Mastering Crypto Options Foundations

Achieving superior execution in crypto options demands a direct line to deep liquidity, a capability precisely delivered by Request for Quote (RFQ) systems. This advanced mechanism allows institutional participants to solicit competitive pricing from multiple liquidity providers simultaneously, securing optimal terms for significant block trades and complex strategies. Understanding this foundational element unlocks a critical operational advantage in volatile digital asset markets.

The core utility of an RFQ system resides in its capacity to centralize dispersed market interest for bespoke derivatives transactions. A single query broadcasts specific options parameters to a network of professional dealers, thereby cultivating an environment of competitive price discovery. Providers vie for the order, ultimately yielding tighter spreads and superior fills for the initiating firm.

Professional-grade RFQ systems serve as a strategic command center, orchestrating liquidity to achieve superior pricing and execution for institutional crypto options trades.

Engaging with an RFQ process transforms options execution from a reactive endeavor into a proactive strategic maneuver. It provides the ability to define precise strike prices, expiry dates, and multi-leg structures, tailoring the instrument to an exact market view. This precision, combined with the inherent confidentiality of the process, safeguards against adverse market impact, a paramount concern for substantial capital deployments.

Strategic Options Execution

Translating market conviction into measurable alpha demands precision execution, especially within the dynamic landscape of crypto options. The strategic deployment of RFQ mechanisms empowers institutional investors to sculpt their desired exposure with unparalleled control, moving beyond simple directional bets to sophisticated, multi-dimensional strategies. This operational discipline forms the bedrock of consistent outperformance.

Achieving superior outcomes in crypto options hinges on the meticulous application of RFQ systems, transforming complex strategies into precise, capital-efficient maneuvers.

Optimizing Block Trades

Executing large crypto options orders, often termed block trades, requires a delicate balance of speed and discretion. RFQ systems facilitate this by providing a confidential channel for soliciting bids on substantial volumes, minimizing the price impact that plagues open market transactions. This process ensures liquidity providers compete directly, yielding a more favorable average entry price for the institution.

Managing Slippage

Slippage represents a silent tax on trading profits, eroding returns through unfavorable price movements between order placement and execution. Utilizing RFQ for block options execution significantly mitigates this risk. The simultaneous solicitation of quotes from multiple dealers creates a robust market environment, effectively locking in prices before order commitment and thereby preserving capital efficiency.

