The Genesis of Market Command

Navigating modern financial markets requires a strategic understanding of execution mechanics. Mastering quote intelligence equips traders with a commanding perspective on liquidity, transforming reactive responses into deliberate, outcome-driven actions. This approach focuses on harnessing advanced trading mechanisms to secure superior pricing and execution quality across complex instruments.

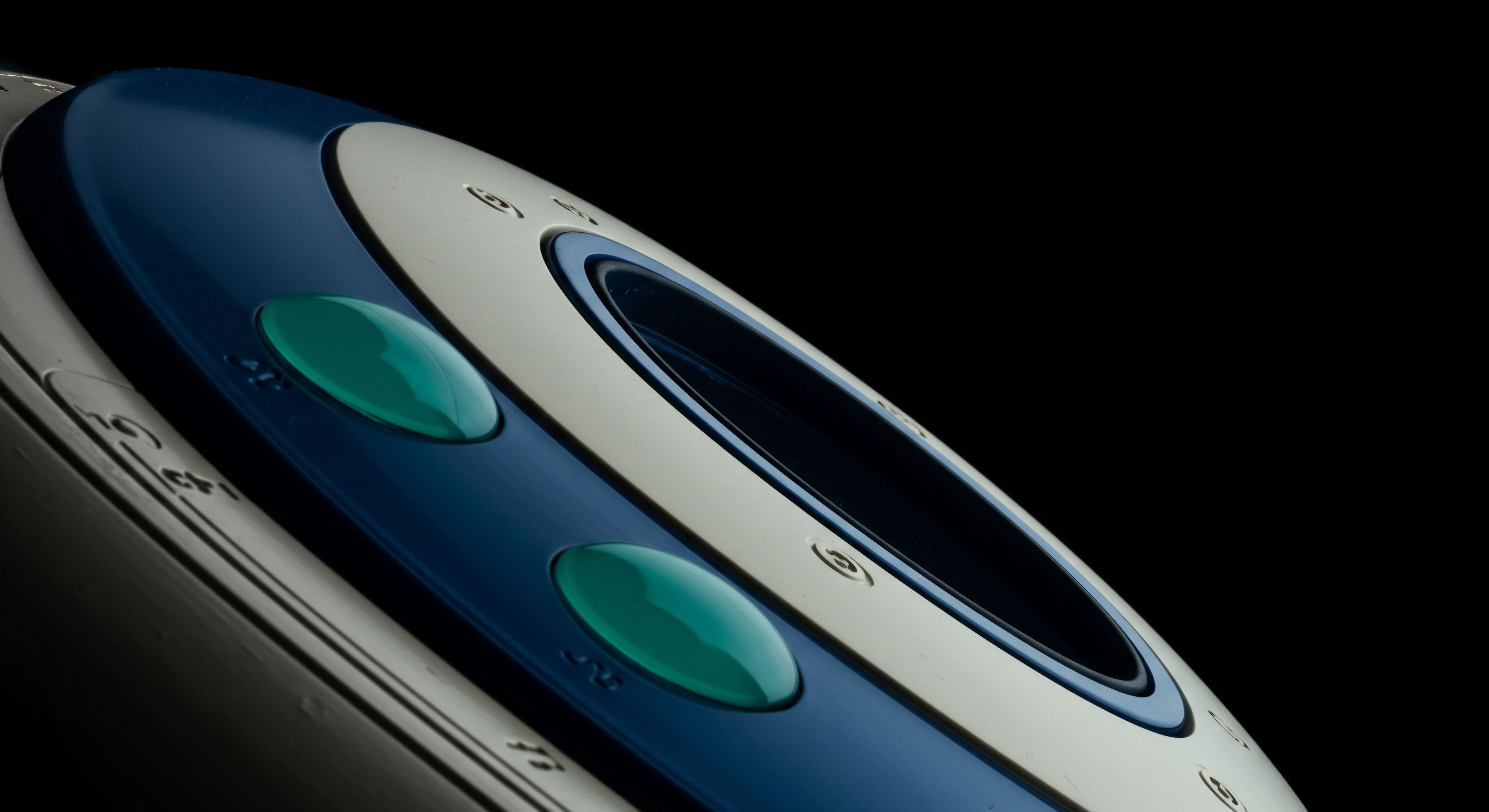

The Request for Quote (RFQ) protocol stands as a cornerstone of this intelligent execution. It facilitates a direct, competitive bidding environment among multiple liquidity providers for specific derivatives contracts. This mechanism ensures that a trader’s order receives optimal pricing, especially for larger block trades where market impact can erode potential gains. Engaging directly with diverse liquidity pools allows for a strategic bypass of fragmented public order books.

