Mastering Block Execution

Engaging with the digital asset markets at scale demands a refined approach to execution. Block trading in cryptocurrencies offers a direct conduit for substantial capital deployment, sidestepping the frictions inherent in fragmented order books. This mechanism allows participants to transact significant volumes with a single counterparty, ensuring a more controlled entry or exit from positions.

Understanding the fundamental principles of these large-scale transactions establishes a crucial advantage. Such trades involve the direct negotiation of price and size between two parties, typically facilitated by an intermediary. This direct interaction mitigates the price impact often associated with large orders placed on public exchanges, preserving the intended valuation of a position.

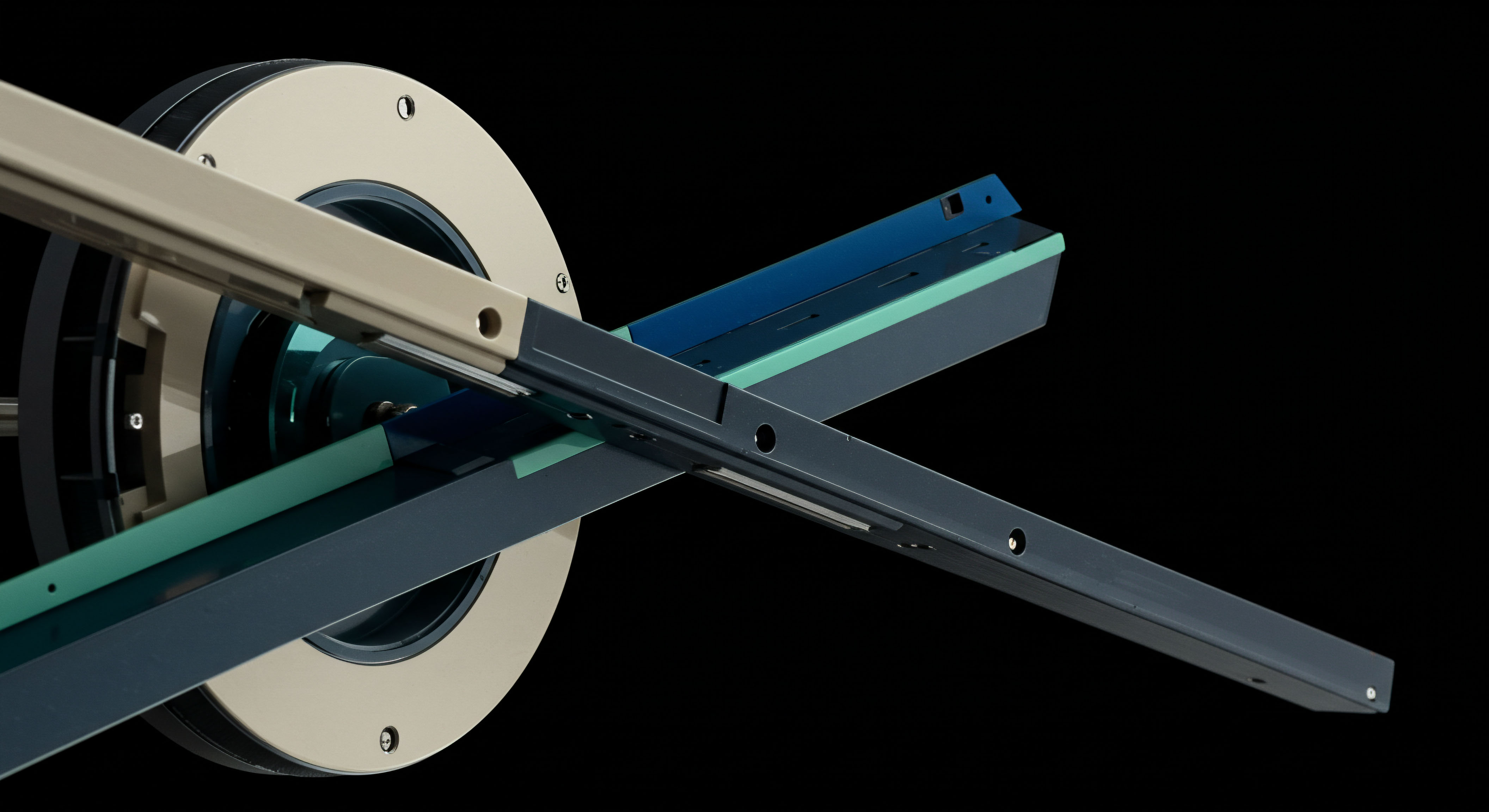

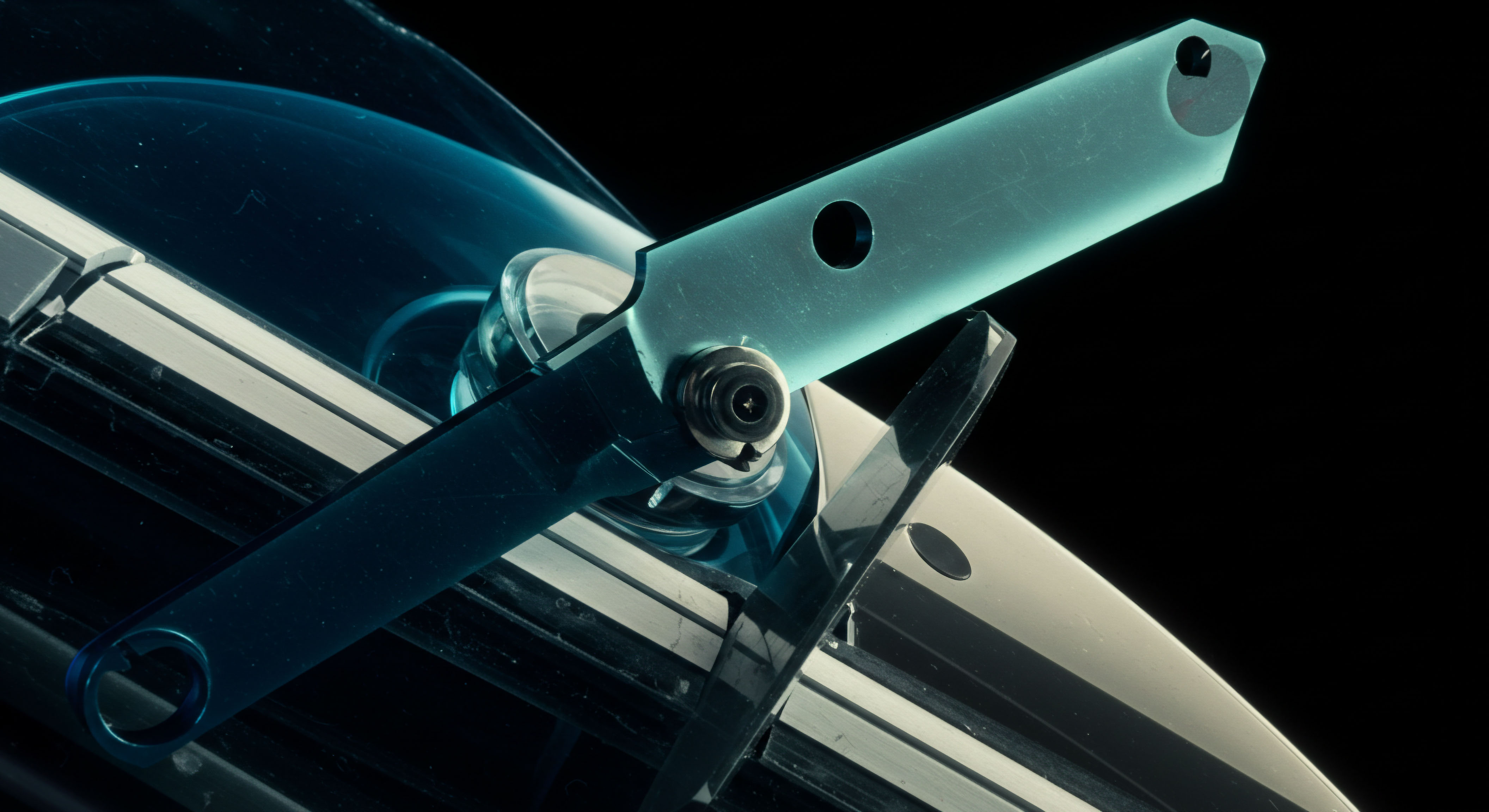

Precision in large-volume crypto execution defines a sophisticated trading approach.

The core utility of block trades lies in their capacity to minimize market disturbance. By moving volume off-exchange or through dedicated venues, participants shield their intentions from general market observation. This discretion safeguards against adverse price movements that often occur when substantial liquidity is sought through conventional means. Achieving this level of transactional control marks a clear progression for any serious market participant.

