The Physics of Price and the Mandate for Stealth

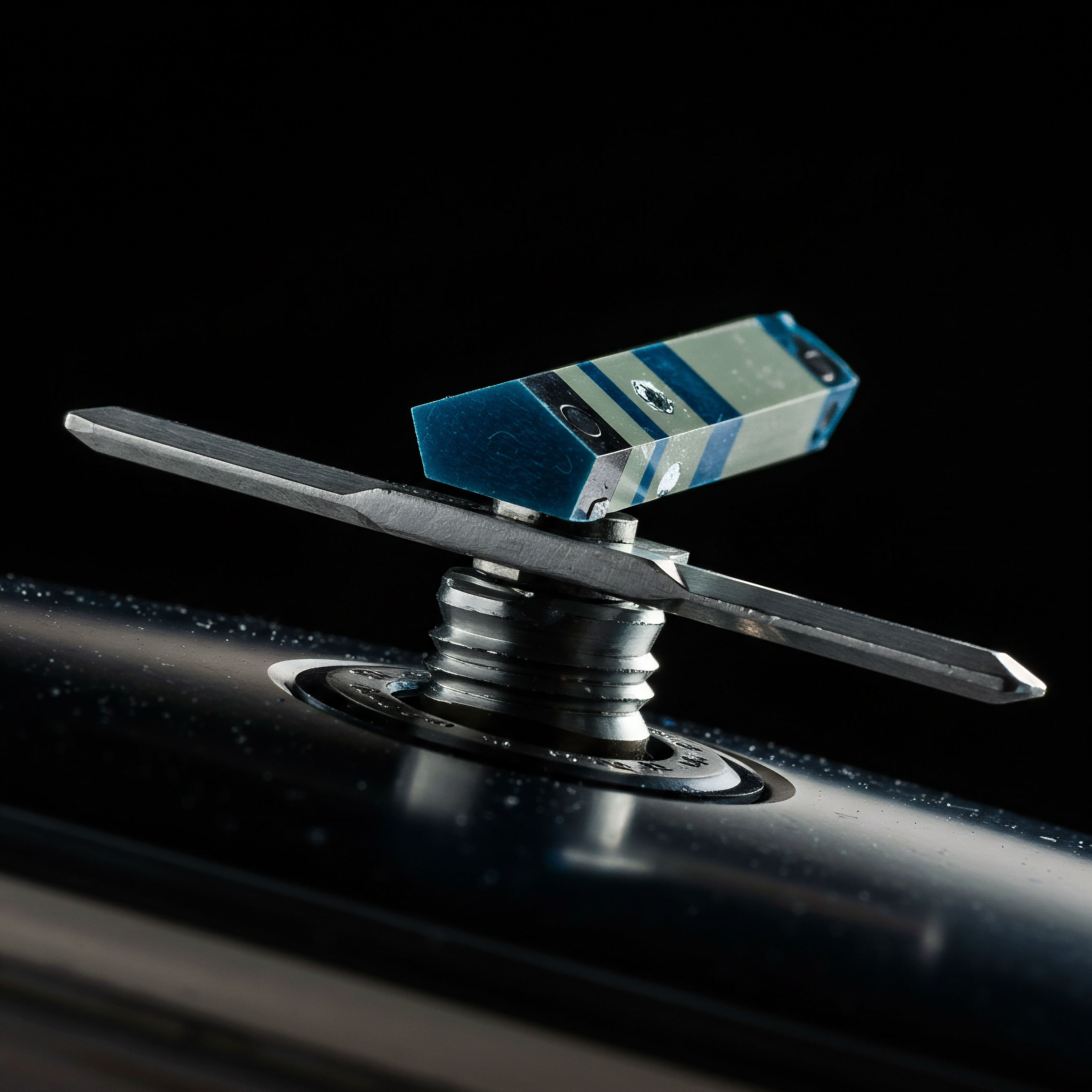

Executing a large order in any market is a confrontation with a fundamental force ▴ visibility creates impact. A significant buy or sell order, placed directly onto the open market, acts like a boulder dropped into a still pond, sending ripples that distort the price before the full position can be established. This phenomenon, known as price impact, is the direct cost of broadcasting intent. It comprises two primary components a temporary liquidity effect, where the price moves to absorb the large volume, and a permanent information effect, where other market participants adjust their valuation based on the perceived knowledge behind the trade.