Understanding the interplay between RFQ and options trading unlocks significant advantages. Options contracts, with their inherent complexity and sensitivity to volatility, benefit immensely from precise price discovery. Employing quote intelligence in this arena means actively soliciting bids and offers for multi-leg strategies or large notional positions, thereby securing favorable terms. This proactive stance contrasts sharply with passive order placement, which frequently incurs hidden costs.

Quote intelligence fundamentally redefines market interaction, moving beyond passive observation to active, strategic engagement for superior execution outcomes.

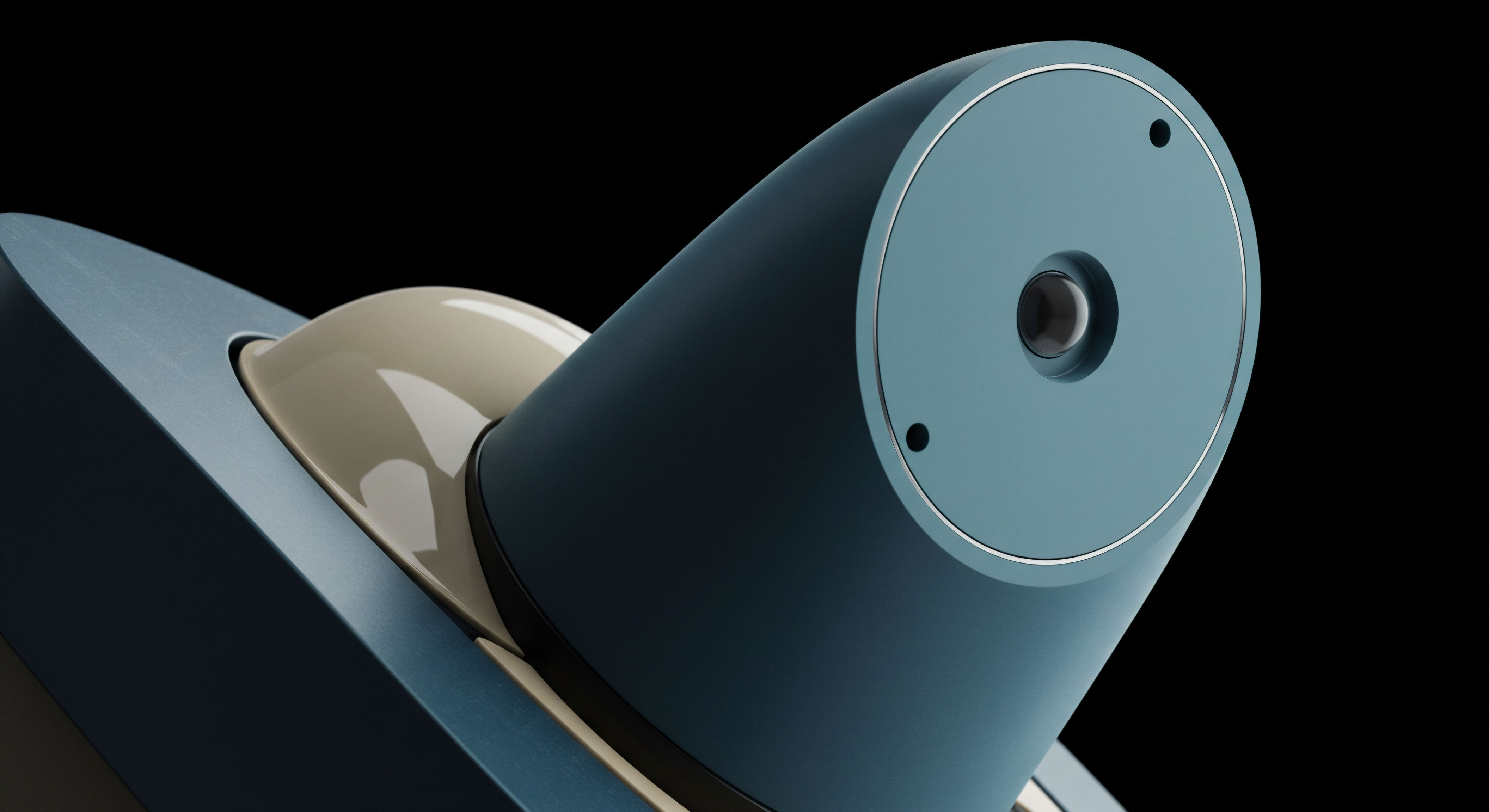

Block trading, particularly in nascent crypto options markets, represents another critical application. Executing substantial volumes without undue price dislocation demands sophisticated tools. A robust RFQ process provides the necessary framework, allowing institutions to move significant capital efficiently.

This method mitigates the risk of adverse selection and ensures discreet entry or exit from positions, preserving the integrity of the intended trade. The systematic pursuit of best execution through these channels defines a new standard.

Deploying Precision in Volatile Fields

Implementing quote intelligence in an investment strategy requires disciplined application and a clear understanding of its tactical advantages. This involves selecting the right execution channel for the specific trade, whether it concerns a single options leg or a complex volatility strategy. The objective remains consistent ▴ optimize price capture and minimize execution slippage.

Optimizing Options Spreads through RFQ

Constructing multi-leg options spreads, such as a BTC straddle block or an ETH collar, benefits immensely from a unified RFQ process. Sending all legs of a spread to multiple dealers simultaneously ensures competitive pricing for the entire structure. This holistic approach prevents adverse price movements on individual legs, which can compromise the intended risk-reward profile of the overall strategy.

- Consolidate Leg Pricing ▴ Obtain a single, composite price for the entire spread, removing the risk of sequential leg execution.

- Access Deeper Liquidity ▴ Engage a broader spectrum of market makers, increasing the probability of a full fill at a favorable price.

- Minimize Execution Risk ▴ Reduce the exposure window to market fluctuations between individual leg executions.

Strategic Block Trading for Digital Assets

Executing large block trades in Bitcoin or Ethereum options demands an institutional-grade approach. Anonymous options trading via RFQ platforms preserves market neutrality, preventing other participants from front-running or reacting to a substantial order. This discreet interaction with multi-dealer liquidity pools is a cornerstone of sophisticated capital deployment. Visible intellectual grappling ▴ The challenge here lies in discerning true liquidity depth versus quoted superficiality; distinguishing between an indicative price and a firm executable bid demands acute analytical scrutiny.