Navigating the nuances of multi-dealer liquidity within this framework reveals a deeper understanding of market dynamics. Securing the best execution for large positions involves soliciting competitive bids from multiple counterparties, a process known as a Request for Quote (RFQ). This competitive environment drives optimal pricing and efficient fills, ensuring that capital is deployed with maximum efficacy.

Achieving superior outcomes in these markets requires a dedication to systemic solutions. This means recognizing the inherent benefits of specialized execution methods over standard approaches, a distinction that fundamentally alters potential returns.

Strategic Capital Deployment

Deploying capital through crypto block trades transforms theoretical market views into tangible, high-impact positions. This section outlines actionable strategies for integrating these powerful execution tools into your investment framework, focusing on the mechanics of achieving superior outcomes across various market conditions.

Volatility Capture through Options Block Trades

Options block trades provide a robust mechanism for expressing complex volatility views with precision. Constructing multi-leg options spreads through a single, negotiated transaction allows for highly specific risk-reward profiles. This approach isolates desired market exposures, such as implied volatility shifts, while controlling directional bias.

Consider a BTC straddle block, where one simultaneously buys both a call and a put option with the same strike price and expiry. Executing this as a block trade minimizes the slippage that could arise from leg-by-leg execution on an order book. The unified execution preserves the intended risk profile, crucial for strategies dependent on exact entry points.

ETH Collar RFQ for Enhanced Portfolio Stability

An ETH collar RFQ provides a sophisticated method for managing risk on existing Ether holdings. This strategy involves selling an out-of-the-money call option and purchasing an out-of-the-money put option, effectively creating a price band for your asset. Utilizing an RFQ process for this multi-leg transaction ensures competitive pricing across all components, optimizing the cost of protection.

The direct negotiation inherent in an RFQ streamlines the process of establishing such a protective structure. This allows a trader to define their desired parameters, receive quotes from multiple liquidity providers, and select the most advantageous terms. The result is a finely tuned hedge that maintains upside potential within defined limits while providing downside protection.

Anonymous Options Trading for Discretion

Maintaining discretion during large options position accumulation holds significant value. Anonymous options trading via block channels allows market participants to build or unwind substantial exposures without signaling their intent to the broader market. This mitigates the risk of front-running or adverse price movements driven by public order flow.

