Learn

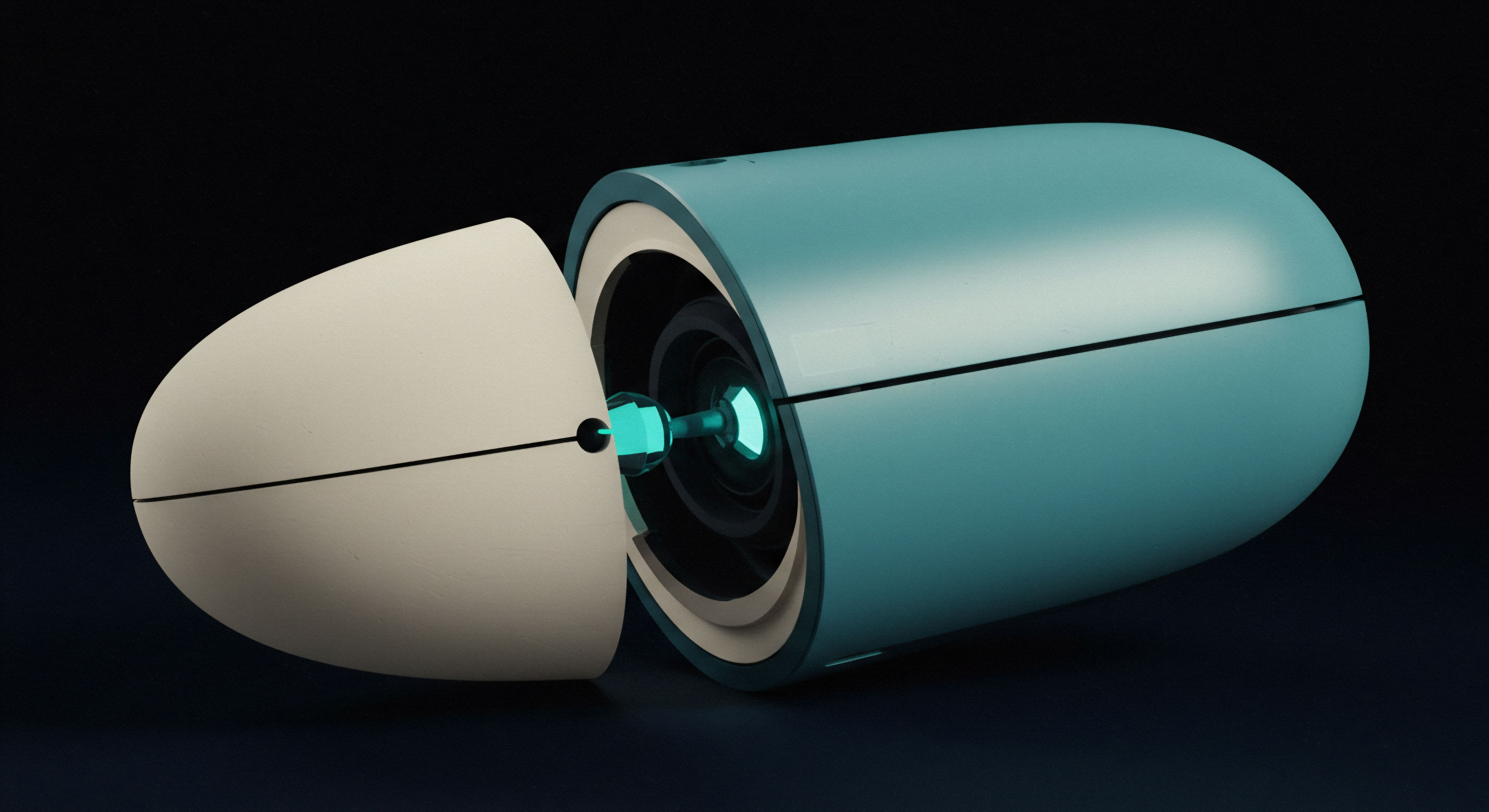

Private auctions represent a significant advancement in crypto options execution. This mechanism provides a structured environment for negotiating substantial block trades, moving beyond the inherent limitations of traditional exchange order books. Participants gain a definitive advantage, allowing them to exert control over liquidity and price discovery with precision.

Understanding the core components of this system empowers traders to navigate complex market dynamics effectively. A structured engagement connects a select group of liquidity providers with a single order. This method significantly mitigates price impact, a persistent challenge within volatile crypto markets.

