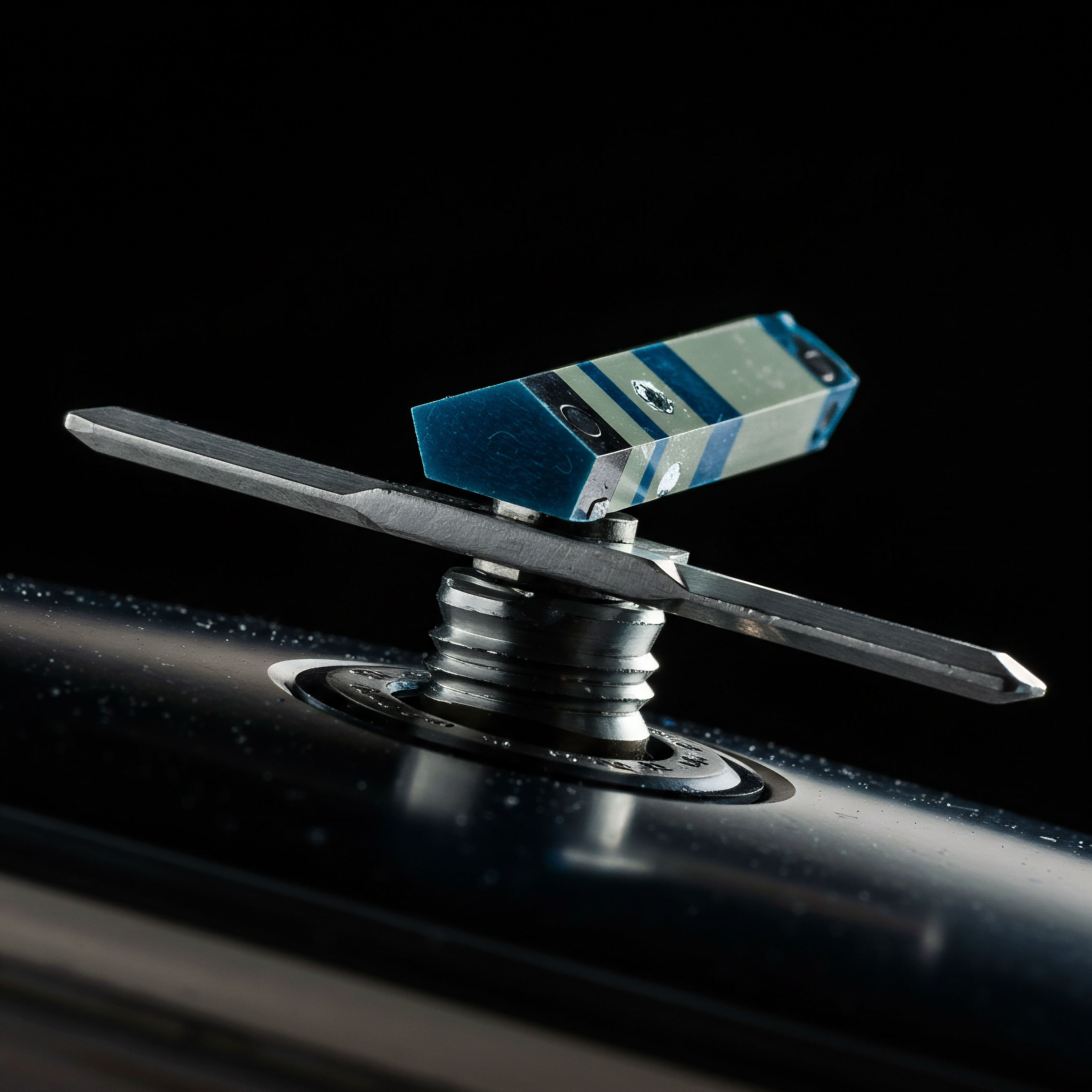

Deploying RFQ for complex options structures ensures concurrent execution, safeguarding the integrity of multi-leg strategies and enhancing overall profitability.

