Private Network Fundamentals

Navigating the volatile currents of crypto markets demands more than conventional execution methods. Engaging with private networks establishes a direct conduit to robust liquidity, a foundational element for sophisticated digital asset trading. These bespoke systems, distinct from public exchanges, facilitate direct engagement between substantial market participants. They streamline the process of executing large orders, minimizing the market impact often associated with significant capital movements.

Understanding the operational mechanics of private networks unlocks a significant advantage. Participants access deep pools of capital, often bypassing the visible order books of centralized exchanges. This direct access provides superior price discovery and enhances transaction efficiency.

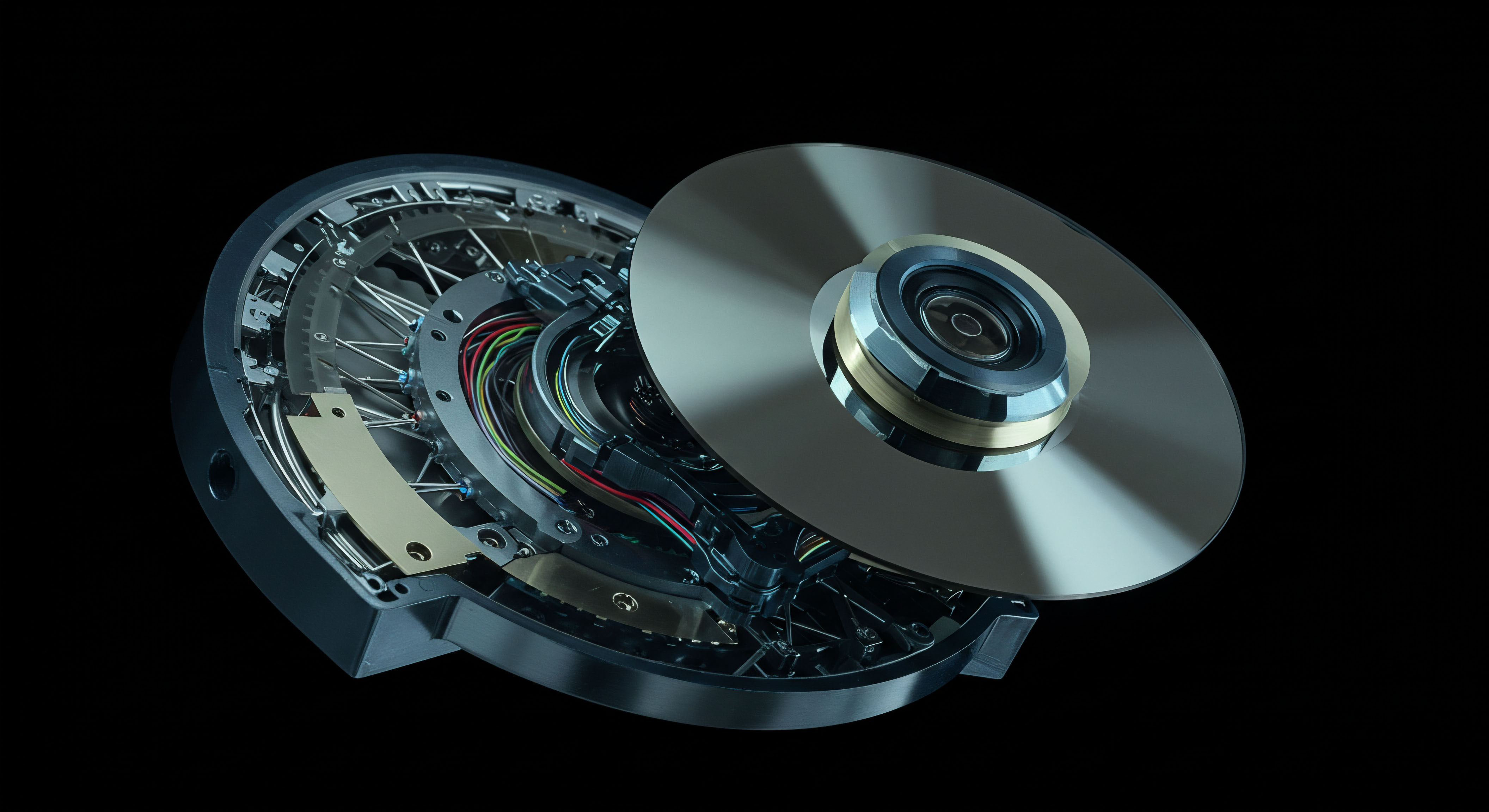

The architecture supports sophisticated order types and bespoke liquidity arrangements, catering to the precise needs of institutional-grade trading strategies. Cultivating proficiency in these environments marks a definitive step towards commanding market dynamics.

