The Foundation of Market-Neutral Advantage

Consistent returns in crypto markets often arise from precise financial engineering, a domain where the basis trade holds significant sway. This powerful mechanism captures value from the differential between a cryptocurrency’s spot price and its corresponding futures contract. A trader simultaneously acquires the underlying asset in the spot market and sells a futures contract for the same asset, creating a market-neutral position. This approach insulates capital from directional price swings, offering a path to steady gains independent of broader market volatility.

Understanding the underlying mechanics of this trade reveals its operational elegance. Futures contracts, especially perpetual ones, often trade at a premium or discount to the spot price. This difference, the “basis,” reflects factors like supply, demand, and prevailing funding rates.

Positive funding rates, where long positions compensate short positions, particularly benefit those employing a short futures leg in a basis trade, providing an additional yield stream. Such a structural advantage allows for the systematic extraction of alpha.

Achieving consistent returns requires a disciplined focus on market structure and the systematic exploitation of pricing discrepancies.

Mastering this fundamental principle sets the stage for a strategic transformation in one’s approach to digital asset markets. It shifts focus from speculative directional bets to a calculated arbitrage of market inefficiencies. The initial grasp of the basis trade represents a significant step towards becoming a sophisticated participant, someone who commands rather than merely reacts to market movements. This initial insight into market-neutral strategies equips individuals with a robust tool for capital growth.

Deploying Capital for Engineered Returns

Translating theoretical understanding into tangible gains requires precise execution and a methodical approach to market observation. The alpha-focused portfolio manager recognizes that consistent profitability stems from a rigorous application of proven methods. Deploying capital effectively within the basis trade demands a keen eye for market conditions and a disciplined adherence to predefined entry and exit criteria. This section details the actionable strategies that elevate basis trading from a conceptual exercise to a revenue-generating operation.

Identifying Opportunities and Executing with Precision

Profitable basis trades originate from identifying discrepancies in pricing across different venues and maturities. A thorough analysis of futures curves and funding rate differentials guides selection. Traders actively seek contracts exhibiting a strong contango, where futures prices exceed spot prices, to maximize potential carry income. Precision matters.