The choice of RFQ parameters significantly influences execution quality. Traders must specify not only the instrument and size but also the desired response time and any specific counterparty preferences. Thoughtful parameterization optimizes the competitive tension among market makers, consistently yielding superior fill rates and advantageous pricing. This meticulous attention to detail forms a cornerstone of professional trading practice.

- Define Precise Parameters: Clearly specify asset, quantity, strike, expiry, and desired execution window.

- Evaluate Counterparty Quotes: Assess received quotes based on price, fill probability, and counterparty reputation.

- Execute with Conviction: Act decisively once the optimal quote is identified, leveraging the temporary liquidity advantage.

- Post-Trade Analysis: Review execution metrics against market benchmarks to refine future RFQ submissions.

My conviction in RFQ stems from observing countless instances where disciplined application yields superior outcomes. The capacity to command better prices, consistently, for any substantial trade, provides an undeniable competitive advantage in these markets. This methodical approach elevates trading from speculative activity to a systematic pursuit of alpha.

Integrated Portfolio Command

Expanding one’s mastery of RFQ execution transcends individual trade optimization; it involves integrating this capability into a broader portfolio management framework. This advanced application focuses on leveraging RFQ for systematic risk management, capital allocation, and the construction of robust, alpha-generating strategies. It represents a progression from tactical execution to strategic portfolio command.

Systematic Risk Mitigation

Integrating RFQ into a risk management framework allows for proactive hedging and exposure adjustment. When portfolio managers identify a concentration risk or a need to rebalance, RFQ provides an efficient channel to execute large, offsetting positions. This minimizes the price impact associated with significant reallocations, preserving the portfolio’s intended risk profile. It offers a surgical approach to managing market exposures.

For instance, managing gamma risk in a large options book demands dynamic adjustments. Using RFQ for delta hedging allows for the efficient execution of underlying crypto assets or futures contracts, securing competitive pricing for the necessary adjustments. This prevents the erosion of P&L that occurs when large hedging trades move the market against the portfolio. The precision offered by RFQ becomes a critical component of sophisticated risk controls.

Enhanced Capital Allocation

RFQ significantly enhances capital allocation efficiency. By consistently securing better execution prices, the capital deployed for each trade works harder, generating higher returns for the same level of risk. This optimization extends to structuring bespoke derivatives positions that precisely match investment mandates, ensuring that capital is always directed towards its most productive use. The ability to tailor execution empowers a more agile investment process.

Consider the strategic advantage of deploying capital into complex, multi-asset options strategies. An RFQ system facilitates the coordinated execution of these intricate positions across different crypto assets and derivatives types. This synchronized execution reduces basis risk and ensures that the intended portfolio structure is implemented with maximal efficiency. It transforms theoretical allocation models into actionable market realities.

The Architecture of Sustained Edge

The sustained edge derived from mastering RFQ execution lies in its capacity to create a feedback loop of continuous improvement. Each precisely executed trade, each optimized spread, and each efficiently managed risk position contributes to a refined understanding of market microstructure. This iterative process allows traders to continuously adapt and enhance their execution strategies, building an insurmountable advantage over time.