Execution Velocity

Accelerated execution velocity represents a primary benefit derived from private network utilization. Transactions route directly to counter-parties, curtailing latency inherent in public venues. This speed proves indispensable when market conditions shift rapidly, allowing for timely entry and exit points that preserve alpha. Traders gain a distinct advantage by capitalizing on fleeting opportunities before they dissipate across broader markets.

Price Discovery

Superior price discovery forms another compelling aspect of private network engagement. Direct interactions between large buyers and sellers foster a more accurate reflection of true market value for substantial positions. This contrasts with the often-fragmented liquidity and price distortions found on open exchanges. The clarity gained from direct price negotiation informs more intelligent trading decisions, leading to more favorable fill rates.

Strategic Capital Deployment

Deploying capital within private networks demands a strategic approach, one focused on maximizing execution quality and optimizing risk parameters. Professional traders leverage these environments for specific outcomes, moving beyond simple spot transactions to complex derivatives and multi-leg strategies. The goal involves orchestrating trades with precision, transforming market insights into tangible returns.

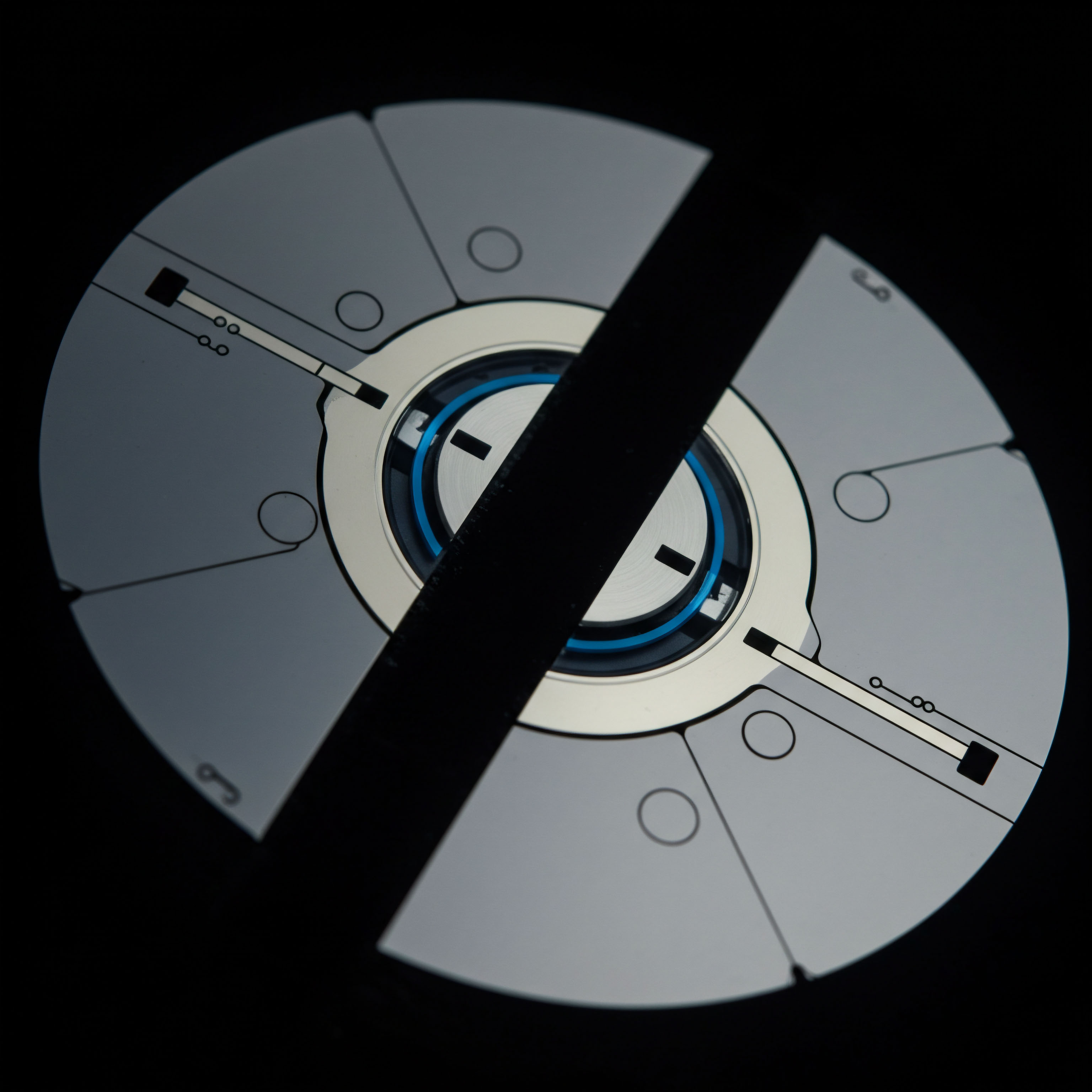

RFQ Mechanism for Block Trading

Implementing a Request for Quote (RFQ) mechanism for substantial block transactions commands superior pricing dynamics. An RFQ solicits bids and offers from multiple liquidity providers simultaneously, creating a competitive environment for large orders. This process significantly reduces price impact, a critical consideration when moving considerable volumes of Bitcoin or Ethereum options.

- Defining Trade Parameters ▴ Clearly specify the asset, quantity, strike price, expiration, and desired side (buy/sell). Precision in defining these parameters ensures relevant quotes from liquidity providers.

- Multi-Dealer Engagement ▴ Circulate the RFQ to a select group of pre-qualified dealers. This competitive tension among multiple counterparties consistently yields more advantageous pricing.

- Execution Decision ▴ Evaluate incoming quotes based on price, size, and counterparty reputation. Rapid decision-making secures the most favorable terms available.