Traders gain direct command over their execution parameters, optimizing for size, timing, and price realization. This foundational comprehension establishes the groundwork for advanced options strategies.

Mastering private auctions transforms options execution into a strategic advantage, securing optimal pricing for significant crypto positions.

The operational flow within a private auction typically follows a request for quotation (RFQ) model. A participant initiates a request for a specific options contract, detailing the desired size and strike. This request then broadcasts to a curated group of liquidity providers.

These providers submit competitive bids, ensuring a transparent and efficient price discovery process. The initiating party selects the most favorable quotation, finalizing the trade.

Invest

Deploying private auctions demands a disciplined strategic approach. This method optimizes for superior execution quality, directly translating into enhanced portfolio performance. Crafting multi-leg options spreads becomes a precise endeavor, mitigating basis risk and volatility exposure. Traders utilize these auctions to acquire large block positions without signaling their intentions to the broader market, a discretion protecting pricing integrity.

Execution for Block Trades

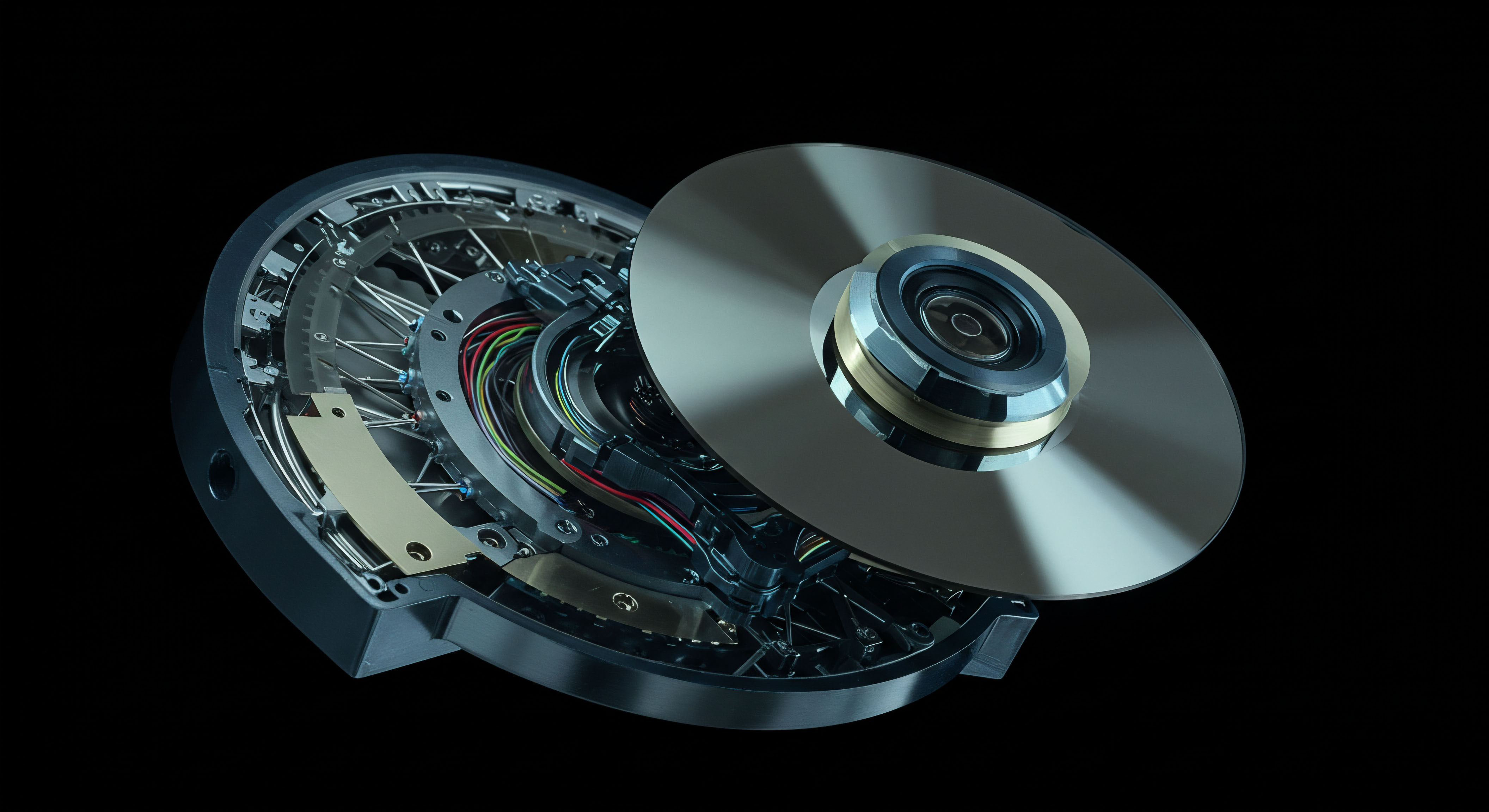

Large-scale block trades in crypto options often suffer from market impact on public exchanges. Private auctions circumvent this by facilitating a confidential negotiation. Traders submit their order, and a restricted set of counterparties competes for the business. This structure ensures that substantial capital allocations can move without adverse price movements, preserving capital efficiency.

Strategic Spreads Deployment

Constructing complex options spreads, such as BTC straddle blocks or ETH collar RFQs, demands accurate and consistent pricing across multiple legs. Private auctions streamline this by allowing simultaneous bidding on linked options contracts. This unified execution minimizes slippage between individual components of a spread. The coherence across legs significantly strengthens the overall trade’s profitability profile.

Executing multi-leg trades through a single private auction yields several benefits:

- Reduced execution risk across individual legs.

- Improved price certainty for complex positions.

- Consolidated liquidity for spread components.

- Enhanced anonymity for strategic market positioning.

Volatility Exposure Management

Managing volatility exposure presents a continuous challenge in crypto derivatives. Private auctions enable precise adjustments to an existing portfolio’s delta or vega. Traders can acquire or divest volatility blocks with minimal market disruption.

This capacity for surgical adjustment becomes indispensable during periods of heightened market fluctuation. A refined approach to managing volatility exposure yields a quantifiable edge.

Capital Efficiency Maximization

Capital efficiency remains a core tenet of sophisticated trading. Private auctions contribute to this by securing tighter spreads and better fill rates for substantial orders. Reduced transaction costs directly impact the overall return on capital deployed.

