Commanding Liquidity Execution

Achieving superior returns in crypto options demands a decisive edge, one forged through precise execution and strategic foresight. Request for Quote (RFQ) execution stands as a paramount mechanism for professional traders, transforming how large-scale derivatives positions are acquired or liquidated. This sophisticated approach moves beyond the limitations of fragmented order books, centralizing liquidity to ensure optimal pricing for substantial trades.

Understanding RFQ functionality reveals its profound impact on market efficiency. When initiating an RFQ, a trader broadcasts their desired options structure to a curated network of liquidity providers. These providers then compete to offer the most favorable prices, fostering an environment of genuine price discovery. This direct negotiation bypasses potential slippage inherent in cascading smaller orders across public exchanges, preserving value for the discerning participant.

The core utility of RFQ stems from its capacity to consolidate disparate liquidity. Instead of navigating multiple venues, a single RFQ command draws competitive bids, ensuring the best available price for complex, multi-leg options strategies. This systematic approach establishes a controlled environment for large block trades, an imperative for any serious contender in the crypto derivatives arena.

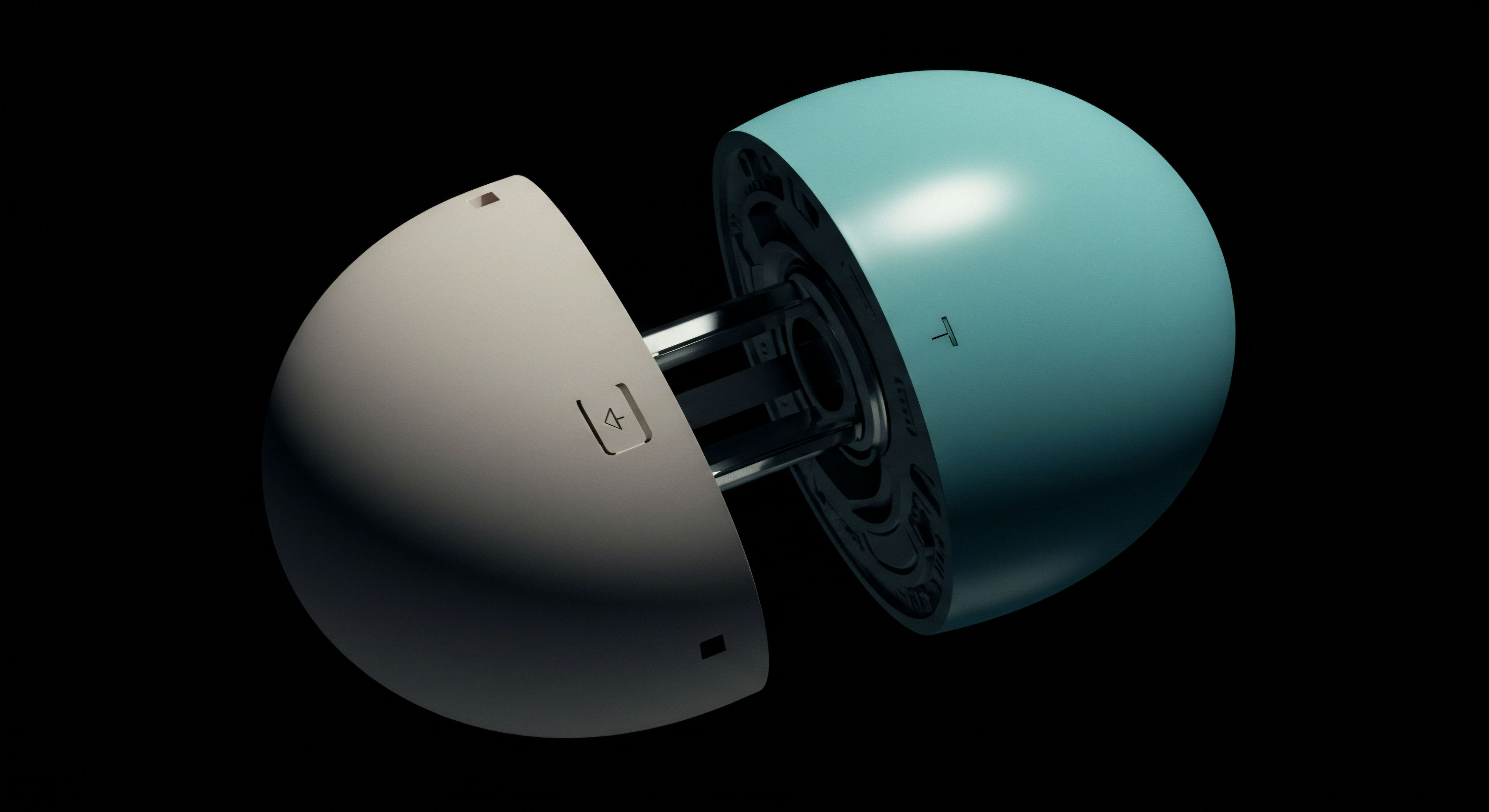

RFQ execution centralizes liquidity, transforming how substantial crypto options positions achieve optimal pricing.

Deploying Advanced Options Strategies

The transition from conceptual understanding to tangible results requires a disciplined application of RFQ in active trading. Mastering this execution pathway enables the deployment of sophisticated options strategies with unparalleled efficiency, securing a quantifiable advantage in volatile markets. This segment outlines practical approaches for leveraging RFQ to construct and manage high-performance crypto options portfolios.