Options Spreads Execution

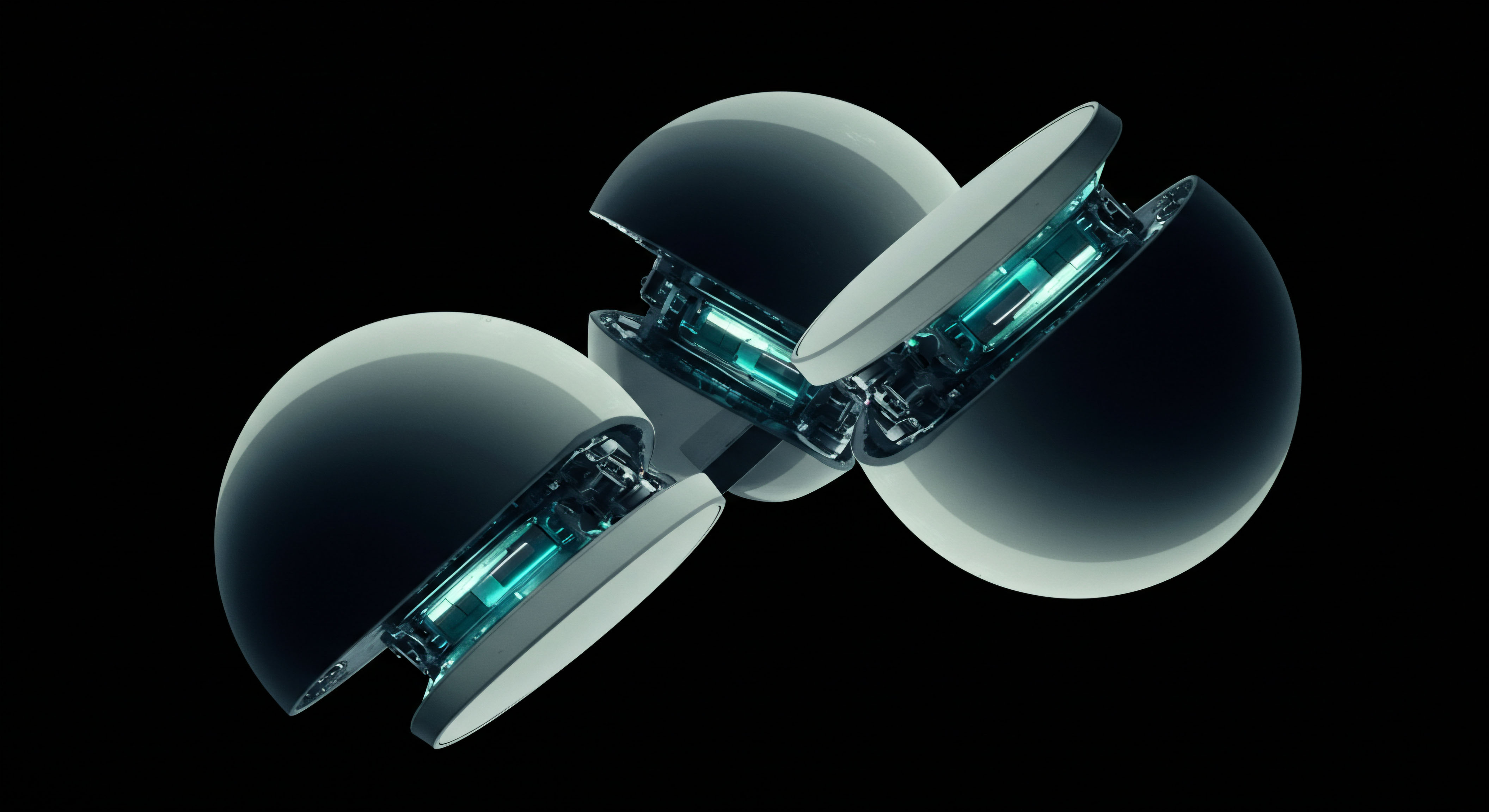

Executing multi-leg options spreads within a private network environment enhances capital efficiency and precision. Combining options legs (e.g. straddles, collars, iron condors) into a single, atomic transaction mitigates leg risk and guarantees simultaneous execution. This unified approach prevents adverse price movements between individual components of a complex strategy.

BTC Straddle Block Execution

A BTC straddle block involves simultaneously buying or selling an equal number of calls and puts with the same strike price and expiration. Executing this as a block trade through a private network streamlines the process, ensuring both legs transact at optimal, correlated prices. This strategy capitalizes on anticipated volatility shifts while managing directional exposure.

ETH Collar RFQ

An ETH collar strategy combines buying a put option and selling a call option against an existing ETH holding. Initiating an RFQ for this three-legged strategy ensures the protective put and the income-generating call are priced efficiently. The private network environment facilitates a coordinated execution, safeguarding the underlying asset against downside risk while generating premium income.

Executing complex options strategies within private networks curtails leg risk and enhances capital efficiency.

A disciplined approach to risk management remains paramount when deploying these strategies. Understanding the Greeks (Delta, Gamma, Vega, Theta) for each options position, especially within multi-leg structures, provides the framework for monitoring and adjusting exposure. Private networks offer the infrastructure for precise execution, yet the underlying strategic intelligence determines overall success. This intersection of robust infrastructure and informed strategy creates a powerful synergy for alpha generation.

Advanced Market Integration

Integrating private networks into a comprehensive portfolio framework elevates the efficacy of intricate derivatives strategies, pushing beyond transactional efficiency to systemic market mastery. The true power resides in their application as foundational elements within a broader, sophisticated trading operation. This involves connecting execution capabilities with advanced risk models and macro-economic insights.