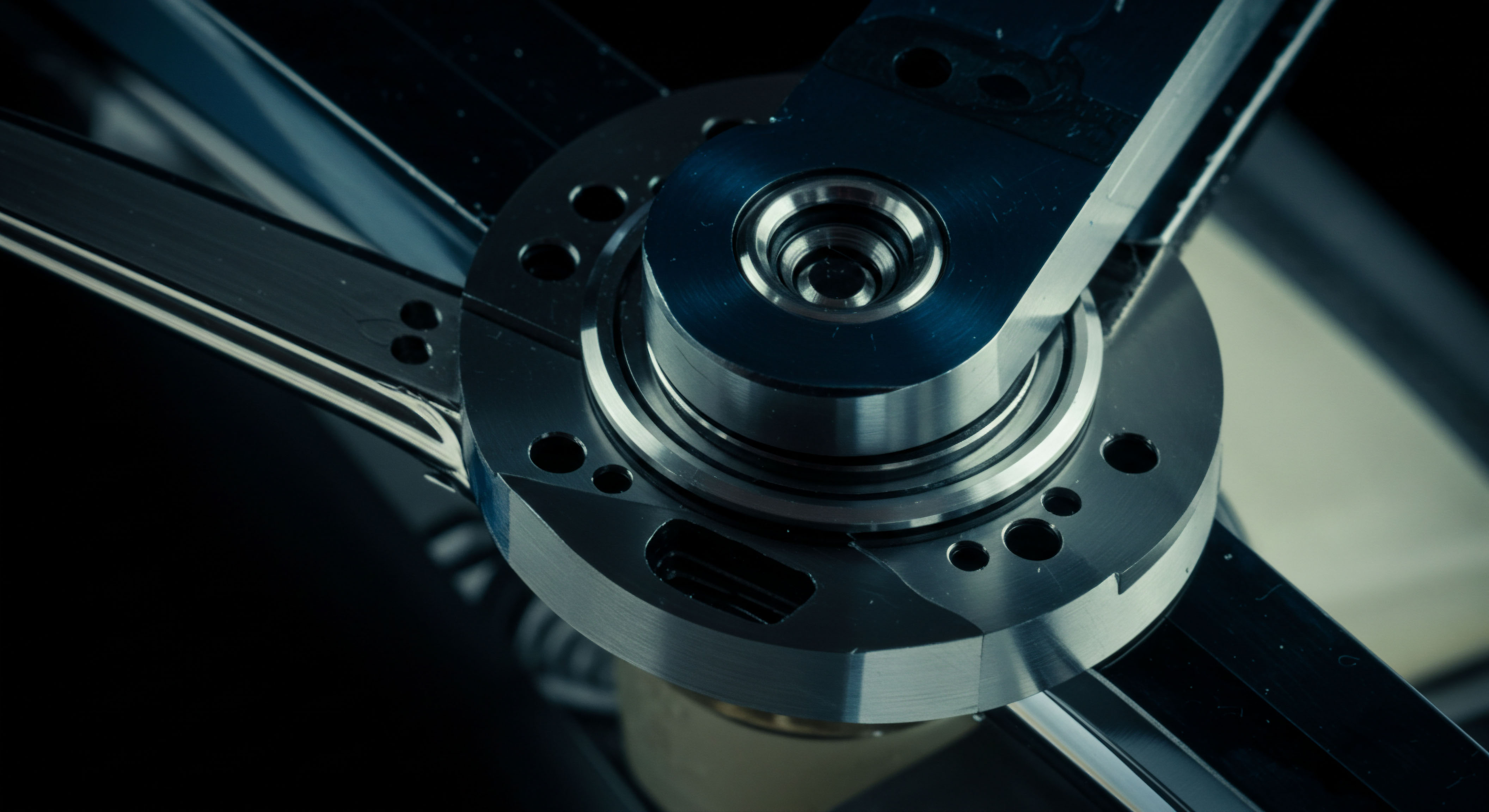

Enhancing Execution Alpha with Volatility Blocks

Volatility block trades, which involve substantial options positions designed to capitalize on implied volatility shifts, gain significant edge through RFQ. A direct price discovery mechanism for these complex instruments allows for precise entry and exit points. This level of control is paramount for strategies sensitive to small pricing discrepancies, directly contributing to measurable execution alpha. Employing RFQ for these transactions ensures the strategic intent translates into a tangible market outcome.

Ascending to Market Sovereignty

The true mastery of quote intelligence extends beyond individual trade execution, integrating into a broader framework of portfolio management and risk mitigation. This advanced application transforms market interaction into a systematic pursuit of sustained advantage. It shifts the focus from transactional gains to enduring structural superiority.

Integrating RFQ into Portfolio Risk Frameworks

Advanced traders leverage quote intelligence to dynamically manage portfolio hedges and rebalance exposures. When adjusting a substantial options book, initiating an RFQ for specific deltas or gamma profiles allows for rapid, efficient execution. This proactive management minimizes the slippage often associated with rebalancing through public order books, preserving capital and maintaining desired risk parameters. The ability to command liquidity on demand becomes a potent defensive and offensive tool.