Optimizing execution parameters within these auctions ensures every unit of capital works harder. This systematic approach differentiates professional-grade operations.

Expand

Mastery of private auctions extends beyond single-trade execution; it shapes a resilient portfolio composition. Integrating these auctions into a broader risk management system allows for dynamic hedging strategies. Advanced participants deploy systematic approaches to identify mispricings across various derivatives. This refined approach to execution strengthens overall portfolio robustness.

Portfolio Hedging Integration

Dynamic portfolio hedging against market downturns or unexpected volatility spikes becomes significantly more effective with private auctions. A portfolio manager can rapidly adjust hedges, acquiring or divesting large options positions with discretion. This capability allows for proactive risk mitigation, shielding capital from adverse movements. A cohesive hedging strategy solidifies long-term performance.

The market often presents situations where theoretical models diverge from observable prices. Reconciling these discrepancies requires a deep understanding of market microstructure and the precise tools to capitalize on such ephemeral opportunities. The challenge lies in discerning genuine mispricings from transient market noise, then executing with speed and discretion. This requires an almost intuitive grasp of liquidity dynamics, where the underlying bid-ask spread itself can reveal much about a market’s true state.

Arbitrage Opportunity Identification

Identifying and capitalizing on arbitrage opportunities across spot and derivatives markets requires superior execution speed and minimal price impact. Private auctions provide the mechanism for executing the options leg of an arbitrage trade with precision. This capacity allows for exploiting fleeting discrepancies, translating theoretical edge into realized gains. A diligent approach to arbitrage demands robust execution capabilities.

Systematic Execution Optimization

Advanced trading groups implement systematic execution optimization algorithms that incorporate private auctions as a core component. These algorithms dynamically route orders, choosing between public exchanges and private auction venues based on liquidity conditions and price impact estimations. This intelligent routing ensures best execution across a diverse set of market conditions. A consistently optimized execution stream becomes a powerful, self-reinforcing advantage.

Market Command Awaits

The command over private auctions represents a significant leap in trading capability. It transforms execution from a reactive endeavor into a strategic art form. Mastering this domain equips traders with the tools to sculpt market exposures precisely.

This capacity for deliberate action yields consistent outperformance, distinguishing those who shape market outcomes from those who merely observe them. Discipline wins.

Glossary

Private Auctions

Crypto Options

Capital Efficiency

Risk Management