Mastering Private Block Trading Crypto Alpha

Achieving superior execution in crypto markets demands a strategic departure from conventional methods. Private block trading represents a refined approach, enabling significant capital deployment with minimized market footprint. This sophisticated mechanism facilitates direct, principal-to-principal transactions, bypassing the open order book’s immediate volatility and potential slippage. Its design prioritizes discreet, efficient transfers of large crypto asset volumes.

Understanding this fundamental market structure provides a critical advantage, shaping how discerning traders command liquidity on their terms. The process empowers participants to secure advantageous pricing, insulating their positions from the immediate impact of broad market movements. This disciplined execution methodology forms the bedrock of advanced trading operations, defining a clear path to enhanced capital efficiency.

The core utility of private block trading centers on its capacity to manage market impact effectively. When transacting substantial positions, the inherent depth limitations of public exchanges frequently lead to adverse price movements. A private block trade mitigates this risk by orchestrating a bilateral agreement between two parties, often facilitated by a specialized desk. This method secures a single, agreed-upon price for the entire transaction, ensuring consistent execution across the full volume.

Participants gain the benefit of price stability, a critical factor when deploying capital at scale. This deliberate approach allows for precise control over entry and exit points, a defining characteristic of professional-grade trading.

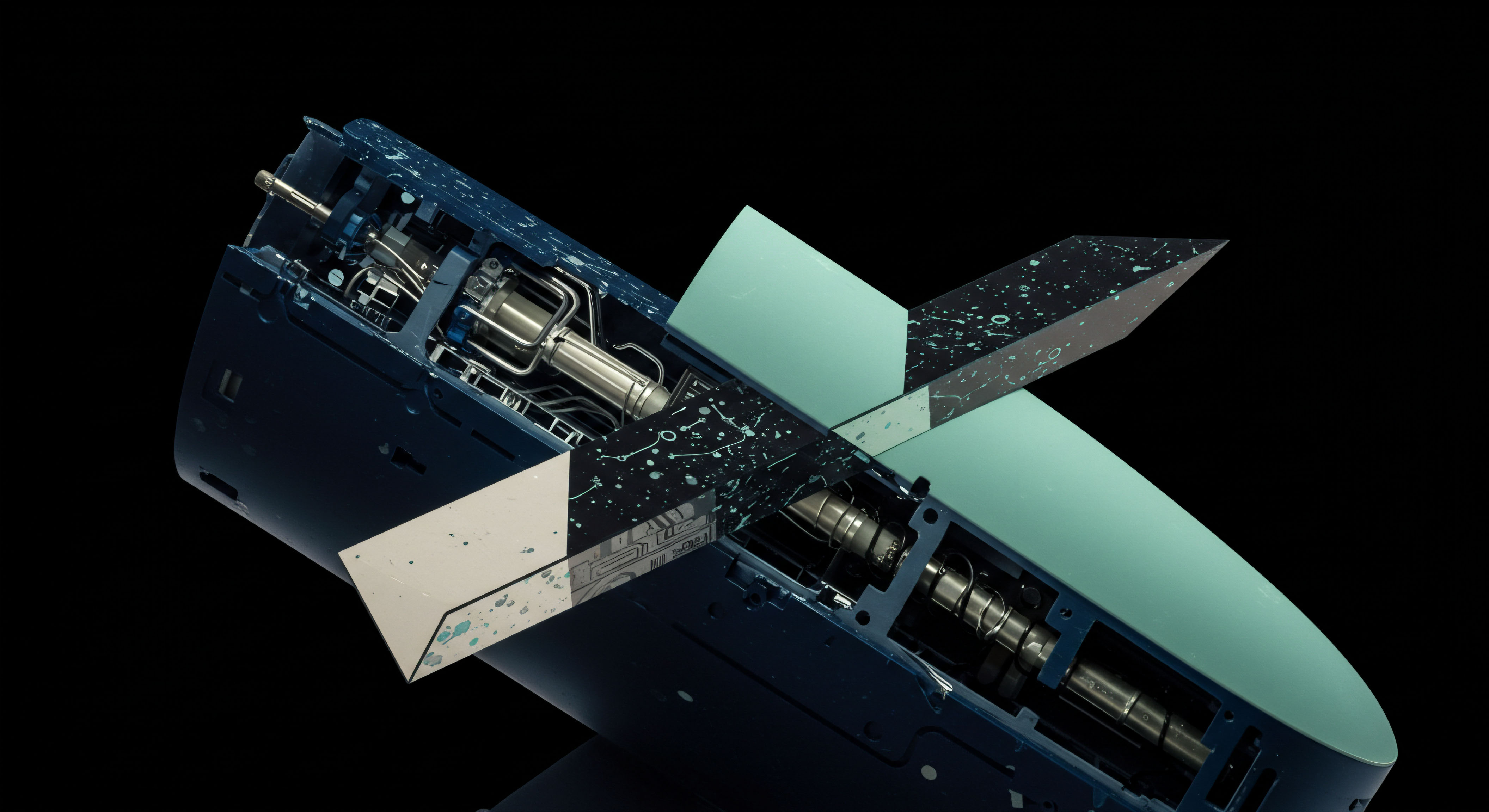

Private block trading orchestrates discreet, efficient crypto transfers, securing consistent execution across significant volumes and mitigating market impact.

