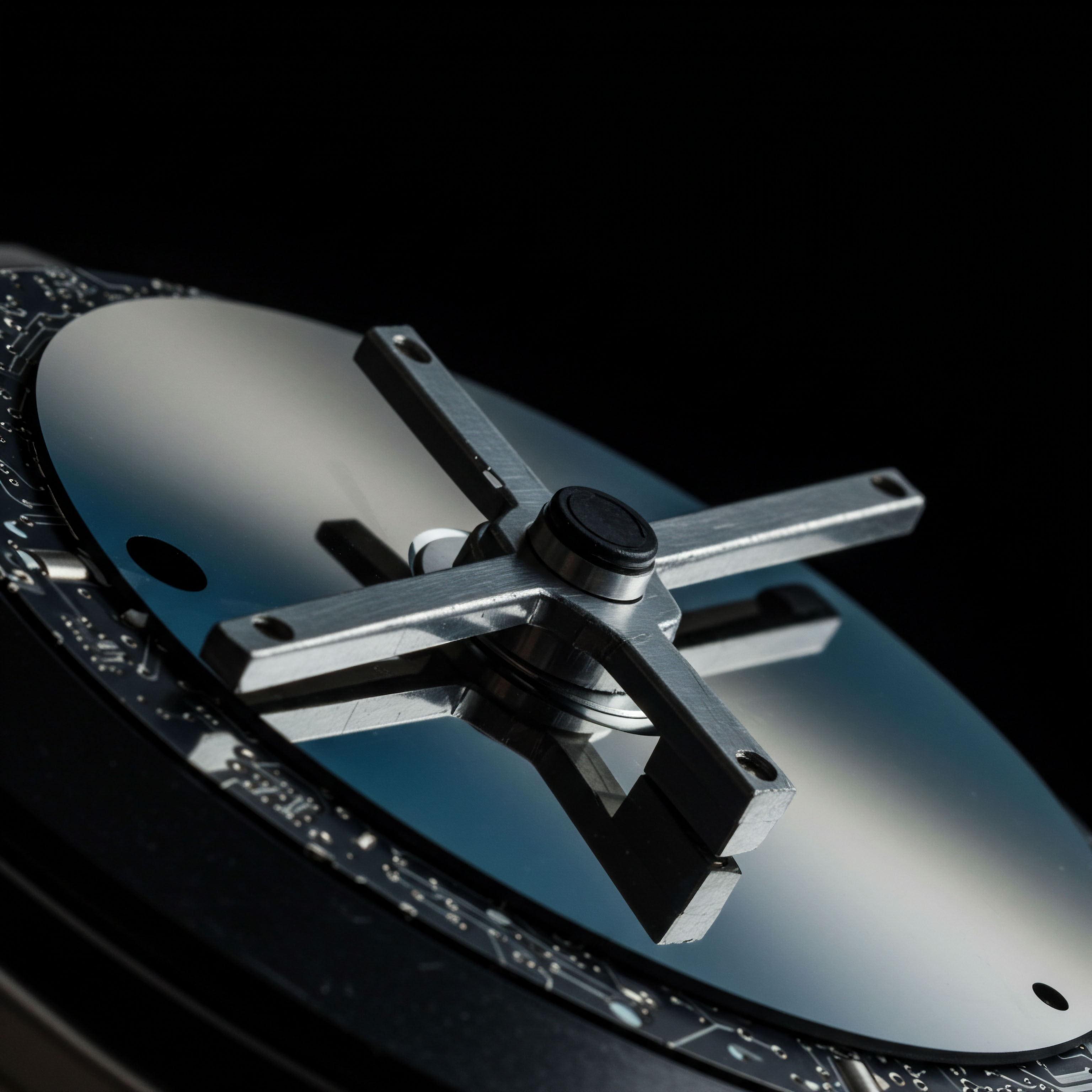

Precision Execution Unlocked

Commanding superior yield from crypto options requires a deliberate shift in operational perspective. Traders must move beyond conventional execution methods, recognizing that the market’s inner workings directly influence realized returns. Mastering this domain means understanding how orders interact with liquidity and how specific tools shape pricing outcomes.

