Yield Generation Systems

The pursuit of superior outcomes in dynamic crypto markets demands a systematic approach. Understanding the mechanisms driving professional-grade yield generation transforms speculative ventures into strategic endeavors. Mastering these systems establishes a distinct market edge.

A Request for Quote, or RFQ, serves as a direct conduit to multi-dealer liquidity. This mechanism empowers participants to solicit competitive pricing for significant options or block trades. It moves beyond passive market engagement, offering a command over execution conditions.

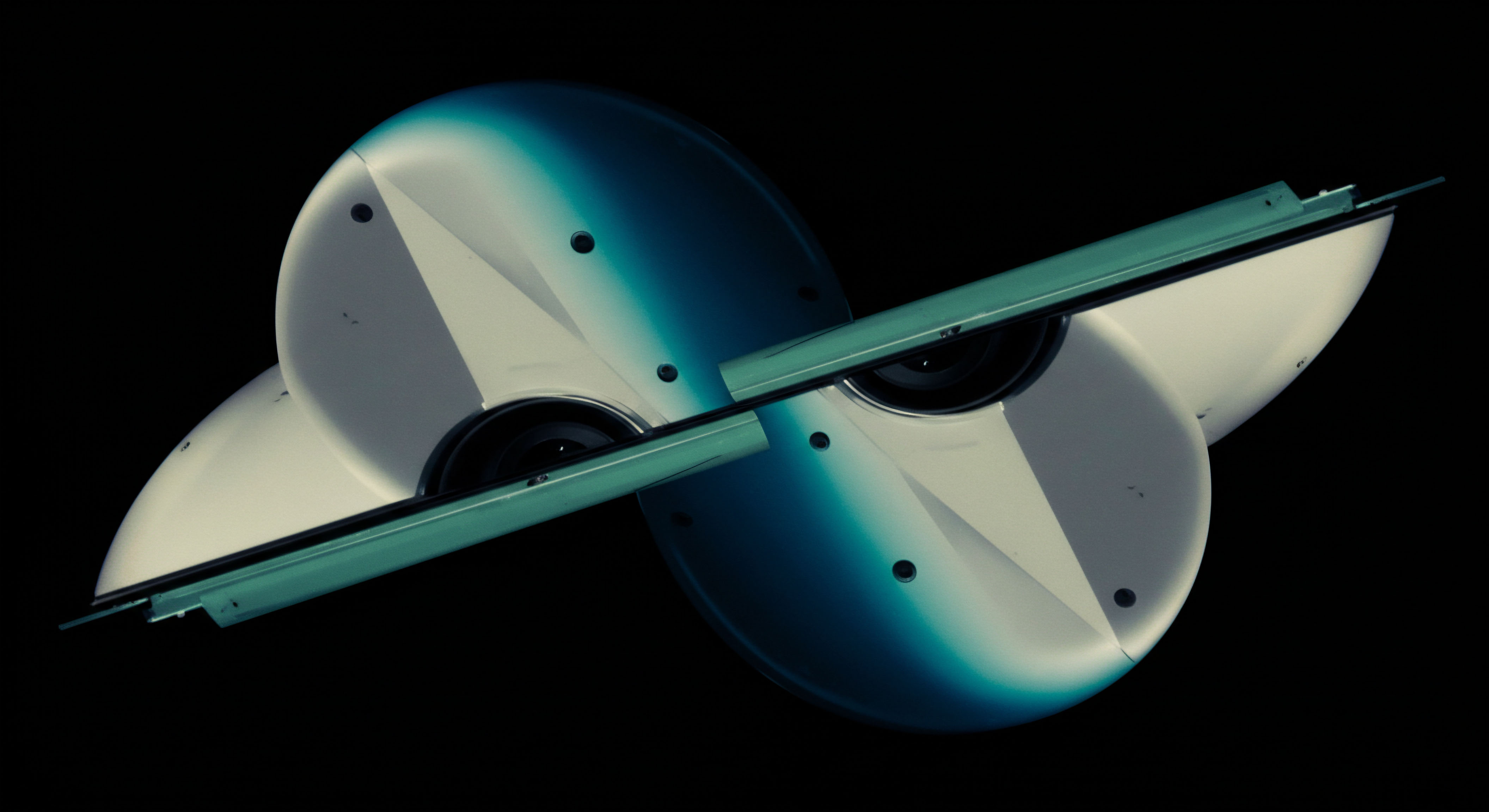

Precision execution through professional systems commands market liquidity.