Volatility Block Trade Orchestration

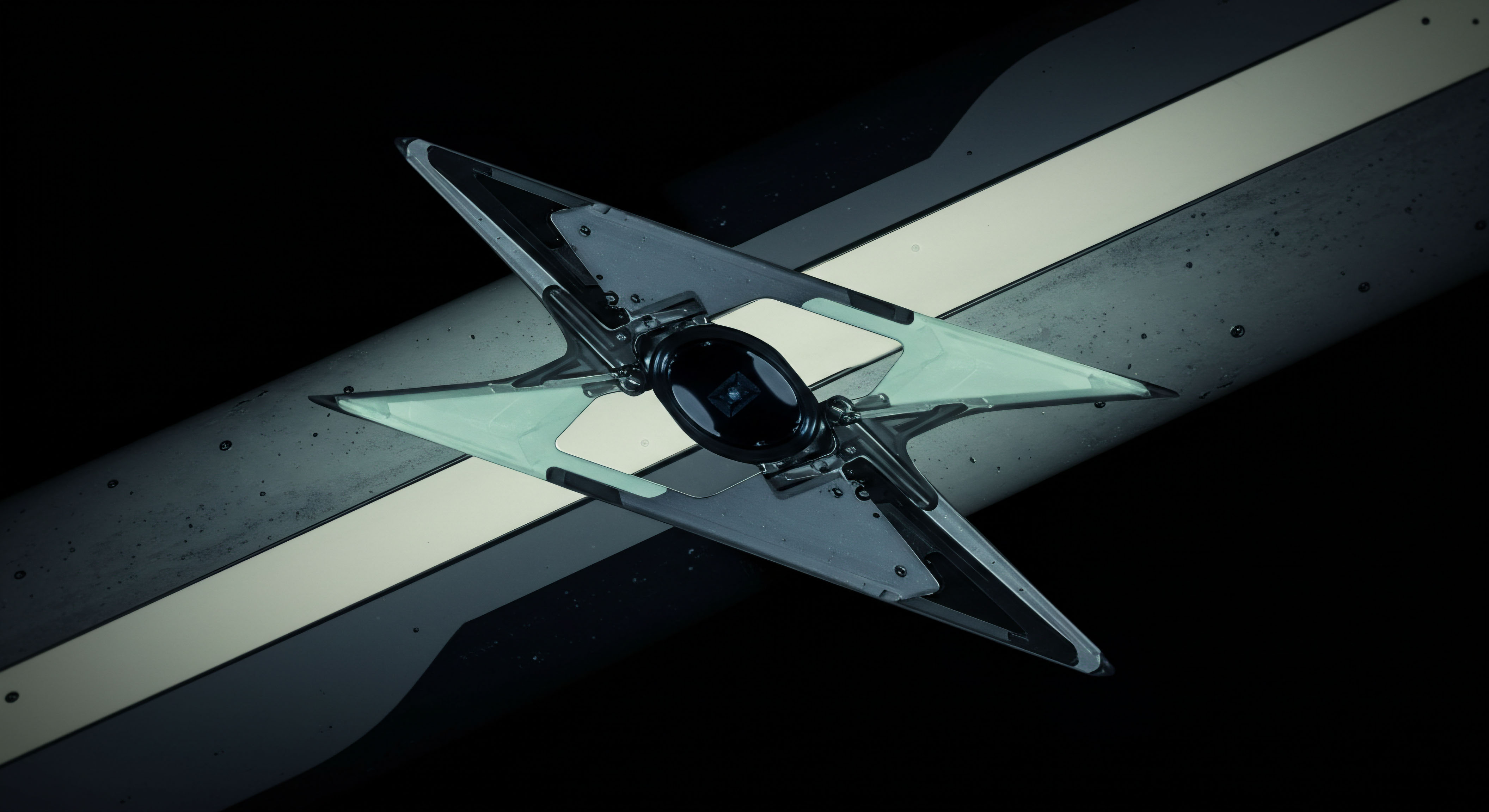

Orchestrating volatility block trades within private networks allows for highly targeted exposure to implied volatility movements. This approach moves beyond directional bets, enabling precise positioning for anticipated shifts in market sentiment or event-driven volatility spikes. Large-scale trades on volatility indices or complex options structures, executed discreetly, minimize signaling to the broader market. This requires a nuanced understanding of volatility surfaces and term structures, translating theoretical models into actionable, high-impact trades.

Multi-Leg Execution Optimization

Optimizing multi-leg execution involves more than simultaneous order placement. It demands an adaptive algorithm capable of identifying optimal liquidity pathways across various private and semi-private venues. The system continuously evaluates price, size, and latency across potential counterparties, routing legs dynamically to secure the best possible aggregated fill. This represents a significant leap from static order execution, transforming a complex strategy into a seamlessly executed sequence of micro-decisions.

The strategic deployment of private networks extends into refining risk management frameworks. Integrating these execution channels with real-time portfolio analytics offers a comprehensive view of exposure across all asset classes. This enables dynamic hedging adjustments and rapid rebalancing of positions, preserving capital and mitigating unforeseen market dislocations. The challenge resides in continuously adapting these frameworks to evolving market microstructure, a task requiring persistent intellectual engagement.

