Liquidity Command Foundations

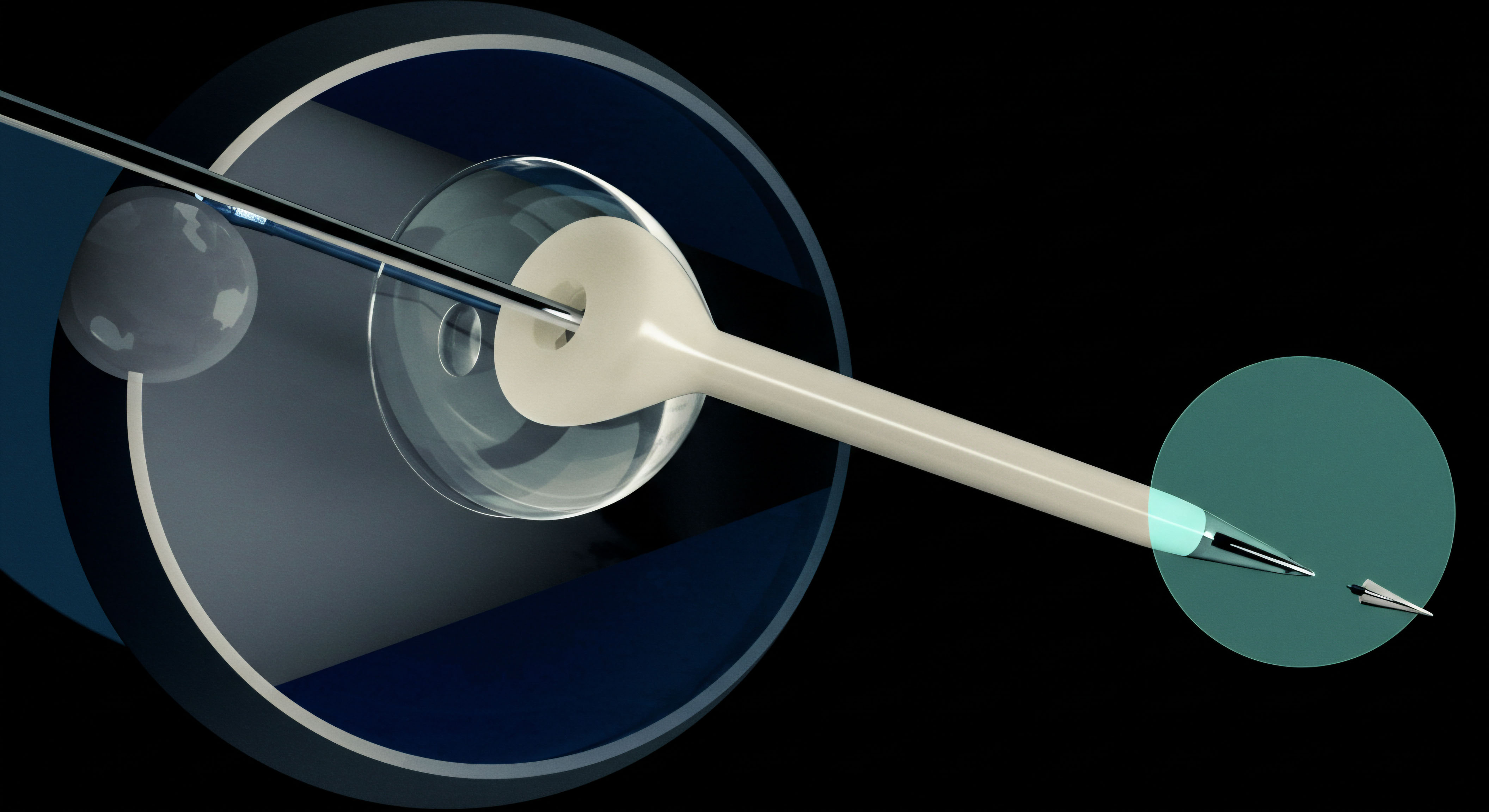

Mastering large crypto orders begins with a fundamental understanding of market structure and the strategic tools available to professional traders. Optimal execution in digital asset markets demands a clear approach to liquidity sourcing, a capability often separating proficient participants from those operating with significant slippage. Request for Quote (RFQ) systems represent a cornerstone of this professional approach, offering a structured environment for negotiating substantial trades directly with multiple liquidity providers. This mechanism transforms what could otherwise devolve into a fragmented and costly execution into a precise, competitive process.

The inherent volatility and occasional thinness of order books within cryptocurrency exchanges present unique challenges for sizable capital deployment. Attempting to fill a large order through traditional spot markets often incurs significant price impact, eroding potential gains before a position fully establishes. RFQ addresses this by enabling a single query to solicit firm, executable quotes from numerous market makers simultaneously.

This creates an immediate, private auction, allowing for the acquisition of significant volume at a consolidated price, bypassing the public order book’s depth limitations. Understanding this foundational system provides the initial mental model for commanding liquidity on one’s terms.

Professional liquidity negotiation through RFQ transforms fragmented markets into a competitive advantage for large crypto orders.

Historically, institutional players in traditional finance have long relied on similar mechanisms to navigate deep markets without disrupting prices. The evolution of digital asset markets now provides comparable infrastructure, democratizing access to superior execution methodologies. A trader’s proficiency in these frameworks dictates the true cost of market entry and exit, profoundly influencing overall portfolio performance. Grasping the mechanics of RFQ, its capacity for price discovery, and its role in minimizing transaction costs constitutes an essential first step toward strategic market engagement.

Strategic Capital Deployment

Deploying capital effectively in crypto markets requires precision, particularly when dealing with large orders. RFQ systems offer a powerful avenue for executing significant positions with controlled price impact, a vital component of preserving alpha. Integrating RFQ into your trading process transforms speculative ventures into calculated, repeatable operations, building a robust framework for consistent performance. This section details actionable strategies for leveraging RFQ and advanced options structures.