Crafting Multi-Leg Strategies

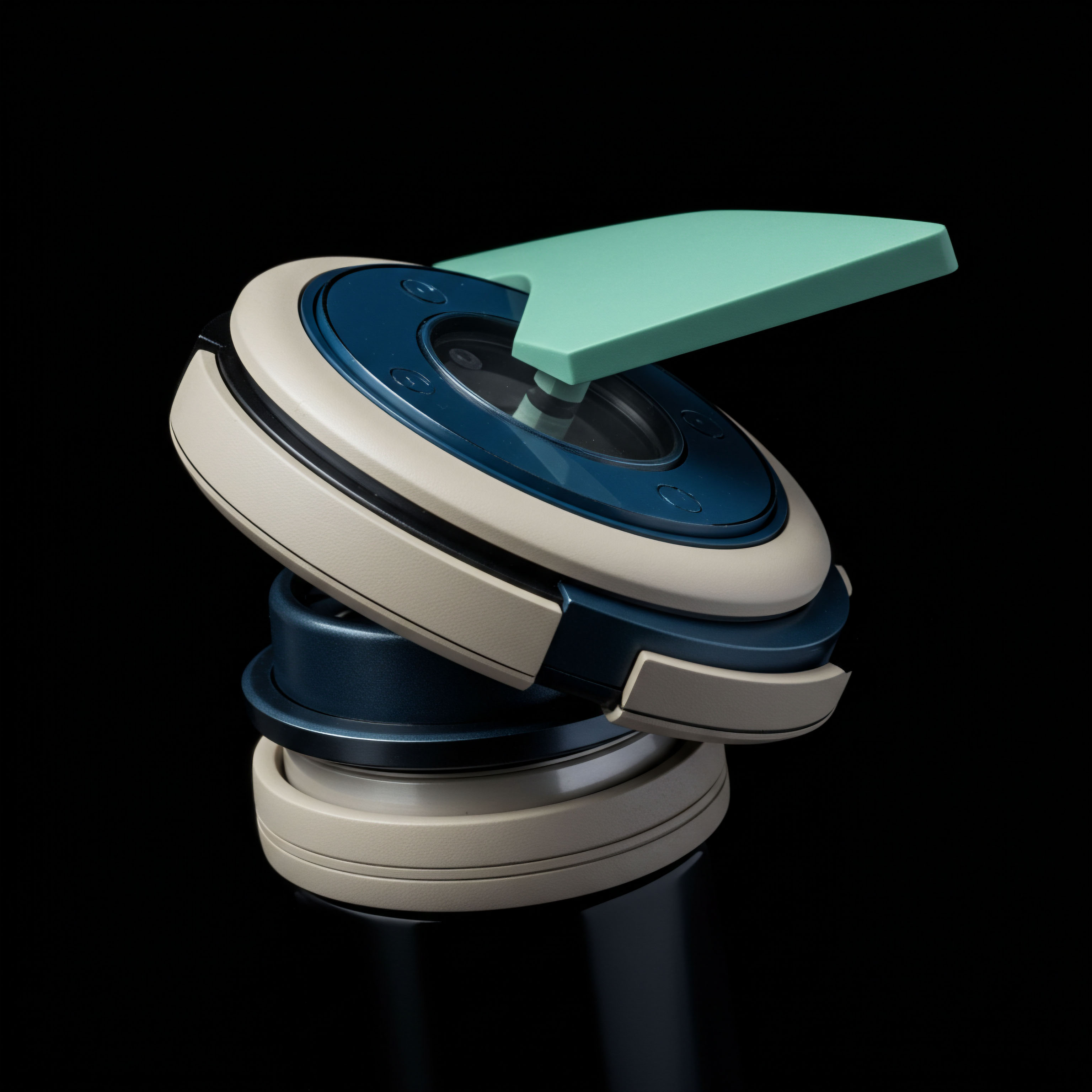

Complex options strategies, such as straddles, collars, or iron condors, involve the simultaneous execution of multiple options legs. Achieving optimal pricing across all components demands a coordinated approach. RFQ platforms excel here, allowing for the submission of an entire strategy as a single unit, ensuring that each leg executes at a price that maintains the desired risk-reward profile.

- Integrated Pricing ▴ Receive a single, consolidated quote for the entire multi-leg strategy, eliminating leg-by-leg execution risk.

- Risk Symmetry ▴ Secure simultaneous fills across all components, preserving the intended profit and loss characteristics of the spread.

- Enhanced Confidentiality ▴ Mask the overall strategy from the broader market, preventing front-running or adverse price discovery on individual legs.

Volatility Surface Engagement

Engaging with the volatility surface through RFQ allows traders to capitalize on specific implied volatility dislocations. Constructing multi-leg trades, like calendar spreads or butterflies, directly through an RFQ process enables precise targeting of specific points on the volatility curve. This approach optimizes the cost basis for expressing views on future price variance.

Anonymous Options Trading

Maintaining anonymity during large options transactions is a significant concern for institutional players, preventing market participants from front-running or exploiting revealed intentions. RFQ systems offer a structured environment for anonymous price discovery, where the initiating firm’s identity remains undisclosed until a quote is accepted. This feature preserves market neutrality and ensures unbiased pricing.

Advanced Portfolio Edge

Ascending to the highest echelons of options trading demands integrating superior execution into a holistic portfolio strategy. Mastering RFQ for crypto options extends beyond individual trade optimization; it shapes the very fabric of risk management and alpha generation across an entire book. This represents a commitment to operational excellence, transforming market engagement into a systematic pursuit of sustained advantage.

Dynamic Hedging Frameworks

Effective risk mitigation within a crypto options portfolio requires dynamic adjustments to market exposures. RFQ systems become indispensable tools for precisely rebalancing delta, vega, and gamma across a diverse set of positions. The ability to solicit competitive bids for bespoke hedges ensures that portfolio adjustments are executed with minimal drag, preserving the integrity of the overall risk profile. This proactive stance on hedging solidifies a firm’s defense against adverse market shifts, ensuring capital remains deployed efficiently towards desired exposures.

Inter-Market Arbitrage Streams

Identifying and capitalizing on pricing discrepancies between different crypto options venues, or even between spot and derivatives markets, presents a sophisticated alpha opportunity. RFQ platforms streamline the execution leg of these inter-market arbitrage strategies. By rapidly sourcing best prices for options components, traders can lock in fleeting inefficiencies, turning theoretical edges into realized profits. This continuous pursuit of market disequilibrium requires robust execution channels, a capability RFQ inherently provides.

Systemic Volatility Management

Managing volatility exposure across a multi-asset crypto portfolio requires a deep understanding of its systemic behavior. RFQ enables precise adjustments to volatility profiles through the strategic deployment of variance swaps or custom volatility index options. The capacity to price and execute these specialized instruments efficiently provides a potent mechanism for controlling portfolio sensitivity to broad market movements, thereby sculpting a desired risk landscape. The inherent complexity of these instruments, often traded in bespoke formats, underscores the value of a competitive multi-dealer environment.

We often grapple with the sheer scale of real-time data required to accurately model these volatility surfaces, especially when accounting for the idiosyncratic liquidity dynamics of various crypto options markets. Synthesizing this torrent of information into actionable, low-latency RFQ strategies remains a constant intellectual endeavor, pushing the boundaries of quantitative finance and execution engineering. This relentless pursuit of micro-efficiency, however, distinguishes the true market architects from mere participants, creating a discernible and defensible edge in an increasingly competitive domain. The commitment to understanding and manipulating these complex relationships, particularly within the nascent yet rapidly evolving crypto derivatives space, becomes the ultimate differentiator.

Long-Term Capital Preservation

Beyond immediate trading profits, the consistent application of best execution practices through RFQ contributes significantly to long-term capital preservation. Reduced transaction costs, minimized slippage, and precise risk management collectively compound over time, enhancing the resilience and growth trajectory of an institutional portfolio. This operational rigor builds a foundation for sustained success.

The Alpha Imperative

The journey towards institutional alpha in crypto options culminates in a mastery of execution, a strategic discipline that transcends mere technical competence. It represents a profound understanding of market microstructure, a command over liquidity dynamics, and an unwavering commitment to operational superiority. This elevated execution standard defines market leadership, solidifying a firm’s position at the vanguard of digital asset derivatives trading. It represents an absolute requirement for those seeking enduring advantage.

Glossary

Crypto Options

Options Execution

Rfq Systems