For the institutional operator, managing this impact is the core discipline. The objective is to transfer significant risk with minimal friction, a task that requires moving away from the public spectacle of the central limit order book and into a more discreet operational theater. This is the strategic purpose of the block trade, a privately negotiated transaction designed to execute large volumes with precision and control.

Block trading is a function of necessity for any serious market participant, from quantitative funds rebalancing a portfolio to corporations managing treasury assets. It addresses the structural limitations of public exchanges, where liquidity for immense orders is fragmented and ephemeral. Attempting to execute a multi-million dollar options position through standard market orders would be an exercise in self-defeat, telegraphing the strategy and systematically worsening the execution price with each partial fill. The professional alternative is to arrange the transaction “upstairs,” away from the continuous market, either through direct negotiation with a known counterparty or, more efficiently, through a competitive auction.

This brings us to the Request for Quotation (RFQ) system, a sophisticated mechanism that operationalizes discretion. An RFQ allows a trader to anonymously solicit competitive bids or offers from a select group of market makers for a specific, large-scale trade. This process transforms the chaotic search for liquidity into a controlled, private auction, ensuring the initiator receives the best possible price from a pool of committed capital providers without ever revealing their hand to the broader market.

The Execution Algorithm a Framework for Action

Mastering large-scale execution requires a systemic approach, moving from brute-force market orders to intelligent, algorithmically-guided strategies. These methods are designed to minimize market footprint by breaking down a single large order into smaller, less conspicuous trades executed over time. The choice of algorithm is a strategic decision, dictated by the urgency of the trade, the liquidity profile of the asset, and the desired risk tolerance for price slippage. Each method represents a different philosophy of interaction with the market’s liquidity, providing a toolkit for precise, objective-driven execution.

Algorithmic Dispersal Strategies

The primary function of execution algorithms is to mask the parent order’s true size and intent. They achieve this by mimicking the natural flow of smaller, routine trades, thereby reducing the information leakage that causes adverse price movement. An understanding of these core strategies is fundamental to constructing a professional-grade execution plan.

Time-Weighted Average Price (TWAP)

The TWAP strategy is a disciplined, methodical approach to execution. It divides the total block order into smaller, identical trade sizes and executes them at regular intervals over a predetermined period. For instance, a 1,000 BTC block order could be executed as 100 trades of 10 BTC each, spaced five minutes apart over approximately eight hours. This method is systematic and predictable, making it an effective tool for executing orders that are not time-sensitive and where the primary goal is to participate with the market’s average price over a specific session.

Its strength lies in its simplicity and its capacity to reduce the impact of any single trade. The core assumption is that by spreading participation evenly over time, the final execution price will closely approximate the time-weighted average, neutralizing the effect of short-term volatility spikes.

Volume-Weighted Average Price (VWAP)

The VWAP strategy introduces a layer of market intelligence to the execution process. Instead of executing trades at fixed time intervals, it links execution to trading volume. The algorithm breaks down the block order and releases smaller trades proportionate to the actual trading volume occurring in the market. During periods of high activity, it trades more aggressively; during lulls, it pulls back.

This dynamic participation is designed to align the execution with the market’s natural liquidity cycles, making the trades less detectable. Research indicates that price impact is a concave function of order size, meaning larger trades have a disproportionately larger impact. By participating more heavily when the market can absorb more volume, VWAP seeks to minimize this friction. This makes it a superior choice for orders where minimizing market impact is the paramount concern and the trader is willing to accept a degree of uncertainty in the execution timeline.

Studies have consistently found that block purchases carry a larger permanent price impact than block sales, suggesting that buy-side orders are perceived as containing more firm-specific private information, while sales may be driven by liquidity needs.