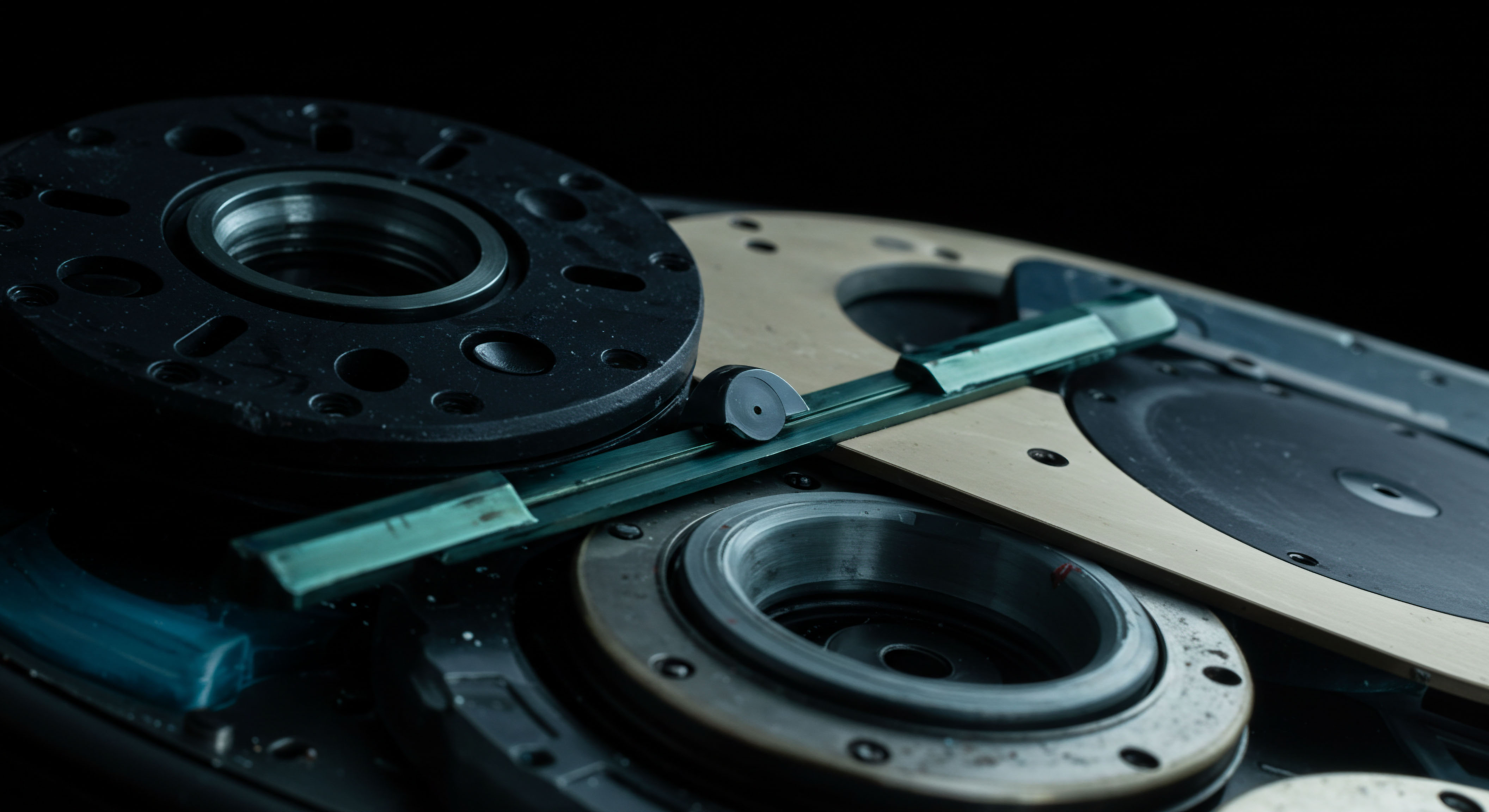

Execution Efficiency with RFQ

Executing large Bitcoin or Ethereum spot orders through an RFQ system allows traders to access deep, multi-dealer liquidity without broadcasting their intentions to the broader market. This discretion protects against front-running and minimizes information leakage, ensuring better average fill prices. Consider a scenario where a fund seeks to acquire a substantial amount of ETH.

Sending an RFQ to a network of vetted liquidity providers secures competitive pricing across the desired volume, a significant improvement over iterative, on-exchange execution. Precision matters.

Spot RFQ for Volume Accumulation

Accumulating a large spot position over time, or executing a single large block, finds its optimal pathway through RFQ. The system aggregates liquidity, offering a consolidated price for the entire block. This streamlines execution, reducing the operational overhead associated with managing multiple smaller orders. It provides a definitive price point, simplifying post-trade analysis and risk attribution.