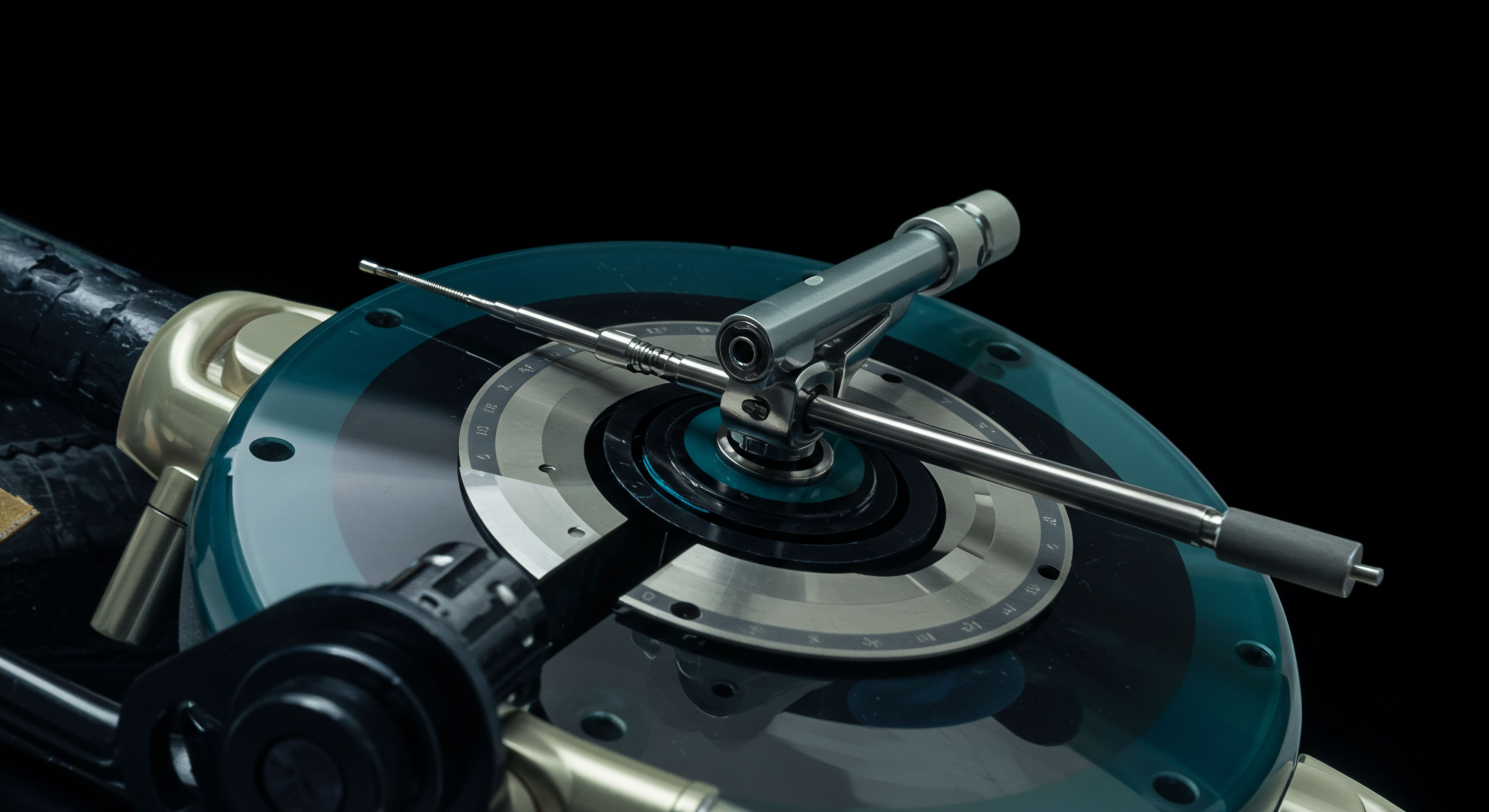

Block trading, particularly for options, can offer superior execution. This involves transacting large orders off-exchange with a pre-negotiated price, minimizing market impact and securing favorable terms.

Leveraging Multi-Dealer Liquidity for Optimal Fills

Accessing a wide array of liquidity providers remains necessary for securing optimal execution. Engaging multiple dealers through private channels or specialized platforms ensures competitive pricing and better fill rates. The objective centers on minimizing slippage, which erodes potential returns.

A sophisticated trader commands liquidity, dictating terms and ensuring their orders move the market minimally. This active management of execution quality directly impacts the trade’s profitability.

Managing Risk and Optimizing Capital

Risk mitigation stands as a foundational element of any sustainable trading operation. The basis trade, while market-neutral in its directional exposure, carries specific risks demanding careful oversight.

- Funding Rate Volatility: Unfavorable shifts in funding rates can diminish or negate the expected yield. Constant monitoring and dynamic adjustments to positions mitigate this exposure.

- Liquidation Risk: Maintaining adequate collateral in futures positions is essential. Unexpected price movements can trigger margin calls, necessitating swift action to avoid forced liquidation.

- Counterparty Risk: When dealing with OTC options or block trades, evaluating the creditworthiness of the counterparty becomes a decisive assessment.

- Operational Overhead: Managing multiple positions across various venues requires robust systems and constant attention. Automation assists in reducing human error and improving response times.

Optimizing capital allocation means deploying only the necessary collateral to maintain positions, freeing up remaining capital for other opportunities. This strategic deployment maximizes the efficiency of every unit of capital. Consistent evaluation of position sizing and exposure limits protects the trading book from unforeseen events. Capital discipline is non-negotiable.

Strategic Integration for Portfolio Dominance

Moving beyond individual trades, the seasoned investor seeks to integrate market-neutral strategies into a cohesive portfolio design. This elevated perspective transforms the basis trade from a standalone tactic into a systemic component of wealth generation. Mastering its advanced applications means deploying it as a versatile tool for capital efficiency, risk hedging, and long-term alpha compounding. A sophisticated understanding of its place within a broader investment universe unlocks its full potential.

Capital Efficiency through Advanced Basis Deployments

Optimizing capital usage defines a superior portfolio. Advanced basis deployments involve layering strategies to enhance returns on deployed capital. Consider using low-volatility assets as collateral for basis trades, thereby generating yield on otherwise static holdings.

The re-hypothecation of assets, carefully managed, can significantly amplify capital velocity without increasing directional exposure. This approach views capital as an active resource, always seeking its highest and best use.