The request for quotation, known as RFQ, stands as a cornerstone in this evolution. It transforms a potentially fragmented landscape into a controlled environment for sourcing liquidity. This mechanism empowers participants to solicit bids and offers from multiple dealers simultaneously, fostering a competitive dynamic for optimal pricing.

Consider the foundational elements of market microstructure. Every trade impacts price discovery, transaction costs, and overall market efficiency. In volatile or less liquid crypto options markets, the method of execution significantly determines the final cost basis of any position. Sloppy execution erodes alpha.

Achieving peak performance in crypto options necessitates a rigorous, system-driven approach to trade execution.

An RFQ system directly addresses these microstructural realities. It provides a structured conduit for large orders, enabling participants to transact substantial blocks without inadvertently telegraphing their intentions to the broader market. This discretion protects against adverse price movements often triggered by significant volume. Understanding its operational flow sets the stage for advanced yield generation.

Strategic Yield Deployment

Deploying capital effectively in crypto options demands a clear, actionable framework for execution. The RFQ system offers a robust pathway for achieving superior fill rates and mitigating slippage across various strategies. Its application extends from straightforward directional plays to intricate multi-leg structures, each benefiting from enhanced liquidity access.

Block Trading Dominance

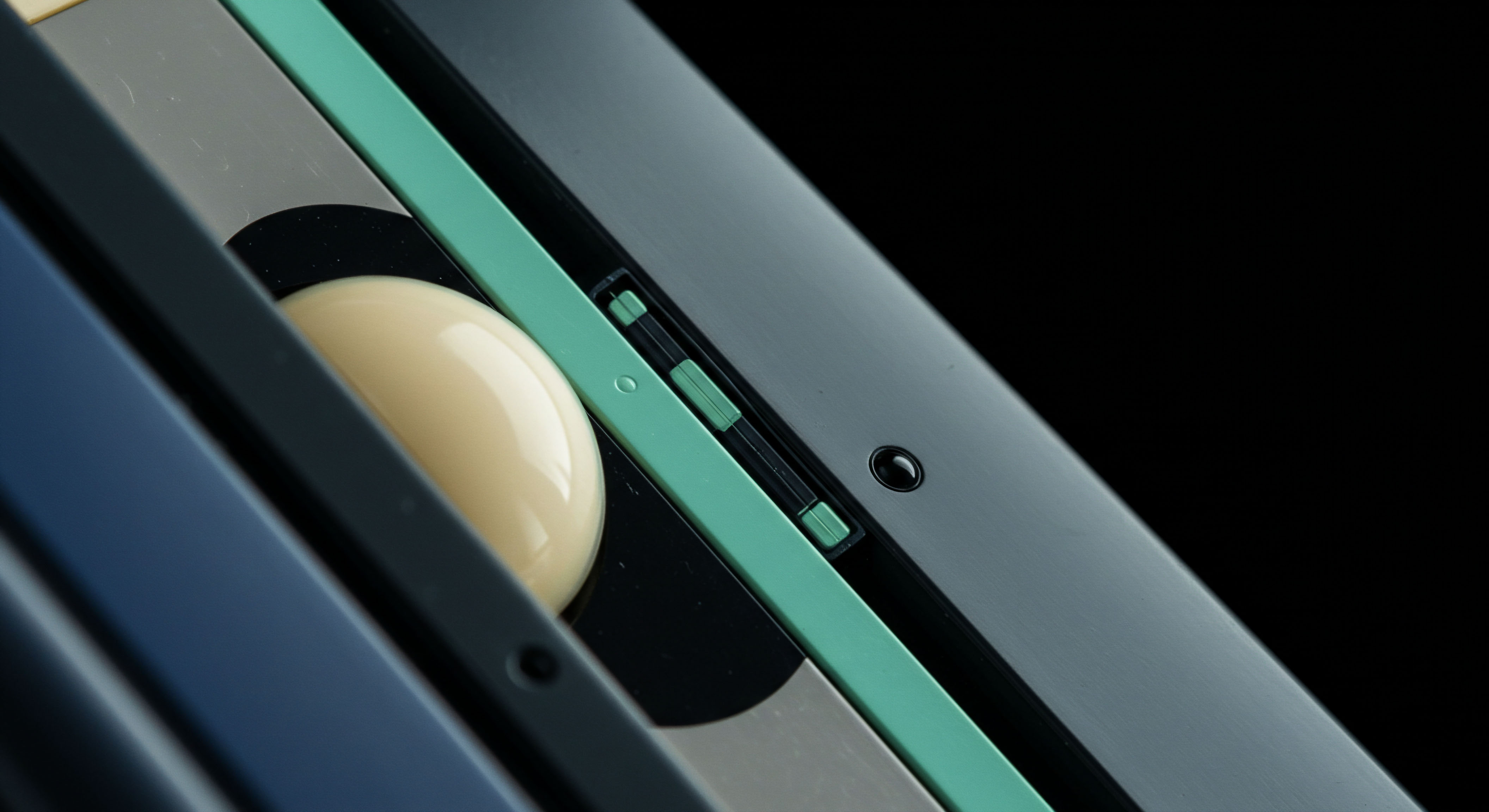

Executing substantial crypto options positions requires a dedicated approach to block trading. Leveraging an RFQ for these large orders ensures access to deep, multi-dealer liquidity pools. This process circumvents the limitations of central limit order books, where significant volume can create undue market impact. The outcome is often a materially improved average execution price.

A key advantage of block trading through RFQ involves the anonymity it provides. Participants can explore liquidity without revealing their full order size or direction, thereby preserving market integrity and preventing front-running. This strategic discretion becomes a measurable edge, directly impacting the profitability of large-scale portfolio adjustments.