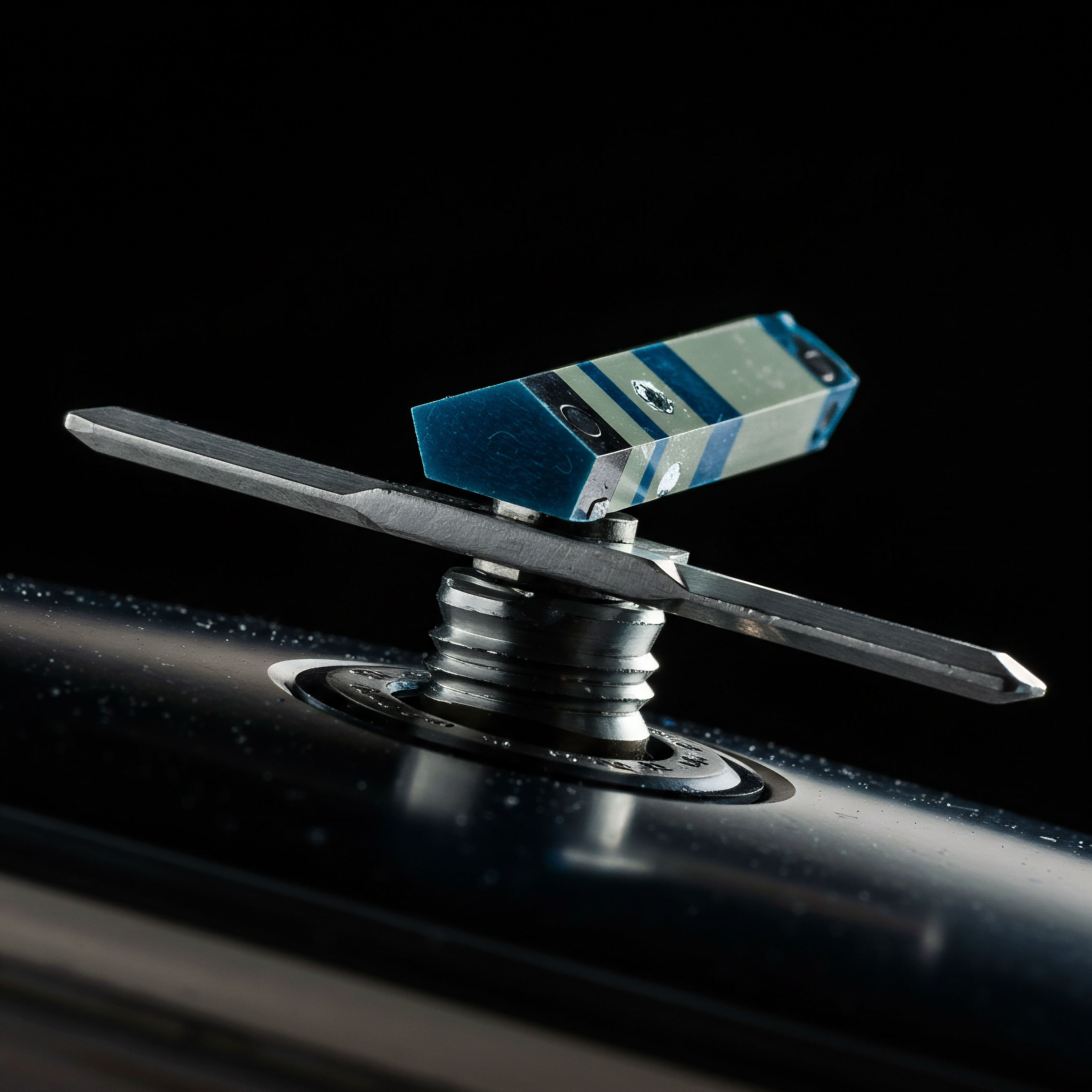

Optimal execution stems from a disciplined process of evaluating and selecting competitive liquidity.

The inherent privacy of OTC options transactions ensures that a trader’s strategic positioning remains confidential. This allows for the execution of complex strategies, such as accumulating a significant directional bet or establishing a large volatility position, without influencing market perception prematurely.

Execution Optimization for Large Crypto Trades

Minimizing slippage stands as a paramount objective for large crypto trades. Block trading, particularly when coupled with multi-dealer liquidity, addresses this directly. Requesting quotes from several institutional counterparties forces competition, driving down transaction costs and securing a superior fill price for the executed volume.

This method contrasts sharply with attempting to fill a large order through incremental trades on an exchange, which can inevitably walk the book and degrade the average execution price. A single, negotiated block trade locks in a specific price for the entire quantity, providing certainty and cost efficiency.