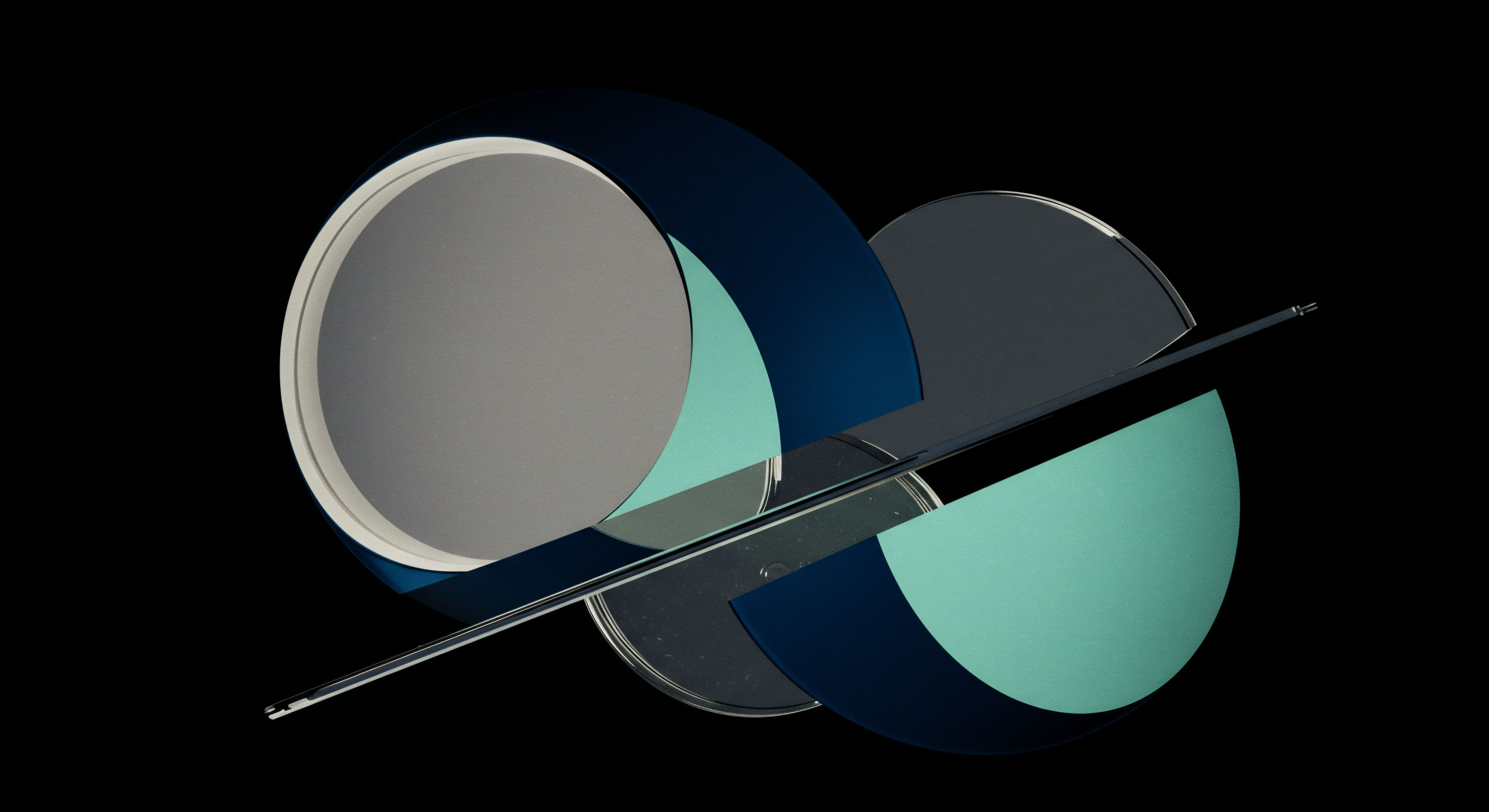

Sourcing Liquidity beyond the Public View

For truly substantial orders, even the most sophisticated algorithms may be insufficient if the only liquidity source is the public order book. Professional execution requires accessing deeper, more concentrated pools of liquidity. This is where dedicated institutional venues become indispensable components of the trading apparatus.

- Dark Pools These are private exchanges where institutions can trade large blocks of assets anonymously. The defining feature of a dark pool is the absence of a public order book; trades are matched without pre-trade price and volume transparency. This opacity is a powerful tool for reducing information leakage, as the size and price of the order are only revealed after the trade is complete. Executing within this environment prevents other market participants from front-running the order or adjusting their strategies in response to the large institutional flow.