Multi-Leg Options Precision

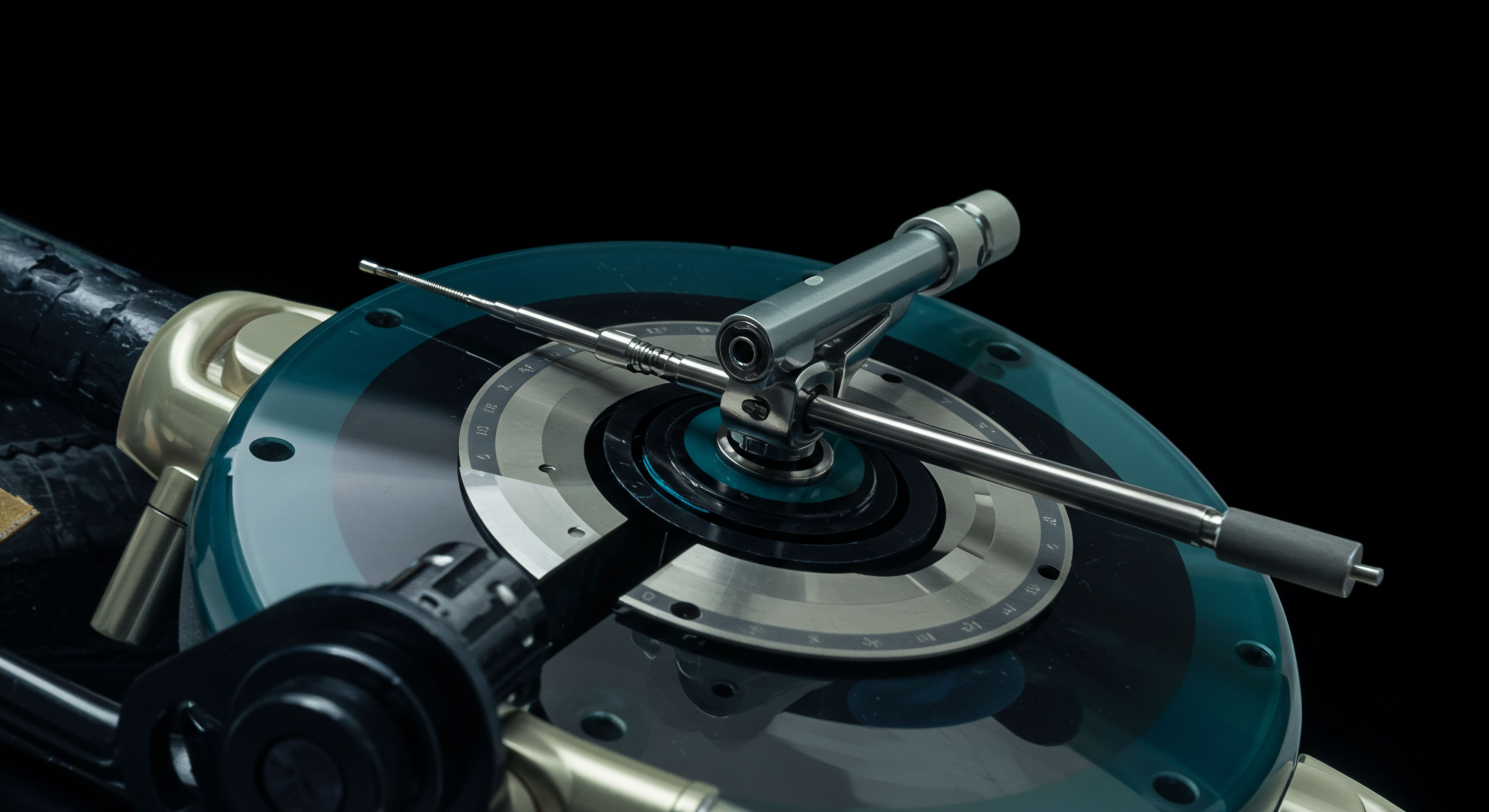

Complex options spreads, such as straddles, strangles, and collars, require synchronous execution of multiple legs. An RFQ streamlines this intricate process, allowing a single request for all components of the spread. Dealers then quote a net price, simplifying execution and ensuring the desired spread relationship holds at the point of transaction. This unified approach eliminates leg risk, a common pitfall in fragmented markets.

For instance, constructing a Bitcoin straddle block involves simultaneously buying or selling both a call and a put option at the same strike and expiration. Attempting this through disparate orders risks significant price divergence between legs. An RFQ for a BTC straddle block delivers a single, cohesive price, preserving the intended volatility exposure.

Execution Parameters for Optimal Yield

To maximize the benefits of RFQ execution, consider these parameters ▴

- Liquidity Provider Selection ▴ Engage a diverse group of liquidity providers to foster genuine competition and secure the tightest spreads.

- Order Size Segmentation ▴ Determine optimal order sizes to balance market impact considerations with operational efficiency.

- Volatility Assessment ▴ Adapt execution strategies based on prevailing market volatility, adjusting RFQ timing and sizing for maximum advantage.

- Real-Time Monitoring ▴ Continuously monitor execution quality and fill rates to refine RFQ deployment over time.

Implementing these refined execution strategies transforms theoretical yield potential into tangible gains. The focus remains on quantifiable improvements in transaction costs and overall portfolio performance, reflecting a commitment to superior operational discipline.

Portfolio Resilience Architected

Beyond individual trade execution, the mastery of crypto options yield extends to its integration within a broader portfolio construct. Precision execution becomes a strategic lever, enhancing capital efficiency and reinforcing risk management frameworks. This holistic perspective views market engagement as a dynamic system, continuously optimized for long-term alpha generation.