Options trading, when approached with structured intent, provides a robust framework for yield capture. These instruments allow for granular expression of market views and precise risk management. Constructing sophisticated options strategies offers pathways to consistent returns, independent of directional price movements.

Block trading complements RFQ by enabling large-volume transactions with minimal market impact. Executing substantial positions discreetly preserves price integrity. This method facilitates efficient capital deployment without signaling intentions to the broader market. The intricate dance of market forces often presents a labyrinthine challenge, yet a precise understanding of its core mechanics unlocks pathways to consistent advantage.

Deploying Capital Strategically

Translating theoretical understanding into tangible returns requires actionable strategies. Professional systems offer a blueprint for disciplined capital deployment. The focus remains on quantifiable edge and measurable performance.

RFQ for Options Precision

Leveraging RFQ for options pricing secures optimal entry and exit points. Submitting a request to multiple liquidity providers ensures competitive bids and offers. This process minimizes slippage and enhances trade economics, directly impacting overall portfolio performance.

- Access competitive pricing across diverse liquidity sources.

- Minimize execution costs through targeted negotiation.

- Achieve superior fill rates for complex options structures.

- Maintain anonymity during large order placement.

Multi-Leg Strategies

Constructing multi-leg options strategies generates yield across various market conditions. Covered calls offer income from existing holdings, reducing cost basis. Spreads allow for refined directional bets with defined risk parameters. Collars provide downside protection while monetizing upside potential.

Execution defines outcomes. Implementing these strategies demands a rigorous, step-by-step approach to position sizing and risk allocation. Each leg of a multi-leg trade must align with a specific market outlook and a clear profit objective.

Block Trading Execution

Executing large crypto positions via block trades preserves market integrity. This method avoids the adverse price movements often associated with large orders on open exchanges. Securing direct counterparty liquidity ensures efficient capital movement. A robust framework for identifying and engaging suitable block venues is essential for substantial capital deployment.

Advanced Market Engagement

Expanding beyond foundational applications elevates market engagement to a strategic domain. Integrating professional systems into a holistic framework unlocks advanced capabilities. The objective centers on sustained alpha generation and robust portfolio resilience.

Systematic Volatility Capture

Advanced traders capture volatility through systematic options strategies. Implementing BTC straddle blocks or ETH collar RFQs allows for precise exposure to anticipated price swings. These sophisticated approaches demand continuous monitoring and dynamic adjustment. Understanding implied volatility surfaces provides a critical edge for structuring these positions.