- Request for Quotation (RFQ) Networks An RFQ system, like the one offered by Greeks.live, represents a more proactive and competitive approach to sourcing liquidity. Instead of passively waiting for a match in a dark pool, a trader initiates an RFQ to a curated list of market makers. This creates a competitive auction for the order. For complex, multi-leg options strategies, this is the superior mechanism. It allows for the simultaneous pricing of the entire structure, eliminating the “legging risk” associated with executing each part of the trade separately in the open market. The competitive nature of the auction ensures best execution by forcing market makers to provide their tightest possible price for the entire package.

- Over-the-Counter (OTC) Desks For the largest and most bespoke trades, direct negotiation with an OTC desk remains a primary channel. These desks specialize in handling transactions that are too large or complex for any other venue. They use their own capital to take the other side of the trade, providing a guaranteed fill at a pre-agreed price. This path offers maximum certainty and discretion, effectively removing the market impact variable from the equation entirely, albeit at a negotiated cost reflected in the bid-ask spread.

The System of Alpha Generation

Mastering block execution is the entry point to a more advanced operational capability. The true strategic horizon opens when these execution techniques are integrated into a holistic portfolio management framework. This involves viewing large-scale trading not as a series of isolated events, but as a continuous process of risk transfer and alpha generation.

The ability to move significant positions with minimal friction unlocks strategies that are structurally unavailable to those confined to the retail-grade order book. It is the difference between reacting to the market and shaping your engagement with it on your own terms.

From Execution Tactic to Portfolio Strategy

The capacity for discreet, large-scale trading transforms how a portfolio is managed. A fund manager can now execute a major thematic shift ▴ for instance, rotating a significant allocation from BTC to ETH ▴ without causing a cascade of front-running that erodes the value of the move. This requires a synthesis of execution tools. The initial analysis might identify the ideal portfolio rebalance.

The next step is to design an execution strategy that combines algorithmic trading for the more liquid components with a series of RFQs for the complex options overlays that hedge the portfolio’s new risk profile. This is a system of interlocking parts, where the efficiency of one component enhances the effectiveness of the whole.