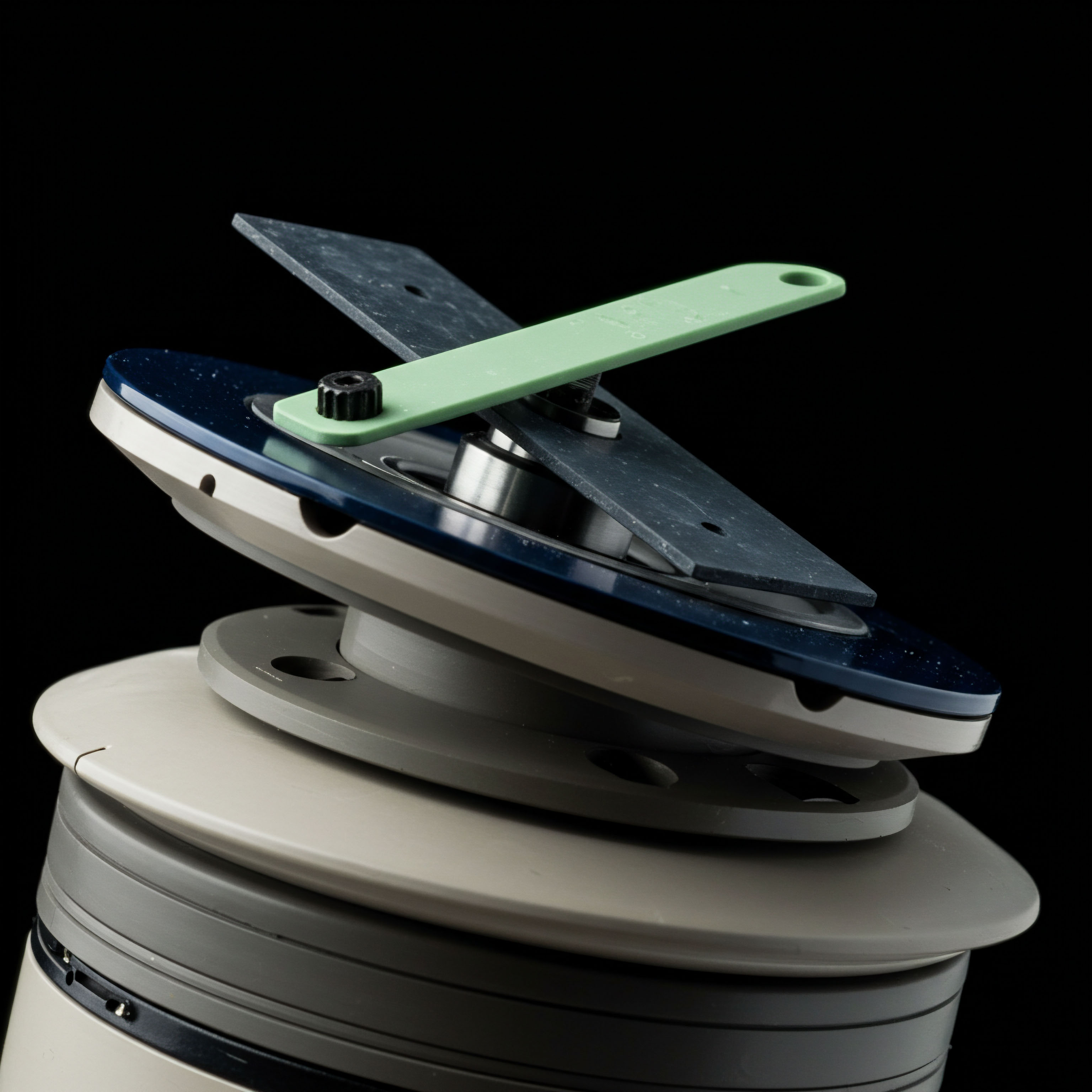

Options RFQ for Volatility Positioning

Options trading introduces another layer of strategic execution, where RFQ systems prove indispensable for complex strategies. Multi-leg options structures, such as straddles or collars on BTC and ETH, involve simultaneous execution of several option contracts. Attempting to leg into these positions on a public order book exposes traders to significant slippage and execution risk on each individual leg. RFQ mitigates this by allowing the entire multi-leg strategy to be quoted and executed as a single package.

- BTC Straddle RFQ ▴ Simultaneously buying an at-the-money call and put on Bitcoin to capitalize on anticipated volatility, executed as a single, firm quote.

- ETH Collar RFQ ▴ Hedging an existing ETH spot position by buying an out-of-the-money put and selling an out-of-the-money call, securing a defined risk-reward profile.

- Options Spreads RFQ ▴ Executing vertical or horizontal spreads on various crypto options, ensuring the precise ratios and prices across all legs.