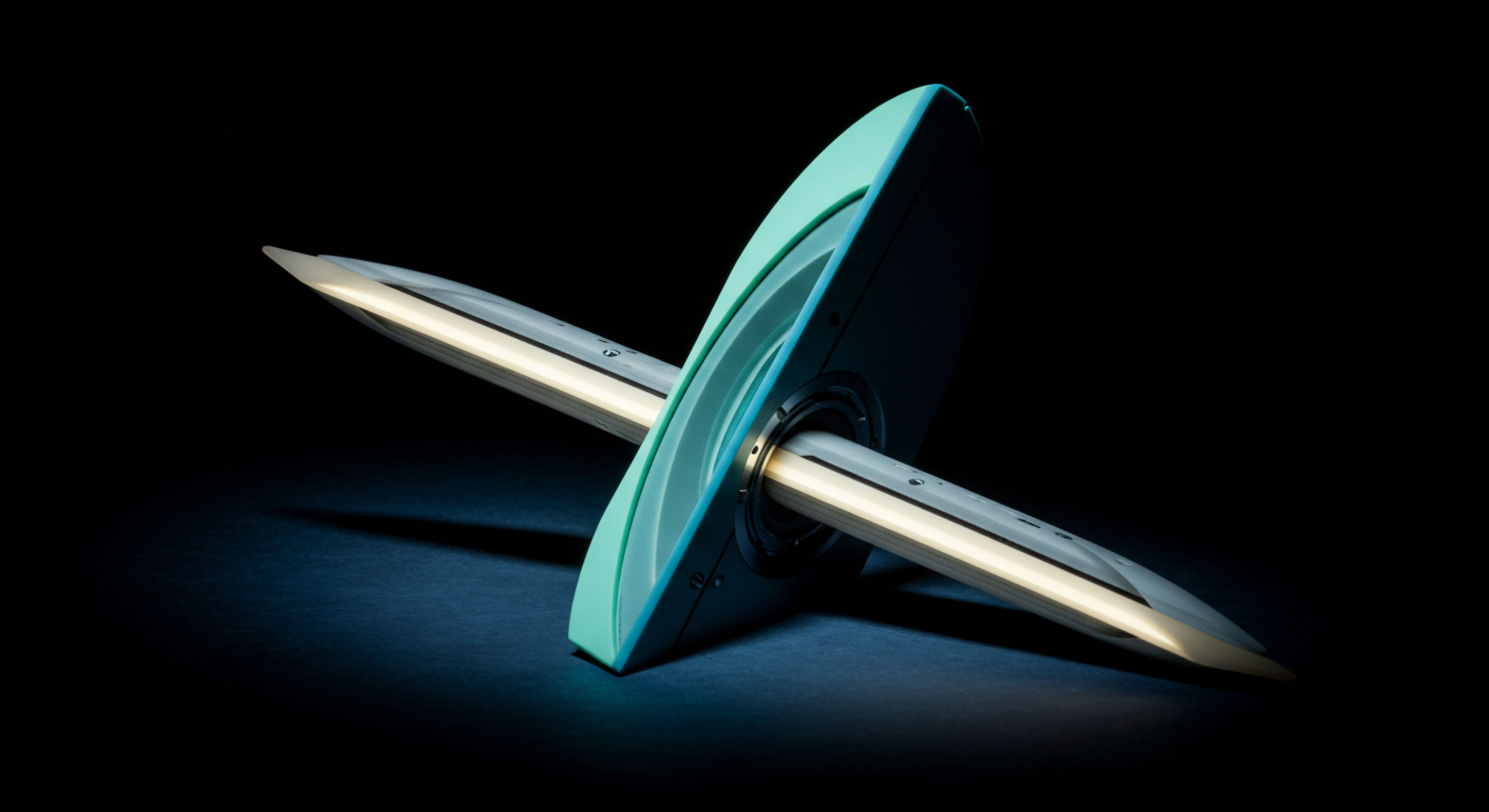

Advanced execution elevates market participation to strategic mastery.

Developing an overarching framework for volatility capture transforms reactive trading into proactive strategy. This involves modeling expected price ranges and calibrating options strikes accordingly. It moves beyond simple directional bets, embracing the inherent dynamism of crypto markets.

Dynamic Risk Management

Robust risk management underpins all advanced applications. Integrating sophisticated execution mechanisms with real-time portfolio analytics is paramount. This includes monitoring delta, gamma, theta, and vega exposures across all positions. A dynamic risk framework adapts to evolving market conditions, protecting capital while optimizing for return.

Understanding the second-order effects of options positions within a broader portfolio context allows for proactive hedging. This systematic approach ensures that even complex multi-leg trades remain within predefined risk tolerances. Managing capital effectively is a continuous feedback loop, refining strategies with each market cycle.

Integrating Liquidity Streams

The strategic integration of diverse liquidity streams optimizes execution across various asset classes. Connecting RFQ capabilities with OTC desks and exchange-based block venues creates a unified liquidity access point. This comprehensive approach ensures best execution across all trade sizes and instrument types. Maximizing fill rates and minimizing price impact remains the core objective.

Command Your Market

The path to superior crypto yield lies in disciplined application and strategic foresight. Professional systems are not mere tools; they are extensions of a refined trading mindset. Cultivating this mastery creates an enduring advantage, transforming market complexity into a field of opportunity.