Precision in Block Trading

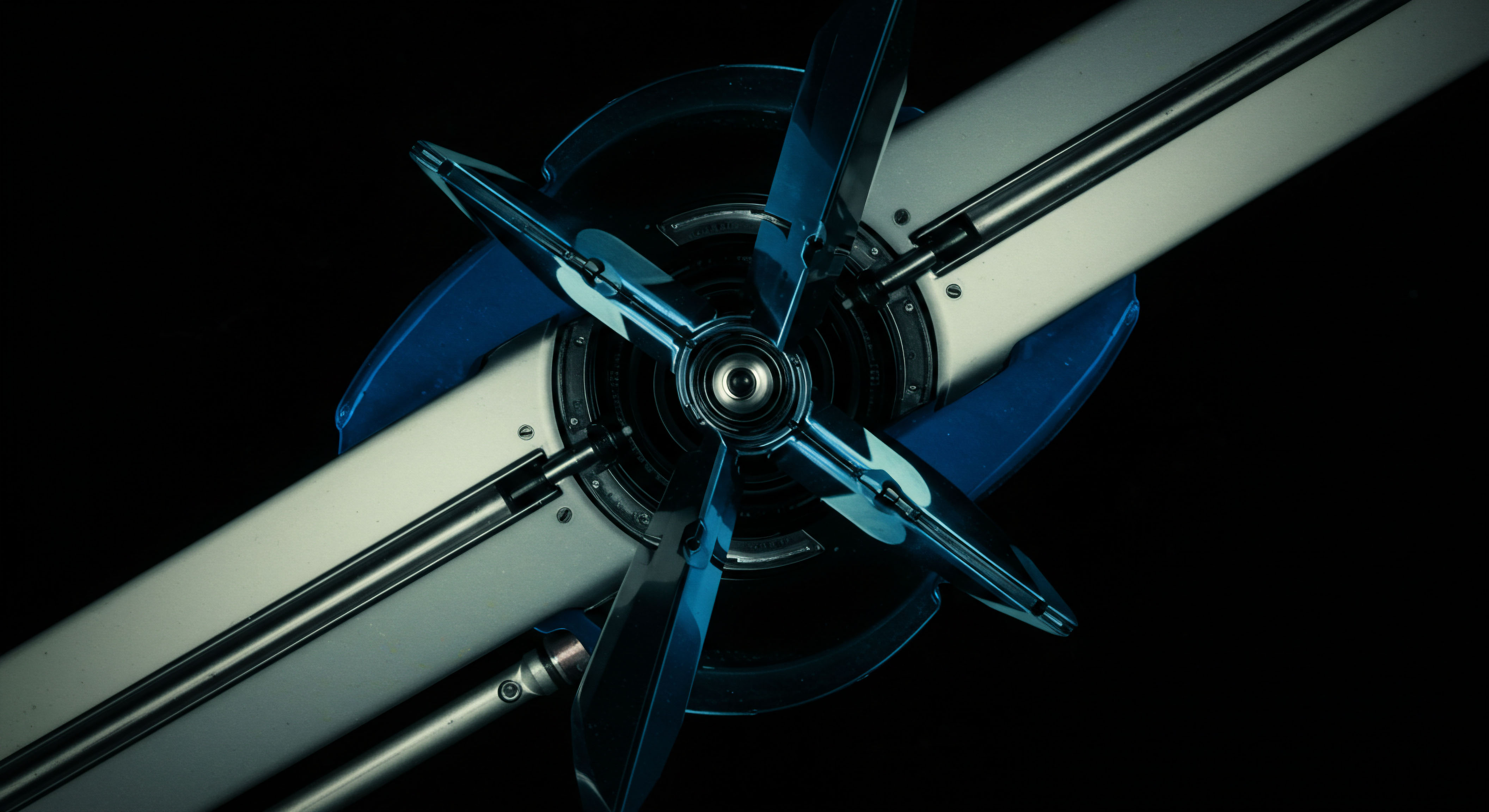

Executing significant Bitcoin or Ethereum options blocks through RFQ minimizes market impact. Direct engagement with liquidity providers facilitates the placement of large orders without moving the market against the trader. This capability becomes especially critical during periods of heightened volatility, preserving the intended risk-reward profile of the position.

Consider the strategic deployment of a BTC Straddle Block. A trader anticipating significant price movement, regardless of direction, can solicit quotes for a large-volume straddle. The RFQ mechanism ensures competitive pricing for both the call and put components, guaranteeing efficient entry into the position. This approach maintains the integrity of the initial market view, preventing adverse price discovery from partial fills.