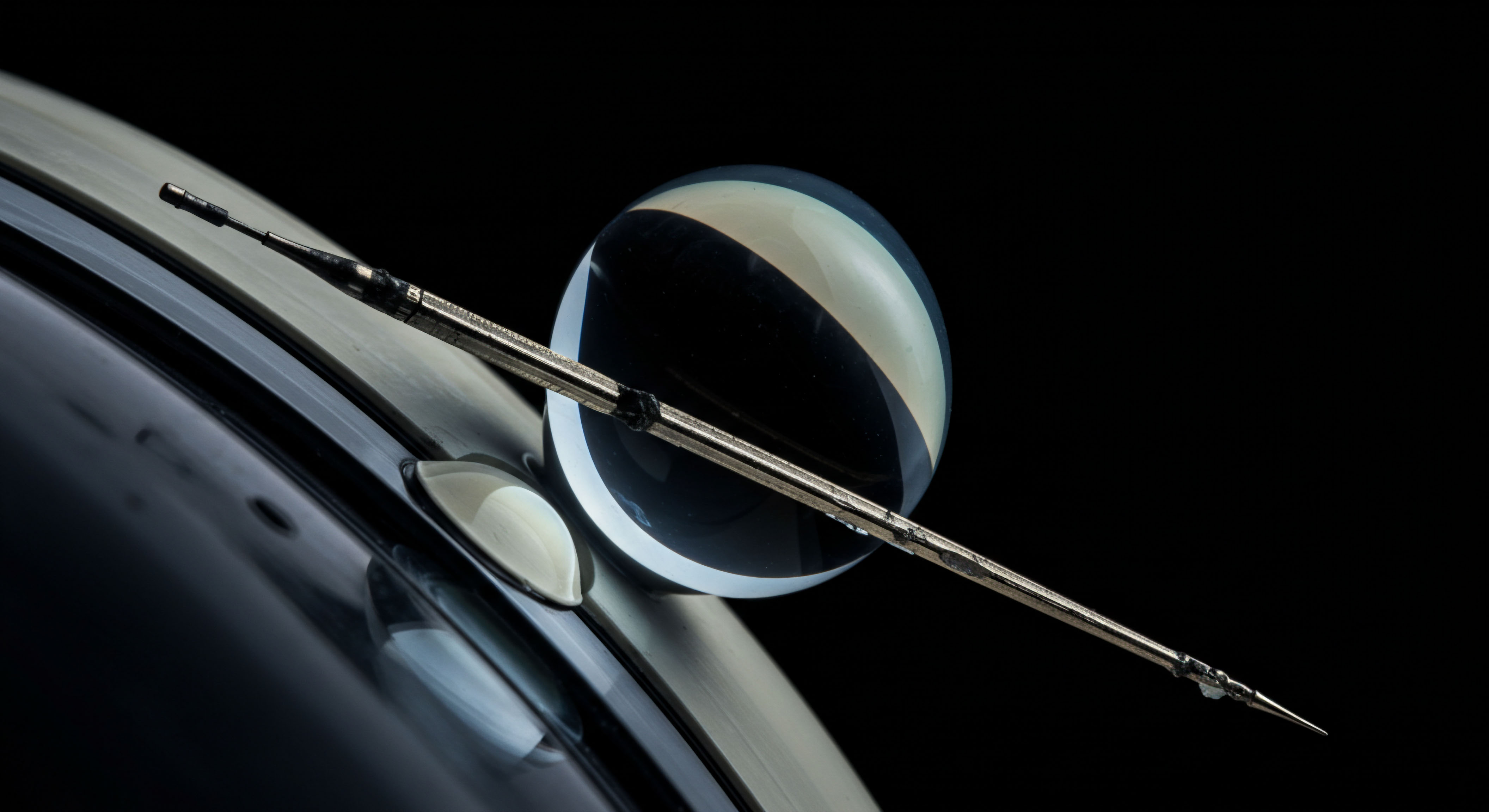

Advanced Applications in Derivatives

The derivatives market is where the mastery of block execution yields its most significant advantages. Consider the execution of a complex, multi-leg options strategy like a “risk reversal” collar on a large holding of a volatile crypto asset. Attempting to execute the buy and sell legs separately on the open market is fraught with peril. Price fluctuations between the execution of each leg can turn a theoretically profitable hedge into a losing proposition.

An RFQ system solves this structural problem. It allows the entire multi-leg position to be quoted and executed as a single, atomic transaction. Market makers compete to price the entire package, providing a net price that eliminates legging risk and ensures the strategic integrity of the position. This capability allows a portfolio manager to deploy sophisticated risk management and yield enhancement strategies with confidence, knowing that the execution will precisely reflect the intended strategy.

This visible intellectual grappling with the nature of market information is essential. The academic literature often separates the temporary liquidity impact from the permanent informational impact of a trade. However, in the real-time pressures of execution, they are deeply intertwined. An algorithm that minimizes the temporary liquidity footprint also inherently dampens the informational signal it sends.

A well-executed block trade, therefore, achieves two goals simultaneously ▴ it secures a better price and it preserves the strategic optionality of the portfolio by keeping its future intentions opaque. The ultimate expression of this mastery is the ability to use block trading not just as a defensive tool to minimize cost, but as an offensive one to establish a strategic core position before the broader market recognizes the opportunity. It is the operational embodiment of foresight.

