Unlocking Latent Liquidity

The pursuit of alpha in crypto options markets demands a profound understanding of execution mechanics. Traditional retail approaches often overlook the vast reservoirs of liquidity residing beyond visible order books. Mastering hidden liquidity represents a critical advantage, transforming opaque market dynamics into a controlled, strategic environment. This advanced capability allows participants to command superior pricing and achieve precise trade fulfillment, fundamentally reshaping their engagement with derivatives.

Professional-grade trading protocols, particularly Request for Quote (RFQ) systems, act as sophisticated conduits to this deeper liquidity. They facilitate direct engagement with multiple market makers, soliciting competitive bids and offers for specific options contracts or multi-leg strategies. This mechanism bypasses the limitations of fragmented order books, revealing aggregated liquidity that would otherwise remain inaccessible. A clear comprehension of these systems provides the foundational knowledge necessary for navigating complex options landscapes with confidence.

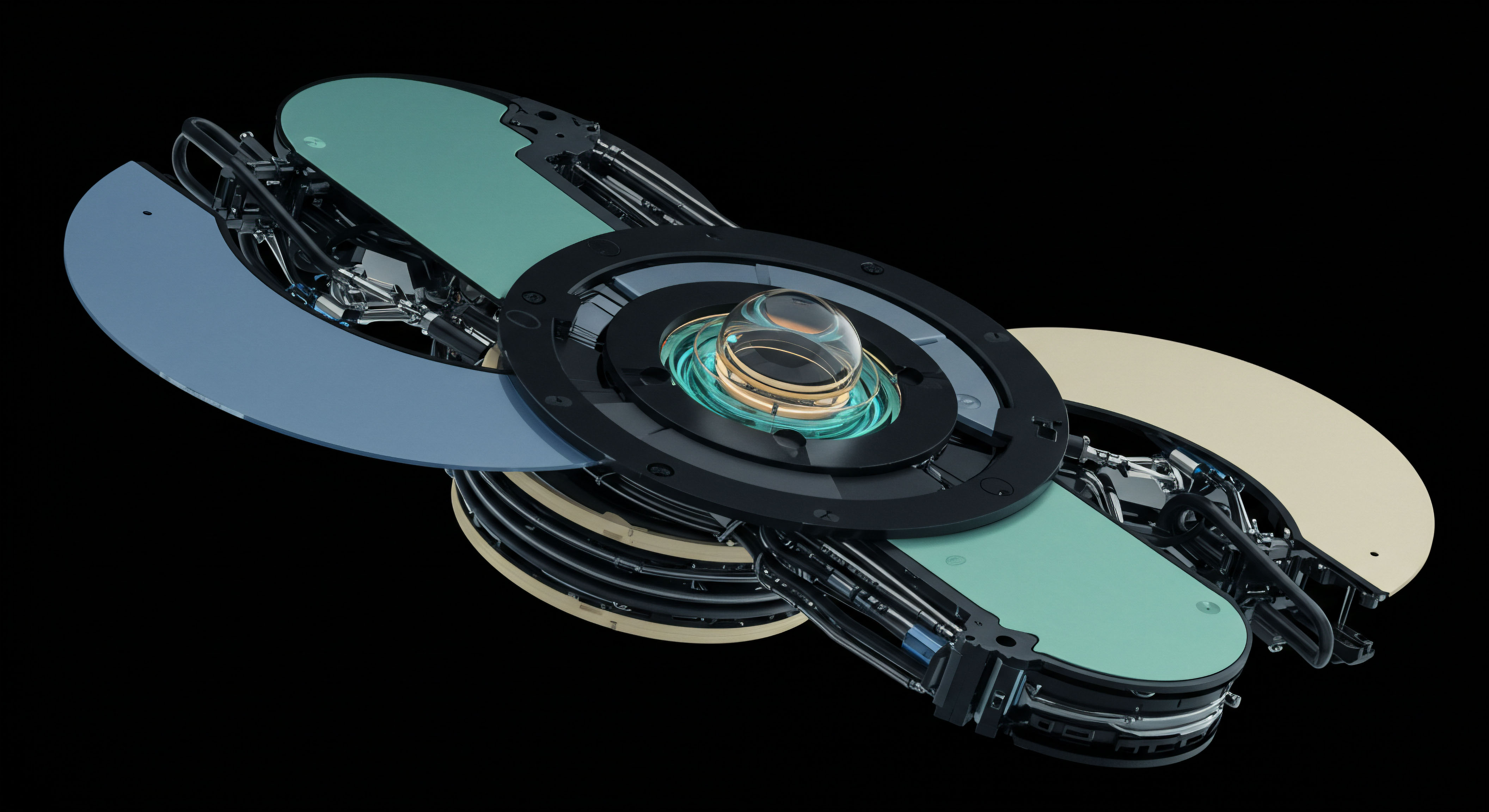

Accessing deeper liquidity through professional RFQ systems redefines execution quality in crypto options.

Understanding the microstructure of crypto options markets reveals why hidden liquidity holds such significance. These markets, characterized by rapid evolution and diverse participant bases, often exhibit varying levels of on-screen depth. RFQ protocols address this by enabling large-volume transactions and intricate multi-leg structures to be priced and executed with minimal market impact. This systemic approach builds confidence, positioning traders to leverage sophisticated tools for consistent performance.