Hedging Volatility with Basis Overlays

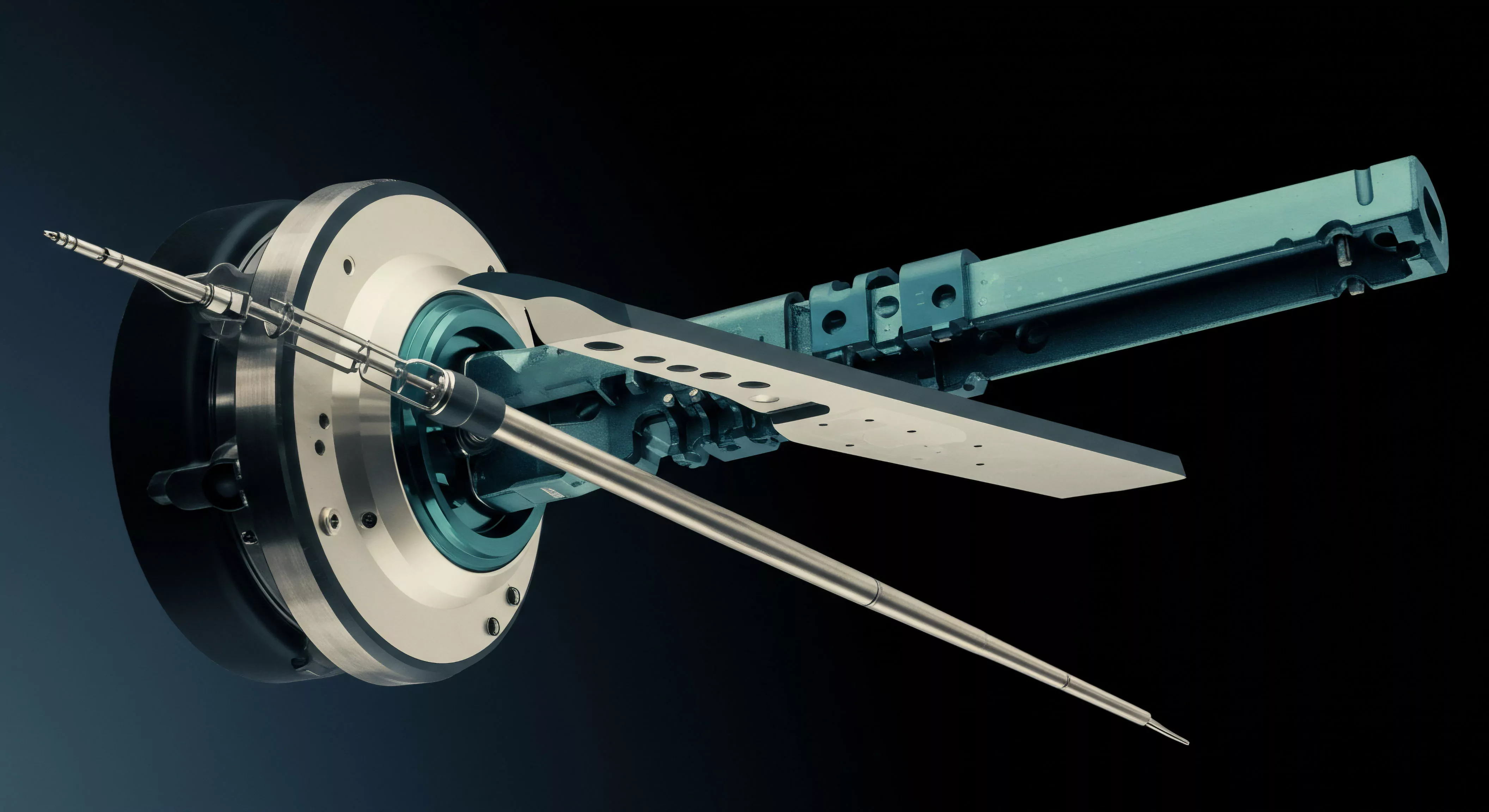

Market volatility, a constant companion in crypto, becomes a source of opportunity when skillfully managed. Basis overlays, for instance, involve pairing a basis trade with complementary options positions. A long straddle on a futures contract, combined with a short basis position, can offer protection against sudden market movements impacting the basis itself. This sophisticated pairing creates a robust defense against unexpected shifts in market structure.

The interaction between implied and realized volatility presents an engaging, often challenging, landscape for such synthetic constructs. Precisely how these complex interdependencies play out under extreme market stress remains an area of ongoing quantitative inquiry and simulation, requiring continuous model refinement.

Algorithmic Execution for Systematic Edge

Automated systems execute basis trades with unparalleled speed and consistency. Algorithmic execution minimizes human error and capitalizes on fleeting market opportunities. Developing custom algorithms that monitor basis differentials, funding rates, and execution costs provides a sustained competitive advantage.

These systems can dynamically adjust position sizes, rebalance collateral, and even search for cross-exchange arbitrage opportunities with precision. Such technological leverage transforms the operational aspect of trading.

The strategic deployment of basis trades within a diversified portfolio contributes to overall risk mitigation. Allocating a portion of assets to market-neutral strategies reduces the portfolio’s beta exposure. This structural reduction in systemic risk enhances stability and provides a reliable income stream during periods of market contraction.

The long-term impact on compounded returns proves considerable, offering a consistent compounding effect over time. Building such resilience shapes enduring financial success.

The Enduring Calculus of Edge

The journey to mastering market-neutral crypto returns culminates in a thorough understanding of market mechanics and one’s own operational discipline. Consistent profitability stems from a relentless pursuit of efficiency and a strategic application of financial tools. The basis trade stands as a demonstration of the power of structured thinking in volatile environments. It offers a clear pathway to constructing a robust financial position, independent of speculative whims.

This strategic mindset, once ingrained, reshapes the entire approach to wealth creation, defining a new standard for market engagement. Future market conditions will always present their unique challenges, yet the principles of engineered returns remain steadfast.

Glossary

Basis Trade

Spot Market

Funding Rates

Market-Neutral Strategies

Basis Trades

Block Trading

Liquidity Providers

Capital Efficiency