A rigorous evaluation of potential liquidity providers forms the bedrock of this process. The ability to compare various quotes for the same block trade, encompassing price, size, and settlement terms, ensures the most favorable outcome. This analytical rigor transforms execution from a reactive event into a proactive, strategic advantage.

- Direct Price Negotiation ▴ Secure a firm price for the entire block volume, avoiding market impact.

- Multi-Dealer Competition ▴ Solicit quotes from various liquidity providers to ensure optimal pricing.

- Reduced Slippage ▴ Execute large orders with minimal deviation from the desired price point.

- Enhanced Discretion ▴ Maintain confidentiality regarding trading intentions for strategic advantage.

- Customizable Structures ▴ Tailor options spreads and complex derivatives to precise market views.

Advanced Market Command

Advancing beyond foundational understanding, the strategic integration of crypto block trades and RFQ mechanisms into a comprehensive portfolio framework unlocks a superior tier of market command. This expansion involves leveraging these tools for sophisticated risk management, alpha generation, and long-term capital preservation.

The true mastery of these instruments lies in their application as components of a dynamic asset allocation model. Consider a scenario where a sudden shift in macroeconomic indicators necessitates a rapid rebalancing of a substantial crypto portfolio. Executing these adjustments through block trades allows for swift, precise changes without incurring the punitive costs of market impact on public venues. The ability to effect such changes with discretion protects the portfolio’s integrity and its intended exposure profile.