Implementing private block trading requires a keen awareness of its operational nuances. The selection of counterparties and the structuring of the trade itself demand meticulous attention. Leveraging established relationships with liquidity providers or specialized desks becomes paramount. These entities possess the network and expertise to source deep liquidity, ensuring efficient matching without exposing intentions to the broader market.

This strategic interaction streamlines the execution process, translating directly into optimized cost basis for substantial positions. Mastery of this domain establishes a clear differentiator in an increasingly competitive landscape.

Strategic Capital Deployment

Deploying capital through private block trading requires a methodical, strategy-first mindset. This approach prioritizes securing optimal entry and exit points for large crypto positions, directly influencing overall portfolio performance. Identifying market inefficiencies and structuring trades to exploit them forms the cornerstone of this investment method.

Volatility Hedging with Options Blocks

Options block trades provide a robust mechanism for managing directional risk and capturing volatility plays. Structuring multi-leg options strategies, such as straddles or collars, through a single block execution minimizes leg risk and ensures a consistent premium. A BTC straddle block, for example, allows a trader to capitalize on anticipated significant price movement without committing to a specific direction. Executing this as a block ensures all components of the strategy are priced and filled concurrently, preserving the intended risk-reward profile.

- BTC Straddle Block ▴ Initiate simultaneous purchase of an equivalent number of out-of-the-money call and put options on Bitcoin. This positions a portfolio to profit from increased volatility, irrespective of price direction, while avoiding the slippage inherent in sequential leg execution on public venues.

- ETH Collar RFQ ▴ Combine a long position in Ethereum with the purchase of an out-of-the-money put option and the sale of an out-of-the-money call option. This structure limits both potential downside risk and upside gain, effectively creating a defined profit range. Requesting quotes for the entire collar as a block ensures synchronized pricing across all components.

- Implied Volatility Block Trade ▴ Execute a large-scale trade on options contracts with specific implied volatility targets. This strategy capitalizes on discrepancies between market-implied volatility and anticipated future realized volatility, securing a premium through precise block execution.

Large-Scale Accumulation and Distribution

Accumulating or distributing significant crypto holdings without disrupting market equilibrium defines a core application of private block trading. A multi-dealer liquidity approach, facilitated through a Request for Quote (RFQ) system, enables participants to solicit bids and offers from multiple counterparties simultaneously. This competitive environment drives optimal pricing for large orders.

The anonymity afforded by many RFQ platforms protects the trader’s intent, preventing front-running and adverse price impact. This strategic deployment allows for the systematic build-up or reduction of positions over time, maintaining market integrity.