Strategic Capital Deployment

Deploying capital effectively within crypto options requires a precise, tactical framework. Alpha generation hinges upon optimizing execution quality, particularly for complex or large-scale positions. Leveraging advanced execution mechanisms ensures that investment strategies translate into tangible outcomes, minimizing slippage and enhancing overall portfolio performance.

Optimized Options Spreads Execution

Executing multi-leg options spreads through RFQ systems offers a significant advantage over sequential order book placements. A single RFQ submission for a spread such as a BTC straddle block or an ETH collar ensures all legs are priced and executed simultaneously, eliminating leg risk and capturing a precise net premium. This coordinated approach provides superior control over the desired risk-reward profile.

Single RFQ for Complex Structures

- Define the precise multi-leg strategy (e.g. butterfly, iron condor, calendar spread).

- Specify contract details ▴ underlying asset, expiry dates, strike prices, and quantities for each leg.

- Submit a single Request for Quote to a network of qualified market makers.

- Evaluate aggregated quotes, focusing on the tightest net premium or discount across the entire structure.

- Execute the entire spread as a single atomic transaction, guaranteeing simultaneous fills.

This integrated execution method ensures that the intended P&L engineering of the spread remains intact, preventing adverse price movements on individual legs from eroding the strategy’s profitability. A disciplined application of this process underpins robust risk management for complex derivatives positions.

Block Trading for Sizeable Positions

For substantial options positions, traditional order books often prove insufficient, leading to significant price impact. Block trading, facilitated through RFQ mechanisms, enables the execution of large volumes discreetly and efficiently. This method ensures best execution by allowing market makers to price the entire block, absorbing the size without undue market disturbance.

Consider a scenario requiring a large Bitcoin options block. Initiating an RFQ for this block provides market makers with the full context of the trade, allowing them to quote a firm price that accounts for the aggregated liquidity required. This contrasts sharply with attempting to fill such an order piecemeal on a public order book, which inevitably leads to adverse price discovery and increased transaction costs.

Professional block trading through RFQ minimizes market impact for significant crypto options positions, preserving capital efficiency.

The strategic deployment of block trading protocols safeguards capital. Traders avoid broadcasting their intentions to the broader market, which prevents front-running and minimizes the footprint of large orders. This level of discretion provides a measurable edge, particularly in volatile crypto markets.

Volatility Block Trade Opportunities

Volatility block trades represent a sophisticated application of hidden liquidity access. When a trader holds a specific view on future volatility, they can initiate an RFQ for a large block of options designed to capitalize on that view, perhaps a large straddle or strangle. The ability to execute these volatility positions in size, without telegraphing market intent, secures favorable entry points. This approach optimizes the capture of implied volatility premiums or discounts.

Advanced Portfolio Command

Moving beyond individual trade execution, the strategic command of hidden liquidity elevates overall portfolio performance. Integrating RFQ and block trading capabilities into a broader investment framework creates a resilient, alpha-generating system. This demands a focus on advanced risk management and sophisticated use cases that leverage these tools for systemic advantage.

Systemic Risk Management Integration

Sophisticated portfolio managers recognize that superior execution extends beyond individual trade P&L. It fundamentally impacts systemic risk management. By ensuring best execution for large options positions through RFQ, portfolios maintain tighter control over their delta, gamma, and vega exposures. This precision prevents unintended risk drift that often arises from fragmented or inefficient execution channels.

Consider a portfolio requiring a rebalance of its overall options exposure. Executing a multi-leg options RFQ for a large ETH collar, for example, allows the portfolio manager to adjust risk parameters with surgical accuracy. This systematic approach reinforces the portfolio’s integrity against sudden market shifts, acting as a financial firewall.

Customized Options Spreads for Macro Views

The ability to construct and execute highly customized options spreads via RFQ becomes invaluable for expressing nuanced macro views. Traders can design intricate multi-leg structures tailored to specific market conditions or anticipated events, securing pricing that reflects the aggregated market maker liquidity. This capability transcends the limitations of standard listed contracts, offering unparalleled flexibility.

This approach moves beyond simple directional bets. It involves constructing positions that capitalize on relative value opportunities, volatility discrepancies, or complex time decay dynamics. The RFQ mechanism provides the conduit for translating these sophisticated market hypotheses into actionable, executable strategies.

Alpha Generation through Liquidity Arbitrage

Mastering hidden liquidity opens avenues for a unique form of alpha generation ▴ liquidity arbitrage. By consistently accessing deeper pools of capital than retail channels, traders can systematically achieve superior fill prices. This persistent edge, compounded over numerous trades, contributes significantly to risk-adjusted returns. It transforms a perceived market inefficiency into a consistent source of outperformance.

This strategy hinges on understanding the inherent fragmentation of crypto options markets. Professional RFQ systems consolidate liquidity, allowing for pricing advantages that are unattainable through conventional means. This operational superiority represents a durable source of alpha, reflecting a disciplined commitment to execution excellence. The strategic advantage of this approach lies in its repeatable nature, providing a continuous edge in competitive markets.

The Alpha Imperative

The pursuit of alpha in crypto options transcends mere speculation; it is an imperative for strategic capital deployment. Mastering hidden liquidity, through professional-grade RFQ and block trading, transforms market engagement from reactive to commanding. This systematic approach empowers traders to sculpt their desired outcomes, extracting value with precision and consistency. The future of superior trading resides in the deliberate command of execution quality, a testament to strategic foresight.

Glossary

Hidden Liquidity

Crypto Options

Btc Straddle Block

Best Execution

Block Trading

Bitcoin Options Block