This packaged execution minimizes the basis risk between legs, ensuring the strategy’s intended P&L profile remains intact. The competitive bidding among liquidity providers further sharpens the pricing for these intricate trades, translating directly into enhanced returns.

A disciplined approach to large orders through RFQ creates a tangible market edge, preserving capital and maximizing strategic outcomes.

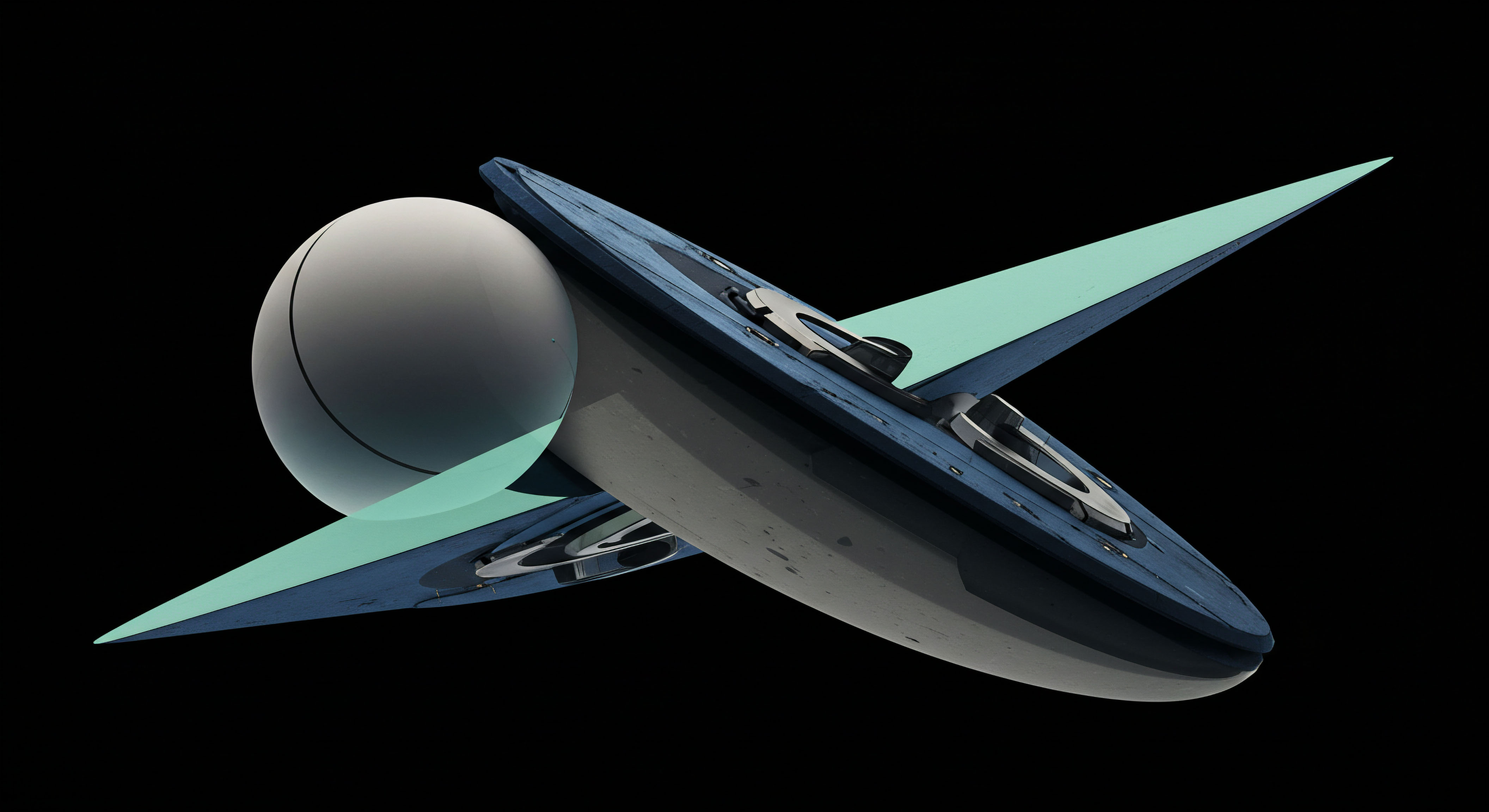

Block Trading Options for Sizing

For institutional participants, executing substantial options positions requires dedicated block trading capabilities. Bitcoin Options Block and ETH Options Block facilities, often integrated with RFQ, allow for off-exchange negotiation of large contracts. These private transactions maintain market integrity while providing the necessary scale for significant portfolio adjustments. They ensure that substantial capital moves without causing adverse price movements in the underlying derivatives or spot markets, upholding the integrity of the execution.

Advanced Strategic Integration

Beyond individual trade execution, the true mastery of large crypto orders lies in their seamless integration into a broader portfolio strategy. RFQ and block trading mechanisms are not isolated tools; they are integral components of a sophisticated operational design that optimizes capital efficiency and risk management across an entire investment universe. This section explores how these mechanisms become foundational elements for constructing a resilient, alpha-generating portfolio.

Portfolio Hedging with Precision

Sophisticated portfolio managers consistently seek methods to hedge directional exposure or manage volatility without incurring excessive costs. Implementing advanced options strategies via RFQ provides this precision. A large portfolio holding a significant ETH position might seek to dampen short-term price fluctuations. Constructing a dynamic options fence, perhaps a series of call and put spreads, executed through a multi-dealer RFQ, offers a tailored risk mitigation solution.

The ability to source competitive pricing for these complex, multi-leg structures ensures that hedging costs remain within acceptable parameters, thereby preserving overall portfolio performance. It compels a deeper examination of the market’s true liquidity contours, recognizing that quoted depth often belies available execution capacity.