Dynamic multi-leg execution, powered by private networks, redefines the boundaries of strategic portfolio management.

True mastery of private networks culminates in their seamless integration with advanced quantitative models. These models predict liquidity concentrations, estimate price impact, and forecast optimal execution windows. The human element, though, remains irreplaceable, translating these data-driven insights into decisive action. This synthesis of technological capability and strategic acumen forms the bedrock of sustained market edge.

Commanding the Digital Horizon

The pursuit of superior trading outcomes in crypto markets remains an ongoing journey, a constant refinement of tools and perspective. Private networks stand as a testament to this evolution, providing the infrastructure for a more controlled, more efficient, and ultimately, more profitable engagement with digital assets. Embracing these advanced execution channels marks a clear delineation between reactive participation and proactive market leadership. The path to sustained alpha requires a commitment to strategic excellence, where every transaction becomes a deliberate act of commanding liquidity.

This level of control, once reserved for the most exclusive desks, now presents a tangible opportunity for any trader ready to elevate their craft. The future of execution resides in this precision, a future you are now equipped to shape.

This commitment to professional-grade tools represents a conviction, a belief in the power of systematic advantage over chance. I find immense satisfaction in witnessing traders transition from battling market inefficiencies to orchestrating their trades with the confidence of a seasoned conductor.

Glossary

Private Networks

Private Network

Btc Straddle Block