Optimizing Multi-Leg Structures

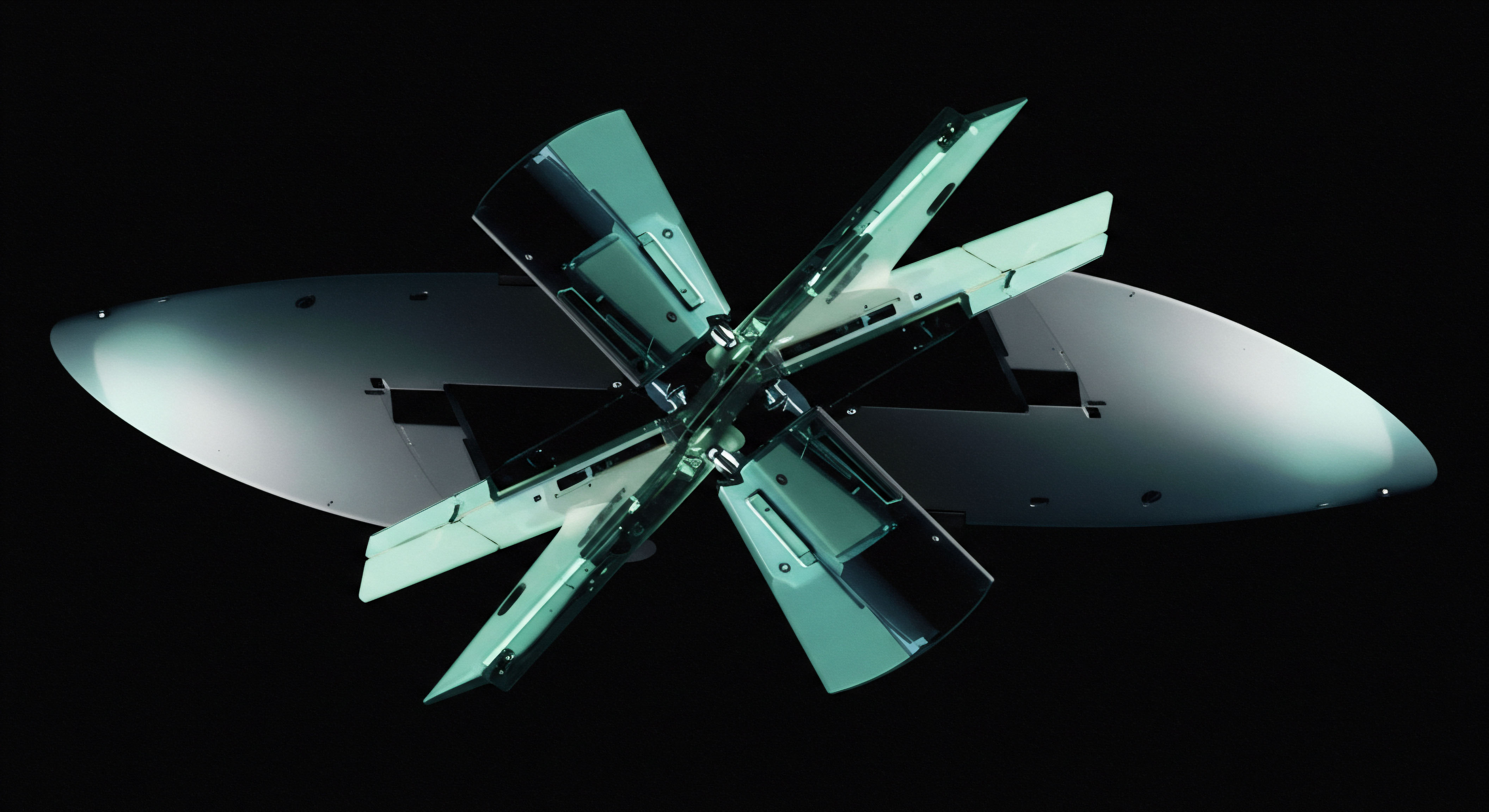

RFQ proves indispensable for constructing multi-leg options spreads, where simultaneous execution of several options is paramount. The integrity of a spread strategy, such as an ETH Collar RFQ, relies on precise, synchronous fills across all legs. Assembling such a structure in a fragmented environment risks significant basis risk, undermining the entire thesis.

A multi-leg execution through RFQ guarantees that all components of a complex strategy, like a calendar spread or an iron condor, are filled at the desired relative prices. This simultaneous pricing capability is fundamental for maintaining the profit potential and risk parameters of the overall trade. The collective bidding process simplifies what would otherwise be a series of challenging, interconnected orders.

- BTC Options Block Execution ▴ Initiate an RFQ for large directional or volatility plays, ensuring a single, consolidated price for substantial volumes.

- ETH Collar RFQ Implementation ▴ Deploy a collar strategy to manage portfolio risk or generate income, with RFQ guaranteeing precise entry points for all legs.

- Options Spreads RFQ ▴ Utilize RFQ for complex multi-leg spreads, mitigating slippage and basis risk through competitive, simultaneous pricing.

- Volatility Block Trade ▴ Capitalize on anticipated volatility shifts by executing large straddles or strangle blocks, securing optimal entry and exit points.

A meticulous approach to RFQ submission includes clearly defining the desired strike prices, expiry dates, and option types. Providing explicit parameters ensures liquidity providers offer the most accurate and competitive quotes. This proactive engagement sets the stage for superior execution outcomes, translating directly into enhanced portfolio performance.

Strategic Portfolio Integration

Advancing beyond individual trade execution, the true power of RFQ lies in its integration into a comprehensive portfolio management framework. This allows for a systems-engineering approach to risk management and alpha generation, cementing a sustainable market edge. Understanding how RFQ influences overall portfolio dynamics is the hallmark of a master strategist.

Enhancing Risk Management Frameworks

The capacity for anonymous options trading through RFQ offers a significant advantage in managing large exposures. Executing substantial positions without signaling intent to the broader market prevents adverse price movements, a critical component of sophisticated risk control. This allows portfolio managers to rebalance or hedge positions discreetly, preserving the integrity of their strategies.

Consider a scenario where a fund holds a significant long spot position in a crypto asset and seeks to implement a protective put strategy. Initiating an RFQ for a large block of puts allows for the acquisition of this insurance without telegraphing the fund’s underlying directional bias. The competitive bidding process ensures a cost-effective hedge, maintaining capital efficiency within the portfolio.

The challenge of balancing immediate execution with market impact becomes a fascinating interplay of game theory and quantitative assessment. The optimal RFQ strategy often involves a careful calibration of desired fill rates against acceptable price concessions, a dynamic puzzle demanding continuous refinement.