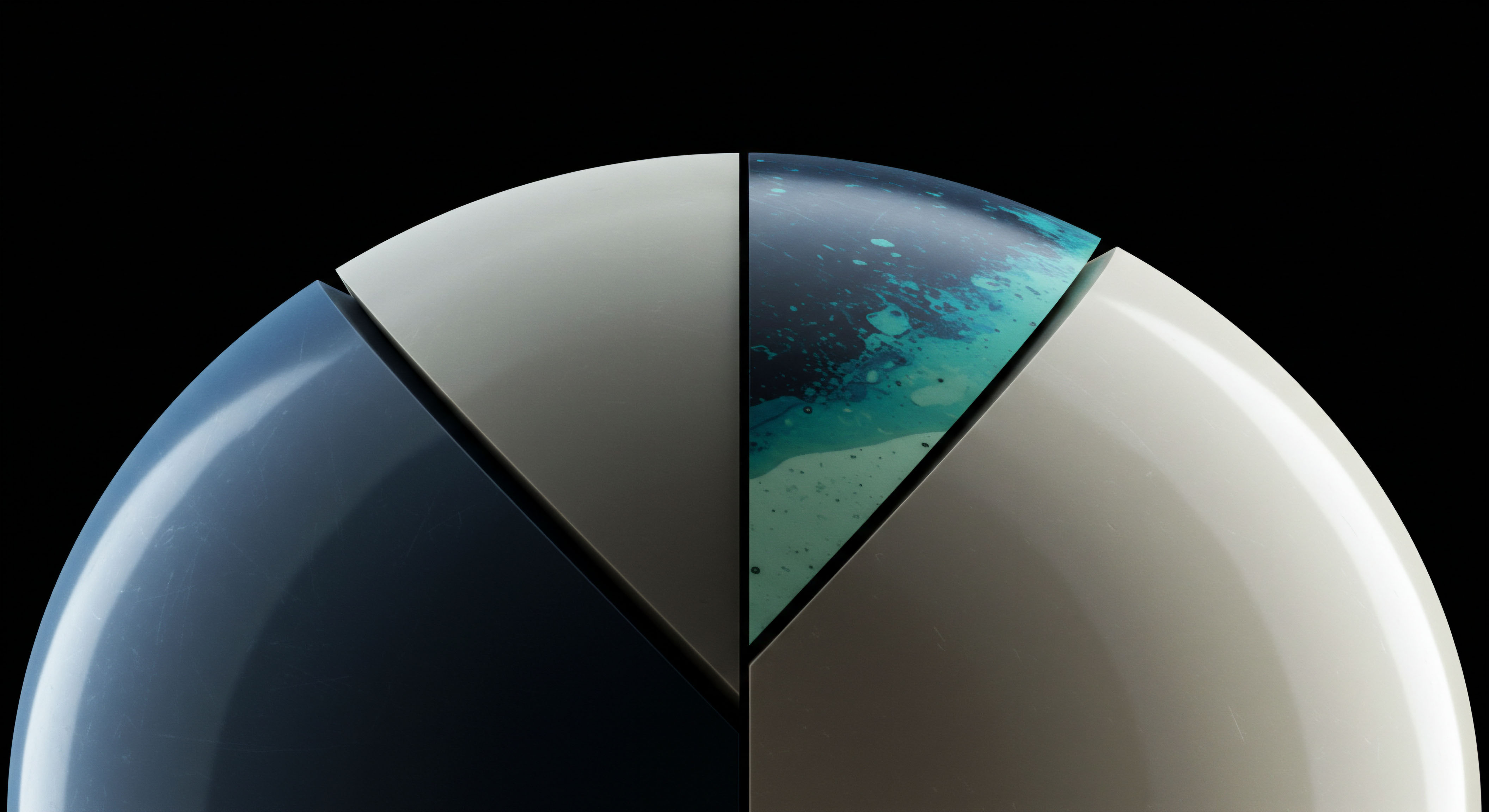

Sophisticated traders leverage RFQ capabilities for volatility block trades, effectively managing exposure to price fluctuations across their entire digital asset holdings. This involves initiating large, bespoke options positions that hedge against specific market scenarios or capitalize on perceived mispricings in implied volatility. The ability to source these blocks with minimal market footprint preserves the integrity of the strategic intent.

Advanced Liquidity Sourcing

Expanding one’s liquidity sourcing capabilities remains paramount. Exploring OTC options markets through RFQ channels allows for bespoke contract terms and larger trade sizes, exceeding the typical constraints of exchange-traded offerings. This access provides unparalleled flexibility for structuring complex hedges or expressing nuanced market views that standard instruments cannot accommodate.