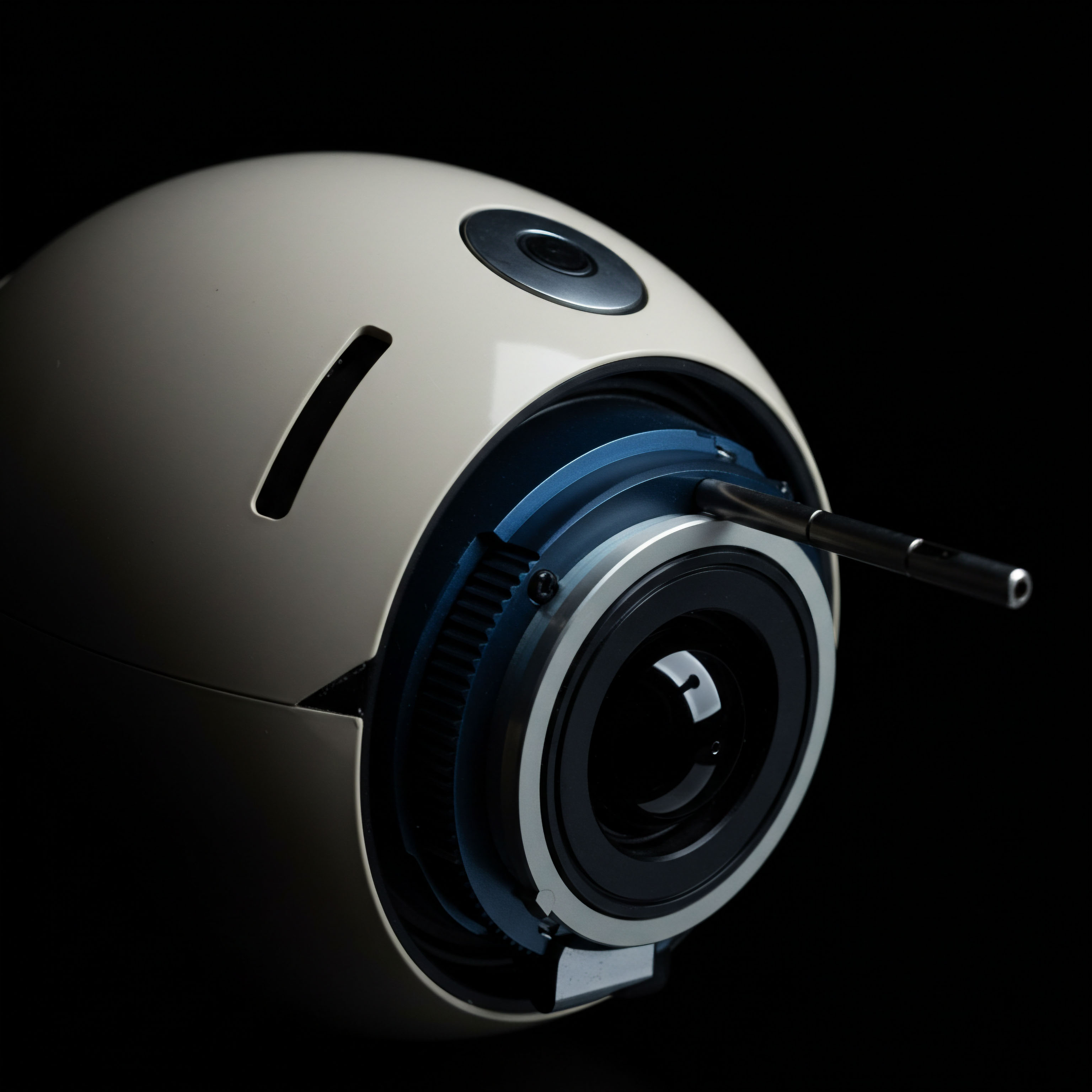

Leveraging multi-dealer liquidity via RFQ systems secures optimal pricing for large orders, preserving anonymity and preventing adverse market impact.

An advanced trader considers the execution algorithm employed by their chosen liquidity provider. Some providers offer smart routing and order slicing capabilities, even within a block trade context, to further optimize execution. This meticulous attention to execution details differentiates proficient trading from mere participation. The goal remains consistent ▴ maximize alpha by minimizing transaction costs and controlling price impact.

Advanced Strategic Integration

Expanding beyond basic execution, private block trading integrates into sophisticated portfolio management frameworks, elevating overall strategy and risk management. This advanced application transforms a tactical tool into a strategic lever for achieving consistent alpha. The focus shifts towards systemic advantages and long-term portfolio resilience.

Portfolio Volatility Management

Mastering volatility management requires a proactive stance, particularly within crypto assets. Utilizing options block liquidity allows for the construction of complex hedging structures that protect existing portfolios against adverse price movements or exploit anticipated volatility shifts. A series of correlated asset options blocks, for instance, provides a robust defense against systemic market shocks.

Executing these as integrated blocks ensures precise correlation capture and avoids individual leg mispricing. This comprehensive approach builds a resilient portfolio capable of navigating turbulent market conditions.

Sophisticated traders view block trading as an essential component of their quantitative risk models. Incorporating these discreet execution channels into value-at-risk (VaR) calculations and stress testing scenarios provides a more accurate representation of potential portfolio outcomes. The reduced slippage and controlled price impact inherent in block trades directly translate into tighter risk parameters. This granular understanding of execution risk refines overall portfolio construction.

Alpha Generation through Arbitrage and Spreads

Unlocking advanced alpha often involves exploiting fleeting market discrepancies. Options spreads RFQ capabilities enable the precise execution of multi-leg arbitrage strategies across different venues or instruments. This includes capturing basis trade opportunities or executing complex calendar spreads with minimal latency and impact.

The ability to request a single quote for an entire spread ensures the desired profit margin remains intact upon execution. This method offers a systematic pathway to extract value from subtle market mispricings.

The true measure of mastery lies in the ability to consistently generate superior returns while managing exposure. Private block trading, when integrated thoughtfully, empowers traders to achieve this balance. It facilitates the precise implementation of directional bets, hedging strategies, and complex arbitrage plays, all while maintaining the integrity of large capital deployments. This systematic advantage positions traders at the forefront of crypto market dynamics.

Commanding Your Crypto Destiny

The journey toward commanding superior market outcomes in crypto demands a relentless pursuit of strategic advantage. Private block trading stands as a testament to this pursuit, offering a refined avenue for executing significant capital movements with precision and discretion. Its thoughtful application transforms market challenges into opportunities for optimized returns. Traders who integrate this mechanism into their operational framework elevate their entire approach, moving with purpose through complex market structures.

This commitment to sophisticated execution defines a path toward sustained alpha generation. The future of high-performance crypto trading resides in such calculated, impactful methodologies.

Glossary

Private Block Trading

Private Block

Block Trading

Btc Straddle Block

Eth Collar Rfq

Volatility Block Trade

Multi-Dealer Liquidity

Options Block Liquidity

Quantitative Risk Models