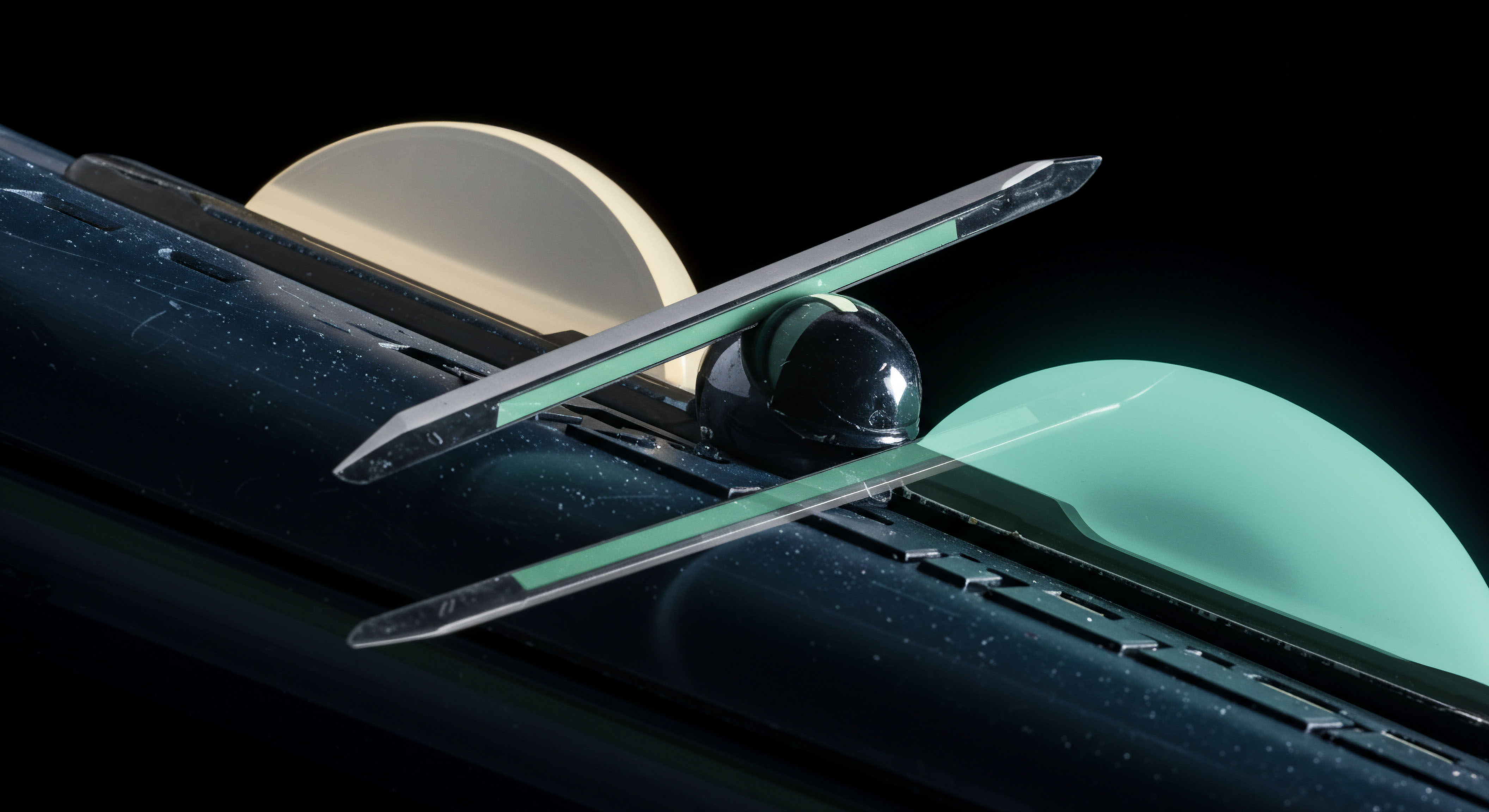

Sophisticated traders utilize block mechanisms to sculpt portfolio risk and capture elusive alpha.

A derivatives strategist understands that the market is a complex adaptive system, where informational asymmetry and liquidity fragmentation present both challenges and opportunities. Block trading, especially within the context of volatility products, allows for the precise monetization of these systemic characteristics. Crafting bespoke options strategies, such as dynamic gamma hedging through a series of block-executed options, becomes a tangible pathway to generating uncorrelated returns.

The integration of algorithmic execution within an RFQ framework further refines this capability. Imagine a proprietary algorithm designed to identify optimal entry points for a large directional trade. Instead of directly executing on a public exchange, the algorithm can trigger an RFQ, soliciting competitive quotes for a block trade. This approach marries the precision of quantitative analysis with the efficiency of off-exchange execution, securing a superior fill while minimizing market footprint.

This is where the distinction between merely trading and truly engineering market outcomes becomes apparent. The deliberate construction of a robust execution framework, one that prioritizes capital efficiency and discretion, serves as a cornerstone for consistent performance. It ensures that the conceptual edge derived from market analysis translates into realized gains, a testament to systematic foresight.

Understanding the interplay between market microstructure and the design of these execution venues reveals the deeper implications. Liquidity, often fragmented across various platforms, coalesces through the RFQ process, providing a centralized point of access for substantial order flow. This aggregation empowers the institutional participant, granting them a degree of control over their execution quality rarely achievable through conventional means. My conviction remains unwavering regarding the necessity of these advanced tools for any serious player in the digital asset space.

A significant portion of a portfolio manager’s edge arises from their capacity to minimize the hidden costs of execution. These often-overlooked expenses, stemming from slippage, information leakage, and adverse selection, can erode alpha over time. By consistently routing large orders through block desks and RFQ platforms, these frictional costs are systematically reduced, directly contributing to enhanced net returns. This disciplined approach elevates execution from a mere transaction to a strategic component of profit generation.

Precision in Digital Asset Markets

The landscape of digital asset trading continues its evolution, demanding ever-greater sophistication from its participants. Mastering crypto block trades signifies a strategic advancement, equipping traders with the capacity to navigate complex markets with unparalleled control and efficiency. This journey towards superior execution is not a destination, but a continuous refinement of process, a commitment to leveraging the most effective tools available for achieving consistent, exceptional results. Your command over these advanced mechanisms defines your position at the vanguard of this dynamic financial frontier.

Glossary

Block Trading

Block Trades

Multi-Dealer Liquidity

Best Execution

Btc Straddle Block

Eth Collar Rfq

Anonymous Options Trading