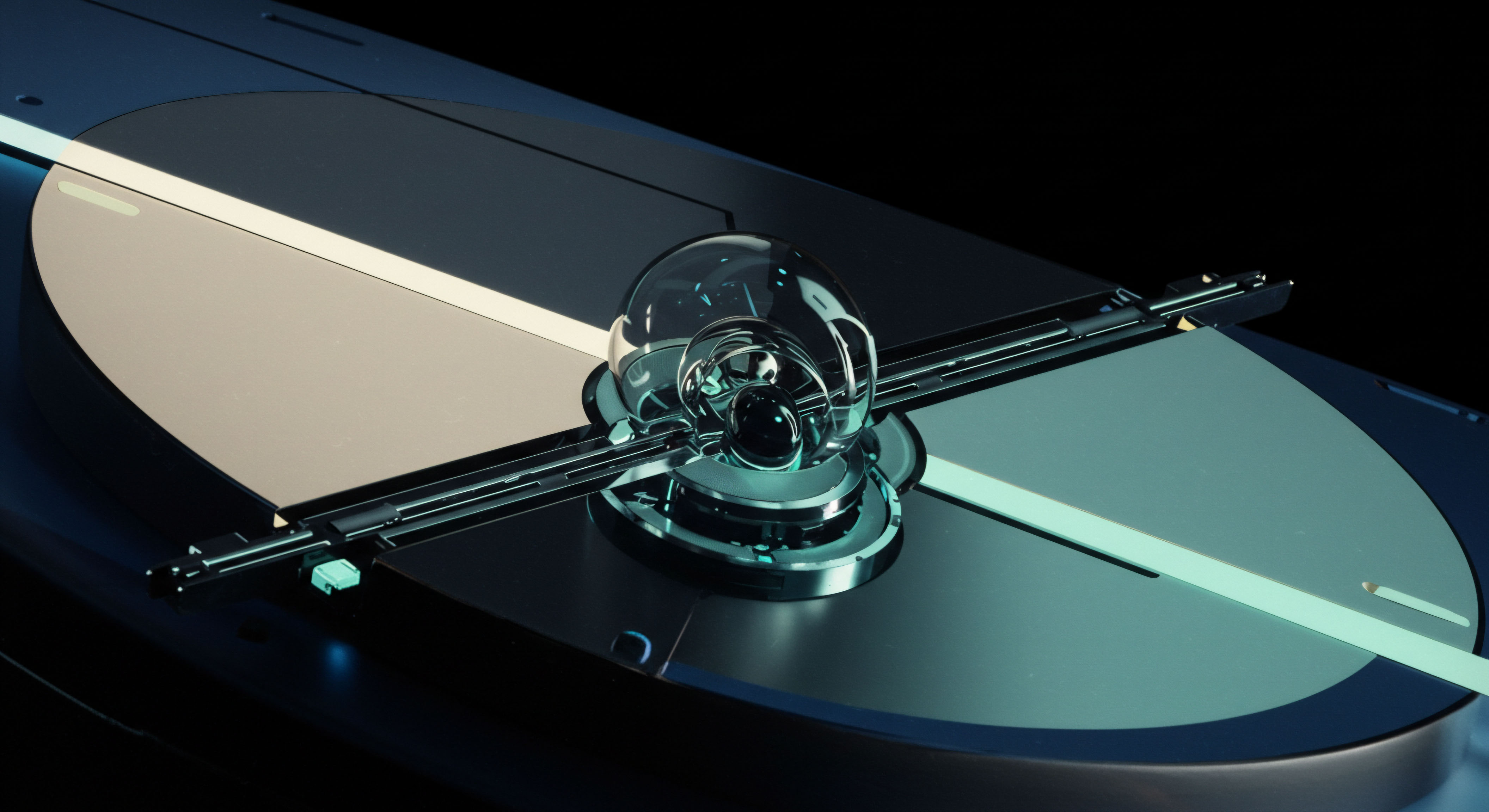

Algorithmic Execution within Quote Intelligence Streams

The confluence of algorithmic trading and RFQ represents the zenith of execution quality. Sophisticated algorithms can analyze incoming quotes from multiple dealers, selecting the optimal price and timing for execution. This automated precision removes human latency, securing the tightest spreads available. Furthermore, these systems can segment larger orders into smaller RFQ requests, minimizing market impact while maximizing fill rates.

The operational efficiency gained provides a significant, compounding edge over time. This approach ensures consistent adherence to predefined execution parameters, elevating the overall trading performance. Such integration transforms execution from an art into a highly refined science, consistently delivering superior outcomes through systemic optimization.

The Long-Term Strategic Impact

Developing a deep command of quote intelligence cultivates a profound market edge. It fosters a trading environment where execution quality becomes a consistent source of alpha. This persistent advantage stems from the ability to consistently access superior pricing, reduce transaction costs, and manage market impact with unparalleled precision. The evolution from merely participating in markets to actively shaping execution outcomes defines the trajectory of a master strategist.

The Perpetual Edge of Informed Action

Embracing quote intelligence represents a commitment to superior market engagement. It signifies a transition to a more disciplined, analytically driven approach where every execution contributes to a quantifiable advantage. This strategic evolution defines the path to sustained market outperformance.

Glossary

Quote Intelligence

Options Spreads

Multi-Dealer Liquidity

Execution Alpha