Dynamic Risk Management Frameworks

Integrating RFQ into a dynamic risk management framework allows for agile adjustments to market conditions. As volatility regimes shift, the optimal hedging strategy or directional exposure changes. The rapid price discovery offered by RFQ enables swift execution of adjustments to options positions, ensuring the portfolio remains optimally positioned.

This adaptability is a hallmark of professional trading, allowing proactive management of systemic and idiosyncratic risks. Consider the implications of rapidly deploying or unwinding a large volatility trade during periods of heightened market uncertainty; the speed and pricing integrity offered by an RFQ system become paramount.

Capital Efficiency and Transaction Cost Analysis

The ultimate goal for any professional trader involves maximizing capital efficiency. RFQ mechanisms contribute significantly by minimizing slippage and securing best execution. Post-trade analysis of RFQ fills provides invaluable data for refining execution strategies and evaluating liquidity provider performance. This continuous feedback loop drives incremental improvements in transaction cost analysis, a critical determinant of long-term profitability.

Understanding the nuances of implicit transaction costs, often obscured by on-exchange execution, becomes clearer through the transparent pricing provided by competitive RFQ bids. This data empowers traders to refine their approach to market engagement, turning execution into a quantifiable source of advantage.

The Strategic Edge

The journey to mastering large crypto orders culminates in a profound understanding of market mechanics and the disciplined application of professional-grade execution systems. It represents a commitment to precision, an embrace of strategic advantage, and a relentless pursuit of superior outcomes. Every successful trade reinforces the conviction that thoughtful design and advanced tooling create an undeniable edge.

This systematic approach transcends mere trading; it becomes a core philosophy, shaping every decision, every position, and every capital allocation. The true professional commands the market, sculpting outcomes with informed intent and unwavering focus.

Glossary

Large Crypto Orders

Multi-Dealer Liquidity

Eth Collar Rfq

Options Spreads Rfq

Bitcoin Options Block

Eth Options Block