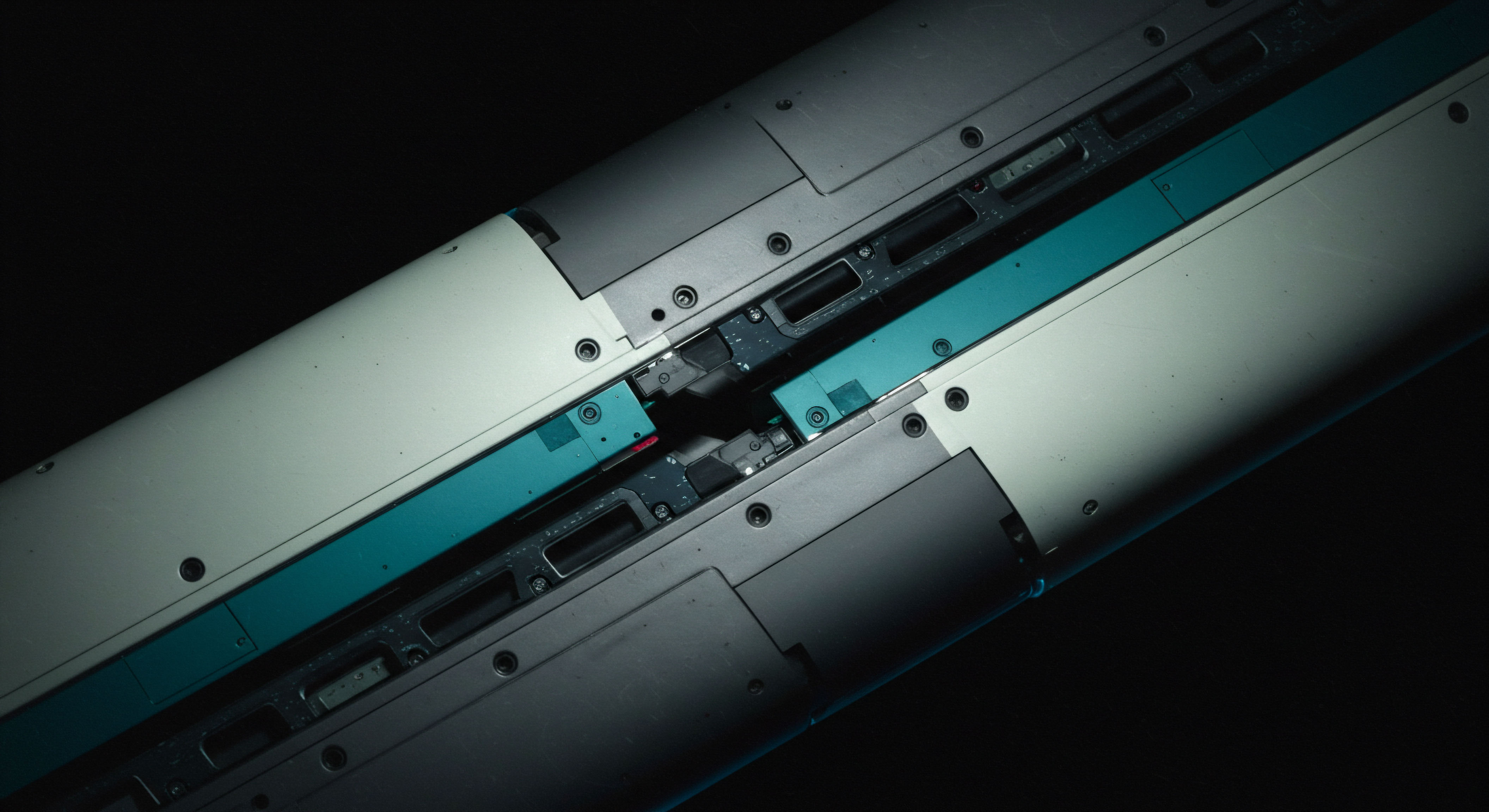

Integrating smart trading principles within RFQ environments elevates execution beyond mere price discovery. Algorithms can dynamically route requests, aggregate quotes, and optimize fill logic based on real-time market data and predefined risk parameters. This intelligent layer ensures consistent best execution, even in rapidly evolving crypto landscapes.

Mastering crypto options yield involves a continuous refinement of execution, transforming market engagement into a precise, strategic advantage.

Consider the systematic impact of controlled slippage. Over many trades, even marginal improvements in execution quality compound into significant capital preservation and enhanced returns. This disciplined approach to every transaction reinforces the foundation of a resilient, alpha-generating portfolio, a hallmark of true market mastery.

Strategic Command of Crypto Options

The journey toward mastering crypto options yield transcends simple participation; it demands an unwavering commitment to operational excellence. Every decision, from strategy conception to execution mechanics, influences the ultimate outcome. Cultivating a proactive stance, where market mechanisms are tools for precise advantage, separates the truly adept from the merely active. This domain rewards rigorous methodology and an unrelenting pursuit of optimal capital deployment.

Glossary

Crypto Options

Market Microstructure

Multi-Dealer Liquidity

Btc Straddle Block

Risk Management

Otc Options