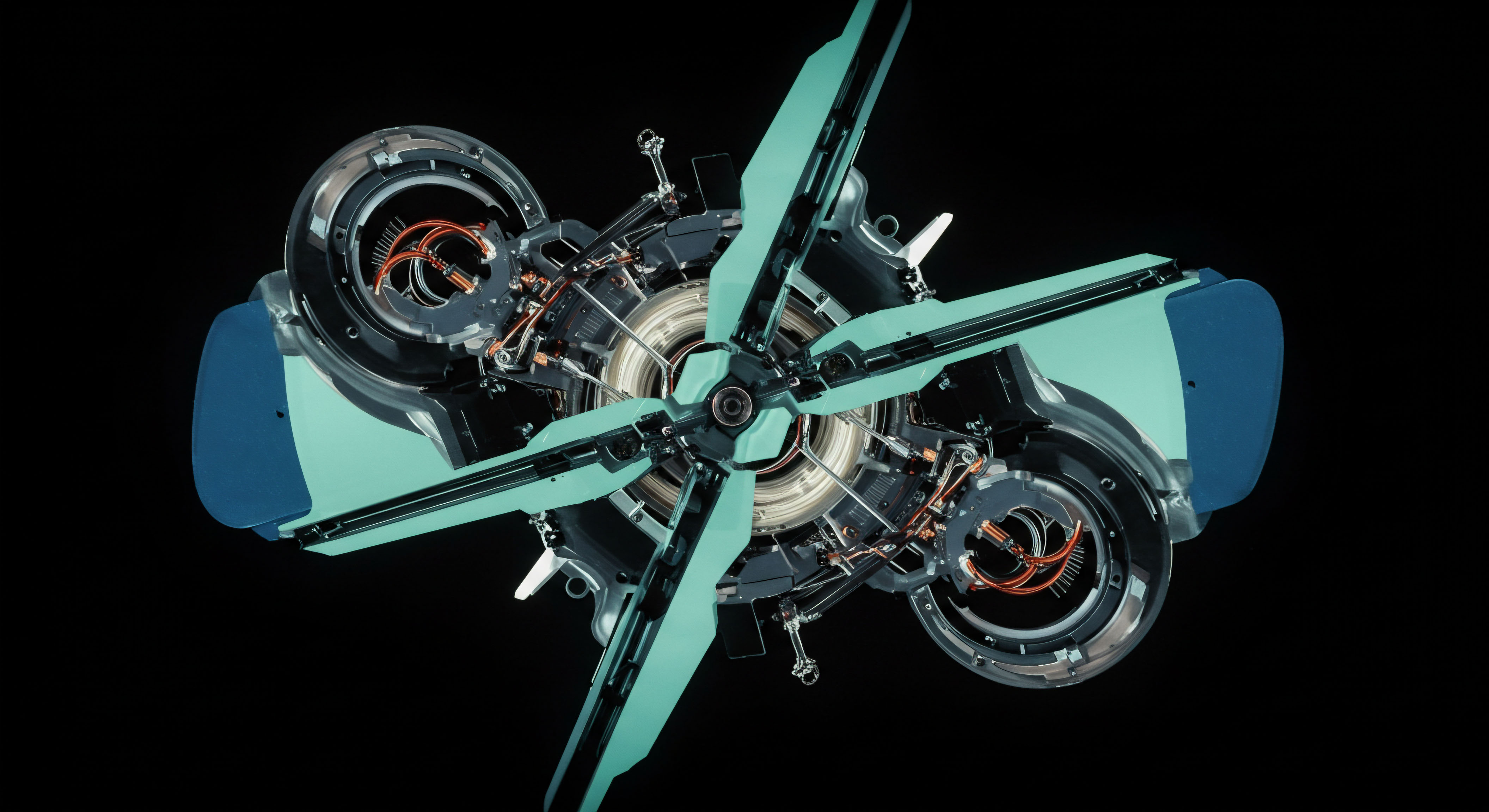

Mastery of RFQ execution transforms individual trades into components of a cohesive, alpha-generating portfolio strategy, securing long-term market advantage.

The true power of RFQ lies in its inherent capacity to provide a measurable advantage across a multitude of market conditions. It enables traders to approach market volatility not with trepidation, but with a toolkit designed to capitalize on dislocation. This empowers a proactive stance, where liquidity is commanded, and pricing is optimized, rather than passively accepted.

Future Market Orchestration

The journey through RFQ execution culminates in a profound redefinition of market engagement. Traders move beyond mere participation, stepping into a role of active market orchestration. The consistent application of these advanced techniques shapes a future where individual ambition converges with systemic advantage, forging an undeniable presence within the volatile crypto derivatives landscape. This strategic command over execution pathways becomes the ultimate differentiator.

Glossary

Bitcoin Options Block

Btc Straddle Block

Eth Collar Rfq

Volatility Block Trade