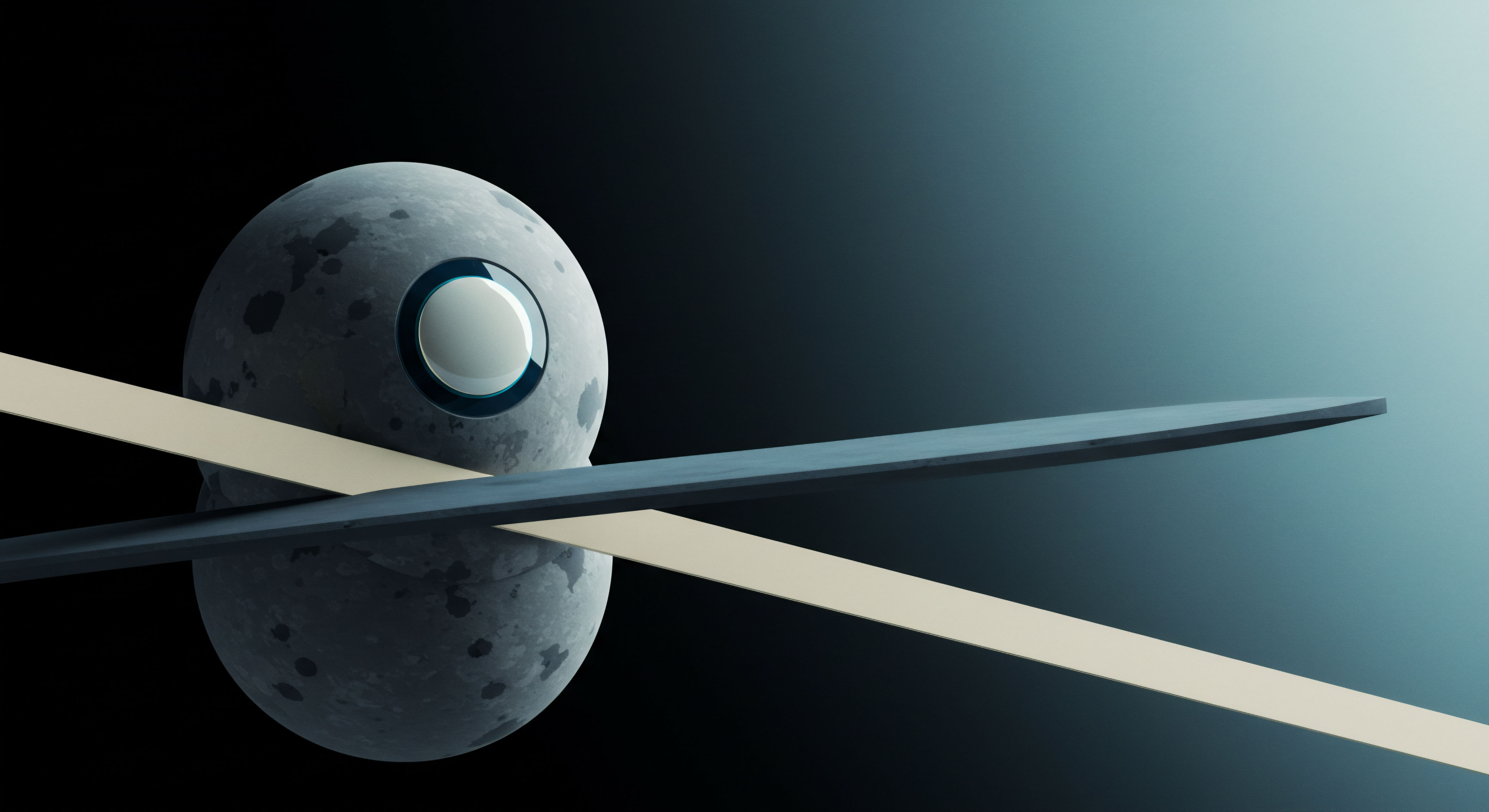

The Quiet Signature of Power

The market is an ocean of noise. Within it, the largest and most effective operators move with a deliberate quietness. Their actions are felt in the shifting tides of capital, yet their direct hand is rarely seen. This is the ultimate objective of mastering large-scale execution ▴ to translate powerful conviction into market position with the silent efficiency of a professional.

The tools and strategies ▴ algorithmic execution, dark pools, RFQ networks ▴ are the grammar of this silent language. They provide the means to operate on a scale that matters, without paying the tax of visibility. The journey from retail-level trading to institutional-grade operation is defined by this progressive mastery of stealth. It is a shift in mindset, from participating in the market as it is presented, to engaging with its deep structures to achieve a specific, strategic outcome. The final measure of success is not the volume of the trade, but the subtlety of its footprint.

Glossary

Order Book

Block Trading

Request for Quotation

Market Makers

Price Slippage

Twap

Vwap

Market Impact

Dark Pools

Best Execution

Rfq