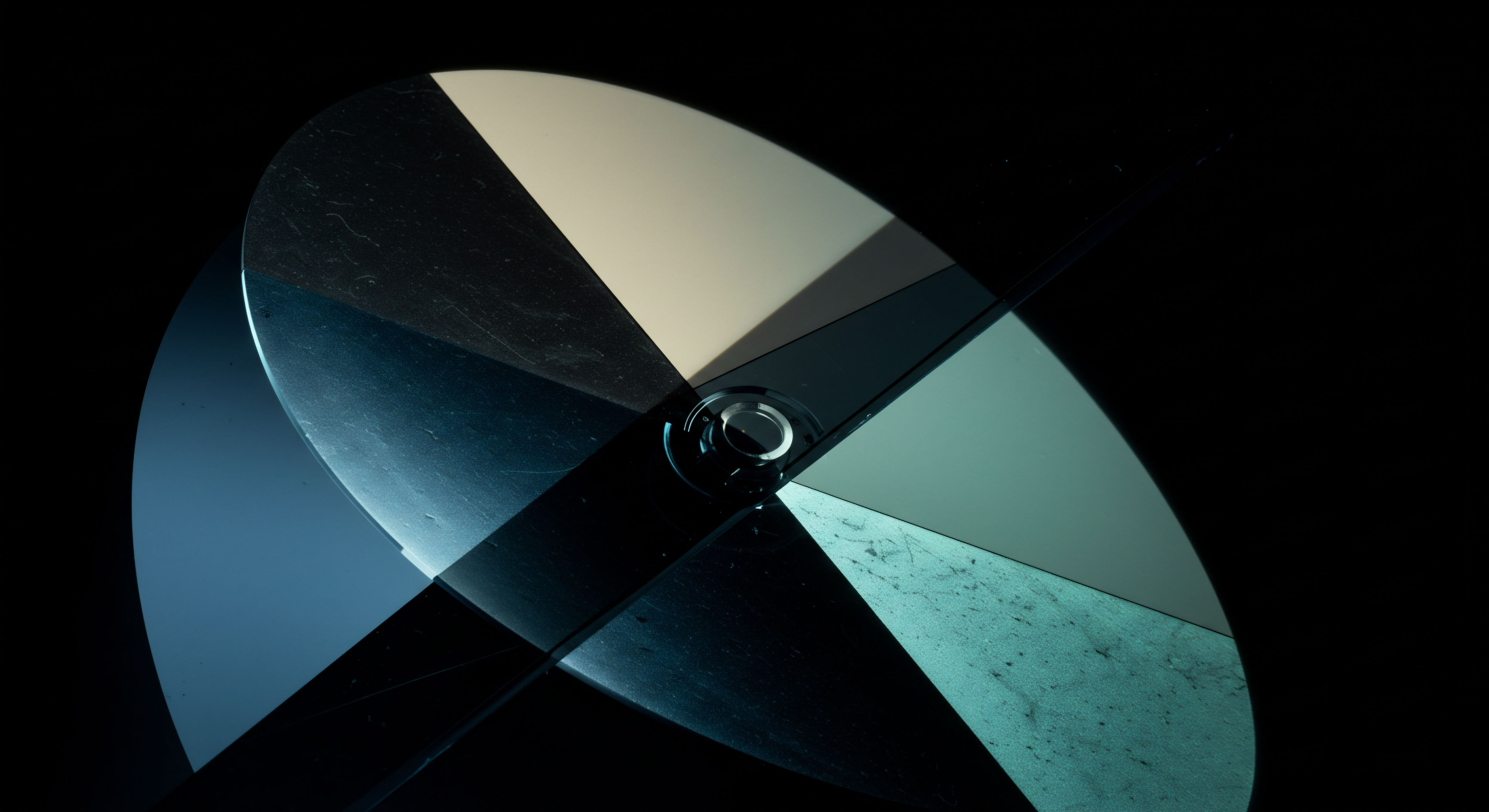

Architecting Superior Execution Quality

The pursuit of best execution through RFQ is an ongoing optimization problem. Traders continuously analyze fill rates, price improvement, and slippage data from their RFQ executions. This data-informed feedback loop refines their approach to liquidity provider selection and order routing, leading to progressively sharper execution quality. The iterative process transforms execution from a transactional event into a strategic lever for alpha generation.

Integrating RFQ into automated trading systems elevates its impact. Algorithmic execution engines can dynamically route orders through RFQ when specific liquidity or size thresholds are met, ensuring that optimal pricing is consistently achieved across the entire portfolio. This systematic deployment of RFQ becomes a cornerstone of an institutional-grade trading infrastructure, enabling superior capital deployment and risk mitigation across diverse market conditions.

The Unseen Advantage

Mastering RFQ execution represents a profound shift in market engagement, moving from reactive participation to proactive command. This is where strategic vision meets operational precision, yielding an undeniable advantage in the relentless pursuit of elite crypto options returns. The discerning trader shapes their own liquidity, defining the terms of engagement and solidifying their position at the forefront of market innovation.

Glossary

Btc Straddle Block

Eth Collar Rfq

Multi-Leg Execution

Options Spreads Rfq

Volatility Block Trade

Anonymous Options Trading

Best Execution